- Home

- »

- Biotechnology

- »

-

Lipid Nanoparticle Raw Materials Market Size Report, 2030GVR Report cover

![Lipid Nanoparticle Raw Materials Market Size, Share & Trends Report]()

Lipid Nanoparticle Raw Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Therapeutics, Research), By Product (Kits, Reagents), By Disease Indication, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-210-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lipid Nanoparticle Raw Materials Market Summary

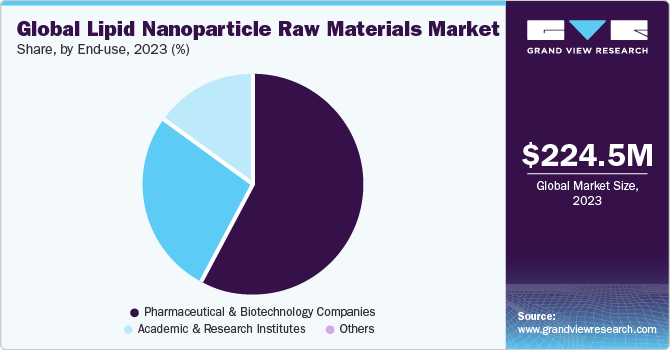

The global lipid nanoparticle raw materials market size was estimated at USD 224.5 million in 2023 and is projected to reach USD 329.2 million by 2030, growing at a CAGR of 5.66% from 2024 to 2030. The market growth is attributed to factors such as increasing demand for drugs that utilize lipid nanoparticles as delivery systems, rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and autoimmune disorders, and advancements in technology.

Key Market Trends & Insights

- North America dominated the market with the revenue share of 40.34% in 2023.

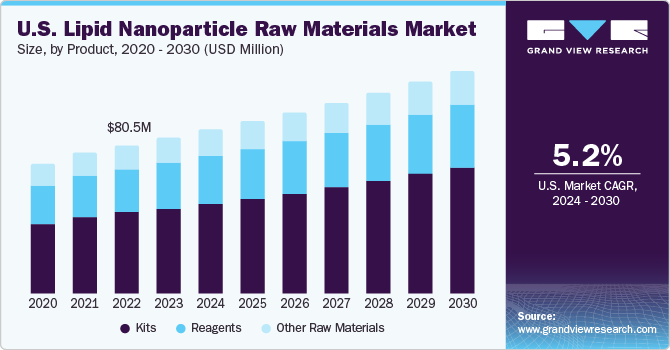

- The lipid nanoparticle raw materials market in the U.S. held the largest share in 2023.

- By application, the therapeutics segment led the market with the largest revenue share of 62.25% in 2023.

- By product, the kits segment led the market with the largest revenue share of 54.88% in 2023.

- By disease indication, the infectious diseases segment held the market with the largest revenue share of 46.34% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 224.5 Million

- 2030 Projected Market Size: USD 329.2 Million

- CAGR (2024-2030): 5.66%

- North America: Largest market in 2023

- Europe: Fastest growing market

Moreover, the increasing number of joint ventures and partnerships amongst market players is also expected to have a positive impact on market growth. For instance, in July 2023, Lawrence Berkeley National Laboratory and Genentech, Inc. partnered to develop more effective lipid nanoparticles (LNPs) for drug delivery. The project is a collaboration between scientists at Berkeley Lab and Genentech, a member of the Roche Group.Furthermore, government funding plays a crucial role in supporting R&D initiatives focused on developing innovative lipid nanoparticle-based products, including drug delivery systems for various therapeutic applications. In addition, increased investment by major players in research and development capabilities drives the market growth by stimulating innovation, expanding market opportunities, and fostering technological advancements. For instance, in June 2022, Evonik announced plans to construct a new and large-scale production plant for pharmaceutical lipids in the U.S. The total investment is USD 220 million. The U.S. government has supported the project with up to USD 150 million in funding through its Biomedical Advanced Research and Development Authority (BARDA).

Innovation in lipid nanoparticle (LNP) formulation techniques leads to the creation of advanced LNP with improved stability, drug-loading capacity, and targeted delivery capabilities. This drives the demand for innovative raw materials that can support the synthesis of these advanced formulations. For instance, in December 2023, a group of researchers from the Leslie Dan Faculty of Pharmacy at the University of Toronto discovered an innovative ionizable LNP. This nanoparticle facilitates the delivery of mRNA specifically to muscle tissues while reducing unintended delivery to other areas of the body. Additionally, the team demonstrated that mRNA transported by these LNP successfully produced strong immune responses at the cellular level. Continuous innovation in lipid nanoparticle technology results in the development of more efficient drug delivery systems.

