- Home

- »

- Sensors & Controls

- »

-

Radio Frequency Components Market, Industry Report 2030GVR Report cover

![Radio Frequency Components Market Size, Share & Trends Report]()

Radio Frequency Components Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Filters, Duplexers, RF Amplifiers, RF Switches), By Application (Consumer Electronics, Military, Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-700-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Radio Frequency Components Market Summary

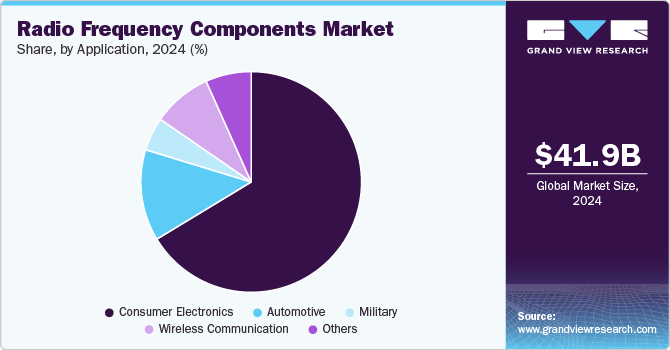

The Global Radio Frequency Components market size was estimated at USD 41,934.4 million in 2024 and is projected to reach USD 89,729.7 million by 2030, growing at a CAGR of 13.5% from 2025 to 2030. Continuous innovations and advancements in mobile handset technology owing to the continuing transition from 2G, and 3G to 4G/LTE, LTE-Advanced, LTE-Advanced Pro, and 5G lead to the rising need for maximizing power efficiency and spectrum range of mobile devices.

Key Market Trends & Insights

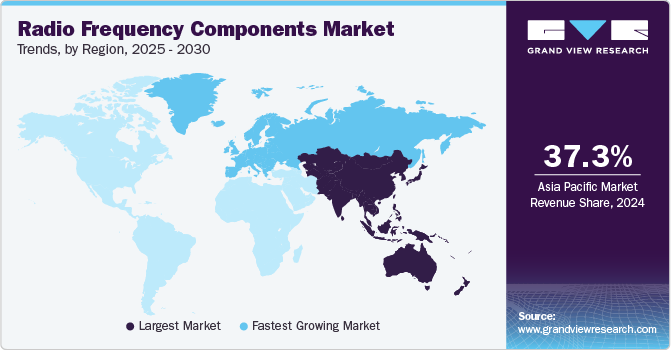

- The radio frequency components market in Asia Pacific held the largest revenue share of 37.29% in 2024.

- The radio frequency components market in U.S. is experiencing robust growth, driven by several key factors.

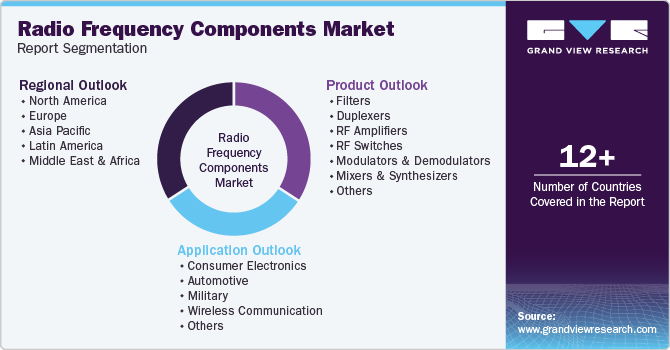

- By product, the segment has been filters, duplexers, RF amplifiers, RF switches, modulators and demodulators, mixers and synthesizers, and others.

- Based on application, the market has been divided into automotive consumer electronics, military, and wireless communication.

Market Size & Forecast

- 2024 Market Size: USD 41,934.4 Million

- 2030 Projected Market Size: USD 89,729.7 Million

- CAGR (2025-2030): 13.5%

- Asia Pacific: Largest market in 2024

This, in turn, is expected to spur the demand for radio frequency (RF) components during the forecast period. According to The World Bank Group, as of 2023, one-third of the global population still does not have access to the internet. With growing internet penetration, the RF components market is expected to grow significantly over the forecast period.

