- Home

- »

- Medical Devices

- »

-

Upper Extremity Implants Market Size & Share Report, 2030GVR Report cover

![Upper Extremity Implants Market Size, Share & Trends Report]()

Upper Extremity Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Shoulder, Elbow, Hand & Wrist), By Biomaterial (Metallic, Ceramic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-069-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Upper Extremity Implants Market Trends

The global upper extremity implants market size was estimated at USD 1.73 billion in 2023 and is projected to grow at a CAGR of 4.0% from 2024 to 2030. The increase in sports-related injuries and a growing preference for implants due to their many benefits fuel market growth. Moreover, the rising number of upper limb surgeries is boosting the demand for artificial limbs and implants. For instance, recent data from the American Academy of Orthopedic Surgeons reveals that more than 53,000 shoulder replacement surgeries are performed annually in the U.S., with shoulder and elbow replacements ranking among the top 10 most common orthopedic procedures.

The growing prevalence of musculoskeletal disorders and sports-related injuries is anticipated to drive market growth throughout the forecast period. Notable implants for upper limb arthritis include HemiCAP Systems from Anika Therapeutics, Inc., and shoulder replacement solutions from Zimmer Biomet. In addition, an article by Johns Hopkins Medicine highlights that around 30 million people in the U.S. participate in organized sports, resulting in over 3.5 million sports injuries each year.

In addition,innovations in implant technology and materials are pivotal in driving market growth. Advances in biocompatible materials, such as titanium and polyethylene, have enhanced the durability and effectiveness of implants. Furthermore, developments in 3D printing and computer-aided design allow customized implants tailored to individual patient anatomies, improving outcomes and reducing complications. These technological advancements improve the functionality and longevity of upper extremity implants and boost patient confidence in opting for surgical solutions. Companies like Zimmer Biomet and Anika Therapeutics, Inc. are at the forefront of these innovations, offering state-of-the-art solutions for upper limb conditions.

Moreover, the development of customized implants, the increasing demand for biocompatible implants with reduced toxicity, and the strong demand for technologically advanced prosthetics from end-users are driving manufacturers to launch innovative products. For instance, in October 2022, Integrum announced that its groundbreaking OPRA Implant System received patent approval from the US Patent and Trade Organization. This novel system features bone-anchored prostheses directly attached to the bone and is suitable for upper and lower limbs.

Furthermore, as people age, they are more prone to conditions like osteoarthritis and fractures that necessitate surgical intervention. The geriatric demographic is expanding globally, leading to an increased need for orthopedic implants and surgeries. Healthcare systems worldwide are adapting to this growing demand, with many facilities enhancing their orthopedic services and capabilities. This demographic trend ensures a continuous need for upper extremity implants, making it a critical factor in the market’s sustained expansion.

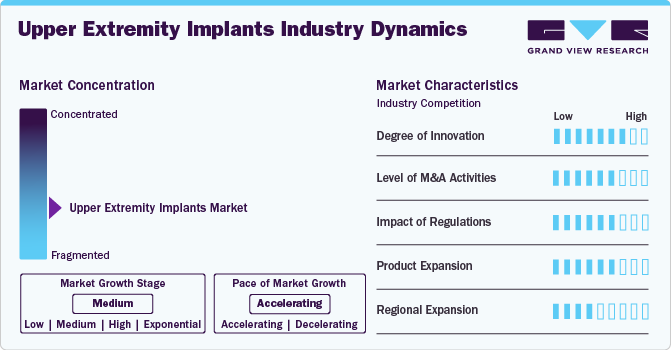

Market Concentration & Characteristics

The market is witnessing significant innovation, marked by the development of customized implants, biocompatible materials with reduced toxicity, and advanced prosthetics. Cutting-edge technologies like 3D printing and bone-anchored systems, exemplified by Integrum's OPRA Implant System, are revolutionizing patient outcomes and setting new standards in orthopedic solutions.

