- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Aerosol Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Aerosol Market Size, Share & Trends Report]()

U.S. Aerosol Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Steel, Aluminum), By Type (Bag In Valve, Standard), By Propellant Type (Nitrogen), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-324-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aerosol Market Summary

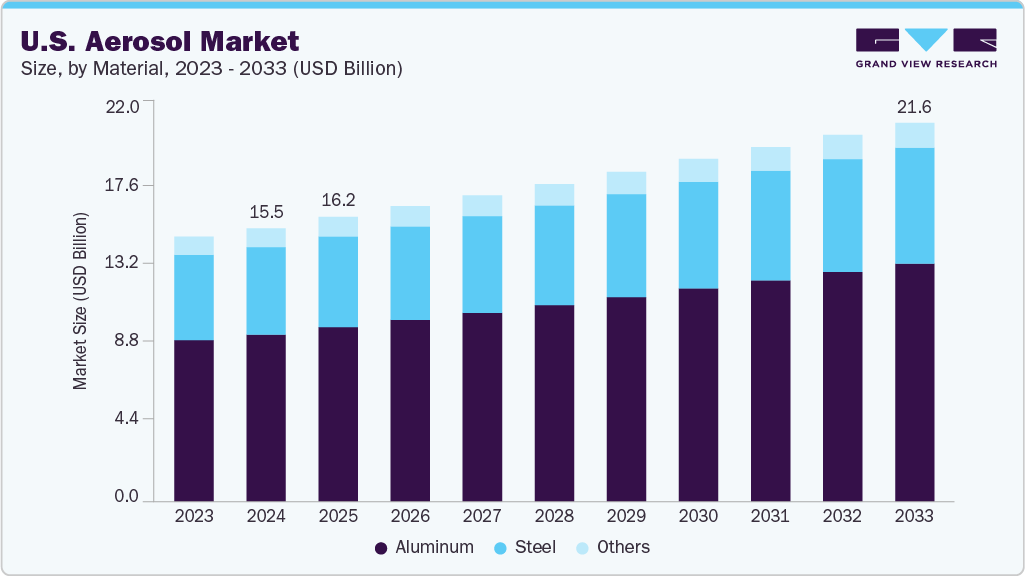

The U.S. aerosol market size was estimated at USD 15.54 billion in 2024 and is projected to reach USD 21.56 billion by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The U.S. aerosol industry is driven by growing demand for personal care and household products, such as deodorants, air fresheners, and disinfectants. In addition, advancements in eco-friendly propellants and sustainable packaging are boosting market growth.

Key Market Trends & Insights

- By material, the steel segment is expected to grow at the fastest CAGR of 3.1% from 2025 to 2033.

- By type, the bag in valve segment is expected to grow at the fastest CAGR of 4.0% from 2025 to 2033.

- By propellant type, the nitrogen segment is expected to grow at the fastest CAGR of 3.8% from 2025 to 2033.

- By application, the personal care segment is expected to grow at the fastest CAGR of 4.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 15.54 Billion

- 2033 Projected Market Size: USD 21.56 Billion

- CAGR (2025-2033): 3.6%

Several key factors, including consumer demand for convenience, technological advancements, and regulatory changes drive the U.S. aerosol industry. Aerosol products, ranging from personal care items like deodorants and hairsprays to household products like disinfectants and air fresheners, are favored for their ease of use and precise application. For example, the growing popularity of dry shampoo aerosols highlights how busy lifestyles and the need for quick grooming solutions propel market growth. In addition, innovations in propellant technology, such as the shift from ozone-depleting CFCs to environmentally friendly alternatives like hydrofluorocarbons (HFCs) and compressed gases, have expanded product sustainability and compliance with environmental regulations.The increasing demand for hygiene and sanitization products, particularly in the wake of the COVID-19 pandemic, also triggered the market growth. Aerosol-based disinfectants and sanitizers saw a surge in sales as consumers prioritized cleanliness and infection control. Companies like Lysol and Clorox capitalized on this trend by expanding their aerosol disinfectant lines. Furthermore, the healthcare sector’s reliance on aerosolized medications, such as asthma inhalers, underscores the market’s importance in medical applications. This segment continues to grow due to rising respiratory diseases and advancements in drug delivery systems.

Sustainability concerns and regulatory pressures are also shaping the aerosol market. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies have imposed strict guidelines on volatile organic compounds (VOCs) and propellant emissions, pushing manufacturers to develop eco-friendly formulations. For instance, brands like Dove and Degree have introduced aerosol deodorants with lower carbon footprints, using compressed air or nitrogen as propellants. The shift toward "green" aerosols aligns with consumer preferences for sustainable products, further driving innovation and market expansion.

