- Home

- »

- Clinical Diagnostics

- »

-

Middle East Oncology Based Molecular Diagnostics Market, 2033GVR Report cover

![Middle East Oncology Based Molecular Diagnostics Market Size, Share & Trends Report]()

Middle East Oncology Based Molecular Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Breast Cancer, Lung Cancer, Prostate Cancer, Liver Cancer), By Product (Instruments, Reagents), By Technology, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-723-6

- Number of Report Pages: 320

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

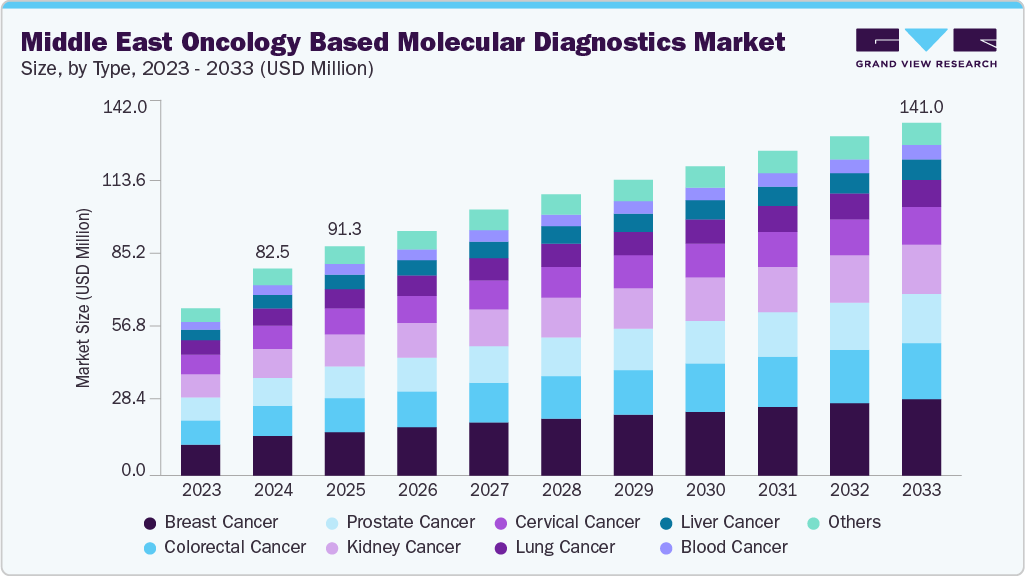

The Middle East oncology based molecular diagnostics market size was estimated at USD 82.5 million in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2033. Growth in the Middle East oncology-based molecular diagnostics market is driven by rising cancer incidence, increasing government investment in healthcare infrastructure, and the growing shift toward precision medicine. National cancer control programs in countries such as the UAE, Saudi Arabia, and Qatar are prioritizing early detection and biomarker-driven treatment. Expanding access to advanced technologies like NGS, PCR, and liquid biopsy is supported by public-private partnerships and multinational collaborations. Additionally, increased awareness, favorable reimbursement reforms, and the entry of global diagnostic companies are accelerating test adoption across the region.

The Middle East oncology-based molecular diagnostics market is experiencing rapid growth, driven by increasing cancer rates, changing disease patterns, and significant public–private investment in precision medicine infrastructure. In the UAE, growth is supported by the Emirati Genome Programme (EGP), launched in 2021, which has sequenced over 214,000 genomes in just 15 months, creating a population-specific reference database to guide clinical decisions. In June 2024, the Department of Health – Abu Dhabi formalized a strategic partnership with Illumina to incorporate next-generation sequencing (NGS) and multi-omics into clinical workflows, improve clinician training, and assess the economic benefits of adopting precision health. Additionally, Burjeel Medical City launched OncoHelix-coLAB in May 2024, in partnership with Canada’s OncoHelix, bringing comprehensive genomic profiling, immunology, and cellular diagnostics to the region-reducing turnaround times, increasing access, and allowing for higher patient throughput. Nonetheless, screening coverage remains uneven, with no unified national program and participation rates for breast and colorectal cancer estimated at less than 25% of the eligible population, creating a need for high-coverage, minimally invasive diagnostics and targeted risk assessment methods.