Regulation profoundly impacts the market by ensuring product safety, efficacy, and quality. Stringent regulatory standards, such as those enforced by the FDA and European Medicines Agency, mandate rigorous testing and clinical trials. Compliance with these regulations can lengthen development timelines and increase costs, but they ultimately protect patients and enhance market trust, driving innovation and maintaining high standards in the industry.

Mergers and acquisitions occur at a moderate to high frequency, reflecting strategic consolidation among companies to broaden product offerings and expand market reach. For instance, in May 2022, CONMED Corporation acquired In2Bones Global, Inc., a privately held company. In2Bones is a global developer, manufacturer, and distributor of medical devices for treating disorders and injuries of the upper extremities. These transactions often aim to leverage complementary technologies and strengthen competitive positions in the orthopedic medical device sector.

Product expansion in the market involves continuous innovation and the introduction of new technologies to address diverse patient needs. Companies frequently expand their product lines by developing advanced implants, biocompatible materials, and surgical techniques. For instance, in August 2021, The Orthopaedic Implant Company introduced its FDA-cleared DRPx wrist fracture plate in Reno, Nevada. The DRPx System stands out as the sole distal radius plating solution with an advanced ergonomic design tailored to orthopedic surgeons' technique preferences. This innovation aims to enhance surgical outcomes and promises substantial cost savings, thereby supporting the financial sustainability of ambulatory surgery centers (ASCs) and hospitals. This expansion aims to enhance surgical outcomes, improve patient satisfaction, and capture larger market shares amidst the growing demand for effective solutions in orthopedic care.

Global expansion involves manufacturers broadening their geographic footprint to tap into emerging markets and meet growing demand. Companies are establishing partnerships, distribution networks, and manufacturing facilities worldwide to ensure accessibility to advanced implant technologies. This expansion strategy aims to cater to diverse patient populations and capitalize on evolving healthcare infrastructures globally.

Type Insights

The shoulder segment held the largest share of 59.52% in 2023. The segment's growth is propelled by a rise in sports injuries, shoulder dislocations, a growing geriatric population, increasing incidence of osteoarthritis, shoulder fractures, accidents, and traumas, all contributing to higher demand for upper extremity implant products. Shoulder replacements dominate orthopedic extremity procedures and stand out as a lucrative segment within orthopedics.As patient satisfaction expectations rise, surgeons increasingly seek treatment options to enhance clinical outcomes. For instance, in May 2024, Shoulder Innovations, a prominent figure in the shoulder replacement implant industry, introduced its newest offering: the InSet 95 Humeral Stem. Specifically engineered to improve surgical outcomes and expedite recovery for individuals with compromised bone quality, this product marks a significant advancement in orthopedic care. This drives the demand for shoulder replacement and arthroplasty implant products, driven by trends such as revision surgeries for older patients with previous shoulder replacements, diverse biomaterial implants, bone-preserving solutions, and advanced joint arthroplasty systems.

The elbow segment is projected to grow fastest in the coming years. The elbow segment is driven by continuous innovation in new elbow implant systems. In addition, the requirement for implant in elbow replacement for primary and revision surgery has uplifted the growth. Elbow surgeries, including replacements and repairs, are increasingly performed to alleviate pain and restore mobility. This trend is bolstered by advancements in implant technology, offering patients enhanced durability and functionality. For instance, in February 2024, in partnership with IIT, the All India Institute of Medical Sciences plans to initiate clinical trials of domestically developed implants designed for elbow replacement surgery tailored specifically for Indian patients.

Biomaterial Insights

The metallic biomaterials segment held the largest share of 40.83% in 2023. This can be attributed to advanced properties such as increased strength, toughness, ductility, hardness, corrosion resistance, and biocompatibility. Furthermore, demand for metallic materials such as stainless steels, titanium (Ti)-based alloys, Co-based alloys, and biodegradable alloys such as Mg-based alloys in the shoulder and elbow replacement surgery has lifted the segment growth. Furthermore, these materials have been approved by the U.S. FDA and are routinely used in orthopedic implants. Furthermore, new designs and conceptions of metallic biomaterials are expected to create the potential for biomedical applications in the upper extremities.

