- Home

- »

- Biotechnology

- »

-

Research Antibodies Market Size, Industry Report, 2033GVR Report cover

![Research Antibodies Market Size, Share & Trends Report]()

Research Antibodies Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Specificity, By Technology, By Source, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-124-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Research Antibodies Market Summary

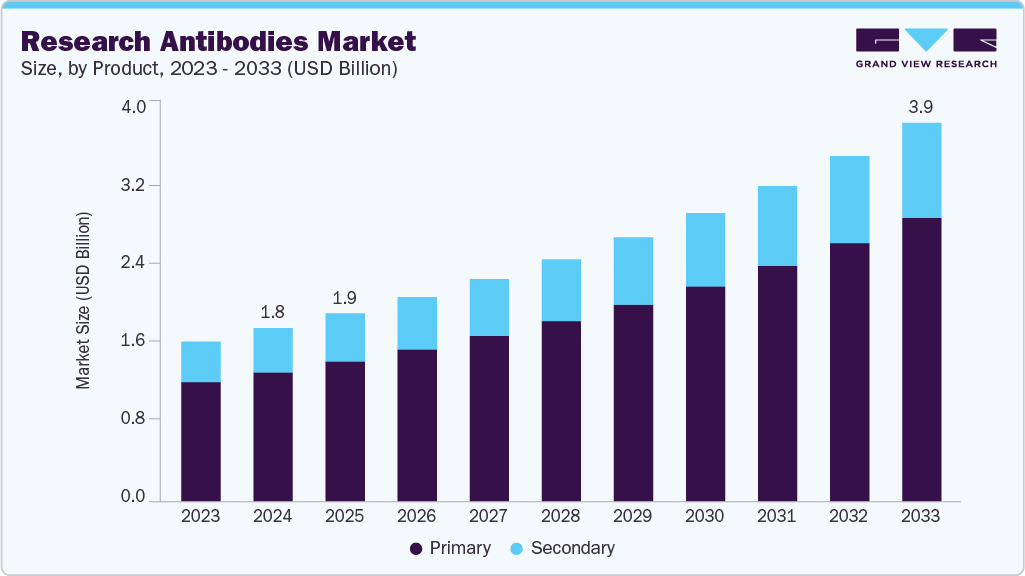

The global research antibodies market size was estimated at USD 1.79 billion in 2024 and is projected to reach USD 3.91 billion by 2033, growing at a CAGR of 9.15% from 2025 to 2033. The market for research antibodies is expanding rapidly due to the rising incidence of infectious and chronic illnesses, improvements in proteomics and genomics research, and the growing use of personalized medicine.

