- Home

- »

- Biotechnology

- »

-

Microcarriers Market Size And Share, Industry Report, 2033GVR Report cover

![Microcarriers Market Size, Share & Trends Report]()

Microcarriers Market (2026 - 2033) Size, Share & Trends Analysis Report By Consumable (Media & Reagents, Microcarrier Beads), By Application (Biopharmaceutical Production, Regenerative Medicine), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microcarriers Market Summary

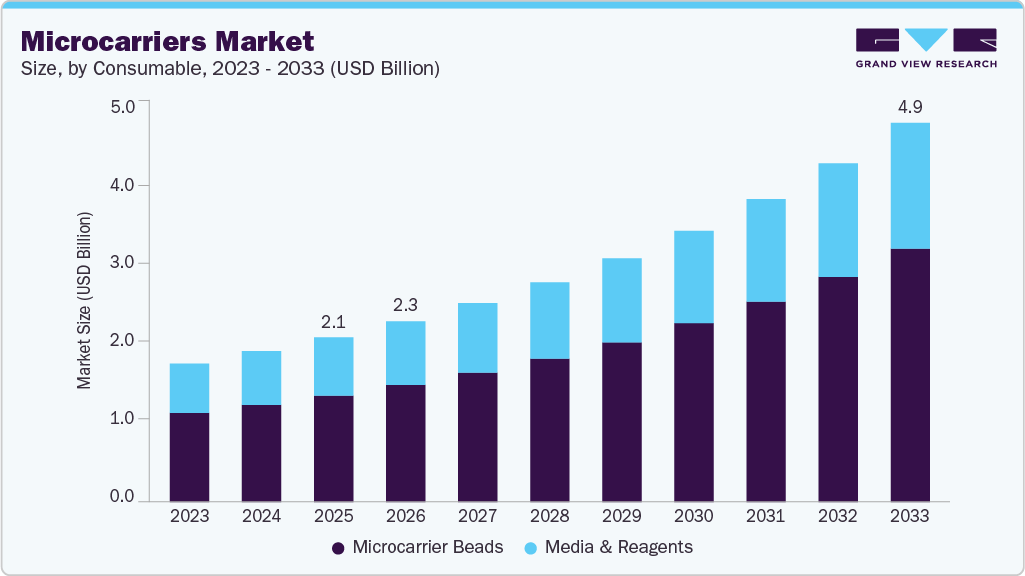

The global microcarriers market size was estimated at USD 2.13 billion in 2025 and is projected to reach USD 4.89 billion by 2033, growing at a CAGR of 11.18% from 2026 to 2033. The growth of the microcarriers industry is attributed to the high demand for cell-based vaccines & therapeutics, the increasing incidence of various diseases & disorders such as diabetes, cancer, rheumatoid arthritis, hemophilia, and others, huge investments for the development of innovative therapies, and consistent technological advancements in cell biology research.

Key Market Trends & Insights

- North America dominated the global microcarriers market with the largest revenue share of 41.21% in 2025.

- The microcarriers industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By consumables, the microcarrier beads segment accounted for the largest market revenue share in 2025.

- Based on application, the biopharmaceutical production segment accounted for the largest market revenue share in 2025.

