- Home

- »

- Communications Infrastructure

- »

-

Pharma E-commerce Market Size And Share Report, 2030GVR Report cover

![Pharma E-commerce Market Size, Share & Trends Report]()

Pharma E-commerce Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Vaccines, Specialty Care, Topical Medicines), By Therapeutic Areas, By Type, By Channel Type, By Platform, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-135-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharma E-commerce Market Summary

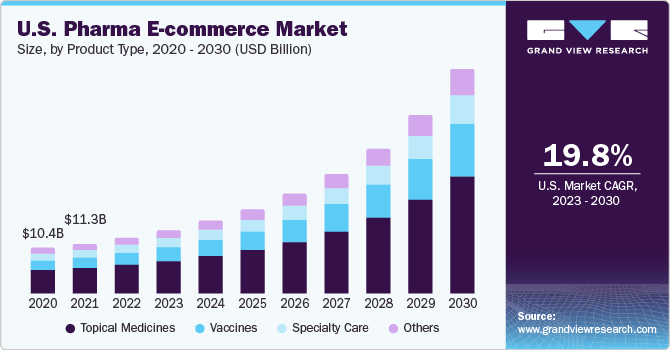

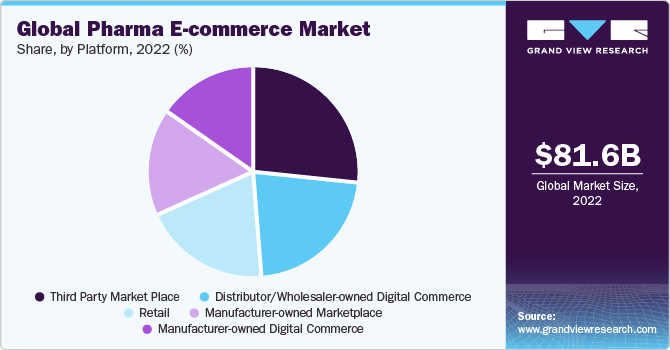

The global pharma E-commerce market size was estimated at USD 81.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.2% from 2023 to 2030. The market growth is driven by technological advancements, shifts in customer behavior, and demand for convenient healthcare solutions, particularly in the wake of the global pandemic.

Key Market Trends & Insights

- Asia Pacific region dominated the market with a share of 35.9% in 2022.

- By product type, the tropical medicines segment accounted for the largest market share of 51.3% in 2022.

- By therapeutic areas, the diabetes segment accounted for the largest market share of 18.6% in 2022.

- By type, the over-the-counter (OTC) segment held a market share of 71.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 81.63 Billion

- 2030 Projected Market Size: USD 277.87 Billion

- CAGR (2023-2030): 17.2%

- Asia Pacific: Largest market in 2022

Customers of online pharmacies increased beyond younger, tech-savvy individuals to include older populations and patients with chronic illnesses who valued the flexibility of online ordering and home delivery. Telemedicine and electronic prescriptions have become increasingly incorporated into pharmaceutical services, allowing patients to communicate with healthcare providers seamlessly and ethically. To personalize the customer experience, online pharmacies are utilizing artificial intelligence and data analytics.

AI-powered algorithms assisted in prescribing medications based on individual health profiles and previous purchases. Several online pharmacies expanded their product offerings to include over-the-counter (OTC) pharmaceuticals, nutritional supplements, healthcare products, and prescription medications. Larger pharmaceutical corporations and established drugstore chains gained a competitive advantage in the global pharma e-commerce sector through acquisitions or creating individual e-commerce sites. This resulted in market consolidation, with established firms attempting to gain a major share of the online pharmaceutical industry by using brand reputation and resources.

Patients can use smartphones to obtain prescriptions, receive prescription refills, and access health information through mobile applications. To improve patient engagement, these applications frequently contain features such as prescription reminders and dosage tracking. Advanced technologies are being adopted to promote authenticated mechanisms, such as two-factor authentication (also known as 2FA) and biometric identification (fingerprint or facial recognition), and strengthen the security of online pharmacy platforms, which ensures that only authorized users have access to them. The global pharma e-commerce industry is anticipated to grow further owing to growing internet penetration, rising healthcare expenses, and increasing convenience of online medicine access. Online pharmacies are increasingly targeting international markets. Regulatory integration efforts and cross-border e-commerce partnerships are expected to make it easier to expand into other markets, driving the growth potential of the market.

