- Home

- »

- Clinical Diagnostics

- »

-

Prostate Cancer Biomarkers Market, Industry Report, 2033GVR Report cover

![Prostate Cancer Biomarkers Market Size, Share & Trends Report]()

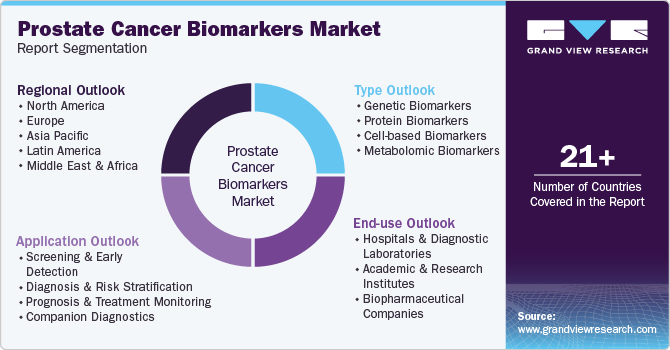

Prostate Cancer Biomarkers Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Genetic Biomarkers, Cell-based Biomarkers, Metabolomic Biomarkers), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-547-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Prostate Cancer Biomarkers Market Trends

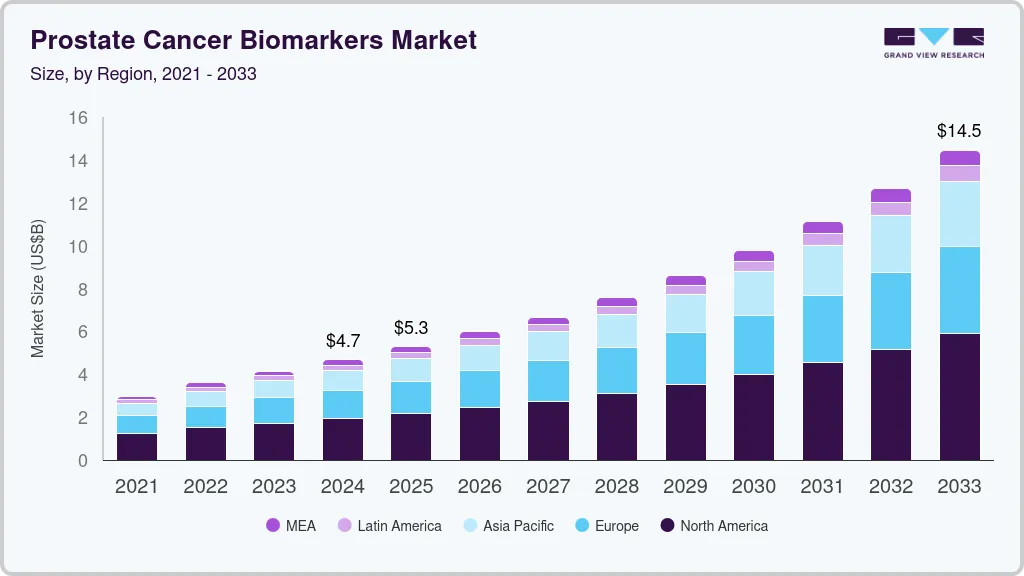

The global prostate cancer biomarkers market size was estimated at USD 4.68 billion in 2024 and is projected to reach USD 14.45 billion by 2033, growing at a CAGR of 13.4% from 2025 to 2033. Some of the major factors expected to drive the market are the rising incidence of prostate cancer and increasing awareness among physicians & patients regarding early detection. Furthermore, advancements in biomarker technologies and growing research efforts for prostate cancer diagnosis & treatment are further propelling the overall market.

The demand for prostate cancer biomarkers is rising due to the need for accurate and early-stage disease detection and the growing adoption of precision medicine. Factors such as the increasing application of biomarkers in targeted therapies and the development of minimally invasive diagnostic techniques further drive market expansion. Regulatory authorities emphasize the importance of biomarker-based diagnostic tools for improving clinical outcomes, leading to greater biomarker validation and standardization investment.

