- Home

- »

- Automotive & Transportation

- »

-

North America Cold Storage Market Size, Report, 2030GVR Report cover

![North America Cold Storage Market Size, Share & Trends Report]()

North America Cold Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Facilities, Equipment), By Temperatures Range (Chilled, Frozen, Deep Freezer), By Application, By Country, And Segment Forecasts

- Report ID: GVR-2-68038-164-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Cold Storage Market Trends

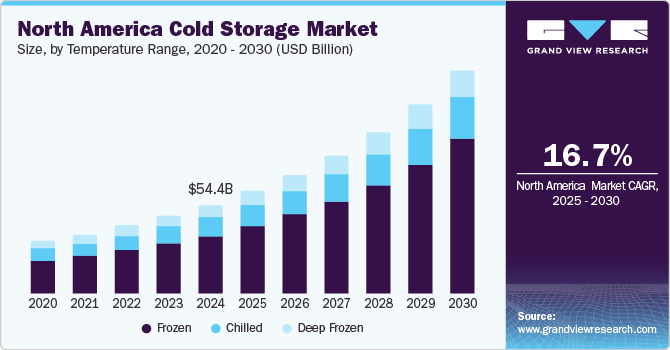

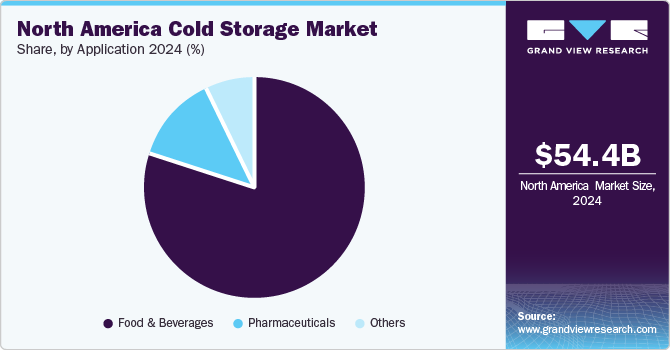

The global North America cold storage market size was valued at USD 54.40 billion in 2024 and is projected to grow at a CAGR of 16.7% from 2025 to 2030. Increasing consumption and demand for perishable goods, including dairy, frozen foods, fresh produce, non-dairy perishable goods, and others, rising growth in online grocery shopping, government regulations and initiatives to enhance food safety, and growing consciousness among consumers regarding health & fitness are some of the key growth driving factors for this market.

Cold storage facilities are extensively used by manufacturers, marketers, e-commerce companies, retailers, producers, distributors, and others for various reasons, including maintaining the quality of the product, extending its shelf life, avoiding spoilages, reducing wastage, minimizing inventory losses, reducing bottlenecks in logistics, and ensuring. The rise in consumer health consciousness and awareness regarding the role of food in health & fitness has driven the demand for perishable goods in recent years. This includes demand for dairy, dairy alternatives, meat alternatives, and fresh produce.

Increasing penetration of connected devices and a large consumer base are the key trends bolstering market growth. Furthermore, the growing automation of refrigerated warehouses is anticipated to enhance the demand for the product. Automation in warehouses is achieved using cloud technology, conveyor belts, robots, energy management systems, and truck loading automation. Integration of workforce management solutions for picking optimization & workforce forecast has led to reduced labor costs.

Cold storage is a temperature-controlled storage space. The method is used by fisheries, aquaculture, horticulture, agriculture, processed food, and dairy industries. Cold storage systems and refrigerated transportation facilities, which connect the farm-level storage facilities, distribution outlets, and processing units, are estimated to improve the supply chain's efficiency and reduce agricultural product wastage. Bilateral free trade agreements such as the North America Free Trade Agreement (NAFTA) have created opportunities for exporters in the U.S. to increase the trading of perishable foods with no import duties. Such trade agreements are projected to work in favor of the market.

The market is likely to witness considerable growth over the forecast period, owing to a combination of technological advancements in the processing, packaging, and storage of seafood products. Integrated refrigerated warehousing is poised to experience high growth over the forecast period.