Natural biomaterials is projected to grow fastest in the coming years, driven by increasing demand for biocompatible solutions that minimize adverse reactions and promote better tissue integration. Natural biomaterials, such as collagen and hyaluronic acid derivatives, offer advantages like enhanced biocompatibility and reduced inflammatory responses. These materials are gaining popularity for their ability to mimic natural tissue properties, improving implant longevity and patient outcomes. Manufacturers are investing in research and development to expand the use of natural biomaterials in upper extremity implants, reflecting a growing trend towards sustainable healthcare solutions.

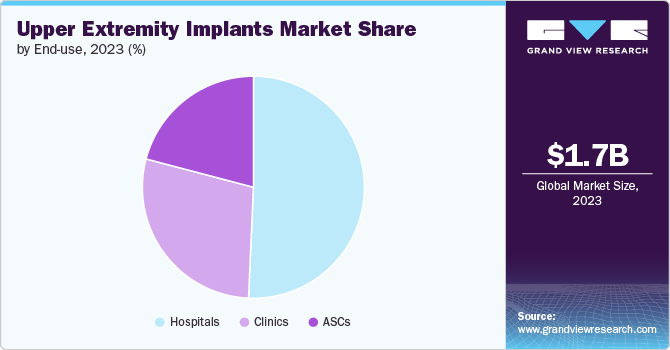

End-use Insights

The hospitals segment held the largest share of 50.69% in 2023. Innovations such as robotic-assisted surgery and advanced imaging techniques enhance surgical accuracy and patient outcomes. Hospitals are increasingly adopting these technologies to streamline operations and improve efficiency, attracting patients seeking state-of-the-art treatment options. For instance, in April 2024, Mumbai's Kokilaben Dhirubhai Ambani Hospital (KDAH) introduced the Arthrex Modular Glenoid System featuring VIP (Virtual Implant Positioning), aiming to enhance shoulder replacement surgeries in India. This innovative technology is expected to improve outcomes for numerous individuals experiencing shoulder joint issues significantly. This trend underscores the pivotal role of technology in driving growth and competitiveness within the market.

The ASCs segment is expected to grow at a significant rate over the forecast period, driven by a growing preference for ASCs in upper extremity procedures. This trend is bolstered by increasing innovations in new products and FDA clearances, contributing to market expansion. ASCs offer patients benefits such as effective postoperative pain management, quick discharge, minimal adverse effects, and cost-effective treatment options, enhancing overall patient care and recovery experience.

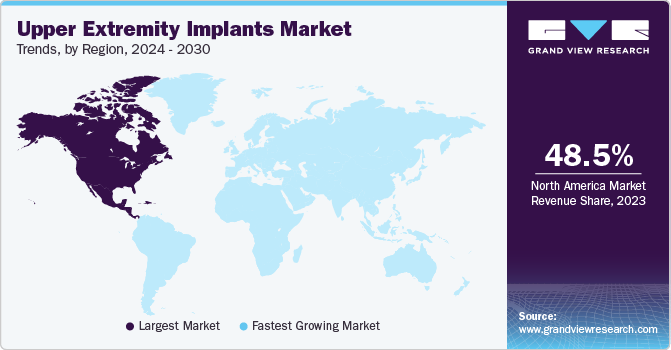

Regional Insights

North America upper extremity implants market dominated the overall global market and accounted for the 48.45% revenue share in 2023. Factors such as rising common shoulder injuries such as include dislocations/separations, sprains/strains, contusions, and fractures. The rise in the geriatric population, increasing number of sports injuries, and presence of key participants in North America are driving regional growth. For instance, in August 2023, Anika Therapeutics, Inc. announced it had received final 510(k) clearance from the FDA for the Integrity Implant System. This system is designed to improve the healing of injured tendons in rotator cuff repair procedures. Alternatively, the presence of established healthcare facilities treating a range of conditions such as fractures, dislocations, tendonitis, and arthritis has increased the requirement for products to a major extent.