Advancements in genomic, proteomic, and metabolomic technologies are enhancing the efficiency and accuracy of prostate cancer biomarker detection. Genomic biomarkers, including PCA3 and TMPRSS2-ERG, improve early diagnosis, while proteomic markers such as PSA and Prostate Health Index (PHI) refine risk stratification. Metabolomic approaches are gaining attention for their potential to distinguish aggressive from indolent prostate cancer. With growing awareness of biomarker-driven diagnostic and prognostic applications, the demand for highly specific and validated prostate cancer biomarkers is expected to continue expanding.

The increasing focus on biomarker-driven diagnostics is transforming prostate cancer detection and management. Advanced biomarker assays contribute to improved risk stratification and support personalized treatment approaches. In January 2025, OncoAssure Ltd announced the clinical validation of its biopsy-based test, OncoAssure Prostate, designed to enhance risk assessment for prostate cancer recurrence. The study, published in BJUI Compass, demonstrated the test’s ability to distinguish between aggressive and low-risk prostate cancers, supporting more precise treatment decisions. These advancements underscore the growing role of biomarker-based diagnostics in improving clinical outcomes and guiding more effective prostate cancer management strategies.

Table below presents Prostate Cancer Biomarkers Clinical Trials

Biomarker

Clinical trial phase

Type of cancer

Patients included

Clinical trial ID

TMPRSS2-ERG

Phase II

mCRPC and recurrent PCa

148

NCT01576172

Phase II

Recurrent PCa, stage IV PCa

29

NCT00330161

Phase II

Prostatic adenocarcinoma

148

NCT01682772

Phase I

Advanced or metastatic PCa

113

NCT00749502

Phase I

High risk PCa

65

NCT02588404

Phase I

Localized or locally advanced PCa, biochemical recurrent PCa

84

NCT03421015

Phase II

High risk PCa

208

NCT02573636

TP53

Phase III

mCRPC

750

NCT03903835

Phase I/II

Prostatic neoplasia

36

NCT00900614

Phase III

Localized PCa

7,776

NCT00001469

Phase I

Localized or locally advanced PCa, biochemical recurrent PCa

84

NCT03421015

AR

Phase I

Hormone refractory PCa

140

NCT00510718

Phase II

PCa

45

NCT01990196

Phase II

Recurrent PCa

42

NCT03311555

Phase I

mCRPC

58

NCT01516866

Phase II

Metastatic PCa, CRPC

60

NCT04090528

Phase I

PCa

40

NCT02411786

Phase II

mCRPC

8

NCT02379390

Phase II

Biochemical recurrent PCa

90

NCT01790126

Phase II

Advanced hormone dependent PCa

90

NCT01861236

BRCA2

Phase II

High risk PCa

100

NCT02154672

Phase III

mCRPC

408

NCT03075735

Phase III

Genetic predisposition to PCa

1,700

NCT00261456

Phase II

mCRPC

40

NCT04038502

Phase II

mCRPC

70

NCT03012321

Phase III

mCRPC

387

NCT02987543

PTEN/P13K/AKT/mTOR

Phase II

High risk PCa

208

NCT02573636

Phase III

CRPC

120

NCT03580239

Phase II

PCa previously treated

108

NCT01251861

Phase I

PCa previously treated with enzalutamide

36

NCT03310541

Phase I

Stage III and IV PCa

62

NCT01480154

Phase II

mCRPC

9

NCT02091531

MGMT

NA

NA

NA

NA

DNMT1

Phase I

mCRPC

19

NCT05037500

NA

Prostatic adenocarcinoma

19

NCT01118741

Phase III

Prostatic adenocarcinoma

80

NCT03535675

Phase I

Adenocarcinoma of the Prostate, Recurrent PCa, Stage I, IIA, IIB, III and IV PCa

32

NCT01912820

Phase I/II

Prostate Carcinoma

NA

NCT03709550

JMJD3

NA

NA

NA

NA

KDM4B

NA

NA

NA

NA

CDK9

Phase I

Castrate Resistant Prostate Cancer

100

NCT05159518

SF3B2

NA

NA

NA

NA

AR-V7

