- Home

- »

- Clinical Diagnostics

- »

-

Molecular Diagnostics For STD Market, Industry Report 2033GVR Report cover

![Molecular Diagnostics For STD Market Size, Share & Trends Report]()

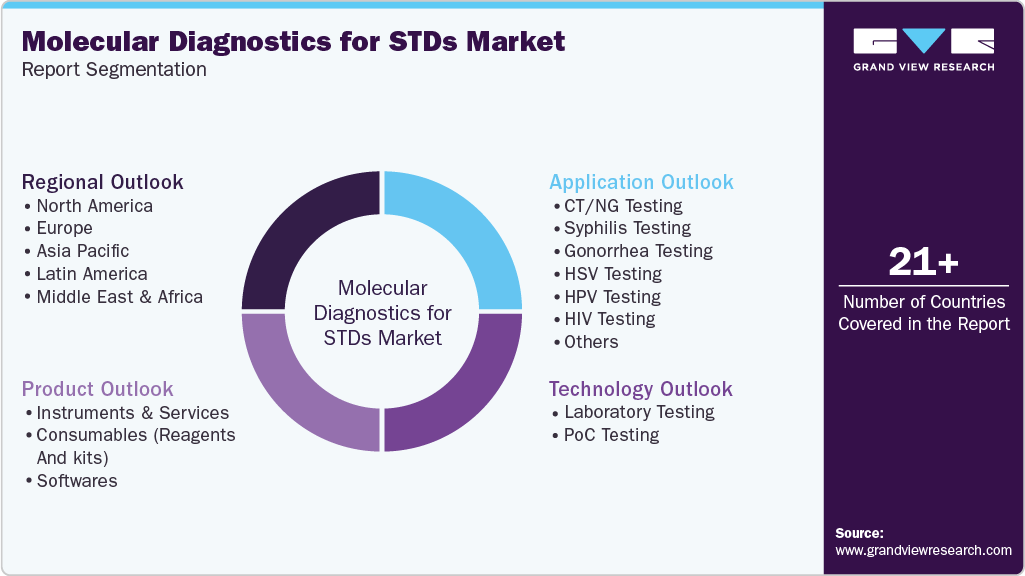

Molecular Diagnostics For STD Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments & Services, Consumables), By Application (Chlamydia Testing, Syphilis Testing), By Technology (Laboratory Testing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-619-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Molecular Diagnostics For STD Market Summary

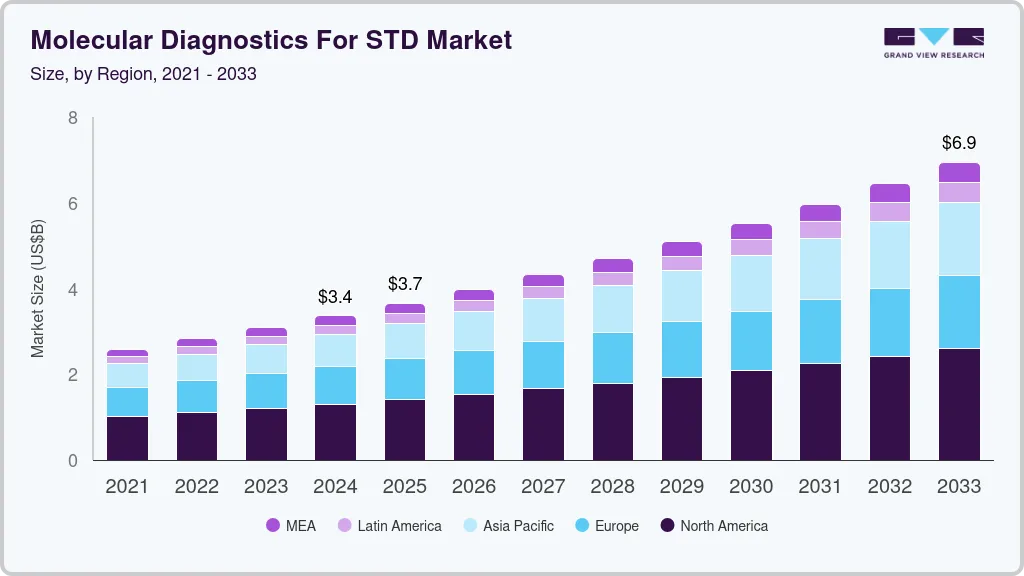

The global molecular diagnostics for sexually transmitted diseases (STDs) market size was estimated at USD 3.36 billion in 2024 and is projected to reach USD 6.94 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2033. The increasing incidence of sexually transmitted infections such as chlamydia, gonorrhea, syphilis, and human papillomavirus (HPV) is a key factor driving market growth.

