- Home

- »

- Distribution & Utilities

- »

-

Micro Inverter Market Size & Share, Industry Report, 2030GVR Report cover

![Micro Inverter Market Size, Share & Trends Report]()

Micro Inverter Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Single-Phase, Three-Phase), By Application (Residential, Commercial), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-609-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro Inverter Market Summary

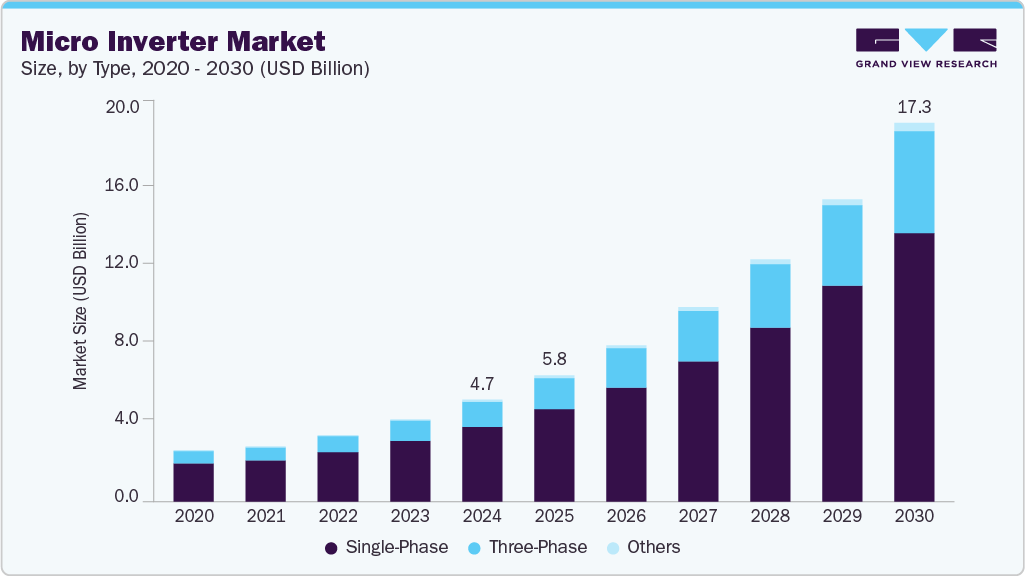

The global micro inverter market size was estimated at USD 4.67 billion in 2024 and is projected to reach USD 17.34 billion by 2030, at a CAGR of 24.58% from 2025 to 2030. The market is experiencing steady growth, driven by the rising adoption of rooftop solar systems and the increasing emphasis on maximizing energy efficiency.

Key Market Trends & Insights

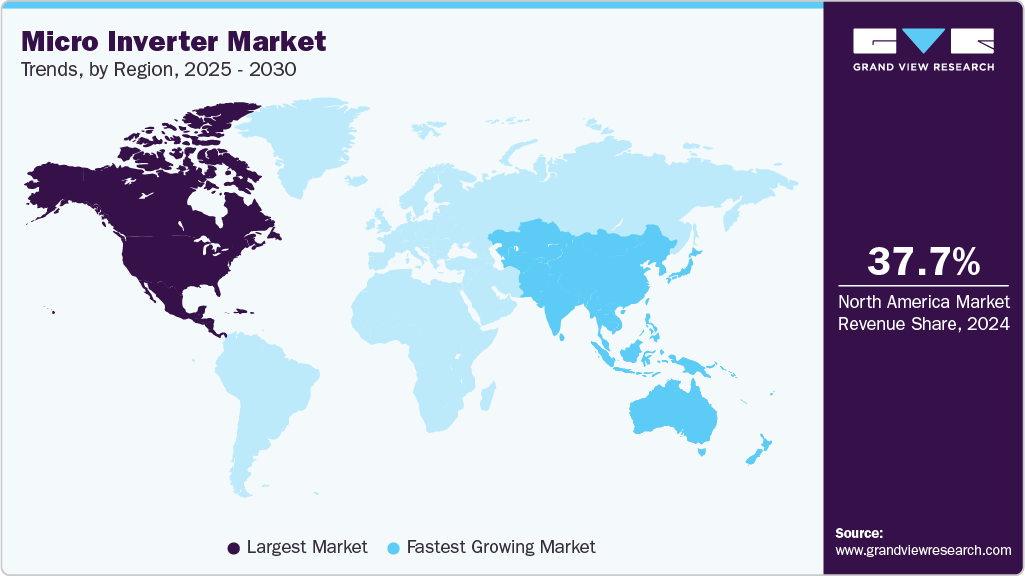

- North America held the largest revenue share of 37.74% in the global micro inverter market.

