- Home

- »

- IT Services & Applications

- »

-

Retail Audience Measurement Solutions Market Report, 2033GVR Report cover

![Retail Audience Measurement Solutions Market Size, Share & Trends Report]()

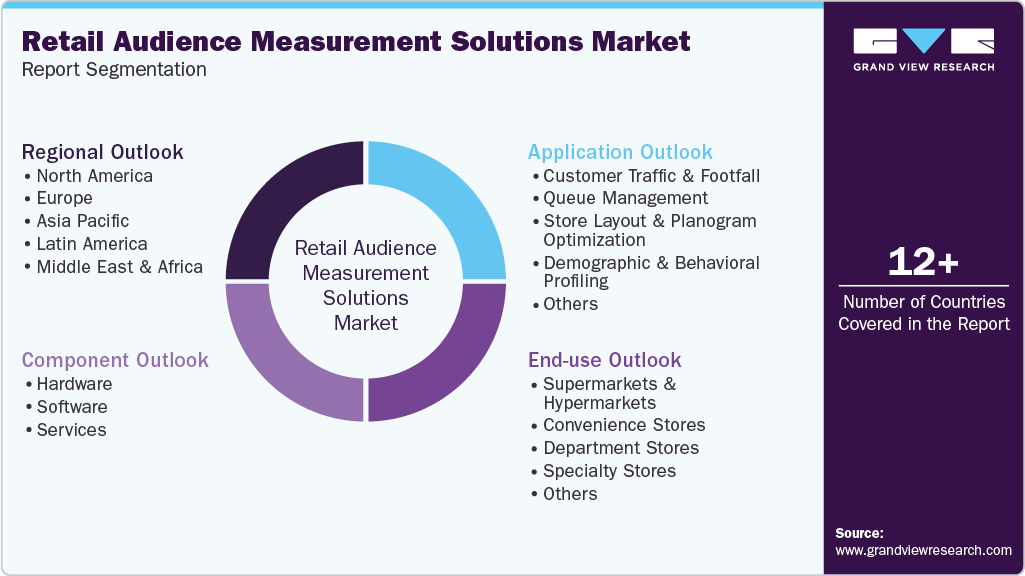

Retail Audience Measurement Solutions Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Customer Traffic & Footfall, Queue Management), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-678-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Audience Measurement Solutions Market Summary

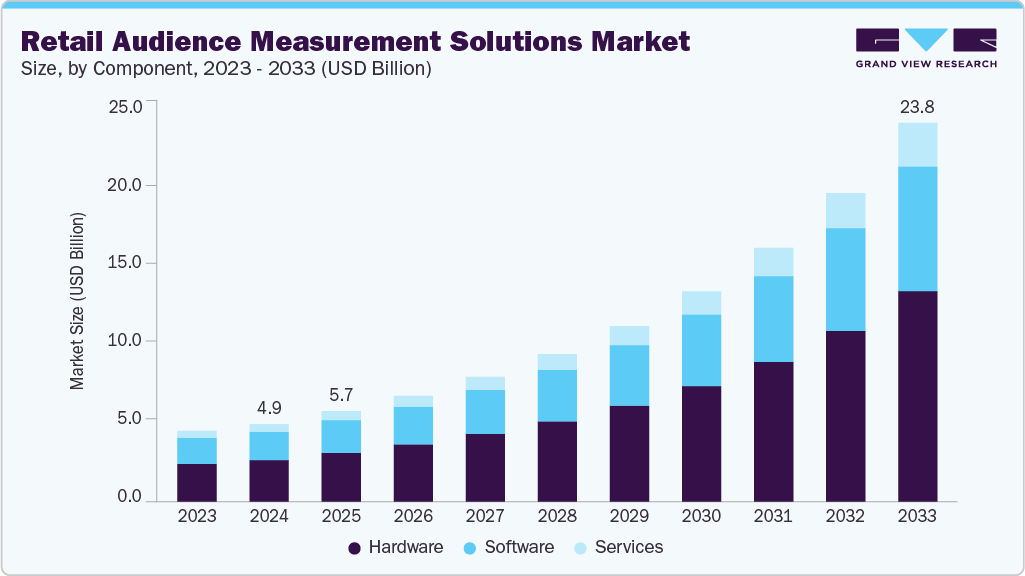

The global retail audience measurement solutions market size was estimated at USD 4.86 billion in 2024 and is projected to reach USD 23.76 billion by 2033, growing at a CAGR of 19.6% from 2025 to 2033. The increasing adoption of digital transformation initiatives and the rising volume and complexity of business data are the key factors driving the market growth.