Key Market Trends & Insights

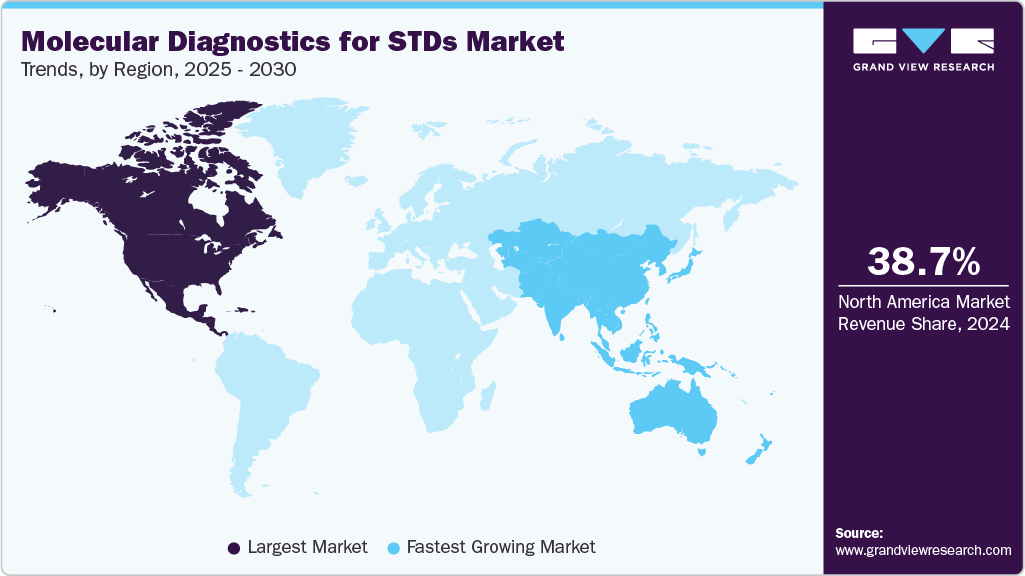

- North America molecular diagnostics for STD market held the largest revenue share of 38.72% in 2024.

- The molecular diagnostics for STDs market in the U.S. is experiencing significant CAGR over the forecast period.

- By product, the consumables segment, which covers reagents and kits, held the largest revenue share in 2024.

- Based on application, the HIV testing segment held the largest revenue share in 2024.

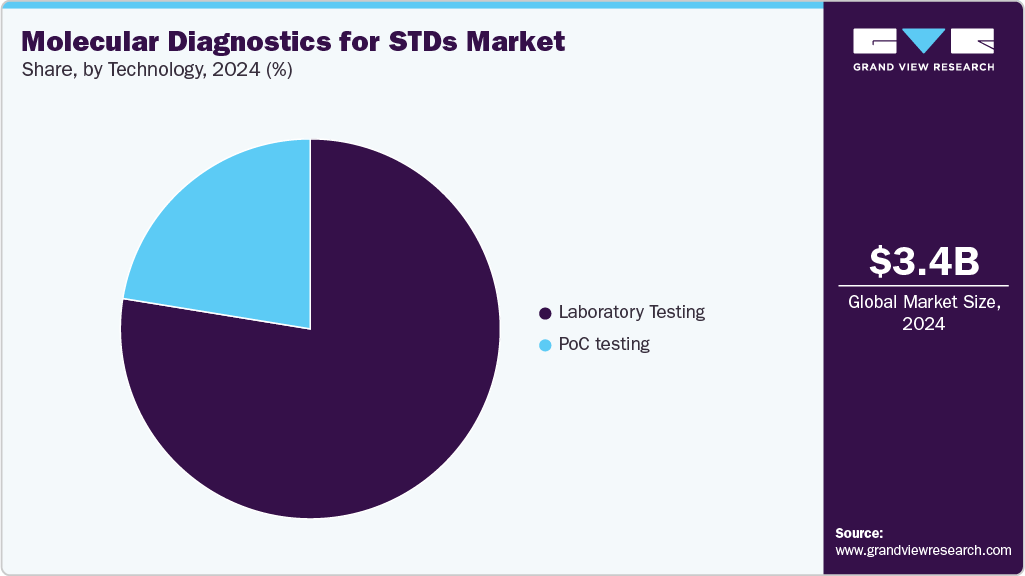

- Based on technology, the laboratory testing segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.36 Billion

