- Home

- »

- Next Generation Technologies

- »

-

Smart Warehousing Market Size, Share, Growth Report 2030GVR Report cover

![Smart Warehousing Market Size, Share & Trends Report]()

Smart Warehousing Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment (Cloud, On-premises), By Technology, By Application, By Warehouse Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-162-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Warehousing Market Summary

The global smart warehousing market size was USD 20.95 billion in 2022 and is projected to reach USD 57.97 billion by 2030, growing at a CAGR of 14.2% from 2023 to 2030. The market growth can be attributed to the rising adoption of automation and robotics solutions, the rapid expansion of the e-commerce industry, and the emergence of multi-channel distribution networks.

Key Market Trends & Insights

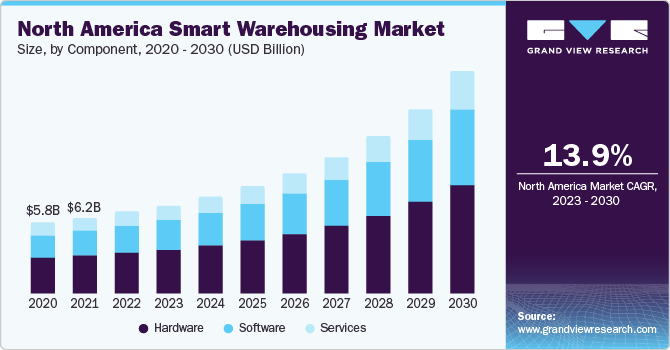

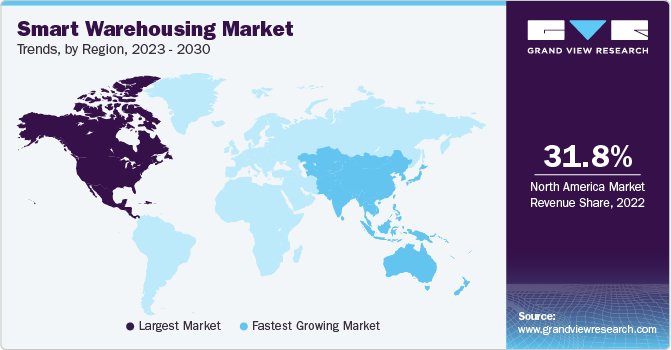

- North America dominated the overall market in 2022, with a market share of 31.8%.

- The Asia Pacific regional market is expected to witness the highest growth, with a CAGR of 15.2% over the projected period.

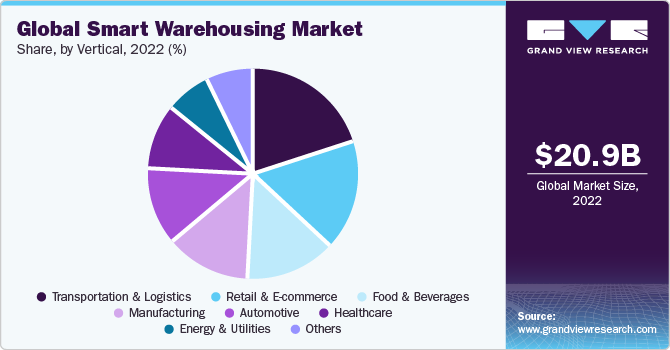

- Based on vertical, the transportation & logistics segment dominated the overall market with a revenue share of 19.8% in 2022.

- Based on vertical, the retail & e-commerce segment registered the fastest CAGR of 15.4% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 20.95 Billion

- 2030 Projected Market Size: USD 57.97 Billion

- CAGR (2023-2030): 14.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The growing e-commerce industry has played a significant role in the expansion of the smart warehousing industry. According to Tidio, the number of online shoppers has increased to over 2.14 billion, observing a substantial increase from the last few years. In the context of the current global population of 7.9 billion, this statistic indicates that 27% of all individuals across the globe are engaged in online purchasing. With the rise in online shopping and consumer expectations for quick and accurate order fulfillment, smart warehousing technologies have become essential for managing the complexities of modern supply chains.