Phase III

Castrate Resistant Prostate Cancer

953

NCT02438007

AR-V3

NA

NA

NA

NA

HDAC6

NA

NA

NA

NA

PRUNE2

NA

NA

NA

NA

Circulating tumor cells

NA

Prostate Cancer Obesity

67

NCT02453139

Phase II

Patients with PSA 4–10 ng/mL

500

NCT03488706

Phase II

Localized PCa

200

NCT01961713

Phase II

mCRPC

11

NCT00887640

Phase II

Advanced PCa

24

NCT02552394

Phase II

mCRPC

140

NCT03050866

Phase I

PCa

60

NCT02450435

cell-free DNA

Phase III

Metastatic PCa

1038

NCT00134056

Phase I

PCa

12

NCT04081428

Phase II

Metastatic PCa

300

NCT02853097

Phase II

PCa

68

NCT02941029

Phase II

PCa

30

NCT03284684

Extracellular vesicles

NA

PCa

108

NCT04298398

miRNAs

Phase II

mCRPC

40

NCT02471469

Phase II

mCRPC

46

NCT04188275

Phase III

High risk PCa

300

NCT01220427

Phase I

PCa

240

NCT03911999

Phase I

PCa

60

NCT02366494

lncRNAS

NA

Prostatic neoplasia

507

NCT01024959

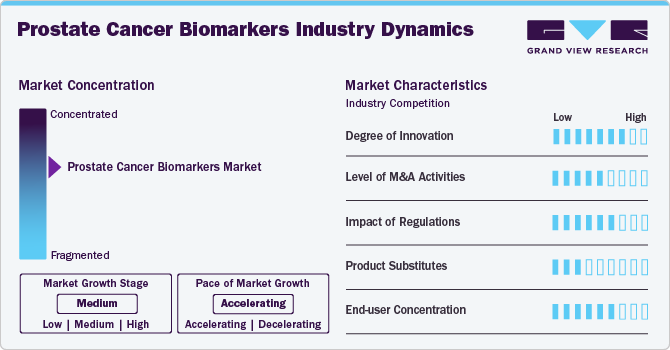

Market Concentration & Characteristics

The degree of innovation in prostate cancer biomarkers is advancing rapidly, driving improvements in early detection, risk assessment, and personalized treatment strategies. Emerging biomarkers such as PCA3, TMPRSS2-ERG fusion, and the Prostate Health Index (PHI) enhance diagnostic accuracy beyond traditional PSA testing. Innovations in liquid biopsy technologies, such as circulating tumor cells (CTCs) and extracellular vesicles, provide non-invasive options for real-time monitoring of disease progression. In addition, artificial intelligence (AI)-driven biomarker analysis is refining predictive models, enabling more precise identification of aggressive versus indolent prostate cancer. These advancements are transforming clinical decision-making, optimizing therapeutic approaches, and improving patient outcomes while reducing unnecessary interventions.

The level of mergers and acquisitions (M&A) in the prostate cancer biomarkers industry is moderate but steadily rising as companies seek to expand their diagnostic capabilities and strengthen their biomarker portfolios. Several diagnostic and biotech firms engage in strategic acquisitions to access novel biomarker technologies, proprietary assays, and advanced molecular platforms. Collaborations between diagnostic and precision medicine firms are also shaping the competitive landscape, reflecting a growing interest in integrated biomarker solutions for prostate cancer. While large-scale acquisitions remain limited, targeted M&A efforts increasingly focus on enhancing expertise in genomics, liquid biopsy, and AI-based analytics for prostate cancer diagnostics.

Regulatory frameworks significantly influence the development, approval, and commercialization of prostate cancer biomarkers. Authorities such as the FDA (U.S.), EMA (Europe), and PMDA (Japan) enforce rigorous standards to ensure biomarker accuracy, analytical reliability, and clinical relevance. The FDA’s Biomarker Qualification Program offers a structured path for biomarker acceptance but requires robust evidence, which can extend the time to market. Similarly, the EU’s In Vitro Diagnostic Regulation (IVDR) has reclassified many diagnostic tests, increasing the burden of documentation and compliance for prostate cancer biomarker developers. In parallel, regulations such as HIPAA in the U.S. and GDPR in Europe govern patient data used in biomarker research, impacting study design and data accessibility. These evolving requirements shape innovation timelines and influence the strategic direction of diagnostic development.

