- Home

- »

- Plastics, Polymers & Resins

- »

-

Injection Molded Plastic Market Size And Share Report, 2023GVR Report cover

![Injection Molded Plastic Market Size, Share & Trends Report]()

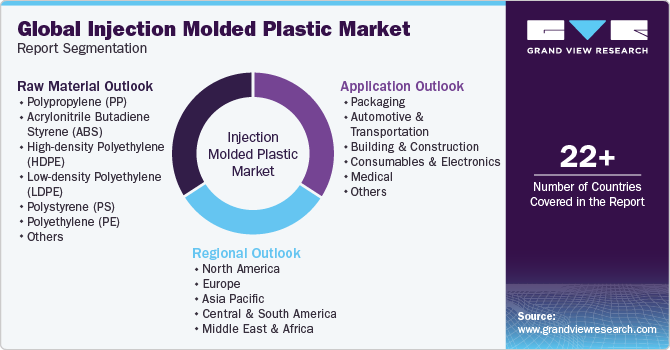

Injection Molded Plastic Market Size, Share & Trends Analysis Report By Raw Material (PP, ABS, HDPE, LDPE, PS, PE, PVC, PET, PU, PEEK), By Application (Packaging, Building & Construction, Automotive & Transportation, Electrical & Electronics, Medical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-128-3

- Number of Pages: 134

- Format: Electronic (PDF)

- Historical Range: 2019 - 2023

- Industry: Bulk Chemicals

Injection Molded Plastic Market Trends

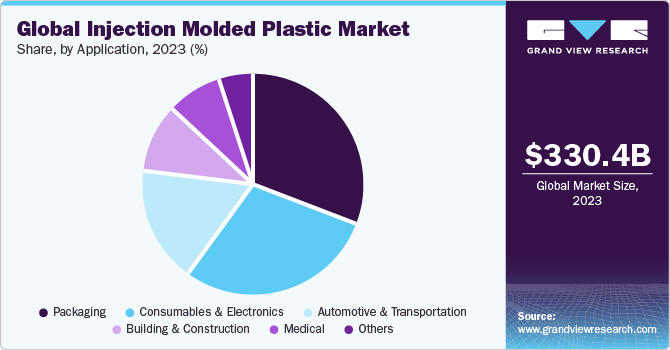

The global injection molded plastic market size was estimated at USD 330. 41 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030. Growing demand for plastic components from various end-use industries including automotive, packaging, home appliances, electrical and electronics, and medical devices is anticipated to drive the growth. Modern advancements that reduce the rate of defective production have increased the usage of injection molded technology in the mass production of complex plastic shapes, which is expected to boost the injection molded plastic market growth over the forecast period.

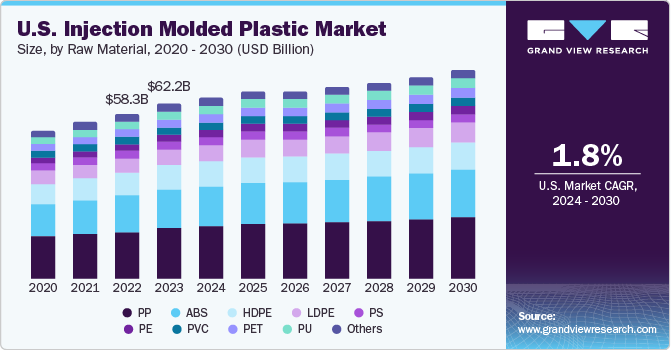

The U.S. market growth is expected to be driven by demand in automotive, medical, and building & construction applications. Increasing electronic appliances such as microwave ovens, washing machines, and refrigerators demand in the U.S. is expected to fuel North America’s injection molded plastics market over the forecast period. The segment accounted for a volume share of 81.7% in overall U.S. injection molded plastics market demand.

