- Home

- »

- Clinical Diagnostics

- »

-

Specimen Collection Cards Market, Industry Report, 2030GVR Report cover

![Specimen Collection Cards Market Size, Share & Trends Report]()

Specimen Collection Cards Market (2025 - 2030) Size, Share & Trends Analysis Report By Type Of Specimen (Blood, Saliva), By Material (Cotton & Cellulose Based), By Product, By Application, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-096-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specimen Collection Cards Market Summary

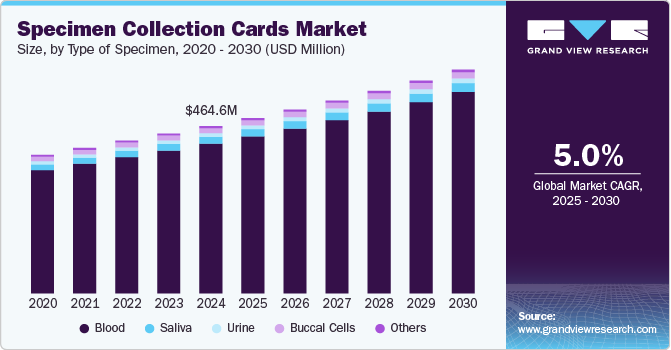

The global specimen collection cards market size was estimated at USD 464.6 million in 2024 and is projected to reach USD 621.3 million by 2030, growing at a CAGR of 5% from 2025 to 2030. The market growth is driven by supportive government regulations and a rising focus on non-invasive procedures.

Key Market Trends & Insights

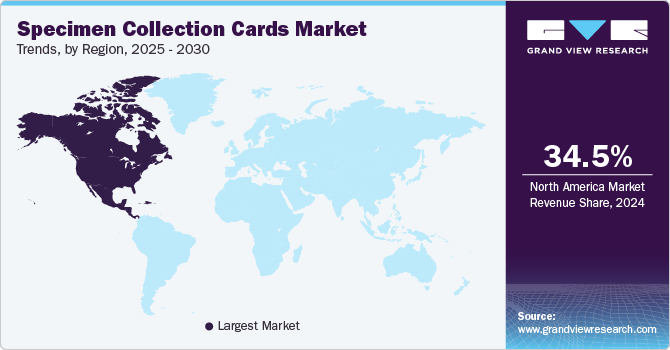

- North America specimen collection cards market dominated and accounted for a 34.5% share in 2024.

- The specimen collection cards market in the U.S. is anticipated to grow during the forecast period.

- Based on type of specimen, the blood sample segment dominated the market with largest revenue share of 89.5% in 2024.

- Based on material, the cotton & cellulose-based segment dominated the revenue share of 59.7% in 2024.

- Based on product, Whatman 903 product segment held revenue share of 40.2% in 2024.

Market Size & Forecast

- 2025 Market Size: USD 464.6 Million

- 2030 Projected Market Size: USD 621.3 Million

- CAGR (2025-2030): 5%

- North America: Largest market in 2024

In addition, the surge in product launches and the growing emphasis on research and development are expected to further drive specimen collection cards industry growth. At the start of the pandemic, the demand for specimen collection products saw a significant increase due to the high volume of testing and research efforts related to vaccine development. As vaccine and virus-related research programs are gaining traction, the demand for alternative products is growing due to their greater applicability and availability. In addition, the imposition of lockdowns and supply chain disruptions negatively affected the specimen collection cards industry.

The rise in forensic toxicology applications has notably influenced the industry for specimen collection cards, promoting their widespread use for efficient and reliable sample collection. These products have become particularly favored in forensic toxicology for their convenience, reliability, and ability to preserve samples over extended periods. Their advantages, such as non-invasiveness, reduced sample volume requirements, and improved sample stability during transport and storage, contribute to enhanced accuracy and efficiency in toxicological testing.

Furthermore, the specimen collection cards industry has benefited from the increasing focus on personalized medicine, genetic testing, and health monitoring. Personalized medicine offers tailored treatments based on an individual’s genetic profile, lifestyle, and other factors, with genetic testing playing a pivotal role in diagnostics, treatment selection, and disease prevention. Specimen collection cards have become indispensable tools in genetic testing, offering an efficient, dependable method for gathering biological samples like saliva, blood, and others. However, the market faces significant challenges related to sample integrity and storage. Ensuring the stability and quality of collected samples is essential for accurate test results. Sample contamination from pollutants, microorganisms, and chemicals can compromise the reliability of test outcomes, leading to false positives or negatives.