E-commerce companies, faced with the challenge of handling a high volume of orders, leverage smart warehousing solutions to enhance operational efficiency, minimize errors, and improve overall customer satisfaction.

Furthermore, the rising adoption of automation and robotics solutions is a key trend in the market for smart warehousing. As companies strive to optimize warehouse operations, reduce manual labor, and enhance throughput, automation technologies such as Autonomous Mobile Robots (AMRs), robotic arms, and conveyor systems are increasingly integrated. For instance, in June 2022, Amazon.com, Inc. announced the launch of its first "fully autonomous" warehouse robot named Proteus, designed to operate freely without being caged away from human workers. The robot will initially be deployed to move "GoCarts," tall wheeled cages containing packages, around warehouses. These technologies not only accelerate order processing but also contribute to cost savings by minimizing the reliance on human labor. The efficiency gains achieved through automation translate into faster order fulfillment and improved overall warehouse performance, aligning with the demands of the e-commerce industry.

The rapid integration of artificial intelligence (AI) and machine learning (ML) has brought advanced predictive and prescriptive analytics capabilities to the smart warehousing sector. AI and ML algorithms enable warehouses to analyze vast amounts of data, predict demand patterns, optimize inventory levels, and enhance decision-making processes. This intelligent data-driven approach helps in real-time monitoring and decision support, allowing warehouses to adapt to changing demands swiftly.

The integration of AI and ML technologies enhances the overall agility and responsiveness of smart warehousing systems, enabling them to meet the demands of the dynamic e-commerce market efficiently. Furthermore, the increasing labor expenses have become a significant concern for businesses, prompting the adoption of smart warehousing solutions. As labor costs rise, companies are driven to automate routine and labor-intensive tasks within warehouses to achieve cost efficiencies. Smart warehousing technologies not only address the labor shortage challenges but also improve accuracy and reduce the risk of errors associated with manual tasks. By automating processes such as order picking, packing, and sorting, businesses can mitigate the impact of increasing labor expenses while simultaneously improving the speed and accuracy of order fulfillment in response to the demands of the growing e-commerce industry.

Vertical Insights

Based on Vertical, the market has been segregated into transportation & logistics, retail & e-commerce, manufacturing, healthcare, energy and utilities, automotive, food & beverages, and others. The transportation & logistics segment dominated the overall market with a revenue share of 19.8% in 2022. The transportation and logistics industry is adopting smart warehousing to enhance operational efficiency and meet the demands of a rapidly evolving market. For instance, major logistics companies such as DHL and UPS are integrating advanced warehouse management systems to streamline order processing, reduce lead times, and improve overall supply chain visibility.

The implementation of real-time tracking solutions and IoT-enabled devices enables precise monitoring of shipments, ensuring timely deliveries and minimizing disruptions. Additionally, the integration of automation technologies, such as Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs) and conveyor systems, is revolutionizing warehouse operations, allowing for faster and more accurate order fulfillment in the transportation and logistics industry.

The retail & e-commerce segment registered the fastest CAGR of 15.4% over the forecast period, fueled by the increasing demand for efficient and automated supply chain solutions. The surge in online shopping and the subsequent need for swift order fulfillment have propelled companies in the retail and e-commerce industry to adopt smart warehousing technologies. Advanced warehouse management systems, coupled with real-time tracking solutions, enable companies to streamline their operations, reduce processing times, and enhance overall efficiency. For instance, companies such as Amazon.com, Inc. have extensively deployed automation, robotics, and AI-powered technologies in their fulfillment centers, resulting in faster deliveries and optimized inventory management. The integration of smart warehousing technologies not only boosts operational agility but also allows retailers to stay competitive in the evolving landscape of e-commerce, where customer expectations for quick and accurate deliveries continue to rise.

