- Home

- »

- Advanced Interior Materials

- »

-

Industrial Maintenance Services Market, Industry Report 2033GVR Report cover

![Industrial Maintenance Services Market Size, Share & Trends Report]()

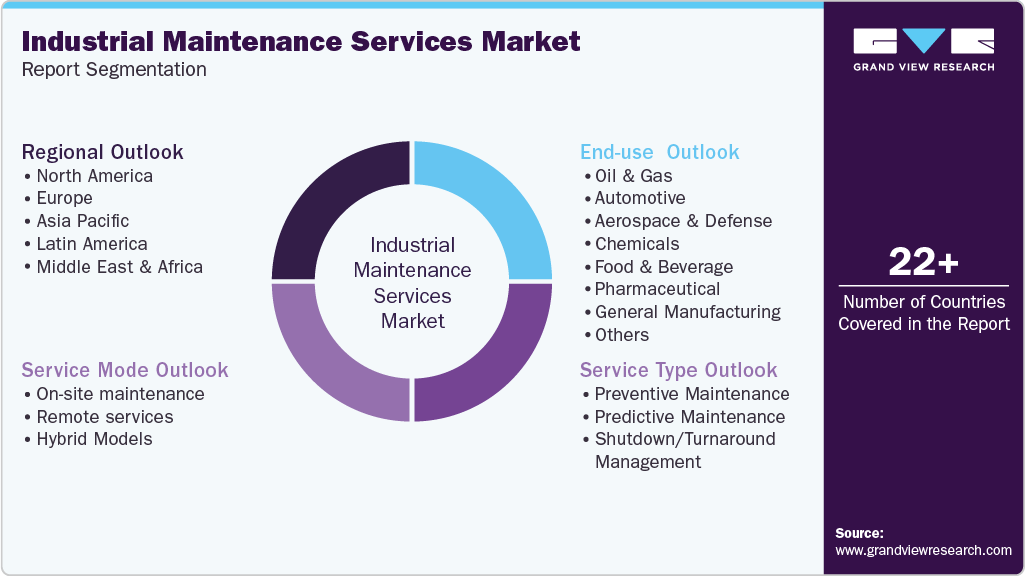

Industrial Maintenance Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Preventive Maintenance, Predictive Maintenance, Shutdown/Turnaround Management), By Service Mode (On-Site Maintenance, Remote Services, Hybrid Models), By End-use (Oil & Gas, Automotive, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-786-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Maintenance Services Market Summary

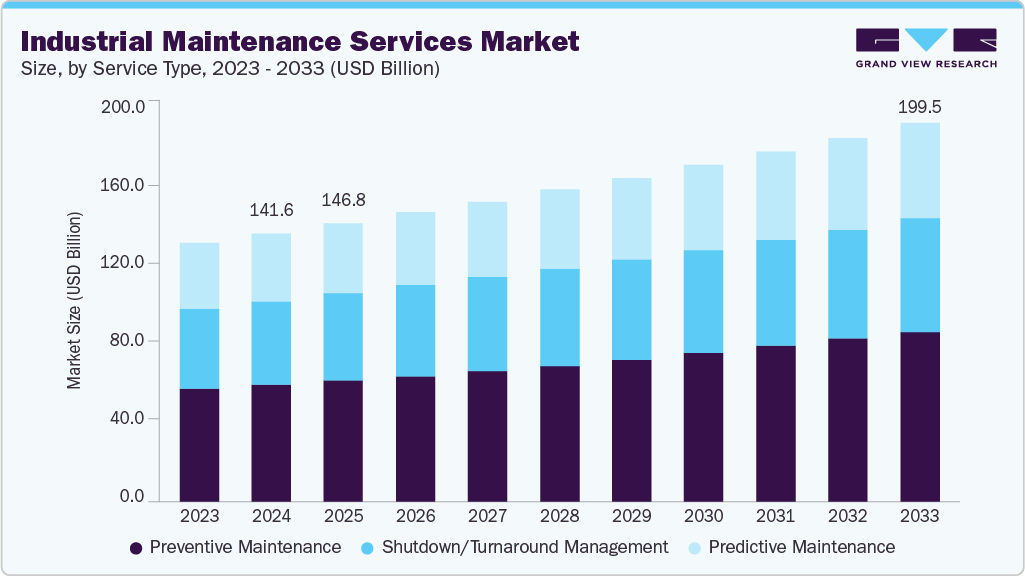

The global industrial maintenance services market size was estimated at USD 141.55 billion in 2024 and is projected to reach USD 199.45 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The increasing focus of the industries on equipment reliability, operational efficiency, and reduced downtime primarily drives the market growth.