Type Of Specimen Insights

The blood sample segment dominated the market with largest revenue share of 89.5% in 2024. The dominance can be attributed to their numerous benefits and global product availability. In addition, regulatory advancements, particularly in newborn screening programs across several countries, are expected to positively impact the growth of this segment. For instance, in February 2023, the North Carolina Department of Health and Human Services announced an update to its newborn screening program, expanding it to include screenings for Mucopolysaccharidosis Type I (MPS I) and Pompe Disease.

The saliva collection segment is projected to grow at a CAGR of 4.6% over the forecast period. Ongoing research and development activities are expected to create a promising environment for the growth of this segment. A key example is OrisDX in June 2022, was awarded a USD 1.76 million investment for its innovative work in saliva-based diagnostics for oral cancers. This investment supports the company’s ongoing research, contributing to the advancement of saliva diagnostics in the medical field.

Material Insights

The cotton & cellulose-based segment dominated the revenue share of 59.7% in 2024. Cotton and cellulose-based specimen collection cards provide significant benefits in collecting and preserving specimens, making them more popular across various healthcare settings and contributing to specimen collection cards industry expansion. Compared to fiber-based products, cellulose-based products, such as Whatman 903 cards, have gained broader usage and have become a standard choice in numerous laboratories and healthcare environments.

Fiber-based segment is expected to register a substantial CAGR of 4.7% during the forecast period. Fiber-based specimen collection cards are experiencing rapid adoption across diverse industries due to their unique properties. Constructed from materials like synthetic fibers, these cards are tailored to meet specific needs, offering distinct advantages for various applications. Their growing demand is fueled by their specialized features and adaptability, making them an ideal choice for targeted use cases. With new product launches, the segment is likely to gain more traction in coming years. For instance, in October 2024, Ahlstrom launched Lipid Saver which is an advanced solution which can be used to store and transport fatty acids from whole blood samples.

Product Insights

Whatman 903 product segment held revenue share of 40.2% in 2024. This segment is expected to experience substantial growth in the coming years, driven by increased adoption in government-sponsored initiatives and research studies. For example, in June 2022, Scientific Reports published a study evaluating the VIDAS HIV Duo Quick and Anti-HCV assays for serosurveillance using dried blood specimens (DBS). The research utilized the Cytiva Whatman 903 Protein Saver Card to collect blood samples for detecting HCV and HIV, highlighting the card's relevance in diagnostics space.

FTA segment is likely to grow at a CAGR of 5.1% over the forecast period. The FTA card segment is projected to experience significant growth in the near future, driven by its increasing use in various clinical applications. For instance, in July 2022, a study focused on screening genetic diseases in newborns using dried blood spots (DBS) highlighted the extensive application of FTA filter papers, particularly those by Thermo Fisher Scientific Inc. The research utilized 29 DBS sets of FTA cards, underscoring their importance in applications such as bacterial genetics research and newborn screening programs.

Distribution Channel Insights

The offline distribution channel segment held market share of 72.2% in 2024. Offline channels, including pharmacies, healthcare clinics, and diagnostic laboratories, provide buyers with the convenience of purchasing specimen collection cards through in-person visits. Additionally, onsite pharmacies or diagnostic centers within healthcare clinics and hospitals serve as accessible offline options for obtaining these cards, catering to individuals who prefer physical shopping experiences.

The online distribution channel is anticipated to exhibit a significant CAGR of 5.3% during the forecast period. Online platforms provide a diverse selection of specimen collection cards designed for various sample types, such as blood, saliva, urine, and stool. These cards are frequently available as standalone products or integrated into home testing kits that include detailed instructions and essential components for sample collection. Key platforms offering such products include Everlywell, HealthLabs, MyLab Box, and Personalabs.

End Use Insights

Hospitals & clinics end use segment held revenue share of 73.5% in 2024. Hospitals and clinics were key end users of specimen collection cards in 2024, owing to mandatory newborn screening in various regions. In the U.S., approximately 98% of women give birth in hospitals. An increase in the capacity of hospitals and clinics is anticipated to boost the demand for specimen collection cards. In addition, the government of Australia announced that they have planned to increase the healthcare budget to USD 122.8 billion for 2027-28 from USD 112.7 billion for the year 2024-2025. Such growth is likely to fuel the demand for specimen collection cards over the next coming years.

The diagnostic center segment is estimated to show a considerable CAGR of 4.6% over the forecast period. Diagnostic centers play a crucial role in driving the demand for specimen collection cards in the market. The growing number of diagnostic laboratories, along with an increasing focus on diagnostic testing for HIV and HCV, is expected to propel the growth of the dried blood spot collection card market. As of November 2024, the U.S. has over 330,000 CLIA-certified laboratories, with the market experiencing an average annual growth rate of 0.8%, further contributing to the industry expansion.