Regional Insights

North America dominated the overall market in 2022, with a market share of 31.8%. The advanced technological infrastructure, coupled with a well-established logistics industry in North America, positions the region as a leader in the adoption and implementation of smart warehousing solutions. Furthermore, the strong presence of major e-commerce companies and retail players is also boosting market growth in North America. The rapid growth of online shopping and the subsequent demand for streamlined and efficient supply chain operations have led companies to invest significantly in smart warehousing technologies. The need for faster order fulfillment, real-time tracking, and optimized inventory management has prompted the widespread adoption of automation, robotics, and advanced warehouse management systems. For instance, in July 2023, Amazon.com, Inc. unveiled two fully autonomous mobile warehouse robots, Proteus and Cardinal, designed to enhance efficiency and safety in fulfillment centers. Proteus can carry up to 5,000 pounds of cargo, moving carts of products. At the same time, Cardinal is a smaller and more agile robot that picks up and moves individual packages, both equipped with sensors for obstacle detection and a slow-moving mode to work safely alongside human employees.

The Asia Pacific regional market is expected to witness the highest growth, with a CAGR of 15.2% over the projected period, driven by the widespread adoption of automation and robotics in supply chain operations. The region’s e-commerce landscape, characterized by an increase in online shopping, has propelled the demand for efficient warehouse management systems and real-time tracking solutions. Companies in Asia-Pacific are investing significantly in technologies such as Autonomous Mobile Robots (AMRs) and conveyor systems to optimize tasks like material handling and packaging, reducing labor costs and enhancing overall operational efficiency.

According to a survey by Zebra Technologies conducted in January and February 2022, nearly nine out of 10 warehouse operators globally recognize the necessity of implementing new technology to remain competitive in the on-demand economy. The survey highlighted a significant increase in warehouse automation, with over 90% of operators in all regions, including APAC, planning to increase the use of technologies such as wearables, mobile printers, rugged tablets, and mobile dimensioning software. Moreover, supportive government initiatives and policies focused on technological innovation, including Industry 4.0 technologies like IoT and AI, have further accelerated the growth of smart warehousing in countries such as China, Japan, and South Korea.

Component Insights

In terms of components, the market is classified into hardware, software and services. The hardware segment held the maximum market share, with a share of 50.1% in 2022. The hardware segment's growth is attributable to its foundational role in implementing advanced technologies within warehouse environments. Automated guided vehicles (AGVs) and robotic systems represent essential hardware components, revolutionizing material handling and enhancing overall operational efficiency. These hardware solutions contribute to significant labor savings by automating tasks such as picking, packing, and transportation, making them integral to smart warehousing strategies. The deployment of sensors, RFID technology, and barcode scanners as part of the hardware infrastructure enables real-time tracking and monitoring of inventory, ensuring accuracy and visibility throughout the supply chain. Warehouse robotics, including robotic arms and autonomous mobile robots (AMRs), empower warehouses with the capability to handle diverse tasks, from sorting to packaging, driving the hardware segment's growth. The integration of smart sensors and IoT-enabled devices into warehouse hardware fosters seamless connectivity, enabling data-driven decision-making and optimization of warehouse processes. The scalability and adaptability of hardware solutions, combined with advancements in technology, make them essential components for warehouses seeking to embrace digital transformations.

The software segment is expected to register the fastest CAGR of 15.0% over the forecast period. Warehouse management software (WMS) plays a crucial role in optimizing inventory, order fulfillment, and overall operational efficiency. The adoption of cloud-based WMS solutions enhances scalability, accessibility, and flexibility for warehouses, driving the segment's rapid growth. Automation software, including robotics process automation (RPA) and warehouse execution systems (WES), contributes significantly to streamlining processes and improving workflow efficiency. T

he integration of artificial intelligence (AI) and machine learning (ML) into software solutions enables predictive analytics, demand forecasting, and data-driven decision-making, further fueling the segment's expansion. Real-time monitoring and analytics software provides warehouse managers with actionable insights into operations, enabling proactive responses to challenges and continuous performance improvements. The increasing need for end-to-end visibility, connectivity, and interoperability in smart warehousing ecosystems propels the software segment's growth. As smart warehouses evolve, software solutions become central to orchestrating the seamless integration of various technologies, ensuring a cohesive and responsive operational environment.