With rapid developments in automotive technologies, conventional plastics are being increasingly replaced by high-performance materials, including thermoplastic elastomers having properties of both plastic and rubber and lesser weight as compared to steel and other plastic materials. The demand for injection molded plastic parts in the country is majorly generated from the expanding automotive industry and the rise in the number of construction activities. The U.S. has witnessed a massive growth in automobile production in the recent past.

Injection molded plastics market prices are highly influenced by factors such as production volume, technologies, regulatory requirements, labor costs, currency fluctuations, elasticity of demand & supply, and raw materials trade-related tariffs. Since 2023, various geopolitical conflicts in Eastern Europe, Western Asia and Horn of Africa have strained routes of shipping, thereby increasing freight costs, which in turn have added to soaring Injection Molded Plastics prices.

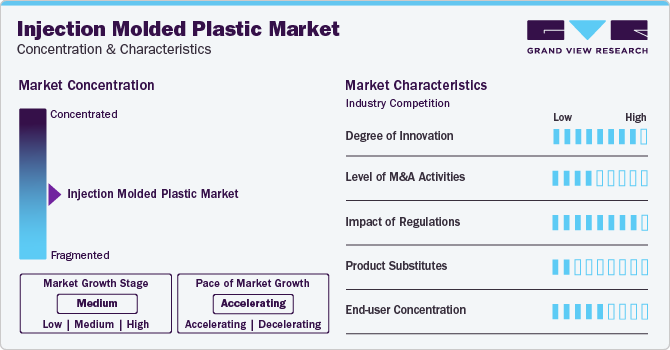

Market Concentration & Characteristics

Market growth is driven by rising investments in the packaging and automotive sector. This leads end-users to spend increasingly on food & beverage packaging for several applications including processed foods, pet foods, bottled water, and tea.

With growing demand patterns, automotive companies such as Fiat Automobiles S.p.A. and Toyota Boshoku Corporation are increasing their production capacities. Moreover, the industry is largely characterized by dominance of regional players, leading within their respective regional markets.

Automobile manufacturers are focusing on reducing vehicle weight in order to enhance fuel efficiency. The increasing usage of plastics to replace metals and alloys in automotive components is predicted to boost product demand in the automobile end-use segment, offering huge opportunities for injection-molded plastics to enter the market.

In addition, injection molding manufacturers are largely supported by their local governments in the form of subsidies, specialized policies for clearances, and other economic incentives, as injection molding offers toughness, stiffness, and strength to the product. For example, in October 2023, IPEX announced the opening of an innovative plastics manufacturing facility in Pineville, North Carolina. The new 200,000-square-foot cutting-edge facility has entirely electric injection molding machines, proprietary automation, cloud connection, and industry-leading health and safety standards. The plant will greatly boost IPEX's US manufacturing capacity for plumbing, electrical, industrial, and municipal fittings.

Raw Material Insights

The polypropylene segment held the largest share of over 20% in 2023 owing to its increasing consumption in automotive components, household goods, and packaging applications. Growing demand for injection molded plastics types including polypropylene finished products penetration in protective caps in electrical contacts and battery housings, food packaging is anticipated to further drive its demand over the forecast period. Polypropylene components are widely used in food packaging and electrical contacts due to corrosion resistance and electrical insulation properties respectively. On account of the aforementioned factors, the segment is expected to witness the highest growth over the forecast period.

Moreover, acrylonitrile butadiene styrene (ABS) emerged as the second most common injection molded plastic in terms of the overall revenue share in 2023. Rising acrylonitrile butadiene styrene component demand in medical devices, automotive components, electronic housings, and consumer appliance manufacturing is expected to drive its growth over the forecast period. Superior product properties, such as strength and durability is anticipated to drive demand over forecast period. The product finds applications in the household appliances, automobile parts, tools, and medical devices industries.

Application Insights

The packaging segment dominated t.he market and accounted for the largest revenue share of 32% in 2023. The finished products used in packaging undergo various development phases to meet regulatory guidelines and end-user requirements. A few requirements plastics need to meet for packaging application are increased shelf life of food products, better performance toward wear, and tear, and durability.