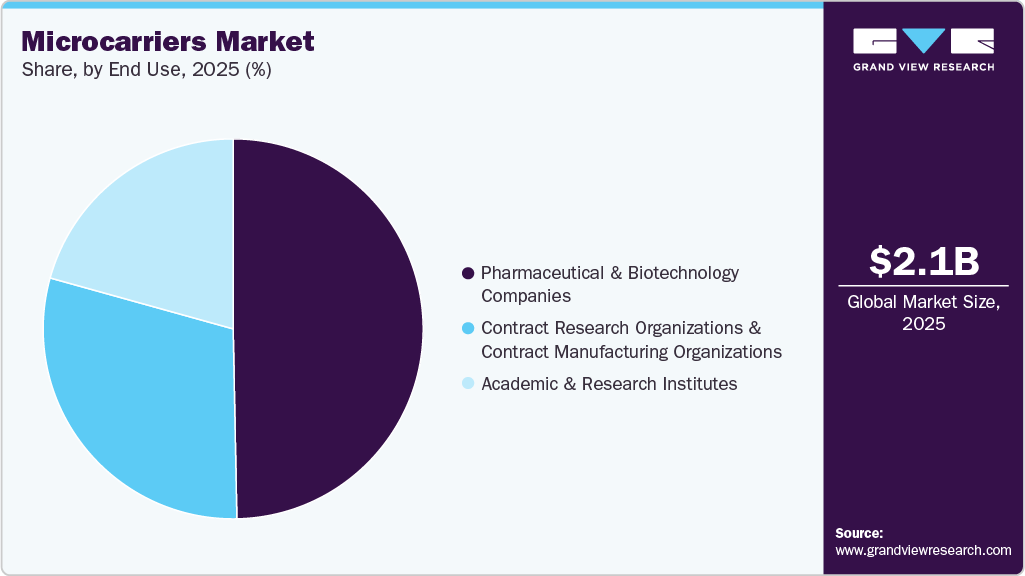

- By end-use, the pharmaceutical & biotechnology segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.13 Billion

- 2033 Projected Market Size: USD 4.89 Billion

- CAGR (2026-2033): 11.18%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

For instance, in May 2024, Sartorius and Sanofi partnered to develop and commercialize a platform that streamlines and optimizes downstream bioprocessing operations, enhancing efficiency and productivity in the production of biopharmaceuticals. This can lead to the development of more sophisticated microcarrier-based bioprocessing technologies.

Rising Demand for Cell-Based Therapies And Regenerative Medicine

The accelerating adoption of cell-based therapies and regenerative medicine is a primary growth driver for the global microcarriers industry. The increasing prevalence of chronic diseases, cancer, cardiovascular disorders, and genetic conditions has intensified the need for advanced treatment approaches that go beyond conventional pharmaceuticals. Cell therapies, including stem cell therapies, immunotherapies, and tissue engineering solutions, require robust and scalable platforms for the expansion of adherent cells. Microcarriers play a critical role in enabling high-density cell growth within bioreactors, making them indispensable for both clinical and commercial-scale manufacturing.

As the global biopharmaceutical industry shifts toward personalized and precision medicine, the demand for large-scale, reproducible, and cost-effective cell expansion technologies continues to rise. Regenerative medicine applications, particularly in orthopedics, neurology, and oncology, rely heavily on the efficient production of high-quality cells. Microcarriers support these requirements by enhancing surface area for cell attachment, improving yield, and enabling controlled scale-up. This scalability advantage is especially critical as multiple cell-based therapies progress from early-stage trials into late-phase clinical development and commercialization.

Furthermore, growing investments by pharmaceutical companies, biotechnology firms, and research institutions in cell therapy pipelines are strengthening the long-term demand outlook for microcarriers. Government funding initiatives and regulatory support for advanced therapies across key markets such as North America, Europe, and Asia-Pacific are also accelerating technology adoption. As the therapeutic scope of regenerative medicine continues to expand, microcarriers will remain a foundational component of upstream cell culture processes, directly supporting the commercial viability of next-generation cell-based treatments.

Growth in Cell & Gene Therapy Approvals

The rising number of regulatory approvals for cell and gene therapies is significantly accelerating the transition from clinical-stage development to commercial-scale manufacturing, thereby driving demand for microcarriers. As more advanced therapies receive approvals across major regulatory agencies, including the U.S. FDA, EMA, and regulatory bodies in Asia-Pacific, biopharmaceutical manufacturers are required to scale up production rapidly while maintaining strict quality and compliance standards. Microcarriers enable efficient large-scale expansion of adherent cells, supporting consistent yields and process reproducibility necessary for commercial supply.