In July 2024, Smiths Interconnect launched a "Mini-Lock Connector" for mission-critical applications requiring reliable high-frequency connectivity. This connector operates up to 110 GHz, enabling faster speeds and reduced downtime. Its robust locking mechanism ensures a stable connection even under extreme vibration and shock, making it suitable for satellites, space flights, radars, unmanned vehicles, and military applications. Designed for harsh environments, it functions in temperatures from -65°C to +165°C. The compact and lightweight connector supports advancements in global connectivity by improving data transfer in demanding applications. Smiths Interconnect emphasizes its commitment to innovation and serving customer needs in frontier industries.

IoT solutions require enhanced wireless connectivity, thereby driving the need for new and advanced radio frequency components. Moreover, increasing sales of smartphones owing to constant product development remains a prominent feature of the market. New smartphones offering improved performance, biosensors, long battery life, and more AI features, and the increasing popularity of low-end smartphones in emerging countries will boost the radio frequency components industry. Thus, the requirement of low-power ICs for maximizing battery life and reducing charging time in smartphones is expected to spur the demand for radio frequency components. Increasing adoption of IoT across industrial, residential, and consumer applications is also expected to impel the radio frequency components demand.

Furthermore, a number of applications and products, such as home robots, smart wearables, self-driving cars, and smart manufacturing solutions and tools, are being integrated with IoT technologies, leading to an increased scope of usage for the radio frequency component. However, the requirement for features, such as longer battery life, low-power wireless connections, and diversified sensors, in these products and applications are pushing radio frequency component manufacturers and solution designers to focus more on technological developments in their deliverables. Owing to the aforementioned factors, the radio frequency component industry is anticipated to attain significant growth in the years to come.

The need for broadband services and better speeds for mobile internet connectivity is driving technological breakthroughs in the sectors of wireless and cellular mobile communication, including the deployment and development stages of 5G networks. Moreover, the 5G network offers a wider coverage area and lower latency than the previous generations, similar to the new generation’s internet connectivity. Due to the necessity for low-frequency and tall antenna macro cell sites for greater area coverage brought on by the introduction of 5G networks in wireless communication, radio frequency components will become more and more common.

The radio frequency components industry is anticipated to be affected by an increase in raw material prices. Silicon wafers, a range of chemicals, and photoresist materials are among the main raw materials utilized in the manufacture of radio frequency components. Due to the scarcity of these raw materials as a result of rising manufacturer demand, there have been price adjustments and delivery delays across the whole market. For instance, the cost of silicon wafers has increased as a result of the semiconductor industry's increased demand.

Product Insights

The segment has been filters, duplexers, RF amplifiers, RF switches, modulators and demodulators, mixers and synthesizers, and others. The filters segment led the market with the largest revenue share of 23.3% in 2024. Filters play a critical role in the RF components market, shaping the performance and efficiency of wireless communication systems. These components are essential for managing signal quality, reducing interference, enhancing reception, and complying with regulatory requirements. The widespread adoption of wireless technologies across various industries has propelled the demand for advanced RF filters. The increasing demand for high-speed data transmission, especially with the advent of 5G technology, necessitates efficient filters to manage the spectrum effectively. Filters enable efficient utilization of available bandwidth, ensuring seamless connectivity and improved spectrum efficiency. They help in channelizing the radio spectrum, avoiding overlap, and reducing interference.

The RF amplifiers segment is estimated to exhibit at a rapid CAGR over the forecast period, which is primarily attributed to rapid growth in the user base of mobile devices and 4G LTE networks. The proliferation of IoT devices demands efficient and power-conscious RF amplifiers for reliable connectivity. These amplifiers enable seamless data transfer and communication between various IoT devices. Moreover, the growing adoption of 5G networks globally has significantly fueled the demand for RF amplifiers. 5G technology demands higher frequency bands and better amplification capabilities, driving the need for advanced RF amplifiers that can operate effectively within these bands. The adoption of RF amplifiers in the market continues to grow in response to the increasing demand for faster and more reliable wireless communication, advancements in technology, and the widespread integration of IoT and 5G technologies. The versatility and critical role of RF amplifiers across diverse industries are driving their adoption and innovation in the market.