Growth of electronics industry coupled with the cost effective availability of electrical appliances is expected to remain a key driving factor for injection molded plastics for the next seven years. Injection molded plastics are lightweight, durable and cost-effectively used in myriad applications such as coffee makers, irons, mixers, hair dryers and electric shavers.

Moreover, injection molded plastics hold immense potential in the medical and automotive industries. The industry is expected to witness the highest growth in the medical devices & components sector. Optical clarity, biocompatibility, and cost-effective methods of production are expected to drive the demand in the medical industry.

Regional Insights

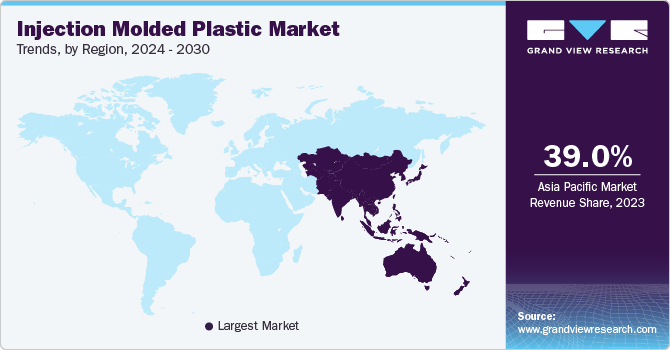

Asia Pacific dominated the market and held a revenue share of over 39.0% in 2023. Increasing infrastructure spending coupled with growing automobile demand in countries such as China, India, Indonesia, and Malaysia is expected to drive market penetration in the region.

Primary end–use industries such as electronics and automobile are shifting their manufacturing base to Asia Pacific countries such as India, Thailand, and Indonesia owing to low labor costs. Government incentives in the form of tax benefits are offered to manufacturers in these regions. This factor increases the requirement for manufacturing various automotive and electrical parts, which in turn is expected to increase injection molded plastics demand over the forecast period.

Europe is anticipated to witness significant growth in the artificial intelligence market. Growth in automotive production, high standard of living, and growing population significantly contribute to growth for injection molded plastics in Europe. Well-developed infrastructure and renowned automakers, including Fiat, BMW, and Volkswagen, are propelling the development of the automotive market in this region, which creates the application scope of injection molded plastics in this region.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In April 2023, Nexa3D acquired Addifab, the parent company of Freeform Injection Molding. The acquisition strengthens the ability of Addifab's high-temperature soluble and high-impact resins to be used in conjunction with Nexa3D's ultrafast 3D printers to produce advanced tools that can be used with any type of injection molding feedstock.

-

In March 2023, ABC Technologies Holdings Inc. acquired WMG Technologies for a sum of USD 165 million. ABC Technologies Holdings Inc. offers products to its clients in three categories: fluids, HVAC, outside systems, interior systems, and others. Likewise, WMGT supplies sophisticated tooling for injection-molded exterior and interior parts, lighting molds, and optic inserts to significant global automotive OEMs at tier-1 and tier-2 levels. Additionally, it offers a wide range of other outside goods.

Key Injection Molded Plastics Companies:

- ExxonMobil Corporation

- BASF SE

- DuPont de Nemours, Inc.

- Dow, Inc.

- Huntsman International LLC.

- Eastman Chemical Company

- INEOS Group

- LyondellBasell Industries Holdings B.V.

- SABIC

- Magna International, Inc.

- IAC Group

- Berry Global, Inc.

- Master Molded Products Corporation

- HTI Plastics Inc.

- Rutland Plastics

- AptarGroup, Inc.

- LACKS ENTERPRISES, INC.

