- Home

- »

- Advanced Interior Materials

- »

-

U.S. Aromatherapy Diffusers Market Size Report, 2030GVR Report cover

![U.S. Aromatherapy Diffusers Market Size, Share & Trends Report]()

U.S. Aromatherapy Diffusers Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Spa & Relaxation, Residential), By Product (Ultrasonic, Nebulizers, Evaporative), By Distribution Channel (Retailers, E-commerce), And Segment Forecasts

- Report ID: GVR-4-68040-175-4

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

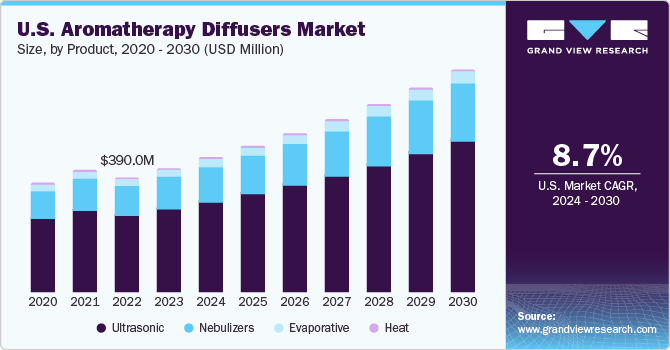

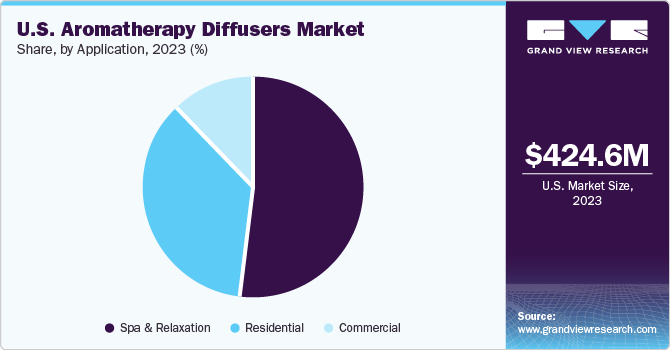

The U.S. aromatherapy diffusers market size was estimated at USD 424.6 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2030. The rising number of offices and hotels in the country has led to a substantial demand for aromatherapy diffusers. There has been a growing emphasis on creating conducive and relaxing environments within offices and hotels in the U.S. Aromatherapy is being increasingly recognized for its potential to enhance overall well-being and reduce stress. Several businesses and hotels have recognized the value of providing a pleasant atmosphere to improve the overall experience of their employees, guests, and customers.

These factors are anticipated to augment the product demand, supporting industry growth. Factors, such as a busy lifestyle of the masses, growing wellness tourism, and increasing product awareness are expected to drive the growth of the spa industry in the country. This, in turn, is anticipated to fuel product demand during the forecast period. Aromatherapy diffusers are widely used in spas to enhance the overall experience of customers. They play a crucial role in creating a calming and pleasing atmosphere, thereby contributing to the relaxing ambience of spas. The flow of essential oils through these diffusers is often integrated into various types of treatment offered by spas, including massages, facials, and aromatherapy sessions.

Hence with the rising number of spas in U.S., the product demand is expected to increase. Fragrances, which are derived from essential oils, play a pivotal role in the market as they directly influence consumer preferences and the effectiveness of aromatherapy. Scents associated with relaxation, stress relief, or specific wellness benefits contribute to the appeal of aromatherapy diffusers. In addition, different fragrances have various wellness benefits. For instance, lavender is often associated with relaxation, while citrus scents may be linked to invigoration. The perceived health benefits associated with specific fragrances drive consumer choices in aromatherapy market.

Aromatherapy diffusers have witnessed a rise in popularity among millennials in the U.S. in recent years. This trend can be attributed to several factors, including a growing interest of this age group in holistic well-being and self-care practices. Millennials, often characterized by their health-conscious lifestyle, are drawn to aromatherapy as a natural and non-invasive way to promote relaxation and alleviate stress. The convenience of aromatherapy diffusers, which allow for easy dispersal of essential oils, aligns with the fast-paced and tech-savvy nature of millennial life.