Key Market Trends & Insights

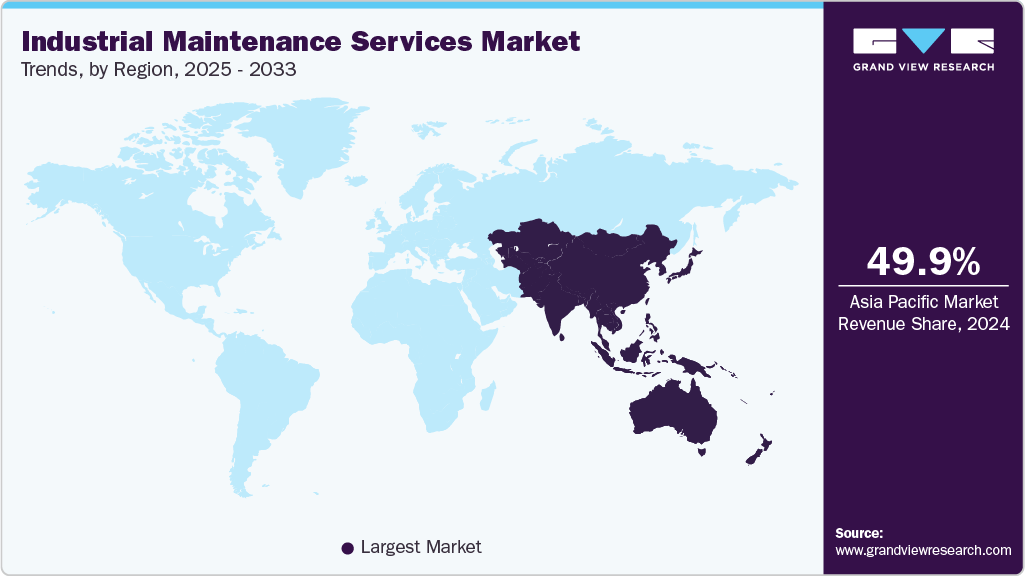

- Asia Pacific dominated the industrial maintenance services market with the largest revenue share of 49.9% in 2024.

- China’s industrial maintenance services market is growing swiftly, driven by the growth of its manufacturing and industrial sectors.

- By service type, the preventive maintenance segment held the dominant market share of 43.6% in 2024.

- By service mode, the on-site maintenance segment continues to dominate the industrial maintenance services industry with a share of 58.3% in 2024.