- The Rodon Group

- Heppner Molds

Injection Molded Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 345.78 billion

Revenue forecast in 2030

USD 423.75 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Malaysia; Indonesia; Australia; New Zealand; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ExxonMobil Corporation; BASF SE; DuPont de Nemours, Inc.; Dow, Inc.; Huntsman International LLC.; Eastman Chemical Company; INEOS Group; LyondellBasell Industries Holdings B.V.; SABIC; Magna International, Inc.; IAC Group; Berry Global, Inc.; Master Molded Products Corporation; HTI Plastics Inc.; Rutland Plastics; AptarGroup, Inc.; LACKS ENTERPRISES, INC.; The Rodon Group; Heppner Molds

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Injection Molded Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Injection Molded Plastics Market report based on raw material, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

High-density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Polystyrene (PS)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polyurethane (PU)

-

Polyether Ether Ketone (PEEK)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Packaging

-

Automotive & Transportation

-

Building & Construction

-

Consumables & Electronics

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

South Korea

-

Malaysia

-

Indonesia

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global injection molded plastic market size was estimated at USD 303.7 billion in 2022 and is expected to reach USD 330.4 billion in 2023.

b. The global injection molded plastic market is expected to grow at a compound annual growth rate of 3.6% from 2023 to 2030 to reach USD 423.7 billion by 2030.

b. The polypropylene raw material dominated the injection molded plastic market and accounted for the largest revenue share of 34.5% in 2022, owing to its increasing consumption in automotive components, household goods, and packaging applications.

b. The packaging application segment dominated the market for injection molded plastics and accounted for the largest revenue share of 30.5% in 2022.

b. Asia Pacific dominated the injection molded plastic market with a share of 39.4% in 2022. This is attributable to the increasing infrastructure spending and growing automobile demand in countries such as China, India, Japan, and South Korea.

b. Some key players operating in the injection molded plastics market include LyondellBasell; SABIC; Eastman Chemical Company; Huntsman; BASF SE, Ineos Group; and DuPont.

Table of Contents

Chapter 1. Injection Molded Plastic Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Injection Molded Plastic Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Injection Molded Plastics Market: Variables, Trends & Scope

3.1. Global Injection Molded Plastics Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Injection Molded Plastics Market: Raw Material Outlook Estimates & Forecasts

4.1. Injection Molded Plastics Market: Raw Material Movement Analysis, 2023 & 2030

4.2. Polypropylene

4.2.1. Market estimates and forecast, 2019 - 2030, (Kilotons) (USD Million)

4.3. Acrylonitrile Butadiene Styrene (ABS)

4.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.4. High Density Polyethylene (HDPE)

4.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.5. Low Density Polyethylene (LDPE)

4.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.6. Polystyrene (PS)

4.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.7. Polyethylene (PE)

4.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.8. Polyvinyl Chloride (PVC)

4.8.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.9. Polyethylene Terephthalate (PET)

4.9.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.10. Polyurethane (PU)

4.10.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.11. Polyether Ether Ketone (PEEK)

4.11.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

4.12. Others

4.12.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

Chapter 5. Injection Molded Plastics Market: Application Outlook Estimates & Forecasts

5.1. Injection Molded Plastics Market: Application Movement Analysis, 2023 & 2030

5.2. Packaging

5.2.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

5.3. Building & Construction

5.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

5.4. Automotive & Transportation

5.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

5.5. Consumables & Electronics

5.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

5.6. Medical

5.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

5.7. Others

5.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

Chapter 6. Injection Molded Plastics Market Regional Outlook Estimates & Forecasts

6.1. Regional Snapshot

6.2. Injection Molded Plastics Market: Regional Movement Analysis, 2023 & 2030

6.3. North America

6.3.1. Market estimates and forecast, 2019 - 2030, (Kilotons) (USD Million)

6.3.2. Market estimates and forecast, by raw material, 2019 - 2030, (Kilotons) (USD Million)

6.3.3. Market estimates and forecast, by application, 2019 - 2030, (Kilotons) (USD Million)

6.3.4. U.S.

6.3.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.3.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.3.4.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.3.5. Canada

6.3.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.3.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.3.5.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.3.6. Mexico

6.3.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.3.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.3.6.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.4. Europe