Key Market Trends & Insights

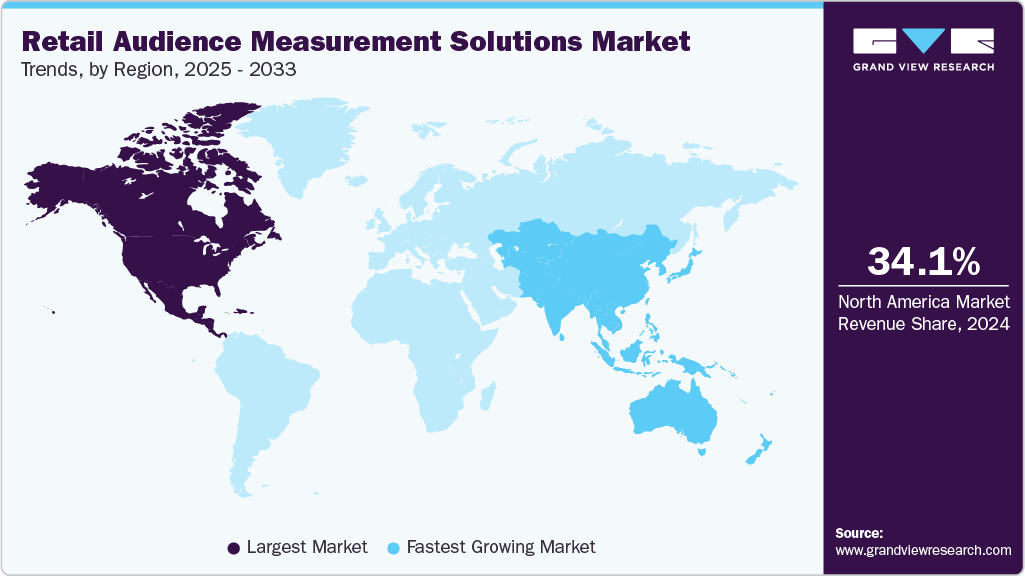

- North America held a 34.1% revenue share of the global retail audience measurement solutions market in 2024.

- The U.S. dominated the retail audience measurement solutions industry in 2024.

- By component, the software segment held the largest revenue share of 53.5% in 2024.

- By application, the customer traffic & footfall segment dominated the retail audience measurement solutions industry with a revenue share of over 29.0% in 2024.

