- Home

- »

- Advanced Interior Materials

- »

-

Global Specialty Silica Market Size Report, 2022-2030GVR Report cover

![Specialty Silica Market Size, Share & Trends Report]()

Specialty Silica Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Precipitated Silica, Fumed Silica, Silica Gel), By Application (Rubber, Agrochemicals, Food), By Region, And Segment Forecasts

- Report ID: 978-1-68038-794-0

- Number of Report Pages: 113

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

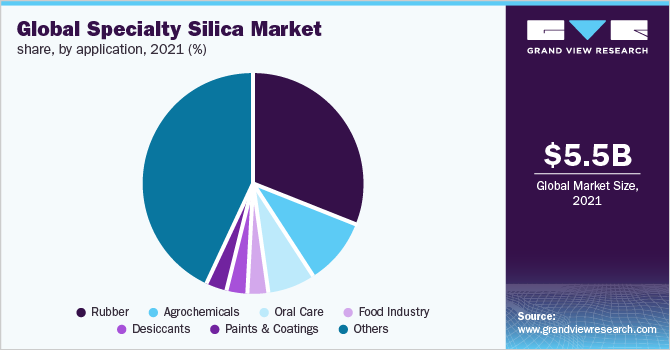

The global specialty silica market size was valued at USD 5.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030. The growth of the market for specialty silica is attributed to the rising demand for rubber and paints and coatings across different industries such as construction and electric vehicles. A significant rise in the production of Electric Vehicles (EVs) is expected to provide a lucrative opportunity for the tire market, which is anticipated to positively influence specialty silica demand. In 2021, the global EV sales reached 6.6 million, which was more than double as compared in 2020.

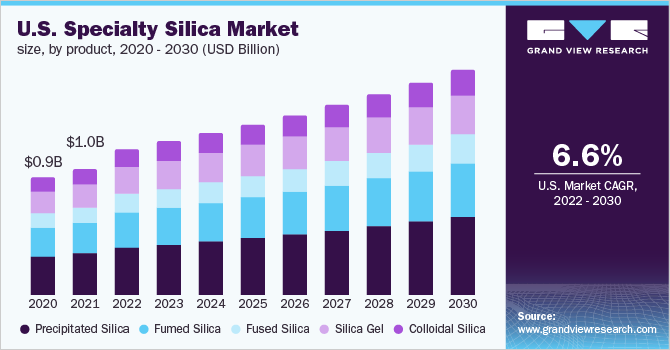

The U.S. holds the largest share of the market for specialty silica in North America. The U.S. automotive industry has shown significant growth in the EVs segment. This has led to the rising demand for advanced and high-efficient rubber tires. Growing production of these vehicles in the country is expected to have a positive influence on specialty silica demand from the U.S. tire industry. For instance, in May 2021, Lion Electric announced that they are going to construct the largest medium and heavy-duty EV plant in the country. The company is expected to invest USD 70 million over a period of three years. The plant is anticipated to have a production capacity of 20,000 all-electric buses and trucks.

Furthermore, the U.S. government is focused to provide affordable homes to its residents, which is expected to propel the demand for paints and coating. For instance, in September 2021, the House Democrats passed the Build Back Better Act, which is expected to allocate a financial aid of USD 170 billion for affordable housing. The government is targeting to preserve or build over one million affordable homes. Increasing product demand from various application industries such as packaging, rubber, and paints and coating is expected to propel market growth over the coming years. For instance, in November 2021, Nouryon announced that they are planning to expand the capacity of their Levasil colloidal silica manufacturing plant in the U.S. The expansion is aimed to meet the increasing demand from the packaging and construction industry.

Product Insights

The precipitated silica segment held the largest revenue share of more than 34.0% in 2021. The product acts as a reinforcing agent and improves abrasion and tear resistance. It also has widespread application in PVC sheets, wherein it acts as a parting agent and helps improve pigment dispersion and tensile strength. Fused silica is expected to register a growth rate of 7.6% in terms of revenue across the forecast period. The product is used in the manufacturing of optical parts such as mirrors, UV and IR transmitting optics, lenses, and metrology. Owing to its physical properties it is used in semiconductor fabrication as well. As the demand for semiconductors is increasing rapidly it is expected to propel the segment growth over the forecast period.