6.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.2.1. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.2.2. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.4.3. Germany

6.4.3.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4.3.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.3.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.4.4. France

6.4.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.4.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.4.5. UK

6.4.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.5.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.4.6. Italy

6.4.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.6.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.4.7. Spain

6.4.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.4.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.4.7.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5. Asia Pacific

6.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.4. China

6.5.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.4.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.5. Japan

6.5.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.5.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.6. India

6.5.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.6.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.7. South Korea

6.5.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.7.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.8. Indonesia

6.5.8.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.8.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.8.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.9. Malaysia

6.5.9.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.9.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.9.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.10. Australia

6.5.10.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.10.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.10.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.5.11. New Zealand

6.5.11.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.5.11.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.5.11.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.6. Central & South America

6.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.6.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.6.4. Brazil

6.6.4.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.6.4.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.6.4.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.6.5. Argentina

6.6.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.6.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.6.5.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.7. Middle East & Africa

6.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.7.3. Market estimates and forecast, by product, 2019 - 2030 (USD Million) (Kilotons)

6.7.4. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.7.5. Saudi Arabia

6.7.5.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.7.5.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.7.5.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.7.6. UAE

6.7.6.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.7.6.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.7.6.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

6.7.7. South Africa

6.7.7.1. Market estimates and forecast, 2019 - 2030 (USD Million) (Kilotons)

6.7.7.2. Market estimates and forecast, by raw material, 2019 - 2030 (USD Million) (Kilotons)

6.7.7.3. Market estimates and forecast, by application, 2019 - 2030 (USD Million) (Kilotons)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Ranking

