- Home

- »

- Medical Devices

- »

-

Midline Catheter Market Size & Share, Industry Report, 2030GVR Report cover

![Midline Catheter Market Size, Share & Trends Report]()

Midline Catheter Market (2025 - 2030) Size, Share & Trends Analysis Report By Design (Single Lumen, Double Lumen), By Product Type (Midline Catheter, Midline Catheter Kit), By Material (Polyurethane, Silicone), By End-use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Midline Catheter Market Size & Trends

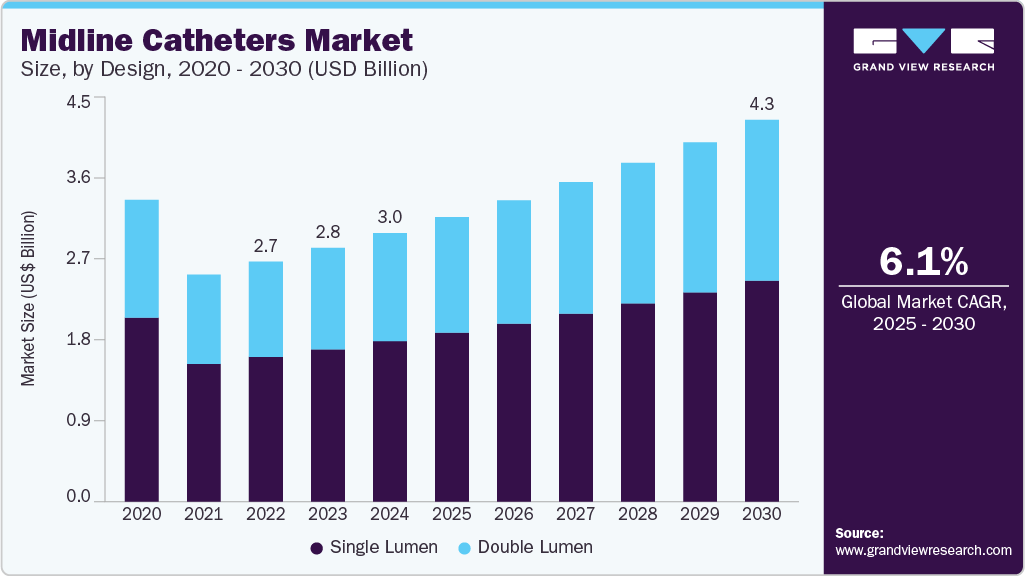

The global midline catheter market size was estimated at USD 3.01 billion in 2024 and is projected to grow at a CAGR of 6.06% from 2025 to 2030. This growth is attributed to the increasing need for safe, cost-effective, and medium-term intravenous access, particularly in patients requiring long-term antibiotic therapy, fluid administration, or chemotherapy.

Key Highlights:

- North America dominated the midline catheters market with the largest revenue share of 40.31% in 2024.

- The midline catheters market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on design, the single lumen segment accounted for the largest market revenue share in 2024.

- Based on product type, the midline catheters segment accounted for the largest market revenue share in 2024.

- Based on material, the polyurethane segment accounted with the largest market revenue share in 2024.

The growing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, coupled with an aging global population, is boosting demand for midline catheters in both hospital and home care settings. According to CDC data published in October 2024, heart disease remains the leading cause of death for men, women, and individuals across most racial and ethnic groups. On average, one person dies from cardiovascular disease every 33 seconds. In 2022, heart disease reported the lives of 702,880 people, accounting for approximately 1 in every 5 deaths.