- The micro inverter market in the U.S. is experiencing strong momentum.

- By type, single-phase segment held the largest market revenue share of over 73.98% in 2024.

- By application, residential segment held the largest market revenue share of over 79.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.67 Billion

- 2030 Projected Market Size: USD 17.34 Billion

- CAGR (2025-2030): 24.58%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Factors such as the growing shift toward module-level power electronics (MLPE), enhanced system performance, and safety benefits fuel the demand for micro inverters across residential and small-scale commercial applications.In addition, advancements in solar technology and supportive policy frameworks are accelerating the deployment of microinverters in key regions. The integration of smart grid capabilities, along with declining solar installation costs, is further encouraging adoption. Moreover, government incentives and renewable energy targets are boosting the uptake of distributed solar systems, positioning micro inverters as a preferred choice for optimizing output and ensuring flexibility in system design.

Technological advancements, including integrating smart home systems and the internet of things (IoT), significantly improve micro inverters' performance and monitoring capabilities. These innovations enable real-time data analytics, fault detection, and remote maintenance, enhancing energy yield and system reliability. As energy systems become increasingly decentralized, micro inverters are vital in optimizing solar output and supporting grid stability, aligning well with global efforts toward cleaner and more resilient energy infrastructures.

The residential and small commercial sectors rapidly embrace micro inverter technology due to its scalability, ease of installation, and safety benefits, such as reduced fire risk. The modular nature of micro inverters allows for flexible solar system design and better performance in shaded or complex rooftop conditions, making them especially suitable for urban environments. This trend is particularly strong in North America and Europe, where supportive policies, net metering schemes, and consumer awareness drive solar adoption.

However, the market faces challenges such as higher upfront costs than traditional string inverters and compatibility issues in certain large-scale installations. Nonetheless, continuous R&D efforts and economies of scale are expected to bring down prices and broaden the application scope of micro inverters. As the global push for renewable energy intensifies, micro inverters are set to become a key component in advancing the efficiency, safety, and accessibility of solar power systems worldwide.

Drivers, Opportunities & Restraints

Increasing incidences of grid failures due to extreme weather events, cyberattacks, and aging infrastructure have made energy resilience a top priority. Microgrids offer a reliable and localized energy solution that can operate independently from the main grid during disruptions. This makes MaaS particularly attractive for critical infrastructure like hospitals, data centers, and military bases.

Opportunities in the market are expanding due to technological advancements and shifting energy consumption patterns. Emerging technologies like IoT, AI, and advanced energy storage systems are making microgrids smarter, more efficient, and easier to manage remotely. There is a significant opportunity in remote, off-grid regions and developing economies where microgrids can offer affordable and reliable power. Moreover, commercial and industrial users are adopting MaaS to meet sustainability goals, reduce energy costs, and ensure uninterrupted operations, particularly in areas with unreliable utility grids or high peak demand charges.

Despite its promising growth, the MaaS market faces several restraints. High initial setup and operational costs for service providers remain a major challenge, especially in customized or large-scale deployments. Regulatory inconsistencies and a lack of standardization across regions complicate implementation and grid integration. In addition, as microgrids become more digitized, concerns around cybersecurity, data privacy, and system reliability in the face of potential cyber threats are growing. Addressing these barriers will be essential for the long-term scalability and success of the MaaS model.

Type Insights

The single-phase segment dominates the market with revenue share of over 73.98% in 2024, primarily driven by its widespread application in residential and small commercial solar installations. Single-phase micro inverters are well-suited for low to medium-energy demand systems, offering a cost-effective and efficient solution for rooftop solar projects. Their ability to optimize the output of individual solar panels makes them ideal for installations where shading or panel orientation may vary. Furthermore, ease of installation and integration with standard household electrical systems has further fueled their adoption, especially in regions with high solar rooftop penetration, such as North America and Europe.

As decentralized energy systems become more prevalent, the demand for flexible and modular solar solutions like single-phase micro inverters continues to grow. These systems also support smart grid compatibility and enable real-time performance monitoring at the panel level, which enhances energy yield and system reliability. The segment benefits from growing awareness of clean energy, supportive government incentives, and the increasing affordability of solar components. While three-phase inverters are favored in larger commercial and industrial setups, single-phase micro inverters remain the top choice for homeowners and small businesses seeking to maximize solar efficiency with minimal complexity.