- 2033 Projected Market Size: USD 6.94 Billion

- CAGR (2025-2033): 8.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The demand for accurate and early detection contributes to the uptake of molecular diagnostic tools. Improvements in nucleic acid amplification technologies and growing awareness about regular STD screening are also supporting market expansion. Supporting this trend, diagnostic developers are concentrating on next-generation molecular tests that offer rapid, multiplexed, and high-throughput detection of sexually transmitted pathogens. Recent innovations include point-of-care nucleic acid amplification tests and portable PCR-based devices designed to deliver accurate results in minimal time. For instance, in March 2025, Visby Medical received U.S. Food and Drug Administration (FDA) De Novo authorization for its Women's Sexual Health Test, the first over-the-counter PCR diagnostic device approved for at-home use. This palm-sized device enables rapid, reliable testing for chlamydia, gonorrhea, and trichomoniasis, providing results within 30 minutes without needing laboratory processing. Such advancements reflect the market's focus on expanding access to reliable testing, reducing diagnostic turnaround time, and enhancing patient management through early and precise detection.

Moreover, technological progress in molecular diagnostic research has enabled the development of more sensitive, specific, and targeted tests for sexually transmitted infections. Innovations in assay design, sample processing, and amplification techniques have improved diagnostic accuracy and reduced false negatives, crucial for effective disease management. These advancements help address existing challenges in detecting asymptomatic infections and co-infections, especially in high-risk populations. In addition, continued investment in research by diagnostic manufacturers and public health organizations supports the expansion of molecular diagnostics pipelines and promotes wider availability across diverse healthcare settings.

Despite ongoing progress, the molecular diagnostics for STD market faces several challenges that may limit growth. The development, validation, and regulatory approval of new molecular tests require substantial time and resources, with manufacturers needing to comply with rigorous safety and performance standards. These factors often cause delays in product launches and restrict market availability. In addition, ensuring consistent access to diagnostic technologies presents logistical difficulties, especially in regions with limited healthcare infrastructure. The need for reliable sample storage, transportation, and skilled personnel complicates test deployment in remote or underserved areas. These challenges highlight the necessity for coordinated efforts to address regulatory hurdles and improve distribution networks to expand access to molecular diagnostics for STDs worldwide.

Types of Molecular Methods

The Molecular Diagnostics for Sexually Transmitted Diseases (STDs) market is evolving with the adoption of various molecular techniques designed to improve the speed, accuracy, and comprehensiveness of STI detection. These methods support early diagnosis and effective treatment, improving disease management and control. Below are some of the key molecular methods shaping this market:

-

Polymerase Chain Reaction (PCR): PCR remains the cornerstone of molecular diagnostics for STDs. It allows for the amplification of specific DNA sequences to detect infections like chlamydia, gonorrhea, and syphilis with high sensitivity.

-

Transcription-Mediated Amplification (TMA): TMA targets RNA sequences and offers rapid and sensitive detection of RNA pathogens, including HIV and hepatitis viruses, facilitating early and precise diagnosis.

-

Strand Displacement Amplification (SDA): SDA operates at a constant temperature, making it suitable for point-of-care testing by simplifying the amplification process without the need for complex thermal cycling.

-

Ligase Chain Reaction (LCR): This technique amplifies DNA by joining adjacent probes, increasing specificity in detecting targeted STD pathogens.

-

Nucleic Acid Hybridization: DNA probe tests use labeled probes to hybridize with pathogen DNA, providing a direct method for identifying specific infections.

-

Reverse Transcription PCR (RT-PCR): RT-PCR converts RNA into complementary DNA (cDNA) for detecting RNA viruses, enhancing the range of detectable STDs.

-

Next-Generation Sequencing (NGS): NGS technology allows comprehensive pathogen profiling and can detect genetic mutations linked to drug resistance, supporting personalized treatment strategies.

These molecular methods collectively enhance diagnostic capabilities, enabling healthcare providers to detect STDs more effectively and tailor interventions accordingly. The continuous innovation in molecular diagnostics is essential for managing the global burden of sexually transmitted infections.