Key Market Trends & Insights

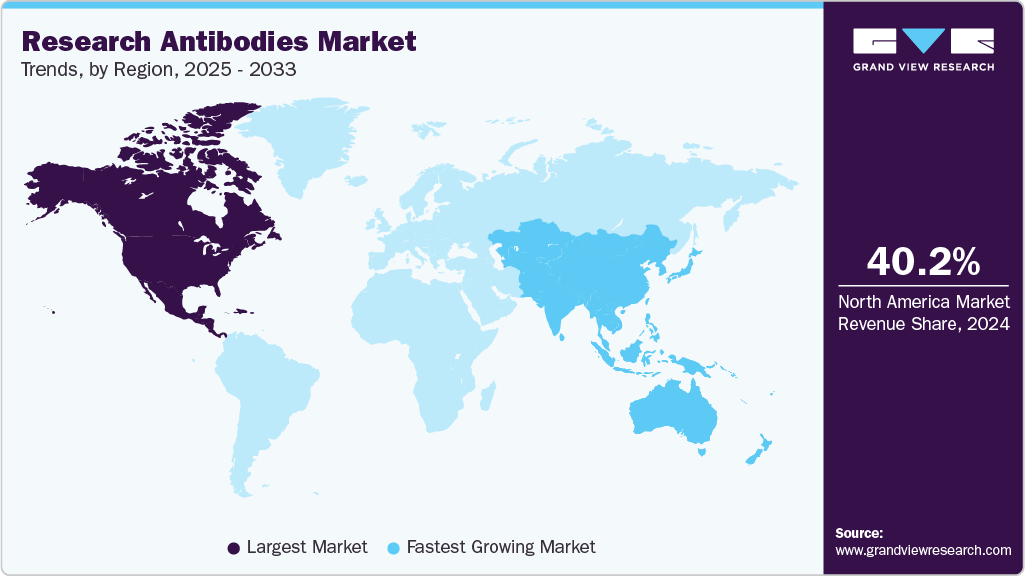

- The North America research antibodies market held the largest share of 40.19% of the global market in 2024.

- The research antibodies industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By product, the primary segment held the highest market share of 74.51% in 2024.

- By specificity, the monoclonal antibodies segment held the highest market share in 2024.

- By technology, the western blotting segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.79 Billion

- 2033 Projected Market Size: USD 3.91 Billion

- CAGR (2025-2033): 9.15%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising burden of chronic and infectious diseases

The growing prevalence of infectious and chronic illnesses worldwide is one of the main factors propelling the growth of the research antibodies industry. The need for cutting-edge research instruments to examine disease pathways and find new therapeutic targets has increased due to the rising prevalence of cancer, cardiovascular diseases, autoimmune diseases, and neurodegenerative conditions. To identify, measure, and examine proteins implicated in disease development, research antibodies are essential tools that help scientists decipher intricate biological processes. For instance, antibodies are widely used in oncology to validate druggable targets, identify tumor markers, and study signaling pathways.

Estimated Number of New Cancer Cases and Deaths by Sex, US, 2025

Cancer Type

Estimated New Cases (2025)

Breast

319,750

Prostate

313,780

Lung & Bronchus

226,650

Colorectal

154,270

Urinary Bladder

84,870

Other

942,590

The continuous threat of infectious diseases, which includes new pathogens like SARS-CoV-2 and seasonal influenza, has also increased demand for research antibodies. In virology and microbiology labs, antibodies are essential for pathogen identification, immune response profiling, and vaccine development. Investment in antibody technologies has increased due to the global COVID-19 pandemic, which highlighted the value of antibody-based assays in therapeutic research and diagnostic testing. Research organizations and pharmaceutical companies are anticipated to increase their reliance on antibodies to spur innovation in preventive and therapeutic solutions due to the emergence of viral outbreaks and antimicrobial resistance, which will sustain market growth over the forecast period.

Expansion of life sciences and biomedical research

One of the main factors propelling the market expansion for research antibodies is the rapid development of biomedical and life sciences research. Research antibodies are widely used by academic institutions, biotechnology companies, and pharmaceutical firms as the emphasis on comprehending intricate cellular and molecular processes grows. Antibodies are indispensable tools in cell biology, molecular biology, and biochemistry, enabling researchers to identify, isolate, and analyze proteins with high specificity and sensitivity.

The role of research antibodies in target validation, lead optimization, and preclinical testing has also been strengthened by the robust pipeline of drug discovery and development programs. Antibodies are being used more and more by biotech and pharmaceutical companies to investigate protein interactions, clarify signaling pathways, and create potential treatments. The constant need for high-quality antibodies is also fueled by the growth of academic-industry partnerships and the construction of cutting-edge research facilities across the globe.