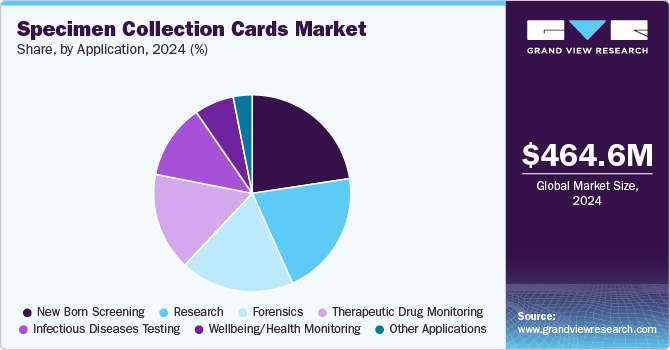

Application Insights

The newborn screening segment led the market with a revenue share of 22.6% in 2024. The segment growth is primarily driven by advancements in newborn screening, supportive government regulations, and ongoing research and development efforts in disease diagnosis. Additionally, the rising number of product launches and innovations is expected to further boost the segment during the forecast period. For instance, in November 2022, PerkinElmer received U.S. FDA marketing approval for its EONIS SCID-SMA assay kit. This platform uses PCR technology to simultaneously screen for severe combined immunodeficiency (SCID) and spinal muscular atrophy (SMA) from a single dried blood spot (DBS) sample, showcasing its potential in enhancing newborn screening programs.

The research segment is projected to grow at the fastest CAGR of 6.1% over the forecast period. The segment is expected to grow significantly during the forecast period, driven by increased investments in research and development activities and a growing focus on personalized medicine development. In addition, organizations offering specialized services for the bioanalysis of blood spot specimens are contributing to this growth by delivering unique solutions that leverage the advantages of dried blood spot (DBS) technology. For instance, Bioanalytical Systems, Inc. (BASi) has established expertise in DBS analysis at its bioanalytical facilities, providing tailored bioanalysis services. Such solution-driven initiatives by service providers are anticipated to further propel the segment's expansion.

Regional Insights

North America specimen collection cards market dominated and accounted for a 34.5% share in 2024. The market growth can be attributed to the increasing demand for drug profiling across various medications, including antiepileptics, immunosuppressants, and antibiotics. This growing need is a key driver of market expansion. Additionally, the presence of a well-established healthcare infrastructure and the availability of government funding for research are expected to further boost market growth in this region, supporting advancements in diagnostic and therapeutic applications.

U.S. Specimen Collection Cards Market Trends

The specimen collection cards market in the U.S. is anticipated to grow during the forecast period. Increased demand for non-invasive and cost-effective diagnostic solutions, particularly in the areas of newborn screening, genetic testing, and infectious disease testing, is driving the market forward.

Europe Specimen Collection Cards Market Trends

The Europe specimen collection cards market is likely to emerge as a lucrative region in the industry. The European market is benefiting from supportive regulatory policies and an increasing focus on early disease detection, which is promoting the adoption of these convenient and reliable diagnostic tools across healthcare settings.

The specimen collection cards market in the UK is projected to grow during the forecast period. The rise in point-of-care testing, coupled with the UK’s focus on personalized medicine and healthcare innovation, is driving the adoption of specimen collection cards.

France specimen collection cards market is expected to show steady growth over the forecast period, driven by France’s strong focus on advancing personalized medicine, improving healthcare accessibility, and enhancing early disease detection.

The specimen collection cards market in Germany is projected to expand during the forecast period. Germany's strong healthcare infrastructure, emphasis on personalized medicine, and growing focus on early disease detection further support market growth.

Asia Pacific Specimen Collection Cards Market Trends

The Asia Pacific specimen collection cards market is expected to experience the highest growth rate of 6.1% CAGR during the forecast period. The market is growing due to the increasing demand for cost-effective and non-invasive diagnostic solutions, particularly in countries with large populations such as China, India, and Japan. The rise in the prevalence of chronic diseases, genetic disorders, and infectious diseases is driving the need for efficient screening and diagnostic methods.

The specimen collection cards market in China is projected to expand throughout the forecast period. With a large and aging population, rising rates of chronic diseases, and growing concerns over infectious disease outbreaks, China is seeing a higher need for accessible and cost-effective diagnostic tools. Specimen collection cards offer a convenient method for collecting and transporting samples, making them ideal for applications like newborn screening, genetic testing, and infectious disease monitoring.

Japan specimen collection cards market is anticipated to grow during the forecast period, due to due to the rising demand for convenient, non-invasive diagnostic tools that align with the country’s aging population and focus on preventative healthcare.

Latin America Specimen Collection Cards Market Trends

The specimen collection market in the Latin America is expected to experience significant growth over the forecast period. The region's large population and the growing prevalence of chronic diseases are driving the need for efficient and accessible diagnostic methods. Specimen collection cards are particularly beneficial in remote and underserved areas, where they facilitate sample collection without the need for extensive healthcare infrastructure.