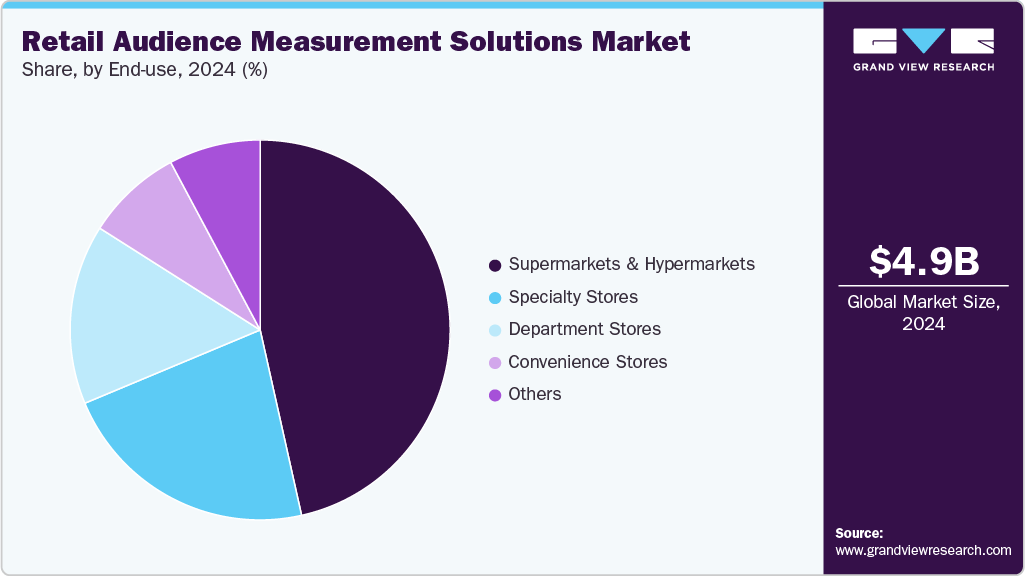

- By end-use, the supermarkets & hypermarkets segment dominated the retail audience measurement solutions market with the revenue share of over 39.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.86 Billion

- 2033 Projected Market Size: USD 23.76 Billion

- CAGR (2025-2033): 19.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The demand for in-store analytics has risen in recent years, as physical retailers seek to compete more effectively with e-commerce platforms by leveraging data-driven insights. Online retailers benefit from a vast ecosystem of tracking tools that capture detailed user behavior, monitoring every click, page view, and scroll. In contrast, physical stores traditionally lacked visibility into how customers navigate the space, engage with products, or make purchasing decisions. This gap is rapidly being addressed through the adoption of advanced audience measurement technologies. Convenience stores are deploying smart cameras, IoT sensors, heatmaps, and AI-driven video analytics to monitor footfall, dwell time, zone engagement, and in-store conversion rates. These tools generate granular insights into customer behavior, including how many people enter the store, where they spend time, what attracts their attention, and how they move between different zones.The rapid expansion of retail media networks (RMNs) is reshaping how brands connect with shoppers within physical retail environments. As in-store digital screens, kiosks, and smart displays become more prevalent, retailers are under pressure to prove the effectiveness of these advertising platforms. Audience measurement solutions play a pivotal role by enabling retailers to validate ad impressions in real time and match them to specific shopper demographics and behaviors. These tools offer granular insights such as dwell time near displays, gender and age profiling, and even the correlation between ad exposure and sales uplift. This level of visibility transforms retail media from a speculative investment into a performance-driven channel. Brands can assess which creative assets and locations yield the highest ROI, while retailers can dynamically adjust content based on audience behavior.

The growing emphasis on smart stores and experience-centric retailing is emerging as a major opportunity for the retail audience measurement solutions industry. As e-commerce continues to dominate transactional retail, physical stores are evolving into immersive environments where experience, discovery, and personalization drive footfall and conversion. Convenience stores are increasingly integrating interactive displays, touchscreens, digital kiosks, smart shelves, and ambient technologies to engage shoppers in more meaningful and memorable ways. This transformation significantly increases the need for real-time audience data to inform decisions around space utilization, product placement, and promotional timing.

Retail audience measurement solutions powered by AI-enabled cameras, IoT sensors, and edge analytics play a crucial role in capturing rich behavioral and demographic insights such as foot traffic patterns, dwell time, age and gender breakdowns, product engagement, and response to visual merchandising. These insights allow retailers to continuously optimize store layouts, reposition high-interest products to maximize visibility, and tailor digital signage or kiosk messaging to match the shopper’s profile and context.

Convenience Stores stores across the U.S. are investing in implementing AI and opening new autonomous stores across the region. For instance, in June 2025, VenHub announced the launch of a 24/7 AI-powered smart store at the Metro Transit Center at LAX, marking a significant step in autonomous retail within travel and transportation hubs. The store uses advanced AI, robotics, and computer vision to enable fully unattended shopping, enhancing convenience for travelers. This initiative reflects the growing adoption of smart, data-driven retail formats that align with shifting consumer preferences for speed, personalization, and frictionless experiences.

Additionally, Walmart and Amazon are accelerating the adoption of agentic AI and robotics to enhance automation and customer loyalty. Both retailers are integrating intelligent systems to streamline supply chains, personalize shopping, and reduce delivery times. By investing in AI-powered decision-making and autonomous technologies, they aim to boost operational efficiency and improve customer experiences. This signals a broader industry shift toward intelligent, responsive retail ecosystems driven by next-gen automation and data analytics.