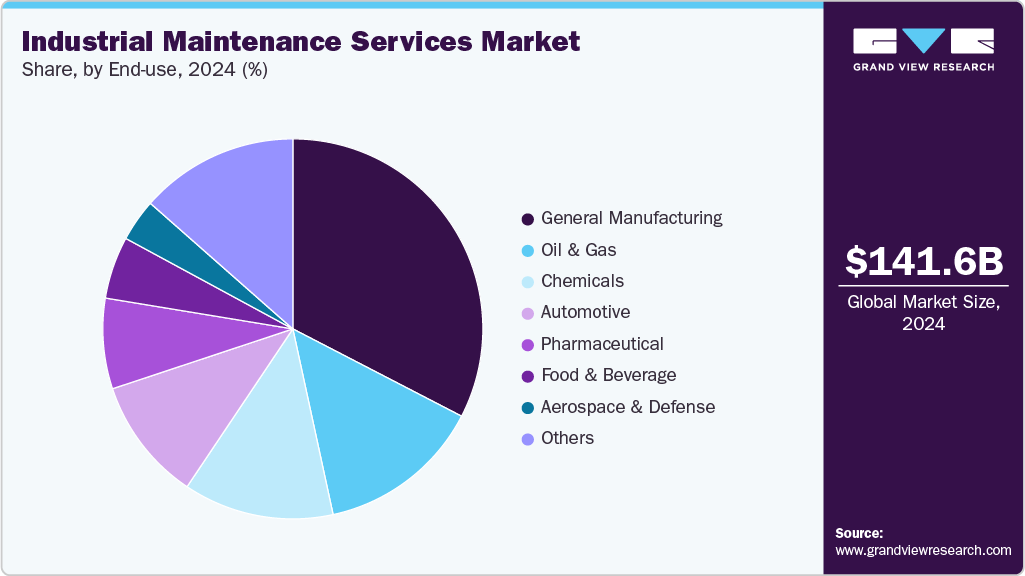

- By end-use, the general manufacturing sector dominates the industrial maintenance services market with a share of 32.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 141.55 Billion

- 2033 Projected Market Size: USD 199.45 Billion

- CAGR (2025-2033): 3.9%

- Asia Pacific: Largest market in 2024

The adoption of digital technologies such as IoT, AI, and predictive analytics is transforming maintenance from reactive to preventive and predictive approaches. These technologies enable real-time monitoring, early fault detection, and optimized maintenance scheduling, minimizing costly disruptions. Rising industrial automation and the need to extend asset life are further driving demand for advanced maintenance services.

Additionally, growing investments in manufacturing, energy, and infrastructure sectors, along with stricter safety and regulatory requirements, are encouraging companies to outsource maintenance operations to specialized service providers. Emerging economies are also playing a key role, with expanding industrial bases creating a greater need for skilled maintenance solutions.

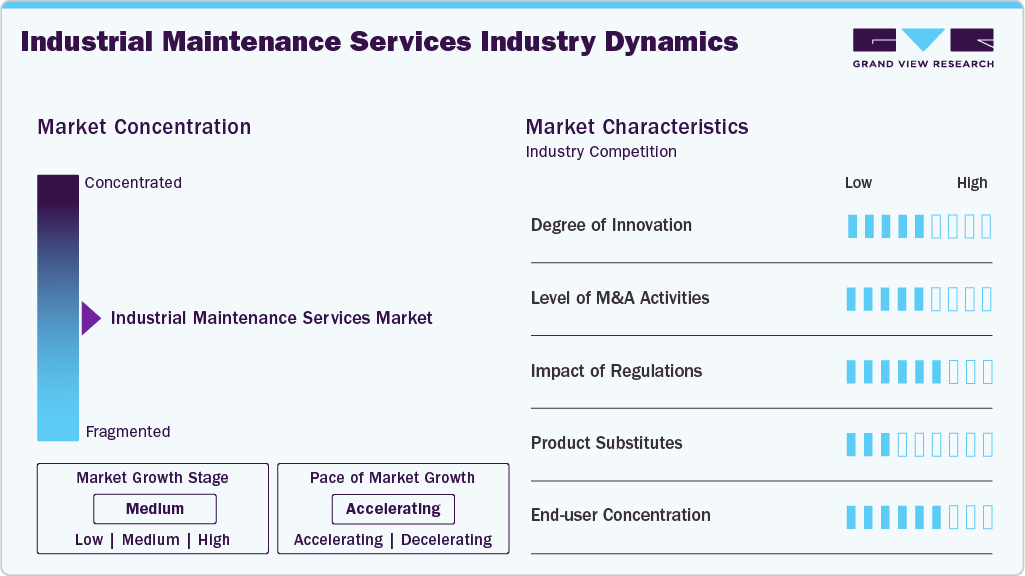

Market Concentration & Characteristics

The global industrial maintenance services industry is moderately fragmented, with numerous regional and international players offering diverse solutions. While a few large companies dominate through broad service portfolios and advanced technologies, many smaller firms cater to niche industries and localized needs. This mix creates healthy competition, encouraging innovation and cost-effective solutions. Market fragmentation also results from varying regional regulations, customer requirements, and technological adoption levels, giving both established providers and emerging specialists opportunities to expand their presence.