Oman is a high-growth market with clear capacity gaps. Cancer accounts for about 6% of disease-related deaths, with crude incidence rates in 2017 of 70.2 per 100,000 males and 80.9 per 100,000 females. GLOBOCAN projects new cancer cases will rise from 2,101 in 2017 to 5,761 by 2030 and 8,549 by 2040. Changes in disease patterns, such as colorectal cancer surpassing gastric cancer, a two- to threefold increase in lung cancer diagnoses, and a fivefold rise in thyroid cancer among females-along with high prevalence of lifestyle risk factors (obesity around 53%, smoking about 15%)-are driving ongoing demand for advanced molecular testing. The National Oncology Center at the Royal Hospital, established in 2004, manages approximately 70% of the country's cancer cases and offers FISH, IHC, and cytogenetics. However, many essential molecular assays, including RAS, BRAF, and PIK3CA, are outsourced to international labs, highlighting an opportunity for local expansion in PCR, NGS, and liquid biopsy capabilities. Oman’s Health Vision 2050, launched in 2014, emphasizes expanding oncology services, creating comprehensive cancer centers, and decentralizing care, supported by a well-developed national cancer registry and successful mobile screening initiatives.

In Kuwait, market growth is being catalyzed by strategic private-sector partnerships. In December 2021, Virtus Health Partners and Datar Cancer Genetics entered into an agreement to deploy advanced, non-invasive, blood-based multi-cancer detection and genomic profiling solutions, aiming to standardize precision oncology care pathways and integrate cutting-edge molecular diagnostics into clinical practice.

Collectively, these developments highlight the market’s upward trend, driven by key factors such as rising cancer rates, supportive government-led genomic initiatives, development of advanced laboratory capabilities locally, unmet needs for early detection tools, and the incorporation of precision oncology into standard care protocols. Companies with portfolios that include PCR (such as digital PCR), NGS platforms, ISH/IHC companion diagnostics, liquid biopsy panels, high-performance reagents, and bioinformatics-based decision support are well-positioned to gain market share in this quickly evolving ecosystem.

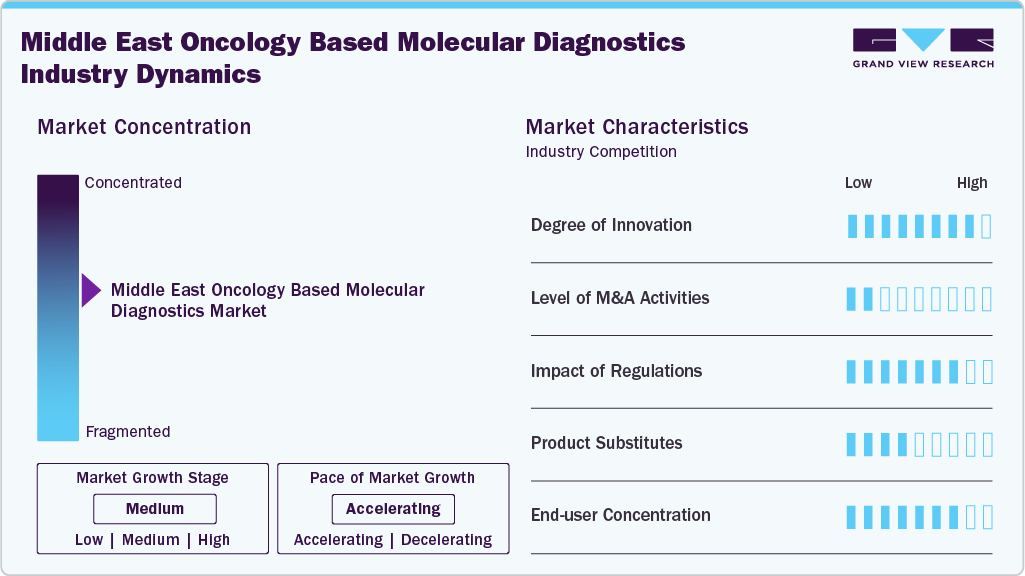

Market Concentration & Characteristics

The Middle East oncology-based molecular diagnostics market demonstrates a high degree of innovation, marked by rapid adoption of next-generation sequencing, liquid biopsy, and multi-cancer early detection platforms. Advancements include integration of genomics with AI-driven analytics, localization of high-complexity testing, and development of population-specific reference genomes. Strategic collaborations between global technology leaders and regional healthcare providers are accelerating the translation of cutting-edge molecular tools into routine clinical practice, improving accuracy, accessibility, and personalized treatment pathways.