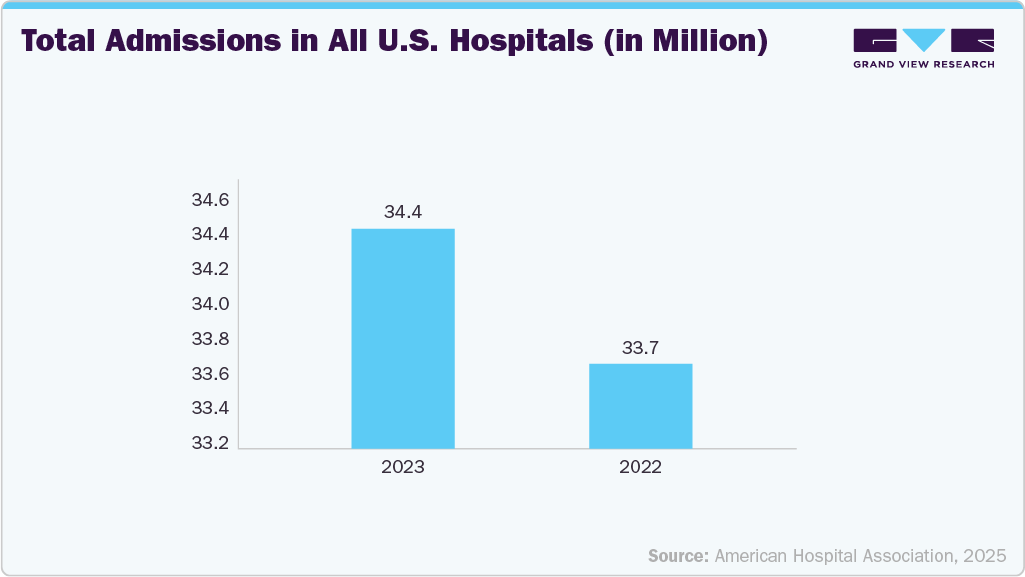

The increase in hospital admissions and surgical procedures is a significant driver of growth in the midline catheter industry, primarily due to the rising demand for efficient, safe, cost-effective intravenous access. With more patients being admitted for acute and chronic conditions, there is a heightened need for vascular access devices that can support medium-term therapies such as antibiotics, fluids, and pain management.

Midline catheters, which are typically inserted in a peripheral vein and extend up to the axillary vein but do not reach central veins, provide a reliable solution for treatments lasting from 1 to 4 weeks. Compared to short peripheral IVs requiring frequent replacement, midline catheters reduce the need for repeated needle sticks, enhancing patient comfort and lowering the risk of complications such as phlebitis and infiltration. In addition, compared to central venous catheters, midline catheters have a lower risk of serious infections like central line-associated bloodstream infections, making them a safer and more cost-effective, especially in post-operative and high-turnover hospital environments. As healthcare systems worldwide strive to improve outcomes while reducing costs and procedural complexity, the demand for midline catheters grows with the increasing volume of hospital-based care and surgical interventions.

The below bar chart illustrates the total number of admissions in all U.S. hospitals for 2022 and 2023, measured in millions. In 2022, there were approximately 33.68 million hospital admissions; in 2023, this number increased to around 34.43 million. This represents a rise of 0.75 million admissions, indicating a growing demand for hospital-based healthcare services. The upward trend reflects factors such as an aging population, increased prevalence of chronic diseases, and possibly a rebound effect following the pandemic, where delayed elective procedures and treatments were rescheduled. This increase in hospital admissions directly correlates with higher demand for intravenous therapies and, consequently, the usage of midline catheters, essential for safe, medium-term vascular access in hospitalized patients.

The increasing incidence of chronic illnesses such as cancer, diabetes, cardiovascular diseases, and renal disorders significantly drives the demand for midline catheters. These conditions require long-term intravenous therapy, including the administration of antibiotics, nutrition, or chemotherapeutic agents. Midline catheters offer a safer and more comfortable option for medium-term venous access, particularly for patients who need treatment lasting from 1 to 4 weeks. This makes them an ideal choice in chronic care management.

The table below highlights a significant projected increase in the prevalence of diabetes and prediabetes between 2024 and 2034. In 2024, approximately 5.8 million individuals-or 15% of the population-are expected to be living with diabetes, including Type 1, diagnosed Type 2, and undiagnosed Type 2 diabetes. By 2034, this number is projected to rise to 7.3 million, accounting for 16% of the population. Notably, the number of diagnosed cases (Type 1 and Type 2) is expected to grow from 4 million (10%) in 2024 to 5.3 million (12%) in 2034, indicating both improved detection and a rising disease burden.

Estimated Diabetes Prevalence - Canada 2024 and 2034

Category

2024

2034

Diabetes (Type 1 + Type 2 diagnosed + Type 2 undiagnosed)

5,804,740 (15%)

7,303,620 (16%)

Diabetes (Type 1 and Type 2 diagnosed)

4,006,850 (10%)

5,300,670 (12%)

Diabetes (Type 1)

5-10% of total diabetes

5-10% of total diabetes

Diabetes (all types incl. undiagnosed) + Prediabetes (incl. undiagnosed)

11,918,090 (30%)

14,122,660 (32%)

Source: Diabetes Canada

Continuous innovation in catheter design and materials is propelling market growth. Modern midline catheters are made with biocompatible materials that reduce infection and thrombosis risks. Integrating ultrasound-guided insertion techniques has also improved placement accuracy and reduced insertion-related complications. Furthermore, the development of antimicrobial-coated catheters and securement devices is enhancing the performance and safety of midline catheters, increasing their adoption among healthcare providers.

