- Home

- »

- Consumer F&B

- »

-

North America Wheat Protein Market Share Report, 2030GVR Report cover

![North America Wheat Protein Market Size, Share & Trends Report]()

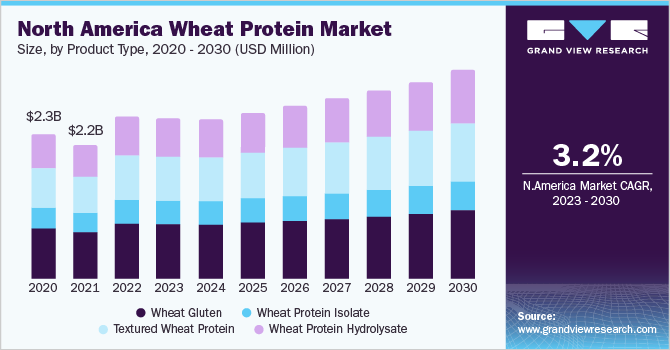

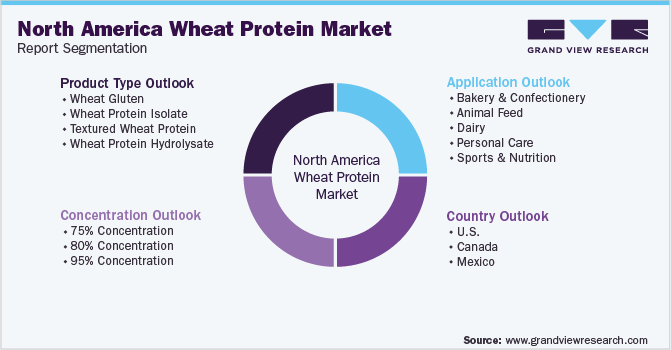

North America Wheat Protein Market Size, Share & Trends Analysis Report By Product Type (Wheat Gluten, Wheat Protein Isolates), By Application (Animal Feed, Dairy), By Concentration (75%, 80%), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-043-9

- Number of Report Pages: 240

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The North America wheat protein market size was valued USD 2.62 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030. The rising demand for protein-based ready-to-drink beverages, nutrition bars, and powders among sports enthusiasts is anticipated to drive the market. Some of the sports & nutrition brands, such as Quest Nutrition, Optimum Nutrition, Bio-Engineered Supplements & Nutrition, Inc. (BSN), NOW Foods, MusclePharm, MuscleTech, and Met-Rx Substrate Technology, Inc., are prominent applications of the protein ingredients. In addition, increasing health consciousness among consumers and the growing tendency of the elderly consumer group toward preventive healthcare, is driving the demand for protein ingredients.

Protein ingredients are derived from animal and plant sources. Animal proteins include whey and casein. Plant-based proteins are sourced from raw materials like soy, peas, oats, and wheat. Although plant-based proteins are healthy and sustainable, dairy proteins still hold a dominant industry position. This is attributed to their cost-effectiveness and improved manufacturing techniques. Some of the key application areas of protein ingredients are sports nutrition, dietary & nutraceutical supplements, beverages, and animal feed. The demand for dairy proteins is significant in applications, such as milk products, ice creams, frozen desserts, and confectionery.

Dairy proteins are preferred in milk-based products owing to the demand for enhanced texture and taste. The growing lactose-intolerant population is one of the major factors limiting the market for dairy protein ingredients. However, the demand for dairy-based protein ingredients, such as whey proteins, is still projected to witness continuous demand as they are vital ingredients in a wide range of end-use applications, such as sports nutrition products, salad dressings, bakery foods, and medical nutrition products. Along with the growing urbanization, the dietary habits of consumers have changed. Proteins and amino acids are two of the largest classes of ingredients preferred by consumers today. Consumers are looking for on-the-go protein snacks and protein-based functional beverages to enhance their sports performance as well as their overall health.

Product Type Insights

In the product types segment, wheat gluten dominated the industry in 2022 and accounted for the largest share of over 34.29% of the overall revenue. The demand for wheat gluten is increasing owing to a rise in the vegetarian and vegan populace. The use of wheat gluten in meat substitutes contributes to segment growth. Wheat gluten is a protein found in wheat,which is often used as a binding agent in several food applications. Gluten provides a wide range of functionalities, such as binding, foaming, viscoelasticity, and emulsification, thereby leading to its widespread usage in the bakery sector. For instance, Loryma GmBH, a Germany-based provider of food ingredients, offers Lory Starch Elar starch that helps in calorie reduction and is used as a filler in bakery products. Furthermore, the segment growth is also driven by the change in consumers eating habits.