Application Insights

The residential segment dominated the market with revenue share of over 79.34% in 2024, driven by the growing adoption of rooftop solar systems among homeowners seeking energy independence and cost savings. Micro inverters are particularly well-suited for residential applications due to their ability to optimize the output of each solar panel, which is critical in rooftop settings where shading, panel orientation, and roof angles can vary. Their ease of installation, enhanced safety features, and compatibility with single-phase power systems further support widespread deployment in the residential sector, especially in countries with favorable net metering policies and solar subsidies.

The demand for residential solar installations is also propelled by increasing electricity costs and heightened environmental awareness. Homeowners are turning to solar energy to reduce utility bills and contribute to sustainability goals. Micro inverters add value by enabling real-time monitoring, efficient energy conversion, and lower maintenance requirements. As solar panel prices continue to decline and smart home integration becomes more prevalent, micro inverters are expected to remain the preferred choice for residential users seeking reliable, high-performance solar solutions with minimal operational complexity.

Regional Insights

The North American micro-inverter market leads globally, driven by strong adoption of residential rooftop solar systems, favorable government incentives, and increasing demand for high-efficiency, module-level power electronics. The U.S. dominates the regional market, supported by federal tax credits, net metering policies, and state-level solar initiatives encouraging household solar adoption. Technological advancements, including integrated monitoring systems and enhanced safety features, make micro inverters a preferred choice for homeowners and small businesses. Canada also sees increased demand, particularly in off-grid and hybrid solar installations across rural and remote communities.

U.S. Micro Inverter Market Trends

The micro inverter market in the U.S. is experiencing strong momentum, fueled by federal tax incentives, net metering policies, and a sharp rise in residential solar installations. Consumers increasingly opt for micro inverters due to their enhanced safety, individual panel-level optimization, and ability to maintain system performance even under shading or panel mismatch conditions. The growing popularity of smart homes and energy monitoring solutions further boosts demand, as micro inverters offer real-time visibility and remote system control.

Asia Pacific Micro Inverter Market Trends

The micro inverter market in Asia Pacific is emerging as one of the fastest-growing regions in the micro-inverter market, propelled by expanding solar installations, rapid urbanization, and ambitious renewable energy targets. Countries like China, India, Japan, and Australia drive growth through large-scale rooftop programs and pro-solar government policies. The growing middle class and demand for reliable, decentralized energy encourage residential users to invest in solar with micro inverter solutions. Moreover, falling costs of solar components and increasing awareness of micro-inverter benefits, such as performance optimization and safety, are accelerating adoption across urban and rural settings.

Europe Micro Inverter Market Trends

The micro inverter market in Europe is expanding steadily, supported by the region’s strong emphasis on renewable energy integration and distributed generation. Nations like Germany, the Netherlands, and France are at the forefront of residential solar adoption, aided by feed-in tariffs and regulatory frameworks that promote clean energy. The push for energy independence, especially in response to geopolitical uncertainties, encourages households and small businesses to invest in self-sustaining solar systems equipped with microinverters. In addition, the trend toward smart homes and grid-connected solutions aligns well with micro inverter technology, further boosting market demand.

Latin America Micro Inverter Market Trends

The micro inverter market in Latin America is witnessing the growing adoption of microinverters as solar power becomes a more viable and attractive energy option across the region. Countries like Brazil, Mexico, and Chile are leading in residential and small commercial solar deployment due to high solar irradiance and increasing electricity costs. Micro inverters are favored in this context for their scalability, ease of installation, and ability to maintain performance under partial shading conditions. Government-led rural electrification efforts and favorable policies are also playing a role in driving market growth, particularly in underserved or remote areas.

Middle East & Africa Micro Inverter Market Trends

The micro inverter market in the Middle East and Africa is gradually expanding, driven by rising interest in decentralized solar solutions to overcome grid unreliability and expand energy access. The UAE and Saudi Arabia are investing in rooftop solar initiatives as part of long-term clean energy strategies, such as Vision 2030 and Energy Strategy 2050. In sub-Saharan Africa, microinverters are gaining traction in off-grid and mini-grid solar projects due to their reliability, safety, and ability to function independently at the panel level. As solar costs continue to fall and demand for resilient power systems grows, micro inverters are poised for wider adoption across the region.

Key Micro Inverter Company Insights

Some key players operating in the market are Enphase, Darfon Electronics Corporation, Deye Inverter, Sparq Systems, Fimer Group, Solis Solar, Tata Power Solar, and others.