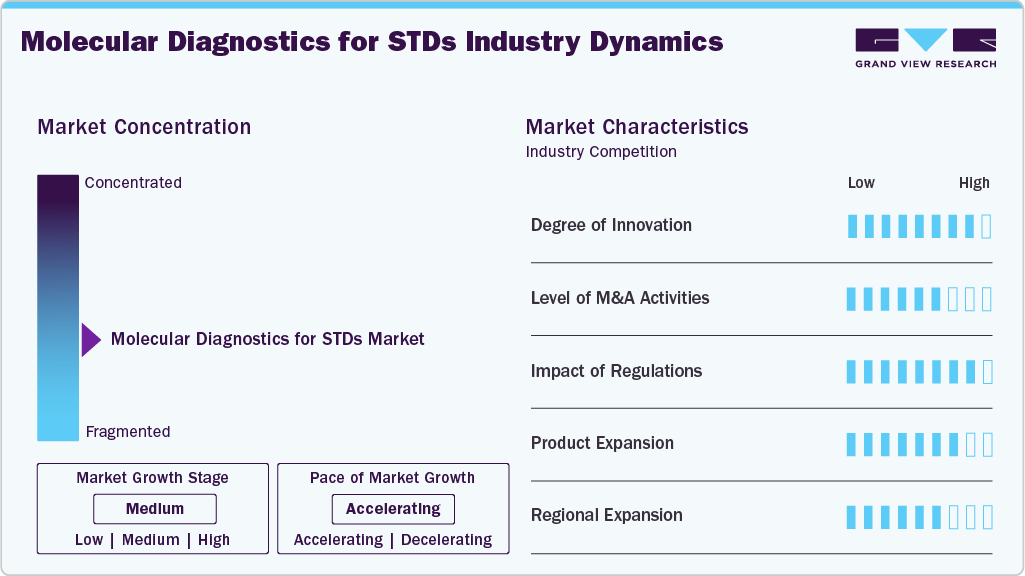

Market Concentration & Characteristics

The molecular diagnostics for STDs market demonstrates a high degree of innovation driven by advancements in nucleic acid amplification technologies such as PCR, TMA, and isothermal methods. These techniques offer improved accuracy, speed, and scalability for detecting a wide range of STD pathogens. Integration of automated platforms, multiplex testing capabilities, and point-of-care diagnostics supports faster clinical decision-making and broader population screening.

In addition, ongoing research in next-generation sequencing and AI-based diagnostic algorithms enhances the ability to detect co-infections and resistance markers. These innovations contribute to more precise, accessible, and efficient STD diagnostics. In July 2023, Altona Diagnostics introduced the FlexStar CT & NG PCR Detection Mix 1.5 (Research Use Only), marking its first product in the STI panel. This assay enables the qualitative detection and differentiation of Chlamydia trachomatis and Neisseria gonorrhoeae DNA. Designed for rapid processing, it allows up to 96 reactions per real-time PCR cycler in approximately one hour.

The market has seen steady mergers and acquisitions to strengthen diagnostic portfolios, expand technological capabilities, and improve global distribution networks. Transactions often focus on acquiring proprietary molecular platforms such as rapid PCR systems, multiplex assays, and isothermal technologies. Larger diagnostic firms target niche companies with specialized assays or automation technologies, while mid-sized players pursue strategic collaborations to diversify test menus and enter new markets. In June 2022, These M&A activities reflect a broader effort to support integrated, high-efficiency diagnostic solutions in response to growing STD screening demands.

Regulation plays a crucial role in shaping the molecular diagnostics for the STD market, with strict approval and quality standards enforced by agencies such as the U.S. FDA and the European Medicines Agency (EMA). Compliance with regulatory requirements governs diagnostic tests' validation, manufacturing, and commercialization, ensuring accuracy, safety, and reliability. Regulatory scrutiny on novel molecular technologies, including automated platforms and next-generation sequencing, influences development timelines and market introduction.

In January 2025, Roche received FDA 510(k) clearance and CLIA waiver for its cobas liat STI multiplex assay panels, including tests for Chlamydia trachomatis and Neisseria gonorrhoeae (CT/NG) and a three-pathogen panel adding Mycoplasma genitalium (CT/NG/MG). These assays enable rapid, point-of-care PCR testing with results in about 20 minutes, allowing diagnosis and treatment decisions during a single visit. In addition, evolving guidelines to improve diagnostic sensitivity and specificity require companies to continuously update their assays to maintain compliance, which can affect product availability across different regions.

The market is witnessing continuous product expansion, with companies developing new diagnostic assays targeting a broader spectrum of sexually transmitted pathogens. Emphasis is placed on enhancing test sensitivity, specificity, and turnaround time through molecular techniques and multiplex testing innovations. Efforts to broaden product pipelines include rapid point-of-care platforms, automated systems, and advanced nucleic acid amplification tests to address unmet diagnostic needs and improve screening efficiency across diverse healthcare settings. In December 2024, Seegene entered into strategic alliances with Hylabs (Israel) and Werfen (Spain) to create joint ventures Hylabs-Seegene and Werfen-Seegene. These partnerships aim to develop and market PCR diagnostic products tailored to local needs, including assays for STIs and vaginitis. The collaborations are part of Seegene's broader strategy to expand its global network and promote the adoption of its syndromic PCR technologies.