Application Insights

Based on application, the market has been divided into automotive consumer electronics, military, and wireless communication. The consumer electronics segment led the market with the largest revenue share of 66.4% in 2024. Over the projected period, the segment is also anticipated to experience significant expansion. This could be attributable to increasing consumer electronics expenditure and rising disposable income on items like smartphones, tablets, laptops, smart wearable notebooks, and smart home accessories.

The demand for consumer electronics products is also being driven by the widespread use of IoT technologies and technical innovations like the integration of AI features (control/voice recognition) in set-top boxes and TVs. Furthermore, government mandates for the installation of set-top boxes in a number of countries are estimated to fuel the segment growth further. The automotive sector is also anticipated to witness rapid growth owing to increasing demand for connectivity features, such as navigation systems, Bluetooth, location trackers, music systems, and central locking systems, in vehicles. An increasing number of automation solution installations in vehicles is also expected to drive the product demand in this segment.

The wireless communication segment is expected to grow at the fastest CAGR of 13.4% during the forecast period. The adoption of radio frequency (RF) components in wireless communication has been pivotal in shaping the modern world. RF components serve as the backbone of wireless communication systems, enabling seamless connectivity across diverse applications. RF components are fundamental to wireless networks, enabling the transmission and reception of signals. In cellular networks such as 2G, 3G, 4G, and 5G, RF components ensure efficient data transfer with a smooth communication experience for users. RF technology plays a crucial role in satellite communication systems. Satellites use RF components for uplink and downlink communication, facilitating television broadcasting, internet access in remote areas, weather forecasting, and global positioning through Global Navigation Satellite Systems (GNSS) such as GPS.

Regional Insights

The North Americaradio frequency components market has witnessed exponential growth, owing to the ever-increasing demand for wireless communication technologies. The rapid evolution of wireless communication technologies, such as 5G networks, the Internet of Things (IoT), and smart devices, has been a significant factor driving the market growth. As these technologies continue to revolutionize various industries, the demand for high-performance RF components, such as filters, amplifiers, and antennas, has surged.

U.S. Radio Frequency Components Market Trends

The radio frequency components market in U.S. is experiencing robust growth, driven by several key factors. RF components are integral in a wide range of applications, including wireless communication, aerospace, defense, healthcare, and the Internet of Things (IoT), making them essential in the increasingly connected world. One of the primary drivers of the RF components market is the relentless expansion of wireless technologies. In addition, the growing use of electronic devices in the daily lives of consumers, ranging from smartphones and tablets to smart home appliances, has led to an ever-increasing demand for RF components.

Asia Pacific Radio Frequency Components Market Trends

The radio frequency components market in Asia Pacific held the largest revenue share of 37.29% in 2024. The growth is ascribed to increasing demand for radio frequency components in consumer electronics applications. Growing adoption of power amplifiers and duplexers for use in a wide range of devices such as mobile phones, tablets, and laptops & notebooks, among others. The Radio frequency components are used for frequency up and down conversion. The radio frequency down converter converts the radio frequency signal to a baseband signal for use in GSM. The demand for radio frequency components in the Asia Pacific region for consumer electronics applications is anticipated to grow exponentially, owing to the increasing adoption of radio frequency components due to their ability to provide or control coverage with some kind of antenna or transmission system.

The radio frequency components market in India is rapidly growing owing to its large labor pool and developing technological infrastructure for the electronics manufacturing sector. According to The World Bank Group, the total labor force in India reached over 523 million in 2022. Moreover, lower labor costs compared to China have led to growing investments in India, making it one of the most promising contenders to the Chinese electronic manufacturing sector. The Indian government and private companies are taking initiatives to develop the country’s electronic manufacturing industry.