In addition, regulatory progression is encouraging increased capital investment in manufacturing infrastructure, including single-use bioreactors and automated cell culture systems where microcarriers play a critical operational role. The shift toward commercial manufacturing of approved therapies is also driving long-term supply agreements with microcarrier vendors and promoting wider adoption across CDMOs. As regulatory momentum for advanced therapies continues to strengthen, the microcarriers industry is expected to witness sustained growth supported by expanding commercial production volumes.

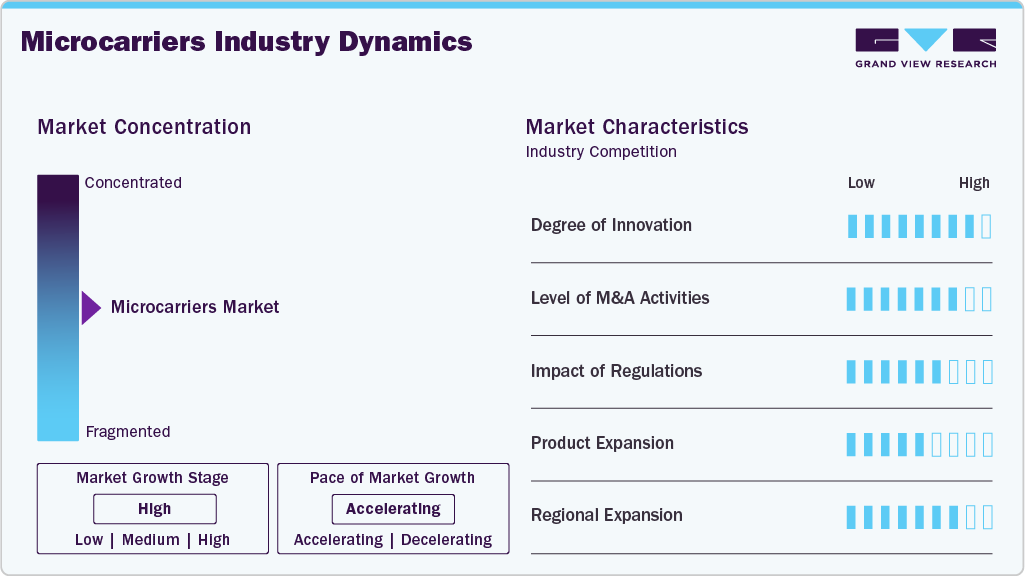

Market Concentration & Characteristics

The degree of innovation in the microcarriers industry is high, driven by rapid advancements in surface chemistry, xeno-free and animal-origin-free formulations, and the growing need for scalable cell culture systems for cell and gene therapies. Continuous product enhancements to improve cell attachment efficiency, yield optimization, and regulatory compliance, along with rising adoption in regenerative medicine and viral vector manufacturing, are the primary drivers supporting high innovation intensity.

The level of M&A activity in the microcarriers industry is driven by strategic acquisitions aimed at strengthening bioprocessing portfolios, expanding cell and gene therapy capabilities, and enhancing geographic reach. Large life sciences companies are selectively acquiring niche technology providers to access advanced surface modification technologies, single-use solutions, and application-specific microcarrier platforms, supporting long-term growth and competitive positioning.

The impact of regulations on the microcarriers industry is high, as products used in cell and gene therapy manufacturing must comply with stringent quality, safety, and traceability standards. Regulatory requirements for xeno-free materials, GMP compliance, and process validation are driving innovation while also increasing entry barriers. At the same time, faster regulatory approvals for advanced therapies are positively supporting commercial-scale adoption of microcarriers.

Product expansion in the microcarriers industry is driven by continuous launches of xeno-free, animal-origin-free, and application-specific microcarriers tailored for cell and gene therapy, vaccine production, and regenerative medicine. Companies are actively broadening their portfolios with surface-engineered and ready-to-use variants to improve cell attachment efficiency, scalability, and regulatory compliance, supporting wider adoption across both clinical and commercial manufacturing.