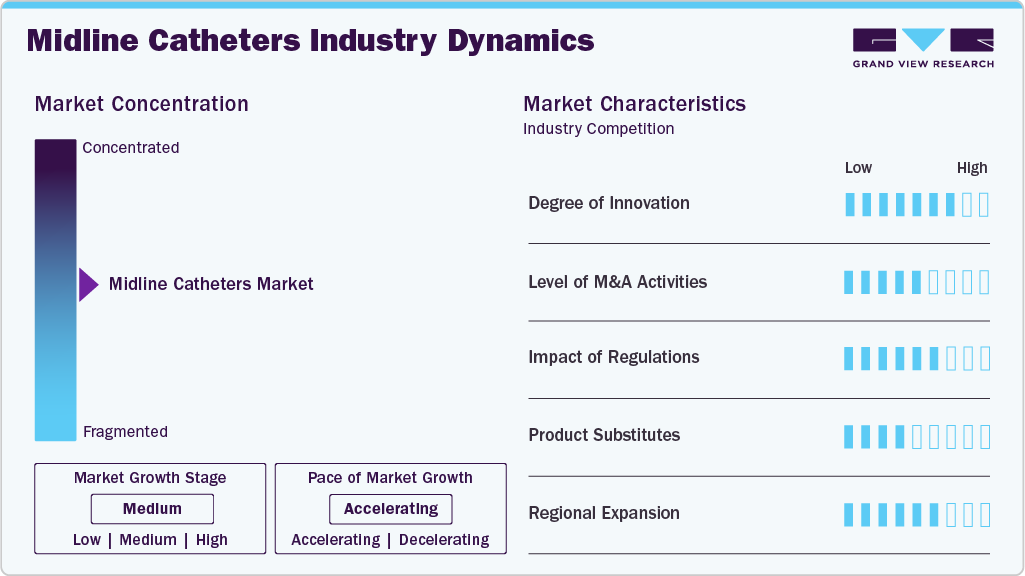

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The rise in hospital admissions, outpatient treatments, and advancements in catheter technology are supporting market growth. Increased focus on patient safety and infection control protocols also contributes to the wider adoption of midline catheters in clinical settings.

The midline catheter industry has witnessed a moderate to high degree of innovation in recent years, driven by the dual need for safer vascular access devices and improved clinical outcomes. Manufacturers and researchers have invested in developing catheters with advanced biomaterials, antimicrobial coatings, and integrated technologies to enhance patient safety, prolong catheter dwell time, and reduce complications such as infections and thrombosis.

The level of mergers and acquisitions (M&A) activity in the midline catheter industry is considered moderate but strategically significant. While the market itself is a niche segment within the broader vascular access and intravenous therapy industry, key players in the medical device sector have pursued M&A to strengthen their vascular access portfolios, expand geographical reach, and integrate complementary technologies. For instance, in January 2022, VitalPath, a custom, complex catheter solutions manufacturer, acquired Modern Catheter Technologies (ModernCath), a Minnesota-based company specializing in advanced catheter delivery systems.

Regulations are critical in shaping the midline catheter industry, from product development and clinical adoption to market entry and post-market surveillance. While these regulations are designed to ensure patient safety and product efficacy, they impose stringent compliance requirements impacting manufacturers’ operations, cost structures, and innovation timelines. In the U.S., the FDA (Food and Drug Administration) requires manufacturers to submit a 510(k) premarket notification demonstrating that their device is substantially equivalent to a legally marketed predicate.

Product expansion in the midline catheter industry has been a key strategy for companies aiming to meet evolving clinical needs, expand patient applications, and gain competitive advantage. This expansion is driven by technological innovation, clinical demand for safer vascular access, and broader use cases across healthcare settings, including hospitals, outpatient clinics, and home care.

Regional expansion is a crucial growth strategy in the midline catheter industry, as companies aim to capture emerging opportunities across both developed and developing healthcare systems. The expansion efforts are largely driven by increasing awareness of midline catheter benefits, the global push for infection prevention, rising healthcare expenditures, and the decentralization of care toward outpatient and home-based settings.

