- Home

- »

- Clinical Diagnostics

- »

-

Proteinase K Market Size And Share, Industry Report, 2030GVR Report cover

![Proteinase K Market Size, Share & Trends Report]()

Proteinase K Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Therapeutic Area (Infectious Diseases, Neurology, Oncology, Cardiology), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-172-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Proteinase K Market Size & Trends

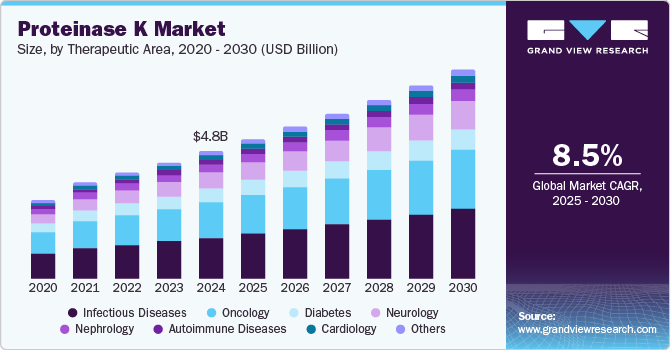

The global proteinase K market size was estimated at USD 4.78 billion in 2024 and is expected to grow at a CAGR of 8.5% from 2025 to 2030. The growing adoption of cell separation techniques by cell banks, diagnostic laboratories, and research institutions is expected to drive the demand of the proteinase K in the coming years. Academic institutions are increasingly focusing on advancing cell separation and sample sequencing technologies. For instance, in April 2022, researchers from Cornell University launched Inso Biosciences, a startup aimed at commercializing patented technology for nucleic acid extraction and sample preparation. This innovative approach significantly reduces processing time, completing sample preparation in 30 to 40 minutes compared to the traditional six hours for DNA fragments ranging from 40 kb to 50 kb.

The increasing demand for proteinase K in point-of-care (POC) diagnostic applications is expected to boost proteinase k industry growth. Advancements in smartphone-based POC devices and related tools have emerged as next-generation solutions, driving the expansion of the proteinase K market. For instance, the ACMC platform integrates a smartphone application with an autonomous capillary microfluidic chip for detecting cardiac troponin I, used in myocardial infarction testing. This technology is particularly suitable for resource-limited settings in developing economies. Consequently, innovative advancements in POC devices are likely to further propel the global market for proteinase K, especially in emerging regions.

The proteinase k industry growth is primarily driven by the extensive use of molecular diagnostic techniques and their associated enzymes in in vitro diagnostics (IVD). Recombinant proteinase K derived from Tritirachium is specifically designed for non-specific digestion in diagnostic and next-generation sequencing (NGS) applications, where minimal residual DNA content is crucial. Proteinase K serves as a key component in molecular diagnostic applications, including NGS and PCR. The adoption of NGS is expected to rise, particularly in personalized medicine and advanced clinical therapies. Common applications of NGS in pathology labs include targeted panels and gene expression profiling via qPCR. Furthermore, the decreasing cost of sequencing has made NGS technologies more accessible, thereby driving the demand for proteinase K in molecular diagnostics in the coming years.

The COVID-19 pandemic significantly increased the demand for proteinase K, accelerating advancements in the market. Proteinase K is a critical component in genetic material extraction protocols, as it digests proteins to prevent cross-contamination of nucleic acids. A study published in PLOS in March 2021 highlighted that proteinase K treatment followed by thermal shock offers a faster and more cost-effective method for RNA extraction in COVID-19 diagnostics. Moreover, companies have incorporated proteinase K in developing diagnostic kits for COVID-19. For instance, the U.S. FDA granted Emergency Use Authorization (EUA) to PerkinElmer’s Coronavirus Nucleic Acid Detection Kit, an RT-PCR test using saliva samples. These advancements in COVID-19 diagnostic kits and the associated use of proteinase K are expected to contribute positively to the market growth.

