- Home

- »

- Plastics, Polymers & Resins

- »

-

Retort Pouch Market Size And Share, Industry Report, 2033GVR Report cover

![Retort Pouch Market Size, Share & Trends Report]()

Retort Pouch Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Polypropylene, Aluminum Foil, Polyethylene), By Packaging (Stand-up, Flat), By Closure (Tear Notch, Zipper, Spout), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-897-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retort Pouch Market Summary

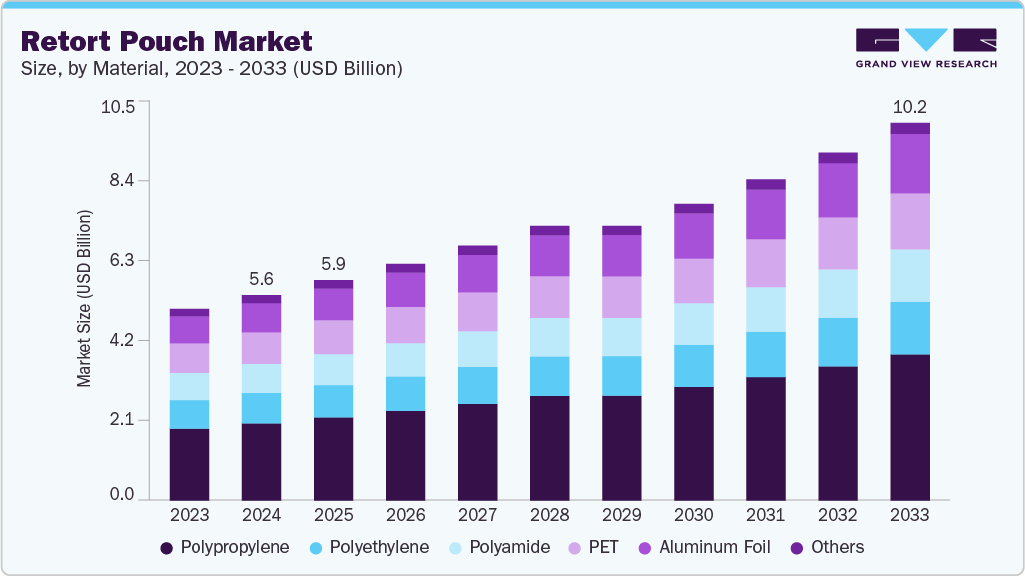

The global retort pouch market size was estimated at USD 5.55 billion in 2024 and is projected to reach USD 10.21 billion by 2033, growing at a CAGR of 7.0% from 2025 to 2033. Factors such as changing consumer lifestyle and preferences, growing middle-class population, and rising number of working people, are expected to drive the demand for packaged foods in the coming years, thereby acting as key drivers for the growth of the retort pouch industry.