Type Insights

Based on type, the storage is further segmented into facilities and equipment. Facilities dominated the regional market with a revenue share of 92.2% in 2024. This includes refrigerated warehouses, private, semi-private, public, and cold rooms. The cold storage facilities have started adopting advanced technology tools to enhance operational excellence and ensure seamless workflows. The emergence of technologies such as voice picking, robotics, Automated guided vehicles (AGVs), 3D bin packing, and others are facilitating cost reductions and improved performances for the cold storage businesses in the region. Automation, online grocery shopping trends, rising urbanization in the region, and increasing demand for cold storage facilities from multiple industries, including food & beverages, consumer goods, pharmaceuticals, healthcare, and others, are expected to drive the growth of this segment in the approaching years.

The equipment segment is expected to experience the fastest CAGR of 18.4% from 2025 to 2030. The primary equipment utilized in cold storage businesses includes blast freezers, walk-in coolers and freezers, deep freezers, and others. These equipment are now integrated with modern technology systems backed by the Internet of Things or Artificial Intelligence to ensure improved efficiency, energy conservation, reduced environmental footprint, and minimized operational costs. Companies have focused on equipment enhancements and adopting automation in the region to provide a competitive advantage over other market participants. For instance, in March 2024, Americold, one of the key companies in the market, commenced operations at its newly expanded Russellville facility, which was built with nearly USD 90 million of investments and state-of-the-art automation capacities.

Temperature Range Insights

The frozen temperature range segment held the largest revenue share of this industry in 2024 owing to the rising utilization of cold storage facilities in the region by businesses that enlist perishable goods in their diversified portfolios, including meat, poultry, seafood, frozen vegetables, frozen snacks, frozen novelties, ice cream products, and others. The presence of prominent organizations of global frozen food industries in the region, such as The Kraft Heinz Company, Nestlé USA, and others, is also contributing to the growing utilization of cold storage in North America. The primary benefit of frozen storage is its ability to effectively preserve perishable goods such as meat, poultry, seafood, and frozen vegetables. Maintaining low temperatures helps extend shelf life, preventing spoilage and food waste. Moreover, the increasing demand for frozen convenience foods, including frozen dinners, pizza, and frozen fruits, has fueled the need for frozen storage. Consumers appreciate the convenience and longer shelf life of these products. In the pharmaceutical industry, frozen storage is crucial for storing vaccines, biologics, and temperature-sensitive medications to ensure the stability and effectiveness of these products.

The chilled segment is anticipated to grow at a significant CAGR during the forecast period. In the chilled storage systems, warehouses store a variety of items that do not require frozen temperatures, including fresh fruits and vegetables, eggs, dairy products, dry fruits, and dehydrated foods. The temperature within these storages is akin to that of a standard refrigerator, effectively preventing the development of harmful bacteria on perishable food items and thereby inhibiting decomposition. The growth of this segment is primarily fueled by the necessity to store and prolong the shelf life of products sensitive to temperature variations.

Application Insights

Based on applications, the food & beverages market dominated the North America cold storage industry in 2024. The food & beverages businesses are one of the primary users of cold storage as logistics & storage play an integral role in their product delivery. Anticipated advancements in technology in the storage, packaging, and processing of seafood are expected to contribute to the growth of this sector. Nevertheless, the processed food segment is projected to experience a substantial increase in the coming years, primarily due to ongoing innovations in packaging materials. The progress in packaging materials plays a key role in extending the shelf life of food products, consequently leading to increased sales of processed foods in recent years. Increasing demand for food and foot items from e-commerce websites, online grocery shopping trends, and adoption of packaging advancements are expected to fuel growth for this segment in the approaching years.

The pharmaceuticals segment is projected to experience the fastest CAGR from 2025 to 2030. Multiple pharmaceutical offerings require cold temperature storage, such as vaccines, Insulin, antibiotics, biological products, cellular and gene therapies, cancer treatment products, etc. The inclusion of smart packaging techniques by pharmaceutical companies, the use of advanced technologies in warehousing and storage, and the emergence of innovation-based equipment are expected to contribute to the growth of this market. Vaccines are biological preparations to protect humans from harmful viruses and bacteria. Being a biological product, temperatures that are too low or too high are likely to degrade active ingredients and hamper the effectiveness of vaccines. Moreover, vaccines cannot be restored once they lose their effectiveness. Hence, temperature-controlled facilities and equipment play a crucial role in the storage and transportation of vaccines. The optimum temperature range to store and transport vaccines is 2°C - 8°C. Equipment to facilitate this includes cold boxes, ice packs, and refrigerators.