Regional expansion in the microcarriers industry is driven by the rapid growth of biopharmaceutical manufacturing and cell therapy research across Asia-Pacific, Latin America, and the Middle East. Leading companies are establishing local manufacturing units, distribution partnerships, and application support centers to strengthen market access, reduce supply chain risks, and capitalize on increasing clinical trial activity and CDMO expansion in emerging economies.

Consumable Insights

The microcarrier beads segment accounted for the largest market revenue share in 2025. The ever-expanding use of microcarrier beads during cell culture contributes to the highest revenue generation in the market. Increased cell biology research, growing demand for regenerative medicines & biopharmaceuticals, and the presence of various microcarrier beads that can be employed for different purposes, attributed to the significant market growth.

Vast product offerings by key market players and continuous developments in microcarrier technology have recreated lucrative opportunities and resulted in the launch of novel products. Companies such as Sartorius AG offer microcarrier beads that are animal component-free and animal protein coated for adherent cell culturing. Thus, microcarrier beads can be extensively used during numerous processes and for research, further increasing the segment's revenue generation.

Application Insights

The biopharmaceutical production segment accounted for the largest market revenue share in 2025, due to the growing cases of infectious diseases & genetic disorders and increasing cancer incidence, resulting in increasing demand for producing safe & effective medicines or treatments. Biopharmaceutical companies are expanding their capacities and product offerings to meet the growing demand. For instance, in August 2022, Celltrion Inc., a Korea-based healthcare company, announced the approval of the European Commission for its Bevacizumab biosimilar, Vegzelma, for treatment of some types of cancer such as glioblastoma, colorectal cancer and others. With this 3rd biosimilar approval, the company has expanded its oncology care portfolio for use in Europe

The regenerative medicine segment is anticipated to grow at the fastest CAGR over the forecast period. This segment is driven by the increasing prevalence of chronic diseases, advancements in stem cell research, and the growing demand for personalized healthcare solutions. In the microcarrier market, the application insights focus on developing innovative drug delivery systems that utilize regenerative medicine principles to enhance targeted therapy and tissue regeneration. For instance, in March 2023, Hyperion Drug Discovery Co., Ltd. (HDD) and Dai Nippon Printing Co., Ltd. (DNP) collaborated in Tokyo to create soluble microcarriers for scaffolds in cell culture processes. These carriers have applications in regenerative medicine, gene therapy, exosomes, biopharmaceuticals, and cultured meat.

End Use Insights

The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 49.69% in 2025. The microcarriers industry is driven by several key factors for pharmaceutical and biotechnology companies, primarily due to the growing demand for scalable and efficient production of biologics, including monoclonal antibodies, cell-based vaccines, and gene therapies. As these companies increasingly invest in cell culture systems for large-scale biomanufacturing, microcarriers become essential for expanding adherent cells, offering a cost-effective solution that supports high-density cultures in bioreactors.

The advancements in regenerative medicine and stem cell research have also spurred the adoption of microcarriers, enabling pharmaceutical and biotech firms to produce therapeutic cells for treatments such as cell therapies. In addition, the focus on process optimization and automation in bioprocessing has driven the demand for microcarrier technologies that facilitate consistent production yields, further supporting the development and commercialization of next-generation biologics and personalized medicines.

The academic & research institutes segment is anticipated to grow at the fastest CAGR over the forecast period, due to the need for advanced tools to conduct experiments, analyze data, and develop innovative solutions. These institutions require microcarriage for various applications such as microscopy, cell manipulation, drug delivery systems, and nanotechnology research. The demand for high-precision equipment with enhanced capabilities fuels the adoption of microcarriage in academic and research settings.