The increasing prevalence of cancers has a significant impact on the demand for LNP raw materials in the pharmaceutical and biotechnology industries. According to the American Cancer Society, in 2024, 2,001,140 new cancer cases and 611,720 cancer deaths are projected to occur in the U.S. With the rising prevalence of cancer worldwide, there is an increasing demand for effective cancer therapeutics. LNP offer a promising platform for delivering anticancer drugs due to their ability to encapsulate a variety of drugs, improve drug solubility, and enhance drug delivery to tumor sites. This drives the demand for raw materials used in the synthesis of LNP.

Market Concentration & Characteristics

The market is witnessing a surge in innovation driven by advances in formulation techniques, tailored lipid design, integration of RNA-based therapeutics, and scalable manufacturing processes. These innovations are revolutionizing drug delivery across diverse therapeutic areas, from infectious diseases to cancer and genetic disorders. As research continues to grow the boundaries of LNP technology, stakeholders must collaborate to accelerate the translation of these innovations into clinically impactful therapies and improve patient outcomes.

The market has seen a significant level of merger and acquisition (M&A) activity in recent years. This can be attributed to the growing demand for LNP in the pharmaceutical industry, which has become a key driver for market growth. The advancements in LNP technology have been a primary driver of M&A activity. As companies strive to enhance their capabilities in formulation development, manufacturing processes, and scalability, acquiring specialized firms with proprietary technologies or expertise becomes an attractive strategy, which is expected to fuel the market growth.

The impact of regulations on the market can be significant. Regulations play a significant role in the global market. The regulatory framework governs the manufacturing, testing, and distribution of lipid nanoparticle-based drug delivery systems. The regulatory bodies ensure the safety, efficacy, and quality of these products and also monitor the compliance of the industry players with the regulatory guidelines. Stringent regulations can increase the time and costs associated with the development and commercialization of lipid nanoparticle-based drug delivery systems.

The market has witnessed significant product expansion trends in recent years. With the increasing demand for advanced drug delivery systems, industry players have been focusing on developing new and innovative products to cater to the evolving needs of the market. Some of the key product expansion trends in the market include the development of new lipid-based drug delivery systems, the use of biodegradable polymers in nanoparticle formulations, and the integration of advanced technologies such as nanotechnology and microfluidics in the manufacturing process. These product expansion trends are expected to drive the market growth and create new opportunities for industry players in the forecast period.

The concentration of regional expansion in the market can vary by region, and it is influenced by factors such as research funding, healthcare policies, and the level of technological adoption in different sectors. Market dynamics also shift based on emerging applications and advancements in LNP technologies.

Application Insights

In terms of application, the therapeutics segment led the market with the largest revenue share of 62.25% in 2023. LNP is widely used in the pharmaceutical industry for drug delivery due to their ability to encapsulate and deliver therapeutic agents to specific targets in the body. As the demand for novel drug delivery systems grows, it is expected to increase the demand for lipid nanoparticle raw materials. With ongoing advancements in nanotechnology and nano-medicine, there is a growing focus on developing lipid-based nanoparticles for targeted drug delivery. These advancements are driving the demand for LNP raw materials in therapeutics

The research segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing demand for efficient drug delivery systems and the use of lipid nanoparticles in various research activities. Lipid nanoparticles are widely used in the development of novel drug formulations, as they possess several advantages, such as biocompatibility, high drug loading capacity, and controlled release of drugs. Moreover, the rising prevalence of chronic diseases such as cancer and the need for targeted drug delivery has further boosted the demand for LNP in research applications.

Product Insights

Based on product, the kits segment led the market with the largest revenue share of 54.88% in 2023. The growing prevalence of Alzheimer's disease and glaucoma and the need for more effective treatment options are some of the key factors driving the demand for LNP in drug delivery. Moreover, the development of new lipid-based drug delivery systems and the increasing adoption of personalized medicine are expected to further fuel the market growth of the kits product segment.

In addition, these kits utilize LNP as carriers for fluorescent probes, dyes, and therapeutic agents to facilitate cellular imaging, drug screening, and other biochemical assays. The rising demand for such assays across pharmaceutical, biotechnology, and academic research sectors is driving the growth of the kits product segment.