The Middle East oncology-based molecular diagnostics market is experiencing moderate to high M&A activity, driven by global companies aiming for strategic entry or expansion through acquisitions and partnerships with regional laboratories, hospitals, and diagnostic service providers. Consolidation is propelled by the need to access established distribution channels, local regulatory knowledge, and high-growth oncology sectors. Key trends include cross-border acquisitions, joint ventures, and technology licensing agreements intended to speed up the adoption of advanced molecular platforms and to broaden precision oncology service offerings.

Regulations in the Middle East oncology-based molecular diagnostics market have a significant impact, shaping market entry, product approvals, and adoption timelines. Countries are increasingly aligning with international quality and accreditation standards such as ISO 15189 and CAP to ensure test accuracy and reliability. Stringent registration processes, particularly for IVD devices and companion diagnostics, influence time-to-market, while evolving frameworks for genetic testing and data privacy affect service delivery models. Supportive government initiatives, reimbursement reforms, and national cancer screening programs are also accelerating adoption of advanced oncology molecular diagnostics.

Product expansion in the Middle East oncology-based molecular diagnostics market is being driven by the launch of advanced assay panels, integration of multi-omics profiling, and adaptation of global platforms to regional clinical needs. Leading players are introducing liquid biopsy solutions, NGS-based comprehensive genomic profiling, and companion diagnostics tailored to prevalent cancer types in the region. Expansion strategies also include enhancing assay menus on existing platforms, developing localized language interfaces, and integrating AI-driven analytics to improve diagnostic accuracy, turnaround times, and clinical decision support in oncology care.

Regional expansion in the Middle East oncology-based molecular diagnostics market is accelerating as global and regional players establish a stronger footprint across high-growth GCC markets such as the UAE, Saudi Arabia, Oman, and Kuwait. Companies are forming strategic partnerships with local healthcare providers, opening regional offices, and collaborating with government-backed cancer centers to integrate advanced molecular diagnostics into national cancer control programs. Expansion is further supported by investments in local distribution networks, training programs for clinicians, and technology transfer initiatives to align with regulatory and infrastructure requirements across diverse markets.

Type Insights

In the Middle East, breast cancer represented the largest share of the oncology-based molecular diagnostics market in 2024, at 19.14%. This dominance is supported by the region’s high incidence of breast cancer, particularly among women under 50, and the growing emphasis on early detection and personalized treatment. Molecular diagnostics play a central role in identifying key biomarkers such as HER2 overexpression and BRCA1/2 mutations, which guide precision therapies and improve clinical outcomes. National cancer control strategies, often aligned with WHO’s Global Breast Cancer Initiative, are being integrated into regional healthcare systems, with governments expanding screening programs, subsidizing advanced diagnostics, and strengthening public-private partnerships to improve access.

Colorectal cancer is emerging as the fastest-growing segment in the Middle East oncology-based molecular diagnostics market during the review period, driven by increasing incidence linked to changing dietary habits, obesity, and sedentary lifestyles. Countries such as Saudi Arabia, the UAE, and Oman have reported a steady rise in colorectal cancer cases, with national cancer registries highlighting a shift toward younger patient populations. Molecular diagnostics, including KRAS, NRAS, and BRAF mutation testing, are gaining popularity to guide targeted therapies, while regional health authorities are prioritizing early screening programs to improve outcomes.

Technology Insights

In the Middle East, the polymerase chain reaction (PCR) technology segment also dominates the oncology-based molecular diagnostics market, holding the largest revenue share in 2024. Its leadership is supported by PCR’s proven ability to provide rapid and sensitive detection of cancer-specific mutations, which is crucial in resource-limited settings across the region. PCR is widely used in breast, colorectal, lung, and hematologic cancers for early diagnosis, treatment guidance, and monitoring. Favorable features like cost-effectiveness, ease of use, and compatibility with existing laboratory infrastructure continue to drive its broad adoption in both public and private hospitals. Additionally, innovations such as multiplex real-time PCR and droplet digital PCR are gaining popularity, enabling detection of low-frequency mutations and supporting precision oncology programs that are expanding in countries like Saudi Arabia and the UAE.

