- Home

- »

- Electronic & Electrical

- »

-

Residential Air Purifier Market Size Report, 2022-2030GVR Report cover

![Residential Air Purifier Market Size, Share & Trends Report]()

Residential Air Purifier Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Standalone/Portable And In-Duct), By Technology (HEPA, Activated Carbon, Ionic Filters), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-912-2

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

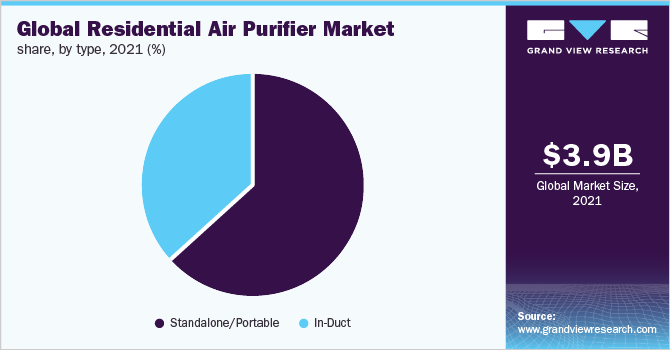

The global residential air purifier market size was valued at USD 3.9 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030. The increasing prevalence of airborne diseases and increasing levels of pollution in urban areas across the globe have been the key factors favoring the growth of this market for residential air purifiers. Also, the global population is growing health consciousness mingled with the improving standards of living and rising disposable incomes. There is a rising awareness pertaining to the harmful impact of air pollution is also driving the adoption of air pollution control equipment, especially in developing regions across the globe. Growing demand for a healthy lifestyle, especially among the urban youth, is expected to be a significant contributor to the growth of this market in the coming years.

According to the World Health Organization (WHO), 9 out of 10 people breathe contaminated air containing high level of pollutants. The organization states that outdoor and indoor air pollution leads to around 7 million premature deaths every year, among which 3.8 million people die as a result of exposure to indoor air pollution. High levels of indoor pollutants and PM2.5 increase the risk of respiratory diseases, heart diseases, cancer, dizziness, fatigue, asthma, and eye irritation among other ailments. Deteriorating air quality across the major regions and growing awareness regarding the benefits and necessity of having air purifiers are expected to drive the growth of the market for residential air purifiers over the forecast period.

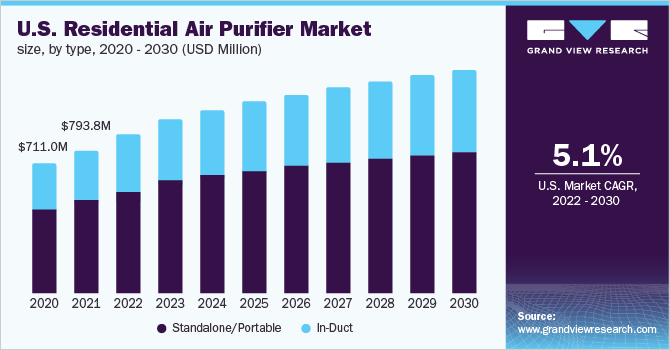

In the U.S., the increasing prevalence of airborne diseases coupled with the rising air pollution levels is anticipated to fuel demand for residential air purifiers. The HEPA technology segment, being the most effective technology for trapping harmful airborne particles, is expected to dominate the U.S. market for residential air purifiers over the forecast period. The U.S. states such as California and New Jersey have regulations for indoor air quality. For instance, the New Jersey Indoor Air Quality standard, N.J.A.C. 12:100-13 (2007) sets guidelines and standards related to indoor air quality during working hours in employee-occupied buildings. The California state-level indoor air quality program focuses on identifying and studying public health problems associated with indoor environments as well as promoting healthy indoor environments in the state.

Technology Insights

In terms of revenue, the High-efficiency Particulate Absorbing (HEPA) filter technology segment held the largest revenue share of around 40.0% in 2021. This is mainly attributed to the high performance and reliability of HEPA filters to effectively trap and remove airborne particles. HEPA are used to remove up to 99.97% of all pollutants having sizes 0.3 microns or larger. The HEPA filtration technology was initially developed by the US Atomic Energy Commission for the nuclear industry for the filtration of harmful radioactive particles. These filters are highly efficient in trapping airborne particles, including pollen, dust, smoke, and bio-contaminants.

The high-quality and reliability of HEPA filters to remove airborne particles is anticipated to fuel its adoption in the residential air purifier market. However, other contaminants in the air such as Volatile Organic Compounds (VOCs), viruses, bacteria, and mold are not trapped in HEPA filters. This, in turn, results in the adoption of HEPA filter along with activated carbon or ionic filters for removing aforementioned contaminants. Activated carbon or activated charcoal filters technology is another substantial segment that is estimated to register a CAGR of around 6.8% during the forecast period.

Activated carbon air filters have excellent trapping capacity owing to the high surface area of the carbon granules and microporosity, which makes them very effective in trapping gases, fumes, odors. These types of filters are used for absorbing gases and odors from cooking, mold, chemicals, pets, and smoke. Some of the other air purification technologies included in this report study are UV irradiation, photocatalytic oxidation, ozonation, non-thermal plasma, and electrostatic precipitators. Ultraviolet light technology uses UV lamps to destroy microorganisms such as mold (fungi), viruses, bacteria, and germs that pass through the lamp. This technology is recommended by the Centers for Disease Control and Prevention (CDC) for preventing diseases and illnesses.