Form insights

The powder segment accounted for the largest market share of 54.2% in 2024, owing to the benefits offered by the technique. Proteinase K in powder form offers several benefits, including a long shelf life, cost-effective shipping, and high stability. Unlike liquid formulations, the powder form maintains its enzymatic activity during storage and transportation, even without specific temperature controls, eliminating the need for ice-pack shipments and reducing associated costs. These advantages make the powder form more versatile and convenient, driving its adoption in various applications and contributing to the growth of this segment.

The liquid form of proteinase K is anticipated to experience the fastest CAGR of 8.9% in the coming years due to its unique advantages. Unlike the powdered form, the liquid formulation is ready to use, eliminating the need for solubilization and saving time in laboratory workflows. Additionally, it minimizes the risk of contamination, ensuring the integrity of RNA or DNA samples, which is crucial in sensitive molecular applications. These benefits make the liquid form ideal for large-scale production and high-throughput processes, further driving its demand and contributing to proteinase k industry growth during the forecast period.

Therapeutic Area Insights

The infectious diseases segment captured the highest share of 32.4% in 2024. The rising prevalence of infectious diseases such as HIV, tuberculosis, and malaria in low- and middle-income countries is driving the development of user-friendly products for low-resource settings. For instance, QIAGEN provides QIAGEN Proteinase K, a subtilisin-type protease derived from the saprophytic fungus Tritirachium album. This product is widely used for isolating DNA and RNA during the diagnosis of viral and bacterial infections. The incorporation of proteinase K in rapid molecular testing solutions is expected to significantly boost market growth by enhancing the efficiency of diagnostic processes in these regions.

The neurology segment is predicted to grow at an exponential CAGR of 9.9% during the forecast period. Several neurological therapies are under development, including small molecule treatments, enzyme replacement, gene editing, splicing, and gene-replacement therapies using adeno-associated vectors. Gene expression profiling has also become a vital tool for identifying diagnostic and therapeutic targets in neurological disorders. Proteinase K plays a crucial role in the extraction process, as it improves RNA yield and ensures that most samples are suitable for array analysis. Innovations in these therapies and the growing reliance on molecular tools like proteinase K are key factors driving the market's growth.

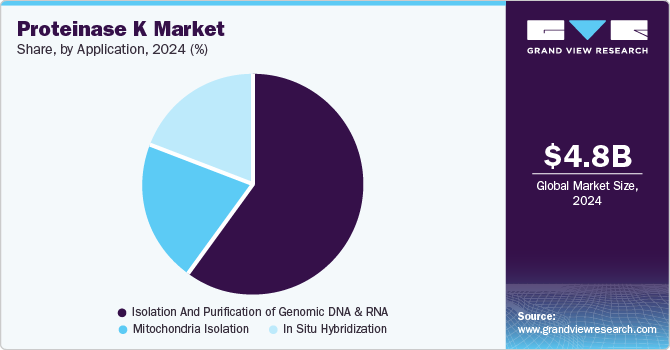

Application Insights

The isolation and purification of genomic DNA & RNA segment held the largest share of 59.7% in 2024. Proteinase K is extensively used at multiple stages in genomic DNA and RNA purification processes. It is typically stored at -20°C before use and plays a critical role during the sample lysis stage, aiding in the processing of cultured cells, mammalian whole blood (non-nucleated), animal tissues, and nucleated whole blood. The routine use of DNA and RNA isolation in contract research organizations (CROs) and biotechnology companies has surged due to the rising demand for personalized treatments in cancer and rare diseases. This increasing need for nucleic acid isolation is expected to drive the market growth, reflecting its essential role in these advanced applications.

The in situ hybridization segment expected to expand at the fastest CAGR of 8.1% by 2030.The growing adoption of proteinase K is largely driven by its benefits, including compatibility with high-volume testing and integration with automated devices that enhance testing speed and accuracy. The rising prevalence of diseases linked to chromosomal aberrations, such as genetic disorders and cancer, along with unmet diagnostic and clinical needs, serves as a significant driver for market growth. These factors underscore the increasing demand for efficient diagnostic solutions, further propelling the adoption of proteinase K in various applications.