U.S. Upper Extremity Implants Market Trends

The upper extremity implant market in the U.S. held a significant share of the North American market in 2023. Innovations such as 3D printing, biocompatible materials, and personalized implant designs enhance surgical outcomes and patient recovery. For instance, in August 2021, DePuy Synthes introduced the INHANCE Shoulder System, the first fully integrated shoulder arthroplasty system on the market. The INHANCE Shoulder System enables surgeons to address a wide variety of cases with a streamlined and comprehensive implant offering featuring common instrumentation and unique intraoperative flexibility. These technological advancements offer improved durability and functionality, making them highly attractive options for both surgeons and patients seeking effective orthopedic solutions.

Europe Upper Extremity Implants Market Trends

The upper extremity implant market in Europe is experiencing notable growth. due to the high rate of shoulder accidents and injuries. Increasing road traffic accidents and sports-related injuries contribute significantly to the demand for shoulder implants. Enhanced healthcare infrastructure and advancements in implant technology further support the market's expansion, addressing the rising need for effective treatment options.

The UKupper extremity implant market is one of the major markets in the region, experiencing notable growth. due to the rising incidence of musculoskeletal disorders and sports injuries. Increased participation in sports and an aging population contribute to higher rates of conditions like arthritis and fractures. This surge in injuries and disorders drives the demand for advanced implant solutions, promoting market expansion and technological innovation in the sector.

The upper extremity implant market in Germany is witnessing notable growth propelled by an increase in shoulder surgeries. Factors such as a rising elderly population, higher rates of sports-related injuries, and advancements in medical technology are fueling this trend. According to an NIH study, the relative proportion of RTSA (reverse total shoulder arthroplasty) among all shoulder arthroplasty procedures rose significantly from 39% in 2012 to 68.6% in 2022 in Germany. Improved surgical techniques and innovative implant designs enhance patient outcomes, make shoulder surgeries more effective, and boost demand for upper extremity implants in the German healthcare sector.

Asia Pacific Upper Extremity Implants Market Trends

The upper extremity implant market in Asia Pacificis experiencing robust growth, driven by increasing healthcare investments and a rising incidence of musculoskeletal disorders. Key market players, such as Johnson & Johnson, Zimmer Biomet, and Stryker, are expanding their presence in the region. For instance, in October 2023, in Japan, Smith+Nephew launched the REGENETEN Bioinductive Implant, providing access to advanced treatment for thousands of patients. This innovative implant is designed to promote healing and improve outcomes for individuals with rotator cuff injuries, marking a significant milestone in orthopedic care. Their innovative implant technologies and strategic partnerships further propel market expansion and improve patient outcomes.

China upper extremity implant market is driven by advanced technology such as 3D printing and biocompatible materials. These innovations enhance surgical precision and patient outcomes, meeting the increasing demand for effective orthopedic solutions.

The upper extremity implant market in Japan is expanding due to a rise in upper extremity accidents. Factors such as workplace injuries and sports-related incidents contribute significantly to the demand for shoulder, elbow, and wrist implants. This trend is driving advancements in implant technology and enhancing treatment options for patients across Japan.

Latin America Upper Extremity Implants Market Trends

The upper extremity implant market in Latin America is growing with increasing awareness and diagnosis rates of musculoskeletal disorders. Rising healthcare access and education contribute to higher diagnosis rates, driving demand for shoulder, elbow, and wrist implants. This trend prompts healthcare providers to adopt advanced implant technologies, improving patient outcomes and expanding the market across the region.

Brazil upper extremity implant market is expanding due to the high incidence of sports injuries and accidents. Rising participation in sports activities and workplace-related incidents contribute significantly to the demand for shoulder, elbow, and wrist implants. This trend underscores the need for advanced orthopedic solutions to address these injuries effectively.