Component Insights

The software segment dominated the retail audience measurement solutions market with a market share of 53.5% in 2024. As retailers strive to deliver seamless customer experiences across in-store, online, and media platforms, there is a rising need for software that can track customer journeys across all touchpoints. These platforms integrate data from in-store sensors, e-commerce platforms, and digital advertising channels to build a comprehensive view of audience behavior. This enables retailers to understand how in-store exposure, online engagement, and ad interactions influence sales performance. By linking audience exposure data with advertising outcomes, retailers can accurately measure campaign effectiveness and optimize future media investments.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The expansion of retail audience measurement solutions into emerging markets is driving significant growth in the services segment, particularly through the provision of consulting, training, and localization support. In regions such as Asia-Pacific, Latin America, and the Middle East & Africa, many retailers lack the in-house technical expertise required to deploy and operate advanced analytics systems. To address this gap, vendors are offering tailored services that help with technology adoption, employee training, and adapting solutions to local languages, cultural norms, and regulatory frameworks.

Application Insights

The customer traffic & footfall segment dominated the retail audience measurement solutions industry with a revenue share of over 29.0% in 2024. Convenience stores are increasingly leveraging footfall data to gain insights into store traffic patterns, conversion rates, and peak shopping hours. This data enables them to make informed decisions regarding staff scheduling, store layout changes, and product placement based on actual customer movement. By aligning operations with real-time traffic trends, retailers can enhance customer service, minimize waiting times, and maximize sales opportunities. Ultimately, the use of footfall analytics helps improve overall store performance, making operations more efficient and responsive to shopper behavior throughout the day.

The store layout & planogram optimization segment is projected to grow significantly over the forecast period. The store layout & planogram optimization segment is growing rapidly as retailers adopt audience measurement tools to make data-driven merchandising decisions. Technologies such as smart cameras, sensors, and heat-mapping systems provide real-time insights into customer movement, dwell time, and product interactions. These analytics help retailers understand how shoppers navigate the store and which displays or aisles attract the most attention. This shift from intuition to data-backed planning enhances the overall shopping experience and increases store effectiveness.

End-use Insights

The supermarkets & hypermarkets segment dominated the retail audience measurement solutions market with the revenue share of over 39.0% in 2024. The growing integration of omnichannel retail strategies is pushing supermarkets and hypermarkets to bridge the gap between online and offline customer journeys. Audience measurement solutions help retailers align in-store behavior with online profiles, creating a more cohesive view of customer preferences and purchasing patterns. This integrated understanding supports cross-channel marketing campaigns, loyalty programs, and dynamic pricing strategies that reflect both digital and physical engagement.

The department stores segment is projected to be the fastest-growing segment from 2025 to 2033. The growing focus on personalization and targeted content delivery is another strong driver. Department stores increasingly use digital signage and interactive displays to communicate with shoppers, and audience measurement tools enable these systems to be more intelligent and responsive. This level of adaptive engagement increases the relevance of marketing messages. It improves customer satisfaction while also allowing advertisers and in-store brands to measure the effectiveness of their campaigns with precision.

Regional Insights

North America dominated the retail audience measurement solutions market with a revenue share of 34.1% in 2024. The growth is strongly driven by strategic alliances that merge AI-powered analytics with in-store digital infrastructure, enabling retailers to transform physical spaces into real-time data ecosystems. For instance, in May 2025, NielsenIQ and VusionGroup entered a strategic alliance aimed at integrating NielsenIQ's audience and behavioral insights with Vusion's digital shelf technologies, including electronic shelf labels (ESLs) and computer vision systems. This partnership highlights the region's push toward digitizing the in-store experience, where retailers gain visibility into shopper engagement and conversion patterns directly at the shelf level. In conclusion, these collaborations highlight the growing demand for data-rich retail environments in North America, firmly establishing audience measurement as a foundational capability for next-generation, insight-driven brick-and-mortar retail operations.

