- Home

- »

- Plastics, Polymers & Resins

- »

-

Rigid Plastic Packaging Market Size, Industry Report, 2033GVR Report cover

![Rigid Plastic Packaging Market Size, Share & Trends Report]()

Rigid Plastic Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (PET, PE, PP, PVC, PS, Bioplastics), By Product (Extrusion, Injection Molding), By Application (Food, Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-231-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rigid Plastic Packaging Market Summary

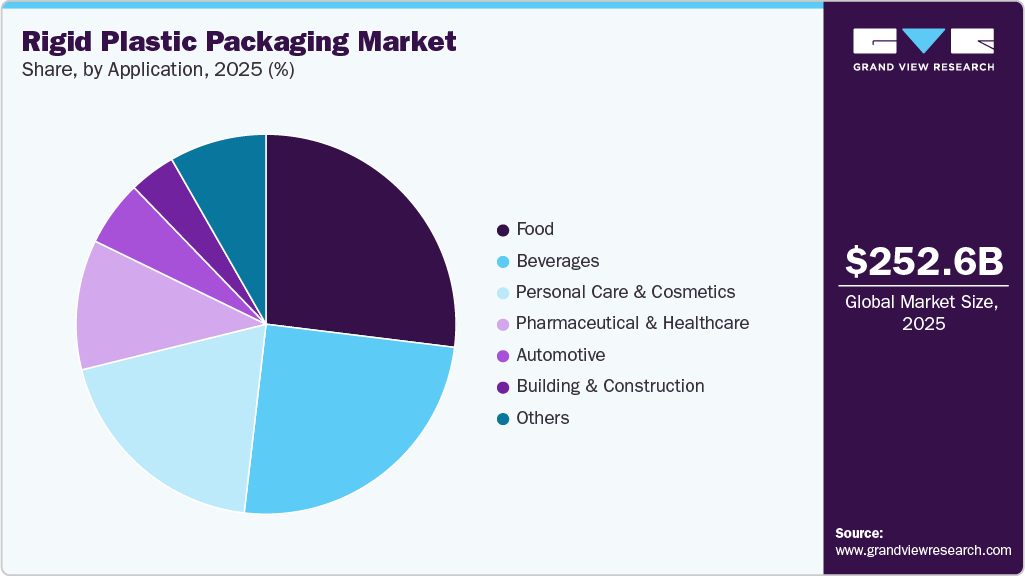

The global rigid plastic packaging market size was estimated at USD 252.64 billion in 2025 and is projected to reach USD 321.19 billion by 2033, growing at a CAGR of 3.0% from 2026 to 2033. Rising demand for packaged food on account of growing preference toward ready-to-eat food products and increased adoption of plastic as a material in rigid packaging products are expected to support market growth.

Key Market Trends & Insights

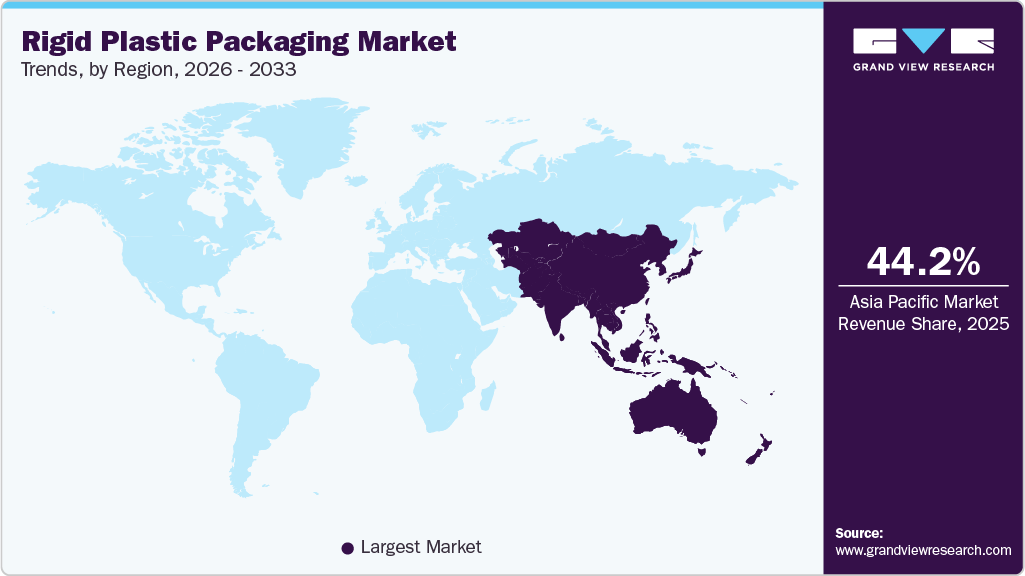

- Asia Pacific dominated the global rigid plastic packaging industry with the largest revenue share of over 44.19% in 2025.