Key Market Trends & Insights

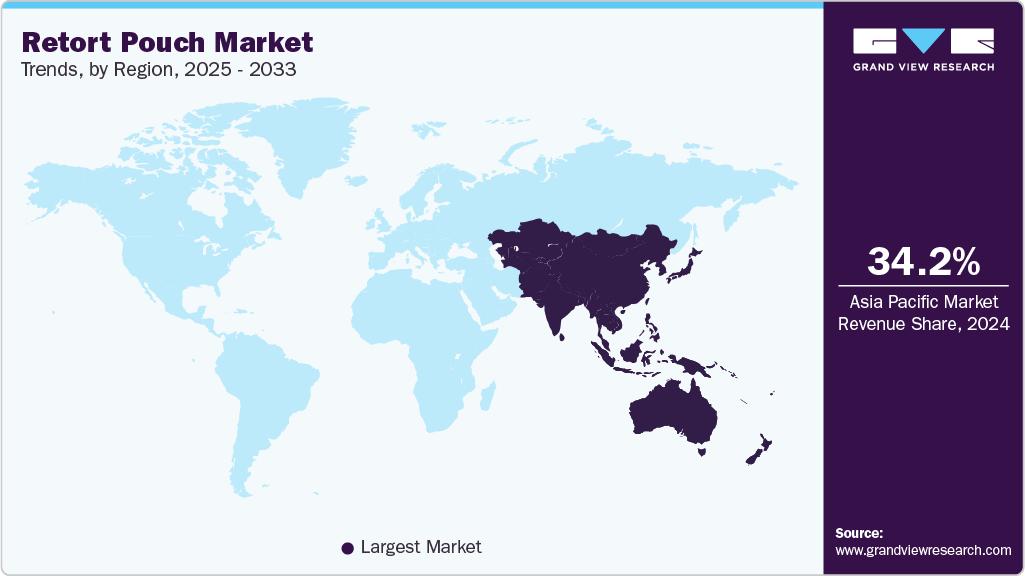

- Asia Pacific dominated the retort pouch market with the largest revenue share of 34.2% in 2024.

- The retort pouch market in Japan is expected to grow at a substantial CAGR of 7.9% from 2025 to 2033.

- By material, the aluminum foil segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue.

- By packaging, the stand-up Pouches is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

- By closure, the spout segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 5.55 Billion

- 2033 Projected Market Size: USD 10.21 Billion

- CAGR (2025-2033): 7.0%

- Asia Pacific: Largest Market in 2024

The growing demand for packaging solutions to extend the shelf-life of food products, such as meat, seafood, baby food, and pet food, is likely to augment the demand for retort packaging over the forecast period. Furthermore, growing demand for pouches owing to their light weight, convenience, and portability as compared to rigid packaging products, is further expected to have a positive impact on market growth.The global shift toward fast-paced lifestyles, especially in urban centers, has significantly fueled the demand for convenient meal solutions that require minimal preparation time. Retort pouches have emerged as a critical enabler of this trend. They offer a modern alternative to traditional packaging formats like metal cans or glass jars by providing a lightweight, easy-to-open, and easy-to-dispose solution. These pouches can withstand the retorting process (thermal sterilization at high temperatures), which allows food to be shelf-stable for up to 12 to 24 months without refrigeration or preservatives. This is particularly attractive in developing regions where cold chain infrastructure may be limited.

Moreover, categories such as ready-to-eat meals, instant soups, gravies, curries, and rice-based dishes benefit significantly from retort packaging. In addition, the COVID-19 pandemic further accelerated demand for shelf-stable food formats, reinforcing the long-term potential of retort pouch applications in emergency preparedness and e-commerce delivery.

The growth of the retort pouch industry is closely linked to continuous innovations in materials science and flexible packaging technology. Traditional retort pouches were constructed using aluminum foil layers to ensure barrier performance; however, newer high-barrier polymer films like EVOH (ethylene vinyl alcohol), polyamide (PA), and metallized PET are now being used to enhance transparency, recyclability, and microwaveability. These advanced multilayer laminates allow pouches to resist high temperatures during sterilization while blocking oxygen, moisture, and light to preserve flavor, texture, and nutrition.

In addition, pouch design has evolved to offer consumer-friendly features such as tear notches, re-sealable zippers, stand-up capabilities, and spouts for liquid content. These features improve functionality and user experience, making them preferable in both domestic and institutional consumption. For example, Japanese and Korean markets have widely adopted spouted retort pouches for sauces and beverages, while in Europe, transparent pouches are being adopted for baby food to allow visual inspection. These advancements expand the scope of retort pouch applications across both food and non-food industries.

Environmental and cost-related benefits are playing a central role in shifting manufacturer preferences from rigid packaging (like cans, jars, and trays) to flexible options like retort pouches. Compared to a metal can of similar volume, a retort pouch uses up to 70% less material by weight, leading to a significant reduction in transportation emissions and energy consumption. Their space-saving form factor also allows better pallet optimization and warehouse efficiency. According to Life Cycle Analysis (LCA) studies, retort pouches generate up to 60% fewer CO₂ emissions than cans during their lifecycle.