Regional expansion is notable in the market, with increased focus on emerging markets in Asia-Pacific, Latin America, and the Middle East driven by rising awareness and investments in healthcare infrastructure. North America and Europe hold substantial market shares owing to well-established screening programs and advanced diagnostic facilities. Growth strategies prioritize partnerships and expanding distribution networks in underserved regions to enhance access to molecular diagnostic testing and address the increasing demand for early and accurate STD detection.

Product Insights

The consumables segment, which covers reagents and kits, held the largest revenue share in 2024. This dominance results from the essential role these consumables play in the accurate and rapid detection of various sexually transmitted infections. Reagents and kits enable streamlined sample preparation and molecular testing processes, critical for timely diagnosis and effective disease management. In April 2023, Thermo Fisher announced the launch of 37 CE-IVD-marked real-time PCR assay kits, including tests for human papillomavirus (HPV) and herpes simplex virus (HSV).

These assays are compatible with the QuantStudio Dx series of instruments and are part of Thermo Fisher's strategy to provide a comprehensive menu of PCR tests for infectious diseases. Further, the widespread adoption of advanced molecular diagnostic techniques, such as PCR and nucleic acid amplification tests (NAATs), has increased demand for consumables. Innovations in reagent formulations and kit design have improved sensitivity and specificity, supporting reliable detection across diverse STD pathogens. Continued research and product development in this area are expected to maintain the segment’s strong position within the market.

The instruments & services segment is expected to witness significant growth over the forecast period in the molecular diagnostics for STD Market. This growth is driven by increasing demand for precise and rapid diagnostic instruments that support early detection and management of STDs. Advanced technologies like PCR and automated analyzers enable efficient and accurate testing while expanding laboratory services, including maintenance and technical support, further contributing to this segment’s development. Despite challenges related to cost and the need for skilled professionals, improvements in technology and rising awareness about STD diagnostics are likely to boost adoption and market expansion.

Application Insights

The HIV testing segment held the largest revenue share in 2024. According to UNAIDS, over 39 million people were living with HIV worldwide by the end of 2023, with sub-Saharan Africa representing the highest disease burden. Molecular diagnostics, particularly nucleic acid amplification tests (NAATs), play a vital role in early diagnosis, viral load monitoring, and antiretroviral therapy (ART) management. The segment's dominance is reinforced by robust global health initiatives such as the UNAIDS 95-95-95 targets, which prioritize universal access to HIV testing. In June 2025, Cepheid announced that Health Canada had granted a medical device license for its Xpert HIV-1 Viral Load XC test, a next-generation molecular diagnostic designed to monitor HIV-1 viral load levels.

This dual-target assay offers extended strain coverage and delivers results in approximately 90 minutes. It is compatible with Cepheid's GeneXpert systems, facilitating on-demand testing in various healthcare settings, including laboratories, hospitals, and community clinics. The test aims to enhance patient care by enabling timely treatment decisions, aligning with global efforts to achieve the UNAIDS 2030 targets. Shipments to Canadian customers are scheduled to commence in June 2025. Additionally, recent technological advancements, such as point-of-care PCR platforms and integrated viral load monitoring solutions, have further increased adoption across both developed and resource-limited settings.

The HPV testing segment is expected to show notable growth during the forecast period. driven by the increasing global burden of human papillomavirus (HPV)-related diseases, especially cervical cancer. Rising awareness campaigns, government-backed screening initiatives, and improved access to healthcare are contributing to the demand for early detection through molecular diagnostic methods. Advancements in PCR-based HPV tests and self-sampling kits are enhancing screening rates, particularly in underserved regions. Additionally, the growing focus on preventive healthcare and routine screening guidelines recommended by organizations such as the WHO and CDC are accelerating the adoption of HPV molecular diagnostics.

Technology Insights

The laboratory testing segment held the largest revenue share in 2024. This dominance is attributed to the high accuracy, reliability, and comprehensive testing capabilities offered by centralized laboratory settings. Laboratories are equipped to perform molecular diagnostic tests for STDs with advanced technologies such as PCR and nucleic acid amplification tests (NAATs), ensuring precise detection and quantification. Strong adoption by hospitals, diagnostic centers, and reference laboratories supports this segment’s leading position.