The reagent segment is expected to grow at a significant CAGR during the forecast period. Reagents are essential raw materials used in the production of lipid nanoparticles, and the increasing demand for these nanoparticles is expected to drive the market growth of the reagent segment. The rising investments in pharmaceutical R&D activities and the increasing prevalence of chronic diseases are also expected to contribute to the market growth, further boosting the demand for reagents.

Disease Indication Insights

Based on disease indication, the infectious diseases segment held the market with the largest revenue share of 46.34% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Lipid nanoparticles are used in the development of mRNA vaccines, which have become a key tool in the fight against COVID-19. The LNP helps protect the mRNA from degradation in the body and facilitates its delivery to cells. As more countries roll out vaccination programs, the demand for lipid nanoparticle raw materials has increased significantly. In addition to COVID-19, lipid nanoparticles are also being studied for the treatment of other infectious diseases, such as HIV and influenza. This has further contributed to the market growth.

The cancer disease segment is anticipated to grow at a significant CAGR during the forecast period. LNP are used as drug delivery to target cancer cells and increase the efficacy of treatment. The raw materials required to produce these nanoparticles include lipids, surfactants, and polymers. According to WHO, it is estimated that the number of new cancer cases is expected to exceed 35 million by the year 2050, showing a significant increase of 77% from the estimated number of cases, which was 20 million in 2022. The rising cancer burden and the potential of LNPs in cancer treatment are driving significant research and development efforts in this area. This R&D activity is fueling the demand for LNP raw materials, including lipids, polymers, and other components.

End-use Insights

Based on end-use, the pharmaceutical & biotechnology companies held the market with the largest revenue share of 57.87% in 2023. Pharmaceutical and biotechnology companies use LNP raw materials to develop advanced drug delivery systems with improved efficacy, safety, and specificity for various therapeutic applications, including cancer treatment, gene therapy, and personalized medicine. The demand for lipid nanoparticle raw materials has risen significantly as pharmaceutical and biotechnology companies seek reliable and high-quality sources to manufacture their products.

Furthermore, the companies that provide LNP raw materials are investing heavily in research and development to improve the quality and efficacy of their products, as well as to expand their market reach. For instance, in January 2024, PHLIP, INC.; and CordenPharma International announced the partnership to commercialize and develop the pHLIP-LNP targeted delivery platform for RNA-based and genetic therapeutics.

The academic & research institutes segment is expected to grow at the fastest CAGR during the forecast period. Academic and research institutes conduct preclinical studies to evaluate the safety, efficacy, and pharmacokinetics of lipid nanoparticle-based drug delivery systems in relevant disease models. These studies provide valuable data on the biodistribution, tissue targeting, and therapeutic potential of lipid nanoparticles loaded with various drugs or therapeutic agents. Successful preclinical outcomes support the translation of advantageous formulations into clinical trials, driving demand for raw materials at scale-up stages. As the number of preclinical studies evaluating lipid nanoparticle-based drug delivery systems expands, there is a corresponding increase in the demand for raw materials used in the formulation and manufacturing of these nanoparticles.

Regional Insights

North America dominated the market with the revenue share of 40.34% in 2023. The presence of a robust pharmaceutical and biotechnology industry in North America contributes to the market growth. Pharmaceutical companies and biotech firms in the U.S. and Canada invest heavily in research and development, driving demand for lipid nanoparticle-based drug delivery systems. The shift towards biologics and gene therapy products in North America has created opportunities for lipid nanoparticle-based delivery systems. Lipid nanoparticles are utilized for the delivery of nucleic acids, including mRNA, siRNA, and gene-editing tools, for the treatment of various diseases. The approval of mRNA vaccines for COVID-19 has further highlighted the potential of lipid nanoparticles in gene therapy.

U.S. Lipid Nanoparticle Raw Materials Market Trends

The lipid nanoparticle raw materials market in the U.S. held the largest share in 2023. Pharmaceutical companies, biotechnology firms, and research institutions in the U.S. are investing heavily in R&D efforts focused on lipid nanoparticle-based therapies. This investment is driving innovation in lipid nanoparticle formulations, manufacturing processes, and applications, thereby expanding the market. For instance, in June 2022, Gattefossé announced the construction of its new production facility in Texas, U.S. with an investment of USD 50 million. The plant is expected to be operational in 2024.