Deployment Insights

The on-premises segment dominated the target market with a market share of 55.9% in 2022. The dominance of the on-premise segment in the market for smart warehousing can be attributed to the unique advantages it offers businesses. On-premise solutions involve deploying and managing the smart warehousing infrastructure within the organization's physical premises. This approach provides businesses with a higher level of control and customization, allowing them to tailor the system according to specific needs and operational requirements. One important aspect favoring on-premise solutions is data management and security. Companies can keep sensitive data within their own secure environment, addressing concerns related to data privacy and compliance with industry regulations. Industries that deal with confidential or regulated information, such as healthcare or finance, often opt for on-premise solutions to maintain a higher level of control over their data. Furthermore, certain industries may have unique operational needs that can be better addressed through on-premise systems. This includes businesses operating in regions with limited or unreliable internet connectivity, where on-premise solutions ensure continuous and reliable system access.

The cloud segment registered the fastest CAGR of 15.4% in 2022. Cloud solutions provide unparalleled scalability, allowing businesses to easily adjust operations based on demand fluctuations. Their cost-efficient subscription models eliminate significant upfront investments, making them particularly attractive to small and medium-sized enterprises (SMEs). Cloud solutions offer rapid deployment, enabling businesses to quickly integrate advanced smart warehousing technologies for a faster return on investment.

Remote accessibility is a significant advantage, facilitating collaboration among geographically dispersed teams. Automatic updates and maintenance by cloud providers ensure access to the latest features and enhanced security without manual interventions. The integration capabilities of cloud platforms support a connected smart warehousing ecosystem, allowing businesses to leverage a diverse range of tools and technologies. Cloud solutions enable efficient data analytics and insights, empowering businesses to make informed decisions. For organizations with global operations, the cloud provides centralized control and uniformity in smart warehousing processes across different locations.

Technology Insights

Based on technology, the market has been segmented into IoT, robotics and automation, AI and analytics, networking and communication, AR and VR, and other. The robotics and automation segment held the largest share of 31.8% in 2022. The segment's growth is attributable to its role in significantly enhancing operational efficiency through task automation and process streamlining. This leads to substantial cost savings by minimizing labor expenses and reducing errors in tasks such as picking and packing. The precision and accuracy of robotics contribute to improved inventory management and order processing.

The 24/7 operational capability of automated systems ensures continuous and responsive smart warehousing operations, enhancing customer satisfaction. Advanced analytics and data insights generated by robotics enable informed decision-making and continuous process optimization. Businesses are also undergoing strategic partnerships to implement robotics and automation in their warehouses. For instance, in May 2022, Walmart is expanding its partnership with Symbotic, a Massachusetts-based robotics company, to deploy its warehouse automation systems in all 42 of Walmart's distribution centers in the U.S. The safety and compliance benefits of automated systems contribute to a secure working environment, aligning with industry regulations.

The IoT segment is expected to register the fastest CAGR of 15.1% from 2023 to 2030, driven by its transformative impact on warehouse operations. IoT facilitates real-time monitoring and visibility, allowing for unprecedented insights into inventory, equipment, and environmental conditions. This data-driven approach enables informed decision-making and strategic optimization, enhancing overall operational efficiency. Efficient inventory management is achieved through continuous tracking enabled by RFID tags, sensors, and connected devices, ensuring accurate and timely information on goods' location and condition.

Predictive maintenance becomes possible with IoT, as sensors on machinery collect performance data, enabling proactive issue identification and minimizing downtime. The seamless connectivity and interoperability fostered by IoT devices create a cohesive operational environment within smart warehouses. The optimization of supply chains is a key outcome, with IoT providing end-to-end visibility and enabling adjustments to routes, lead times, and overall performance. The convergence of IoT with other technologies, such as artificial intelligence and machine learning, further propels its growth, making it an indispensable component of emerging smart warehousing solutions.