7.4. Heat Map Analysis

7.5. Market Strategies

7.6. Vendor Landscape

7.6.1. List of raw material supplier, key manufacturers, and distributors

7.6.2. List of prospective end-users

7.7. Strategy Mapping

7.8. Company Profiles/Listing

7.8.1. ExxonMobil Corporation

7.8.1.1. Company Overview

7.8.1.2. Financial Performance

7.8.1.3. Product Benchmarking

7.8.2. BASF SE

7.8.2.1. Company Overview

7.8.2.2. Financial Performance

7.8.2.3. Product Benchmarking

7.8.3. DuPont de Nemours, Inc.

7.8.3.1. Company Overview

7.8.3.2. Financial Performance

7.8.3.3. Product Benchmarking

7.8.4. Dow, Inc.

7.8.4.1. Company Overview

7.8.4.2. Financial Performance

7.8.4.3. Product Benchmarking

7.8.5. Huntsman International LLC.

7.8.5.1. Company Overview

7.8.5.2. Financial Performance

7.8.5.3. Product Benchmarking

7.8.6. Eastman Chemical Company

7.8.6.1. Company Overview

7.8.6.2. Financial Performance

7.8.6.3. Product Benchmarking

7.8.7. INEOS Group

7.8.7.1. Company Overview

7.8.7.2. Financial Performance

7.8.7.3. Product Benchmarking

7.8.8. LyondellBasell Industries Holdings B.V.

7.8.8.1. Company Overview

7.8.8.2. Financial Performance

7.8.8.3. Product Benchmarking

7.8.9. SABIC

7.8.9.1. Company Overview

7.8.9.2. Financial Performance

7.8.9.3. Product Benchmarking

7.8.10. Magna International, Inc.

7.8.10.1. Company Overview

7.8.10.2. Financial Performance

7.8.10.3. Product Benchmarking

7.8.11. IAC Group

7.8.11.1. Company Overview

7.8.11.2. Financial Performance

7.8.11.3. Product Benchmarking

7.8.12. Berry Global, Inc.

7.8.12.1. Company Overview

7.8.12.2. Financial Performance

7.8.12.3. Product Benchmarking

7.8.13. Master Molded Products Corporation

7.8.13.1. Company Overview

7.8.13.2. Financial Performance

7.8.13.3. Product Benchmarking

7.8.14. HTI Plastics Inc.

7.8.14.1. Company Overview

7.8.14.2. Financial Performance

7.8.14.3. Product Benchmarking

7.8.15. Rutland Plastics

7.8.15.1. Company Overview

7.8.15.2. Financial Performance

7.8.15.3. Product Benchmarking

7.8.16. AptarGroup, Inc.

7.8.16.1. Company Overview

7.8.16.2. Financial Performance

7.8.16.3. Product Benchmarking

7.8.17. LACKS ENTERPRISES, INC.

7.8.17.1. Company Overview

7.8.17.2. Financial Performance

7.8.17.3. Product Benchmarking

7.8.18. The Rodon Group

7.8.18.1. Company Overview

7.8.18.2. Financial Performance

7.8.18.3. Product Benchmarking

7.8.19. Heppner Molds

7.8.19.1. Company Overview

7.8.19.2. Financial Performance

7.8.19.3. Product Benchmarking

List of Tables

Table 1. Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (Kilotons)

Table 2. Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million)

Table 3. Polypropylene (PP) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 4. Acrylonitrile Butadiene Styrene (ABS) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 5. High-Density Polyethylene (HDPE) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 6. Low-Density Polyethylene (LDPE) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 7. Polyethylene (PE) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 8. Polyvinyl Chloride (PVC) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 9. Polyethylene Terephthalate (PET) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 10. Polyurethane (PU) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 11. Polyether ether ketone (PEEK) Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 12. Other Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 13. Injection Molded Plastics Market estimates and forecasts, by packaging, 2019 - 2030 (USD Million) (Kilotons)

Table 14. Injection Molded Plastics Market estimates and forecasts, by consumables & electronics, 2019 - 2030 (USD Million) (Kilotons)

Table 15. Injection Molded Plastics Market estimates and forecasts, by automotive & transportation, 2019 - 2030 (USD Million) (Kilotons)

Table 16. Injection Molded Plastics Market estimates and forecasts, in building & construction, 2019 - 2030 (USD Million) (Kilotons)

Table 17. Injection Molded Plastics Market estimates and forecasts, in medical, 2019 - 2030 (USD Million) (Kilotons)

Table 18. Injection Molded Plastics Market estimates and forecasts, in others, 2019 - 2030 (USD Million) (Kilotons)

Table 19. North America Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 20. North America Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 21. North America Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 22. North America Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 23. North America Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 24. U.S. Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 25. U.S. Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 26. U.S. Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 27. U.S. Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 28. U.S. Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 29. Canada Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 30. Canada Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 31. Canada Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 32. Canada Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 33. Canada Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 34. Mexico Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 35. Mexico Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 36. Mexico Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 37. Mexico Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 38. Mexico Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 39. Europe Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 40. Europe Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 41. Europe Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 42. Europe Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 43. Europe Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 44. Germany Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 45. Germany Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 46. Germany Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 47. Germany Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 48. Germany Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 49. France Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 50. France Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 51. France Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 52. France Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 53. France Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 54. U.K. Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 55. U.K. Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 56. U.K. Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 57. U.K. Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 58. U.K. Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 59. Italy Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 60. Italy Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 61. Italy Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 62. Italy Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 63. Spain Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 64. Spain Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 65. Spain Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 66. Spain Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 67. Spain Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 68. Asia Pacific Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 69. Asia Pacific Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 70. Asia Pacific Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 71. Asia Pacific Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 72. Asia Pacific Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 73. China Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 74. China Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 75. China Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 76. China Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 77. China Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 78. Japan Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 79. Japan Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 80. Japan Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 81. Japan Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 82. Japan Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 83. South Korea Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 84. South Korea Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 85. South Korea Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 86. South Korea Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 87. South Korea Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 88. India Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 89. India Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 90. India Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 91. India Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 92. India Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 93. Indonesia Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 94. Indonesia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 95. Indonesia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 96. Indonesia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 97. Indonesia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 98. Malaysia Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 99. Malaysia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 100. Malaysia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 101. Malaysia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 102. Malaysia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 103. Australia Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 104. Australia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 105. Australia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 106. Australia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 107. New Zealand Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 108. New Zealand Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 109. New Zealand Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 110. New Zealand Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 111. New Zealand Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 112. Central & South America Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 113. Central & South America Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 114. Central & South America Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 115. Central & South America Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 116. Central & South America Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 117. Brazil Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 118. Brazil Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 119. Brazil Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 120. Brazil Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 121. Argentina Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 122. Argentina Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 123. Argentina Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 124. Argentina Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 125. Argentina Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 126. Middle East & Africa Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 127. Middle East & Africa Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 128. Middle East & Africa Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 129. Middle East & Africa Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 130. Middle East & Africa Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 131. Saudi Arabia Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 132. Saudi Arabia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 133. Saudi Arabia Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 134. Saudi Arabia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 135. Saudi Arabia Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 136. UAE Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 137. UAE Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 138. UAE Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 139. UAE Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 140. UAE Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