Meanwhile, the in situ hybridization (ISH) sector is expected to grow significantly in the Middle East, especially as oncology centers increasingly focus on precise biomarker testing. ISH is crucial for detecting HER2 amplification in breast cancer and ALK/ROS1 rearrangements in lung cancer, both of which are becoming more common in the region. Its ability to offer morphological context along with molecular information enhances its clinical usefulness for pathologists. The recent adoption of automated ISH platforms in top hospitals in the UAE and Qatar, combined with increasing demand for companion diagnostics in line with international treatment guidelines, is boosting its adoption. With national cancer strategies emphasizing biomarker-focused care, ISH is projected to see strong growth throughout the forecast period.

Product Insights

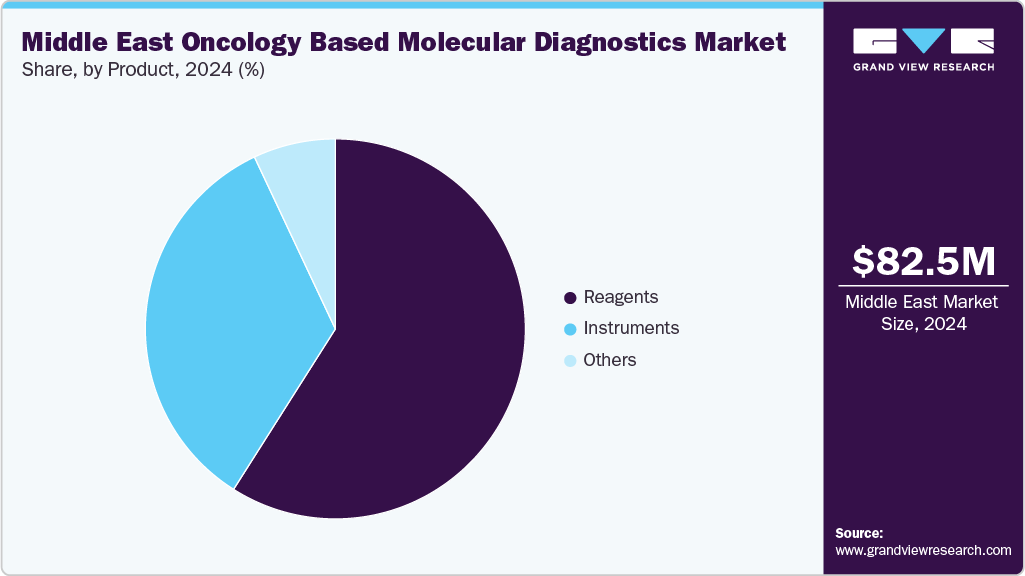

In the Middle East, the reagents segment accounted for the largest share of the oncology-based molecular diagnostics market in 2024, highlighting their vital role in enabling key technologies such as PCR, next-generation sequencing (NGS), and in situ hybridization. Essential components like enzymes, primers, probes, nucleotides, and buffers form the foundation of molecular assays that are increasingly adopted by leading cancer centers in Saudi Arabia, the UAE, and Qatar. Rising cancer rates, combined with national efforts to incorporate precision oncology into healthcare systems, have notably increased testing volumes in regional hospital pathology labs and reference laboratories. The rapid expansion of biomarker-driven clinical trials in partnership with global pharmaceutical companies is further driving reagent demand.

The Middle East reagents segment is projected to grow at a healthy CAGR of 5.9% over the forecast period, supported by the adoption of high-throughput, automated diagnostic platforms and the shift toward multiplex testing. Laboratories across the region are prioritizing high-quality, platform-compatible reagents to ensure diagnostic accuracy and compliance with international regulatory standards such as CE-IVD and IVDR. Advances in reagent formulations are also improving assay sensitivity and reproducibility, enabling laboratories to handle larger volumes of samples with improved efficiency. Furthermore, increasing collaborations between global reagent manufacturers and regional healthcare providers are enhancing local access to advanced kits, supporting capacity building and technology transfer. These trends are positioning the reagent segment as a cornerstone of oncology-based molecular diagnostics expansion in the Middle East, aligning with broader precision medicine initiatives.

Country Insights

The Middle East oncology-based molecular diagnostics market is poised for rapid growth, as several countries in the region are transitioning from limited screening infrastructure to more organized cancer detection initiatives. Historically, the absence of national screening programs and the high costs of advanced diagnostic tools slowed adoption, but recent developments are changing this outlook. For instance, the UAE and Saudi Arabia have rolled out structured breast and colorectal cancer screening programs in line with international guidelines. These programs are creating demand for reliable molecular diagnostic platforms that can support early detection and personalized treatment decisions.

