- Home

- »

- Medical Devices

- »

-

Pharmaceutical Transportation Services Market Report, 2030GVR Report cover

![Pharmaceutical Transportation Services Market Size, Share & Trends Report]()

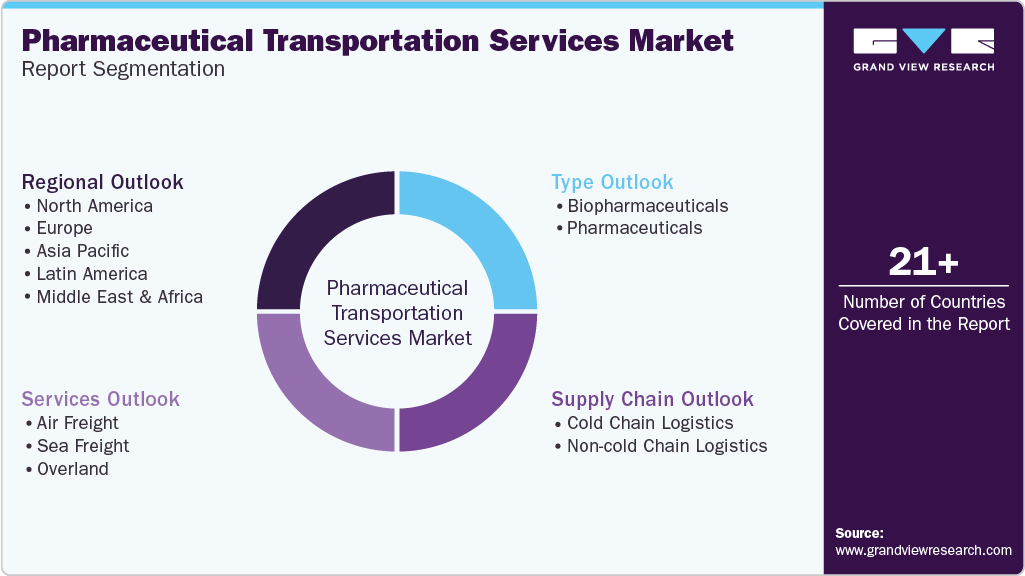

Pharmaceutical Transportation Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Biopharmaceuticals, Pharmaceuticals), By Service (Air Freight, Sea Freight, Overland), By Supply Chain, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-581-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

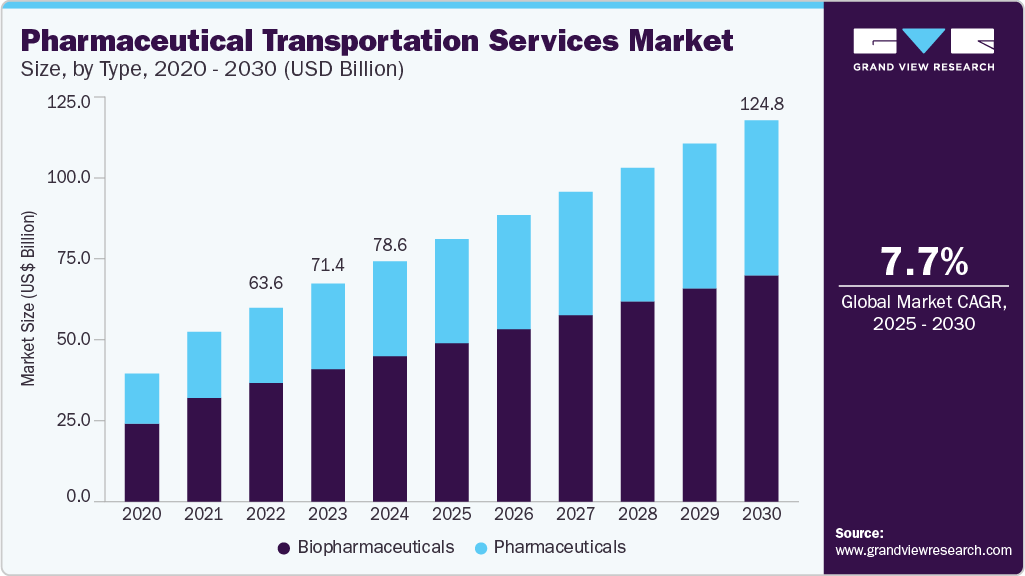

The global pharmaceutical transportation services market size was estimated at USD 78.61 billion in 2024 and is projected to grow at a CAGR of 7.71% from 2025 to 2030. The growth of the industry is mainly due to increasing demand for temperature-sensitive biologics, vaccines, and cell and gene therapies.