A rise in cases of various health disorders, such as diabetes, blood pressure, and cholesterol, is driving the demand for food derived from natural sources, which contain a high source of protein. Several companies are launching innovative products and expanding their reach through business expansions and mergers. For instance, in February 2022, PureField Ingredients, a U.S.-based provider of wheat protein, completed the expansion of its facility in Kansas. The increase in capacity will help them meet the rising demand for wheat protein-based products. In December 2021, ICM, Inc., a technology supplier for the ethanol and feed industries in the U.S., partnered with Summit Sustainable Ingredients to build a wheat protein manufacturing facility in Kansas. The facility will develop vital wheat gluten to be used in foods, specialty feeds, and pet foods.

The market for wheat protein hydrolysates is expected to witness significant growth over the projected period. It is a product derived from wheat protein that has been hydrolyzed or broken down into smaller peptides and amino acids. This process makes the protein more easily digestible and can improve its nutritional value. Wheat protein hydrolysate is used as a dietary supplement or ingredient in a variety of food and cosmetic products. For example, Cargill Inc. provides Prowliz hydrolyzed wheat protein, which is used in baked goods and increases the level of protein content in food and beverages. The rising cases of gluten intolerance coupled with an increase in the number of vegan consumers are expected to drive the demand for wheat protein hydrolysate. The rising preference for organic and healthy substitutes by consumers is also expected to drive segment growth.

Concentration Insights

The market for 75% protein concentration was the largest in 2022 and accounted for the maximum share of more than 51.10% of the overall revenue. 75% wheat protein concentrate is often used as a supplement to add protein to the diet, especially for consumers who follow a vegan diet. It is also used as an ingredient in food and beverage products, such as protein-enhanced pasta, protein bars, and snacks. Several companies offer wheat protein with 75% concentrate, including NOW Foods, Solgar, and Garden of Life. For instance, U.S.-based PureFields offers HEARTLAND 75 vital wheat gluten, which is used in food and beverage applications. The segment for 80% wheat protein concentration in the North America market is expected to witness significant growth over the projected period.

It is a food ingredient with a high concentration of protein. The protein is derived from wheat flour after processing to remove fat and carbohydrates. A large number of athletes are looking for protein supplements to build muscle. The application of 80% wheat protein concentrate in the sports nutrition sector is boosting segment growth. Furthermore, the rising health and wellness consciousness among consumers has increased the demand for 80% wheat protein concentrate-based products. For example, a U.S.-based provider of food ingredients, Archer Daniels Midland (ADM), offers WhetPro 80, a wheat protein used as a binding agent and as a source of protein in food and beverage applications.

Application Insights

The bakery & confectionaries segment held the highest revenue share of more than 42.75% in 2022.This trend is anticipated to continue over the forecast period as wheat protein is used in the dough to improve the elasticity and structure of baked goods. It also enhances the ability to trap the carbon dioxide produced by yeast, resulting in a chewy and soft texture. As a result, the application of wheat protein in the bakery and confectionery industry is rising. In the confectionery sector, gluten is often used in chocolate and candy products to enhance their texture. Personal care application in the North America regional market is expected to witness significant growth over the projected period.

In the personal care industry, wheat protein is used as a nourishing and moisturizing agent in conditioners, body lotions, and shampoos. Elements, such as dust, pollution, and smoke, can damage the structural integrity, surface quality, and sensitivity of the skin and scalp over time. Hydrolyzed wheat protein protects the skin and hair against damage caused by these factors, making it an ideal ingredient in skincare and haircare formulations. In addition, wheat protein is considered to be a safe and natural ingredient, making it especially appealing to consumers who prefer natural personal care products. There are a number of companies offering wheat-protein-based sports & nutrition products. For instance, U.S.-based MGP Ingredients offers Optein, a wheat protein hydrolysate powder that is an ideal alternative to soy and other plant-based ingredients.