The point-of-care (PoC) testing segment is expected to experience the fastest growth during the forecast period. The growing demand for rapid, on-site diagnostic solutions that provide quick results without the need for complex laboratory infrastructure is driving this trend. PoC molecular diagnostics facilitate timely clinical decisions and improve patient management, particularly in resource-limited settings or outpatient clinics. Increasing awareness about the benefits of PoC testing and ongoing innovations to enhance test portability and ease of use are expected to sustain this growth.

Regional Insights

North America molecular diagnostics for STD market held the largest revenue share of 38.72% in 2024. This is driven by widespread awareness of sexually transmitted infections, comprehensive screening programs, and the rapid adoption of advanced molecular diagnostic technologies. The U.S. leads this growth, supported by proactive government initiatives and widespread access to rapid, accurate testing methods, which help improve diagnosis and treatment rates.

For instance, in March 2023, Visby Medical received 510(k) clearance and a CLIA waiver from the U.S. Food and Drug Administration for its second-generation point-of-care PCR test. The Visby Medical Sexual Health Test rapidly detects Chlamydia trachomatis, Neisseria gonorrhoeae, and Trichomonas vaginalis in women, delivering accurate results outside traditional laboratory settings. This innovation shortens diagnostic turnaround times, allowing healthcare providers to initiate timely treatment, reduce transmission, and improve patient outcomes.

The availability of such advanced point-of-care molecular diagnostics expands access to quality STD testing in diverse healthcare environments, including clinics, emergency departments, and community health centers. Along with ongoing public health campaigns and increased funding for STD prevention, these technological advancements position North America to maintain its leading role in the molecular diagnostics market for STDs.

U.S. Molecular Diagnostics for STDs Market Trends

The U.S. molecular diagnostics for sexually transmitted diseases (STDs) market is experiencing significant growth, supported by strong public health initiatives and the increasing burden of sexually transmitted infections across various population groups. The presence of a robust healthcare infrastructure, high awareness levels, and established screening programs has contributed to the widespread adoption of molecular testing for infections such as chlamydia, gonorrhea, syphilis, and HPV.

These tests are increasingly preferred for their speed, accuracy, and ability to detect infections at early stages. In January 2025, Roche received FDA clearance and a CLIA waiver for its cobas liat molecular assays, designed to diagnose sexually transmitted infections (STIs) at the point of care. These PCR-based tests can rapidly detect chlamydia, gonorrhea, and Mycoplasma genitalium, delivering results in approximately 20 minutes. The rapid turnaround enables healthcare providers to diagnose and treat patients during a single visit, potentially reducing the spread of STIs and improving patient outcomes. The tests are user-friendly and require minimal training, making them suitable for various healthcare settings, including urgent care centers, retail clinics, and community health venues.

A favorable regulatory environment and consistent investment in diagnostic innovation drive market expansion. The country has seen a shift toward point-of-care and at-home molecular testing solutions, improving accessibility for underserved populations and enhancing user privacy. In addition, collaborative efforts among federal agencies, clinical laboratories, and diagnostics developers have strengthened early detection and intervention strategies. These factors reinforce the U.S. as a major contributor to the global molecular diagnostics for STDs market, with continued advancements expected to improve screening coverage and reduce infection rates.

Europe Molecular Diagnostics for STDs Market Trends

The Europe molecular diagnostics for sexually transmitted diseases (STDs) market is experiencing steady growth, supported by robust public health policies, increased healthcare investment, and growing awareness about sexually transmitted infections. Countries such as Germany, France, and the United Kingdom are leading the region's efforts, with comprehensive screening programs and advanced laboratory facilities enhancing diagnostic capabilities.

Government initiatives and collaborations between public health bodies and private diagnostic companies foster innovation and facilitate the adoption of advanced molecular diagnostic technologies. The European Centre for Disease Prevention and Control (ECDC) provides consistent data reporting and policy recommendations, promoting testing and early intervention. Additionally, the rising prevalence of STDs, particularly among young adults, underscores the need for effective diagnostic solutions. These factors collectively strengthen Europe's position in the global molecular diagnostics for STDs market.

The UK molecular diagnostics for sexually transmitted diseases (STDs) marketcontributes significantly to the growth of the molecular diagnostics for STDs market, supported by an advanced research infrastructure, national screening programs, and strong public health initiatives. The National Health Service (NHS) offers comprehensive sexual health services, including molecular diagnostic testing for STDs, helping to ensure early and accurate detection across diverse populations. Academic institutions and public health bodies actively engage in research projects to enhance diagnostic capabilities, particularly using PCR-based methods and point-of-care technologies.