Europe Lipid Nanoparticle Raw Materials Market Trends

The lipid nanoparticle raw materials market in Europe is expected to grow at the fastest CAGR over the forecast period. Europe has a robust pharmaceutical and biotechnology industry that is continuously seeking innovative drug delivery systems to improve therapeutic outcomes. Lipid nanoparticles offer advantages such as enhanced drug solubility, stability, and targeted delivery, making them increasingly attractive to pharmaceutical companies developing novel therapeutics. Collaboration between academia, industry, and research institutions is common in Europe, facilitating interdisciplinary research and technology transfer. Collaborative initiatives aimed at advancing lipid nanoparticle technologies, such as Horizon 2020 projects and public-private partnerships, contribute to market expansion by fostering innovation and knowledge exchange.

The UK lipid nanoparticle raw materials market held a significant share in 2023. The increasing prevalence of chronic diseases such as cancer and cardiovascular diseases has led to a growing need for more effective therapies. In addition, the UK government has been investing heavily in the development of advanced drug delivery systems, including lipid nanoparticles, which have also contributed to the market growth.

The lipid nanoparticle raw materials market in the France held the significant share in 2023. France has a well-established regulatory framework for the approval and commercialization of pharmaceutical products. Regulatory agencies such as the French National Agency for Medicines and Health Products Safety (ANSM) ensure product safety and efficacy, which enhances investor confidence and supports market growth. France faces healthcare challenges such as an aging population, increasing prevalence of chronic diseases, and rising healthcare costs. Lipid nanoparticles offer advantageous solutions for addressing these challenges by improving drug delivery efficiency, reducing side effects, and enhancing therapeutic outcomes. The growing demand for innovative healthcare solutions drives the market growth in France.

The Germany lipid nanoparticle raw materials market held the significant share in 2023. Germany boasts a leading pharmaceutical industry, renowned for its research and development capabilities. This strong foundation fuels high demand for innovative drug delivery solutions, including LNPs, for various therapeutic applications. The German government actively supports advancements in LNP technologies through funding and policy initiatives. It includes the "Biotech 2030" strategy and the "Clusters4Future" program, fostering a stimulating environment for research, development, and commercialization of LNP-based products, ultimately driving the raw materials market.

Asia Pacific Lipid Nanoparticle Raw Materials Market Trends

The lipid nanoparticle raw materials market in Asia Pacific is expected to exhibit the fastest CAGR over the forecast period. The region is experiencing rapid economic growth, leading to higher healthcare expenditure and investments in medical research and development. As healthcare infrastructure improves and access to healthcare services expands, there is a growing demand for advanced drug delivery systems, including lipid nanoparticles, driving market growth. Furthermore, governments in the Asia Pacific region are increasingly supporting research and development initiatives in the life sciences sector through grants, subsidies, and incentives. For instance, initiatives such as China's "Made in China 2025" plan and India's "Biotechnology Industry Research Assistance Council" (BIRAC) aim to promote innovation and entrepreneurship in biotechnology. Such support encourages investment in lipid nanoparticle research and development, contributing to market growth.

The China lipid nanoparticle raw materials market held the significant share in 2023. Cancer is a significant driver of the lipid nanoparticle market in China. Lipid nanoparticles are utilized for the delivery of chemotherapy drugs, RNA-based therapeutics, and imaging agents for cancer diagnosis and treatment monitoring. The ability of lipid nanoparticles to encapsulate and target cancer drugs to tumor cells while minimizing systemic toxicity is particularly valuable in cancer therapy. In addition, China faces various infectious disease challenges, including viral infections such as hepatitis, influenza, and COVID-19, as well as bacterial infections. Lipid nanoparticles are being investigated for the delivery of antiviral drugs, vaccines, and RNA-based therapeutics for infectious diseases. The development of lipid nanoparticle-based COVID-19 vaccines and treatments has further accelerated the market growth in China.

The lipid nanoparticle raw materials market in the Japan held the significant share in 2023. It is driven by the increasing adoption of lipid nanoparticles in drug delivery systems due to their enhanced bioavailability, biocompatibility, and controlled drug release properties. In addition, the rising prevalence of chronic diseases such as cancer and cardiovascular diseases has led to an increase in demand for lipid nanoparticle-based therapies in the country. Furthermore, government initiatives to promote R&D activities in the field of nanotechnology are also expected to boost the market growth in Japan.

Middle East & Africa Lipid Nanoparticle Raw Materials Market Trends

The lipid nanoparticle raw materials market in Middle East Africa (MEA) is expected to grow at a significant CAGR over the forecast period. Governments and private investors in the MEA region are focusing on improving healthcare infrastructure and access to new technologies. This is expected to drive the demand for advanced drug delivery systems, such as LNPs. In addition, the prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular diseases is rising in the MEA region. This is creating a demand for novel and effective treatment options, which is fueling the market growth. However, the MEA region currently lacks a skilled workforce in the field of nanotechnology, which is essential for the development and manufacturing of LNPs. These factors hinder market growth in the MEA region.