The market faces competition from several conventional and emerging diagnostic approaches. Traditional methods such as digital rectal examination (DRE), prostate-specific antigen (PSA) testing, and multiparametric MRI (mpMRI) continue to serve as primary tools in prostate cancer screening and diagnosis. These techniques, while accessible and cost-effective, often lack the precision of newer biomarker-based tests. In addition, tissue biopsies and genomic profiling—when used without biomarker integration—can offer diagnostic insights but may not fully support risk stratification or treatment personalization. In cost-sensitive healthcare systems, the reliance on these established tools may limit the adoption of newer biomarker technologies, particularly where reimbursement frameworks are not well aligned with advanced diagnostics.

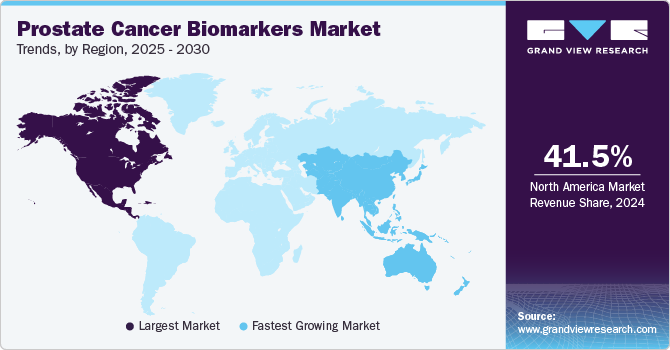

The market is expanding geographically due to rising investments in cancer diagnostics, increasing awareness of early detection, and ongoing research efforts. In North America, the use of biomarker-based tests is supported by established screening programs, access to advanced technologies, and regulatory initiatives. Europe is witnessing steady growth through government-backed cancer research and public health strategies. In Asia-Pacific, awareness and adoption of these tests are growing as healthcare systems improve and research activities increase in countries such as China, Japan, and India. Latin America and the Middle East are gradually adopting biomarker diagnostics with support from improvements in healthcare infrastructure and focused efforts to enhance cancer detection, contributing to broader market growth across regions.

Type Insights

Protein biomarkers dominated the market, accounting for a share of 57.7% in 2024. Protein biomarkers are essential in prostate cancer diagnostics, enabling early detection and monitoring of disease progression by identifying abnormal protein expression patterns. The rising demand for personalized medicine and targeted therapies drives the adoption of protein-based diagnostic tools. Technological advancements such as mass spectrometry and immunoassays have improved the accuracy and efficiency of protein analysis in biological fluids like blood and urine. These developments support broader clinical adoption and research applications, strengthening the segment’s contribution to the market.

Metabolomic biomarkers are expected to grow fastest, with a CAGR of 14.1% over the forecast period. The rising interest in understanding metabolic changes associated with prostate cancer is driving the growth of this segment. Metabolomic biomarkers provide insights into disease mechanisms by analyzing small molecule profiles in biofluids such as urine, serum, and plasma. These markers support early detection and offer the potential for distinguishing aggressive from indolent cancer forms. Advances in analytical techniques like NMR spectroscopy and mass spectrometry have improved the detection and quantification of metabolic changes. Growing investments in precision oncology and increasing use of metabolomics in research and clinical trials are further accelerating the segment’s expansion.

Applications Insights

Screening and early detection dominated the market, accounting for a share of 45.1% in 2024. This segment's growth is driven by the rising need for timely identification of prostate cancer to improve treatment outcomes and reduce disease burden. Biomarkers play a vital role in detecting cancer at an early stage, often before symptoms appear, allowing for more effective and less invasive interventions. Integrating biomarker-based tests in routine health check-ups and screening programs is increasing across hospitals and diagnostic centers. Advances in non-invasive testing methods, such as liquid biopsies and multiplex assays, also improve detection accuracy and patient compliance. These developments support the growing adoption of biomarkers in prostate cancer screening and early diagnosis.

Companion diagnostics is expected to grow fastest at a CAGR of 14.5% over the forecast period. This segment is gaining traction due to the increasing need for personalized treatment strategies in prostate cancer management. Companion diagnostics help identify patients most likely to benefit from targeted therapies based on specific biomarker profiles. These tools improve treatment accuracy and reduce the risk of adverse effects by guiding therapeutic decisions. Advances in molecular testing and regulatory support for precision medicine drive the development and approval of companion diagnostic tests. With more targeted therapies entering the market, the demand for reliable biomarker-based companion diagnostics is expected to grow steadily, supporting this segment’s expansion.