Key Micro Inverter Companies:

The following are the leading companies in the micro inverter market. These companies collectively hold the largest market share and dictate industry trends.

- Deye Inverter

- Darfon Electronics Corporation

- Enphase

- Fimer Group

- Fenice Energy

- Sparq Systems

- Sensol

- Statcon Energiaa

- SunEvo Solar

- Solis Solar

- Tata Power Solar

Recent Developments

-

In February 2024, Enphase Energy announced the launch of its new IQ8P Microinverter, designed to support higher-powered solar panels up to 480 W. This innovation aligns with the growing trend toward more powerful residential PV systems. It offers improved energy harvesting and faster installation.

-

In January 2024, Darfon Electronics expanded its micro inverter product line by releasing a three-phase model targeting small commercial rooftop projects. The launch supports the growing shift towards scalable, distributed energy systems that optimize performance and safety at the panel level.

Micro Inverter Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.78 billion

Revenue forecast in 2030

USD 17.34 billion

Growth rate

CAGR of 24.58% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Deye Inverter; Darfon Electronics Corporation; Enphase; Fimer Group; Fenice Energy; Sparq Systems; Sensol; Statcon Energiaa; SunEvo Solar; Solis Solar; Tata Power Solar

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro Inverter Market Report Segmentation

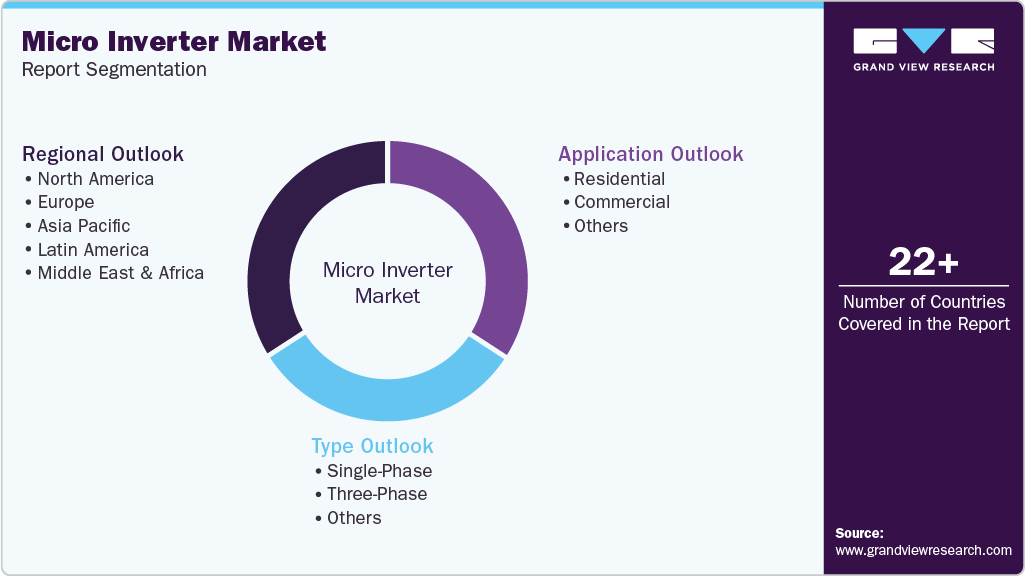

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micro inverter market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Phase

-

Three-Phase

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global micro inverter market size was estimated at USD 4.67 billion in 2024 and is expected to reach USD 5.78 billion in 2025.

b. The global micro inverter market is expected to grow at a compound annual growth rate of 24.58% from 2025 to 2030 to reach USD 17.34 billion by 2030.

b. The Single-Phase segment dominated the global micro inverter market with a revenue share of over 73.98% in 2024. Single-phase micro inverters are widely preferred in residential applications due to their cost-effectiveness, ease of installation, and compatibility with low-voltage home solar systems.

b. Some of the key vendors of the global micro inverter market are Enphase; Darfon Electronics Corporation; Deye Inverter; Fimer Group; Fenice Energy; Sparq Systems; Sensol; Statcon Energiaa; SunEvo Solar; Solis Solar; and Tata Power Solar.

b. The key factors driving the growth of the global micro-inverter market include the rising adoption of rooftop solar systems, growing demand for panel-level optimization, and increasing consumer preference for safer and more efficient solar technologies. Micro inverters offer advantages over traditional string inverters, such as enhanced energy yield, greater design flexibility, and improved system monitoring capabilities. These benefits are particularly attractive in residential and small commercial settings, where maximizing energy output and space utilization is critical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.