The Saudi Arabia lipid nanoparticle raw materials market held the significant share in 2023, primarily due to factors such as the increasing focus on research and development activities, the growing demand for advanced drug delivery systems, and the rising prevalence of chronic diseases. In addition, the increasing investments in the healthcare sector and the growing awareness about the benefits of LNP in drug delivery are also driving the market growth in Saudi Arabia. The market is expected to continue its growth in the coming years due to favorable government initiatives and policies aimed at promoting the adoption of advanced healthcare technologies.

The lipid nanoparticle raw materials market in the Kuwait held the significant share in 2023. Kuwait market is expected to grow at the fastest CAGR over the forecast period. It is driven by factors such as the increasing demand for advanced drug delivery systems, the rising prevalence of chronic diseases, growing investment in research and development activities, and the rising adoption of nanotechnology in the healthcare sector. Additionally, the increasing geriatric population benefits of LNP in drug delivery are also contributing to the market growth.

Key Lipid Nanoparticle Raw Materials Company Insights

The market players operating in the lipid nanoparticle raw materials market are adopting product approval to increase the reach of their products in the market and improve the availability of their products & services in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Lipid Nanoparticle Raw Materials Companies:

The following are the leading companies in the lipid nanoparticle raw materials market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Echelon Biosciences

- BroadPharm

- Avanti Polar Lipids

- Tebubio

- CordenPharma International

- Creative Biolabs

- Biopharma PEG Scientific Inc.

- NOF AMERICA CORPORATION

- Polysciences, Inc.

Recent Developments

-

In February 2024, researchers based in the U.S. at the University of Pennsylvania have engineered a specialized high-throughput screening platform tailored specifically for the assessment of mRNA encapsulated within lipid nanoparticles. This innovative platform enables the rapid screening of extensive libraries of LNPs designed for brain targeting. Its implementation facilitates the progression of gene editing therapies by expediting the evaluation and optimization of LNPs intended for delivery to the brain

-

In July 2023, Cytiva has introduced a formulation system designed to facilitate smooth end-to-end manufacturing of lipid nanoparticle medicines across clinical and commercial stages. This system simplifies the process, enabling efficient and comprehensive production of lipid nanoparticle-based medications from development through to commercialization

-

In July 2023, ModernaTX, Inc. and McGill University announced the collaboration. The collaboration is focused on two new projects focused on LNP research-the projects into specific aspects of LNP properties, potentially their characteristics or comparison to naturally occurring particles

Lipid Nanoparticle Raw Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 236.6 million

Revenue forecast in 2030

USD 329.2 million

Growth rate

CAGR of 5.66% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Revenue in USD Million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, disease indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Merck KGaA; Echelon Biosciences; BroadPharm; Avanti Polar Lipids; Tebubio; CordenPharma International; Creative Biolabs; Biopharma PEG Scientific Inc.; NOF AMERICA CORPORATION; Polysciences, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lipid Nanoparticle Raw Materials Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the lipid nanoparticle raw materials market based on application, product, diseases indication, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Research

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ionizable lipids

-

PEGylated lipids

-

Sterol lipids

-

Neutral phospholipids

-

Kits

-

-

Reagents

-

Other raw materials

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious Diseases

-

Blood Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lipid nanoparticle raw materials market size was estimated at USD 224.5 million in 2023 and is expected to reach USD 236.6 million in 2024.

b. The global lipid nanoparticle raw material market is expected to grow at a compound annual growth rate of 5.66% from 2024 to 2030 to reach USD 329.2 million by 2030.

b. The therapeutics segment dominated the overall market with the largest revenue share of 62.25% in 2023. LNP is widely used in the pharmaceutical industry for drug delivery due to their ability to encapsulate and deliver therapeutic agents to specific targets in the body. As the demand for novel drug delivery systems grows, it is expected to increase the demand for lipid nanoparticle raw materials.

b. Some key players operating in the lipid nanoparticle raw material market include Merck KGaA, Echelon Biosciences, BroadPharm, Avanti Polar Lipids, Tebubio, CordenPharma International, Creative Biolabs, Biopharma PEG Scientific Inc., NOF AMERICA CORPORATION, Polysciences, Inc.

b. The growth of the market is attributed to factors such as Increasing demand for drugs that utilize lipid nanoparticles as delivery systems, rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and autoimmune disorders, and advancements in technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.