The industrial maintenance services market is witnessing significant innovation driven by digital transformation. Technologies such as IoT, AI, machine learning, and predictive analytics are enabling condition-based maintenance and real-time monitoring. Automation, robotics, and cloud-based maintenance platforms are improving accuracy, reducing downtime, and enhancing asset management efficiency. These innovations are reshaping traditional maintenance practices, making them more data-driven, proactive, and cost-efficient across industries like manufacturing, energy, and infrastructure.

Mergers and acquisitions in the market are driven by the need to expand service portfolios, enhance technological capabilities, and strengthen regional presence. Large players are acquiring specialized maintenance firms to integrate predictive maintenance, automation, and digital monitoring solutions. These strategic moves help companies gain a competitive advantage, diversify customer bases, and enter new markets. The consolidation trend also fosters collaboration, innovation, and operational efficiency across the global industrial service landscape.

Government regulations and industry standards play a crucial role in shaping the market for industrial maintenance services. Stricter safety, environmental, and operational compliance requirements compel industries to adopt preventive and condition-based maintenance strategies. Regulations related to equipment safety, emissions control, and workplace health drive demand for certified maintenance providers. Additionally, adherence to ISO and OSHA standards encourages companies to invest in advanced, compliant maintenance practices that ensure reliability, safety, and sustainability.

Drivers, Opportunities & Restraints

A key driver for the industrial maintenance services industry is the growing adoption of automation and advanced machinery across industries. As equipment becomes more complex, the need for regular maintenance to ensure reliability and minimize downtime increases. Companies are focusing on preventive and predictive maintenance strategies to enhance productivity, extend asset life, and comply with stringent safety and performance standards, fueling steady market growth worldwide.

An emerging opportunity in the market lies in the integration of digital technologies such as IoT, AI, and data analytics. These innovations enable predictive maintenance, remote monitoring, and real-time performance optimization. Service providers can leverage these tools to offer smarter, data-driven maintenance solutions that improve efficiency, reduce costs, and create long-term partnerships with clients, particularly in industries undergoing digital transformation and sustainability initiatives.

A major challenge in the industrial maintenance services market is the shortage of skilled technicians capable of managing advanced, technology-driven maintenance systems. As industries adopt IoT-based and AI-enabled maintenance solutions, the demand for workers proficient in both mechanical and digital systems is rising. This skill gap limits the effective implementation of modern maintenance practices, leading to potential inefficiencies, increased downtime, and higher operational costs for industrial operators.

Service Type Insights

The preventive maintenance segment held the dominant market share of 43.6% in 2024, as industries prioritize reducing equipment downtime and extending asset life. Regular inspection and scheduled servicing help prevent costly breakdowns and maintain operational efficiency. Companies are increasingly adopting preventive maintenance to comply with safety standards and minimize unplanned outages.

Predictive maintenance segment is expected to grow at a considerable CAGR of 3.8% from 2025 to 2033 in terms of revenue. The predictive maintenance segment is growing due to advancements in IoT, AI, and data analytics. These technologies enable real-time monitoring and early detection of equipment failures, allowing maintenance to be performed only when necessary. This approach helps optimize resource use, reduce maintenance costs, and increase equipment uptime. As industries digitize operations, predictive maintenance is becoming essential for achieving higher productivity and operational efficiency.

Service Mode Insights

The on-site maintenance segment continues to dominate the industrial maintenance services industry with a share of 58.3% in 2024. On-site services enable technicians to address equipment issues directly at the facility, ensuring faster problem resolution and continuous production. Increasing industrial automation and complex machinery require skilled, on-location support. This hands-on approach is particularly valuable in manufacturing, oil and gas, and energy sectors where equipment reliability isessential.

The hybrid models segment is expected to grow at a considerable CAGR of 4.8% from 2025 to 2033 in terms of revenue, combining on-site support with remote monitoring and predictive analytics. This model leverages digital tools like IoT sensors and cloud platforms to detect issues early, while technicians perform targeted maintenance when needed. The approach reduces costs, enhances efficiency, and allows flexible service delivery. As industries embrace digital transformation, hybrid models are becoming a preferred choice for smart, data-driven maintenance strategies.