Table 141. South Africa Injection Molded Plastics Market estimates and forecasts, 2019 - 2030 (USD Million) (Kilotons)

Table 142. South Africa Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (USD Million)

Table 143. South Africa Injection Molded Plastics Market estimates and forecasts, by raw material, 2019 - 2030 (Kilotons)

Table 144. South Africa Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 145. South Africa Injection Molded Plastics Market estimates and forecasts, by application, 2019 - 2030 (Kilotons)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market snapshot

Fig. 6 Segmental outlook- Raw Material, product, and application

Fig. 7 Competitive outlook

Fig. 8 Injection Molded Plastics Market, 2018-2030 (USD Million) (Kilotons)

Fig. 9 Value chain analysis

Fig. 10 Market dynamics

Fig. 11 Porter’s Analysis

Fig. 12 PESTEL Analysis

Fig. 13 Injection Molded Plastics Market, by raw material: Key takeaways

Fig. 14 Injection Molded Plastics Market, by raw material: Market share, 2023 & 2030

Fig. 15 Injection Molded Plastics Market, by application: Key takeaways

Fig. 16 Injection Molded Plastics Market, by application: Market share, 2023 & 2030

Fig. 17 Injection Molded Plastics Market, by region: Key takeaways

Fig. 18 Injection Molded Plastics Market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Injection Molded Plastics Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Injection Molded Plastics Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Injection Molded Plastics Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

- North America

- North America Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- North America Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- U.S.

- U.S. Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- U.S. Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- U.S. Injection Molded Plastics Market, By raw material

- Canada

- Canada Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Canada Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Mexico

- Mexico Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Mexico Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Mexico Injection Molded Plastics Market, By raw material

- North America Injection Molded Plastics Market, By raw material

- Europe

- Europe Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Europe Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Germany

- Germany Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Germany Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Germany Injection Molded Plastics Market, By raw material

- France

- France Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- France Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- U.K.

- U.K. Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- U.K. Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- U.K. Injection Molded Plastics Market, By raw material

- Italy

- Italy Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Italy Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Italy Injection Molded Plastics Market, By raw material

- Spain

- Spain Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Spain Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Spain Injection Molded Plastics Market, By raw material

- Europe Injection Molded Plastics Market, By raw material

- Asia Pacific

- Asia Pacific Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Asia Pacific Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- China

- China Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- China Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- China Injection Molded Plastics Market, By raw material

- South Korea

- South Korea Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- South Korea Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Japan

- Japan Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Japan Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Japan Injection Molded Plastics Market, By raw material

- India

- India Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- India Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Indonesia

- Indonesia Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Indonesia Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Indonesia Injection Molded Plastics Market, By raw material

- Malaysia

- Malaysia Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Malaysia Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Malaysia Injection Molded Plastics Market, By raw material

- Australia

- Australia Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Australia Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Australia Injection Molded Plastics Market, By raw material

- New Zealand

- New Zealand Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- New Zealand Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- New Zealand Injection Molded Plastics Market, By raw material

- India Injection Molded Plastics Market, By raw material

- Asia Pacific Injection Molded Plastics Market, By raw material

- Central & South America

- Central & South America Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Central & South America Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Brazil

- Brazil Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Brazil Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Brazil Injection Molded Plastics Market, By raw material

- Argentina

- Argentina Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Argentina Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Central & South America Injection Molded Plastics Market, By raw material