Application Insights

Based on application, the market has been segmented into inventory management, order fulfillment, asset tracking, predictive analytics, and others. The order fulfillment segment held the largest market share of 33.9% in 2022. Smart warehousing solutions play a crucial role in order fulfillment by optimizing processes, minimizing errors, and ensuring swift and accurate product delivery. These solutions leverage technologies such as real-time tracking, automation, and advanced analytics to streamline order processing, inventory management, and logistics coordination.

By integrating smart warehousing solutions, businesses can significantly improve the speed and accuracy of order fulfillment, resulting in enhanced customer satisfaction and a competitive advantage. In November 2023, FORTNA, a leading automation and software company, formed a global strategic partnership with Geek+, a mobile robotics solutions provider for logistics. The collaboration aims to transform order fulfillment by integrating Geek+'s goods-to-person and mobile sortation systems into FORTNA's offerings, enhancing efficiency, scalability, and optimized warehouse operations, ultimately leading to increased consumer satisfaction and a safer workplace for employees.

The inventory management segment registered the fastest CAGR of 14.9% from 2023 to 2030. The inventory management application segment plays a significant role in addressing the evolving needs of modern supply chain management. As businesses increasingly recognize the importance of efficient inventory control and real-time visibility, the adoption of advanced inventory management applications has become paramount. These applications leverage technologies such as RFID, IoT sensors, and data analytics to provide accurate, up-to-date information on inventory levels, location, and demand patterns. The rising demand for improved accuracy drives the inventory management segment by offering reduced lead times and enhanced order fulfillment capabilities. Businesses are investing in these applications to optimize stock levels, minimize stockouts or overstock situations, and improve overall warehouse efficiency. For instance, in August 2023, SupplyPro announced the launch of Inventory Shelf Tag, a key component of the UStockit platform, following a successful beta testing phase. This smart technology integrates electronic shelf labels with powerful inventory management software, turning any shelf, storeroom, or warehouse into a virtual vending machine, providing real-time access to inventory counts and enhancing efficiency for distributors and customers. Additionally, the integration of inventory management software with other smart warehousing solutions, such as automated picking systems and real-time tracking, further contributes to the segment's rapid growth.

Warehouse Size Insights

Based on warehouse size, the market has been segregated into small, medium and large. The large warehouse size segment dominated the overall market with a revenue share of 48.0% in 2022. Large warehouse sizes are well-suited for smart warehousing due to the scalability and operational complexities that come with managing extensive inventories and high-volume order processing. In such warehouses, the adoption of smart technologies becomes significant for optimizing various aspects of warehouse management. The scale of operations in large warehouses necessitates the implementation of advanced systems to ensure efficient inventory management, accurate order fulfillment, and seamless logistics operations. These warehouses often deal with diverse product lines, extensive storage areas, and a high volume of orders, making manual management challenging and prone to errors. Smart warehousing solutions, including warehouse management systems, real-time tracking, and automation technologies, help these large facilities enhance operational efficiency, reduce labor costs, and improve overall productivity. As a result, the adoption of smart warehousing in large facilities aligns with the imperative to meet the demands of modern supply chain dynamics, contributing to the sector's largest market share.

The medium warehouse size segment registered the fastest CAGR of 14.9% over the forecast period. Medium-sized warehouses are well-suited for smart warehousing as they frequently serve as a bridge between the extensive requirements of large facilities and the agility of smaller ones. These warehouses benefit significantly from the adoption of smart technologies as they face challenges in managing growing inventories and increasing order volumes. Medium-sized warehouses can efficiently implement and integrate advanced technologies cost-effectively.

Smart warehousing solutions, such as automated warehouse management systems, warehouse execution systems, real-time tracking, and robotics, enable medium-sized warehouses to enhance order accuracy, reduce processing times, and adapt to evolving supply chain demands. The flexibility and cost-effectiveness of these technologies make them particularly appealing to medium-sized warehouses aiming to optimize operations without the logistical challenges associated with larger facilities.

