- Home

- »

- Advanced Interior Materials

- »

-

Semiconductor Bonding Market Size & Share Report, 2030GVR Report cover

![Semiconductor Bonding Market Size, Share & Trends Report]()

Semiconductor Bonding Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Die Bonder, Wafer Bonder, Flip Chip Bonder), By Application (RF Devices, LED, 3D NAND), By Process Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-376-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Bonding Market Summary

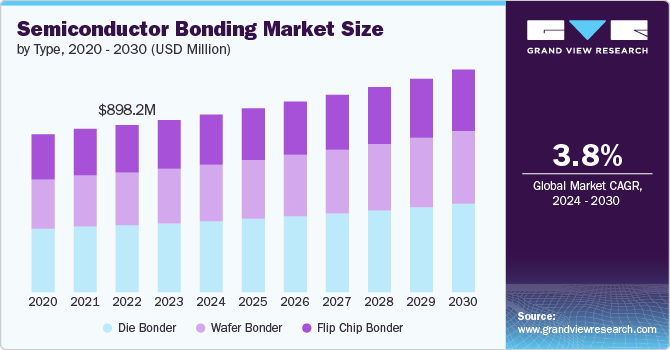

The global semiconductor bonding market size was estimated at USD 925.00 million in 2023 and is projected to reach USD 1.20 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030. The market is experiencing robust growth driven by the burgeoning demand for advanced electronic devices such as smartphones, electric vehicles, and renewable energy systems.

Key Market Trends & Insights

- The Asia Pacific region holds a significant share in the global market primarily due to its significant contributions to semiconductor manufacturing.

- The semiconductor bonding market in China is estimated to grow at a significant CAGR of 5.5% over the forecast period.

- Based on process type, the die to die bonding segment led the market and accounted for 51.99% of the global revenue share in 2023.

- Based on type, the die bonder segment accounted for 40.04% of the global market revenue share in 2023.

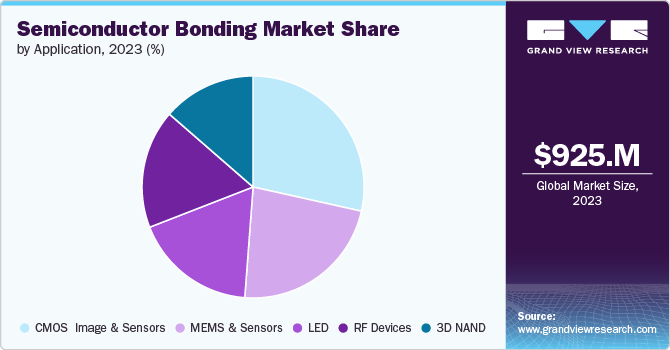

- Based on application, the CMOS image & sensors application segment accounted for 28.49% of the global market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 925.00 Million

- 2030 Projected Market Size: USD 1.20 Billion

- CAGR (2024-2030): 3.8%

- Asia Pacific: Largest market in 2023

This market encompasses a wide array of bonding techniques, including die bonding, wafer bonding, and flip-chip bonding, each crucial for producing integrated circuits and microelectronic components. Semiconductor bonding is a critical process in the fabrication of microelectronic devices. It involves joining two semiconductor materials or a semiconductor and another material, such as metal or insulator, to form a functional unit. This process, essential for assembling integrated circuits and forming microelectronic structures, utilizes various techniques such as wafer bonding, die bonding, and flip-chip bonding. The surge in IoT devices and AI applications and the push towards miniaturization and high-performance computing further propel the market.

Increasing investments in semiconductor manufacturing, the growing need for efficient thermal management, and higher performance in electronic devices are driving the market's expansion. As industries continue to evolve towards more complex and integrated technology solutions, the market is expected to play a key role in shaping the future of global electronics manufacturing.

Drivers, Opportunities & Restraints

The market is primarily driven by the continuously increasing demand for advanced electronic devices, including smartphones, wearable technology, and the expansion of the Internet of Things (IoT) ecosystem. These applications require more sophisticated semiconductor chips, thus fueling the need for innovative bonding techniques that can cater to miniaturization while ensuring performance and reliability.

The advent of electric vehicles (EVs) and renewable energy technologies necessitate the development of power-efficient and high-density semiconductor devices. In addition, advancements in medical electronics for patient monitoring and diagnostics will positively impact the market.

However, the market faces significant challenges, such as the high initial investment required for setting up semiconductor fabrication and bonding facilities. Moreover, the complexity of the bonding process and the need for high precision pose substantial technical challenges. The rapidly changing technology landscape also demands continuous R&D investments to cope with evolving device architectures and materials, adding to the constraints faced by market players.

Process Type Insights

“The demand for die to wafer bonding segment is expected to grow at a CAGR of 4.5% from 2024 to 2030 in terms of revenue.”

The die to die bonding segment led the market and accounted for 51.99% of the global revenue share in 2023. The die to die (D2D) bonding segment of the market is witnessing significant growth, driven by the increasing complexity and performance requirements of electronic devices. D2D bonding, a critical technique in 3D integration, allows for the vertical stacking of semiconductor chips, leading to considerable enhancements in performance and functionality while reducing space and power consumption. The push towards smaller, faster, and more energy-efficient devices across industries, including consumer electronics and telecommunications, presents substantial opportunities to expand the D2D bonding market.