- The China rigid plastic packaging industry is anticipated to experience consistent growth

- By material, the Polyethylene Terephthalate (PET) segment accounted for the largest revenue share of 30.60% in 2025.

- By application, the pharmaceutical & healthcare segment is expected to grow at the fastest CAGR of 3.5% from 2026 to 2033 in terms of revenue.

- By product, bottles & jars dominated the product segment and accounted for a revenue share of 51.54% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 252.64 Billion

- 2033 Projected Market Size: USD 321.19 Billion

- CAGR (2026-2033): 3.0%

- Asai Pacific: Largest market in 2025

The global market for rigid plastic packaging is anticipated to experience consistent growth, fueled by a rising need from the food and beverage industry for packaging that is durable, tamper-proof, and lightweight. The expansion of e-commerce and retail is expected to further enhance the demand for protective and ready-to-shelf rigid containers, particularly for personal care, pharmaceutical, and electronic goods.Furthermore, the growth of e-commerce and retail distribution channels is anticipated to drive the need for protective and stackable rigid packaging formats, especially in industries such as personal care, pharmaceuticals, and electronics. These sectors depend significantly on packaging that can endure the stresses of transportation while preserving brand aesthetics.

In addition, regulatory requirements set by organizations such as the FDA and EPA are encouraging businesses to implement compliant, high-performance rigid plastics for the safe storage and distribution of consumables and delicate products. These regulations are likely to promote the development and adoption of food-grade and medical-grade rigid packaging solutions.

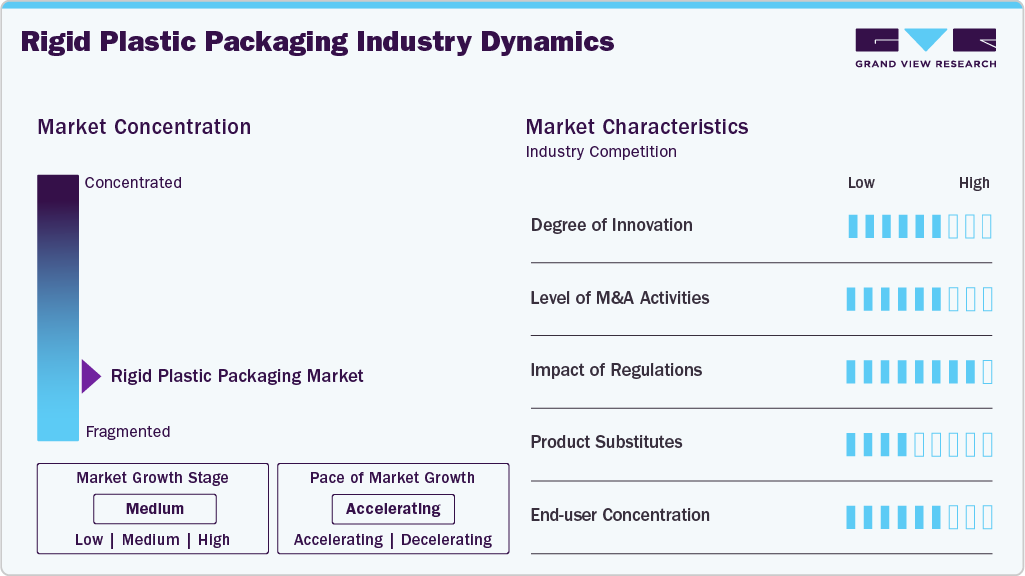

Market Concentration & Characteristics

Prominent players operating in rigid plastic packaging industry include Berry Global Inc., Amcor plc, Sonoco Products Company, ALPLA, WINPAK LTD, Nuplas Industries, DS Smith, Genpak, SILGAN PLASTICS, Anchor Packaging LLC, and PLASTIPAK HOLDINGS, INC.