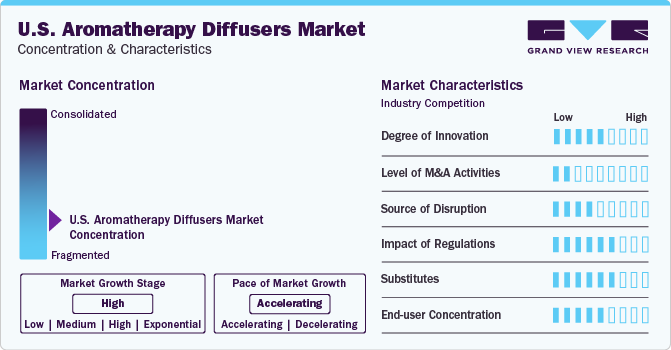

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements driven by factors, such as diffusers with Bluetooth capabilities, enabling users to play soothing music or control the device through a mobile app. Furthermore, ultrasonic technology has become standard, providing a quiet and efficient diffusion process.

Key strategies undertaken by major players include new product development, strategic partnerships, and expansions. In July 2019, Young Living Essential Oils made a strategic move by acquiring Nature's Ultra, a company known for its extensive hemp farms spanning over 1,500 acres in Colorado. This acquisition marked a significant initiative for Young Living, as it provided them with access to pristine conditions in the Rocky Mountains, enabling the sourcing of pure CBD from hemp fields in Colorado.

Notably, these hemp fields adhere to sustainable practices being cultivated without the use of pesticides. The collaboration aimed to leverage Nature's Ultra's expertise in hemp cultivation to enhance Young Living's portfolio and commitment to offer high-quality, natural products. The merger is expected to enhance the quality, value, and range of solutions to both suppliers and customers.

The degree of innovation factor is expected to remain significantly important in this market. Manufacturers are increasingly prioritizing sustainability by opting for eco-friendly materials. For instance, companies are transitioning from plastics like polycarbonate (PC) to environmentally conscious alternatives, such as bamboo, wood, and glass. By embracing sustainable materials, manufacturers not only contribute to environmental conservation but also cater to a conscientious consumer base.

Product Insights

The ultrasonic products segment led the market with a revenue share of 66.7% in 2023.Ultrasonic diffusers make use of electronic frequencies to generate vibrations in water that are further carried to the surface where the essential oil is floating. Furthermore, the vibrations evaporate the essential oils and diffuse them into the air without using any form of heat. Moreover, these diffusers can be used as humidifiers and are suitable for small spaces.

The nebulizers segment is anticipated to register the fastest CAGR from 2024 to 2030.Nebulizers or cold air diffusers utilize room-temperature air for blowing and vaporizing the essential oils in the surrounding. Furthermore, these diffusers are capable of diffusing the essential oils very quickly and efficiently, thereby acting as an extremely strong odor and germ killer.The aforementioned product characteristics are thereby likely to boost the nebulizers market growth.

Distribution Channel Insights

The hypermarkets/supermarkets segment held for the largest revenue share of 43.0% in 2023. A hypermarket is a large retail store having a deep product assortment and product variety, offering products at a cheap cost. In comparison to hypermarkets, supermarkets have lower product variety and offer products at higher costs. These retail formats offer convenience to potential end-users, as various categories of diffusers are readily available under one roof. Moreover, rising cross-selling practices and easy availability of oils used in these diffusers at hypermarkets are further driving the consumers’ preference for hypermarkets in the U.S.

The e-commerce segment is anticipated to register the fastest CAGR from 2024 to 2030.Information and usage of products are usually mentioned on e-commerce websites, offering consumers detailed information about the product along with ratings and reviews from other customers. In addition, increased advertising & marketing by key players is propelling product sale through the E-commerce route. According to the data published by the U.S. Census Bureau in November 2023, e-commerce sales in the third quarter of 2023 have increased by 7.6% from the third quarter of year 2022. Thus, with a rise in e-commerce, this segment is expected to have significant revenue by 2030.

Application Insights

The spa & relaxation segment dominated the market with a share of 52.5% in 2023 and anticipated to register the fastest CAGR during the forecast period.In the spa industry, aromatherapy diffusers are used to create a relaxing environment for clients. Aromatherapy diffusers add an extra level of luxury and improve the spa experience. Using therapeutic essential oils, these diffusers can make the atmosphere truly soothing.

Furthermore, the increasing incidences of skin conditions have led to a huge demand for aromatherapy products. Skin allergies and dermatological problems can be effectively cured with aromatherapy. People with skin rashes often seek aromatherapy, which helps nourish the skin and reduce inflammation. Hence, with the rising dermatological imbalances and skin allergies, the demand for aromatherapy diffusers is expected to increase.

Key Companies & Market Share Insights

Some of the key players operating in the market include Young Living Essential Oils, LC,Ryohin Keikaku Co., Ltd (Muji), ESCENTS and dōTERRA.