Key Highlights:

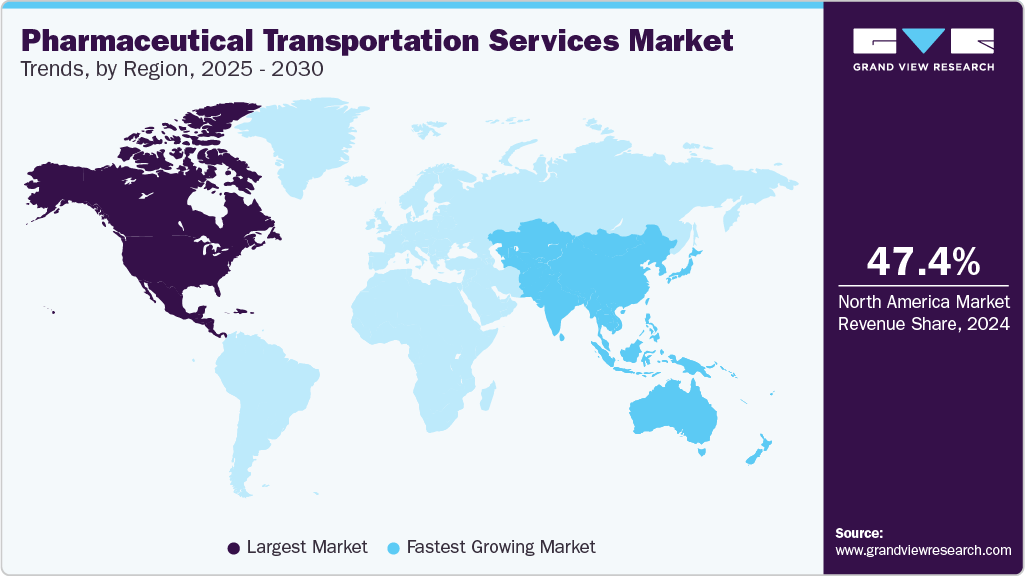

- North America pharmaceutical transportation services market accounted for the largest share of 47.40% in 2024.

- The pharmaceutical transportation services market in the U.S. is driven by the country’s highly developed regulatory landscape (FDA, GDP, GMP) that mandates strict cold chain compliance.

- By type segment, the biopharmaceuticals segment captured the largest market share in 2024, accounting for 60.61%.

- In terms of services type, the air freight segment dominated the market in 2024.

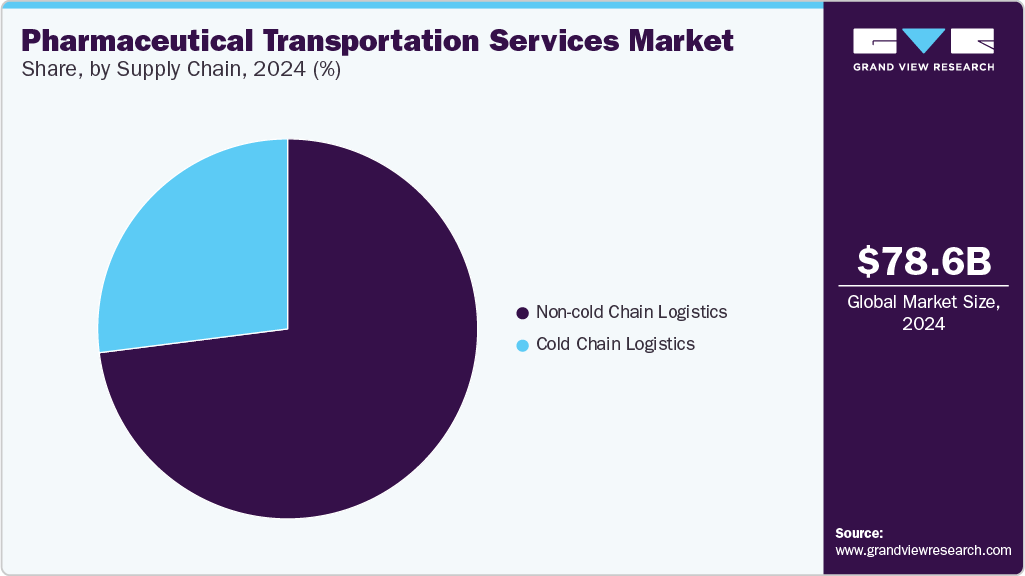

- By supply chain segment, the non-cold chain logistics segment dominated the market in 2024.