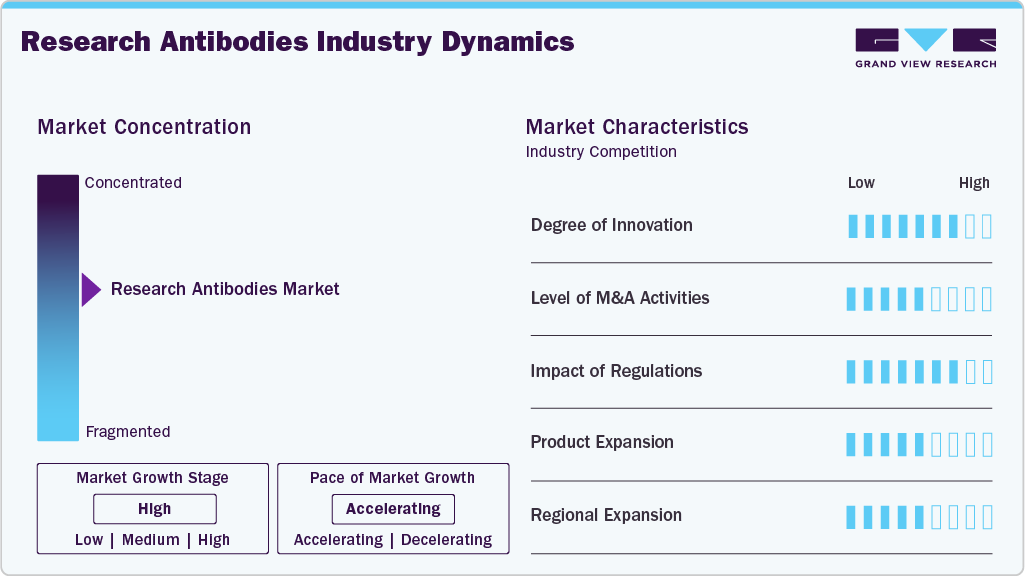

Market Concentration & Characteristics

The research antibodies market shows a high degree of innovation, driven by the shift from traditional polyclonal and monoclonal antibodies to recombinant and engineered variants that offer greater specificity and reproducibility. Proteomics, diagnostics, and precision medicine applications are growing thanks to innovations like nanobodies, multiplex assays, and AI-enabled antibody discovery, which make the market dynamic and highly innovative.

Several key players are undertaking mergers and acquisitions in the research antibodies industry to maintain their market presence. For instance, in April 2025, UK-based Epsilogen acquired Boston’s TigaTx, expanding its oncology pipeline with IgA and IgE antibody assets to establish a leading pan-isotype cancer antibody company. Such strategies are anticipated to drive the market growth.

Regulations in the research antibodies market include guidelines for enhancing data reproducibility and trust in experimental outcomes. However, navigating complex regulatory landscapes can pose challenges for companies, impacting product development timelines and research and development activities costs.

Product expansion in the industry is driven by the shift from conventional antibodies to recombinant, nanobodies, and conjugated variants tailored for applications like immunohistochemistry, flow cytometry, and proteomics. Companies are broadening portfolios with multiplex-ready antibodies and assay kits, supporting advanced research needs and boosting market growth.

Regional expansion in the research antibodies market is driven by strong R&D funding in North America, government-backed initiatives in Europe, and rapid growth in Asia-Pacific, particularly China and India. Companies leverage these opportunities to strengthen distribution, tap new research hubs, and boost antibody adoption globally.

Product Insights

The primary antibodies segment captured the highest revenue share in 2024 and is projected to grow the fastest throughout the forecast period. This can be attributed to the increasing availability of primary antibodies using rabbit, mouse, goat, and other species as hosts, as well as the wide range of utility offered by such antibodies for applications in the R&D space. Also, the segment is predicted to grow exponentially owing to the usage of primary antibodies for frequently performed laboratory procedures, such as staining and imaging.

The secondary antibodies segment is expected to grow at a significant CAGR from 2025 to 2033, as these are more convenient and cost-effective to develop. The demand for secondary research antibodies is also anticipated to increase due to the availability of ready-to-use conjugated antibodies that can improve product development activities by assisting in identifying, grouping, and purifying targeted antigens.