Type Insights

The standalone or portable air purifier segment dominated the market for residential air purifiers and accounted for the largest revenue share of around 65.5% in 2021. The dominance of standalone air purifiers is mainly attributed to its portability, simple operation without any structural changes in the house and easy maintenance. Also, the wide range of capabilities offered by the standalone air purifiers, such as smart controls, sensors, multiple filtration layers and ability to move around, make it the most suitable for household or residential applications. Poor indoor air quality hampers productivity causes illness and increases the changes of chronic pulmonary disorders, which makes it essential to have a portable air purifier to breathe-in clean air.

The in-duct air purifiers segment is expected to witness a CAGR of around 6.5% in the market for residential air purifiers during the forecast period. The healthy growth of this segment is primarily due to the rising awareness pertaining to the lung diseases associated with deteriorating outdoor air quality. With growing health consciousness mingled with the increasing disposable income of people across the globe, there is rising spending on home improvement and installation of air purification in the overall HAVC system of the residential area. This air purifier system works furnace unit and central HVAC to filter the air entering into the home. It ensures that the air entering the rooms is sanitized.

Regional Insights

Asia Pacific dominated the market for residential air purifiers and accounted for the largest revenue share of around 42.0% in 2021. Some of the major factors favoring the dominance of the region include robust urbanization and rapid industrialization, along with a growing population, increasing disposable income, and overall income levels. Also, there are growing concerns over increasing smog and worsening air pollution, mainly in major countries such as India and China. Furthermore, the growing awareness and government interventions in mitigating the impacts of air pollution on the population has resulted in increasing the adoption of air purifiers, thereby complementing the regional market growth. According to the Clean Air Coalition report published in 2019, over 35% of the global premature deaths from air pollution occurred in East Asia, followed by South Asia. Additionally, South Korea ranks the highest among OECD countries for an average annual PM 2.5 exposures as coal plants contribute over 40% of the country’s energy mix.

In North America, the market for residential air purifiers is estimated to expand at a CAGR of 5.3% over the forecast period. High penetration and increasing adoption of the residential air purifiers in the North American households in mainly attributed to the air quality policies such as establishing national ambient air quality standards by the U.S. EPA, the U.S. Clean Air Act, and comprehensive strategies for emission reduction by the Environment Canada. Such policy interventions are anticipated to offer new opportunities and growth avenues for residential air purifier manufacturers. Furthermore, the growing installation of comprehensive ambient air quality monitoring systems, coupled with the development and implementation of regulatory actions and organizing air quality management programs to create awareness among people, is expected to surge the demand for air purifiers in Mexico in the coming years.

Key Companies & Market Share Insights

The key players account for considerable revenue shares in the market for residential air purifiers and have a strong presence across the globe. The market is highly competitive with a substantial presence of both international and regional or domestic manufacturers. Companies in the market are focusing on various business strategies and initiatives such as mergers and acquisitions, product development, new product launch, technological investments, and distribution agreement to strengthen their position in this market and expand revenue share. For instance, in March 2021, Blueair, a brand owned by Unilever, launched its DustMagnet air purifier series. These air purifiers with patent-pending technology attract airborne dust before it settles on surfaces and floors. These air purifiers seamlessly blend into décor, serving both as an air purifier as well as a piece of furniture in the home. Some of the prominent players in the residential air purifier market include:

-

DAIKIN INDUSTRIES, Ltd.

-

Sharp Home (Sharp Corporation)

-

Honeywell International Inc.

-

Panasonic Corporation

-

LG Electronics

-

Koninklijke Philips N.V.

-

Dyson

-

SAMSUNG

-

Whirlpool

-

Blueair (Unilever)

Residential Air Purifier Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.4 billion

Revenue forecast in 2030

USD 6.7 billion

Growth Rate

CAGR of 6.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; China; Japan; Brazil; Saudi Arabia

Key companies profiled

DAIKIN INDUSTRIES, Ltd.; Sharp Home (Sharp Corporation); Honeywell International Inc.; Panasonic Corporation; LG Electronics; Koninklijke Philips N.V.; Dyson; SAMSUNG; Whirlpool; Blueair (Unilever)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global residential air purifier market on the basis of type, technology, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Standalone/Portable

-

In-Duct

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

HEPA

-

Activated Carbon

-

Ionic Filters

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global residential air purifier market was estimated at USD 3.9 billion in 2021 and is expected to reach USD 4.4 billion in 2022.

b. The global residential air purifier market is expected to grow at a compound annual growth rate of 6.2% from 2022 to 2030 to reach USD 6.7 billion by 2030.

b. The Asia Pacific dominated the residential air purifier market with a share of 42% in 2021. This is attributed to the robust urbanization and rapid industrialization, along with a growing population, increasing disposable income, and overall income levels.

b. Some key players operating in the residential air purifier market includes DAIKIN INDUSTRIES, Ltd.; Sharp Home (Sharp Corporation); Honeywell International Inc.; Panasonic Corporation; LG Electronics; Koninklijke Philips N.V.; Dyson; SAMSUNG; Whirlpool; and Blueair (Unilever)

b. Key factors that are driving the residential air purifier market growth include the increasing prevalence of airborne diseases and increasing levels pollution in urban areas across the globe

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.