End-use Insights

The general manufacturing sector dominates the industrial maintenance services market with a share of 32.6% in 2024, due to rising automation, production expansion, and the need to maintain equipment efficiency. Manufacturers are increasingly investing in maintenance services to reduce downtime, improve productivity, and extend machinery lifespan. As factories adopt smart manufacturing and digital tools, demand for both preventive and predictive maintenance solutions will rise, ensuring consistent output and compliance with safety and quality standards.

The aerospace & defense segment is expected to grow at a significant CAGR of 6.2% from 2025 to 2033 in terms of revenue, as maintenance requirements for complex and high-precision equipment become more critical. Strict regulatory and safety standards drive continuous servicing, inspection, and monitoring of aircraft, defense systems, and manufacturing assets. The adoption of advanced diagnostics, predictive analytics, and digital maintenance platforms enhances reliability and operational readiness. Increased defense spending and aircraft production further support sustained demand for specialized maintenance services.

Regional Insights

The Asia Pacific industrial maintenance services industry accounted for a revenue share of 49.9% in 2024, due to expanding industrialization and infrastructure development. Countries across the region are adopting preventive and predictive maintenance strategies to ensure efficiency and minimize downtime. Increasing use of automation, robotics, and digital maintenance platforms supports operational improvements. Growing investment in manufacturing, energy, and process industries continues to fuel service demand across the region.

China’s industrial maintenance services market is growing swiftly, driven by the growth of its manufacturing and industrial sectors. As production facilities adopt automation and smart technologies, the need for advanced maintenance solutions is increasing. Companies are focusing on predictive maintenance to enhance productivity and reduce equipment failures. Government initiatives promoting industrial efficiency and environmental compliance are further supporting the adoption of modern maintenance services.

The industrial maintenance services market in India is growing as rapid industrialization and infrastructure expansion increase the need for reliable maintenance practices. Manufacturing, power, and chemical industries are adopting preventive and predictive maintenance to reduce unplanned downtime and extend equipment lifespan. The rise of digital technologies, government initiatives for industrial modernization, and foreign investments are further boosting the adoption of professional maintenance services across diverse sectors.

North America Industrial Maintenance Services Market Trends

The North America industrial maintenance services market is expected to grow at a CAGR of 2.3% over the forecast period, due to widespread industrial automation and a focus on operational efficiency. The region’s mature manufacturing, oil and gas, and energy sectors are investing in predictive and preventive maintenance solutions. Increasing adoption of digital technologies, such as IoT and analytics, supports data-driven maintenance practices, reducing downtime and improving asset performance across industrial facilities.

U.S. Industrial Maintenance Services Market Trends

The U.S. industrial maintenance services industry is experiencing strong growth as industries modernize operations and prioritize equipment reliability. Advanced manufacturing, power generation, and aerospace sectors are driving demand for predictive and condition-based maintenance solutions. The growing use of smart sensors, automation, and analytics enables proactive servicing, minimizing production disruptions and enhancing efficiency. Strong regulatory standards and workforce safety initiatives further encourage investment in maintenance services.

Mexico’s industrial maintenance services market is growing with the expansion of the manufacturing, automotive, and energy sectors. As industrialization accelerates, companies are investing in regular maintenance to improve productivity and extend equipment life. The integration of digital maintenance tools and increased foreign investment in industrial facilities are supporting service demand. Local service providers are also collaborating with global firms to enhance technical capabilities and meet evolving maintenance requirements.

Europe Industrial Maintenance Services Market Trends

Europe’s industrial maintenance services industry is growing rapidly, driven by aging industrial infrastructure and strict regulatory standards for operational safety. Manufacturers and energy companies are adopting predictive and preventive maintenance to reduce equipment failures and improve efficiency. The region’s focus on sustainability and digital transformation is encouraging the use of smart maintenance systems that optimize resource use and ensure compliance with environmental regulations.

Germany’s industrial maintenance services market is growing due to its strong manufacturing and engineering base. The country’s focus on Industry 4.0 and smart factories has accelerated the adoption of predictive maintenance technologies. Companies are integrating IoT, automation, and data analytics to enhance equipment reliability and reduce downtime. Additionally, Germany’s emphasis on energy efficiency and operational excellence supports ongoing investments in advanced maintenance practices.