Country Insights

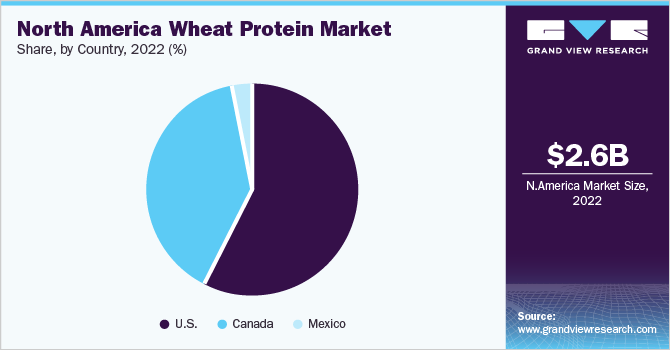

In terms of revenue, the U.S. led the industry and accounted for over 62.40% share in 2022. The number of pet owners is increasing in the country. According to the 2021-2022 APPA National Pet Owners Survey, USD 50 billion were spent on pet food and treats in the U.S. According to the American Feed Industry Association (AFIA), the U.S. had more than 5,800 animal feed-producing facilities in 2021 and produces over 284 million tons of pet food and finished feed on average every year. In addition, 8 million tons of wheat-based products were used as ingredients in animal feed, including wheat protein. Thus, the increasing usage of protein ingredients in the animal feed and pet food sector to provide essential amino acids and increase their resistance to diseases is driving the wheat protein demand.

The baking industry in Canada has been growing immensely in the last few years owing to the increasing population as a result of the rising number of immigrants. The adoption of functional foods in the daily diet has been slowly and steadily rising among Canadians, which is accelerating the demand for products, such as fortified bread, in the country. According to Agriculture and Agri-food Canada, in 2021, Canada registered health and wellness baked goods sales worth USD 2.6 billion and ranked third in the global market. Thus, the high demand for wheat protein in the bakery & confectionery sector will support the region’s growth.

Mexico has witnessed high seafood demand in the last few years owing to the increasing domestic consumption of shrimp, tilapia, catfish, and trout. This factor is driving the demand for wheat protein in the aquafeed application as the product is high in protein but low in ash and fiber. According to a survey done by COMEPESCA, which is the Mexican Council for Promotion of Seafood Consumption, in 2022, the local seafood and marine resources should be preserved to fulfill the local demand for seafood in restaurants and retail outlets owing to its rising demand. According toAgriculture and Agri-food Canada, in 2021, Mexico imported fish and seafood products from the world at a value of USD 75.9 million and 304,013 tons in volume. Mexico’s major importers are the U.S., China, and Chile.

Key Companies & Market Share Insights

The industry is expected to witness moderate competition among the companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, many companies are expanding their product portfolios to gain a competitive edge in the market. Manufacturers are also increasingly engaged in R&D activities to meet the growing demand. For instance, in September 2020, ADM introduced Arcon T pea protein, Prolite, MeatTEX wheat protein Prolite, and MeatXT non-textured wheat protein. These functional protein products improve the density and texture of meat substitutes and are suitable for achieving the meat-like texture that consumers desire. The key companies operating in the North America wheat protein market include:

-

Archer Daniels Midland Company (ADM)

-

Agridient

-

MGP Ingredients

-

AB Amilina

-

Cargill Inc

-

Manildra Group

-

Crespel & Deiters GmbH and Co. KG

-

Kroener Staerke

-

Crop Energies AG

North America Wheat Protein Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.37 billion

Growth rate

CAGR of 3.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2020

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volumeforecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, concentration, application,countries

Regional scope

North America

Countries scope

U.S.; Canada; Mexico

Key companies profiled

Archer Daniels Midland Company (ADM); Agridient; MGP Ingredients; AB Amilina; Cargill Inc.; Manildra Group; Crespel & Deiters GmbH and Co. KG; Kroener Staerke; Crop Energies AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Wheat Protein Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the North America wheat protein market report on the basis of product type, concentration, application, and country:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Wheat Gluten

-

Wheat Protein Isolate

-

Textured Wheat Protein

-

Wheat Protein Hydrolysate

-

-

Concentration Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

75% Concentration

-

80% Concentration

-

95% Concentration

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Bakery & Confectionery

-

Animal Feed

-

Aqua Feed

-

Dry Pet Food

-

Wet Pet Food

-

Pet Treats

-

-

Dairy

-

Personal Care

-

Sports & Nutrition

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America wheat protein market size was estimated at USD 2.62 billion in 2022 and is expected to reach USD 2,607.9 million in 2023.

b. The North America wheat protein market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 3.37 billion by 2030.

b. U.S. dominated the North America wheat protein market with a revenue share of 62.66% in the year 2022 owing to the high demand and large consumer base present in this area.

b. Some of the key market players in the North America wheat protein market are Archer Daniels Midland Company (ADM), Agridient, MGP Ingredients, AB Amilina, Cargill Inc, Manildra Group, Crespel & Deiters GmbH and Co. KG, Kroener Staerke, Crop Energies AG.

b. Key factors that are driving the North America wheat protein market growth include the rising demand for protein-based ready-to-drink beverages, nutrition bars, and powders among sports enthusiasts is anticipated to drive the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."