- Home

- »

- Healthcare IT

- »

-

U.S. Augmented Reality And Virtual Reality In Healthcare Market, 2030GVR Report cover

![U.S. Augmented Reality And Virtual Reality In Healthcare Market Size, Share & Trends Report]()

U.S. Augmented Reality And Virtual Reality In Healthcare Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology Type (Augmented Reality, Virtual Reality), And Segment Forecasts

- Report ID: GVR-4-68040-643-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

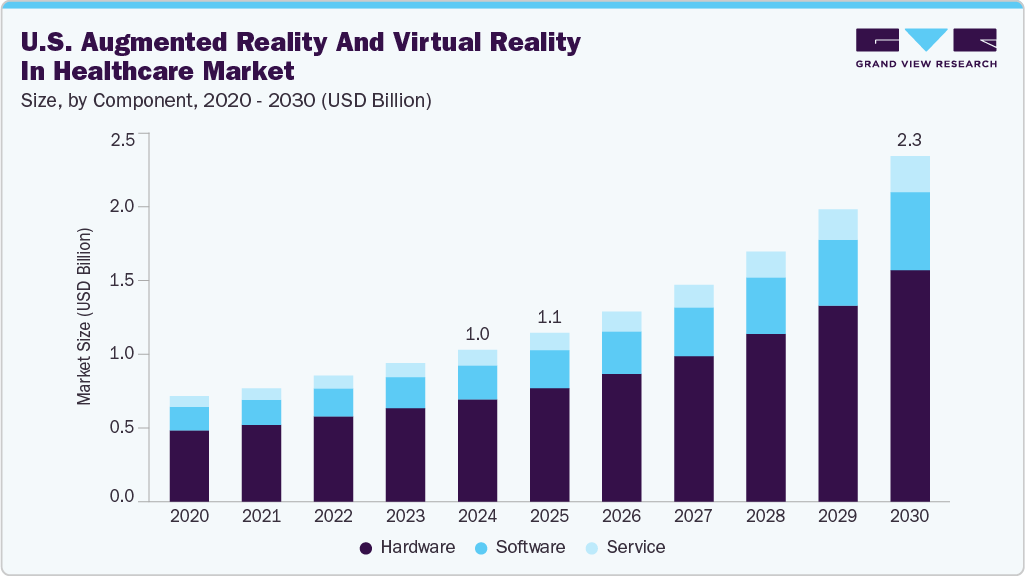

The U.S. augmented reality and virtual reality in healthcare market size was estimated at USD 1.03 billion in 2024 and is projected to grow at a CAGR of 15.4% from 2025 to 2030. Advancements in healthcare IT infrastructure and increased venture capital investment, fueled by numerous start-ups and government programs such as NIH and FDA initiatives, support AR/VR research. In addition, the declining cost of head-mounted devices, rising demand from telemedicine, chronic disease care, and minimally invasive surgery, and integration with AI and 5G technologies for enhanced real-time diagnostics and clinical training.

AR and VR are crucial innovations in immersive technology. AR enhances real-world perception by directly integrating digital information, such as sounds, images, or text, into our real-world viewpoint. This facilitates interactive experiences, allowing for the visualization of complex concepts within a tangible context. VR offers a comprehensive immersion, transporting users to a simulated environment. This allows for interaction within a digital space, offering an experience entirely distinct from the real world. These technologies are instrumental in advancing user engagement and understanding in various sectors.

Virtual reality is revolutionizing medical education by offering immersive and interactive experiences that enhance knowledge retention and furnish environments for training devoid of risks. For instance, in March of 2023, Dr. Kei Ouchi, an Associate Professor of Medicine at Harvard Medical School and advisor of Jolly Good, collaborated with Brigham and Women's Hospital to create VR content designed for emergency care. Under the guidance and supervision of Dr. Ouchi, Jolly Good is expected to develop live-action VR content across various medical specialties, with a collaborative focus on evaluating its educational impact.