Stricter regulatory requirements for drug safety during transit are driving companies to adopt specialized logistics solutions. Expansion of global clinical trials and cross-border drug trade is also driving the need for reliable, compliant transportation networks.

The growth of pharmaceutical transportation services is primarily driven by rising demand for high-value, temperature-sensitive drugs. Biologics, cell and gene therapies, and novel vaccines have stringent handling requirements during transit. Drug developers are increasingly outsourcing logistics to specialized partners capable of maintaining precise environmental conditions. Globalization of pharmaceutical production led to more complex supply chains spanning multiple countries. Increasing frequency of cross-border shipments creates a pressing need for time-sensitive, compliant transport solutions. Healthcare providers and pharmacies expect real-time visibility into drug deliveries. Failure in temperature control can render entire shipments useless, pushing stakeholders to invest in more secure and intelligent transport systems. Governments and regulatory agencies have imposed stricter guidelines on pharmaceutical handling, increasing pressure on logistics providers to upgrade their capabilities.

Globalization of the pharmaceutical supply chain is also one of the factors fueling the growth of transportation services. The expansion of pharmaceutical production, particularly in emerging markets, has introduced greater complexity into supply chains, creating a pressing need for reliable and efficient transportation solutions. Cross-border trade in drugs is increasing due to the rising demand for affordable medications and quicker access to innovative therapies, which requires logistics networks capable of handling these diverse and time-sensitive shipments. Transportation providers must navigate complex regulatory environments, including customs regulations and drug-specific requirements, while ensuring compliance with import and export standards. This complexity increases the demand for specialized logistics services that can manage multiple regulatory challenges, ensure end-to-end visibility, and mitigate the risks associated with international trade. Consequently, the growth of cross-border pharmaceutical trade is driving the need for advanced and flexible transportation services that can meet these evolving demands.

Opportunity Analysis

The pharmaceutical transportation services industry is expanding due to the increasing integration of personalized medicine and gene therapies. These innovative treatments often require specialized handling, transportation, and storage, creating demand for logistics providers who can deliver high-quality services. The shift toward individualized patient care means more frequent, smaller shipments, creating an opportunity for transportation companies to cater to niche needs like home delivery of high-value treatments or emergency shipments for life-saving therapies.

The growing focus on environmental sustainability within the pharmaceutical supply chain is presenting new opportunities. Pharmaceutical transportation providers are increasingly expected to minimize their carbon footprints and adopt green logistics practices. This includes using energy-efficient vehicles, optimizing routes to reduce fuel consumption, and implementing eco-friendly packaging. Companies that prioritize sustainability will not only align with the broader trend toward environmental responsibility but also benefit from cost savings and improved customer loyalty.