Specificity Insights

The monoclonal antibodies segment accounted for the dominant share of the research antibodies market in 2024, due to a sharp increase in the number of cancer research projects that demand high specificity antibodies. As monoclonal antibodies can efficiently adhere to or block antigens on cancer cells, they are employed in the identification and development of new medicines for various cancer types. This factor is expected to expand the growth prospects for the segment in the near future.

The polyclonal antibodies segment is projected to grow significantly over the forecast period, as these antibody structures are essential for research focusing on the purification of antigens and the examination of histopathological tissue. Furthermore, polyclonal antibodies provide benefits like stability, practical storage methods, strong affinity, and excellent compatibility for ELISA and western blotting technologies, propelling market growth. For instance, in November 2024, U.S.-based GigaGen dosed the first patient in a Phase 1 trial of GIGA-2339, a recombinant polyclonal antibody candidate to provide a functional cure for chronic hepatitis B.

Technology Insights

The western blotting segment accounted for the largest market share of 29.77% in 2024, due to the widespread availability and adoption of the technique. In addition, due to the increased accuracy that the western blotting technique offers, it is typically chosen over alternative technologies for applications involving the detection of important protein entities. These attributes are expected to positively affect the segment growth.

The immunohistochemistry segment is projected to grow at the fastest CAGR throughout the forecast period. The segment is anticipated to expand steadily due to its significant applications in detecting enzymes, antigens, tumor suppressor genes, and tumor cell growth for cell-based research. Moreover, rising R&D spending and a high level of scientific awareness regarding the technique have led to increasing growth prospects for immunohistochemistry. Furthermore, benefits provided by the method, such as high sensitivity & simplicity of use, are some of the factors anticipated to drive market growth.

Source Insights

The rabbit source segment led the research antibodies industry with the largest share of 49.99% in 2024. Rabbits are extensively used for antibody production, owing to several advantages, such as higher-affinity antibodies provided by rabbits than those obtained from other animal hosts. Furthermore, the higher specificity provided by these antibodies makes them ideal for detecting small molecules, hormones, toxins, and other biologically important substances.

The mice source segment is anticipated to witness the fastest CAGR over the forecast period, because of its small size and higher production rate. Mice have been the primary animal used in the production of antibodies. The primary element driving their extensive use is the structural resemblance between human and mouse antibodies, which can greatly accelerate their uptake for research and development applications.

Application Insights

The oncology segment held the largest share, 32.67%, in 2024, driven by the rising cancer burden and growing use of antibodies in tumor marker detection, biomarker discovery, and targeted therapy development. According to the National Cancer Institute, Cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. Moreover, strong R&D investments and precision oncology initiatives are expected to sustain this dominance.

The stem cells segment is expected to grow significantly over the forecast period, owing to increased global stem cell research activities. The growth is also attributable to increased adoption of stem cells for treating various chronic ailments such as diabetes, cancer, Alzheimer’s, Parkinson’s, rheumatoid arthritis, and kidney and lung diseases. Furthermore, antibodies are also used for stem cell research areas that include disease modeling, developmental biology, drug screening, reprogramming techniques development, and cell therapy, which can positively affect market growth.