Similar to VR, AR is significantly transforming medical education. It allows students to examine anatomical structures and disease pathologies through an interactive, three-dimensional format. For instance, in June 2024, GE HealthCare and MediView XR successfully implemented the first-ever clinical use of the OmnifyXR Interventional Suite at a medical center in Minneapolis. This cutting-edge solution combines augmented reality with live imaging and 3D anatomical views, aiming to streamline radiology procedures and improve real-time collaboration.

The integration of Artificial Intelligence (AI) with Augmented Reality (AR) and Virtual Reality (VR) is transforming healthcare by enabling more accurate diagnostics, immersive medical training, and enhanced surgical planning. AI powers real-time data interpretation in AR/VR platforms, improving clinical decision-making and personalization of treatment. This convergence is gaining traction in education and healthcare alike, as seen in cross-industry partnerships. For instance, in August 2023, EON Reality, Inc. partnered with Sandals Corporate University (SCU) to introduce Spatial AI technology, utilizing AI-powered XR solutions to enhance learning and information retention through immersive experiences.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. augmented reality and virtual reality in healthcare are slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high. The market is experiencing significant innovation driven by rapid technological advancements and increasing clinical adoption. Innovations include AR-assisted surgeries that project 3D anatomical structures onto patients in real time, VR-based rehabilitation programs tailored to neurological conditions, and immersive training modules for medical professionals. For instance, in March 2022, CAE Healthcare launched an updated CathLabVR cardiac training tool. This cardiovascular noninvasive simulator, combined with Microsoft HoloLens 2, delivers realism while practicing cardiac and vascular tissue treatments.

The level of partnerships & collaboration activities by key players in the industry is high to increase their capabilities, expand product portfolios, and improve competencies. For instance, in April 2023, Stryker partnered with IRCAD North America to establish an advanced surgical training center in Charlotte, North Carolina. This facility focuses on education in robotics, virtual and augmented reality, surgical artificial intelligence, and simulation training, aiming to enhance the skills of medical professionals worldwide.

The impact of regulations on the market is high. Various regulations significantly influence the U.S. augmented reality and virtual reality in the healthcare market. The Food and Drug Administration regulates augmented reality and virtual reality technologies in healthcare, ensuring their safety and effectiveness. As updated by the U.S. Food and Drug Administration in September 2024, the FDA has authorized 69 AR and VR medical devices across various medical fields, reflecting the growing adoption of these technologies in clinical settings.

The industry's level of regional expansion is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

Case Study:

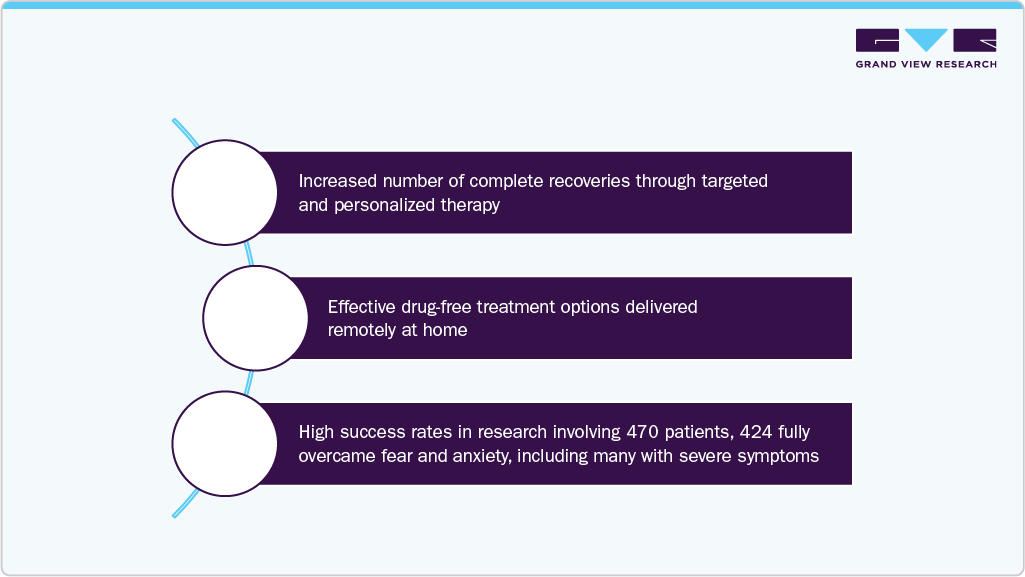

XRHealth offers a VR-based virtual clinic that delivers personalized, at-home therapy for mental health disorders like phobias, depression, and psychosis under licensed therapist supervision. This innovative solution uses immersive simulations to safely treat patients remotely.

