- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Foam Market Size, Industry Report, 2033GVR Report cover

![North America Foam Market Size, Share & Trends Report]()

North America Foam Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (PU Foam, PS Foam, PVC Foam, Phenolic Foam, Polyolefin Foam), By Application (Packaging, Building & Construction), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-669-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Foam Market Summary

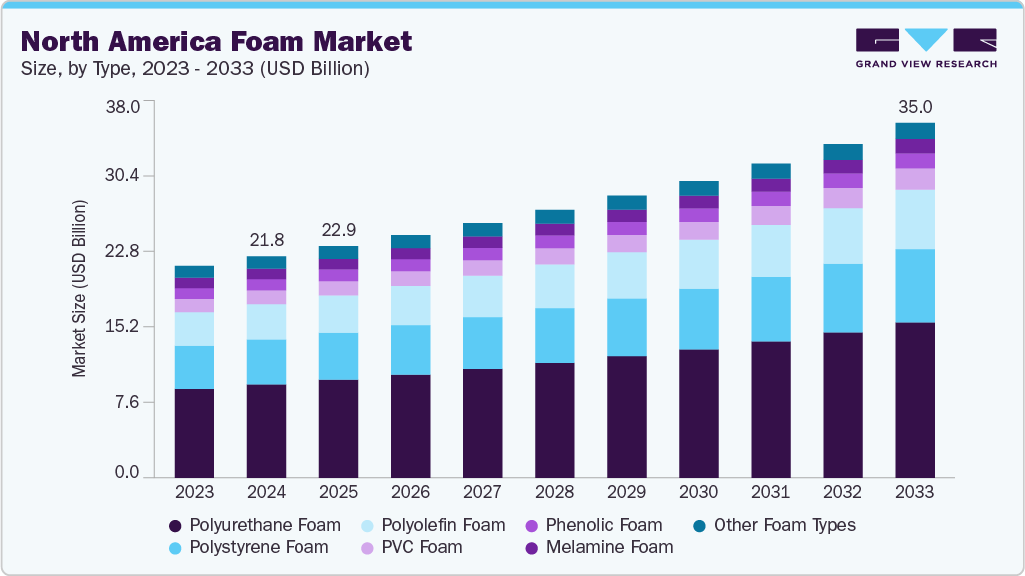

The North America foam market size was estimated at USD 21.85 billion in 2024 and is projected to reach USD 35.04 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is projected to grow steadily, fueled by increasing demand from important industries like packaging, construction, automotive, and furniture.

Key Market Trends & Insights

- U.S. dominated the North America foam market with the largest revenue share of over 70% in 2024.

- By type, the polyurethane foam segment dominated the type segment in 2024 with a revenue share of 42.20%.

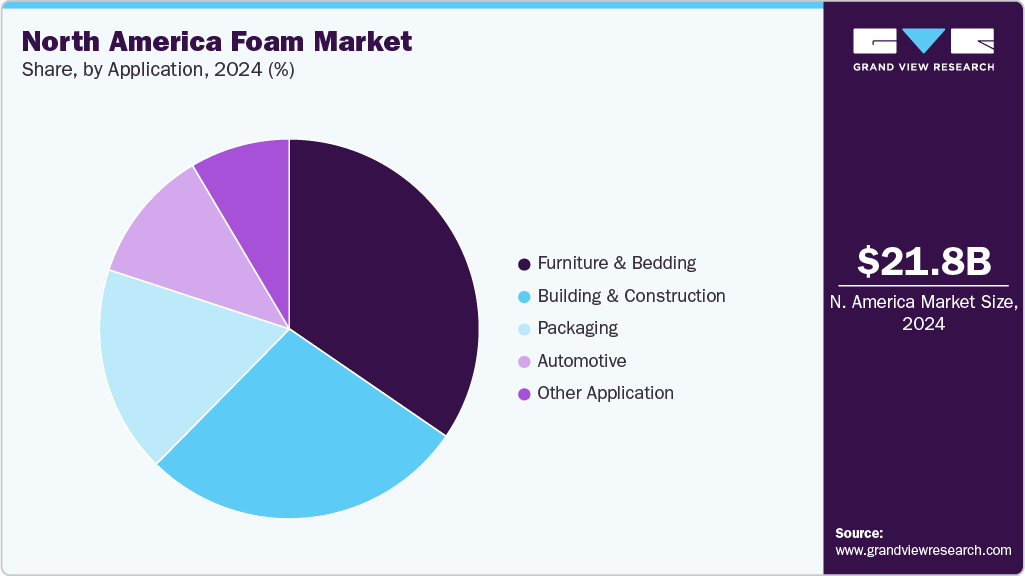

- By application, furniture & bedding application dominated the market with a share of 34.56% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.85 billion