MEA Upper Extremity Implants Market Trends

The upper extremity implant market in MEA is experiencing growth driven by an increase in surgical procedures for shoulder, elbow, and wrist conditions. Factors such as aging populations, sports injuries, and advancements in healthcare infrastructure contribute to the rising demand for orthopedic implants in the region.

Saudi Arabia upper extremity implant market is expanding rapidly due to its aging population facing increasing joint problems. With age-related conditions like arthritis and fractures becoming more prevalent, there is a rising demand for shoulder, elbow, and wrist implants to address these orthopedic challenges effectively.

Key Upper Extremity Implants Company Insights

The market is highly competitive, with key players such as Smith & Nephew, Medtronic, Aesculap, BioTek Instruments, Conmed, and Arthrex, Inc. holding significant positions. The major companies are undertaking various strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansion, to serve their customers' unmet needs.

Key Upper Extremity Implants Companies:

The following are the leading companies in the upper extremity implants market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- DePuy

- Zimmer Biomet

- Smith & Nephew

- Medtronic

- Aesculap

- BioTek Instruments

- Conmed

- Arthrex, Inc.

- Ossur

- DJO Global

- Acumed LLC

Recent Developments

-

In February 2024, Smith+Nephew, a global medical technology company, launched its AETOS Shoulder System for full commercial availability in the U.S. Moreover, it has received 510(k) clearance for its integration with 3D Planning Software for total shoulder arthroplasty.

-

In April 2024, Zimmer Biomet Holdings, Inc., a prominent global leader in medical technology, announced the successful execution of the inaugural robotic-assisted shoulder replacement surgery utilizing its ROSA Shoulder System.

-

In January 2024, Enovis Corporation, acquired LimaCorporate S.p.A., a prominent global orthopedic leader specializing in advanced implant solutions that restore motion.

Upper Extremity Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.80 billion

Revenue forecast in 2030

USD 2.28 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, biomaterial, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; DePuy; Zimmer Biomet; Smith & Nephew; Medtronic; Aesculap; BioTek Instruments; CONMED; Arthrex, Inc.; Ossur; DJO Global; Acumed LLC

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Upper Extremity Implants Market Report Segmentation

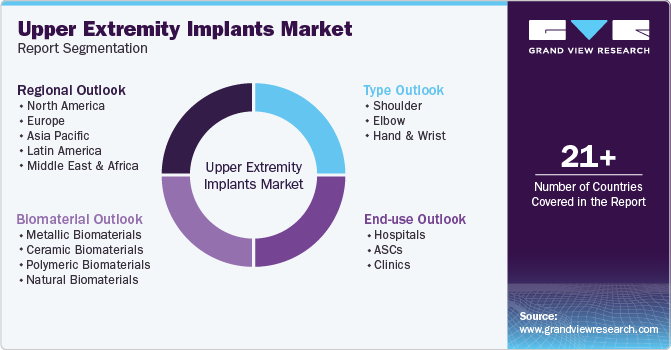

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global upper extremity implants market report based on type, biomaterial, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Shoulder

-

Elbow

-

Hand & Wrist

-

-

Biomaterial Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic Biomaterials

-

Ceramic Biomaterials

-

Polymeric Biomaterials

-

Natural Biomaterials

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

ASCs

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina Mexico

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global upper extremity implants market size was estimated at USD 1.73 billion in 2023 and is expected to reach USD 1.8 billion in 2024.

b. The global upper extremity implants market is expected to grow at a compound annual growth rate of 4.03% from 2024 to 2030 to reach USD 2.28 billion by 2030.

b. The shoulder segment held the largest share of 59.5% in 2023 owing to constant product demand for shoulder replacement developments and increased implant demand in the treatment of fractures

b. Some of the key players oerating the market include Stryker Corporation, DePuy Synthes, Zimmer Biomet, Smith & Nephew, and Medtronic among others.

b. The increasing prevalence of musculoskeletal disorders such as osteoarthritis and osteoporosis coupled with the rising geriatric population across the world are the major factors driving the global upper extremity implants market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.