Design Insights

The single lumen segment accounted for the largest market revenue share in 2024, due to their widespread clinical acceptance, cost-effectiveness, and lower risk of complications. These catheters are typically preferred for short- to medium-term intravenous therapies such as antibiotics, hydration, and medications where a single infusion line is sufficient. Their simpler design reduces insertion complexity and maintenance requirements, making them the first choice in most general inpatient and outpatient settings. In addition, healthcare providers often favor single lumen devices due to their lower infection risk than other alternatives, contributing to their strong market share.

The double lumen midline catheters segment is expected to register at the fastest CAGR during the forecast period, driven by the increasing demand for more complex and simultaneous infusion therapies. These catheters allow the administration of incompatible drugs or fluids without needing multiple insertion sites, improving patient comfort and treatment efficiency in critical care and oncology settings. As hospitals and infusion centers adopt more advanced care protocols and strive to minimize catheter-related complications, the utility of double lumen catheters in managing multi-therapy regimens is determinate. This growing clinical demand expected to propel this segment's rapid market expansion.

Product Type Insights

The midline catheters segment accounted for the largest market revenue share in 2024, due to their growing adoption as a safer and cost-effective alternative to central venous catheters for intermediate-duration intravenous therapies. These catheters, typically inserted in the upper arm and extending to the axillary vein, are associated with fewer complications such as bloodstream infections and thrombosis than CVCs. Their increasing use in hospital and outpatient settings for administering antibiotics, fluids, and other medications has made them the preferred choice among clinicians. In addition, their suitability for use up to 2-4 weeks without the risks associated with peripherally inserted central catheters further boosts their strong market presence.

The midline catheter kit segment is expected to witness at the fastest CAGR during the forecast period, driven by the growing demand for ready-to-use, sterile, and comprehensive solutions that streamline the insertion procedure. These kits typically include the catheter, introducer needle, guidewire, and other necessary components, which reduce the time required for preparation, lower infection risks, and enhance procedural efficiency. Hospitals and outpatient clinics increasingly prefer all-in-one kits to improve patient care outcomes and adhere to infection control protocols. Furthermore, advancements in kit design and rising awareness of the benefits of midline catheterization among healthcare providers are contributing to the accelerating growth of this segment.

Material Insights

The polyurethane segment accounted with the largest market revenue share in 2024. This dominance is driven by its optimal balance of strength, flexibility, and biocompatibility. It offers superior kink resistance and tensile strength, making it ideal for maintaining catheter integrity during extended dwell times. Polyurethane catheters are easier to insert and more durable, reducing the risk of complications such as breakage or dislodgement. In addition, its compatibility with power injection for contrast-enhanced imaging procedures adds to its widespread adoption in hospital and outpatient settings. These functional advantages position polyurethane as the preferred choice for clinicians, reinforcing its dominance in the market.

The silicone segment is expected to grow at the fastest CAGR during the forecast period, owing to its superior biocompatibility and softness, which are particularly beneficial for long-term vascular access. Its flexible and atraumatic properties minimize irritation and vein trauma, improving patient comfort and reducing the incidence of thrombophlebitis. Silicone catheters are especially advantageous for sensitive populations, such as pediatric, geriatric, and oncology patients. As healthcare providers increasingly prioritize patient-centered care and long-term safety, the demand for silicone-based midline catheters is expected to grow rapidly, driving its robust market expansion.