Moreover, less water and energy are required during production and sterilization. This aligns with corporate sustainability goals and global initiatives like Extended Producer Responsibility (EPR), which are pushing manufacturers to reduce packaging waste. With growing awareness among environmentally conscious consumers and tightening regulations around plastic and packaging waste-especially in Europe and North America-brands that use retort pouches position themselves as forward-thinking and sustainable. Additionally, for emerging businesses, retort pouches offer cost advantages in transportation and storage, which is especially critical in price-sensitive markets such as India, Indonesia, and Brazil.

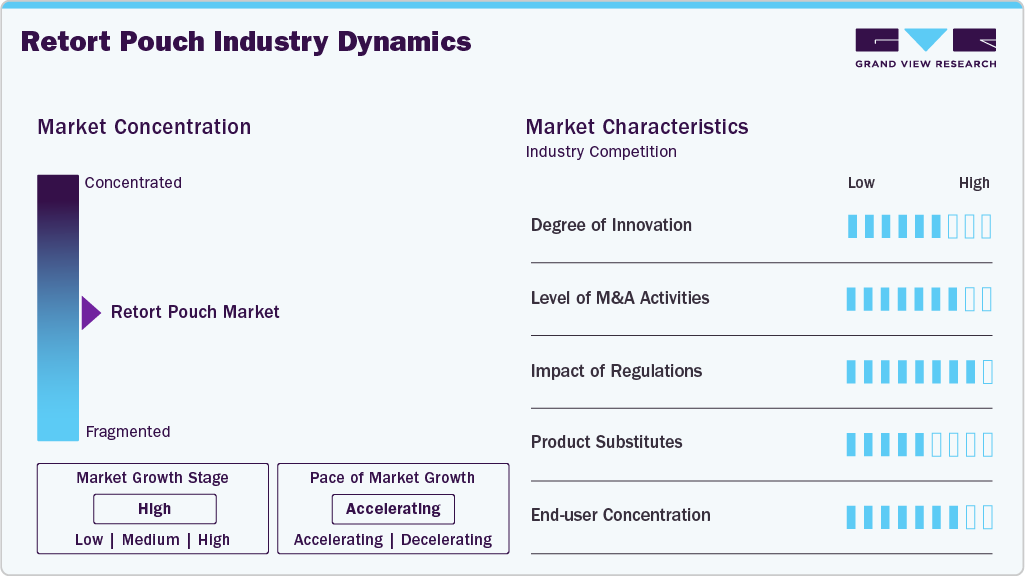

Market Concentration & Characteristics

The retort pouch industry is characterized by a high degree of technological innovation and product customization, driven by evolving consumer preferences, stringent food safety standards, and the demand for sustainable solutions. The industry is moderately to highly fragmented, with the presence of global packaging giants such as Amcor, Sealed Air, Mondi, and Coveris, alongside a large number of regional players catering to localized needs. These players continuously invest in research and development to improve barrier properties, enhance thermal resistance, and introduce consumer-friendly features like easy-open seals, spouts, and transparent windows.

There is also a growing trend of customization based on food types (liquid vs. solid), sterilization process requirements, and branding objectives, with many companies offering tailored solutions to food processors, pharmaceutical firms, and pet food manufacturers. The dynamic nature of the market also sees constant shifts in design aesthetics, material composition (e.g., recyclable vs. multilayer laminates), and form factors (flat, stand-up, gusseted), giving manufacturers opportunities to differentiate themselves in a competitive space.