-

Young Living Essential Oils, LC is known for its Seed to Seal process, which conserves the integrity of its essential oils. As of December 2019, the company had offices across various countries including Australia, New Zealand, Japan, Singapore, Ecuador, Canada, Hong Kong, Indonesia, Malaysia, Mexico, the Philippines, Taiwan, the U.S., and the UK

-

dōTERRA is engaged in providing wellness, health, and fitness products. Furthermore, it functions by manufacturing and selling a diversified array of products through more than 2 million wellness advocates/distributors spread across the globe. The company’s offices are located in Australia, China, Japan, Mexico, Singapore, South Korea, and Taiwan

Greenair, Organic Aromas, Ellia, and Pilgrim are some of the emerging market participants in the U.S. aromatherapy diffusers market.

-

Greenair is a privately held company with expertise in aroma diffuser technology. The aromatherapy diffusers offered by the company include various technologies such as atomizing, ultrasonic, and fan diffusion. The diffusers are widely suitable for various end-use applications such as households, offices, cars, and schools

-

Organic Aromas is committed to crafting efficient, secure, and aesthetically pleasing instruments for dispersing, applying, and savoring exquisite aromas and inherent health benefits found within genuine essential oils

Key U.S. Aromatherapy Diffusers Companies:

- Young Living Essential Oils, LC

- dōTERRA

- Ryohin Keikaku Co. Ltd (Muji)

- Greenair

- ESCENTS

- Organic Aromas

- Puzhen

- Ellia

- Pilgrim

- Edens Garden

- NOW Foods

- Rocky Mountain Oils, LLC

- Helias Oils

- Stadler Form

Recent Developments

-

In October 2023, Young Living introduced a delightful winter-themed product line in anticipation of the holiday season. Among the offerings was a portable diffuser, providing users with the convenience of on-the-go aromatherapy., the WanderBliss portable diffuser adds a touch of whimsy to the festive season, offering a unique and aromatic experience for users seeking a cozy and joyful ambience

-

In August 2023, Escents launched a fresh line of natural fragrance diffusers and reed essential oils, aiming to elevate the experience of body aromatherapy. The innovative Reed Diffusers introduced by Escents present customers with a distinctive approach to aromatherapy. These diffusers incorporate micro-mini straws serving as natural wicks, efficiently drawing the liquid upward and dispersing it into the surrounding air. This design proves especially well-suited for smaller and confined spaces, offering a unique and effective method for experiencing the benefits of aromatherapy

-

In December 2022, Young Living launched two new essential oil diffusers perfect for gift-giving. The launch was for the holiday season. The new two launches, Duet Diffuser and Sprout the Puppy Diffuser use innovative technologies to provide two perfect diffusing options for users of any age.

U.S. Aromatherapy Diffusers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 460.2 million

Revenue forecast in 2030

USD 762.4 million

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, application

Country scope

U.S.

Key companies profiled

Young Living Essential Oils, LC; dōTERRA; Ryohin Keikaku Co. Ltd. (Muji); Greenair; ESCENTS; Organic Aromas; Puzhen; Ellia; Pilgrim; Edens Garden; NOW Foods; Rocky Mountain Oils, LLC; Helias Oils; Stadler Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aromatherapy Diffusers Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aromatherapy diffusers market report based on product, distribution channel, and application:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Ultrasonic

-

Nebulizers

-

Evaporative

-

Heat

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Retailers

-

Hypermarkets/Supermarkets

-

E-commerce

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Spa & Relaxation

-

Frequently Asked Questions About This Report

b. The U.S. aromatherapy diffusers market size was estimated at USD 424.6 million in 2023 and.is expected to reach USD 460.2 million in 2024.

b. The U.S. aromatherapy diffusers market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 and reach USD 762.4 million by 2030.

b. Hypermarkets/Supermarkets segment accounted for the largest market revenue share of 43.0% in 2023, owing to the convenience and availability offered by these retail formats to the potential aromatherapy diffuser end users.

b. Some of the key players operating in the U.S. aromatherapy diffusers market include, Young Living Essential Oils, LC., dōTERRA, Ryohin Keikaku Co., Ltd (Muji), Greenair, ESCENTS, Organic Aromas, Puzhen, Ellia, Pilgrim, Edens Garden, NOW Foods, Rocky Mountain Oils, LLC, Helias Oils, Stadler Form, sparoom.

b. The rising number of offices & hotels in the U.S., rising tourism, growing awareness regarding the aromatherapy to reduce the stress & anxiety, and rising number of spas in the U.S has led to a substantial demand for aromatherapy diffusers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.