The industrial maintenance services market in the UK is growing due to modernization in the manufacturing, energy, and infrastructure sectors. The transition toward digital and automated operations is driving demand for predictive and condition-based maintenance. Companies are focusing on minimizing operational costs and improving reliability through technology integration.

Middle East & Africa Industrial Maintenance Services Market Trends

The industrial maintenance services industry in the Middle East and Africa is emerging due to increased industrialization and infrastructure investment. Oil and gas, power generation, and manufacturing sectors are key drivers of service demand. Companies are adopting preventive and condition-based maintenance to improve efficiency and safety. Growing awareness of digital solutions and sustainability practices is also influencing maintenance strategies in the region.

Saudi Arabia’s industrial maintenance services market is growing as part of its broader economic diversification and industrial development goals. Expanding petrochemical, energy, and manufacturing sectors are driving demand for maintenance services to ensure continuous operation. Companies are adopting predictive and preventive maintenance supported by digital tools to improve reliability and safety. Ongoing infrastructure and industrial projects further contribute to market growth in the country.

Latin America Industrial Maintenance Services Market Trends

Latin America’s industrial maintenance services industry is expanding with growing investments in manufacturing, energy, and mining. Companies are focusing on improving operational efficiency and minimizing production losses through regular maintenance. The adoption of digital maintenance tools is gradually increasing as industries modernize. Economic recovery, industrial automation, and regional infrastructure projects are driving greater demand for reliable and cost-effective maintenance services.

Brazil’s industrial maintenance services market is growing, supported by strong activity in manufacturing, oil and gas, and mining sectors. Industries are investing in preventive and predictive maintenance to improve equipment uptime and reduce costs. The modernization of production facilities and the adoption of automation technologies are enhancing demand for specialized maintenance solutions. Government focus on industrial development further supports market expansion.

Key Industrial Maintenance Services Company Insights

Some of the key players operating in the market include Siemens AG, Flowserve Corporation, and Schneider Electric SE.

-

Siemens AG is a technology company headquartered in Munich. It specializes in automation, electrification, and digitalization, offering products and services across energy, healthcare, and infrastructure sectors. Siemens focuses on innovation and sustainability to support industrial transformation and improve efficiency in various industries worldwide.

-

Flowserve Corporation, based in Irving, Texas, provides flow control products and services, including pumps, valves, seals, and automation solutions. It serves industries such as oil and gas, chemicals, and power generation, emphasizing performance optimization and risk reduction to help clients improve operational efficiency and reliability.

Key Industrial Maintenance Services Companies:

The following are the leading companies in the industrial maintenance services market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- General Electric Company

- SKF Group

- Parker‑Hannifin Corporation

- Metso Outotec

- Wärtsilä Corporation

- Flowserve Corporation

- Petrofac Limited

- Bilfinger SE

Recent Developments

-

In March 2025, Siemens expanded its Industrial Copilot with new generative AI technology. This AI-powered solution supports all stages of the maintenance cycle, helping industries move beyond traditional methods by improving predictive capabilities, optimizing maintenance schedules, and enhancing decision-making for better operational efficiency.

-

In March 2025, ABB launched My Measurement Assistant+, an AI-powered digital tool for maintaining and troubleshooting industrial measurement devices. It combines generative AI, cloud computing, and AR to provide unified access to data, diagnostics, and remote support, enhancing operational efficiency.

Industrial Maintenance Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 146.84 billion

Revenue forecast in 2033

USD 199.45 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, service mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Siemens AG; ABB Ltd.; Schneider Electric SE; Honeywell International Inc.; Emerson Electric Co.; Rockwell Automation, Inc.; Mitsubishi Electric Corporation; General Electric Company; SKF Group; Parker‑Hannifin Corporation; Metso Outotec; Wärtsilä Corporation; Flowserve Corporation; Petrofac Limited; Bilfinger SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Maintenance Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial maintenance services market report based on service type, service mode, end-use, and region:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Preventive Maintenance

-

Predictive Maintenance

-

Shutdown / Turnaround Management

-

-

Service Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-site maintenance

-

Remote services

-

Hybrid Models

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Automotive

-

Aerospace & Defense

-

Chemicals

-

Food & Beverage

-

Pharmaceutical

-

General Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.