Brazil specimen collection cards market is anticipated to grow during the forecast period. With rising rates of chronic diseases, infectious diseases, and genetic disorders, there is a greater need for efficient and accessible diagnostic methods. Specimen collection cards are particularly advantageous in Brazil's remote and rural areas, where healthcare infrastructure may be limited.

Middle East & Africa Specimen Collection Cards Market Trends

The MEA specimen collection cards market growth can be attributed to ongoing government initiatives focused on improving early diagnosis and treatment of various life-threatening

diseases in the MEA region. The high prevalence of chronic kidney disease in Kuwait, along with increased awareness and accessible healthcare services, also drives the demand for blood chemistry tests. This, in turn, fuels the growth of the specimen collection market, which is essential for maintaining sample integrity & ensuring accurate test results.The specimen collection cards market in Saudi Arabia is growing due to the increasing demand for efficient, non-invasive diagnostic tools, driven by the country's focus on improving healthcare services and advancing medical technologies. As part of its Vision 2030 initiative, Saudi Arabia is investing in healthcare infrastructure, which includes expanding access to advanced diagnostic methods such as specimen collection cards.

Key Specimen Collection Cards Company Insights

The industry is characterized by the presence of several key players offering a range of innovative products for various diagnostic applications, including genetic testing, newborn screening, and infectious disease monitoring. Major companies in the market are focusing on technological advancements, such as improved card designs, enhanced sample stability, and easier usability, to cater to the growing demand for non-invasive and cost-effective diagnostic tools. For instance, in November 2024, Capitainer launched its Capitainer SEP10 blood collection card which allows cell separation from plasma without centrifugation.

Key Specimen Collection Cards Companies:

The following are the leading companies in the specimen collection cards market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- PerkinElmer Inc.

- DBS System SA

- Danaher Corporation

- Eastern Business Forms, Inc.

- Ahlstrom

- ARCHIMED Life Science GmbH

- GenTegra LLC

- FortiusBio

- CENTOGENE N.V.

Recent Developments

-

In November 2024, Capitainer launched Capitainer SEP10 collection card which allows users to separate cells from plasma at the site of collection without centrifugation. The product will be available in the U.S., and the European Union.

-

In September 2022, Capitainer, a Swedish startup, announced the highly positive results of its qDBS card. It is a volumetric dried blood spot sampling device that showcases accurate outcomes for phenylketonuria. The new technology addresses the concern of fluctuation in volume and hematocrit of blood in conventional cards.

-

In January 2024, Capitainer launched miQro Lab Solutions, a new U.S. laboratory in Warwick, Rhode Island. This initiative emphasizes the company’s goal to incorporate its innovative self-sampling technologies more swiftly into the U.S. healthcare framework. The establishment of miQro Lab Solutions is to expedite the adoption of Capitainer’s efficient and user-friendly solutions.

Specimen Collection Cards Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 487.0 million

Revenue forecast in 2030

USD 621.3 million

Growth rate

CAGR of 5.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of specimen, material, product, application, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK;, France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

QIAGEN; PerkinElmer Inc.; DBS System SA; Danaher Corporation; Eastern Business Forms, Inc.; Ahlstrom; ARCHIMED Life Science GmbH; GenTegra LLC; FortiusBio; CENTOGENE N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specimen Collection Cards Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specimen collection cards market report based on type of specimen, material, product, application, distribution channel, end use, and region:

-

Type of Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Saliva

-

Urine

-

Buccal Cells

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton & Cellulose-based

-

Fiber-based

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Whatman 903

-

Ahlstrom 226

-

FTA

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Born Screening (NBS)

-

Infectious Diseases Testing

-

Therapeutic Drug Monitoring

-

Forensics

-

Research

-

Wellbeing/Health Monitoring

-

Other Applications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostics Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global specimen collection cards market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 621.3 million by 2030.

b. North America dominated the specimen collection cards market with a share of 34.54% in 2024. This is attributable to rising initiatives for newborn screening and growing investments in research & development activities.

b. Some key players operating in the specimen collection cards market include Danaher Corporation; Ahlstrom; Qiagen; PerkinElmer; Eastern Business Forum, Inc.; Shimadzu Corporation; Spot On Sciences; Sedia Biosciences Corporation; HemaXis; GenTegra LLC.; CENTOGENE N.V.; and ARCHIMED Life Science GmbH.

b. Key factors that are driving the market growth include increasing focus on personised medicine, favorable government policies for disease screening, and cost efficiency.

b. The global specimen collection cards market size was estimated at USD 464.6 million in 2024 and is expected to reach USD 487.0 million in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.