End-use Insights

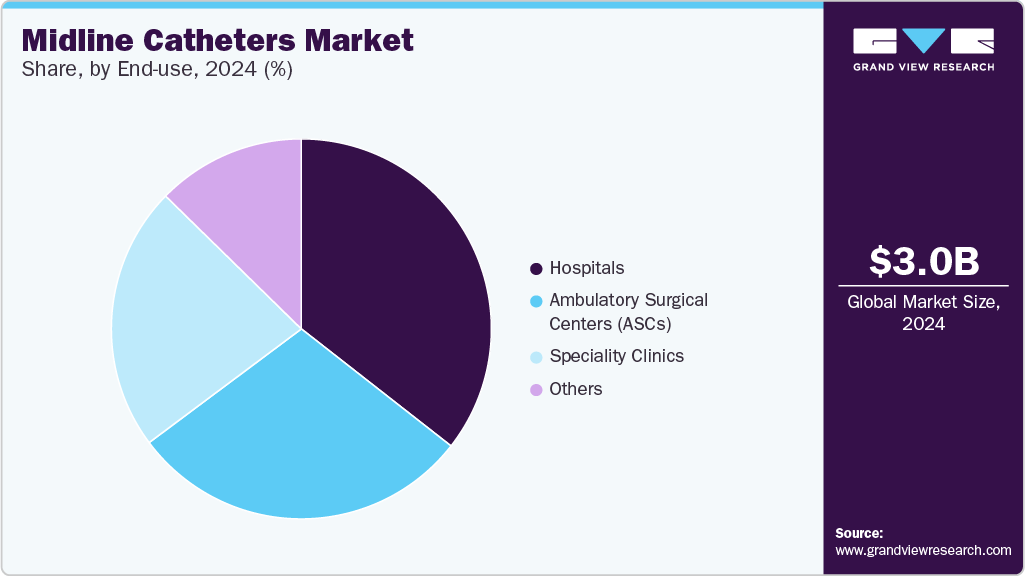

The hospital segment led the market with the largest revenue share of 35.56% in 2024, due to their extensive infrastructure and high patient volume requiring vascular access for various treatments such as prolonged antibiotic therapy, hydration, and medication administration. The presence of specialized departments, such as oncology, intensive care, and surgery units, further drives the demand for reliable and safe vascular access devices like midline catheters. Hospitals also have the necessary trained staff and resources to insert and manage these catheters, contributing to their dominant position in the market. The critical care needs and inpatient treatment protocols ensure consistent and significant utilization of midline catheters within hospital settings.

The ambulatory surgical centers (ASCs) segment is anticipated to witness at the fastest CAGR over the forecast period. Due to rising preference for outpatient procedures and minimally invasive surgeries. ASCs offer cost-effective and convenient healthcare delivery, making them increasingly popular for short-term treatments that still require vascular access, such as chemotherapy or intravenous therapies. The shift towards outpatient care driven by advancements in medical technology, reimbursement policies favoring ASCs, and increasing patient demand for faster recovery times are key factors propelling growth in this segment. Consequently, the growing number of ASCs worldwide is expected to significantly boost the adoption of midline catheters in these settings over the forecast period.

Regional Insights

North America dominated the midline catheters market with the largest revenue share of 40.31% in 2024. North America's dominance is the widespread implementation of evidence-based clinical guidelines that favor using midline catheters as a safer alternative to central venous catheters for intermediate-term intravenous therapy. Leading healthcare bodies such as the Centers for Disease Control and Prevention and the Infusion Nurses Society have provided clear recommendations on when to use midlines, contributing to increased standardization and adoption across hospitals, long-term care facilities, and outpatient settings. Moreover, the region benefits from major industry players, continuously driving product innovation and market penetration.

U.S. Midline Catheters Market Trends

The midline catheters market in the U.S. accounted for the largest market revenue share in North America in 2024.One of the major contributors is the treatment of chronic and acute infections, such as osteomyelitis, sepsis, and complicated skin infections. Patients with these infections often require long courses of intravenous antibiotics, and midline catheters offer a safer and more comfortable alternative to central venous catheters for outpatient therapy, reducing hospital stays and the risk of serious complications like bloodstream infections. Other conditions such as diabetes-related complications and gastrointestinal diseases also drive midline catheter use.

Diabetic patients with chronic wounds or infections need prolonged antibiotic therapy, while patients with disorders like Crohn’s disease may require parenteral nutrition delivered via midline catheters. According to the CDC 2024, around 14.7% of U.S. adults have diabetes. Approximately 38.4 million U.S. adults and children are affected by the condition, with 29.7 million of these cases being diagnosed and 8.7 million remaining undiagnosed, as reported by the American Diabetes Association (ADA, 2023). Furthermore, the CDC 2024 states that there are 1.2 million new cases of diabetes among U.S. adults each year, translating to an incidence rate of about 5.9 per 1,000 people.

Cancer and oncology patients also significantly influence the demand for midline catheters. Many individuals undergoing chemotherapy or supportive treatments like hydration and parenteral nutrition require consistent venous access over several weeks or months. Midline catheters are less invasive and lower-risk than central lines, especially for therapies that do not mandate central venous access, making them preferable in many oncology care settings. According to estimates from the American Cancer Society (ACS), there will be 152,810 new cases of colorectal cancer in 2024. Of these, 81,540 cases are expected to occur in men and 71,270 in women. It includes 106,590 cases of colon cancer and 46,220 cases of rectal cancer.