Moreover, the influence of e-commerce and digital marketing has amplified aerosol product accessibility and visibility. Online platforms enable brands to reach a broader audience, while targeted ads educate consumers on product benefits. For example, social media campaigns for aerosol sunscreens or cosmetic mists have driven sales among younger demographics. As urbanization and disposable incomes rise, the demand for portable, efficient aerosol products is expected to grow, ensuring the market’s continued expansion across multiple sectors.

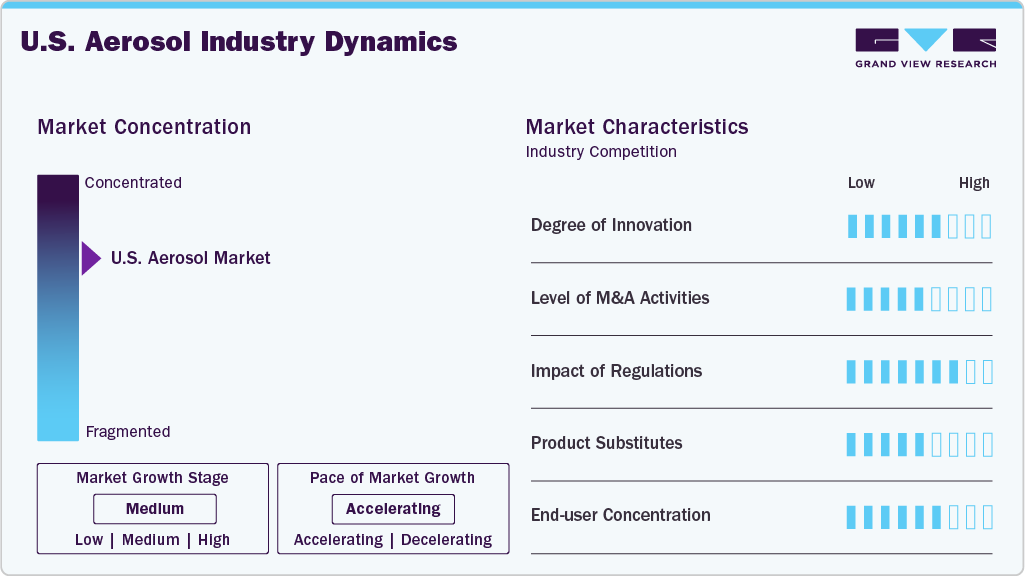

Market Concentration & Characteristics

The U.S. aerosol industry is characterized by its broad and diverse end-use applications, ranging from personal care and household products to industrial and pharmaceutical uses. This diversification offers resilience to market fluctuations in any one segment. For instance, while deodorant or hairspray sales may be influenced by fashion trends, the demand for pharmaceutical aerosols such as inhalers or cleaning products like disinfectant sprays tends to remain stable or even increase during health crises (e.g., flu season or pandemics). This wide applicability creates multiple revenue streams for manufacturers and offers flexibility for innovation.

While the U.S. aerosol industry is relatively mature, it remains dynamic due to continuous product and packaging innovations. Companies are focusing on improved formulations, sustainable propellants, ergonomic designs, and value-added features such as 360-degree spraying or fine mist control. The demand for environmentally friendly alternatives, including aluminum aerosol cans and recyclable plastic components, is driving R&D investment. Moreover, smart packaging technologies and antimicrobial coatings are gradually making their way into aerosol packaging, helping companies differentiate their offerings in a competitive space.

Material Insights

The aluminum segment led the market with the largest revenue share of 61.0% in 2024. Aluminum is a dominant material in the U.S. aerosol packaging market for personal care and cosmetic products, including deodorants, hair sprays, and shaving foams. It is valued for its lightweight, corrosion-resistant, and aesthetically appealing nature. The material allows for monobloc (seamless) can construction, enhancing safety and premium product appeal. Its compatibility with various formulations and propellants also adds to its utility. The demand for aluminum in aerosol packaging is primarily driven by consumer preference for premium and sustainable packaging, especially in personal care. Its lightweight nature reduces transportation costs and carbon footprint, while its infinite recyclability fits perfectly into the U.S. circular economy push.