The Die to Wafer (D2W) bonding market is gaining traction within the semiconductor industry, fueled by the accelerating demand for high-density and high-performance semiconductor devices across various sectors, including consumer electronics, automotive, and healthcare. D2W bonding is crucial for heterogeneous integration, where dies with different functionalities are bonded onto a single wafer, thus enabling the fabrication of complex, multi-functional devices within a compact footprint.

Type Insights

“The demand for wafer bonder segment is expected to grow at a CAGR of 4.3% from 2024 to 2030 in terms of revenue.”

Die bonder segment accounted for 40.04% of the global market revenue share in 2023. The market is driven by the escalating demand for more compact, efficient, and high-performance electronic devices across various applications. Die bonders are pivotal in the assembly process of semiconductors, facilitating the precise placement and attachment of dies onto substrates or into packages. This segment's growth is propelled by advancements in consumer electronics, automotive electronics, and the increasing proliferation of IoT devices requiring sophisticated semiconductor components, which will drive the market.

The market for wafer bonders is witnessing substantial growth, fueled by the ever-increasing demand for advanced semiconductor devices in sectors such as consumer electronics, automotive, healthcare, and telecommunications. Wafer bonders play a crucial role in manufacturing by facilitating the bonding of semiconductor wafers, which is essential for creating multi-layered semiconductor devices. This process is pivotal in producing MEMS (Micro-Electro-Mechanical Systems), 3D integrated circuits, and advanced sensors, integral components of modern electronic devices, from smartphones to autonomous vehicles.

Application Insights

“The demand form LED application segment is expected to grow at a significant CAGR of 4.3 % from 2024 to 2030 in terms of revenue.”

CMOS image & sensors application segment accounted for 28.49% of the global market revenue share in 2023. CMOS images & sensors, pivotal in converting light into electronic signals, are integral to a multitude of applications, from smartphones and digital cameras to automotive safety systems, medical devices, and emerging areas like drones and IoT devices. This wide-ranging applicability propels the demand for advanced semiconductor bonding techniques to enhance these devices' performance, efficiency, and miniaturization. The expansion of smart cities and smart home technologies also contributes to the burgeoning demand for sensors that can capture and process vast amounts of data with high precision and reliability.

The market for MEMS and sensors is poised for substantial growth, given their escalating integration into a broad spectrum of applications. This surge is attributed to MEMS and sensors' critical role in enhancing device functionality and intelligence, spanning sectors from automotive and healthcare to consumer electronics and industrial automation. These techniques ensure MEMS and sensor device reliability, performance, and miniaturization.

Regional Insights

The Asia Pacific region holds a significant share in the global market primarily due to its significant contributions to semiconductor manufacturing. This region is home to several key players in the semiconductor industry, including countries like South Korea, Taiwan, China, and Japan, which are leading in semiconductor production and developing cutting-edge semiconductor bonding technologies. The increasing demand for semiconductor devices in the Asia Pacific region, driven by the growth in consumer electronics, automotive, and telecommunications sectors, fuels the market.

“China to witness fastest market growth at 5.5% CAGR”

The semiconductor bonding market in China is estimated to grow at a significant CAGR of 5.5% over the forecast period. China's market is rapidly growing, reflecting the country's ambitious drive to bolster its position in the global semiconductor industry. As one of the largest consumers of semiconductor devices, fuelled by its vast electronics manufacturing sector and booming demand for consumer electronics, China is investing heavily in developing its domestic semiconductor capabilities. This effort is part of a broader strategy to reduce dependence on foreign technology and achieve self-sufficiency in the semiconductor supply chain.

North America Semiconductor Bonding Market Trends

The semiconductor bonding market in North America is significantly fuelled by the growing need for more sophisticated electronic devices across various sectors, such as automotive, consumer electronics, healthcare, and defense. The automotive industry's rapid shift towards electric and autonomous vehicles, which require advanced semiconductor components for better performance and safety features, is a notable example. In addition, the expansion of the IoT, artificial intelligence (AI), and 5G technologies in the region underscores the critical need for reliable and efficient semiconductor bonding solutions to ensure high-performance and miniaturized electronic devices. Hence, it is anticipated to drive the market growth during the projected years.

Europe Semiconductor Bonding Market Trends

The semiconductor bonding market in Europe is predominantly driven by the region's strong focus on innovation, sustainability, and advanced manufacturing technologies. The emphasis on renewable energy sources and energy efficiency is pushing for the adoption of power semiconductors. These components require specialized bonding techniques for optimal performance in converting and managing electrical power. Innovations in 3D ICs (Integrated Circuits), MEMS, and advanced packaging techniques further fuel the European market.

Key Semiconductor Bonding Company Insights

Some of the key players operating in the market include EV Group, ASMPT Semiconductor Solutions, and MRSI Systems (Myronic AB).