Key Companies & Market Share Insights

The market is competitive and is characterized by the presence of various major market players. Some prominent players in the market include Honeywell International Inc., Siemens, Zebra Technologies Corporation, IBM Corporation, Oracle Corporation, SAP SE, KION Group AG, Cognex Corporation, ABB Ltd., Tecsys, Inc., Manhattan Associates, PSI Logistics, and Reply, among others. These players are adopting strategies such as new product launches, and partnerships and collaborations to gain a competitive edge. For instance, in January 2022, HAI ROBOTICS announced a strategic partnership with Voyatzoglou Systems, the leading intralogistics provider in Greece, to provide smart warehousing solutions in Greece and the Balkan region.

The collaboration leverages HAI ROBOTICS' expertise in Autonomous Case-handling Robotic (ACR) systems, particularly the HAIPICK ACR system, which has gained recognition globally for its flexible deployment and efficiency in optimizing warehouse storage. Furthermore, in November 2023, Tecsys Inc. announced the introduction of Elite WMS for Healthcare Distribution, a warehouse management system designed to facilitate efficient compliance with U.S. Food and Drug Administration (FDA) regulations, particularly those outlined by the Drug Supply Chain Security Act (DSCSA). As the industry's first system to locally maintain full inference data on the GS1 system of standards, it streamlines workflows. It ensures real-time compliance for wholesale pharmaceutical distributors and third-party logistics providers, offering a comprehensive solution for meeting DSCSA mandates.

Key Smart Warehousing Companies:

- Honeywell International Inc.

- Siemens

- Zebra Technologies Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- KION Group AG

- Cognex Corporation

- ABB Ltd.

- Tecsys, Inc.

- Manhattan Associates

- PSI Logistics

- Reply

Smart Warehousing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.83 billion

Revenue forecast in 2030

USD 57.97 billion

Growth rate

CAGR of 14.2% from 2023 to 2030

Base year for estimation

2022

Historic year

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, application, warehouse size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Honeywell International Inc.; Siemens; Zebra Technologies Corporation; IBM Corporation; Oracle Corporation; SAP SE; KION Group AG; Cognex Corporation; ABB Ltd.; Tecsys, Inc.; Manhattan Associates; PSI Logistics; Reply.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Warehousing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global smart warehousing market report based on component, deployment, technology, application, warehouse size, vertical, and regions:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

IoT

-

Robotics and Automation

-

AI and Analytics

-

Networking and Communication

-

AR and VR

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Inventory Management

-

Order Fulfillment

-

Asset Tracking

-

Predictive Analytics

-

Others

-

-

Warehouse Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small

-

Medium

-

Large

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation & Logistics

-

Retail & E-commerce

-

Manufacturing

-

Healthcare

-

Energy and Utilities

-

Automotive

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart warehousing market size was estimated at USD 20.95 billion in 2022 and is expected to reach USD 22.83 billion in 2023.

b. The global smart warehousing market is expected to grow at a compound annual growth rate of 14.2% from 2023 to 2030 to reach USD 57.97 billion by 2030.

b. North America dominated the smart warehousing market and held a share of 31.8% in 2022, owing to the advanced technological infrastructure and well-established logistics industry.

b. The major market players includes Honeywell International Inc., Siemens, Zebra Technologies Corporation, IBM Corporation, Oracle Corporation, SAP SE, KION Group AG, Cognex Corporation, ABB Ltd., Tecsys, Inc., Manhattan Associates, PSI Logistics, and Reply, among others.

b. The Smart Warehousing market growth is driven by increasing demand for automation and robotics solutions across various industries, the increasing online shopping, and rising focus on the green initiatives and sustainability to minimize waste. Furthermore, the rapid expansion of the e-commerce industry, and the emergence of multi-channel distribution networks is also boosting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.