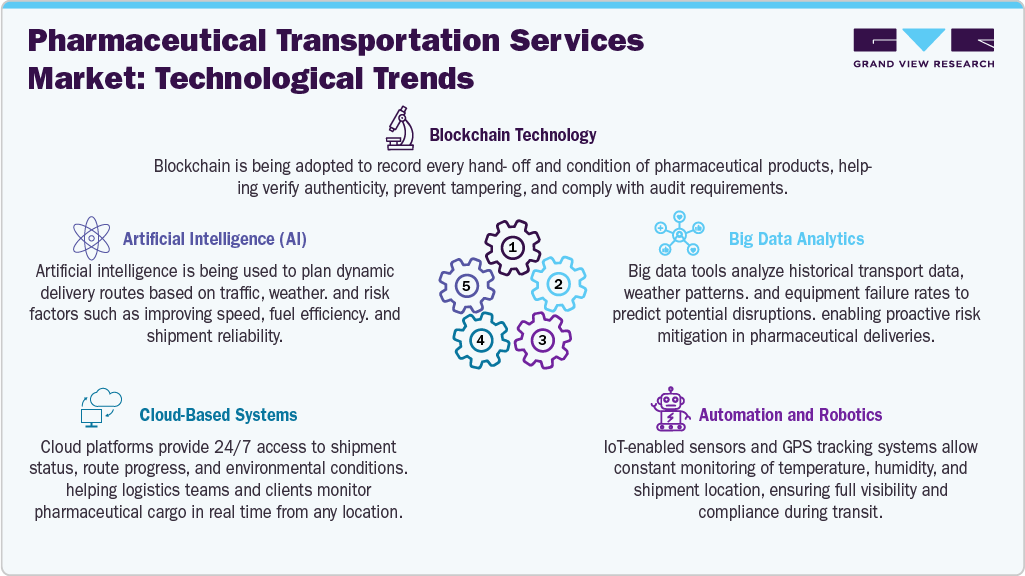

Technological Advancements

The technological landscape is rapidly advancing, shaped by the industry's growing need for precision, speed, transparency, and compliance. Logistics providers are moving beyond traditional models and adopting integrated digital ecosystems that enhance visibility and control across the supply chain. Cloud-based platforms are enabling centralized coordination and real-time tracking, while AI and data analytics are improving decision-making in route optimization, demand forecasting, and risk management. Automation and robotics are streamlining warehouse and packaging operations to maintain temperature integrity and reduce manual errors. Meanwhile, technologies like blockchain are strengthening traceability and security, addressing concerns related to counterfeiting and regulatory compliance. This evolving landscape reflects a shift toward connected, intelligent infrastructure capable of supporting complex pharmaceutical delivery needs across diverse geographies.

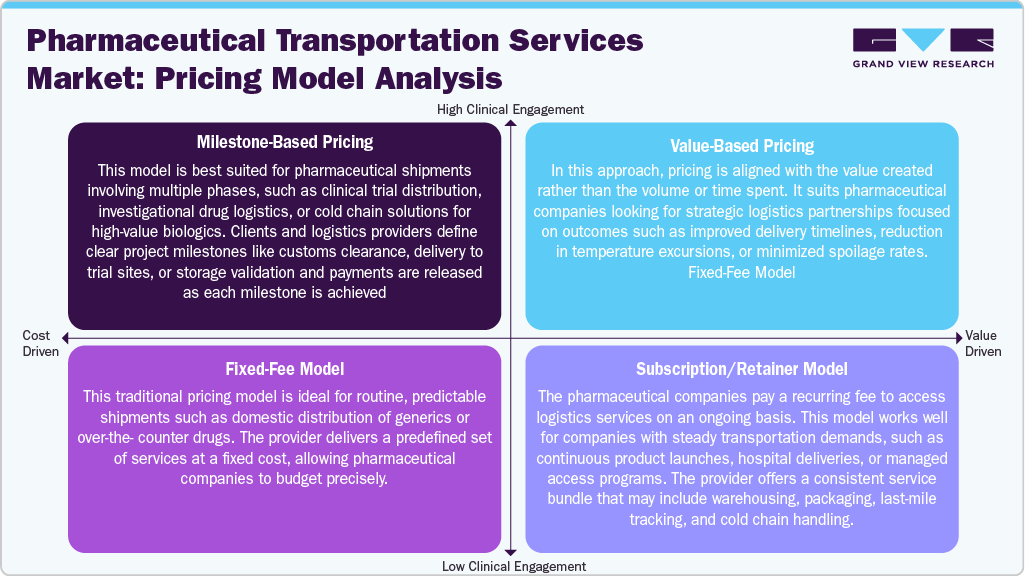

Pricing Analysis

The pricing landscape in the industry is evolving toward more flexible, client-aligned models driven by complexity, regulation, and specialization in logistics. Companies are moving away from purely cost-centric approaches to structures that emphasize service value, outcome assurance, and adaptability across diverse shipment needs. Demand for high-touch services like cold chain compliance, real-time visibility, and risk-managed global deliveries is encouraging the adoption of pricing formats that reward precision and reliability. This shift reflects a broader transformation in logistics partnerships, where pricing is not just a financial agreement, but a strategic framework aligned with delivery performance, patient safety, and regulatory expectations.

Type Insights

The biopharmaceuticals segment captured the largest market share in 2024, accounting for 60.61%. The growth of the segment is due to the growing demand for temperature-sensitive therapies such as monoclonal antibodies, cell and gene therapies, and recombinant proteins that require strict cold chain logistics. Expanding R&D pipelines, especially in personalized medicine and biologics, have increased the volume and complexity of these shipments. Regulatory requirements for temperature integrity and quality assurance during transit further drive the need for specialized transportation solutions.

