- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Plastics Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Plastics Market Size, Share & Trends Report]()

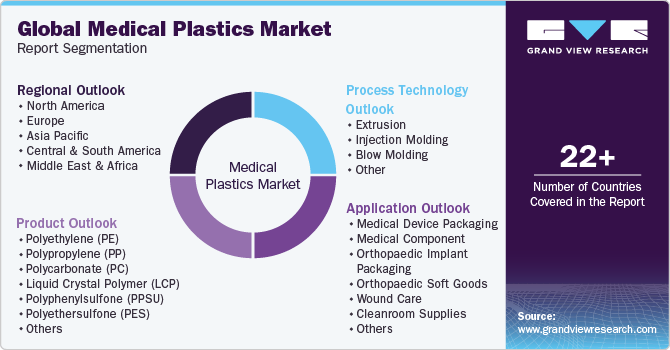

Medical Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (PE, PP, PC, LCP, PPSU, PES, PEI, PMMA), By Process Technology (Extrusion, Injection Molding), By Application, By Regions, And Segment Forecasts

- Report ID: GVR-1-68038-823-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Plastics Market Summary

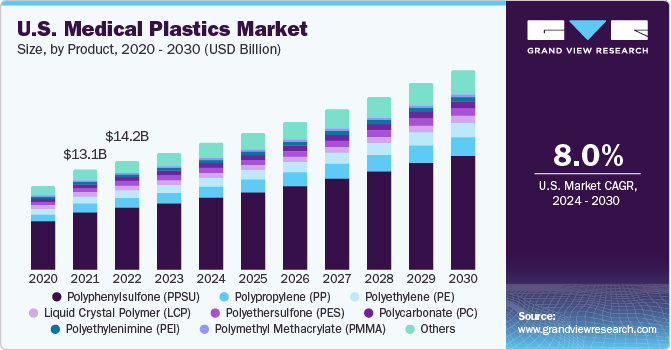

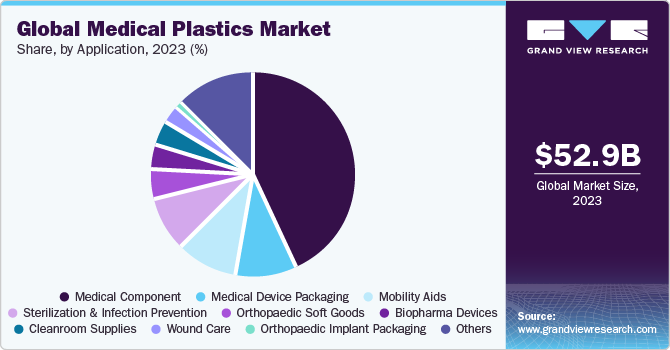

The global medical plastics market size was estimated at USD 52.9 billion in 2023 and is projected to reach USD 87.58 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. This growth can be attributed to the development of advanced plastics and plastic composites used in medical components such as catheters, surgical instrument handles, and syringes.

Key Market Trends & Insights

- North America dominated global medical plastics market with a market share of above 33.0% in 2023.

- Based on application, the medical components segment dominated with a revenue share above 40.0% in 2023.

- Based on product, the poyphenylsulfone (PPSU) resin segment dominated the market with a revenue share of above 51.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 52.9 Billion

- 2030 Projected Market Size: USD 87.58 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

The demand for medical device packaging is likely to be driven by a rise in demand for in-house and advanced medical devices. Plastics including polyethylene, polypropylene, and polycarbonate are increasingly being utilized for the manufacturing of medical devices. The growth of home healthcare due to its low costs compared to hospital care and intensive care has resulted in a rise in demand for medical devices.

According to the latest U.S. census, 16.8% of the U.S. population is over the age of 65 years and this number is anticipated to reach 74 million by 2030. People aged over 85 need the most care and their population is growing rapidly. In March 2021, the U.S. President, Joe Biden, proposed spending USD 400 billion on Medicaid over eight years to fund at-home care for elderly and disabled people as well as increase the wages of caregivers.