Silica gel is another vital product segment of the market for specialty silica and it is expected to register a CAGR of 6.2% in terms of revenue in the said forecast period. The product is widely used as a desiccant to control the humidity of the environment to avoid spoilage. The rising demand for pharmaceuticals and packaged food is expected to drive the segment growth across the forecast period. As the demand for silica gel is increasing rapidly, key market players are investing to expand their capacity. For instance, in May 2021, W. R. Grace and Co. announced that it has completed the expansion of its manufacturing plant of silica gel in Kuantan, Malaysia. The plant is expected to cater to the rising demand from various industries such as biofuel, purification anti-blocking in plastic films and bags, leather, matting furniture, and coils.

Application Insights

The rubber segment dominated the market for specialty silica and held a revenue share of over 30.0% in 2021. Specialty silica is one of the key reinforcing agents in the rubber industry, as it provides high modulus, high tear strength, and fatigue resistance. It is widely used for fuel-saving tires, which is projected to augment the segment growth over the coming years. Paints and coating is another key application segment of the market for specialty silica and it is expected to register the fastest growth rate across the forecast period. Specialty silica is widely used as a low-cost extender and is preferred for its chemical inertness allowing good heat, offering chemical and acid resistance, and lastly, it tends to improve the viscosity of paints and coatings.

Agrochemicals is another significant application segment of the market for specialty silica. The product is widely used in agrochemicals for aiding crop protection, seed treatment, and production of fertilizers. Increasing crop production is propelling the manufacturing of agrochemicals as well, which in turn is benefitting market growth. The desiccants application segment is projected to grow at a CAGR of 7.0% in terms of revenue across the forecast period. Desiccants are used in numerous industries such as leather, bags, pharmaceuticals, food and beverages, chemicals, and electronics. Growth in the aforementioned industries is anticipated to positively impact the segment growth over the forecast period.

Regional Insights

The Asia Pacific dominated the specialty silica market and held a revenue share of more than 40% in 2021. Growing economic development in the emerging countries of the region is anticipated to play a key role in boosting tire production. In addition, the coatings industry is poised to witness growth on account of rising construction activities in the region. Growing product demand is increasing key market players to expand their production facilities. For instance, in October 2021, Evonik Wynca (Zhenjiang) Silicon Material started its fumed silica plant, which is Evonik’s first fumed silica plant in China. Evonik aims at positioning itself by building a global supply chain for its customers in China and Asia.

North America accounted for the second-largest share, in terms of revenue in 2021. The countries in the region are investing in the construction of affordable houses which is expected to propel the demand for paints and coating. For instance, in April 2022, the Canadian government allocated USD 10 billion to the total housing package over the next 5 years. Europe is one of the key regions of the market for specialty silica. Various industries such as pharmaceuticals, automotive, FMCG, and high-end luxury products are driving the product demand in the region. The regulations concerning the VOC emission reduction in the paints and coatings industry are expected to propel the demand for eco-friendly specialty silica in the region over the coming years.

Key Companies & Market Share Insights

The market for specialty silica is highly competitive with key multinationals dominating the industry. Rising product demand in various regions and sectors has led these companies to increase investments in R&D and focus on new product development. Some of the prominent players in the specialty silica market include:

-

Elkem

-

Evonik Industries AG

-

Madhu Silica Pvt. Ltd.

-

Nouryon

-

PPG Industries, Inc.

-

PQ Corporation

-

Sinosi Group Corporation

-

Tosoh Corporation

-

Wacker Chemie AG

Specialty Silica Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.38 billion

Revenue forecast in 2030

USD 10.1 billion

Growth rate

CAGR of 7.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Brazil

Key companies profiled

Elkem; Evonik Industries AG; Madhu Silica Pvt. Ltd.; Nouryon; Oriental Silicas Corporation; PPG Industries; PQ Corporation; Sinosi Group Corporation; Solvay; Tosoh Corporation; Wacker Chemie AG; W.R. Grace & Co.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global specialty silica market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

Precipitated Silica

-

Fumed Silica

-

Fused Silica

-

Silica Gel

-

Colloidal Silica

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

Rubber

-

Agrochemicals

-

Oral Care

-

Food Industry

-

Desiccants

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global specialty silica market was estimated at USD 5.5 billion in 2021 and is expected to reach USD 6.38 billion in 2022.

b. The specialty silica market is expected to grow at a compound annual growth rate of 7.1% from 2022 to 2030 to reach USD 10.1 billion by 2030.

b. Precipitated silica was the key product segment of the market with a revenue share of above 34.0% of the market in 2021 owing to its increasing usage across multiple application sectors.

b. Some of the key players operating in the specialty silica market are Elkem, Evonik Industries AG, Madhu Silica Pvt. Ltd and Nouryon, among others.

b. Growing production for tires in the automotive industry coupled with rising demand for paints & coatings are the key growth drivers for the specialty silica market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.