- 2033 Projected Market Size: USD 35.04 billion

- CAGR (2025-2033): 5.1%

The growth of e-commerce is greatly enhancing the need for protective and cushioning foams, while tougher insulation regulations and the transition toward lighter automotive materials are also promoting foam usage throughout the region.The North America foam industry is projected to experience consistent growth, fueled by robust demand in the packaging, automotive, construction, and healthcare industries. Foam materials are essential for improving thermal insulation in buildings, lowering vehicle weight for enhanced fuel efficiency, and providing protective cushioning for packaging and medical uses. The increasing focus on energy-efficient infrastructure, the rise of electric vehicles, and the growth of e-commerce are major factors driving demand in the region. Furthermore, the transition towards recyclable, low-VOC, and bio-based foam products is accelerating, driven by regulatory requirements and corporate sustainability objectives in both the U.S. and Canada.

In North America, increasing urbanization, continuous improvements in infrastructure, and the swift growth of cold chain logistics are leading to a higher demand for foam across various sectors. As producers focus on performance, longevity, and compliance with environmental regulations, the need for advanced foam materials in insulation, protective packaging, and temperature-sensitive transportation is projected to rise consistently in the future.

Drivers, Opportunities & Restraints

The North America foam market is expected to continue its growth trend, propelled by significant demand from the packaging, construction, automotive, and healthcare industries. Its lightweight, insulating, and cushioning characteristics render it crucial for energy-efficient buildings, lightweight automotive parts, and protective packaging solutions. Furthermore, the increasing adoption of foams in medical devices, mattresses, and temperature-sensitive packaging contributes to market growth, particularly in light of rising investments in healthcare infrastructure and cold chain logistics throughout the region.

Emerging prospects in the North America foam sector are anticipated as a result of an increased emphasis on sustainability and circular economy practices. The advancement of recyclable and bio-based foam options is gaining traction, propelled by regulatory demands and corporate environmental, social, and governance (ESG) objectives. Furthermore, the growth of e-commerce, ongoing infrastructure expansion, and the swift rise in electric vehicle production are creating new uses for foams in applications like thermal insulation, impact resistance, and lightweight structural elements.

The North American foam industry is anticipated to encounter various challenges due to growing environmental concerns about foam waste and its limited recyclability. Heightened regulatory demands regarding the use of particular blowing agents and raw materials may make it difficult for manufacturers to adhere to compliance requirements. Fluctuations in raw material costs and disruptions in the supply chain could affect production expenses and the availability of materials. Competition from alternative materials, along with stringent performance and safety regulations, may also hinder the adoption of foam in certain end-use sectors.

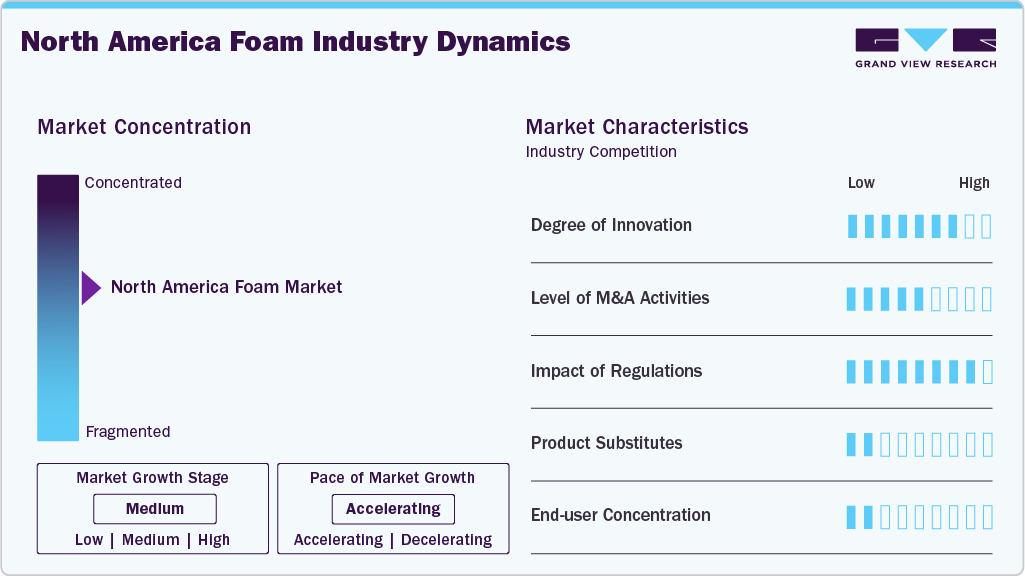

Market Concentration & Characteristics

The North America foam market is presently experiencing moderate growth, gaining traction due to an increase in applications in sectors like construction, automotive, packaging, and healthcare. Although the market is still fragmented, key players exert considerable influence over competitive dynamics. Prominent companies such as Armacell, BASF SE, SABIC, ExxonMobil, and Borealis AG are actively impacting the market by innovating high-performance and sustainable foam solutions. Their emphasis on creating eco-friendly materials and advanced formulations aligns with changing regulatory requirements and the rising need for energy-efficient and recyclable products across various end-use sectors.