End Use Insights

The biotechnology companies accounted for the largest share of 36.5% in 2024. The rising application of In Situ Hybridization (ISH) techniques in clinical and preclinical studies by biotechnology companies is expected to drive the demand for proteinase K. ISH protocols, including staining, tissue sectioning, high-resolution full-slide scanning, scoring, and image analysis, often require the use of proteinase K. This enzyme plays a critical role in tissue sample digestion during ISH procedures, making it an essential component in the successful implementation of these protocols. As ISH techniques continue to expand, the usage of proteinase K is anticipated to grow simultaneously.

The academic institutes segment is expected to witness the fastest CAGR of 8.6% during the forecast period. Academic institutes provide comprehensive services for all stages of clinical research, from development to commercialization. These labs often collaborate with academic and industrial partners to advance new technologies and clinical trial procedures, such as expert reviews of biopsy histopathology or cytology. The review of histological assays frequently requires the use of proteinase K for tissue sample digestion, which has increased its adoption in academic laboratories. This growing usage further supports the expansion of the market in research and diagnostic applications.

Regional Insights

The North America proteinase K industry dominated and accounted for a 45.88% share in 2024. The regional market is experiencing growth due to the high demand for proteinase K and the rising prevalence of infectious diseases. During the COVID-19 pandemic, the FDA issued Emergency Use Authorizations (EUAs) for in vitro diagnostic tests, including enzyme-linked immunosorbent assays (ELISA) and reverse transcription polymerase chain reaction (RT-PCR)-based tests for SARS-CoV-2 detection. Given the critical role of enzymes like proteinase K in RT-PCR processes, such advancements have significantly contributed to revenue generation in the North American market.

U.S. Proteinase K Market Trends

The U.S. proteinase K industry is projected to grow significantly during the forecast period, driven by several factors, including advancements in molecular diagnostics, high adoption of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies, and the increasing prevalence of infectious diseases and genetic disorders.

Europe Proteinase K Market Trends

The Europe proteinase K industry is likely to emerge as a lucrative region, driven by region's strong focus on molecular diagnostics, genetic research, and advancements in biotechnology. High adoption rates of next-generation sequencing (NGS) and PCR technologies, combined with increasing demand for precision medicine and personalized treatments.

The UK Proteinase K market is projected to grow during the forecast period. High prevalence of genetic disorders, cancer, and infectious diseases increases the need for advanced diagnostic tools. The UK also fosters innovation through academic and industry collaborations, government funding, and initiatives to develop cutting-edge diagnostic technologies, further supporting the market growth.

The Proteinase K market in France is expected to show steady growth over the forecast period, driven by the position of France in biotechnology and pharmaceutical research. France's healthcare system is highly advanced, with a strong emphasis on personalized medicine, cancer treatment, and genetic testing.

The Germany Proteinase K market is projected to expand during the forecast period. Germany's reputation as a hub for innovation, coupled with research partnerships between academia, industry, and government support for scientific advancements, further contributes to the market growth in the country.

Asia Pacific Proteinase K Market Trends

The Asia Pacific proteinase K industryis expected to experience the highest growth rate of 9.4% CAGR during the forecast period owing to increasing demand for advanced molecular diagnostic technologies, rising prevalence of infectious diseases, and a growing focus on genomics and personalized medicine. Countries such as China, Japan, and India are seeing significant investments in biotechnology and life sciences research, leading to a higher adoption of techniques like next-generation sequencing (NGS) and PCR for diagnostic and therapeutic purposes.

The China proteinase K market is projected to expand throughout the forecast period, driven by country's rapid advancements in biotechnology and molecular diagnostics. As China increases its focus on genomics, personalized medicine, and next-generation sequencing (NGS) technologies, there is a growing demand for proteinase K in applications such as DNA and RNA extraction, PCR, and genetic testing.

The proteinase K market in Japan is anticipated to grow during the forecast period, driven by increasing demand for precision medicine and genetic testing fuels the need for proteinase K in DNA/RNA extraction processes. Additionally, Japan's significant investments in research and development, along with government initiatives to promote biotechnology, further contribute to the market growth.