Europe Radio Frequency Components Market Trends

The radio frequency components market in Europe is expected to grow at the fastest CAGR of 13.8% during the forecast period. The automotive sector is playing a significant role in driving the growth of the market in Europe. RF technology integration in modern vehicles is vital for advanced driver assistance systems, infotainment, and vehicle-to-vehicle communication. As the automotive industry continues its evolution toward autonomous and connected vehicles, the demand for RF components is expected to continue to increase. The electric vehicle (EV) industry in Europe is at the forefront of technological innovation, and RF components play a crucial role in enhancing the performance, safety, and connectivity of electric vehicles. For instance, as per the GVR analysis in Q1 2023, Europe witnessed a year-on-year increase of more than 13% in the sales of electric vehicles.

The UK radio frequency components market is dynamic and thriving, driven by several key factors that contribute to its growth and significance on both the national and global levels. The UK is renowned for its aerospace and defense industries, which heavily rely on RF components for radar systems, satellite communication, electronic warfare, and navigation. As national security requirements evolve and technology advances, there is a consistent demand for cutting-edge RF technology.

Key Radio Frequency Components Company Insights

Some of the key players operating in the industry include Texas Instruments; and NXP Semiconductors.; among others.

-

An extensive portfolio of innovative and high-performance RF solutions is allowing Texas Instruments Incorporated (TI) to take the lead in the global market. The company specializes in RF integrated circuits, transceivers, amplifiers, and power management solutions. The company’s strength lies in its strong commitment to research and development, leading to cutting-edge technologies addressing the evolving needs of 5G, IoT, and wireless communication systems. A customer-centric approach and global presence are also allowing it to command a leading position in the market.

-

NXP Semiconductors is known for its advanced RF solutions catering to automotive, IoT, and industrial applications. The company’s comprehensive product offerings and focus on emerging technologies, such as 5G and IoT, further bolster its leadership position. The company’s commitment to sustainable and innovative solutions also ensures it remains at the forefront of the market, meeting the evolving demands for connectivity and communication across various industries and industry verticals.

MACOM Technology Solutions Holdings, Inc. and Tippmann Group are some of the emerging companies in the global market

-

MACOM offers a diverse range of RF components, including amplifiers, mixers, switches, attenuators, and other semiconductor devices. Their product portfolio is designed to meet the demanding requirements of applications such as telecommunications, aerospace, defense, and industrial markets. With a global presence, MACOM has established itself as a key player in the market. Their components are integral to the development and deployment of communication systems, radar systems, satellite communication, and other applications where RF technology is fundamental.

-

IQE plc specializes in semiconductor technology, particularly in the field of compound semiconductors. Their expertise extends to the design and manufacture of semiconductor materials that are crucial for RF components used in diverse applications. The semiconductor materials offered by IQE plc find applications in various markets, including telecommunications, data communications, aerospace, defense, and consumer electronics. Their contributions to RF technology support the development of advanced communication systems and devices.

Key Radio Frequency Components Companies:

The following are the leading companies in the radio frequency (RF) components market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom, Inc.

- Fujitsu Limited

- IQE plc

- NXP Semiconductors

- Renesas Electronics Corporation

- Murata Manufacturing Co. Limited

- Taiwan Semiconductor Manufacturing Co. Limited

- Texas Instruments, Inc.

- TDK Corporation

- ROHM Co., Ltd

- Toshiba Electronics Devices & Storage Corporation

- United Monolithic Semiconductors

- MACOM Technology Solutions Holdings, Inc.

- WIN Semiconductors

- SV Microwave (Amphenol Corporation)

- Wolfspeed, Inc.

- Qorvo, Inc

- Analog Devices, Inc

- Marki Microwave, Inc.

- Knowles Corporation

- Skyworks Solutions, Inc.

- Gotmic AB

Recent Development

-

In October 2024, CG Power, part of the Murugappa Group, acquired Renesas' RF components business for USD 36 million, entering the semiconductor design sector. The acquisition includes IP, tangible assets, and select employees in areas like semiconductor design, marketing, and applications.