Challenge:

Patients with mental health disorders like phobias often face difficulty accessing effective treatment or experience anxiety in real-world therapeutic settings. Traditional therapies can be less personalized and sometimes require in-person visits, which may limit patient engagement and progress.

Solution:

XRHealth’s VR-based virtual clinic provides immersive, safe simulations tailored to patients’ fears. For example, it recreates scenarios with large crowds for those with social phobia. Patients gradually progress through increasingly challenging situations, with continuous monitoring and support from licensed therapists via a mobile app and data analytics.

Outcome:

Component Insights

The hardware segment dominated the market in 2024, accounting for the largest revenue share of 67.36%. Devices such as head-mounted displays, smart glasses, and 3D sensors hold significant shares in the market. Head-mounted devices and smart glasses are widely used in training and simulation, surgeries, diagnostics, telemedicine, and many other applications. In the current market scenario, AR/VR hardware has a large, commercialized product base with a high adoption rate, especially in developed countries, as companies are actively investing in advancing AR and VR devices to enhance their applications in healthcare. For instance, in January 2024, Ocutrx Technologies, Inc. launched the ORLenz headset. This product is engineered to replace traditional optical surgical loupes, providing an advanced digital substitute with superior resolution and increased magnification. Furthermore, it enhances ergonomics, aiming to increase the comfort and efficiency of surgeons throughout surgical operations.

The service segment is expected to grow at the fastest CAGR during the forecast period. The complexity of AR and VR technologies necessitates specialized expertise for their implementation, integration, customization, maintenance, and support within healthcare systems. Moreover, healthcare institutions often require customized solutions that seamlessly integrate AR/VR with existing systems like medical imaging devices. In addition, the demand for AR and VR in medical training, education, and simulation is driving service providers to offer training programs and simulation development, further fueling the growth of this segment.

Technology Type Insights

The augmented reality segment dominated the market in 2024 based on technology type. The growth is attributed to its use in various medical sciences, such as surgical preparation and minimally invasive surgery. Technological advancements and rising demand for reducing the complexity of medical procedures result in increased adoption of augmented reality technology. Market players operating in AR technology are partnering with domestic players to expand their product reach and launch new products. For instance, in April 2023, Vuzix, specializing in smart glass and AR technology, collaborated with VSee, offering telemedicine solutions, to develop smart glass for the telemedicine industry.

The virtual reality segment is expected to grow at the fastest CAGR during the forecast period. The growth is due to various healthcare IT companies increasingly investing in this sector, considering the potential growth opportunities. For instance, in September 2022, Osso VR, Inc. raised USD 14 million, led by Kaiser Permanente. The company plans to use the funds to develop VR-based surgical and medical device training modules.

Key U.S. Augmented Reality And Virtual Reality In Healthcare Company Insights

The market is fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are key in propelling market growth.

Key U.S. Augmented Reality And Virtual Reality In Healthcare Companies:

- Elevate Healthcare

- Stryker

- EON Reality, Inc.

- Intuitive Surgical Operations, Inc.

- GE HealthCare

- Microsoft

- WorldViz, Inc.

- Medscape (WebMD LLC)

- Apple Inc.(Meta)

- CAE Healthcare Inc.

- Hologic, Inc.

- EchoPixel

- Surgical Theater, Inc.

- SAMSUNG

- HTC Corporation

- Siemens Healthineers

- Koninklijke Philips N.V.

Recent Developments

- In February 2025, XRHealth acquired the medical XR Company RealizedCare.The acquisition strengthens XRHealth’s market leadership and accelerates the adoption of MR technologies across broader medical specialties.