In the U.S., the frequent increment in costs and reduced margins have severely impacted healthcare providers and health plans. This compelled the government to ensure a significant transformation of healthcare funding and insurance coverage segments in the country through the introduction of ACA and Medicaid.

The COVID-19 pandemic has made in-home care more appealing than nursing home facilities as home care reduces healthcare costs and is more convenient for patients. According to Medicaid and CHIP Payment and Access Commission (MACPAC), it costs about USD 26,000 a year for home care compared to USD 90,000 a year for a nursing home. Increasing investment in healthcare by the government and rising preference for home care are expected to drive the medical plastics market in the U.S. over the forecast period.

The presence of key manufacturers such as Dow, Inc., Eastman Chemical Co., and DuPont can be regarded as one of the major factors driving the market for medical plastics in the country.

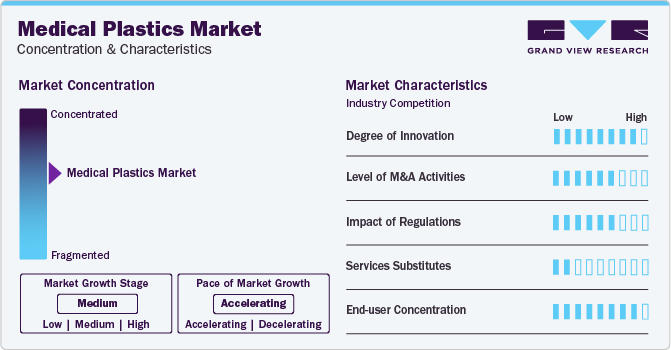

Market Concentration & Characteristics

Market growth stage is high, and pace of market growth is accelerating owing to overly consolidated market. Medical plastic manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, production expansion, among others.

For instance, In November 2023, TekniPlex Healthcare announced the acquisition of Seisa Medical, a medical device manufacturer based in El Paso, Texas, offering various services throughout the product development cycle. This acquisition will enhance the company's materials science and process technologies worldwide for interventional therapy devices and minimally invasive. From development and design to component manufacturing, final assembly, and packaging, Seisa provides global contract manufacturing services for Class II and III medical devices and specialty components.

Process Technology Insights

Injection molding is a widely used process in the medical plastics industry. It has many advantages, including compliance with medical industry standards and regulations. The use of engineering-grade plastics ensures that parts are created to enhance patient safety and comply with FDA (Food and Drug Administration) guidelines. Injection molding is highly flexible, allowing parts to be fully customizable to fit the consumer.

Medical blow molding is a popular process used in the manufacturing of plastic products such as bottles and containers that are commonly used in the medical industry. The molds used in this process are simpler and more cost-effective compared to molding used in injection.

Application Insights

The medical components segment dominated with a revenue share above 40.0% in 2023. The COVID-19 pandemic increased the demand for medical components such as personal protective equipment (PPE), face masks, gloves & gowns, and magnetic resonance imaging (MRI) scanners. The emerging countries manufactured PPE, face masks, and gloves, whereas, developed countries manufactured technology-intensive equipment such as MRI scanners and mechanical ventilators. Hence, the demand for the aforementioned equipment was rising during the pandemic, which in turn is expected to drive the segment’s growth.

Medical device packaging is necessary for medical devices to retain their characteristics and performance during product shelf life. Packaging protects the devices from physical damage, biological contamination, external disturbance, and humans, and keeps the device sterile before it is being used in hospitals and other end-use applications. Proper packaging ensures the identification of the device through labeling.

Medical plastics used for orthopedic implant packaging should be compatible with multiple sterilization methods, excellent puncture and abrasion resistance. Packaging is very crucial when it comes to orthopedic implants such as knee, hip, spine, and thumb as these implants should be protected from physical damage and biological contamination before their use. Thermoplastic polyurethane (TPU) and polyethylene are commonly used for orthopedic implant packaging. UFP MedTech introduced FlexShield TPU and cross-linked polyethylene (XLPE) for orthopedic packaging. Both are gamma and ETO sterilization compatible and provide abrasion and puncture resistance.