-

In August 2024, General Dynamics received an USD 88.5 million order from the U.S. Navy to build AN/USC-61(C) maritime software-defined radios for ships and submarines. These multifunction radios offer various waveforms and multi-level security, including NSA Type 1 encryption across HF, VHF, UHF line-of-sight, and UHF SATCOM bands. The contract covers digital modular radio (DMR) systems, high-frequency distribution amplifier group components, and spare parts.

-

In August 2023, MACOM acquired Wolfspeed's Radio Frequency Business for USD 25 million. As per the agreement, MACOM will take ownership of a wafer fabrication facility located in North Carolina, expected to be operational within approximately two years following the closing. In addition, MACOM will gain access to over 1,400 patents linked to the RF business, along with design teams, relevant product development assets, and production capabilities situated in California and Malaysia.

-

In June 2023, Broadcom, Inc. introduced four RF front-end modules designed to power routers compliant with Wi-Fi 7, the latest wireless networking standard. These modules are versatile and can be utilized in the construction of Wi-Fi Access Points (APs) as well. APs are essential devices used by enterprises to enable wireless connectivity within their office spaces. The newly launched modules are finely tuned for optimal performance in Wi-Fi 7 routers and access points. At the launch, the company presented four modules, each with distinct configurations.

-

In April 2023, Renesas Electronics Corporation launched its new wireless microcontroller incorporating Bluetooth 5.3 low energy, utilizing its 22-nanometer process technology. This innovative technology aims to deliver essential features such as Radio Frequency (RF) while effectively reducing power consumption. Leveraging a more compact die area for equivalent functionality, these diminutive chips offer comparable performance while achieving greater integration of peripherals and memory.

Radio Frequency Components Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47,285.2 million

Revenue forecast in 2030

USD 89,729.7 million

Growth rate

CAGR of 13.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Market revenue in USD million/billion, CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

The U.S.; Canada; the UK; Germany; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa.

Key companies profiled

Broadcom, Inc.; Fujitsu Limited; IQE plc; NXP Semiconductors; Renesas Electronics Corporation; Murata Manufacturing Co. Limited; Taiwan Semiconductor Manufacturing Co. Limited; Texas Instruments, Inc.; TDK Corporation; ROHM Co., Ltd; Toshiba Electronics Devices & Storage Corporation; United Monolithic Semiconductors; MACOM Technology Solutions Holdings, Inc.; WIN Semiconductors; SV Microwave (Amphenol Corporation); Wolfspeed, Inc.; Qorvo, Inc.; Analog Devices, Inc.; Marki Microwave, Inc.; Knowles Corporation; Skyworks Solutions, Inc.; Gotmic AB

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radio Frequency Components Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radio frequency components market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Filters

-

Duplexers

-

RF Amplifiers

-

RF Switches

-

Modulators and Demodulators

-

Mixers and Synthesizers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Mobile Phones

-

Tablets

-

Smart TVs & Set-top Boxes.

-

Laptops & Notebooks

-

Others

-

-

Automotive

-

Military

-

Wireless Communication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global radio frequency components market size was estimated at USD 41,934.4 million in 2024 and is expected to reach USD 47,285.2 million in 2025.

b. The global Radio Frequency (RF) components market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 89,729.7 million by 2030.

b. Filters segment dominated the radio frequency components market with a share of 23.3% in 2024. This is attributable to which is primarily attributed to rapid growth in the user base of mobile devices and 4G LTE networks.

b. Some key players operating in the RF components market include Broadcom, Inc.; Fujitsu Limited; International Quantum Epitaxy Plc; NXP Semiconductors N.V.; Renesas Electronics Corporation; Murata Manufacturing Co. Limited; Taiwan Semiconductor Manufacturing Co. Limited; Texas Instruments, Inc.; and TDK Corporation.

b. Key factors that are driving the market growth include rising need for maximizing power efficiency and spectrum range of the mobile devices considering steady transition to next-generation network technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.