Another defining characteristic of the retort pouch industry is the complex interplay between regulatory compliance, cost efficiency, and sustainability. Packaging used for heat-treated, shelf-stable products must comply with stringent regulations regarding food contact safety, sterilization protocols, and migration limits under thermal processing conditions. Authorities like the U.S. FDA, European Food Safety Authority (EFSA), and Japan’s Food Sanitation Act impose strict standards, pushing manufacturers to ensure full traceability and material compliance. At the same time, end-use sectors like food and pharmaceuticals are extremely cost-sensitive, making cost optimization in raw materials, laminates, and converting processes a top priority.

Material Insights

Based on material, the market for retort pouches has been segmented into polypropylene, polyethylene, polyamide, polyethylene terephthalate (PET), aluminum foil, and others. Retort packaging is generally manufactured from either three or four plastic laminates, with the inner layer generally made from polypropylene, followed by an optional polyamide layer, a barrier layer of aluminum foil, and an outer layer of PET.

The polypropylene segment accounted for the largest revenue share of 37.6% in 2024 in the retort pouch industry. Polypropylene acts as a sealing layer and provides flexibility and strength to the pouch. Polypropylene is a tough and robust plastic material that assists in retaining the freshness of various food items, owing to which it is widely used in manufacturing retort pouches.

The aluminum foil segment is expected to expand at the fastest CAGR of 8.2% during the forecast period. One of the key drivers of the aluminum retort pouch demand is the growing need for convenient and lightweight packaging solutions. Aluminum retort pouches are lightweight and easy to carry, making them ideal for on-the-go consumption. They are also flexible, which allows for easy storage and transportation. The convenience factor associated with these pouches has led to their increased adoption in various industries, including food and beverage, healthcare, and personal care.

The polyamide segment is expected to advance at a significant CAGR through 2033. Polyamide offers properties such as puncture resistance, abrasion resistance, heat stabilization, dimensional stability, and high stiffness, thereby increasing the overall strength of the retort pouch. Aluminum foil, on the other hand, acts as a barrier layer and protects the pouch from odors, light, moisture, and gases.

PET is generally used as an outer layer in retort pouches. It provides strength and also acts as an excellent printable surface, owing to which it is widely utilized in making retort pouches. Moreover, beneficial properties including high strength, lightweight, non-reactivity, flexibility, and recyclability, among others, make PET a suitable choice as a packaging material in retort pouches.

Packaging Insights

The global market has been segmented into stand-up pouches and flat pouches, based on packaging. The stand-up pouches segment accounted for the largest revenue share of 55.2% in 2024 and is further expected to expand at the fastest CAGR of 7.3% during the forecast period, owing to their various advantages such as aesthetics, performance, and cost. The overall construction and aesthetics of stand-up pouches act as an excellent product marketing tool, which is further expected to augment their demand in the coming years.

Stand-up pouches assist in product differentiation as they have large surfaces on which high-quality graphics can be printed, thereby attracting customers, especially in supermarkets and convenience stores where people make quick purchasing decisions. In addition, these stand-up pouches also come with several value-added features such as different types of closure, including spouts, tear notches, and zippers, which offer convenience and functionality.

The flat pouches segment is anticipated to advance at a notable CAGR during the forecast period. Various types of flat retort pouches, such as pillow pouch, four-side-seal pouches, and three-side-seal pouches, are used across several food and pet food applications. Flat retort pouches are used for packaging various food items such as meat, seafood, and poultry, among others, as well as pet food, including cat food and dog food. The growing trend towards the use of single-serve and portion packs is likely to drive the demand for this segment over the coming years.

Closure Insights

Based on closure, the global market has been segmented into tear notch, zipper, and spout. The zipper segment accounted for the largest revenue share of 40.0% in 2024. Zippers offer several benefits to the packaging, including convenient reclose ability, as well as protection against spills and contamination. Furthermore, zipper pouches also help in lessening food wastage as people can use the contents in the pouch at a later stage.