Orthopedic soft goods have a growing demand because of the aging population in developed countries such as Europe, the U.S., and Japan. In addition, the growing fitness and sports industries in emerging economies such as India are going to drive the market over the forecast period. The consumers include all age groups, be it senior citizens, young adults, or teens, as soft goods help with joint pain resulting from disease, occupational, or sports-related injuries. Orthopedic soft goods include rehabilitation aids, knee braces and support, wrist and wrist-thumb support, back support brace, ankle supports, elbow straps, abdominal binders, rib belts, hernia supports, and cervical collars. Besides, they are used in injuries caused by fractures, muscle pain, and other orthopedic issues.

Regional Insights

In 2023, North America dominated global medical plastics market with a market share of above 33.0%. This is expected to augment the demand for generic drugs as well as medical devices in the coming years, thereby driving North America medical plastics market over the forecast period. The key applications catered to by this industry include pharmaceutical packaging and medical components manufacturing.

Rising demand for medical plastics in pharmaceutical packaging applications and the rapid growth of the pharmaceutical industry in Mexico and Canada are expected to drive the medical plastics market in the region. For instance, the elimination of stringent regulations by the Mexican government, which had earlier restricted the establishment of new manufacturing units, has resulted in the establishment of new pharmaceutical manufacturing facilities for major companies such as Takeda and Astellas in Mexico.

This strategy has played an important role in driving the domestic pharmaceutical industry, which, in turn, is likely to fuel the demand for medical plastics in the coming years. The applications considered for analysis of the North American medical plastics industry include medical device packaging, medical components, wound care, mobility aids, and tooth implants. Increasing incidences of lifestyle-related disorders and diseases in the region, including diabetes and cardiac arrests, have resulted in increased spending on healthcare by the population. This is expected to boost the demand for medical devices, generic drugs, and healthcare services, thereby, driving the medical plastics market over the forecast period.

The increasing geriatric population and rising occurrence of chronic diseases are expected to boost the demand for medical devices. This is expected to drive the demand for plastics in equipment manufacturing over the forecast period. Increasing government investment in the healthcare sector and the growing home healthcare market are anticipated to drive the demand for medical devices, which, in turn, is expected to have a positive influence on the medical plastics market over the forecast period.

Product Insights

The Poyphenylsulfone (PPSU) resin segment dominated the medical plastics market with a revenue share of above 51.0% in 2023. The heat and chemical resistance of PPSU can be attributed to this dominance. These plastics possess high strength and durability, making essential surgical tools. These are preferred in surgical robots and biopharmaceutical processing. Polyphenylsulfone exhibits good heat and chemical resistance, making it ideal for metal replacement in medical applications. These plastics possess high flexural strength, impact resistance, and durability and are ideal for producing single- and multi-use surgical instruments. Its high-temperature resistance makes it suitable for multi-use medical devices that are repeatedly steam-sterilized.

Polyethylene (PE) does not retain bacteria and is resistant to cleaning chemicals, which makes it suitable for medical equipment, devices, and supplies. It offers excellent impact resistance, chemical resistance, stability, flexibility, environmental friendliness, and minimal moisture absorption, ideal for medical-grade devices and components. Additionally, PE is a porous synthetic polymer and does not degrade in the human body, therefore is used in plastic surgery implants, tubing, bottles, and other such applications.

Polypropylene (PP) is used for manufacturing protective packaging and medical equipment due to its high toughness and durability. The strong chemical bonds make it suitable for manufacturing medical components including disposable syringes, connectors, finger-joint prostheses, non-absorbable sutures, reusable plastic containers, pharmacy prescription bottles, clear bags, beakers, test tubes, and others. Moreover, it is specifically used in hernia and pelvic organ prolapse repair surgeries being as a transvaginal mesh.

Key Companies & Market Share Insights

Some key market players include BASF SE; Celanese Corporation; Evonik Industries AG; SABIC; Dow, Inc.; Solvay S.A.; Trinseo S.A.; and Eastman Chemical Company.