Regional Insights

North America dominated the global microcarriers market with the largest revenue share of 41.21% in 2025. The area is witnessing a surge in chronic and infectious diseases, necessitating advanced medical treatments. This growing health concern has led to a rising demand for personalized medicines that cater to individual patient needs. For instance, the U.S. FDA predicts that by 2025, it will start approving around 10 to 20 cell & gene therapy products annually due to the current clinical success rates and the product pipeline. Also, as per a fact sheet in November 2021, the U.S. FDA stated that about 621 biologic products are licensed. Continuous product approvals and the growth of the bio-manufacturing market drive the microcarriers industry's presence in North America.

U.S. Microcarrier Market Trends

The microcarrier market in the U.S. accounted for the largest market revenue share in North America in 2025 and is expected to grow rapidly over the forecast period. The driving factors behind this growth include the increased utilization of microcarriers for cell-based vaccine manufacturing, advancements in technology that support cell production using microcarriers, higher investments in cell and gene therapy research, a preference for single-use technologies, and a rise in R&D expenditure for biopharmaceutical production. For instance, in August 2023, Astellas Pharma Inc. and Poseida Therapeutics, Inc. announced a strategic partnership. This aims to support Poseida’s efforts in advancing cancer cell therapy, reflecting the increasing demand for microcarriers in the US due to the growing number of chronic disease cases and the approval of various cell and gene therapies.

Europe Microcarrier Market Trends

The microcarriers market in Europe presents significant growth opportunities, driven by the increasing adoption of advanced technologies in cell culture processes. The rising demand for biopharmaceuticals, gene therapies, and regenerative medicine drives the need for efficient cell culture solutions. In addition, the emergence of 3D cell culture techniques and the growing demand for monoclonal antibodies and biosimilars offer prospects for market expansion.

The UK microcarriers market is anticipated to grow at a significant CAGR during the forecast period. Substantial investments in cell and gene therapy studies, the rising adoption of microcarriers in cell-based vaccine manufacturing, advancements in technology for producing cells using microcarriers, increased R&D expenditures in biopharmaceutical manufacturing, and a preference for disposable technologies are shaping the UK market. Opportunities arise from rising demand for 3D cell culture, increasing demand for monoclonal antibodies (mAbs) and biosimilars, and the high-growth potential of emerging economies within the UK’s sphere of influence.

The microcarriers market in Germany is recognized for its robust R&D capabilities, particularly in areas related to biopharmaceuticals and cell culture technologies. The increasing R&D activities and technological innovations in Germany contribute to the market’s growth. The adoption of single-use technologies, a significant trend driving the global microcarrier industry, is also observed in Germany. The shift towards single-use technologies in cell culture, including the use of consumables such as media and reagents, promotes growth within the microcarrier industry.

Asia Pacific Microcarrier Market Trends

The microcarriers market in the Asia Pacific region is primarily influenced by the increasing demand for biologics within its domestic market and the growth of its economies, alongside having the highest population of seniors. Moreover, numerous local Asian and international companies are establishing various cutting-edge bioprocessing facilities in this area. For example, in March 2024, MilliporeSigma announced a significant €300 million (USD 349.68 million) investment in establishing a new bioprocessing facility in South Korea. This state-of-the-art facility will cater to the growing demand for biologics within the Asia-Pacific region, providing comprehensive support to biotech and pharmaceutical companies.

The Japan microcarriers market is experiencing significant growth driven by several key factors. The increasing demand for cell-based therapies has been a major catalyst for market expansion. Cell culture techniques are crucial in producing cell therapies, leading to a surge in the need for microcarriers that provide a three-dimensional environment for cell growth. The focus on personalized medicine and the development of innovative cell-based therapies is expected to further drive the market growth in Japan during the forecast period.

The microcarriers market in China has witnessed significant growth and is expected to continue the upward trajectory. Market dynamics in China for microcarriers are influenced by various increasing investments in cell and gene therapy research, technological advancements supporting microcarrier-based cell production, and the growing demand for biopharmaceutical production. For instance, in July 2023, cell and gene therapy production in China is scaled up by leveraging 3D manufacturing platforms and microcarrier technology to enhance efficiency and scalability.