Europe Midline Catheters Market Trends

The midline catheters market in the Europe held a substantial market share in 2024. Europe benefits from a well-established network of hospitals, outpatient clinics, and long-term care facilities embracing midline catheters for diverse patient populations. Countries such as Germany, France, the UK, and Italy lead in market adoption due to their sophisticated healthcare infrastructure and proactive infection control policies. In addition, growing awareness and education around vascular access best practices have accelerated clinician acceptance across the continent. The expanding home healthcare and outpatient infusion markets in Europe also contribute to the growing use of midline catheters, driven by trends toward decentralization of care and cost containment. Midline catheters provide a safer, more convenient option for patients receiving therapies like antibiotics, hydration, and parenteral nutrition outside traditional hospital settings.

The UK midline catheters market is expected to grow at a significant CAGR during the forecast period. Cardiovascular disease (CVD) is a leading health challenge in the United Kingdom, representing a significant burden on the healthcare system. The high prevalence of conditions such as heart failure, coronary artery disease, and peripheral vascular disease creates a strong clinical demand for effective vascular access solutions, which in turn drives growth in the midline catheter market. Patients with CVD often require intravenous therapies, including medications like diuretics, anticoagulants, and inotropes, to manage symptoms and prevent complications. Midline catheters provide an effective and safer means of delivering these treatments over intermediate durations, particularly when peripheral veins are difficult to access due to poor circulation or repeated needle sticks. Compared to central venous catheters, midline catheters pose a lower risk of serious infections and complications, making them highly suitable for CVD patients who often have compromised immune responses or other comorbidities.

The table below highlights the significant impact of cardiovascular diseases across the UK and its constituent nations. England accounts for the highest number of CVD-related deaths and people living with CVD, followed by Scotland, Wales, and Northern Ireland.

Data on Deaths from and Numbers Living with Heart and Circulatory Diseases (CVD) for the UK

Nation

No. of People Dying from CVD (2023)

No. of People Under 75 Years Old Dying from CVD (2023)

Estimated Number of People Living with CVD (Latest Estimate)

England

142,460

38,996

6.4 million +

Scotland

17,787

5,313

730,000

Wales

9,701

2,918

340,000

Northern Ireland

4,227

1,133

225,000

UK Total

174,693

48,697

7.6 million +

Source: British Heart Foundation, 2025

The midline catheters market in Germanyis growing. Cancer is one of the leading causes of morbidity and mortality in Germany, resulting in a substantial demand for effective and safe vascular access devices such as midline catheters. Patients undergoing chemotherapy, immunotherapy, and supportive treatments like hydration and parenteral nutrition require reliable intravenous access over extended periods. Midline catheters have become increasingly preferred in oncology care due to their balance of safety, ease of insertion, and suitability for intermediate-term use. Furthermore, the increasing incidence of cancer in Germany, combined with advancements in treatment protocols that extend patient survival and require repeated intravenous therapy, fuels ongoing demand for midline catheter solutions. The German healthcare system’s focus on outpatient and home-based care models also supports midline catheter use, enabling patients to receive treatment outside the hospital, which enhances quality of life and reduces healthcare costs.

According to the Robert Koch Institute, a Federal Institute within the portfolio of the Federal Ministry of Health in Germany, colorectal cancer remains one of the most prevalent malignancies, with a significant burden on public health. In 2022, there were 24,654 new cases in women and 29,956 in men. The age-standardized incidence rates, adjusted to the old European standard population, were 29.5 per 100,000 for women and 44.6 per 100,000 for men, highlighting a higher risk among males. In terms of mortality, 2023 saw 10,313 deaths among women and 12,357 among men due to colorectal cancer.

Asia Pacific Midline Catheters Market Trends

The midline catheters market in Asia Pacific is experiencing fastest growth. Rapid urbanization, expanding healthcare infrastructure, increasing prevalence of chronic diseases, and rising awareness about infection control have collectively accelerated the adoption of midline catheters in countries such as China, India, Japan, South Korea, and Australia. The growth drivers are the large and aging population in the Asia Pacific region, which results in a higher incidence of diseases requiring intravenous therapies, such as cancer, diabetes, cardiovascular diseases, and infections. As healthcare providers strive to offer safer and more efficient vascular access options, midline catheters are becoming the preferred choice for intermediate-term infusion therapy, balancing patient safety with cost-effectiveness.

