- Home

- »

- Advanced Interior Materials

- »

-

U.S. Bio-based Textiles Market Size, Industry Report, 2030GVR Report cover

![U.S. Bio-based Textiles Market Size, Share & Trends Report]()

U.S. Bio-based Textiles Market (2025 - 2030) Size, Share & Trends Analysis Report By Source Material (Plant-Based, Animal-Based, Microbial/Bioengineered), By Application (Apparel, Home Textiles, Industrial Textiles), And Segment Forecasts

- Report ID: GVR-4-68040-623-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bio-based Textiles Market Size & Trends

The U.S. bio-based textiles market size was valued at USD 6.08 billion in 2024 and is anticipated to grow at a CAGR of 8.5% from 2025 to 2030. The bio-based textiles industry is expected to grow with increasing demand for sustainable products, heightened environmental awareness, and supportive regulatory frameworks. Bio-based textiles are biodegradable and engineered to decompose naturally at the end of their lifecycle. These are manufactured from renewable resources, such as plants, algae, and microorganisms, which help minimize landfill accumulation and eliminate microplastic pollution. This market shift reflects a broader transition toward environmentally responsible manufacturing and consumption practices.

Textiles are vital to everyday life, from clothing and furniture to medical and protective equipment. As textile usage continues to grow, so does its impact on the environment. Most textile fibers today are made from fossil-based materials like polyester, which contribute to greenhouse gas emissions, high water usage, and the depletion of natural resources. To address these issues, many companies in the U.S., including Mylo (U.S.), Bolt Threads, and Allbirds, are developing bio-based textiles made from renewable sources such as wood, fiber crops, algae, fungi, and agricultural waste. These materials are often biodegradable and more environmentally friendly. They also offer new opportunities for innovation and are helping drive the expected growth in the sustainable textile market.

Moreover, the growing focus on ‘Made in U.S.A.’ textile products has increased the import and export of high-tech driven apparel and fabrics. In 2023, U.S. textiles accounted for over 83% of the output of the textile and apparel industry, which is also contributing to the rise of bio-based textiles in the U.S. There are three main types of bio-based fibers, which include natural, semi-synthetic, and synthetic. Each type follows a distinct value chain shaped by different production technologies, which results in textiles with unique properties and applications. By replacing conventional synthetic textiles with bio-based textiles, such as bamboo or hemp, and adopting sustainable manufacturing processes, the industry can expect significant reduction in emissions and waste.

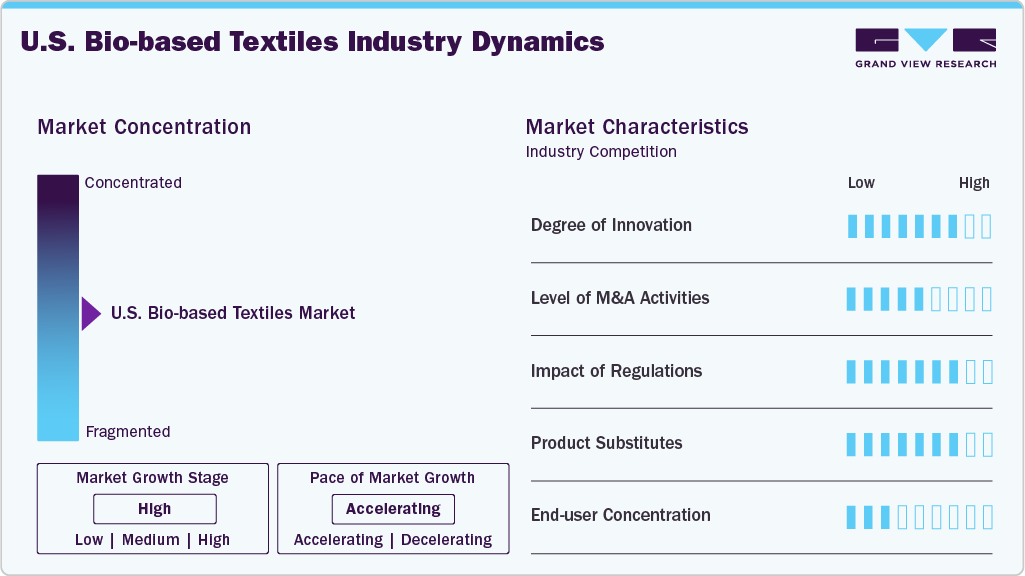

Market Concentration & Characteristics

The bio-based textiles market is moderately fragmented in nature. Growing awareness and the aim to reduce carbon footprint have led to the emergence of innovative startups and corporations committed to sustainable and advanced textile solutions. Key players in the market include Patagonia, EnviroTextiles LLC, and Bolt Threads.