"We are thrilled to become a part of XRHealth’s groundbreaking digital therapeutics platform. By integrating our triage tool with XRHealth’s cutting-edge XR and mixed reality capabilities, we can expand access to evidence-based, value-based care solutions, helping more individuals manage chronic pain and mental health conditions."

- Aaron Gani, RealizedCare founder and CEO, and chairman of the board of directors at the Digital Therapeutics Alliance.

-

In June 2024, GE HealthCare and MediView XR, Inc. announced their augmented reality solution's inaugural installation and clinical deployment, the OmnifyXR Interventional Suite, at North Star Vascular and Interventional in Minnesota. The successful clinical implementation of OmnifyXR marks an advancement in MR applications within healthcare, potentially accelerating the adoption of similar technologies across various medical specialties.

“OmnifyXR will change the way I approach my cases, With GE HealthCare’s Allia platform, I can create a highly detailed 3D generated model in a matter of minutes without having to remove my sterile gloves to help maintain sterility during the procedure. Using MediView’s OmnifyXR, I can virtually place this 3D model anywhere in the room - allowing me to walk around it and evaluate it from different angles and perspectives in order to make more informed decisions about the way I approach and navigate my procedures.”

- Dr. Amin Astani3 of North Star Vascular and Interventional

- In December 2023, EON Reality announced the renewal of its strategic partnership with the Children’s Hospital of Orange County (CHOC). This partnership highlights a mutual dedication to leveraging advanced AR and VR technologies to revolutionize pediatric healthcare education and improve patient experiences.

“We are thrilled to continue our partnership with CHOC to bridge the gap between medical knowledge and patient experience. Our joint efforts with Bioflight VR and Smiley Scope reflect a successful fusion of technology and compassion, ensuring that our solutions resonate with and support the extraordinary care provided by CHOC’s medical professionals.”

-Dan Lejerskar, Founder of EON Reality

U.S. Augmented Reality And Virtual Reality In The Healthcare Market Report Scope

Report Attribute

Details

Market Size for 2025

USD 1.14 billion

Revenue forecast in 2030

USD 2.34 billion

Growth rate

CAGR of 15.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology type

Key companies profiled

Elevate Healthcare; Stryker; EON Reality, Inc.; Intuitive Surgical Operations, Inc.; GE HealthCare; Microsoft; WorldViz, Inc.; Medscape (WebMD LLC.); Apple Inc.; CAE Healthcare Inc.; Hologic, Inc.; EchoPixel; Surgical Theater, Inc.; SAMSUNG; HTC Corporation; Siemens Healthineers; Koninklijke Philips N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Augmented Reality And Virtual Reality In Healthcare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. augmented reality and virtual reality market report on the basis of component and technology type

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality

-

Surgical Application

-

Rehabilitation

-

Training & Continuing Medical Education

-

-

Virtual Reality

-

Simulation

-

Diagnostics

-

Virtual Reality Exposure Therapy (VRET)

-

Rehabilitation

-

Pain Distraction

-

-

Frequently Asked Questions About This Report

b. The U.S. augmented reality and virtual reality in healthcare market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.14 billion in 2025.

b. The U.S. augmented reality and virtual reality in healthcare market is expected to grow at a compound annual growth rate of 15.4% from 2025 to 2030 to reach USD 2.34 billion by 2030.

b. Hardware segment dominated the market in 2024 accounted for the largest revenue share of 67.36%. Due to increasing adoption of advanced head-mounted displays, AR/VR surgical simulators, and smart glasses for training, diagnostics, and surgical planning.

b. Some key players operating in the U.S. augmented reality and virtual reality in healthcare market include Elevate Healthcare, Stryker, EON Reality, Inc., Intuitive Surgical Operations, Inc., GE HealthCare, Microsoft, WorldViz, Inc., Medscape (WebMD LLC.), Apple Inc., CAE Healthcare Inc., Hologic, Inc., Siemens Healthineers, Koninklijke Philips N.V.

b. Key factors that are driving the market growth include advancements in healthcare IT infrastructure and increased venture capital investment, fueled by numerous start ups and government programs such as NIH and FDA initiatives supporting AR/VR research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.