The steel segment is expected to grow at the fastest CAGR of 3.1% during the forecast period. Steel is widely used in aerosol packaging, particularly for products requiring high-pressure resistance and durability, such as automotive sprays, household insecticides, and industrial products. In the U.S., tinplate-coated steel is commonly utilized due to its strength, compatibility with various propellants, and ease of mass production. Steel aerosol cans are also favored for their recyclability and compatibility with traditional manufacturing infrastructure. The use of steel in aerosol packaging is driven by its cost-effectiveness, strength under pressure, and high recycling rates. In the U.S., strict safety regulations for pressurized containers, especially in automotive and industrial sectors, favor steel’s robust properties.

Type Insights

The standard segment led the market with the largest revenue share of 86.1% in 2024. Standard aerosol packaging is the conventional format in which the product and the propellant are mixed inside a metal can and dispensed together when the valve is actuated. This format remains dominant in many segments such as household cleaners, automotive sprays, air fresheners, deodorants, hair sprays, and industrial products. It offers a cost-effective and high-volume packaging solution, making it highly suitable for mass-market consumer goods.

The bag in valve segment is expected to grow at the fastest CAGR of 4.0% during the forecast period. Bag-in-valve (BOV) aerosol packaging consists of a multi-layered laminated bag attached to a valve system inside the can. The product is stored in the bag while the propellant is kept outside the bag in the can. This design separates the product from the propellant, ensuring longer shelf life and higher product integrity. In the U.S., BOV packaging is widely used in pharmaceutical sprays, cosmetic formulations (e.g., mousse, facial sprays), food-grade aerosols (e.g., whipped cream), and medical devices due to its hygienic, non-contaminating dispensing capability.

Propellant Type Insights

The others segment led the market with the largest revenue share of 72.7% in 2024. This segment includes a mix of propellants such as carbon dioxide (CO₂), compressed air, dimethyl ether (DME), and hydrofluoroolefins (HFOs). Each of these propellants has specific use cases depending on the product category. For instance, CO₂ is used in certain food and industrial sprays, while DME is common in personal care aerosols due to its solvency and pressure characteristics. HFOs, which are low global warming potential (GWP) alternatives to hydrofluorocarbons (HFCs), are increasingly used in technical and specialty products.

The nitrogen segment is expected to grow at the fastest CAGR of 3.8% during the forecast period. Nitrogen is one of the most used propellants in the U.S. aerosol packaging market, especially for products that require an eco-friendly and inert gas option. It is particularly favored due to its non-reactive nature and absence of volatile organic compounds (VOCs). Unlike hydrocarbons, nitrogen does not contribute to ozone depletion or smog formation, aligning with both regulatory and sustainability objectives in the country. The primary driver for the increasing adoption of nitrogen as a propellant is the growing demand for environmentally sustainable packaging solutions.

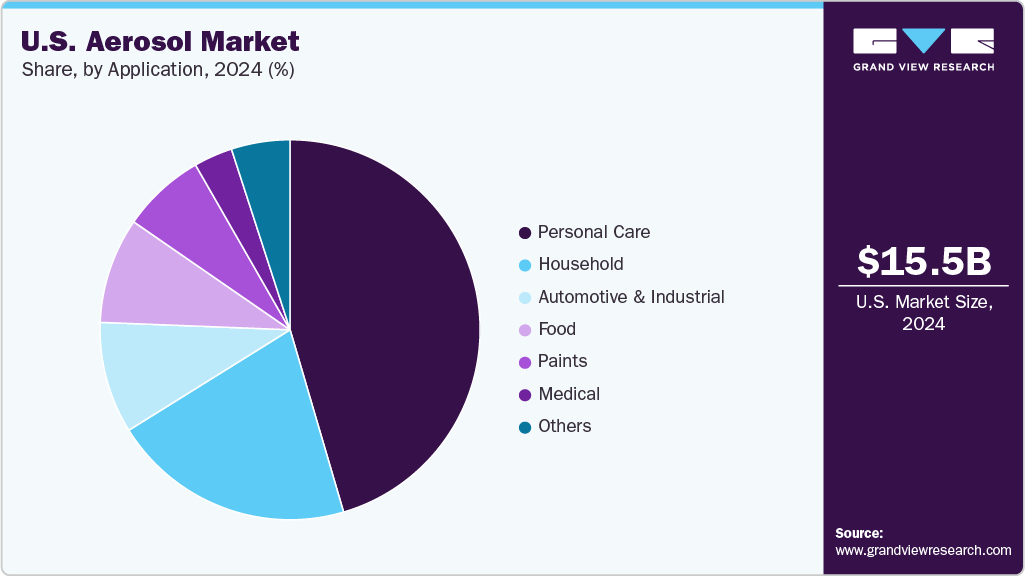

Application Insights

The personal care segment led the market with the largest revenue share of 45.5% in 2024 and is projected to grow at the fastest CAGR of 4.1% during the forecast period. The personal care segment is the largest application area for aerosol packaging in the U.S. It includes products like deodorants, hair sprays, shaving creams, dry shampoos, and body sprays. Aerosol packaging in this category offers consumers convenience, hygiene, and ease of application, especially in on-the-go lifestyles. The demand for personal grooming products, especially among millennials and Gen Z, is a major driver.