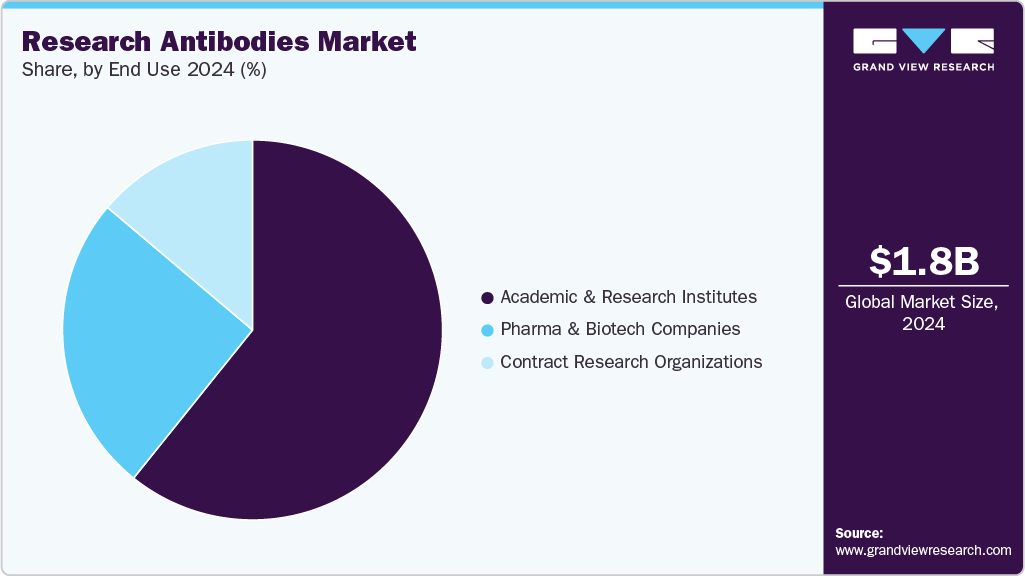

End Use Insights

The academic & research institutions captured the highest revenue share of 60.77% in 2024. This can be attributed to the increased scientific initiatives by such centers to develop novel therapies and tests for chronic diseases. For instance, in January 2021, researchers at The University of Texas Medical Branch at Galveston (UTMB Health) and The University of Texas Health Science Center at Houston (UTHealth) discovered two novel antibodies, CoV2-06 and CoV2-14, for a potential novel antibody therapy for COVID-19 infection. Such initiatives can positively affect the segment growth over the forecast period.

The pharmaceutical and biotechnology companies segment is expected to grow at a significant CAGR over the forecast period. This can be attributed to the increase in R&D activities in the life sciences domain. Furthermore, the increasing importance of antibodies in the development of novel biologic products and the rising demand for quality control applications for various techniques, such as PCR and electrophoresis, are likely to boost the segment's growth.

Regional Insights

North America dominated the global research antibodies market with a revenue share of 40.19% in 2024, supported by strong healthcare spending, robust government and private R&D investments, and a high concentration of pharmaceutical and biotech companies. The region benefits from widespread clinical adoption of antibody-based tools in genomics, proteomics, and precision medicine.

U.S. Research Antibodies Market Trends

The U.S. remains the largest contributor to the regional growth of the research antibodies industry, driven by its dense network of academic research centers, extensive NIH funding, and active biopharma pipeline. Research in immunology, neurology, and oncology extensively uses antibodies, and drug discovery and biomarker development initiatives are driving up demand for them. The FDA's approval of antibody-linked diagnostics and recent advancements in antibody-based assays strengthen the nation's position as a leader.

Europe Research Antibodies Market Trends

Europe shows steady expansion, supported by well-established research ecosystems, collaborative EU-funded programs, and growing demand for reproducible antibodies in translational research. European academic centers and biotech hubs are heavily engaged in biomarker discovery, antibody validation, and large-scale cohort studies. Harmonized regulatory pathways and increased adoption of open-science standards are helping Europe strengthen its role in high-quality antibody research.

The UK research antibodies market benefits from strong academic-industry collaborations, national genomics programs, and the NHS infrastructure that supports translational antibody research. Focus areas that incorporate antibody-based tools into diagnostics and therapeutic development include immunology, neurobiology, and oncology. Targeted government funding and venture-backed biotech startups are expediting the commercialization of antibody-based assays and companion diagnostics.

The research antibodies market in Germany is expected to grow over the forecast period. Germany represents a key European hub with strong demand for antibodies in biologics R&D, immuno-oncology, and biomarker-driven clinical trials. German research institutes and pharma companies are leaders in validating novel recombinant and monoclonal antibodies for drug discovery and advanced diagnostics. Strategic partnerships between academia and industry continue to accelerate antibody innovation and commercialization.