The North America foam industry is experiencing a considerable impact from mergers and acquisitions, as leading firms take over specialized companies to enhance their regional presence, diversify their product lines, and bolster their supply chains. These strategic actions are fostering innovation in sustainable foam technologies, as companies adapt to intensified regulatory pressures. Changing environmental regulations across the region are influencing material selections, urging manufacturers to pursue low-emission, recyclable, and non-toxic options. The increasing costs of compliance and the transition towards environmentally friendly standards are driving greater investments in cleaner production techniques and advanced reformulated foam products.

The market experiences moderate rivalry from substitute materials such as fiberglass, rigid plastics, and natural fibers, particularly in the areas of insulation and packaging. Nevertheless, foams maintain a strong position due to their excellent lightweight nature, thermal insulation capabilities, and cushioning features. The market also demonstrates significant concentration among end users, especially in the construction and automotive industries, where major OEMs and contractors significantly influence purchasing choices. This concentration affects product specifications and demand trends, rendering the market sensitive to industry cycles and changing customer needs.

Type Insights

Polyurethane foam dominated the North America foam market, securing a revenue share of 42.20% in 2024. This segment is projected to experience consistent growth due to its extensive application in construction, automotive, furniture, and packaging sectors. The superior thermal insulation, cushioning, and structural characteristics of polyurethane (PU) foam make it well-suited for energy-efficient buildings, noise reduction, and lightweight components in vehicles. The rising demand for high-performance insulation in both residential and commercial properties, particularly in light of stricter energy efficiency standards, continues to propel the adoption of PU foam throughout North America and other advanced markets.

In addition, the growth of e-commerce is driving the need for efficient protective packaging, and the increasing popularity of electric vehicles is heightening the demand for lightweight and high-performance foam materials. With sustainability emerging as a vital factor in the market, advancements in bio-based and low-VOC polyurethane foams are anticipated to facilitate the ongoing development and progress of the North American foam market.

The North America foam industry for polystyrene is anticipated to showcase consistent growth during the forecast period, at a CAGR of 5.3%, fueled by ongoing demand from the packaging, construction, and consumer goods sectors. Its lightweight nature, resistance to moisture, and superb insulating characteristics make it suitable for uses such as protective packaging, food storage containers, and insulation in buildings. In the construction industry, expanded polystyrene (EPS) is commonly utilized for thermal insulation in walls, roofs, and foundations, especially in areas with stringent energy efficiency regulations.

Application Insights

The furniture and bedding sector was the leading segment in the North America foam market, representing a revenue share of 34.56% in 2024. This leadership can be attributed to the prevalent use of flexible polyurethane foams in items such as mattresses, cushions, and upholstered furniture, due to their superior comfort, durability, and resilience. The expansion of the housing and hospitality industries, along with increasing consumer preferences for ergonomic and high-quality home furnishings, is driving market growth. Moreover, a growing emphasis on sustainable living is promoting the use of low-VOC and bio-based foam options in the furniture and bedding sector.

The automotive sector is anticipated to experience a significant CAGR of 5.6% throughout the forecast period, playing a key role in the growth of the North America foam industry. The rising demand for lightweight, durable, and energy-absorbing materials in vehicle production is propelling the use of foams such as polyurethane, polyethylene, and polypropylene. These materials are commonly utilized in aspects like seating, headliners, door panels, and sound insulation components to improve comfort, decrease vehicle weight, and enhance fuel efficiency. Furthermore, the accelerating transition toward electric vehicles (EVs) and the incorporation of advanced acoustic and thermal management technologies are likely to increase foam consumption in the automotive industry.

Moreover, the swift rise of e-commerce, the growth of cold chain logistics, and the increasing demand for secure and efficient product delivery are fueling the need for lightweight, impact-resistant, and affordable foam solutions in the packaging industry. Materials like EPS, EPE, and PU are becoming more popular due to their protective cushioning, thermal insulation, and moisture resistance, making them perfect for packaging food, electronics, appliances, and goods sensitive to temperature changes.

Country Insights

The North America foam industry is set for consistent growth, fueled by robust demand in vital sectors including construction, automotive, packaging, furniture & bedding, and healthcare. The region enjoys a strong industrial foundation, sophisticated manufacturing capabilities, and an increasing focus on energy efficiency and sustainability. The growing use of foam materials in insulation, lightweight vehicle parts, and protective packaging, particularly driven by the surge in e-commerce and electric vehicles, is promoting market growth.