A significant milestone occurred in January 2024 when Guardant Health, Inc. partnered with Hikma Pharmaceuticals PLC to expand access to advanced liquid and tissue biopsy tests across the Middle East. Through this agreement, Hikma obtained exclusive rights to commercialize Guardant’s portfolio in key regional markets, including the UAE, Saudi Arabia, Kuwait, and Qatar. The portfolio includes Shield for cancer screening, Guardant Reveal for minimal residual disease detection and recurrence monitoring, and Guardant360 along with Guardant360 TissueNext for comprehensive genomic profiling. This partnership not only speeds up the availability of precision oncology tools in the region but also supports national efforts to reduce late-stage cancer diagnoses.

With increasing cancer rates, growing government investment in healthcare modernization, and expanding partnerships between international diagnostic companies and regional distributors, the Middle East market is evolving into a center for precision oncology. Although challenges like high test costs and shortages of skilled professionals remain, ongoing collaborations and regulatory support are likely to greatly improve access to and the adoption of molecular diagnostics across the region.

Saudi Arabia Oncology Based Molecular Diagnostics Market Trends

The Saudi Arabia oncology-based molecular diagnostics market is expanding rapidly, supported by Vision 2030 healthcare reforms, rising cancer incidence, and the shift toward precision oncology. Leading centers such as KFSHRC are integrating NGS, PCR, and liquid biopsy into clinical workflows, enabling biomarker-driven therapy decisions. The SFDA’s regulatory alignment with global standards and expanding insurance coverage are improving test accessibility. While PCR remains dominant for routine biomarker detection, NGS and ctDNA-based assays are witnessing faster adoption for comprehensive profiling and recurrence monitoring. Growing public-private partnerships and technology transfer initiatives are strengthening local capacity, positioning Saudi Arabia as a regional hub for oncology diagnostics.

UAE Oncology Based Molecular Diagnostics Market Trends

The United Arab Emirates (UAE) oncology-based molecular diagnostics market is advancing rapidly, driven by national precision health strategies and investments in genomic infrastructure. The Emirati Genome Programme (EGP), launched in 2021, has quickly established a population-specific genomic database, supporting personalized oncology solutions. Leading hospitals are adopting advanced molecular tools-including NGS panels, liquid biopsies, and companion diagnostics-into standard cancer care, which shortens turnaround times and lessens dependence on external testing. Alignment with international standards (such as IVDR and ISO) improves test quality and facilitates market access. Increasing public-private partnerships, including high-tech lab collaborations and clinician training programs, are strengthening the UAE’s role as a regional innovation hub in oncology diagnostics.

Kuwait Oncology Based Molecular Diagnostics Market Trends

The oncology molecular diagnostics market in Kuwait is gaining momentum, driven by rising cancer rates and increased healthcare investments. A main driver is the 2021 partnership between Virtus Health Partners and Datar Cancer Genetics, which introduced non-invasive, blood-based multi-cancer detection and comprehensive genomic profiling into clinical workflows. This collaboration is expanding access to precision diagnostics and helping standardize screening and follow-up procedures. Healthcare authorities are also enhancing regulatory oversight of molecular tests, aligning with global standards to ensure quality. While PCR remains a cost-effective default, the market is quickly adopting liquid biopsy and NGS-based assays for early detection, MRD monitoring, and personalized treatment plans.

Qatar Oncology Based Molecular Diagnostics Market Trends

Qatar is quickly advancing its oncology molecular diagnostics sector, driven by strategic investments in precision medicine and a strong genomics base. A key initiative is the Qatar Genome Programme, which aims to sequence 350,000 Qatari genomes to create a population-specific resource for personalized healthcare. Supported by Sidra Medical & Research Center, this effort is facilitating local biomarker discovery and customized diagnostic development.

Complementing this, Qatar’s Cancer Plan 2023 - 2026 highlights the integration of molecular pathology and diagnostics into national oncology services, strengthening infrastructure for advanced testing and companion diagnostics.

Institutionally, Qatar University’s Biomedical Research Center (BRC) plays a pivotal role, conducting omics-based research and supporting laboratory quality through ISO‑accredited operations in genomics and translational medicine.