- Middle East & Africa

- Middle East & Africa Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Middle East & Africa Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Saudi Arabia

- Saudi Arabia Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- Saudi Arabia Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- Saudi Arabia Injection Molded Plastics Market, By raw material

- UAE

- UAE Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- UAE Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- South Africa

- South Africa Injection Molded Plastics Market, By raw material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

- South Africa Injection Molded Plastics Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

- South Africa Injection Molded Plastics Market, By raw material

- Middle East & Africa Injection Molded Plastics Market, By raw material

- North America

Injection Molded Plastic Market Dynamics

Driver: Increasing penetration in automotive applications

The growth of the injection-molded plastics industry is directly proportional to the growth of the automotive industry, and it is their dominating end-use segment. The growth in the automotive industry, particularly in the Asia Pacific region, has stabilized the global market and paved the way for the injection-molded plastics industry to grow. Furthermore, with rising technological innovations in automotive components, thermoplastic elastomers, and other injection-molded plastics, the automobile industry has developed new applications for the injection-molded plastics market. Moreover, the industry-wide need for lightweight materials has led toward plastic’s exploration as a viable alternative for the formerly used steel auto components. Consequently, the market is anticipated to grow further over the forecast period.

Driver: Growing construction spending in emerging markets

Injection molded plastics find applications in varied markets; however, it is primarily utilized in construction, packaging and automotive industries. This is attributed to the growing demand for injection molded products in these industries, specifically in the Asia Pacific and Latin America regions. In the building and construction industry, injection molded plastics have become a popular choice for applications such as flooring, roofing, insulation, walls, doors, and windows. Their use in this sector provides a cost-effective alternative to traditional materials.

China stands as a major player in the production and consumption of these plastics, with the global market’s expansion closely linked to China’s own industry growth. Factors such as rising income levels and an improving standard of living among China’s large and growing population further fuel this market growth. As living standards rise, so does the demand for quality construction materials like injection molded plastics. This trend is not only observed in China but is a global phenomenon, contributing to the overall growth of the injection molded plastics industry.

Restraint: Growing environmental concerns

While the global injection molded plastics market is growing, it faces significant challenges due to the environmental impact associated with its production. Plastics, derived from crude oil, emit substantial amounts of toxic gases during production and combustion, contributing to global carbon dioxide emissions. These emissions are on the rise, particularly in developing countries undergoing rapid industrialization.

China, a major player in the global market, is also one of the largest emitters of carbon dioxide. This is largely due to the country’s swift infrastructure development and industrialization, with industries such as construction, transportation, and chemicals expanding rapidly.

In 2020, developed countries like the U.S. managed to reduce their emissions, largely due to government environmental policies. However, China’s CO2 emissions reached a staggering 10.32 billion tons in 2012, accounting for nearly 29% of global emissions.

In response to these environmental concerns, the International Energy Agency (IEA) has recommended using coal as a feedstock for petrochemicals instead of naphtha and natural gas, given its lower CO2 emissions. The IEA also advocates for countries to reduce fossil-fuel subsidies and adopt more energy-efficient production methods. These recommendations aim to mitigate the environmental impact of industries like injection molded plastics.

What Does This Report Include?

This section will provide insights into the contents included in this injection molded plastic market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Injection molded plastic market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Injection molded plastic market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the injection molded plastic market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for injection molded plastic market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of injection molded plastic market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Injection Molded Plastic Market Categorization:

The injection molded plastic market was categorized into three segments, namely raw material (Polypropylene, Acrylonitrile Butadiene Styrene, High-density Polyethylene, Low-density Polyethylene, Polystyrene, Polyethylene, Polyvinyl Chloride, Polyethylene Terephthalate, Polyurethane, Polyether Ether Ketone), application (Packaging, Automotive & Transportation, Building & Construction, Consumables & Electronics, Medical), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

Segment Market Methodology:

The injection molded plastic market was segmented into raw material, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology: