- Home

- »

- Next Generation Technologies

- »

-

Middle East Gaming Market Size, Industry Report, 2030GVR Report cover

![Middle East Gaming Market Size, Share & Trends Report]()

Middle East Gaming Market (2024 - 2030) Size, Share & Trends Analysis Report By Device (Console, Mobile, Computer), By Type, By Genre, By Monetization Model (Free-to-play, Pay-to-play, Subscription-based), And Segment Forecasts

- Report ID: GVR-4-68040-227-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Gaming Market Size & Trends

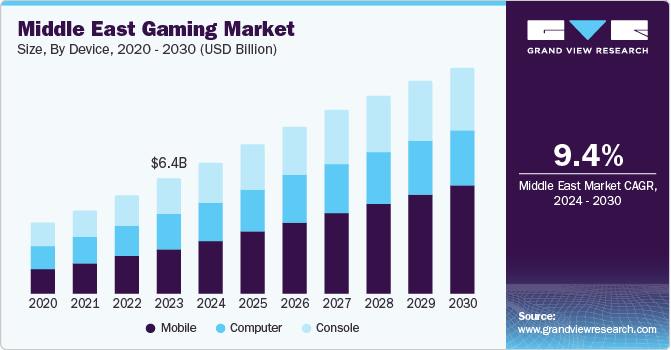

The Middle East gaming market size was valued at USD 7.45 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. The market is experiencing constant modernization & updates and is amongst the most popular forms of entertainment. The continually evolving business models of video games to meet the needs and preferences of gamers are one of the key factors driving the growth of the market. The availability of games across digital as well as physical platforms is instrumental in further propelling their demand. The availability of different payment options is also supporting the growth of the market.

The industry, which is currently in its eighth-generation stage, has witnessed many changes in processing technology and devices. The game systems of the consoles have faced major competition from mobile OS platforms such as Apple or Android operating systems. Since mobile phones offer cheaper platforms for gaming and users can turn their smartphones into VR gaming devices with the help of VR peripherals, the number of smartphone users is rising rapidly.

After the release of the eighth generation of consoles in 2012, the major companies came up with VR supporting consoles and peripherals. This transformation signifies how the market has geared up for the advent of new technology. There has been a rapid advancement in the development of VR peripherals supported by the major game consoles and desktops. The market for wearable devices, such as head mounted displays, body suits, gloves, and motion trackers, is expected to contribute to the market expansion.

Advancements in 5G technology provide support to a significant number of devices at a time which is expected to increase the numbers of gamers. It will also allow developers to deliver an enhanced gaming experience in the online gaming market. The increasing trend of e-sports, social gaming, cloud-based gaming, and roguelike gaming has a positive impact on growth of the market. The availability of games across devices such as consoles, smartphones, portable gaming devices, computers, and tablets and key market companies focusing on launching interactive games attract young generations for entertainment purposes.

Market Concentration & Characteristics

The industry is growing fast and is characterized by a moderate to high degree of innovation. The convergence of AI-based technologies and gaming has enabled natural interaction and created an immersive gaming experience. Cloud gaming and AR/VR trends are further attracting the general populace toward the gaming industry.

The market is also characterized by a high degree of merger and acquisition activities. For instance, in February 2022, Nintendo announced the acquisition of SRD Co., Ltd., a major contributor of Nintendo's first-party games such as Donkey Kong and The Legend of Zelda. In May 2022, Reuters reported that Saudi Arabia's Public Investment Fund had purchased 5% stake in Nintendo. By January 2023, its stake in the company had increased to 6.07%.

Most of the Middle Eastern countries have a very strict laws regarding gaming and it is not easy for companies to make easy transaction with any online gaming provider, always, because of the strict laws and financial regulations. For instance, The UAE’s National Media Council (NMC) has a list of guidelines that balances content and digital expression for the country. The rules seek to ensure that the market respects the religious, cultural and social values of the country.

Similarly, the General Authority of Media Regulation (GAMR, or Gmedia) introduced Saudi Arabia's official age rating system for video games in 2016. Any game title is effectively banned if the body refuses to give it a rating, unless publishers possibly address concerns and remove violating content specifically for the market.

Device Insights

The mobile segment dominated the market with the largest revenue share of 39.0% in 2023 due to the rising use of smartphones among people. Mobile phones offer cheaper platforms for gaming and users can turn their smartphones into VR gaming devices with the help of VR peripherals such as Google Cardboard etc. Unlike consoles, mobile devices offer benefits such portability and convenience. Mobile gaming includes devices such as mobile phones, tablets, and Personal Digital Assistant (PDA), among others.

Consoles are another important devices that allow users to play games through an electronic device that is usually connected to a television and equipped with controllers such as joysticks, gamepads, steering wheel, and gun, among others. The different types of gaming consoles include handheld consoles, home video game consoles, dedicated consoles, and microconsoles, among others.

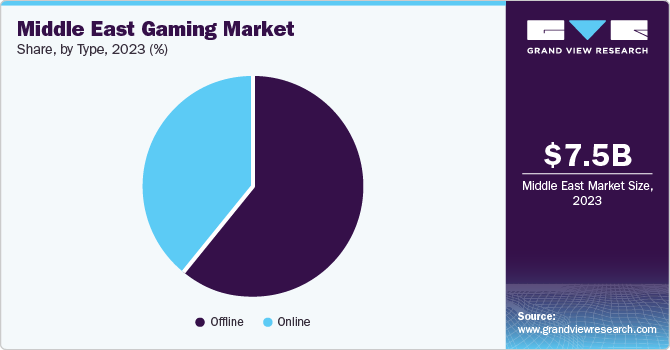

Type Insights

Based on type, the market can be segmented into online and offline, and the online segment is expected to grow with the highest CAGR during the forecast period. Games that require an internet connection for playing are termed as online games. These games offer more convenience as they eliminate the need for downloading and installing games on a system and can be played on-the-go. Online games enable users to use subscriptions, pay-per-item, and microtransactions, among others, to play games online.

Technological trends like augmented reality (AR), virtual reality (VR), and mixed reality (MR) have inclined people toward gaming. The growing number of e-sports events and multiplayer gaming has transformed the online gaming segment. Multiplayer modes keep gamers involved through social engagement and a feeling of achievement among companies. Companies are interested in making in-app purchases and pay only to stay in the game. Trends such as live streaming of games and multiplayer games are expected to fuel the growth of online gaming in the forecasted period.

Country Insights

Turkey Gaming Market Trends

Turkey dominated the Middle East gaming market with the largest revenue share in 2023. Gaming has become a big business in Turkey, especially post-Covid-19 pandemic. Turkish game developers have attracted significant financing and investments in the recent few years. For instance, in June 2020, Zynga acquired Turkey-based company Peak Games. Additionally, with the ongoing advancements in technology, the gaming industry in Turkey is able to reach a wider audience and develop new titles to cater to consumer demand. Moreover, the most widely used video game content rating system Pan European Gaming Information (PEGI), does not have a legal basis in Turkey, and Turkey is not officially represented in the PEGI council.

Jordan Gaming Market Trends

The market in Jordan is expected to grow with the highest CAGR from 2024 to 2030. The gaming industry in Jordan is experiencing significant growth due to advancements in AR, VR, and cloud gaming technologies, and the penetration of high-speed internet. Moreover, according to the World Bank, almost 50% of the population of Jordan is estimated to be under the age of 25. These facts support the gaming industry in the country as the market especially attracts the younger population. Tamatem, FATE Esports, Haddaf, iDeal Lifestyle App, Dinero LTD, Dimensions-studio, and Rayah Interactive Studio are some of the regional game developers of Jordan.

Key Middle East Gaming Company Insights

Some of the leading companies operating in the market include Sony Group Corporation, Microsoft Corporation, and Nintendo.

-

Sony Group Corporation is engaged in developing software and hardware for gaming. It also develops and publishes video games for mobile, PC, and console platforms. The company oversees the PlayStation brand and family of its products in the global market.

-

Nintendo has developed a wide range of handheld video games and gaming consoles, including Nintendo Entertainment System, Super Nintendo Entertainment System, Nintendo 64, GameCube, Wii, Wii U, and Nintendo Switch. Gameboy, Nintendo DS, and Nintendo 3DS are its major handheld gaming consoles. Some of the popular games developed by the company include The Legend of Zelda, Pokemon, and Mario.

Wemade, Gamerji, and BlueStacks Inc. are some other companies in the Middle East gaming market.

- BlueStacks Inc. is popular for its creation of the BlueStacks App Player and other cloud-based cross-platform products that enable the execution of Android applications on computers running Microsoft Windows or macOS.

Key Middle East Gaming Companies:

- Apple Inc.

- BlueStacks Inc

- Electronic Arts Inc.

- Game Power 7 Corp

- GamerJi E-Sports Private Limited

- Google LLC (Alphabet Inc.)

- Juego Studios Private Limited

- Microsoft Corporation

- Nintendo Co., Ltd.

- NVIDIA Corporation

- Play3arabi

- Rovio Entertainment Corporation

- Sega Corporation

- Tamatem Games

- Tencent Holdings Ltd.

- Valve Corporation

- Wemade Co., Ltd

Recent Developments

-

In June 2022, Gamerji announced its expansion to the Middle East. Its services became available in Saudi Arabia and the United Arab Emirates. The organization currently hosts four games: PUBG Mobile, FIFA 22, Call of Duty, and Clash Royale.

-

In March 2021 BlueStacks Inc., the pioneer of Android gaming on PC and the world’s leading mobile gaming platform, launched its biggest update ever, BlueStacks 5 (Beta), a powerhouse of speed and performance.

Middle East Gaming Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.62 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, type, genre, monetization model

Regional scope

Middle East

Country scope

Egypt; Jordan; Saudi Arabia; UAE; Turkey; Rest of Middle East

Key companies profiled

Apple Inc.; BlueStacks Inc.; Electronic Arts Inc.; Game Power 7 Corp.; GamerJi E-Sports Private Limited; Google LLC (Alphabet Inc.); Juego Studios Private Limited; Microsoft Corporation; Nintendo Co., Ltd.; NVIDIA Corporation; Play3arabi; Rovio Entertainment Corporation; Sega Corporation; Tamatem Games; Tencent Holdings Ltd.; Valve Corporation; Wemade Co., Ltd

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Gaming Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Middle East gaming market report on the basis of device, and type:

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Console

-

Mobile

-

Computer

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Genre Outlook (Revenue, USD Billion, 2018 - 2030)

-

Action & Adventure

-

Puzzle

-

Role Playing

-

Simulation

-

Strategy

-

Sports

-

Others

-

-

Monetization Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Free-to-play

-

Pay-to-play

-

Subscription-based

-

Frequently Asked Questions About This Report

b. The Middle East gaming market size was estimated at USD 7.45 billion in 2023.

b. The Middle East gaming market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 14.62 billion by 2030.

b. The mobile type segment dominated the market with the largest revenue share of 38.9% in 2023 due to the rising use of smartphones among people.

b. Some key players operating in the Middle East gaming market include Apple, Inc., Electronic Arts Inc., Google LLC, Microsoft Corporation, NVIDIA Corporation, and Sega Corporation.

b. The continually evolving business models of video games to meet the needs and preferences of gamers are one of the key factors driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.