- In November 2022, Celanese Corporation announced the acquisition of DuPont's Mobility & Material (M&M) business for USD 11 billion. This strategic move enables Celanese to expand its global reach and enhance its offerings in the environmental sector, particularly in sustainable transportation.

Key Medical Plastics Companies:

The following are the leading companies in the medical plastics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these medical plastics companies are analyzed to map the supply network.

- Röchling SE & Co. KG

- Nolato AB

- Saint-Gobain

- SABIC

- Orthoplastics Ltd

- Eastman Chemical Company

- Celanese Corporation

- Dow, Inc.

- Tekni-Plex, Inc.

- Solvay S.A.

- HMC Polymers Company Limited

- ARAN BIOMEDICAL TEORANTA

- Trelleborg Group

- Avantor, Inc.

- Trinseo

- Evonik Industries AG

Recent Developments

Some key players operating in market include BASF SE; Celanese Corporation; Evonik Industries AG; SABIC; Dow, Inc.; Solvay S.A.; Trinseo S.A.; Eastman Chemical Company among others.

-

In February 2023, Cleanse Corporation announced the acquisition of DUPONT's mobility and mobility business for USD 11.00 billion. This strategic move enables Cleanse to expand its global reach and enhance its offerings in the environmental sector, particularly in sustainable transportation.

-

In June 2023, SABIC acquired Clariant's 50% stake in Scientific Design, a renowned catalysis leader. This acquisition bolstered the non-cyclical, technology-driven business and brought it closer to becoming a leading global specialist.

Medical Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 57.2 billion

Revenue forecast in 2030

USD 87.58 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, process technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherland, China; India; Japan; Brazil; Argentina, Saudi Arabia, UAE

Key companies profiled

Röchling SE & Co. KG; Nolato AB; Saint-Gobain; SABIC; Orthoplastics Ltd; Eastman Chemical Company; Celanese Corporation; Dow, Inc.; Tekni-Plex, Inc.; Solvay S.A.; HMC Polymers Company Limited; ARAN BIOMEDICAL TEORANTA; Trelleborg Group; Avantor, Inc.; Trinseo; and Evonik Industries AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Plastic Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical plastic market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons & Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polycarbonate (PC)

-

Liquid Crystal Polymer (LCP)

-

Polyphenylsulfone (PPSU)

-

Polyethersulfone (PES)

-

Polyethylenimine (PEI)

-

Polymethyl Methacrylate (PMMA)

-

Others

-

-

Process Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Injection Molding

-

Blow Molding

-

Other

-

-

Application Outlook (Volume, Kilotons & Revenue, USD Million, 2018 - 2030)

-

Medical Device Packaging

-

Medical Components

-

Orthopedic Implant Packaging

-

Orthopedic Soft Goods

-

Wound Care

-

Cleanroom Supplies

-

BioPharm Devices

-

Mobility Aids

-

Sterilization and Infection Prevention

-

Tooth Implants

-

Denture Base Material

-

Other Implants

-

Others

-

-

Region Outlook (Volume, Kilotons & Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Netherland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical plastics market size was estimated at USD 52.9 billion in 2023 and is expected to reach USD 57.2 billion in 2024.

b. The global medical plastics market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 87.6 billion by 2030.

b. The medical components segment dominated the medical plastics market with a share of 40.92% in 2023. This is attributed to the rising product demand in product demand in various applications such as diagnostic devices, trays, pans, containers, syringes, implant trials, and medical cover sheets.

b. Some key players operating in the medical plastics market include Solvay S.A. Celanese Corporation, Eastman Chemical Company, Dow, SABIC and Evonik Industries AG

b. Key factors that are driving the medical plastics market growth include rising healthcare expenditure, ascending demand for better healthcare facilities, improving medical infrastructure, and increasing demand for surgical instruments and tools such as gloves, clamps, forceps, syringes, surgical trays, and others.

b. North American region led the global medical plastics market in 2023 accounting for the largest revenue share of more than 33.0%

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.