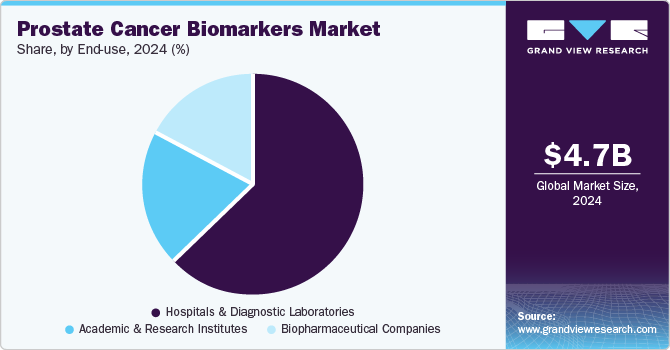

End Use Insights

Hospitals and diagnostic laboratories dominated the market, accounting for a share of 63.2% in 2024. These facilities are central to adopting and applying prostate cancer biomarkers, as they handle large volumes of diagnostic testing and patient monitoring. Their role in early detection, treatment planning, and ongoing disease surveillance supports the growing use of biomarker-based diagnostics. With advancements in clinical workflows and access to improved testing platforms, hospitals, and labs can process biomarker tests faster and more accurately. The emphasis on personalized care and integration of molecular diagnostics into routine practice continues to strengthen the position of this segment in the market.

Academic and research institutes are expected to grow at the fastest CAGR of 14.4% over the forecast period. These institutions are actively involved in discovering and validating prostate cancer biomarkers, contributing significantly to translational research and clinical innovation. With strong academic networks and access to research funding, they are advancing biomarker studies through collaborative projects and clinical trials. The increasing focus on personalized medicine and precision diagnostics encourages the adoption of novel biomarkers in academic research. Moreover, partnerships with healthcare providers and biotech firms help translate research findings into practical diagnostic tools, supporting the segment's steady growth.

Regional Insights

North America accounted for the largest share of 41.47% in 2024 and is anticipated to register steady growth over the forecast period. The increasing recognition of biomarkers in guiding prostate cancer diagnostics and therapy decisions contributes to market expansion. In addition, strong support from local regulatory agencies is helping facilitate the development and validation of biomarker-based tests. These agencies are actively involved in promoting awareness of precision medicine and its role in improving prostate cancer outcomes, which is encouraging broader adoption across healthcare systems in the region.

U.S. Prostate Cancer Biomarkers Market Trends

The U.S. accounted for a substantial share of the North American prostate cancer biomarkers market in 2024, driven by advanced healthcare infrastructure, significant research funding, and the increasing adoption of biomarker-based diagnostics. The market is bolstered by high awareness and institutional support for early detection and precision medicine in prostate cancer care. Research organizations and academic institutions actively engage in studies to validate novel biomarkers, enhancing clinical confidence in these diagnostic tools.

For instance, in February 2022, Datar Cancer Genetics Inc. received the U.S. Food and Drug Administration's Breakthrough Device Designation for its 'TriNetra-Prostate blood test, designed to detect early-stage prostate cancer. This test demonstrated high accuracy (>99%) without false positives and requires only a 5 mL blood sample. It is indicated for males aged 55-69 years with serum PSA of 3 ng/mL or higher. The test identifies prostate adenocarcinoma-specific Circulating Tumor Cells (CTCs) in the blood, potentially reducing the need for invasive biopsies among individuals with benign prostate conditions and improving detection rates among those with prostate cancer.

Europe Prostate Cancer Biomarkers Market Trends

The Europe prostate cancer biomarkers market is growing steadily with rising awareness about early cancer detection and personalized treatment. Governments across countries such as Germany, France, and the UK are supporting research and encouraging the use of advanced diagnostic tools. The European Medicines Agency (EMA) is helping by providing clear guidelines supporting biomarkers' use in drug development. Research partnerships across universities, hospitals, and companies are also helping discover new and more accurate biomarkers. With better access to non-invasive tests like liquid biopsies and wider insurance coverage, the use of prostate cancer biomarkers is gradually increasing across the region.