Global rigid plastic packaging industry is highly fragmented with presence of significant number of packaging manufacturers. Companies operational in this market space are focusing developing new products catering to changing regulatory landscape, indicating a high impact level of regulations. For instance, in December 2023, Novolex, a U.S. based packaging manufacturer launched food packaging containers having 10% post-consumer recycled plastic content. According to Association of Plastic Recyclers as of 2023, four states of the U.S. have passed laws mandating inclusion of recycled content in plastic packaging. Also, active proposals related to recycled plastic-based packaging are progressing in European Union and Canada, which pushes companies to develop rigid packaging complying to these laws.

Significant presence of companies also influences level of mergers and acquisitions. Well-established mature players which are seen to acquire emerging or small local level companies to grow their market presence. For instance, in October 2023, Greif Inc announced its intent and its ongoing discussions to acquire small plastic containers and jerrycan manufacturer PACKCHEM Group SAS for a transaction valued at USD 538.0 million.

Material Insights

Based on material, the market is segmented into polyethylene terephthalate (PET), polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polystyrene (PS), bioplastics, and others. PET dominated the material segment and accounted for the largest revenue share of 30.60% in 2025. Properties such as lightweight, recyclability, durability, along with its excellent transparency makes it a popular choice for end users, which require product visible packaging, thereby contributing to its high market share.

Bioplastics are expected to progress at a CAGR of 5.1% from 2026 to 2033. High growth rate can be attributed to growing concerns related to plastic packaging waste pollution and its environmental impacts. Governments worldwide are imposing stringent regulations such as ban on single use plastics, which can push rigid packaging manufacturers to shift from fossil fuel-based plastics to plant derived bioplastics.

Production Process Insights

Injection molding dominated the production process segment and accounted for a revenue share of more than 35.0% in 2025. Injection molding facilitates manufacturing of small containers to complex shaped containers or other rigid packaging products. This makes it suitable for a wider range of applications compared to blow molding production process. Furthermore, injection molding production process caters to various plastic materials such as PE, PP to high performance plastics such as PC and ABS. These factors contribute to its high market share.

Thermoforming production process is expected to register a significant growth rate from 2026 to 2033. Low tooling costs, versatility, and suitability to produce customizable, durable, lightweight packaging products are expected to contribute to its high growth rate.

Product Insights

Based on product, the market is segmented into trays & clamshells; bottles & jars; tubs, cups, and pots; pallets; drums & barrels; crates; and pallets among others. Bottles & jars dominated the product segment and accounted for a revenue share of 51.54% in 2025. The bottles & jars segment demand is driven by their versatility. In terms of versatility, bottles & jars are available in variety of sizes and shapes, catering to a vast range of end-use industries such as beverage, cosmetics, pharmaceutical, and industrial. In addition, its high market share is also correlational to the consumption of beverages. High population results in increased beverage consumption, directly influencing demand for bottles & jars.

Plastic pallets and other products are expected to progress with a significant CAGR of 2.4% over forecast period. High growth rate can be attributed to increasing shift of end-use industries from traditional wooden pallets to plastic pallets on account of rising logistics costs and high price of wooden pallets.

Application Insights

Based on application, the market is segmented into food, beverages, pharmaceutical & healthcare, personal care & cosmetics, automotive, building & construction, and other applications. Food dominated the application segment and accounted for the largest revenue share of 26.95% in 2025. This positive outlook is due to growing demand for packaged food products and requirement for sturdy packaging products to protect food during transit. Furthermore, rise in online food delivery industry is also expected to contribute to high dominance of food in rigid plastic packaging industry.

The pharmaceutical & healthcare application segment is expected to progress with a CAGR of 3.5% over the forecast period. High growth rate can be attributed to growing use of plastic based rigid packaging products such as bottles, jars, trays in packaging of sensitive pharmaceutical dosages and medical devices. Excellent barrier properties along with lightweight of plastics contribute to their high adoption in pharmaceutical & healthcare rigid packaging.

Regional Insights

Asia Pacific rigid plastic packaging industry dominated the global market, accounting for the largest revenue share of 44.19% in 2025. The region is likely to dominate the industry over the forecast period. Asia Pacific boasts major plastic resin manufacturers such as LG Chem, TORAY INDUSTRIES, INC, Reliance Industries Limited, Mitsui Chemicals, Inc, Indorama Ventures Public Company Limited, BASF SE, and China Petrochemical Corporation among others creating strong raw material supply network, thereby contributing to the market. Furthermore, the region boasts a rapidly growing population, particularly in countries like China and India, creating a huge consumer base for various products, from food and beverages to personal care items, creating a strong demand for rigid plastic packaging.