Latin America Microcarrier Market Trends

The microcarriers market in Latin America is bolstered by increasing demand for biopharmaceuticals and cell therapies, driven by the growth of the healthcare sector and the rising prevalence of chronic diseases. Advancements in microcarrier technology, rising R&D activities, and government support are further fueling market growth. Moreover, the preference for single-use technologies promotes the adoption of microcarriers in bioprocessing applications across the region.

The Brazil microcarriers market in anticipated to grow at a significant CAGR during the forecast period. The trends in the Brazilian market align with broader global trends but could also be influenced by specific factors relevant to the Brazilian biopharmaceutical and research landscape. These trends include adoption rates of microcarriers for cell production, preference for single-use technologies, and substantial investments in cell and gene therapy research.

Middle East & Africa Microcarrier Market Trends

The microcarriers market in the Middle East & Africa is driven by a growing biopharmaceutical industry and increasing demand for cell and gene therapies across the region. Advancements in microcarrier technology, combined with increasing research and development activities and government initiatives, contribute to market expansion.

The UAE microcarriers market is growing due to the expansion of the biopharmaceutical and healthcare sectors, which are driven by increasing investments and government initiatives. Rising demand for cell-based therapies and vaccines, and advancements in microcarrier technology are further propelling market expansion.

Key Microcarriers Company Insights

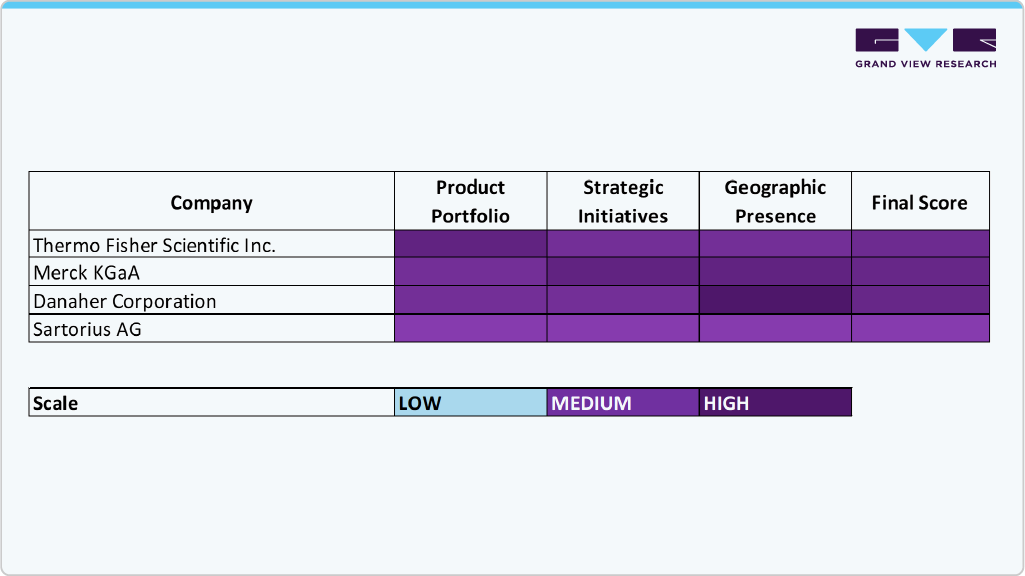

The global microcarriers industry is moderately consolidated, with a mix of established life sciences corporations and specialized bioprocessing solution providers competing across pharmaceutical manufacturing, cell therapy, and vaccine production applications. Key players are strengthening their market positions through extensive product portfolios, global distribution networks, and strong technical support capabilities. Market leaders benefit from long-term relationships with biopharmaceutical manufacturers and contract development and manufacturing organizations (CDMOs), which ensures consistent demand across upstream cell culture workflows.

