- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Engineering Plastics Market Size Report, 2033GVR Report cover

![Middle East Engineering Plastics Market Size, Share & Trends Report]()

Middle East Engineering Plastics Market (2025 - 2033) Size, Share & Trends Analysis Report By Resin Type (Styrene Copolymers (ABS and SAN), Fluoropolymer, Polyamide (PA), Liquid Crystal Polymer (LCP)), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-732-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Engineering Plastics Market Summary

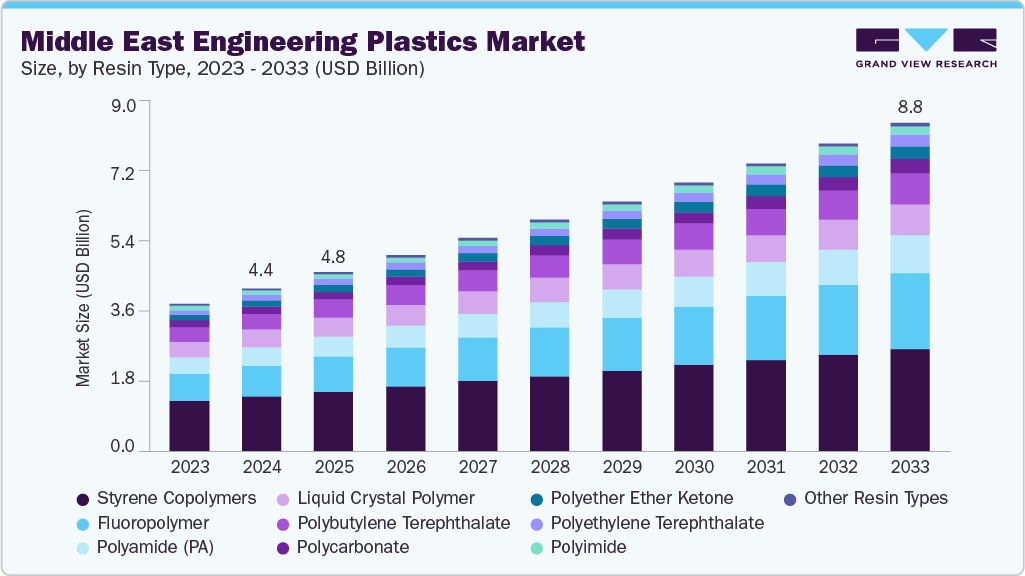

The Middle East engineering plastics market size was estimated at USD 4.37 billion in 2024 and is expected to reach USD 8.81 billion by 2033, expanding at a CAGR of 7.9% from 2025 to 2033. The market is driven by the rapid expansion of construction, automotive, and electrical industries demanding durable, lightweight, and high-performance materials.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East engineering plasticsmarket with the largest revenue share of over 30.0% in 2024.

- By resin type, the fluoropolymer segment is expected to grow at a considerable CAGR of 10.2% from 2025 to 2033 in terms of revenue.

- By end use, the security / authentication segment is expected to grow at a considerable CAGR of 10.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4.37 Billion

- 2033 Projected Market Size: USD 8.81 Billion

- CAGR (2025-2033): 7.9%

In addition, government-backed industrial diversification and infrastructure projects boost the adoption of engineering plastics across the region. The Middle East engineering plastics market is largely driven by the region's robust industrial and manufacturing growth. With countries such as Saudi Arabia, UAE, and Qatar investing heavily in industrial diversification under initiatives such as Saudi Vision 2030 and UAE’s Industrial Strategy, there is a growing demand for high-performance plastics. Engineering plastics such as polycarbonate (PC), acrylonitrile butadiene styrene (ABS), and polyamide (PA) are increasingly preferred over traditional materials due to their superior mechanical strength, thermal stability, and chemical resistance, enabling manufacturers to optimize production and reduce maintenance costs. For instance, in automotive and construction applications, these plastics are replacing metals in components like engine covers, HVAC ducts, and electrical housing.

In addition, the rapid expansion of the automotive and electronics sectors in the region is propelling market growth. The Middle East has seen increased automotive production, especially in passenger vehicles and electric vehicles (EVs), which rely heavily on engineering plastics for lightweighting, fuel efficiency, and improved design flexibility. Companies such as SABIC in Saudi Arabia are supplying high-performance polymers to global automotive OEMs, supporting local production of lightweight dashboards, bumpers, and electrical components. Similarly, the growing electronics industry, including consumer electronics and household appliances, is increasingly adopting engineering plastics for durable and heat-resistant components.

Infrastructure development and construction activities also propel the demand for engineering plastics in the Middle East. With extensive urbanization, mega-projects such as NEOM in Saudi Arabia and Expo City in Dubai require materials that can withstand extreme environmental conditions such as high temperatures and UV exposure. Engineering plastics are preferred for piping, electrical insulation, roofing sheets, and façade components due to their durability, corrosion resistance, and ease of fabrication. This trend is particularly evident in HVAC systems, water management solutions, and electrical conduits, where engineering plastics offer both performance and cost advantages over traditional metals.

Moreover, the increasing focus on sustainability and lightweight solutions is further accelerating market growth. Middle Eastern industries are adopting engineering plastics to reduce carbon footprint and improve energy efficiency in transportation, packaging, and industrial machinery. For example, polyamide-based plastics are used in lightweight automotive parts to improve fuel efficiency, while polyphenylene sulfide (PPS) is utilized in chemical and oil & gas pipelines for long-term durability. Coupled with growing regional investments in polymer production and processing facilities, such as SABIC’s polymer innovation centers, the market is poised for continued expansion, driven by both technological innovation and regulatory support for sustainable industrial practices.

Market Concentration & Characteristics

Engineering plastics in the Middle East are valued for their superior mechanical, thermal, and chemical properties compared to commodity plastics. They offer high strength-to-weight ratios, excellent dimensional stability, and resistance to heat, chemicals, and UV exposure. These characteristics make them suitable for demanding applications in automotive, construction, electronics, and industrial machinery. For example, polycarbonate (PC) is widely used in lighting and electrical housings due to its transparency and heat resistance.

There is an increasing emphasis on sustainable solutions and lightweight materials across industries. Engineering plastics contribute to fuel efficiency in automotive, energy savings in construction, and recyclability in manufacturing. Polyamide and polyphenylene sulfide (PPS) are examples of plastics that meet performance and sustainability requirements, offering durability while reducing carbon footprint.

Resin Type Insights

The Styrene Copolymers (ABS and SAN) segment recorded the largest market revenue share of over 33.0% in 2024. ABS & SAN are widely used engineering plastics in the Middle East for applications requiring high impact resistance, dimensional stability, and ease of processing. ABS is preferred in automotive parts, consumer electronics, and appliances, whereas SAN is often used in transparent and decorative applications. Growing consumer electronics and automotive sectors in GCC countries are driving ABS demand. SAN growth is fueled by increased demand in transparent packaging, household appliances, and cosmetic components due to its glossy finish and chemical resistance.

Fluoropolymer is expected to grow at the fastest CAGR of 10.2% during the forecast period. Fluoropolymers, including PTFE, FEP, and PVDF, are high-performance plastics known for excellent chemical resistance, thermal stability, and low friction. They are used in chemical processing, oil & gas, aerospace, and electrical insulation applications. The expansion of oil & gas infrastructure and chemical processing industries in Saudi Arabia and UAE is driving fluoropolymer demand. High-performance applications requiring extreme temperature and chemical resistance further boost adoption.

End Use Insights

The automotive & transportation segment recorded the largest market share of over 32.0% in 2024.The automotive and transportation segment in the Middle East engineering plastics market encompasses components such as bumpers, interior trims, dashboards, fuel system parts, and lightweight structural components. Engineering plastics like polyamide (PA), polycarbonate (PC), and acrylonitrile butadiene styrene (ABS) are extensively used to enhance fuel efficiency, reduce vehicle weight, and improve durability. Additionally, the expansion of public transportation and logistics infrastructure projects across the region stimulates demand for durable plastic components in buses, trains, and commercial vehicles.

The medical segment is projected to grow at the fastest CAGR of 10.5% during the forecast period. Engineering plastics in medical applications include surgical instruments, diagnostic devices, medical implants, and hospital equipment components. Materials such as PEEK, PC, and medical-grade polypropylene (PP) are chosen for their biocompatibility, sterilizability, and mechanical strength. Investments in healthcare infrastructure across the Middle East, particularly in Saudi Arabia and UAE, support this segment.

Country Insights

Saudi Arabia Engineering Plastics Market Trends

In 2024, Saudi Arabia led the market, accounting for over 30.0% of revenue share. Saudi Arabia is the largest market for engineering plastics in the Middle East, driven by its strong petrochemical and manufacturing sector. The country is home to major chemical producers such as SABIC, which manufacture high-performance polymers and specialty plastics. The growth is largely driven by Saudi Arabia’s industrial diversification initiatives, particularly Vision 2030, which focuses on developing the non-oil manufacturing sector.

UAE Engineering Plastics Market Trends

The UAEis projected to register the fastest CAGR of 8.9% during the forecast period, owing to its diversified industrial economy. Dubai and Abu Dhabi are major centers for plastics processing, particularly in construction, automotive, and packaging. The UAE also attracts multinational corporations looking to establish regional headquarters and manufacturing facilities. The market is driven by rapid urbanization, smart city projects, and a robust construction industry. Government initiatives such as the UAE Plastics Pact encourage sustainable and advanced polymer usage.

Turkey Engineering Plastics Market Trends

Turkeyserves as a regional hub for engineering plastics due to its well-established manufacturing base, particularly in automotive, electronics, and construction materials. The country imports high-end polymers but also has a growing domestic polymer processing industry that produces high-quality engineering plastics for industrial applications. Turkey’s strategic geographic location, bridging Europe and Asia, facilitates exports and imports of raw materials and finished products.

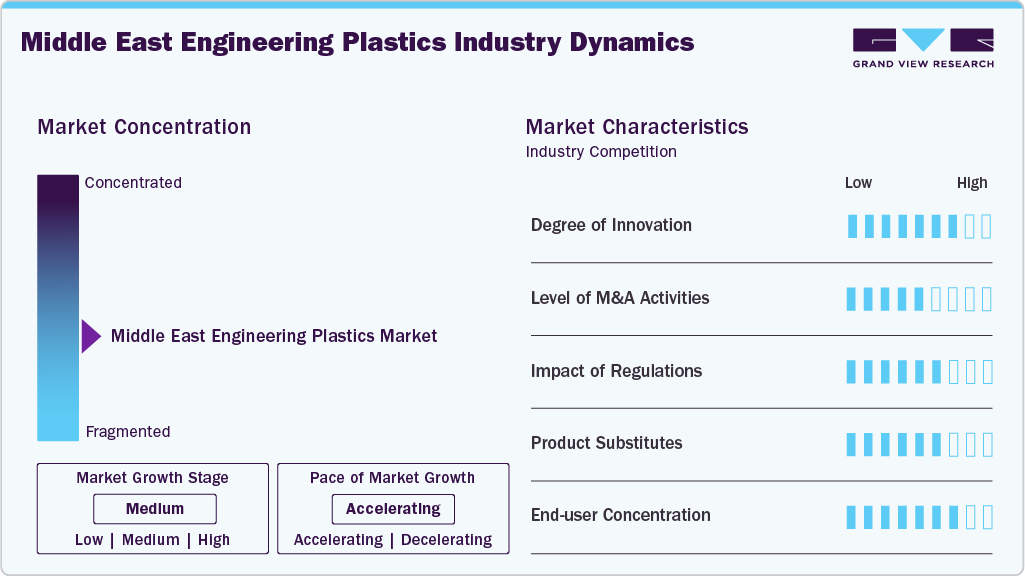

Key Middle East Engineering Plastics Company Insights

The competitive environment of the Middle East engineering plastics industry is moderately fragmented, dominated by a mix of large multinational polymer producers and regional manufacturers. Key players focus on leveraging advanced technologies, strategic partnerships, and localized production to meet the growing demand from automotive, construction, electrical & electronics, and industrial sectors.

Market competition is driven by product innovation, cost-efficiency, and the ability to provide customized solutions tailored to regional requirements. While multinational companies maintain a strong foothold through brand reputation and technological expertise, regional players compete aggressively on price, supply chain flexibility, and proximity to end-users, making the market dynamic yet highly competitive.

-

In July 2025, SABIC launched LNP Thermotuf WF0087N, the first flame-retardant PBT compound for nano molding technology (NMT), offering high impact resistance and 60% stronger metal bonding. Targeted at consumer electronics, it enables lightweight, durable, and water- and dust-resistant metal-plastic hybrid components, meeting IEC 62368-1 standards. Applications include smartphone frames, tablets, smartwatches, and laptops, with benefits such as improved aesthetics, RF transparency, and easier processing.

-

In May 2025, Astra Polymers partnered with UK climate tech startup Levidian to develop sustainable, graphene-enhanced plastics, focusing on the automotive and EV sectors in the Middle East. Using Levidian’s low-carbon LOOP graphene technology, they are trialing HDPE-based components that are stronger and more eco-friendly. The collaboration aims to support regional supply chains, create high-value jobs, and position the UAE as a hub for sustainable materials and the growing electric vehicle market.

Key Middle East Engineering Plastics Companies:

- SABIC

- Borouge

- NATPET - National Petrochemical Industrial Company

- SIPCHEM

- Tasnee

- BASF

- Polyram Group

- DuPont

- Covestro AG

- Petro Rabigh

Middle East Engineering Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.81 billion

Revenue forecast in 2033

USD 8.81 billion

Growth rate

CAGR of 7.9% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Resin type, end use, country

Country scope

UAE; Saudi Arabia; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

SABIC; Borouge; NATPET - National Petrochemical Industrial Company; SIPCHEM; Tasnee; BASF; Polyram Group; DuPont; Covestro AG; Petro Rabigh

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Engineering Plastics Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East engineering plastics market report based on resin type, end use, and country:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Styrene Copolymers (ABS & SAN)

-

Fluoropolymer

-

Ethylenetetrafluoroethylene (ETFE)

-

Fluorinated Ethylene-propylene (FEP)

-

Polytetrafluoroethylene (PTFE)

-

Polyvinyl fluoride (PVF)

-

Polyvinylidene Fluoride (PVDF)

-

-

Liquid Crystal Polymer (LCP)

-

Polyamide (PA)

-

Aramid

-

Polyamide (PA) 6

-

Polyamide (PA) 66

-

Polyphthalamide

-

-

Polybutylene Terephthalate (PBT)

-

Polycarbonate (PC)

-

Polyether Ether Ketone (PEEK)

-

Polyethylene Terephthalate (PET)

-

Polyimide (PI)

-

Polymethyl Methacrylate (PMMA)

-

Polyoxymethylene (POM)

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive & Transportation

-

Electrical & Electronics

-

Building & Construction

-

Consumer Goods & Appliances

-

Industrial

-

Medical

-

Aerospace

-

Other End-uses

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.