The prostate cancer biomarkers market in France is growing with support from national research programs and strong public-private partnerships. The government has invested in projects focused on improving cancer diagnostics, helping research centers like Inserm work closely with biotech companies. There is also a push to use digital tools and artificial intelligence in labs to make biomarker testing faster and more accurate. France’s well-developed clinical trial network and partnerships with international pharmaceutical companies are also helping expand access to advanced biomarker-based tests. This progress supports early detection and more personalized treatment approaches across the country.

The prostate cancer biomarkers market in Germany is showing steady growth due to strong research capabilities, well-established healthcare systems, and rising interest in early cancer detection. Government-backed programs and partnerships between universities, hospitals, and diagnostic companies support developing and using biomarker-based tests. The German Cancer Research Center (DKFZ) plays a key role in promoting biomarker research through national initiatives focused on precision oncology. There is growing use of genetic and protein-based biomarkers in hospitals to improve diagnosis and treatment planning for prostate cancer. Ongoing clinical studies and access to advanced lab technologies are also helping expand the market. These factors contribute to the wider adoption of prostate cancer biomarkers nationwide.

Asia Pacific Prostate Cancer Biomarkers Market Trends

The Asia Pacific prostate cancer biomarkers market is expected to register the fastest CAGR of 14.1% during the forecast period, supported by a growing aging population, rising cancer awareness, and greater emphasis on early diagnosis. Countries such as Japan, China, and South Korea are making notable progress in biomarker research through public health initiatives and institutional collaborations. Japan focuses on improving non-invasive diagnostics, while China is strengthening its biomarker testing capabilities through increased R&D investments.

India is also witnessing a gradual shift toward personalized medicine, with hospitals and diagnostic centers adopting biomarker-based approaches for improved disease detection. With healthcare infrastructure improving and clinical research activities expanding across the region, biomarker integration in prostate cancer diagnostics is expected to gain more traction.

The Japan prostate cancer biomarkers market is expanding with growing awareness of early detection and personalized cancer care. The country’s aging population and focus on precision medicine have encouraged research on genetic and protein-based biomarkers. National institutions such as RIKEN and the National Cancer Center are supporting studies aimed at improving prostate cancer diagnosis through non-invasive biomarker tests. The Pharmaceuticals and Medical Devices Agency (PMDA) is streamlining the approval of innovative diagnostics, which is helping more hospitals and labs adopt these technologies. This supportive environment contributes to steadily adopting prostate cancer biomarkers across Japan.

Latin America Prostate Cancer Biomarkers Market Trends

Latin America prostate cancer biomarkers market is growing with better access to diagnostic services and increasing efforts in cancer awareness. Countries such as Brazil, Mexico, and Argentina focus on early detection strategies through biomarker-based testing. In Brazil, research centers like Fiocruz support the development of diagnostic tools to improve prostate cancer outcomes. Mexico is encouraging academic and private sector partnerships to enhance biomarker research, while Argentina’s CONICET is contributing to studies on genetic and protein markers for cancer detection. These regional efforts and gradual improvements in healthcare infrastructure are helping expand the prostate cancer biomarkers market across Latin America.

The prostate cancer biomarkers market in Brazil is progressing with support from national research institutions, growing awareness, and efforts to improve early cancer detection. Organizations such as Fiocruz and the University of São Paulo are involved in biomarker research focused on improving diagnostic accuracy and treatment planning for prostate cancer. Government funding bodies like FAPESP and CAPES are encouraging research in precision medicine, contributing to local innovation. Collaborations between public hospitals and biotech firms are also helping expand access to biomarker-based diagnostics. These combined efforts are driving the adoption of prostate cancer biomarkers across Brazil’s healthcare sector.

Middle East & Africa Prostate Cancer Biomarkers Market Trends

The prostate cancer biomarkers market in the Middle East & Africa is gradually expanding with increasing efforts to improve early cancer detection, modernize healthcare systems, and promote research in precision oncology. Countries like Saudi Arabia and the UAE support prostate cancer diagnostics through national health strategies and collaborations with global institutions. Saudi Arabia’s Vision 2030 encourages investment in biomarker-based innovations, including those focused on prostate cancer. In Africa, institutions like the University of Cape Town are exploring biomarker applications to enhance prostate cancer diagnosis and treatment planning. While these developments create opportunities, challenges such as limited access to specialized testing and uneven research funding continue to affect wider market adoption.