The tear notch segment is expected to expand at a CAGR of 7.1% during the forecast period. Tear notch closure assists the consumer in easy opening of the pouch in order to access the pouch’s contents. The rapidly rising demand for single-serve packages, ready-to-eat meals, and smaller portion packages is likely to augment the growth of this segment over the forecast period. The spout closure segment is likely to grow at the fastest rate through 2033, as it offers advantages such as functionality and convenience in dispensing pouch contents. This is particularly applicable to liquid and semi-liquid products.

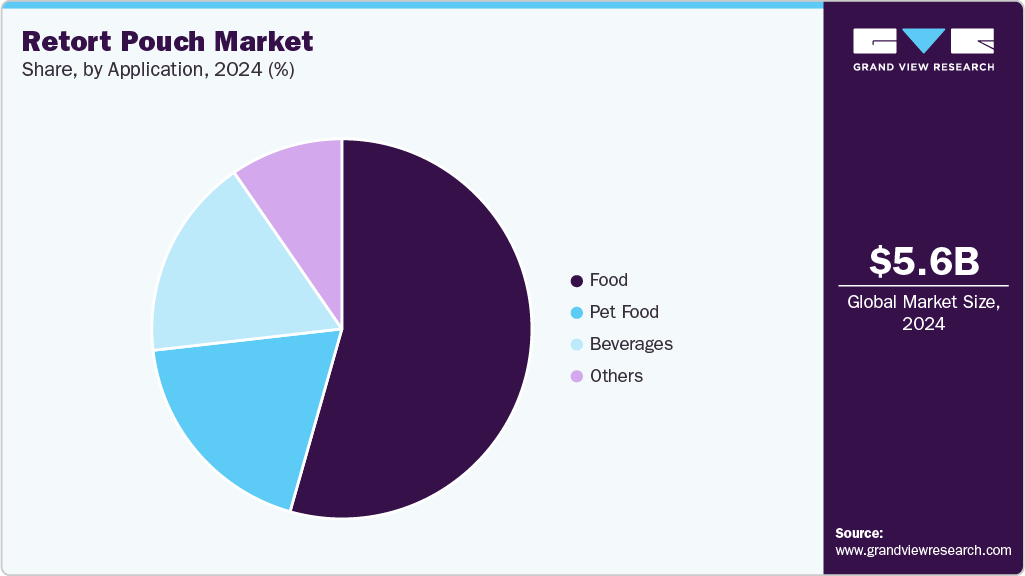

Application Insights

In terms of application, the market has been segmented into food, beverages, pet food, and others. The food segment accounted for the largest revenue share of 54.4% in 2024. Retort pouches are widely used for packaging several food products, including soups, sauces, baby food, dry-ready meals, frozen ready meals, chilled ready meals, meal replacement products, and dairy products.

The pet food segment is expected to expand at the fastest CAGR of 8.1% during the forecast period. The growing trend of pet humanization has led to an increased number of people owning pets and feeding them high-quality food. In addition, the rising trend towards pet adoption, especially among families characterized by working parents and a single child, is further likely to augment the demand for pet food globally, which is very likely to favor the market growth.

The beverages segment is also expected to grow at a lucrative rate during the forecast period. Retort pouches are widely used for packaging several types of beverages, including ready-to-drink products, energy & sports drinks, soft drinks, and juices. The rapidly rising demand for a wide variety of beverages, particularly organic and healthy beverages, is expected to have a positive impact on market growth over the coming years.

Regional Insights

The North America retort pouch industry is benefiting from a strong consumer shift toward sustainable, lightweight, and smart packaging formats across multiple sectors, including food, pet care, and healthcare. There is a notable surge in demand for clean-label, organic, and ethnic food products that require high-barrier, sterilized packaging, especially among millennials and Gen Z consumers. The market is also seeing innovation in smart retort pouches-integrating QR codes, freshness indicators, and recyclable materials, especially from startups and mid-sized brands leveraging digital retail. Growth is further supported by strategic collaborations between food brands and packaging firms to create visually appealing and re-sealable pouch formats that meet consumer expectations for both convenience and sustainability.