Cytiva, Merck KGaA, and Thermo Fisher Scientific Inc. collectively account for a significant share of the global revenue in 2024. These companies dominate through continuous innovation in synthetic and biologically coated microcarriers optimized for high-density cell expansion, particularly for adherent stem cells and vaccine-producing cell lines. Sartorius AG and Danaher Corporation also hold notable market shares, supported by their strong presence in bioprocess instrumentation, consumables, and integrated cell culture platforms.

Emerging and mid-sized players such as Corning Incorporated, Pall Corporation, Lonza Group, and Eppendorf SE & Co. KG are expanding their footprint by launching application-specific microcarriers for advanced therapeutics, including viral vector production and regenerative medicine. These players are focusing on surface chemistry modifications, animal-origin-free formulations, and improved batch-to-batch reproducibility to meet regulatory and scalability requirements across clinical and commercial manufacturing.

Strategic developments such as capacity expansions, licensing collaborations, and portfolio acquisitions remain central to competitive positioning. Several companies are also investing in sustainable manufacturing and ready-to-use microcarrier systems to address the growing demand for single-use bioprocessing. As cell-based therapies transition from clinical trials to commercial-scale production, the competitive landscape is expected to further intensify, with both multinational corporations and specialized innovators pursuing differentiation through performance efficiency, regulatory compliance, and customization capabilities.

Key Microcarriers Companies:

The following are the leading companies in the microcarriers market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- Sartorius AG

- Corning Incorporated

- Eppendorf SE

- Bio-Rad Laboratories, Inc.

- HiMedia Laboratories Pvt. Ltd.

- denovoMATRIX GmbH

Recent Developments

-

In October 2023, Kuraray Co., Ltd., headquartered in Chiyoda-ku, Tokyo, under the leadership of President Hitoshi Kawahara, developed PVA hydrogel microcarriers for cellular cultures in regenerative medicine. These pioneering items are slated for launch in January 2024, initially in Japan, with plans for subsequent expansion into the United States and other global markets.

-

In October 2023, Semarion, a biotechnology company specializing in innovative solutions for cell culture applications, unveiled its Early Adopter Programme for the SemaCyte Microcarrier Platform. This program was designed to introduce and promote the adoption of their new microcarrier platform among early adopters in the scientific and research community.

-

In June 2023, Teijin Frontier Co., Ltd., a company within the Teijin Group specializing in fibers and product conversion, introduced novel nonwoven microcarriers designed to enhance rapid, large-scale, and high-quality cell culture. These microcarriers serve as supportive structures for various cell types, promoting attachment and growth in three dimensions.

Microcarriers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.33 billion

Revenue forecast in 2033

USD 4.89 billion

Growth rate

CAGR of 11.18% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Consumable, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Sartorius AG; Merck KGaA; Danaher Corporation; HiMedia Laboratories Pvt. Ltd.; Eppendorf SE; Corning Incorporated; Bio-Rad Laboratories, Inc.; denovoMATRIX GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Microcarriers Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global microcarriers market report based on the consumable, application, end use, and region:

-

Consumable Outlook (Revenue, USD Million, 2021 - 2033)

-

Media & Reagents

-

Microcarrier Beads

-

Collagen Coated Beads

-

Cationic Beads

-

Protein Coated Beads

-

Untreated Beads

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Production

-

Vaccine Production

-

Therapeutic Production

-

-

Regenerative Medicine

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations & Contract Manufacturing Organizations

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microcarriers market size was estimated at USD 2.13 billion in 2025 and is expected to reach USD 2.33 billion in 2026.

b. The global microcarriers market is expected to grow at a compound annual growth rate of 11.18% from 2026 to 2033 to reach USD 4.89 billion by 2033.

b. Microcarrier beads segment dominated the microcarriers market with a share of 64.67% in 2025.

b. Some of the key players in the microcarriers market include Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Sartorius AG, Corning Incorporated, Eppendorf SE, Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., and denovoMATRIX GmbH.

b. Key factors that are driving the microcarriers market are growing demand of cell based vaccines & therapeutics, and technological advancements in cell biology research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.