U.S. Retail Audience Measurement Solutions Market Trends

The U.S. dominated the retail audience measurement solutions industry in 2024. Retail media networks are also playing a significant role in fueling the adoption of audience measurement tools. As major retailers in the U.S., such as Walmart, Target, and Kroger, build them in-store media ecosystems to generate new revenue streams, they require accurate and transparent audience metrics to attract advertisers. Brands investing in in-store promotions or digital shelf displays want data on impressions, engagement, and demographic reach, similar to what they receive from digital ad platforms. Retail audience measurement solutions provide the necessary analytics to support campaign performance evaluation, budget justification, and optimization, making them an essential component of the growing retail media landscape.

Asia Pacific Retail Audience Measurement Solutions Market Trends

The Asia Pacific retail audience measurement solutions industry is expected to grow at the fastest CAGR of 21.5% over the forecast period. The regional market is accelerating rapidly, driven by surging AI-enabled retail infrastructure, growing emphasis on performance-driven retail media, and the urgency of delivering seamless omnichannel experiences. As consumers increasingly engage through mobile commerce and smart devices, retailers across the region are deploying advanced footfall analytics, in‑store digital displays, and edge‑AI computer vision tools to capture real-time behavior insights and optimize engagement across offline and online touchpoints.

The retail audience measurement solutions market in China is growing significantly during the forecast period. The market is expanding rapidly, driven by a multifaceted ecosystem that blends smart retail innovation, retail media monetization, and AI-led operational optimization. The country’s vast retail media networks, spanning e-commerce giants like Alibaba and JD.com, are establishing measurement standards that are directly influencing physical store analytics. Additionally, China’s strong government backing for smart cities and digital store infrastructure provides a supportive landscape for deploying edge-based AI cameras, shelf-monitoring tools, and edge computing platforms. Moreover, the shift toward private-domain data strategies, such as WeChat mini-programs and loyalty platforms, further fuels demand for in-store audience analytics capable of linking offline behavior to broader data ecosystems.

Europe Retail Audience Measurement Solutions Market Trends

The retail audience measurement solutions industry in Europe is expected to register considerable growth from 2025 to 2033. The growth is driven by the growing adoption of structured digitalization in physical retail, growing pressure for performance-based in-store media, and the region’s commitment to data governance. European retailers are increasingly investing in AI-powered sensors, demographic analytics, and real-time in-store engagement tracking tools to optimize campaign ROI, drive merchandising decisions, and unify shopper intelligence across physical and digital channels.

The retail audience measurement solutions market in the UK is growing significantly during the forecast period. The market is growing combination of privacy-conscious innovation, retail media integration, and strategic technology partnerships. The UK retailers and media networks are rapidly adopting in-store analytics such as demographic detection, attention measurement, and footfall tracking to enhance campaign accountability and drive precision retail media monetization.

Key Retail Audience Measurement Solutions Company Insights

Some of the key companies operating in the market include Dor Technologies and Quividi.

-

Dor Technologies specializes in providing accurate, actionable foot traffic data through a novel battery-powered thermal sensing device. The company’s solution helps retailers and facility managers understand in-store traffic patterns, peak hours, conversion rates, and marketing effectiveness via an intuitive analytics dashboard. Dor’s technology is designed to be affordable, easy to install without professional help or Wi-Fi, and highly accurate, enabling retailers to optimize staffing, improve sales, and enhance customer experience.

-

Quividi specializes in AI and computer vision-based platforms that provide real-time audience measurement and shopper engagement solutions for Digital Out-of-Home (DOOH) and retail media. Their platform delivers granular insights such as footfall, demographic segmentation, dwell time, and attention metrics, supporting both traditional and programmatic DOOH channels.

V-Count and Walkbase are some of the emerging participants in the target market.

-

V-Count specializes in AI-powered visitor analytics and people-counting technology, serving over 600 customers across 128 countries. The company designs, develops, and manufactures its own hardware and software solutions, offering highly accurate people counting, demographic analysis, queue management, real-time occupancy tracking, heatmaps, and storefront analytics. V-Count’s patented AI-on-chip technology enables features such as gender and age recognition, staff exclusion, and group counting, all while ensuring GDPR-compliant data privacy.