Asia Pacific Research Antibodies Market Trends

The Asia Pacific research antibodies industry is projected to grow at the fastest CAGR of 9.75% during the forecast period, fueled by rising investments in biomedical research, expanding biotech hubs, and government-backed initiatives in China, India, Japan, and South Korea. The region's use of antibodies is being strengthened by the growing use of proteomics and genomics in academic institutions as well as the rising demand for precision medicine. Local manufacturing capabilities and international partnerships are also accelerating adoption. For instance, in August 2025, India's BRIC-THSTI invited biopharma partners to co-develop a novel monoclonal antibody drug, advancing it from research to GMP manufacturing and IND-enabling studies under a ₹10 crore project.

The China research antibodies market is rapidly expanding as a major space, supported by favorable government funding, fast-track regulatory approvals, and heavy investment in genomics and precision medicine. Local biotech companies and research institutions are advancing recombinant and monoclonal antibody platforms tailored to cancer and infectious disease research. Strategic partnerships with Western firms are boosting technology transfer and scaling domestic production.

The research antibodies market in Japan is expected to grow during the forecast period. Japan’s strong biomedical research infrastructure, focus on precision medicine, and aging population drive demand for advanced antibody products. The use of antibodies in translational research is growing, especially in neurology, age-related diseases, and oncology. Academic-industry collaborations and government funding for antibody innovation programs reinforce Japan’s role as a leading Asia-Pacific market.

MEA Research Antibodies Market Trends

The MEA research antibodies industry is in an early but growing phase, driven by rising investment in healthcare infrastructure, academic collaborations, and research funding in major hubs such as Saudi Arabia, the UAE, and South Africa. Although adoption is concentrated in leading urban centers, antibody demand for infectious disease research and precision medicine programs is rising. International collaborations are gradually building local capacity for antibody production and utilization.

The Kuwait research antibodies market is projected to grow over the forecast period. Kuwait’s research antibody market is developing and is supported by government-led healthcare modernization and targeted investments in life sciences. Strategic partnerships with academic institutions and international research organizations make the introduction of sophisticated antibody-based assays for drug discovery and diagnostics possible. Early-stage precision medicine and biomarker development initiatives are creating new growth opportunities for global antibody suppliers entering the market.