Public funding bodies such as UK Research and Innovation (UKRI) support innovation in molecular diagnostics, while the Medicines and Healthcare Products Regulatory Agency (MHRA) ensures safe and efficient regulatory processes. Rising awareness of sexual health, along with efforts to reduce infection rates and improve treatment pathways, contributes to sustained demand. These factors position the UK as a key market for molecular STD diagnostics within Europe.

Germany molecular diagnostics for sexually transmitted diseases (STDs) market plays a vital role in the Europeon market, supported by an advanced healthcare system, strong public health surveillance, and ongoing investment in diagnostic innovation. The country benefits from a well-developed network of laboratories and academic institutions actively engaged in molecular diagnostics research, particularly in detecting infections such as chlamydia, gonorrhea, and HPV using PCR-based and nucleic acid amplification techniques.

The Robert Koch Institute plays a central role in STD monitoring and research, while the Federal Institute for Drugs and Medical Devices (BfArM) provides a clear regulatory pathway for molecular diagnostic tools. Government-funded programs promote STD screening and education, particularly among high-risk groups, contributing to early diagnosis and timely intervention. These elements reinforce Germany’s position as a leading contributor to molecular STD diagnostic development and accessibility within the European market.

Asia Pacific Molecular Diagnostics for STDs Market Trends

Asia Pacific molecular diagnostics for sexually transmitted diseases (STDs) market is witnessing the fastest CAGR in the molecular diagnostics for STDs market over the forecast period. This growth is supported by the rising burden of sexually transmitted infections, increased awareness campaigns, and expanding diagnostic infrastructure across major countries such as China, India, and Japan. The growing emphasis on early and accurate detection, particularly through nucleic acid amplification tests (NAATs), contributes to greater adoption of molecular testing methods in urban and rural healthcare settings.

In addition, government-led public health initiatives and international collaborations are improving access to screening programs and laboratory-based testing. Investments from global and regional diagnostic manufacturers are increasing, driven by the region’s large population base and unmet diagnostic needs. With rising healthcare expenditure, improved laboratory capacity, and efforts to integrate point-of-care molecular tests, Asia Pacific is becoming a key growth engine in the global market for STD molecular diagnostics.

China’s molecular diagnostics for sexually transmitted diseases (STDs) market is expected to witness robust growth over the forecast period, supported by expanding public health initiatives and a high burden of sexually transmitted infections across both urban and rural populations. Government efforts to improve early detection and treatment, especially for diseases like HIV, syphilis, and chlamydia, have strengthened demand in healthcare settings. The country’s large population and rapid urbanization have increased the need for accessible and efficient diagnostic solutions, driving a greater focus on prevention and control. Domestic manufacturers are advancing molecular diagnostic technologies with backing from national health authorities, while regulatory agencies such as the National Medical Products Administration (NMPA) continue to streamline product approvals. These factors collectively contribute to the rising adoption of molecular diagnostics for STDs in China.

Japan molecular diagnostics for sexually transmitted diseases (STDs) market holds a significant position in the Asia Pacific market, supported by strong government initiatives, a highly advanced healthcare system, and a well-established pharmaceutical industry. The country prioritizes preventive healthcare and comprehensive screening programs, particularly targeting high-risk groups. Leading research institutions such as the National Institute of Infectious Diseases actively contribute to developing and surveilling diagnostic technologies for sexually transmitted infections. Japan’s regulatory authority, the Pharmaceuticals and Medical Devices Agency (PMDA), ensures strict evaluation and approval processes, promoting the safety and reliability of diagnostic tests. Continued investment in innovative molecular diagnostics and public health awareness campaigns reinforces Japan’s role in advancing early detection and control of STDs across the region.

Latin America Molecular Diagnostics for STDs Market Trends

The Latin America molecular diagnostics for sexually transmitted diseases (STDs) market is showing steady growth, supported by expanding screening programs, increasing awareness of sexually transmitted infections, and ongoing improvements in healthcare infrastructure. Brazil and Argentina play key roles, with national initiatives promoting widespread testing for diseases such as chlamydia, gonorrhea, and syphilis. Government efforts to improve access to molecular diagnostic technologies enhance coverage, especially in underserved and rural areas. In addition, collaborations between public health agencies and international partners support the procurement and distribution of advanced diagnostic tools. These combined efforts and investments in healthcare modernization and training are strengthening Latin America’s position in the global molecular diagnostics for STDs market.

