- Home

- »

- Plastics, Polymers & Resins

- »

-

India Injection Molded Plastic Market, Industry Report, 2030GVR Report cover

![India Injection Molded Plastic Market Size, Share & Trends Report]()

India Injection Molded Plastic Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (Polypropylene, Acrylonitrile Butadiene Styrene, HDPE, LDPE, Polystyrene, Polyethylene, PET, Polyvinyl Chloride, PEEK, PU), By Application (Medical), And Segment Forecasts

- Report ID: GVR-4-68040-508-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Injection Molded Plastic Market Trends

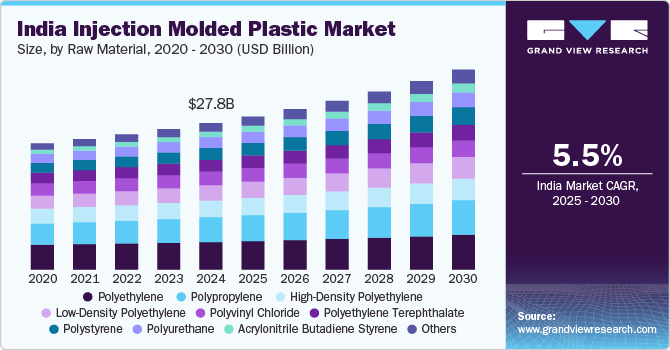

The India injection molded plastic market size was estimated at USD 27.84 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. The India injection molded plastic industry’s growth is driven by the booming packaging, automotive, and electronics sectors, fueled by rapid urbanization and rising consumer demand for lightweight, durable, and cost-effective materials. Additionally, government initiatives promoting "Make in India" and sustainable practices are accelerating market growth.

India’s electronics market has been rapidly expanding, driven by factors such as rising disposable incomes, increased urbanization, a growing middle class, and government initiatives promoting electronics manufacturing. This growth is significantly fueling the demand for injection molded plastics, which are widely used in electronics components and enclosures due to their lightweight, cost-effectiveness, and design flexibility. With the "Make in India" initiative and schemes such as the Production-Linked Incentive (PLI) for electronics manufacturing, the domestic production of smartphones, laptops, and consumer electronics has seen a significant boost, requiring extensive use of injection molded plastics for casings, connectors, and structural components.

One key example is the smartphone industry in India, which is among the fastest growing in the world. According to the India Cellular and Electronics Association (ICEA), mobile phone production in India has experienced remarkable growth, achieving a compound annual growth rate (CAGR) of 40.76% between 2015 and 2024. In the financial year 2024, the industry reached a significant milestone, with a valuation of USD 49.55 billion (Rs. 4,10,000 crore).

The Indian pharmaceutical sector, a key pillar of the healthcare industry, also plays a vital role in driving the demand for injection-molded plastics. India is one of the largest producers of generic drugs and exports to over 200 countries. To meet international standards, pharmaceutical manufacturers rely heavily on injection-molded plastic packaging for maintaining the sterility and integrity of drugs. The adoption of pre-filled syringes and tamper-proof plastic caps for vials is a testament to the growing integration of injection-molded plastics in this segment.

Moreover, the rise in medical tourism in India, fueled by affordable healthcare services and advanced medical facilities, has further amplified the demand for injection-molded plastic products. According to India Tourism Statistics, India's medical tourism market was valued at USD 7.69 billion in 2024 and is projected to grow to USD 14.31 billion by 2029. In 2023, approximately 634,561 foreign tourists sought medical treatment in India, accounting for nearly 6.87% of the total international visitors to the country. The Medical Value Travel (MVT) segment is estimated to be worth between USD 5-6 billion, with around 500,000 international patients visiting annually for various medical services.

Raw Material Insights

Polyethylene (PE) led the India injection molded plastic industry and recorded the largest revenue share of over 18.0% in 2024. Polyethylene, a family of polymers including HDPE and LDPE, is one of the most widely used plastics. It is flexible, durable, and resistant to moisture and chemicals. Applications include packaging, agricultural films, and consumer goods.

Polypropylene (PP) is a thermoplastic polymer widely used in injection molding due to its excellent chemical resistance, low cost, and versatility. It offers high impact resistance, low moisture absorption, and excellent fatigue resistance, making it suitable for a variety of applications such as automotive parts, packaging, and consumer goods.

ABS is a tough and impact-resistant plastic known for its rigidity and excellent surface finish. It is commonly used in automotive components, consumer electronics, toys (e.g., LEGO bricks), and household appliances. Its ease of processing and ability to be electroplated or painted make it highly desirable.