The pharmaceuticals segment is projected to experience the fastest growth due to the ongoing shift towards personalized medicine, increasing regulatory approvals, and a broader expansion of healthcare access globally. These factors are expected to create more demand for efficient transportation of both active pharmaceutical ingredients (APIs) and finished dosage forms, particularly in emerging markets.

Services Insights

The air freight segment dominated the market in 2024. The growth of the segment can be attributed to its speed, global reach, and ability to handle temperature-sensitive products. Air transportation ensures rapid delivery, which is crucial for biopharmaceuticals and other time-sensitive medicines, reducing the risk of product degradation. In addition, the extensive global connectivity of air freight enables efficient international distribution, while specialized cold chain solutions ensure compliance with temperature control requirements.

The sea freight segment is projected to witness lucrative growth during the forecast period. The growth of the segment is mainly attributed to its cost-effectiveness and capacity to handle large volumes of pharmaceutical products. Sea freight is often more affordable than air freight, making it an attractive option for shipping bulk pharmaceutical goods, especially those with longer shelf lives and less time sensitivity. The increasing demand for global distribution, particularly to emerging markets, further boosts the appeal of sea freight.

Supply Chain Insights

The non-cold chain logistics segment dominated the market in 2024 due to its broader applicability, lower cost, and simplicity compared to cold chain logistics. Many pharmaceutical products, such as traditional small-molecule drugs, do not require temperature-sensitive transport, making them suitable for non-cold chain logistics. This segment benefits from the growing volume of generic drugs and established pharmaceutical products, which often have longer shelf lives and are less sensitive to environmental conditions.

The cold chain logistics segment is projected to witness the fastest CAGR from 2025 to 2030. The growth is driven due to the increasing demand for temperature-sensitive pharmaceutical products, particularly biopharmaceuticals, vaccines, and gene therapies. These products require precise temperature control throughout the supply chain to maintain their efficacy, driving the need for specialized logistics solutions. As the global biopharmaceutical market continues to grow, the demand for cold chain services is expected to rise, especially in emerging markets where healthcare access is expanding.

Regional Insights

North America pharmaceutical transportation services market accounted for the largest share of 47.40% in 2024 due to its advanced healthcare infrastructure and established cold chain networks that support the complex demands of pharmaceutical logistics. The region benefits from a high concentration of precision medicine developers, driving increased demand for specialized transportation.

U.S. Pharmaceutical Transportation Services Market Trends

The pharmaceutical transportation services market in the U.S. is driven by the country’s highly developed regulatory landscape (FDA, GDP, GMP) that mandates strict cold chain compliance. In addition, rising pharmaceutical exports and increased outsourcing of logistics operations to specialized providers are further accelerating the market growth.

Europe Pharmaceutical Transportation Services Market Trends

The pharmaceutical transportation services market in Europeis experiencing growth. The region has seen rising investments in GDP-compliant cold storage facilities and last-mile delivery solutions that support sensitive and high-value therapies. The European Medicines Agency (EMA) enforces strict compliance guidelines, encouraging logistics providers to adopt real-time temperature monitoring systems and proactive risk mitigation strategies.

The UK pharmaceutical transportation services market held a significant share in 2024. The country’s market growth is supported by a strong pharmaceutical supply chain and high demand for cold chain logistics due to an active biotech and vaccine sector. The impact of Brexit has added complexity to cross-border movement, making cold chain efficiency and traceability even more critical.

The pharmaceutical transportation services market in France is driven by the growing biologics and vaccine production sector, with government-backed pharmaceutical manufacturing and R&D initiatives increasing the need for specialized logistics infrastructure.

Germany pharmaceutical transportation services market is anticipated to grow due to a strong biopharma base and expanding clinical trials. The country’s well-developed cold chain infrastructure, combined with EU regulatory standards, is encouraging sustained investment in precision logistics.

Asia Pacific Pharmaceutical Transportation Services Market Trends

The pharmaceutical transportation services market Asia Pacificis projected to grow at the fastest CAGR over the forecast period. Market growth is supported by the rise in pharmaceutical manufacturing, vaccine exports, and increasing demand for biologics and CGT. The region is witnessing large-scale investment in temperature-controlled warehouses, IoT-based tracking systems, and express cold chain transportation tailored for personalized therapies.