-

EV Group (EVG) is a prominent player in the market, renowned for its expertise in wafer bonding and lithography equipment for the microelectronics, compound semiconductor, MEMS, and nanotechnology sectors.The company's product portfolio is diverse, catering to various steps in the semiconductor manufacturing process, including lithography, coating, cleaning, and bonding.

-

ASM Pacific Technology (ASMPT), headquartered in Hong Kong, is a leading supplier in the semiconductor and electronics assembly sectors, offering a comprehensive range of equipment and solutions. The company's extensive portfolio encompasses die-attach, flip chip bonding, encapsulation, and wire bonding, catering to the entire spectrum of assembly processes required for semiconductor device fabrication.

BE Semiconductor Industries NV7, Fasford Technology Co.Ltd (Fuji Group), Kulicke, and Soffa Industries Inc. are some of the emerging market participants.

-

BE Semiconductor Industries NV7's focus on advanced packaging technologies, including die attachment, die sorting, and packaging processes pivotal for producing semiconductor devices. Besi's product offerings are integral to assembling a wide array of devices for applications in consumer electronics, computing, automotive, telecommunications, and other sectors demanding high-quality semiconductor components.

-

Fasford Technology caters to a wide range of applications, including conventional IC assembly and high-density packaging needs from sectors such as consumer electronics, automotive, and industrial electronics.

Key Semiconductor Bonding Companies:

The following are the leading companies in the semiconductor bonding market. These companies collectively hold the largest market share and dictate industry trends.

- EV Group

- ASMPT Semiconductor Solutions

- MRSI Systems. (Myronic AB)

- WestBond Inc

- Panasonic Holding Corporation

- Palomar Technologies

- Dr. Tresky AG7

- BE Semiconductor Industries NV7

- Fasford Technology Co.Ltd (Fuji Group)

- Kulicke and Soffa Industries Inc.

- DIAS Automation (HK) Ltd

- Shibaura Mechatronics Corporation

- SUSS MicroTec SE

- Tokyo Electron Limited

Recent Developments

-

In March 2024, TANAKA Kikinzoku Kogyo K.K., a leading company in the precious metals industry, recently pioneered the semiconductor bonding field by developing a gold particle bonding technology. This innovative method utilizes AuRoFUSE, a specialized low-temperature fired paste, to facilitate gold-to-gold bonding in high-density semiconductor mounting applications.

-

In December 2023, Tokyo Electron Kyushu developed an Extreme Laser Lift Off (XLO) technology. This cutting-edge approach is set to revolutionize the field of 3D integration for advanced semiconductor devices that utilize permanent wafer bonding. By enabling precise control and efficient integration processes, XLO technology promises to enhance the performance and reliability of semiconductor devices, paving the way for innovations in the electronics industry.

Semiconductor Bonding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 954.5 million

Revenue forecast in 2030

USD 1.20 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, process type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Taiwan; Brazil; Argentina; South Africa; Saudi Arabi;, UAE

Key companies profiled

EV Group; ASMPT Semiconductor Solutions; MRSI Systems. (Myronic AB); WestBond Inc.; Panasonic Holding Corporation; Palomar Technologies; Dr. Tresky AG7; BE Semiconductor Industries NV7; Fasford Technology Co.Ltd (Fuji Group); Kulicke and Soffa Industries Inc.; DIAS Automation (HK) Ltd; Shibaura Mechatronics Corporation; SUSS MicroTec SE; Tokyo Electron Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Bonding Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global semiconductor bonding market based on type, Process Type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Die Bonder

-

Wafer Bonder

-

Flip Chip Bonder

-

-

Process Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Die to Die Bonding

-

Die to Wafer Bonding

-

Wafer to Wafer Bonding

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

RF Devices

-

MEMS & Sensors

-

CMOS Image & Sensors

-

LED

-

3D NAND

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

Taiwan

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global semiconductor bonding market size was estimated at USD 925.0 million in 2023 and is expected to reach USD 954.5 million in 2024.

b. The global semiconductor bonding market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 1.20 billion by 2030.

b. Asia Pacific dominated the semiconductor bonding market with a revenue share of 68.3% in 2023. The Asia Pacific region hold significant share in the global semiconductor bonding market primarily due to its significant contributions to semiconductor manufacturing. This region is home to several key players in the semiconductor industry, including countries like South Korea, Taiwan, China, and Japan, which are not only leading in semiconductor production but also in the development of cutting-edge semiconductor bonding technologies.

b. Some of the key players operating in the semiconductor bonding market include EV Group, ASMPT Semiconductor Solutions, MRSI Systems. (Myronic AB), WestBond Inc, Panasonic Holding Corporation, Palomar Technologies, Dr. Tresky AG7, BE Semiconductor Industries NV7, Fasford Technology Co.Ltd (Fuji Group), Kulicke and Soffa Industries Inc., DIAS Automation (HK) Ltd, Shibaura Mechatronics Corporation, SUSS MicroTec SE, Tokyo Electron Limited.

b. The semiconductor bonding market is experiencing robust growth driven by the burgeoning demand for advanced electronic devices such as smartphones, electric vehicles, and renewable energy systems. This market encompasses a wide array of bonding techniques including die bonding, wafer bonding, and flip-chip bonding, each crucial to produce integrated circuits and microelectronic components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.