Latin America Proteinase K Market Trends

The Latin America proteinase K industryis expected to experience significant growth throughout the forecast period. The growing prevalence of infectious diseases, cancer, and genetic disorders in Latin America is driving demand for efficient diagnostic solutions, where proteinase K plays a crucial role in DNA and RNA extraction processes. Increased government and private sector initiatives to improve healthcare infrastructure and promote personalized medicine also contribute to the market's growth in Latin America.

The Brazil proteinase K market is anticipated to grow during the forecast period. Brazil has a large and diverse population, which drives the need for efficient diagnostic solutions, especially in the areas of genetic testing, infectious diseases, and cancer. The use of proteinase K in molecular diagnostic applications, including DNA and RNA extraction for next-generation sequencing (NGS) and PCR, is becoming more widespread as healthcare institutions in Brazil adopt these advanced technologies.

Saudi Arabia Proteinase K Market Trends

The Saudi Arabia proteinase K industryis anticipated to experience substantial growth during the forecast period. As Saudi Arabia modernizes its healthcare infrastructure and focuses on advancing diagnostic technologies, the demand for molecular diagnostic tools such as PCR and next-generation sequencing (NGS) is rising.

Key Proteinase K Company Insights

Key players in the proteinase K market are actively pursuing both organic and inorganic growth strategies to expand their market presence. Organic strategies include product innovations, such as the development of new formulations and improved applications of proteinase K, as well as expanding their product portfolios to cater to diverse industries such as biotechnology, diagnostics, and research. Companies are also involved in mergers and acquisitions to gain market share. For instance, in February 2022, Merck KGaA completed the acquisition of Exelead and announced plans to invest approximately USD 542 million in scaling up its technology. The initiative is expected to broaden the company’s portfolio of offerings and can positively affect its growth.

Key Proteinase K Companies:

The following are the leading companies in the proteinase k market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Qiagen

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-la Roche Ltd.

- Abcam Plc

- Agilent Technologies, Inc.

- Biocatalysts Ltd.

- Minerva Biolabs GMBH

- Promega Corporation

- Takara Bio, Inc.

- New England Biolabs

- MP Biomedicals

Recent Developments

-

In December 2022, ArcticZymes Technologies announced that they had upscaled the production of their ArcticZymes Proteinase. The upscaled production is anticipated to meet the increasing industry demand for proteinase

-

In April 2022, Thermo Fisher Scientific, Inc. collaborated with Matrix Clinical Trials to enhance its clinical research solutions and boost its market prospects for decentralized trial solutions and associated products

Proteinase K Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue forecast in 2030

USD 7.84 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, therapeutic area, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Merck KGaA; Qiagen; Thermo Fisher Scientific, Inc.; F. Hoffmann-la Roche Ltd.; Abcam Plc; Agilent Technologies, Inc.; Biocatalysts Ltd.; Minerva Biolabs GMBH; Promega Corporation; Takara Bio, Inc.; New England Biolabs; MP Biomedicals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Proteinase K Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the proteinase K market report based on form, therapeutic area, application, end use, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Neurology

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Isolation and Purification of Genomic DNA & RNA

-

In Situ Hybridization

-

Mitochondria isolation

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Research Organization

-

Academic Institutes

-

Biotechnology Companies

-

Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the proteinase K market include Merck KGaA, Codexis, Inc., F. Hoffmann-La Roche Ltd., Amano Enzyme Inc., Advanced Enzymes Technologies Ltd., Biocatalysts Ltd., Amicogen, Dyadic International, BBI Solutions, Affymetrix, and American Laboratories.

b. Key factors that are driving the proteinase K market growth include broad applications of molecular diagnostic techniques and their associated enzymes for IVD, rise in demand of point of care diagnostics coupled with the utility of proteinase K in POC diagnostic tests, and rising incidence of chronic disorders.

b. The global proteinase K market size was estimated at USD 4.78 billion in 2024 and is expected to reach USD 5.22 billion in 2025.

b. The global proteinase K market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 7.84 billion by 2030.

b. North America dominated the proteinase K market with a share of 45.88% in 2024. This is attributable to owing to well-established healthcare infrastructure, an increase in investments by the public & private sectors in In Vitro Diagnostics (IVD), the high adoption rate of molecular diagnostics, and the presence of a substantial number of market players in this region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.