With the rise in pharmaceutical e-commerce, the healthcare industry has experienced ease, accessibility, and affordability. However, strict pharmaceutical laws and the alarming rise in drug counterfeiting significantly hinder market expansion and the company’s credibility. By nature, counterfeit pharmaceuticals are harmful to patients. Counterfeit drugs often lack the essential active components or contain dangerous materials. Patients who unintentionally acquire fake medications face the risk of receiving inadequate treatments or experiencing negative health impacts, leading to reduced confidence in online pharmacies. In February 2023, Amazon.com, Inc., and healthplus.flipkart.com were issued short notice by the Drug Controller General of India for violating the norms for the online sale of drugs. The global reach of e-commerce involves navigating multiple regulatory frameworks. The differences in restrictions from region to region form a complex matrix demanding comprehensive planning and market expansion preparation. This geographical variation poses compliance and adaptation challenges.

As more countries boost their healthcare systems and increase internet connectivity, the demand for e-pharmacy is expected to continue to increase. Pharmaceutical e-commerce has enormous opportunities to expand in emerging regions such as Asia, Africa, and Latin America. Pharmaceutical cross-border trade is expected to continue to increase. Online pharmacies are expected to gain profit from globalization by using multinational supply chains to offer a greater selection of items and competitive pricing. Global pharmacy expansion is expected to provide enormous growth opportunities for global pharma e-commerce businesses in the future.

Product Type Insights

Based on product type, the tropical medicines segment accounted for the largest market share of 51.3% in 2022. The segment growth can be attributed to the extensive selection of online pharmacies' topical medications that cater to a wide range of diseases and needs, including products for treating skin disorders, controlling discomfort, tackling dermatological problems, and dressing up. Several e-commerce sites offer both Over-the-Counter (OTC) and prescription topical drugs. While prescription products may need verification and clearance, OTC products can be self-purchased. By enabling customers to explore, compare, and buy topical medications from the ease of their homes, the e-commerce sector offers improved convenience.

The vaccines segment is expected to grow at a CAGR of 19.1% during the forecast period. The COVID-19 pandemic led to a notable increase in public awareness about the value of vaccination for general wellness. Growing customer preference for e-commerce platforms for pharmaceutical products could lead to a rise in vaccine sales on e-commerce platforms, contributing to market growth. E-commerce platforms make it more convenient for people to arrange vaccination appointments, get information about the available vaccines, and buy vaccines with ease. The pandemic has also shifted priorities in healthcare. The notable rise in COVID-19 vaccine demand fueled the expansion of online shopping sites focusing on pharmaceuticals.

Therapeutic Areas Insights

Based on therapeutic areas, the diabetes segment accounted for the largest market share of 18.6% in 2022. The segment’s growth is attributed to the growth of products related to diabetes, such as insulin, glucose monitors, and diabetic supplies. Diabetes patients benefit from internet retailers' broad product selections, affordable prices, and easy home delivery. In addition, the use of digital health solutions, such as telemedicine and diabetes management applications, has accelerated the growth of this segment. The digital era has offered patients more authority to manage their healthcare. Using smartphone applications and wearables, people with diabetes frequently monitor their blood sugar levels, medicines, and diet plans. These technologies have been incorporated into e-commerce platforms, enabling consumers to purchase pharmaceuticals, refill prescriptions, and receive individualized health advice.

The immune-system diseases segment is expected to grow at a CAGR of 20.0% over the forecast period. The immune-system diseases segment is witnessing growth owing to numerous illnesses belonging to the category of immune-system diseases, including autoimmune diseases such as rheumatoid arthritis and inflammatory bowel disease. The need for specialty drugs and biologics is driving the growth of the pharmacy e-commerce sector for immune-system illnesses. Patients can easily obtain medications through online platforms, which frequently provide support services, including instructional materials and programs for medication adherence. Additionally, e-commerce platforms' convenience has benefitted people with immune-system disorders.

Type Insights

Based on type, the over-the-counter (OTC) segment held a market share of 71.2% in 2022 and is expected to dominate the market by 2030. This segment growth can be attributed to OTC products sold through e-commerce sites generally aim at individual consumers who want easy access to medicines, nutritional supplements, personal hygiene items, and other medical necessities for personal care and well-being. This includes pain relievers, cold and flu drugs, allergy cures, aids for digestion, vitamins, dietary supplements, skincare goods, and other OTC items. OTC product orders are filled quickly and shipped immediately to the consumer's door, increasing convenience.