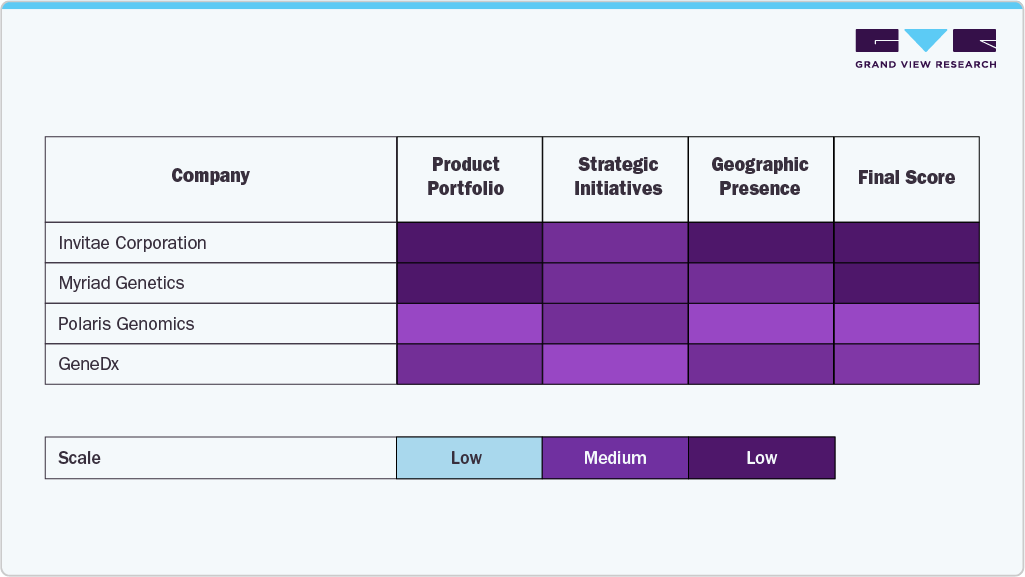

Key Research Antibodies Company Insights

The research antibodies industry is characterized by several well-established players that dominate through extensive product portfolios, global reach, and continuous investments in research and development. By providing high-quality, validated antibodies for a variety of applications, including oncology, immunology, neuroscience, and infectious disease research, industry leaders like Abcam Plc, Merck KGaA, Thermo Fisher Scientific, Inc., Cell Signaling Technology, Inc., and Santa Cruz Biotechnology Inc. maintain a substantial market presence. Their emphasis on reproducibility, proprietary platforms, and robust distribution networks has strengthened their leadership positions.

By creating novel and application-specific antibody solutions, such as recombinant antibodies, secondary antibodies, and assay kits, businesses like PerkinElmer, Inc., Becton, Dickinson and Company, Bio-Techne Corporation, Proteintech Group, Inc., and Jackson ImmunoResearch Inc. are actively growing their footprints.

As a result, the market for research antibodies sees a dynamic balance between established leaders and up-and-coming innovators. The industry is changing due to increased competition from technical developments in antibody engineering and validation. Businesses are well-positioned to provide long-term value in this quickly growing industry if they can effectively combine innovation with customer-focused solutions and strong technical support.

Key Research Antibodies Companies:

The following are the leading companies in the research antibodies market. These companies collectively hold the largest market share and dictate industry trends.

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson ImmunoResearch Inc.

Recent Developments

-

In April 2025, Germany-based Merck KGaA acquired Stamford, U.S.-based SpringWorks Therapeutics for USD 3.9 billion, gaining its rare cancer and tumor drugs, including FDA-approved Ogsiveo and Gomekli, to expand global oncology offerings.

-

In August 2023, U.S.-based Danaher acquired UK biotech Abcam for USD 5.7 billion, aiming to expand its Life Sciences division with Abcam’s antibody portfolio and life sciences tools, which serve over 750,000 researchers.

Research Antibodies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.94 billion

Revenue forecast in 2033

USD 3.91 billion

Growth rate

CAGR of 9.15% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, specificity, technology, source, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abcam Plc; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; PerkinElmer, Inc.; Becton, Dickinson and Company; Bio-Techne Corporation; Proteintech Group, Inc.; Jackson ImmunoResearch Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Research Antibodies Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global research antibodies market report based on product, specificity, technology, source, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Primary Antibodies

-

Secondary Antibodies

-

-

Specificity Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Immunohistochemistry

-

Immunofluorescence

-

Western Blotting

-

Flow Cytometry

-

Immunoprecipitation

-

ELISA

-

Others

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Mouse

-

Rabbit

-

Goat

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Diseases

-

Immunology

-

Oncology

-

Stem Cells

-

Neurobiology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Primary antibodies dominated the research antibodies market with a share of 74.51% in 2024. This is attributable to high adoption due to benefits such as easy availability, greater specificity, and suitability to various research needs.

b. Some key players operating in the research antibodies market include PerkinElmer, Inc.; F.Hoffmann La Roche Ltd.; Thermo Fisher Scientific; Merck Millipore; Bio-Rad Laboratories; Abcam PLC; BD; Lonza Group; Cell Signalling Technology, Inc.; and Agilent Technologies.

b. Key factors that are driving the research antibodies market growth include a rise in the number of R&D activities by various biopharmaceutical and pharmaceutical companies and increasing incidence of neurodegenerative diseases such as Huntington’s disease, Multiple Sclerosis, and Parkinson’s disease.

b. The global research antibodies market size was estimated at USD 1.79 billion in 2024 and is expected to reach USD 1.94 billion in 2025.

b. The global research antibodies market is expected to grow at a compound annual growth rate of 9.15% from 2025 to 2033 to reach USD 3.91 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.