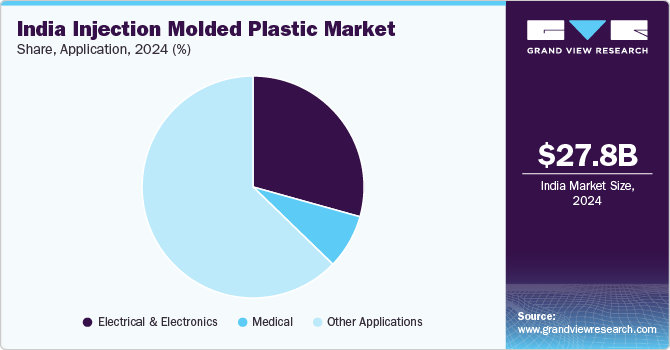

Application Insights

The electronics and electrical segment recorded a revenue share of over 29.0% in 2024. Injection molded plastics are extensively used in the electrical and electronics (E&E) industry in India due to their ability to provide excellent insulation, lightweight properties, and design flexibility. They are commonly utilized in the production of housing for electronic devices, connectors, switches, and other small components that require precise dimensions and durability. The growth of India's consumer electronics market, fueled by increasing urbanization, rising disposable incomes, and government initiatives like “Make in India,” is driving demand for injection molded plastics in this segment.

In the medical sector, injection molded plastics are used for manufacturing syringes, surgical instruments, diagnostic devices, and packaging for pharmaceuticals. The ability of these plastics to meet stringent hygiene and sterilization requirements makes them a preferred choice for medical applications. The growing healthcare sector in India, rising awareness of hygiene, and the increasing use of disposable medical devices are key drivers for injection molded plastics in this segment.

The other applications dominated the application segment by registering the largest revenue share of over 62.0% in 2024. This segment includes diverse uses of injection-molded plastics in sectors such as automotive, packaging, construction, and consumer goods. In automotive, they are employed in the production of lightweight parts, while in construction, they are used for piping and insulation materials. Similarly, the consumer goods sector utilizes injection-molded plastics for products such as toys, household items, and furniture components.

Key India Injection Molded Plastic Company Insights

The competitive environment of the India injection molded plastic industry is characterized by the presence of both multinational corporations and local players competing across a variety of end-use industries such as automotive, packaging, construction, electronics, and healthcare. Prominent players dominate the domestic market, leveraging economies of scale, diversified product portfolios, and strong distribution networks.

-

In December 2024, Pricol Limited announced its plans to acquire the injection molding business of Sundaram Auto Components Ltd (SACL) for INR 215.3 crore (USD 24.85 million). This acquisition will be carried out through Pricol's wholly owned subsidiary, Pricol Precision Products Pvt Ltd, and is expected to increase Pricol's revenue by approximately INR 730.0 crore (USD 84.25 million), leveraging SACL's strong financial performance and market presence.

-

In September 2024, Rosti Group, a global plastics injection molding company, announced the opening of a new facility in Chennai, India, as part of its strategy to expand its manufacturing presence in Asia. This move follows a long-term cooperation agreement with an existing major customer, aimed at enhancing precision and supply chain security.

Key India Injection Molded Plastic Companies:

- Veejay Plastic Injection Molding Company

- Primexplastic (Primex Plastics Pvt. Ltd.)

- Tooling Temple

- Micro Plastics Private Limited

- A.G Industries Pvt. Ltd.

- Rikki Plastic Pvt. Ltd.

- Innocorp Limited

- Sparrow Technologies Ltd.

- Magna International Inc.

- Berry Global Inc

India Injection Molded Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.12 billion

Revenue forecast in 2030

USD 38.13 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, application

Country scope

India

Key companies profiled

Veejay Plastic Injection Molding Company; Primexplastic (Primex Plastics Pvt. Ltd.); Tooling Temple; Micro Plastics Private Limited; A.G Industries Pvt. Ltd.; Rikki Plastic Pvt. Ltd.; Innocorp Limited; Sparrow Technologies Ltd; Magna International Inc.; Berry Global Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Injection Molded Plastic Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India injection molded plastic market report based on raw material and application:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

High-Density Polyethylene (HDPE)

-

Low-Density Polyethylene (LDPE)

-

Polystyrene (PS)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polyurethane (PU)

-

Polyether Ether Ketone (PEEK)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics

-

Dispenser

-

Laptops and Accessories

-

Electrical and Electronic Casings

-

Batteries

-

Air and Water Purifiers

-

Home Appliances

-

Electrical Lighting

-

Others

-

-

Medical

-

Prosthetics & Implants

-

Dialysis Machine

-

Surgical Instruments

-

Drug Delivery Systems

-

Medical Device Housings

-

Diagnostic Equipment Components

-

IV Components

-

Others

-

-

Other Applications

-

Frequently Asked Questions About This Report

b. The India injection molded plastic market size was estimated at USD 27.84 billion in 2024 and is expected to reach USD 29.12 billion in 2025.

b. The India injection molded plastic market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 38.13 billion by 2030.

b. Polyethylene dominated the India injection molded plastic market across the raw material segmentation in terms of revenue, accounting for a market share of over 18.0% in 2024.

b. Some key players operating in the India injection molded plastic market include Veejay Plastic Injection Molding Company; Primexplastic (Primex Plastics Pvt. Ltd.); Tooling Temple; Micro Plastics Private Limited; A.G Industries Pvt. Ltd.; Rikki Plastic Pvt. Ltd.; and Innocorp Limited

b. The India injection molded plastic market is driven by the booming packaging, automotive, and electronics sectors, fueled by rapid urbanization and rising consumer demand for lightweight, durable, and cost-effective materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.