Middle East and Africa Molecular Diagnostics for STDs Market Trends

The Middle East and Africa market is accelerating, driven by increasing healthcare investment and a stronger focus on preventive care. National initiatives such as the UAE’s expanded screening programs and Saudi Arabia’s Vision 2033 emphasize broader access to molecular diagnostic testing for sexually transmitted infections. Public-private partnerships facilitate the wider availability of advanced diagnostic tools, particularly in underserved and remote areas. The region’s high burden of STDs and ongoing regulatory enhancements support faster adoption of targeted testing programs. Collaboration with international health organizations and growth in local manufacturing contribute to strengthening the molecular diagnostics ecosystem across the region.

Key Molecular Diagnostics for STDs CompanyInsights

Key players in the molecular diagnostics for sexually transmitted diseases (STDs) Market are concentrating on obtaining regulatory approvals for innovative vaccines, expanding their product portfolios, and forming strategic collaborations to strengthen their market position. For example, in June 2024, the U.S. FDA expanded the age indication for GSK’s RSV vaccine, Arexvy, to include adults aged 50 to 59 years who are at increased risk of RSV-related lower respiratory tract disease. This approval reflects the growing need for effective prevention among broader age groups and supports the rising demand for advanced respiratory vaccines.

Key Molecular Diagnostics for STDs Companies:

The following are the leading companies in the molecular diagnostics for sexually transmitted diseases (STDs) market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- F. Hoffmann-La Roche Ltd

- Hologic Inc.

- Abbott

- Cepheid (Danaher)

- Qiagen

- OraSure Technologies, Inc.

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Seegene Inc.

- DiaSorin S.p.A

Recent Developments

-

In February 2025, Abbott received FDA 510(k) clearance for its Simpli COLLECT STI Test, a self-collection kit enabling lab-based molecular detection of Chlamydia trachomatis, Neisseria gonorrhoeae, Trichomonas vaginalis, and Mycoplasma genitalium. The clearance supports growing demand for at-home sample collection paired with centralized molecular testing, reflecting broader trends toward improved accessibility and patient-centered STD diagnostics.

-

In January 2025, Roche received U.S. FDA 510(k) clearance and a CLIA waiver for its cobas liat sexually transmitted infection (STI) multiplex assay panels, including tests for chlamydia, gonorrhea (CT/NG), and Mycoplasma genitalium (CT/NG/MG). These assays enable rapid, accurate detection and differentiation of multiple STIs from a single sample, supporting timely clinical decision-making. This approval advances the molecular diagnostics market for STDs by expanding access to point-of-care multiplex testing solutions that improve disease management and patient outcomes.

Molecular Diagnostics For STDs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.65 billion

Revenue forecast in 2033

USD 6.94 billion

Growth rate

CAGR of 8.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD, F. Hoffmann-La Roche Ltd; Hologic Inc.; Abbott; Cepheid (Danaher); QIAGEN; OraSure Technologies, Inc.; Bio-Rad Laboratories, Inc.; bioMérieux SA; Thermo Fisher Scientific, Inc.; Seegene Inc.; DiaSorin S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Diagnostics For STDs Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global molecular diagnostics for sexually transmitted diseases (STDs) market report based on product, application, technology, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments & Services

-

Consumables (Reagents and kits)

-

Softwares

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

CT/NG Testing

-

Syphilis Testing

-

Gonorrhea Testing

-

HSV Testing

-

HPV Testing

-

HIV Testing

-

Trichomonas

-

Ureaplasma + Mycoplasma

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Laboratory Testing

-

Commercial/Private Labs

-

Public Health Labs

-

-

PoC testing

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global molecular diagnostics for STDs market size was estimated at USD 3.36 billion in 2024 and is expected to reach USD 3.65 billion in 2025

b. The global molecular diagnostics for STDs market is expected to grow at a compound annual growth rate of 5.74% from 2025 to 2030 to reach USD 6.94 billion by 2030.

b. The HIV testing segment dominated the molecular diagnostics for STDs market with a share of 31.31% in 2024. This is attributable to the growing prevalence of HIV. According to UNAIDS, over 39 million people were living with HIV worldwide by the end of 2023, with sub-Saharan Africa representing the highest disease burden.

b. Some key players operating in the molecular diagnostics for STDs market include BD, F. Hoffmann-La Roche Ltd, Hologic Inc., Abbott, Cepheid (Danaher), QIAGEN, OraSure Technologies, Inc., Bio-Rad Laboratories, Inc., bioMérieux SA, Thermo Fisher Scientific, Inc., Seegene Inc., and DiaSorin S.p.A.

b. Key factors that are driving the market growth include increasing incidence of sexually transmitted infections such as chlamydia, gonorrhea, syphilis, and human papillomavirus (HPV).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.