-

Walkbase is a provider of advanced in-store analytics and marketing automation solutions for retailers, a subsidiary of STRATACACHE. The company specializes in transforming brick-and-mortar retail by leveraging highly precise indoor location technologies and real-time sensor data to analyze customer behavior, such as pathing, dwell time, and engagement. Walkbase’s platform enables retailers to optimize store operations, marketing effectiveness, and customer experience by linking online and offline customer journeys, delivering personalized in-store marketing, and measuring the impact of retail media networks.

Key Retail Audience Measurement Solutions Companies

The following are the leading companies in the retail audience measurement solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Advertima

- Broox Technologies S.L.U.

- Nielsen

- Dor Technologies

- Engagis Pty Ltd

- Macnica, Inc.

- AdQuick

- Kantar

- Quividi

- Raydiant (Sightcorp)

- Convenience StoresNext

- V-Count

- Walkbase

Recent Developments

-

In May 2025, Advertima partnered with Publicis Media Middle East to integrate its real-time audience targeting and measurement capabilities into in-store retail media campaigns, enabling advertisers to buy physical retail media using audience segments just like online ads. This collaboration bridges the gap between in-store shopper behavior and digital advertising, enhancing cross-channel campaign performance and measurability.

-

In March 2025, Nielsen expanded its partnership with LiveRamp to make its Marketing Cloud audience segments directly accessible through LiveRamp’s Data Marketplace. This integration allows advertisers and publishers to seamlessly activate Nielsen’s retail, media, and demographic data for more targeted, cross-channel advertising campaigns.

-

In January 2025, Walkbase launched a new millimeter-wave sensor solution at NRF 2025, offering camera-free, anonymous tracking of customer movements, dwell time, and engagement in retail spaces. This innovation enhances privacy compliance while delivering highly accurate in-store audience measurement even in low-light or visually obstructed environments.

-

In February 2024, Quividi launched its Navigator Dashboards, a suite of advanced AI-powered tools that provide detailed performance analytics, benchmarking, and predictive insights for in-store and digital-out-of-home (DOOH) campaigns. These dashboards help retailers and advertisers optimize content and audience engagement with intuitive, shareable visualizations.

Retail Audience Measurement Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.67 billion

Revenue forecast in 2033

USD 23.76 billion

Growth rate

CAGR of 19.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Poland; Romania; Spain; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Advertima; Broox Technologies S.L.U.; Nielsen; Dor Technologies; Engagis Pty Ltd; Macnica, Inc.; AdQuick; Kantar; Quividi; Raydiant (Sightcorp); Convenience StoresNext; V-Count; Walkbase

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Audience Measurement Solutions Market Report Segmentation

This report forecasts revenue growths at the global, regional, and country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global retail audience measurement solutions market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Camera

-

Wi-Fi/Bluetooth beacons

-

Sensors

-

Media Player

-

Others

-

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Customer Traffic & Footfall

-

Queue Management

-

Store Layout & Planogram Optimization

-

Demographic & Behavioral Profiling

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Department Stores

-

Specialty Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Poland

-

Romania

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail audience measurement solutions market size was estimated at USD 4.86 billion in 2024 and is expected to reach USD 5.67 billion in 2025.

b. The global retail audience measurement solutions market is expected to grow at a compound annual growth rate of 20.8% from 2025 to 2033 to reach USD 23.76 billion by 2033.

b. The software segment dominated the retail audience measurement solutions market with a market share of 53.5% in 2024. As retailers strive to deliver seamless customer experiences across in-store, online, and media platforms, there is a rising need for software that can track customer journeys across all touchpoints.

b. Some key players operating in the market include Advertima, Broox Technologies S.L.U., Nielsen, Dor Technologies, Engagis Pty Ltd , Macnica, Inc., AdQuick , Kantar , Quividi, Raydiant (Sightcorp), Convenience StoresNext, V-Count, Walkbase

b. Factors such as the increasing adoption of digital transformation initiatives and the rising volume and complexity of business data are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.