U.S. Retort Pouch Market Trends

The U.S. retort pouch industry is driven by a mature packaged food ecosystem, widespread microwave usage, and the rising popularity of premium pet food brands shifting from cans to pouches. The growth of private-label and store-brand meal solutions in major retail chains like Walmart, Kroger, and Target has created large-scale demand for cost-effective yet high-performance packaging. Additionally, innovation in military and emergency ration packs by U.S. defense contractors and FEMA (Federal Emergency Management Agency) continues to drive demand for long-shelf-life, puncture-resistant retort pouches. Growing consumer acceptance of globally inspired cuisines, such as Indian curries, Thai soups, and Latin American stews-often imported in retort packaging-has further cemented the pouch’s relevance in both ethnic and mainstream food segments.

Asia Pacific Retort Pouch Market Trends

Asia Pacific retort pouch industry dominated the global market and accounted for the largest revenue share of over 34.2% in 2024. Moreover, the region is expected to expand at the fastest CAGR of 7.9% during the forecast period. Asia Pacific comprises several emerging economies, including China and India. Factors such as changing consumer lifestyles, rising disposable incomes, and growing demand for packaged foods such as ready-to-eat meals are expected to augment the demand for retort pouches in the region over the forecast period.

The retort pouch industry in China is thriving due to the country's aggressive expansion in domestic food processing and export-oriented manufacturing. The government’s focus on enhancing food safety and shelf stability, especially in tier-2 and tier-3 cities where cold chain logistics remain underdeveloped, has driven significant adoption of retort pouches. Moreover, rising e-commerce food delivery, growing demand for single-serve meals, and increased consumer acceptance of packaged traditional Chinese dishes-like ready-to-eat congee, meat stews, and noodle bowls-are boosting the popularity of retort formats. Local players are also investing in high-speed retort systems and advanced barrier film technologies to cater to both domestic demand and export markets in Southeast Asia and Africa, where shelf-stable Chinese foods are widely consumed.

Europe Retort Pouch Market Trends

Europe’s retort pouch industry is expanding due to stringent EU regulations on packaging waste and a strong push toward circular economy principles. European food brands are transitioning from traditional multi-material laminates to mono-material retort pouches that are easier to recycle, in response to upcoming directives such as the EU Packaging and Packaging Waste Regulation (PPWR). The region is also witnessing increased adoption in organic baby food, functional beverages, and vegan ready meals-segments where visual appeal and portion control are key. Retort pouches are being leveraged not only for food but also for nutraceuticals, adult nutrition products, and travel-safe liquid supplements. The emphasis on traceability, food safety, and extended shelf life in both domestic and export markets (particularly intra-Europe trade) has further solidified retort pouches as a preferred packaging solution.

Germany’s retort pouch industry is propelled by its advanced packaging manufacturing ecosystem, strong consumer preference for high-quality, sustainable products, and a well-developed food retail sector that favors innovation. German consumers place a premium on hygiene, freshness retention, and visual packaging cues-needs that retort pouches meet efficiently, especially in baby food, gourmet soups, and chilled ready meals. The country also has a well-established infrastructure for recycling multilayer materials, which encourages manufacturers to invest in eco-conscious pouch development. Furthermore, Germany’s position as a leading exporter of processed foods and sauces to other EU nations and beyond has led to increased adoption of retort pouches that reduce transportation costs and packaging waste while preserving product integrity over long distances.

Key Retort Pouch Company Insights

The competitive environment of the retort pouch industry is marked by intense rivalry, continuous innovation, and strategic consolidation, driven by both global packaging giants and agile regional players. Key industry leaders such as Amcor plc, Mondi Group, Sealed Air Corporation, Coveris, and ProAmpac dominate the market by leveraging their extensive R&D capabilities, global distribution networks, and diverse product portfolios. These companies focus heavily on developing high-barrier, recyclable, and custom-engineered laminates to cater to evolving consumer and regulatory demands.