Oman ME Oncology Based Molecular Diagnostics Market Trends

Oman’s oncology molecular diagnostics market is experiencing steady growth, driven by increasing cancer rates, especially in colorectal, thyroid, uterine, breast, and prostate cancers-which have all shown significant annual rises in age-standardized rates from 1996 to 2019. The National Oncology Center (NOC) at the Royal Hospital treats over 70% of cases and serves as the main site for deploying molecular tests.

While PCR and IHC remain widely used, there’s growing demand for NGS and liquid biopsy platforms to improve early detection and personalized care. Oman’s Health Vision 2050 underscores plans to expand cancer centers, decentralize services, and strengthen molecular

Key Middle East Oncology Based Molecular Diagnostics Company Insights

Some of the key players in the ME oncology-based molecular diagnostics market are adopting various strategies to strengthen their position, such as expanding test menus, forming partnerships with healthcare providers, and investing in advanced technologies like NGS and liquid biopsy. These efforts aim to improve diagnostic accuracy, increase access to personalized cancer testing, and remain competitive in a market shaped by rising cancer burden, evolving clinical guidelines, and the growing emphasis on precision medicine.

Key Middle East Oncology Based Molecular Diagnostics Companies:

- Abbott

- Bayer AG

- BD

- Cepheid

- Agilent Technologies, Inc.

- Danaher

- Hologic, Inc.

- Qiagen

- F. Hoffmann-La Roche Ltd.

- Siemens

- Sysmex

Recent Developments

- In March 2023, Mylab Discovery Solutions announced an exclusive joint venture with AstraGene LLC-UAE’s first molecular diagnostics manufacturer-to strengthen its footprint in the UAE and Kuwait. This collaboration focuses on co-developing automated molecular diagnostic platforms, including reagents, kits, and fully automated devices tailored to regional healthcare needs. The initiative aligns with both nations’ ambitions to modernize laboratory infrastructure and expand precision medicine capabilities. By combining Mylab’s broad assay portfolio with AstraGene’s regional expertise, the partnership is set to accelerate access to innovative oncology diagnostics, support high-throughput testing, and enhance patient outcomes in fast-growing Middle Eastern markets.

Middle East Oncology Based Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 91.3 million

Revenue forecast in 2033

USD 141.0 million

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Abbott; Bayer AG; BD; Cepheid; Agilent Technologies, Inc.; Danaher; Hologic, Inc.; Qiagen; F. Hoffmann-La Roche Ltd.; Siemens; Sysmex

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Oncology Based Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East oncology based molecular diagnostics market based on product, technology, type, and region:

-

Type Outlook (USD Million, 2021 - 2033)

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Liver Cancer

-

Lung Cancer

-

Blood Cancer

-

Kidney Cancer

-

Others

-

-

Product Outlook (USD Million, 2021 - 2033)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (USD Million, 2021 - 2033)

-

PCR

-

In situ hybridization

-

INAAT

-

Chips and microarrays

-

Mass spectrometry

-

Sequencing

-

TMA

-

Others

-

-

Regional Outlook (USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East oncology based molecular diagnostics market size was estimated at USD 82.5 million in 2024 and is expected to reach USD 91.3 million in 2025.

b. The Middle East oncology based molecular diagnostics market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 141.0 million by 2033.

b. In the Middle East, breast cancer represented the largest share of the oncology-based molecular diagnostics market in 2024, at 19.14%. This dominance is supported by the region’s high incidence of breast cancer, particularly among women under 50, and the growing emphasis on early detection and personalized treatment.

b. Some key players operating in the Middle East oncology based molecular diagnostics market includeAbbott; Bayer AG; BD; Cepheid; Agilent Technologies, Inc.; Danaher; Hologic, Inc.; Qiagen; F. Hoffmann-La Roche Ltd.; Siemens; Sysmex

b. Growth in the Middle East oncology-based molecular diagnostics market is driven by rising cancer incidence, increasing government investment in healthcare infrastructure, and the growing shift toward precision medicine. National cancer control programs in countries such as the UAE, Saudi Arabia, and Qatar are prioritizing early detection and biomarker-driven treatment. Expanding access to advanced technologies like NGS, PCR, and liquid biopsy is supported by public-private partnerships and multinational collaborations. Additionally, increased awareness, favorable reimbursement reforms, and the entry of global diagnostic companies are accelerating test adoption across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.