The prescription medicine segment is expected to have significant growth at a CAGR of 19.7% over the forecast period. The growth of the prescription medicine segment can be attributed to E-commerce platforms allowing customers to obtain prescription medications conveniently from their homes or offices. Patients can consult with licensed healthcare providers online due to the integration of telehealth offerings with e-commerce platforms. Through these virtual consultations, healthcare providers can diagnose diseases, prescribe medications, and transmit electronic prescriptions directly to the e-commerce site for delivery. The rapidly aging world is increasing the requirement for prescription pharmaceuticals.

Channel Type Insights

Based on channel type, the B2B2C segment held a market share of 31.1% in 2022 and is expected to dominate the market by 2030. The growth of the business segment can be attributed to B2B2C connections with drug producers or wholesalers with final customers, including individual patients, pharmacies, and healthcare institutions. The growing consumer need for easy access to prescription and over-the-counter pharmaceuticals, health and wellness items, and healthcare information is driving the segment growth. Pharmaceutical firms collaborate with online merchants and e-pharmacies to directly access a larger client base. These alliances provide advantages such as pharmaceutical home delivery, telemedicine services, and individualized health advice. The COVID-19 pandemic has accelerated the shift to online healthcare product sales, making B2B2C a quickly expanding segment.

The B2C is expected to grow at a CAGR of 18.3% over the forecast period. The B2C segment of the global pharmaceutical e-commerce market primarily caters to individual consumers who purchase healthcare and pharmaceutical products directly from online retailers or e-pharmacy. The convenience, accessibility, and affordability offered by online platforms have contributed to the substantial growth of this segment. Consumers value the ability to compare prices, read reviews, and access a wide range of healthcare products from the comfort of their homes. Moreover, the increasing prevalence of chronic diseases and the aging population have resulted in higher demand for prescription medications and health-related products, further boosting the B2C segment growth.

Platform Insights

Based on platform, the third-party marketplace segment held a market share of 26.7% in 2022 and is expected to dominate the market by 2030. The growth of the business segment can be attributed to its wide selection of pharmaceutical products from various manufacturers and suppliers, including prescription and over-the-counter medicines, medical equipment, and healthcare-related items. This comprehensive selection meets the demands of both healthcare practitioners and consumers. In addition to pharmaceuticals, third-party markets offer a wide range of product categories, such as beauty and skin care, nutritional supplements, and personal care items. The healthcare sector is changing, with a greater emphasis on online health services and patient-centered treatment. Third-party marketplaces cater to these trends by providing convenient and technologically advanced healthcare services.

The manufacturer-owned marketplace is expected to grow at a CAGR of 19.4% over the forecast period. The manufacturer-owned marketplace segment of the global pharmaceutical e-commerce market primarily caters to serve as a direct sales channel, allowing pharmaceutical companies to sell directly to healthcare professionals (B2B) and, in some instances, to individual customers (B2C). In contrast with conventional distribution channels, which require intermediaries such as retailers and wholesalers, a manufacturer-owned marketplace allows the pharmaceutical producer to connect directly with healthcare practitioners, pharmacies, and potentially individual customers. Manufacturer-owned marketplaces' future in the pharmaceutical e-commerce sector is likely to be influenced by technological improvements, shifting customer demands, and a dedication to enhancing healthcare accessibility, cost, and ease.

Regional Insights

The Asia Pacific region dominated the market with a share of 35.9% in 2022. The growth of the Asia Pacific (APAC) global pharma e-commerce industry can be attributed to the innovations underway, large-scale production, vast customer base, and higher foreign investments in countries, such as China, India, Japan, Vietnam, and South Korea. China and India are poised to become the major producers of generic drugs and Active Pharmaceutical Ingredients (APIs) globally. Moreover, APAC countries, such as Thailand and Singapore, have become popular destinations for medical tourism due to the high-quality healthcare services, skilled medical professionals, and competitive pricing available in these countries.