The China rigid plastic packaging industry is anticipated to experience consistent growth, fueled by heightened demand from the food and beverage sector, growing urbanization, and changing consumer habits. As e-commerce and food delivery services expand, the requirement for sturdy, lightweight, and protective packaging options is expected to rise, making rigid plastics a favored choice.

The rigid plastic packaging industry in Southeast Asia is expected to progress at a significant CAGR over forecast period. This is attributed to various factors such as rising urban population and increasing cosmetic trend. Thailand is a major original equipment manufacturer (OEM) for international cosmetic brands. There are over 762 cosmetics manufacturing plants is Thailand as per Thai Cosmetic Cluster, indicating a strong personal care & cosmetics sector growth. This can simultaneously influence rigid plastic packaging industry growth related to it.

North America Rigid Plastic Packaging Market Trends

North American rigid plastic packaging industry is expected to progress at a moderate CAGR. While growth is expected, sustainability concerns and changing consumer preferences are driving innovation and adaptation within the industry. For instance, growing environmental awareness and stringent regulations are pushing manufacturers towards sustainable alternatives like recycled plastics and bioplastics.

The U.S. rigid plastic packaging industry dominated the North American regional space, accounting for a share of over 80.90% in 2025. High share is driven by growing demand of functional beverages in country and increased demand for packaged food products.

The rigid plastic packaging industry in Canada is driven by growing exports of fruits. Canada has free trade agreements with several major markets, which facilitates export growth. The USMCA agreement eliminates tariffs for agricultural exports which can promote agricultural produce export and contribute to rigid plastic packaging industry.

Europe Rigid Plastic Packaging Market Trends

The rigid plastic packaging industry in the Europeis anticipated to grow over the forecast period.According to European Commission, the pharmaceutical sector is a leading contributor to region’s economy. Pharmaceutical strategy for Europe adopted in November 2020 aims to boost research and technologies to boost local pharmaceutical sector which presents positive outlook for the market.

The rigid plastic packaging industry in Germany is anticipated to grow on account of rising organic packaged food market. Germany dominated the market in Europe. Growing awareness related to organic farming and its associated health benefits are expected to create a strong market forecast for organic products such as organic spread, ready meals, baby food, dairy products, organic baked goods, and confectionary.

Central & South America Rigid Plastic Packaging Market Trends

The rigid plastic packaging industry in Latin America is estimated to grow over the forecast period owing to steady economic growth, leading to rising disposable incomes and increased consumer spending. This fuels demand for packaged goods. According to National Library of Medicine, consumption of carbonated soft drinks has increased significantly, thus contributing to demand of rigid plastic packaging products.

The rigid plastic packaging industry in Brazil dominated the Central & South American regional space in 2025. Brazil has emerged as an attractive market for personal care and cosmetics production. According to Associação Brasileira da Indústria de Higiene (Abhipec) international trade of Brazil’s personal care & cosmetic products registered a growth of 30.9% in first quarter of 2023 compared to the same period in 2022. Skin creams and tanning products recorded highest sales percentage, thus presenting positive market forecast for rigid plastic packaging products used for packaging personal care & cosmetic products.

Middle East & Africa Rigid Plastic Packaging Market Trends

The rigid plastic packaging industry in Middle East & Africa is growing due to rising bottled mineral water consumption in region. Lack of confidence in quality of water supplied through pipeline and tankers as well as growing tourism sector in Middle East & Africa is expected to contribute to bottled water market and relative rigid plastic packaging industry growth.

The rigid plastic packaging industry in Saudi Arabia is expected to grow at a lucrative CAGR due to high production of dairy products within the country. Saudi Arabia dominated the rigid plastic packaging industry in 2025 in the Middle East & Africa region. Saudi Arabia is among the leading dairy products exporting countries in Middle East and across the globe.

The rigid plastic packaging industry in South Africa is expected to progress with a significant CAGR over forecast period. Growing carbonated soft drink consumption is encouraging entry of soft drink manufacturer such as Varun Beverages into South Africa, presenting positive rigid plastic packaging forecast.

Key Rigid Plastic Packaging Company Insights

The rigid plastic packaging industry is highly fragmented with a significant presence of global as well as local companies offering various types of rigid plastic packaging products. Major players operating in rigid plastic packaging industry undertake various strategies such as mergers, acquisitions, geographical expansion, new product launches, and joint ventures to strengthen their market presence.