The prostate cancer biomarkers market in Saudi Arabia is expanding with a growing emphasis on early cancer detection, precision medicine, and healthcare modernization. National health programs under Vision 2030 prioritize research and innovation in oncology, creating a favorable environment for biomarker-based diagnostics. Government-backed institutions such as King Faisal Specialist Hospital and Research Centre are involved in developing and validating prostate cancer biomarkers for clinical use. Additionally, partnerships with international research organizations are helping advance diagnostic capabilities. These efforts, along with improved access to laboratory infrastructure and a strong focus on personalized care, are contributing to the growth of the prostate cancer biomarkers market in the country.

Key Prostate Cancer Biomarkers Company Insights

Major market players engage in various strategies, such as distribution agreements, mergers and acquisitions, and expansions. Most crucially, they exhibit a high degree of innovation in product research and development to improve their market penetration.

Key Prostate Cancer Biomarkers Companies:

The following are the leading companies in the prostate cancer biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Exact Sciences Corporation

- Myriad Genetics, Inc.

- Bio-Techne

- ExoDx

- OPKO Health,Inc.

- mdxhealth

- Veracyte, Inc.

- Beckman Coulter, Inc.

- Nucleix

- DiaCarta

Recent Developments

-

In February 2025, Myriad Genetics partnered with PATHOMIQ to exclusively license PATHOMIQ_PRAD, an AI-driven technology platform for prostate cancer, in the U.S. This partnership integrates AI-enabled diagnostics into Myriad's oncology portfolio, supporting more informed treatment decisions before and after prostate cancer therapy. By leveraging advanced artificial intelligence, the collaboration aims to strengthen diagnostic precision in prostate cancer care, aligning with evolving needs in the Prostate Cancer Biomarker market.

-

In February 2024, DiaCarta entered a strategic collaboration with OncoAssure Ltd to commercialize a prostate cancer prognostic test. This 6-gene expression assay evaluates the risk of aggressive disease following diagnosis and estimates the probability of biochemical recurrence within five years post-surgery. The partnership utilizes DiaCarta's clinical diagnostic capabilities to support validation and market expansion of the test, contributing to more tailored prostate cancer management through biomarker-based risk stratification.

Prostate Cancer Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.3 billion

Revenue forecast in 2033

USD 14.45 billion

Growth rate

CAGR of 13.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; Thailand; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Exact Sciences Corporation; Myriad Genetics, Inc.; Bio-Techne; ExoDx; OPKO Health, Inc.; mdxhealth; Veracyte, Inc.; Beckman Coulter, Inc.; Nucleix; DiaCarta; Genomic Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prostate Cancer Biomarker Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the market trends in each of the sub-markets from 2021 to 2033. For this study, Grand View Research has segmented the global prostate cancer biomarkers market report on the basis of type, application, end use, and region:

-

Type Outlook (USD Million; 2021 - 2033)

-

Genetic Biomarkers

-

Protein Biomarkers

-

Cell-based Biomarkers

-

Metabolomic Biomarkers

-

-

Application Outlook (USD Million; 2021 - 2033)

-

Screening and Early Detection

-

Diagnosis and Risk Stratification

-

Prognosis and Treatment Monitoring

-

Companion Diagnostics

-

-

End Use Outlook (USD Million; 2021 - 2033)

-

Hospitals & Diagnostic Laboratories

-

Academic & Research Institutes

-

Biopharmaceutical Companies

-

-

Regional Outlook (USD Million; 2021 - 2033)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global prostate cancer biomarker market size was estimated at USD 4.7 billion in 2024 and is expected to reach USD 5.3 billion in 2025.

b. The global prostate cancer biomarker market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2030 to reach USD 9.8 billion by 2030.

b. The protein biomarkers segment dominated the global prostate cancer biomarker market and accounted for the largest revenue share of 57.73% in 2024.

b. Some key players operating in the prostate cancer biomarker market include Exact Sciences Corporation; Myriad Genetics, Inc.; Bio-Techne; ExoDx; OPKO Health, Inc.; mdxhealth; Veracyte, Inc.; and Beckman Coulter, Inc

b. Key factors that are driving the prostate cancer biomarker market growth include rising incidence of prostate cancer and increasing awareness among physicians & patients regarding early detection. Furthermore, advancements in biomarker technologies and growing research efforts for prostate cancer diagnosis & treatment are further propelling the overall market..

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.