North America is anticipated to rise as the fastest-developing regional market with a CAGR of 19.4% over the forecast period. The growth of the North American global pharmaceutical e-commerce market can be attributed to the increased adoption of digital technologies, shifting consumer behavior, and the evolving need for companies to streamline their distribution processes. Consumers are increasingly turning to e-pharmacy platforms to order prescription and Over the Counter (OTC) drugs from the comfort of their homes, eliminating the need for making visits to brick-and-mortar pharmacies. Furthermore, North America is witnessing a significant rise in the deployment of AI chatbots, self-serving customer support systems, and Machine Learning (ML) algorithms, to analyze data, explore consumer buying patterns, track inventory, and maintain a record of supply chain activities in real time.

Key Companies & Market Share Insights

The key players are investing resources in research & development (R&D) activities to support growth and enhance their internal business operations. The report will include company analysis based on their financial performances, product benchmarking, key business strategies, and recent strategic alliances. Companies can be seen engaging in mergers & acquisitions, and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development and enhancement of existing products to acquire new customers and capture more market shares. For instance, in May 2023, Sandoz, a business division of Novartis AG, announced a distribution and collaboration agreement with Adalvo, a global pharmaceutical company. Based on this agreement Sandoz offered exclusive rights to Adalvo for commercializing six products in the U.S. across key therapeutic areas, including oncology, antifungal/antibiotic, and pulmonary. Some prominent players in the global pharma E-commerce market include:

-

Amazon, Inc

-

Apotek

-

CVS Health

-

DocMorris

-

Express Scripts

-

Giant Eagle, Inc.

-

L Rowland & Co (Retail) Ltd

-

McKesson Corporation

-

Netmeds Marketplace Ltd.

-

Optum, Inc.

-

SHOP-APOTHEKE EUROPE N.V.

-

The Kroger Co.

-

Walmart

-

Walgreens Boots Alliance, Inc.

-

Zur Rose Group AG

Pharma E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 91.67 billion

Revenue forecast in 2030

USD 277.87 billion

Growth rate

CAGR of 17.2% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product type, therapeutic areas, type, channel type, platform, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia, Poland, Algeria, Turkey, China; India; Japan; Australia; South Korea; Indonesia, Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Amazon, Inc; Apotek; CVS Health; DocMorris; Express Scripts; Giant Eagle, Inc.; L Rowland & Co (Retail) Ltd; McKesson Corporation; Netmeds Marketplace Ltd.; Optum, Inc.; SHOPAPOTHEKE EUROPE N.V.; The Kroger Co.; Walmart; Walgreens Boots Alliance, Inc.; Zur Rose Group AG.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharma E-commerce Market Report Segmentation

This report forecasts revenue growth at the global level, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharma E-commerce market report based on product type, therapeutic areas, type, channel type, platform, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vaccines

-

Specialty Care

-

Topical Medicines

-

Others

-

-

Therapeutic Areas Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diabetes

-

Immune-system Diseases

-

Cardiovascular Diseases

-

Neurodegenerative Diseases

-

Cancer

-

HIV/AIDS

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription Medicine

-

Over-the-Counter (OTC)

-

-

Channel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

B2B2B

-

B2B2C

-

B2C

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturer-owned Digital Commerce

-

Distributor/Wholesaler-owned Digital Commerce

-

Manufacturer-owned Marketplace

-

Third Party Market Place

-

Retail

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Poland

-

Algeria

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pharma E-commerce market size was estimated at USD 81.63 billion in 2022 and is expected to reach USD 91.67 billion by 2023.

b. The global pharma E-commerce market is expected to grow at a compound annual growth rate of 17.2% from 2023 to 2030 to reach USD 277.87 billion by 2030.

b. Topical Medicines dominated the pharma E-commerce market with a share of 51.3% in 2022. This is attributable to the to the extensive selection of online pharmacies' topical medications that cater to a wide range of diseases and needs, including products for treating skin disorders, controlling discomfort, tackling dermatological problems, and dressing up.

b. Some key players operating in the pharma E-commerce market Amazon, Inc; Apotek; CVS Heath; DocMorris; Express Scripts; Giant Eagle, Inc.; L Rowland & Co (Retail) Ltd; McKesson Corporation; Netmeds Marketplace Ltd.; Optum, Inc.; SHOPAPOTHEKE EUROPE N.V.; The Kroger Co.; Walmart; Walgreens Boots Alliance, Inc.; Zur Rose Group AG.

b. Key factors driving the market growth include advanced technologies being adopted to promote authenticated mechanisms, such as two-factor authentication (also known as 2FA) and biometric identification (fingerprint or facial recognition), and strengthen the security of online pharmacy platforms, which ensures that only authorized users have access to them.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.