The U.S. bio-based textiles industry exhibits a high degree of innovation, driven by the use of agricultural waste, mushrooms, algae, fungi, and lab-grown silk. This innovation is fueled by rising sustainability demand, government support, and strong collaborations between biotech firms and apparel brands. For instance, in February 2015, EnviroTextiles partnered with Bears for Humanity on an organic teddy bear campaign, producing 100% certified organic natural fiber teddy bears. Similarly, Bolt Threads has developed vegan silk using clean water, sugar, yeast, and salt, demonstrating a sustainable approach to next-generation textile manufacturing.

The level of mergers and acquisitions (M&A) in the U.S. bio-based textiles market is moderate, driven by the growing focus on sustainability and the need to reduce the use of synthetic fibers, which pollute the environment at a major scale. In 2017, Bolt Threads and Stella McCartney announced a partnership which focused on sustainable fashion and luxury materials development. These deals enable large firms to integrate cutting-edge materials while helping startups scale their technologies, ultimately accelerating the commercialization and adoption of sustainable textiles.

The impact of regulations on the market is high because the mandate of environmental compliance is high. Regulations also stimulate innovation, shape market access, enhance consumer trust, and define the competitive landscape, ultimately accelerating the growth and credibility of the industry. The U.S. has a specific process that companies must follow to qualify for the BioPreferred label. This process protects the certification’s integrity so customers can trust that the product contains what the certification promises.

There are various alternatives to bio-based textiles, such as synthetic fibers, which offer durability, affordability, and high performance, which results in high level of product substitutes. The availability of alternatives, such as polyester, nylon, and acrylic, lowers user concentration, as consumers have multiple options to choose from.

Source Material Insights

The plant-based segment held the largest revenue share of 63.9% in 2024, driven by abundant availability of raw materials, lower production costs, and strong consumer familiarity. Plant-based materials are gaining popularity due to their widespread use in home textiles, automotive interiors, footwear, and accessories. Fibers such as hemp, Piñatex (a leather alternative made from pineapple leaves), banana fiber, cotton, and linen are increasingly preferred in the U.S. market because they are breathable, biodegradable, and align with the growing demand for sustainable products. Their eco-friendly characteristics make them a favorable choice for environmentally conscious consumers and companies.

The growth in agricultural and regenerative farming practices is expected to further drive demand for plant-based textiles. Leading U.S. companies like Patagonia, Allbirds, Levi’s, and PACT are actively incorporating materials such as organic cotton, hemp, and eucalyptus fibers into their product lines. These brands are at the forefront of the shift toward sustainable fashion and lifestyle goods, emphasizing renewable resources, biodegradability, and ethical production practices.

The microbial/bioengineered segment is expected to record the fastest CAGR of 9.2% over the forecast period. These textiles are innovative fabrics developed using living organisms or biological processes, such as bacteria, yeast, algae, fungi, or engineered cells. They are gaining popularity due to their unique ability to mirror the qualities of plant- and animal-based textiles. Examples include lab-grown silk (such as Bolt Threads' Microsilk) and mycelium leather (like Mylo), which offer sustainable alternatives to conventional fibers. In July 2019, Stella McCartney and Adidas introduced the Biofabric Tennis Dress, made from a blend of Microsilk and cellulose fiber and designed to be fully biodegradable. Unlike traditional textiles that depend on plant, animal, or petroleum-based sources, which consume significant land, water, and other resources, microbial or bioengineered fabrics are grown or synthesized in labs or controlled environments using biotechnology. This production method enhances their sustainability and sets them apart as a next-generation material solution.