U.S. Foam Market Trends

The United States dominated the North America foam industry with over 70% of the revenue share in 2024, maintaining a leading position. This prominence is attributed to the nation's robust industrial sector, well-developed construction industry, and significant e-commerce and automotive markets. Increased demand for energy-efficient insulation in both residential and commercial properties, along with a rise in the usage of lightweight and durable materials in automobile production, continues to drive foam consumption. Additionally, heightened investments in healthcare infrastructure, innovative packaging solutions, and product development focused on sustainability are further contributing to the growth of the foam market throughout the U.S.

Canada Foam Market Trends

The Canada foam market is projected to experience steady growth, fueled by the increasing demand in the construction, automotive, packaging, and furniture industries. The rising focus on energy-efficient building materials is enhancing the utilization of insulation foams such as polyurethane and polystyrene in both residential and commercial construction projects. The growth of e-commerce and cold chain logistics is further increasing the need for protective and thermal packaging solutions. Moreover, Canada's heightened emphasis on sustainability and recycling is promoting the creation and use of low-VOC, recyclable, and bio-based foam products.

Key North America Foam Market Company Insights

The North America foam market is highly competitive, with major players actively shaping the industry through innovation, sustainability initiatives, and strategic expansion. Key companies such as BASF SE; Armacell LLC; Huntsman Corporation; Dow Inc.; and Carpenter Co. play a critical role in driving technological advancements and expanding foam applications across construction, automotive, packaging, furniture, and healthcare sectors. These firms are heavily investing in R&D to improve product performance, enhance recyclability, and develop bio-based and low-emission foam solutions.

Key North America Foam Companies:

- Arkema Group

- Armacell International S.A.

- BASF SE

- Borealis AG

- SABIC

- Japan Polypropylene Corporation

- Braskem

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings B.V.

- Huntsman Corporation

- Evonik Industries AG

- Covestro AG

- Fritz Nauer AG (acquired by Recticel NV)

- Koepp Schaum GmbH

- JSP Corporation

- Polymer Technologies, Inc.

- Recticel NV

- Rogers Corporation

- SEKISUI ALVEO AG

- Synthos S.A.

- DuPont de Nemours, Inc.

- Trelleborg AB

- Zotefoams plc

- Woodbridge Foam Corporation

- Sealed Air Corporation

Recent Developments

-

In May 2025, T.A.S. Corporation partnered with Formosa to launch the TECO Flexshield PU Foam, a product specially developed for heavy industrial environments. The foam featured high resistance to acid and chemicals, making it suitable for protecting against acid fumes in industrial settings. This innovation aimed to enhance safety and durability in harsh chemical conditions, supporting T.A.S.'s commitment to advanced, high-quality insulation solutions.

-

In February 2025, Carlisle Companies Incorporated completed its acquisition of ThermaFoam, a Texas-based manufacturer of expanded polystyrene insulation products, in early 2025. ThermaFoam, headquartered near Dallas/Fort Worth, serves commercial, residential, and infrastructure construction markets.

North America Foam Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.86 billion

Revenue forecast in 2033

USD 35.04 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, country

Regional Scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Arkema Group; Armacell International S.A.; BASF SE; Borealis AG; SABIC; Japan Polypropylene Corporation; Braskem; Exxon Mobil Corporation; LyondellBasell Industries Holdings B.V.; Huntsman Corporation; Evonik Industries AG; Covestro AG; Fritz Nauer AG (acquired by Recticel NV); Koepp Schaum GmbH; JSP Corporation; Polymer Technologies, Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; DuPont de Nemours, Inc.; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Foam Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America foam market report based on type, application, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyurethane Foam

-

Polystyrene Foam

-

PVC Foam

-

Phenolic Foam

-

Polyolefin Foam

-

Polyethylene Foam

-

Polypropylene Foam

-

-

Melamine Foam

-

Other Foam Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Food & Beverage packaging

-

Industrial protective packaging

-

Consumer Electronics Packaging

-

E-Commerce Mailers & Shipping

-

Pharmaceuticals & healthcare packaging

-

-

Building & Construction

-

Insulation boards (walls, roofs, floors)

-

Soundproofing/acoustic panels

-

HVAC duct insulation

-

Sealants & gap fillers

-

Waterproofing membranes

-

-

Furniture & Bedding

-

Mattresses

-

Upholstered furniture cushions

-

Office chairs

-

Foam toppers & pads

-

-

Automotive

-

Seating foam

-

Interior trim & headliners

-

Acoustic insulation

-

Bumper & crash pads

-

Air filters & HVAC foams

-

-

Other Applications

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.