Country Insights

U.S. Cold Storage Market Trends

The U.S. cold storage market dominated the regional industry with a revenue share of 77.4% in 2024 owing to the growing demand for large enterprises operating in the food and beverage industry, robust manufacturing and food processing sector, expansion of facilities, equipment, and storage capacities by key companies, the opening of new cold storage facilities in the country, and large-scale import-export activities driven by global demands.

Mexico Cold Storage Market Trends

The Mexico cold storage market is projected to experience the fastest CAGR of 17.9% from 2025 to 2030. The growing demand for perishable food products such as dairy, meat, poultry, vegetables, fruits, and others, the increasing availability of advanced warehousing and storage technology solutions, and the rising demand for effective logistics and supply chain offerings are some of the key growth driving factors for this market.

Key North America Cold Storage Company Insights

Some of the key companies operating in the North America cold storage market include Americold Logistics, Inc., Lineage, Inc., United States Cold Storage, Burris Logistics and others. To address the growing competition, key market participants are adopting strategies such as facility expansions, new facility development, equipment enhancements, technology advancements, and more.

-

Americold Logistics, Inc., one of the prominent companies in the industry, offers supply chain solutions, technology portfolio, transportation solutions, and more. This includes facilities, design-build-operate, port capabilities, services, cold storage, and others. It is one of the applauded organizations for its technology driven engineering solutions designed for temperature-controlled supply chain requirements.

-

LINEAGE LOGISTICS HOLDING, LLC is a U.S.-based firm providing warehousing and logistics solutions to users in various industries. The company’s solutions consist of temperature-controlled public warehousing facilities for storing various types of food, including pork, beef, poultry, bakery products, fruits & vegetables, seafood, ice creams, and vegetables.

Key North America Cold Storage Companies:

- Americold Logistics, Inc.

- Burris Logistics

- Lineage, Inc.

- Wabash National Corporation

- United States Cold Storage

- Tippmann Group

- NFI Industries

- Penske Corporation, Inc.

- Seafrigo Group

- NewCold

Recent Developments

-

In July 2024, Lineage, Inc., one of the major market participants in the cold storage industry of North America, managed to raise USD 4.44 billion in an initial public offering in the U.S., which is expected to consolidate the company’s position in the market in one of the prime organizations for cold storage solutions.

-

In February 2024, Americold, a temperature-controlled logistics solutions company, declared its plan to partner with Canadian Pacific Kansas City (CPKC) to develop and operate an Americold warehouse facility on the CPKC rail network. The facility in Missouri, if developed, is expected to assist Mexico and the U.S. Midwest market operations.

North America Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 62.49 billion

Revenue forecast in 2030

USD 134.98 billion

Growth Rate

CAGR of 16.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, temperature range, application, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Americold Logistics, Inc.; Burris Logistics; Lineage, Inc.; Wabash National Corporation; United States Cold Storage; Tippmann Group; NFI Industries; Penske Corporation, Inc.; Seafrigo Group; NewCold

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Cold Storage Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America cold storage market report based on type, temperature range, application and country.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Storage

-

Facilities

-

Refrigerated Warehouse

-

Private & Semi-private

-

Public

-

-

Cold Room

-

Refrigerated Warehouse

-

Cold Room

-

-

-

Equipment

-

Blast Freezer

-

Walk-in Cooler And Freezer

-

Deep Freezer

-

Others

-

-

-

-

Temperature Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chilled

-

Frozen

-

Deep Frozen

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice Cream

-

Others

-

-

Fish, Meat, And Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America cold storage market size was estimated at USD 38.70 billion in 2020 and is expected to reach USD 42.36 billion in 2021.

b. The North America cold storage market is expected to grow at a compound annual growth rate of 10.7% from 2021 to 2028 to reach USD 86.48 billion by 2028.

b. Key factors that are driving the North America cold storage market growth include increasing penetration of connected devices and rising automation in refrigerated warehouses.

b. Production stores dominated the North America cold storage market with a share of 49.1% in 2020. This is attributable to its suitability and preference for storing fruits, vegetables, flour, cooking ingredients, and canned goods for a long time without any spoilage.

b. Some key players operating in the North America cold storage market include Americold Logistics LLC; Burris Logistics, Inc.; Cloverleaf Cold Storage Company; Lineage Logistics; VersaCold Logistics Services; and Henningsen Cold Storage Company.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.