Application Insights

The apparel segment led the market in 2024, accounting for the largest revenue share. This growth is driven by increasing consumer awareness, evolving sustainability regulations, technological advancements, and a cultural shift from fast fashion to slow, conscious fashion. Consumers are becoming increasingly aware of the harmful environmental effects of synthetic textiles, leading to a significant shift toward bio-based alternatives in apparel. As a result, numerous brands, including Stella McCartney, Patagonia, and Levi’s, are incorporating sustainable and bio-based materials into their collections.

The apparel industry has also witnessed major innovations, enabling sustainable textiles to meet the performance and aesthetic demand of casual wear, sportswear, and high fashion. For instance, in March 2017, Bolt Threads launched its first commercially available Microsilk tie made from lab-grown spider silk. All of its 50 limited-edition neckties sold out within minutes, showcasing strong consumer interest in next-generation materials.

The industrial textiles segment is expected to grow at the fastest pace, with a projected CAGR of 9.4% during the forecast period. Industrial textiles are widely used across various sectors, including automotive, construction, agriculture, filtration, and medicine. As these industries continue to modernize and expand, the demand for high-performance, durable, and sustainable materials is expected to grow significantly. Companies are increasingly replacing conventional synthetic materials, such as polyester and nylon, with bio-based alternatives to reduce carbon footprint and comply with green manufacturing policies. Bio-based industrial textiles such as hemp composites and PLA fibers offer key advantages, including strength, biodegradability, and regulatory compliance. Furthermore, government regulations promoting sustainable infrastructure, green building practices, and eco-compliant automotive production are accelerating the adoption of these materials.

Key U.S. Bio-based Textiles Company Insights

Some key players in the U.S. bio-based textiles industry include Bolt Threads, Allbirds, and Origin Materials, which focus on a sustainable future and reducing their carbon footprint.

-

Bolt Threads is a biotechnology company that develops sustainable, bioengineered materials like Microsilk (lab-grown spider silk) and Mylo (mycelium-based leather) as alternatives to traditional textiles, aiming to reduce environmental impact in the fashion and materials industries.

-

Allbirds is a sustainable footwear and apparel brand known for using eco-friendly materials like merino wool and sugarcane. It focuses on low carbon emissions and creating comfortable, stylish products with minimal environmental impact.

Key U.S. Bio-based Textiles Companies:

- DuPont

- Bolt Threads

- Allbirds

- Natural Fiber Welding, Inc.

- Origin Materials

- Sustainable Fiber Technologies

- BastCore

Recent Developments

-

In December 2024, Acme Mills introduced Natura, a line of bio-based Polylactic Acid (PLA) fabrics made from renewable resources like corn starch and sugarcane. These are designed to replace petroleum-based materials like PET, PP, and Nylon and thereby reduce the environmental impact.

-

In October 2024, Allbirds, a sustainable footwear and apparel provider, announced a 22% reduction in its per-product carbon emissions during 2023. This indicates its advancement in achieving its sustainability goals.

U.S. Bio-based Textiles Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 9.91 billion

Growth Rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends.

Segments covered

Source material, application

Key companies profiled

DuPont; Bolt Threads; Allbirds; Natural Fiber Welding, Inc.; Origin Materials; Sustainable Fiber Technologies; BastCore

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bio-based Textiles Market Report Segmentation

This report forecasts revenue at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bio-based textiles market report based on source material and application:

-

Source Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plant-Based

-

Animal-Based

-

Microbial/Bioengineered

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Home Textiles

-

Industrial Textiles

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bio-based textiles market size was estimated at USD 6.07 billion in 2024 and is expected to reach USD 6.59 billion in 2025.

b. The U.S. bio-based textiles market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 9.91 billion by 2030.

b. The plant-based segment led the market and accounted for the largest revenue share, 63.9%, in 2024, due to its wide availability, established supply chains, and consumer preference for natural, eco-friendly materials.

b. DuPont, Bolt Threads, Allbirds, Natural Fiber Welding (NFW), Origin Materials, Sustainable Fiber Technologies, and BastCore Inc. are prominent companies in the U.S. bio-based textiles market.

b. Key factors driving the U.S. bio-based textiles market include rising environmental awareness, regulatory support for sustainability, innovation in biodegradable materials, and growing consumer demand for eco-friendly products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.