China pharmaceutical transportation services market is expected to grow over the forecast period. The country’s growth is due to the rapid development of cold storage and refrigerated transport infrastructure to meet the rising demand for high-precision treatments. Government regulations are also tightening around pharmaceutical cold chain compliance, further boosting investment in GDP-certified logistics.

The pharmaceutical transportation services market in Japan is witnessing significant growth over the forecast period. The country’s growth is due to advanced regulatory compliance, demand for regenerative medicine, and a highly developed cold chain. The country features robotic cold storage, AI-driven logistics systems, and RFID-based tracking, making it one of the most advanced markets for precision medicine logistics.

India pharmaceutical transportation services market is witnessing considerable growth due to the increasing government support. The government’s "Make in India" initiative is accelerating the development of domestic cold chain infrastructure.

Latin America Pharmaceutical Transportation Services Market Trends

The pharmaceutical transportation services market in Latin Americais projected to grow over the forecast period. The growth in the region is due to increasing pharmaceutical imports and expanding healthcare access. Countries like Brazil are leading investments in cold storage and refrigerated transportation. Challenges such as infrastructure gaps, regulatory variations, and high logistics costs are pushing providers to adopt cost-effective, region-specific cold chain strategies.

Brazil pharmaceutical transportation services market is expected to grow over the forecast period. The country has a rapidly expanding biologics and vaccine distribution network, necessitating better cold chain storage and compliance-driven logistics solutions. Regulatory reforms and increased pharmaceutical trade agreements are enhancing international logistics operations.

Key Pharmaceutical Transportation Services Companies Insights

Key players operating in the pharmaceutical transportation services market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Pharmaceutical Transportation Services Companies:

The following are the leading companies in the pharmaceutical transportation services market. These companies collectively hold the largest market share and dictate industry trends.

- CEVA Logistics

- Cencora Corporation (ICS)

- DB SCHENKER

- Kuehne+Nagel

- Kerry Logistics Network Limited

- Cardinal Health

- McKesson Corporation

- EVERSANA

- Thermo Fisher Scientific

- Knipper Health

- FedEx

- DHL

Recent Developments

-

In March 2025, DHL announced the acquisition of Cryopdp to enhance its services in the life sciences and healthcare sector. Cryopdp specializes in shipping, storage, and packaging for pharmaceutical and biotech companies. This move aims to strengthen DHL's supply chain services.

-

In June 2024, DHL announced the expansion of its specialized logistics services for the life sciences and healthcare sector in France through a long-term strategic partnership with Sanofi. The collaboration includes warehousing, inventory management, picking and packing, and order fulfillment across three key sites in France.

Pharmaceutical Transportation Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 86.08 billion

Revenue forecast in 2030

USD 124.81 billion

Growth rate

CAGR of 7.71% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, supply chain, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Japan; China; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

CEVA Logistics; Cencora Corporation (ICS); DB SCHENKER; Kuehne+Nagel; Kerry Logistics Network Limited; Cardinal Health; McKesson Corporation; EVERSANA; Thermo Fisher Scientific; FedEx; DHL; Knipper Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Transportation Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical transportation services market report based on type, services, supply chain, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceuticals

-

Vaccines

-

Biosimilars

-

Plasma Derived Products

-

Others

-

-

Pharmaceuticals

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air Freight

-

Sea Freight

-

Overland

-

-

Supply Chain Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cold Chain Logistics

-

Non-cold Chain Logistics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical transportation services market size was estimated at USD 78.61 billion in 2024 and is expected to reach USD 86.08 billion in 2025.

b. The global pharmaceutical transportation services market is expected to grow at a compound annual growth rate of 7.71% from 2025 to 2030 to reach USD 124.81 billion by 2030.

b. North America dominated the pharmaceutical transportation services market with a share of 47.42% in 2019. This is attributable to the presence of several key players in the region coupled with growing research and development activities.

b. Some key players operating in the pharmaceutical transportation services market include CEVA Logistics, Cencora Corporation (ICS), DB SCHENKER, Kuehne+Nagel, Kerry Logistics Network Limited, Cardinal Health, McKesson Corporation, EVERSANA, Thermo Fisher Scientific, FedEx, DHL

b. Key factors that are driving the market growth include increasing demand for temperature-sensitive biologics, vaccines, and cell and gene therapies. Stricter regulatory requirements for drug safety during transit are driving companies to adopt specialized logistics solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.