Household aerosol products include air fresheners, insect repellents, fabric refreshers, and surface cleaners. Aerosol packaging is preferred due to its ability to dispense cleaning agents and maintain product integrity over time evenly. Convenience and time-saving benefits are important for consumers managing busy home environments. Heightened awareness of hygiene and cleanliness-especially post-COVID-has significantly increased the consumption of disinfectants and surface cleaners. Consumers also value functionality, with sprays that offer reach into hard-to-clean areas. Product innovations with natural or low-VOC (Volatile Organic Compound) formulas are also driving demand.

Key U.S. Aerosol Company Insights

The competitive environment of the U.S. aerosol industry is characterized by the presence of several well-established players, intense innovation, and a strong emphasis on sustainability and regulatory compliance. Key companies such as Ball Corporation, Crown, CCL Container, Trivium Packaging, and Sonoco Products Company dominate the landscape, leveraging advanced manufacturing technologies and eco-friendly materials to meet growing consumer and regulatory demands.

Competition is driven by product differentiation, lightweight and recyclable materials, and customization capabilities for personal care, household, and industrial applications. The market is moderately consolidated, with larger players holding significant market share, while regional and niche manufacturers compete on cost and flexibility, particularly in contract manufacturing and private labeling segments.

Key U.S. Aerosol Companies:

- Crown

- Ball Corporation

- CCL Container

- Sonoco Products Company

- Trivium Packaging

- ITW Sexton

- Montebello Packaging

- Tecnocap S.p.A.

- PLZ Corp

- DS Containers

Recent Development

-

In December 2024, Sonoco Products Company completed its acquisition of Eviosys, a major metal packaging company, for approximately USD 3.8 billion, marking a significant step in Sonoco's portfolio transformation strategy to focus on sustainable growth and expand its core metal packaging business globally. Eviosys specializes in metal food cans, aerosol cans, closures, and promotional packaging.

-

In May 2024, Mauser Packaging Solutions announced its exit from the U.S. aerosol can manufacturing business, planning to close its plants in Sturtevant, Wisconsin, and Cincinnati, Ohio. Economic difficulties were the primary reason for the closures.

-

In May 2024, Sonoco Products Company announced the opening of a new, multi-million-dollar, state-of-the-art Technical and Engineering Center for Metal Packaging Innovation located in Ohio. This 11,000 square foot facility features modern laboratories, prototyping equipment, training rooms, and collaboration spaces, aimed at advancing sustainable metal packaging.

U.S. Aerosol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.19 billion

Revenue forecast in 2033

USD 21.56 billion

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, propellant type, application

Country scope

U.S.

Key companies profiled

Crown; Ball Corporation; CCL Container; Sonoco Products Company; Trivium Packaging; ITW Sexton; Montebello Packaging; Tecnocap S.p.A.; PLZ Corp; DS Containers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aerosol Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. aerosol market report based on material, type, propellant type, application:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Steel

-

Aluminum

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Bag in Valve

-

Standard

-

-

Propellant Type Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Nitrogen

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Food

-

Paints

-

Medical

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. aerosol packaging market was estimated at around USD 15.54 billion in the year 2024 and is expected to reach around USD 16.19 billion in 2025.

b. The U.S. aerosol packaging market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach around USD 21.56 billion by 2033.

b. Personal care emerged as the dominating end use segment in the U.S. aerosol market due to rising demand for products such as deodorants, hair sprays, and shaving foams driven by evolving grooming habits.

b. The key players in the U.S. aerosol market include Crown; Ball Corporation; CCL Container; Sonoco Products Company; Trivium Packaging; ITW Sexton; Montebello Packaging; Tecnocap S.p.A.; PLZ Corp; DS Containers

b. The U.S. aerosol market is driven by growing demand for personal care and household products, such as deodorants, air fresheners, and disinfectants in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.