The India midline catheters market is anticipated to witness at a significant CAGR over the forecast period. According to a 2023 report by the American College of Cardiology, cardiovascular diseases are responsible for approximately 30% of deaths in India, with ischemic heart disease being the leading cause. The report highlights that the high prevalence of diabetes and hypertension, combined with urban lifestyle factors like poor diet and pollution, are significant contributors to this alarming trend. In addition, the central government has noted a rise in heart attack-related deaths over the past three years, potentially exacerbated by the remaining effects of the COVID-19 pandemic. This growing burden of CVDs is driving the demand for advanced diagnostic and therapeutic technologies, such as midline catheters.

The midline catheters market in China is growing, driven by the country’s expanding healthcare infrastructure, rising prevalence of chronic diseases, and increasing demand for safer and more efficient vascular access solutions. As China continues to modernize its healthcare system and shift focus toward patient-centered care, midline catheters are gaining popularity as an intermediate-term option for intravenous therapy. A significant factor contributing to market growth is the growing burden of chronic illnesses such as cancer, cardiovascular diseases, diabetes, and infectious diseases, which require prolonged intravenous treatments. Midline catheters provide a safer alternative to central venous catheters by reducing the risk of bloodstream infections and other complications, making them attractive for hospital and outpatient settings. For instance, data from the International Diabetes Federation (IDF) reveals that in 2021, China had a 13% diabetes prevalence among its adult population, equating to over 140 million cases.

Middle East And Africa Midline Catheters Market Trends

The midline catheters market in the Middle East and Africa (MEA) is experiencing significant growth, propelled by improvements in healthcare infrastructure, rising prevalence of chronic and infectious diseases, and growing awareness of infection control practices. As healthcare systems in the region continue to evolve and modernize, the demand for safer, cost-effective, and efficient vascular access solutions like midline catheters is increasing. The rising incidence of conditions such as cancer, diabetes, cardiovascular diseases, and long-term infections drives the market. These health challenges require prolonged intravenous therapy, for which midline catheters are highly suitable. Compared to central venous catheters, midline catheters offer a lower risk of bloodstream infections and complications, making them ideal in regions where healthcare resources may be limited and infection prevention is a priority.

Key Midline Catheters Company Insights

Some key companies operating in the market includeICU Medical, Inc., Teleflex, VYGON and BD. Strategic initiatives involve mergers, acquisitions, and collaborations to broaden product offerings and market presence, alongside focused research and development to improve product efficacy and utilize innovative technologies.

Key Midline Catheters Companies:

The following are the leading companies in the midline catheters market. These companies collectively hold the largest market share and dictate industry trends.

- ICU Medical, Inc.

- Teleflex

- Spectrum Vascular

- Haolang Technology (Foshan) Limited Co.

- VYGON

- Health Line Medical Products

- Harsoria Healthcare Pvt Ltd

- BD

- Cook

- Argon Medical Devices

Recent Developments

-

In May 2025, SkyDance Vascular has received U.S. FDA 510(k) clearance of its Osprey Midline Closed IV Catheter System, an innovative extended dwell catheter designed to enhance patient safety and clinical outcomes in peripheral intravenous catheter (PIVC) procedures.

-

In February 2024, AngioDynamics, Inc. announced the completion of the sale of its peripherally inserted central catheter and midline catheter product portfolios to Spectrum Vascular.

-

In June 2022, Teleflex Incorporated has launched its new Arrow Pressure Injectable Midline Catheter across Europe, the Middle East, and Africa (EMEA). This addition to their vascular access portfolio aims to enhance patient safety and procedural efficiency by addressing common clinical challenges.

Midline Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.18 billion

Revenue forecast in 2030

USD 4.27 billion

Growth rate

CAGR of 6.06% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Design, product type, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ICU Medical, Inc.; Teleflex; Spectrum Vascular; Haolang Technology (Foshan) Limited Co.; VYGON; Health Line Medical Products; Harsoria Healthcare Pvt Ltd.; BD; Cook; Argon Medical Devices

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Midline Catheters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global midline catheters market report based on design, product type, material, end-use, and region:

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Lumen

-

Double Lumen

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Midline Catheter

-

Midline Catheter Kit

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Silicone

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Speciality Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.