At the same time, smaller regional manufacturers in Asia-Pacific and Latin America are gaining traction by offering cost-effective, localized solutions, often tailored to specific cuisines or product types. The market also sees increasing vertical integration, with some food processing companies investing directly in pouch manufacturing to secure supply and reduce packaging costs. Strategic partnerships between food brands and packaging innovators are becoming more common, especially in premium food and pet food segments.

-

In April 2023, Huhtamaki announced that it would be launching innovative sustainable flexible packaging. The company has employed scientific techniques to create revolutionary mono-material technology. This flexible packaging is ecological and inventive and claims to address the needs of both its clients and their end-users. The solutions have been made available in paper, PE, and PP retort forms

-

In April 2022, ProAmpac introduced its distinctive ProActive PCR Retort pouch. These pouches have been designed for food packaging for humans and pets. The packaging uses less virgin resins, instead offering 30% weight or higher PCR content. These inventive pouches also adhere to UK Plastics Packaging Tax (PPT) regulations

-

In October 2021, Mondi launched the RetortPouch Recyclable, a high-barrier pouch designed for wet pet food and food items. This 100% recyclable mono-material retort packaging solution aims to replace multi-layer, non-recyclable packaging, ensuring product preservation and reducing food waste

Key Retort Pouch Companies:

The following are the leading companies in the retort pouch market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- ProAmpac

- Sonoco Products Company

- Mondi

- Coveris

- CLONDALKIN GROUP

- Sealed Air

- Huhtamaki

- Constantia Flexibles

- FLAIR Flexible Packaging Corporation

- WINPAK LTD.

- DNP America, LLC

- HPM GLOBAL INC.

- SOPAKCO Packaging

- AIPIA

- Clifton Packaging Group Limited

- Floeter India Retort Pouches (P) Ltd

Retort Pouch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.96 billion

Revenue forecast in 2033

USD 10.21 billion

Growth Rate

CAGR of 7.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Million Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, packaging, closure, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; UAE

Key companies profiled

Amcor plc; ProAmpac; Sonoco Products Company; Mondi; Coveris; CLONDALKIN GROUP; Sealed Air; Huhtamaki; Constantia Flexibles; FLAIR Flexible Packaging Corporation; WINPAK LTD.; DNP America, LLC; HPM GLOBAL INC.; SOPAKCO Packaging; AIPIA; Clifton Packaging Group Limited; Floeter India Retort Pouches (P) Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retort Pouch Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global retort pouch market report based on material, packaging, closure, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyamide (PA)

-

Polyethylene Terephthalate (PET)

-

Aluminum Foil

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2021 - 2033)

-

Stand-up Pouches

-

Flat Pouches

-

-

Closure Outlook (Revenue, USD Million, 2021 - 2033)

-

Tear Notch

-

Zipper

-

Spout

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food

-

Beverages

-

Pet Food

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global retort pouch market was estimated at around USD 5.55 billion in 2024 and is expected to reach around USD 5.96 billion in 2025.

b. The global retort pouch is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach around USD 10.21 billion by 2033.

b. Asia Pacific region dominated the retort pouch market with a revenue share of 34.2% in 2024 owing to the abundant raw material availability and large production and export levels in the processed food & beverage industry.

b. The key market player in the retort pouch market includes Constantia Flexibles, Amcor PLC, Mondi, Huhtamaki, Sealed Air, FUJIMORI KOGYO, WINPAK, Sonoco Products Company, Clondalkin Group, FLAIR Flexible Packaging Corporation, Clifton Packaging Group Limited, ProAmpac, DNP America, LLC, Floeter India Retort Pouches (P) Ltd, Coveris, HPM GLOBAL INC., SOPAKCO Packaging

b. Growing consumer-driven demand for packaged food & beverage products owing to its convenience and ease of consumption is expected to drive the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.