-

In March 2025, LyondellBasell introduced Pro-fax EP649U, a novel polypropylene impact copolymer tailored for the rigid packaging sector. This cutting-edge product is specifically engineered for thin-walled injection molding, making it perfect for food packaging uses. Pro-fax EP649U boasts excellent flow characteristics and rapid crystallization, allowing for the efficient manufacture of thin-walled containers while improving both productivity and the quality of the final product. The additive formulation in Pro-fax EP649U promotes smooth mold release, minimizes static, and enhances downstream handling on high-speed filling lines.

-

In February 2025, Berry Global Group Inc. finalized its purchase of CMG Plastics, a company specializing in rigid packaging manufacturing. Berry continues to expand through acquisitions, as it approaches a key milestone in its acquisition by Amcor plc. Today, shareholders from both firms are set to vote on the all-stock agreement valued at USD 8.4 billion. The boards of directors for both companies have unanimously endorsed the deal. The acquisition of Berry by Amcor, which is anticipated to finalize by mid-2025, is projected to generate USD 650 million in annual cost savings and additional synergies within three years.

Key Rigid Plastic Packaging Companies:

The following are the leading companies in the rigid plastic packaging market. These companies collectively hold the largest Market share and dictate industry trends.

- Berry Global Inc.

- Amcor plc

- Pactiv Evergreen Inc.

- Sonoco Products Company

- ALPLA

- WINPAK LTD

- Nuplas Industries

- DS Smith

- Genpak

- SILGAN PLASTICS

- Anchor Packaging LLC

- PLASTIPAK HOLDINGS, INC.

- Greif

- Gerresheimer AG

- Manjushree Technopack Ltd

- Mold-Tek Packaging Ltd

- Greiner Packaging

- Takween Advanced Industries

- Ladain Alyamamah Plastic Factory

- Arabian Plastic Industrial Company Co

- Crown Packaging Int’l

- S.E.A. Global Pte. Ltd

- Dynapackasia

Rigid Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 261.70 billion

Revenue forecast in 2033

USD 321.19 billion

Growth rate

CAGR of 3.0% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in Kilotons; Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume Forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, production process, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Berry Global Inc.; Amcor plc; Pactiv Evergreen Inc.; Sonoco Products Company; ALPLA; WINPAK LTD; Nuplas Industries; DS Smith; Genpak; SILGAN PLASTICS; Anchor Packaging LLC; PLASTIPAK HOLDINGS, INC.; Greif; Gerresheimer AG; Manjushree Technopack Ltd; Mold-Tek Packaging Ltd; Greiner Packaging; Takween Advanced Industries; Ladain Alyamamah Plastic Factory; Arabian Plastic Industrial Company Co; Crown Packaging Int’l; S.E.A. Global Pte. Ltd; Dynapackasia

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rigid Plastic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global rigid plastic packaging market report based on material, production process, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene Terephthalate (PET)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Polyvinyl Chloride (PVC)

-

Bioplastics

-

Others

-

-

Production Process Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Extrusion

-

Injection Molding

-

Blow Molding

-

Thermoforming

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bottles & Jars

-

Trays & Clamshells

-

Tubs, Cups, and Pots

-

Pallets

-

Drums & Barrels

-

Crates

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food

-

Beverages

-

Pharmaceutical & Healthcare

-

Personal Care & Cosmetics

-

Automotive

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rigid plastic packaging market size was estimated at USD 252.64 billion in 2025 and is expected to reach USD 261.70 billion in 2026.

b. The global rigid plastic packaging market is expected to grow at a compound annual growth rate of 3.0% from 2026 to 2033 and reach USD 321.19 billion by 2033.

b. Asia Pacific dominated the rigid plastic packaging market with a share of over 44.19% in 2025. This is attributable to the rising population driving the demand for packaged food and beverages, thereby influencing the demand for rigid packaging market.

b. Some of the key players in the rigid plastic packaging market include Berry Global Inc., Amcor plc, Pactiv Evergreen Inc., Sonoco Products Company, ALPLA, WINPAK LTD, Nuplas Industries, DS Smith, Genpak, and SILGAN PLASTICS among others.

b. The factors driving the rigid plastic packaging market are the growing consumption of bottled water & functional drinks and the rising demand for packaged food due to changing consumer eating habits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.