- Home

- »

- Biotechnology

- »

-

U.S. Cell Culture Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Cell Culture Market Size, Share & Trends Report]()

U.S. Cell Culture Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Biopharmaceutical Production, Drug Development, Diagnostics, Tissue Culture & Engineering), And Segment Forecasts

- Report ID: GVR-4-68040-272-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cell Culture Market Size & Trends

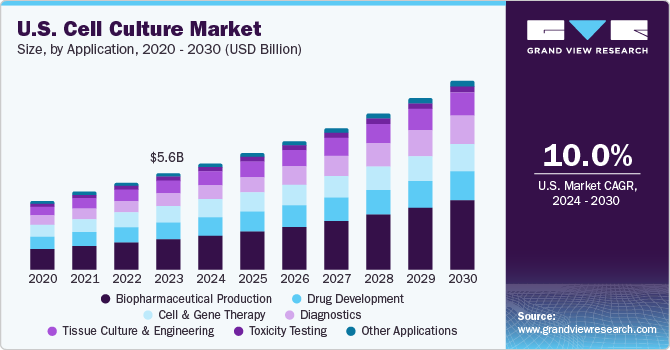

The U.S. cell culture market size was estimated at USD 5.61 billion in 2023 and is projected to grow at a CAGR of 10.02% from 2024 to 2030. The market growth can be attributed to the increasing prevalence of chronic & infectious diseases (including COVID-19), the rapid adoption of cell culture techniques to develop substrates for safe production of viral vaccines, and the rising global demand for advanced therapy medicinal products. Furthermore, novel three-dimensional cell culture techniques and the growing need for them in biopharmaceutical development & vaccine production are expected to drive the market growth over the forecast period.

COVID-19 had a positive impact on the U.S. market. During the COVID-19 pandemic, many pharmaceutical and biotechnology companies have been investing heavily in research and development to create effective vaccines, therapies, and testing kits. This has led to a rise in the demand for cell culture tools and new cell-based models for drug discovery and research purposes. In addition, there has been an increased need for bioreactors and culture systems to facilitate vaccine production and drug testing in response to the urgency of the situation.

Biopharmaceutical products consisting of vaccines, blood & blood components, somatic cells, gene therapy, tissues, and recombinant therapeutic proteins have been gaining importance in the life sciences segment over the past few decades. With the substantial growth of specialty drugs and personalized medicine, the demand for biologics is observed to be increasing. Furthermore, biologics play a key role in the development of precision medicines. As a result, around 15 new biologics were approved by the U.S. FDA in 2022, including cancer therapeutics such as Kimmtrak, Opdualag, Imjudo, and others.

The growing demand for serum-free, specialty, and customized media is anticipated to drive market growth. In addition, rising investment is further projected to boost market growth over the forecast period. For instance, in July 2023, Merck announced the expansion of its facility in the U.S. to increase the production capacity to manufacture cell culture media.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. Advancements in biotechnology and the pharmaceutical industry are driving demand for cell culture technologies, as they play a crucial role in drug discovery, biopharmaceutical production, and research applications. In addition, the emergence of innovative techniques and the growing adoption of cell-based therapies are further fueling global cell culture market growth.

In the U.S. market, partnerships and collaboration activities are high levels of engagement within the industry. Companies are engaging in strategic partnerships, acquisitions, and mergers to strengthen their portfolios, expand market presence, and harness synergies in the rapidly evolving biotechnology and pharmaceutical sectors. This heightened level of activity reflects a strategic response to the increasing demand for advanced cell culture technologies and the need for comprehensive solutions in areas such as biopharmaceutical production and regenerative medicine. For instance, in July 2021, Sartorius Stedim Biotech acquired Xell AG, based in Bielefeld, Germany. Xell AG creates, manufactures, and sells media and feed additives for cell cultures, particularly for producing viral vectors used in gene therapies and vaccinations.

Stringent regulatory standards, particularly those set forth by agencies like the FDA, govern the safety, quality, and efficacy of cell culture products and processes. Compliance with these regulations is essential for market players to ensure the approval and market acceptance of their products, driving investment in research and development as well as manufacturing infrastructure. Moreover, regulatory frameworks also influence market dynamics by shaping competitive barriers, market entry strategies, and innovation pathways. While stringent regulations may pose challenges in terms of compliance costs and timelines, they ultimately serve to uphold product quality standards, ensure patient safety, and foster trust within the industry, thereby contributing to long-term sustainability and market growth.

The market is experiencing a significant wave of product expansion, characterized by the introduction of innovative technologies, diverse product offerings, and expanded applications across various sectors, including biopharmaceuticals, regenerative medicine, and basic research. Companies are continually investing in research and development to enhance existing products, develop novel solutions, and cater to the evolving needs for the market growth. This surge in product expansion is driven by factors such as increasing demand for biologics, advancements in cell therapy, and the pursuit of more efficient and scalable manufacturing processes. As a result, the market is witnessing a proliferation of new cell culture products, tools, and services, reflecting the industry's commitment to driving forward scientific innovation and addressing emerging challenges in healthcare and life sciences. For instance, in September 2022, Thermo Fisher Scientific Inc. introduced the Thermo Scientific DynaSpin Single-use Centrifuge equipment at the BioProcess International yearly conference in Boston, Massachusetts. The equipment is intended to give an excellent single-use solution enabling large-scale cell culture extraction.

Product Insights

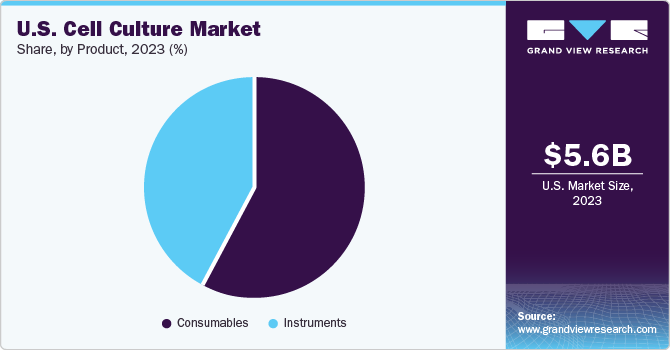

The market is segmented into consumables and instruments. The consumables segment held the market with the largest revenue share of 58.0% in 2023, due to recurring demand and purchase of consumables. Another factor propelling the sector is increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop sophisticated biologics, such as monoclonal antibodies & vaccines. Consumables are expected to continue to be in high demand during the forecast period. The demand for cell culture consumables is also expected to remain high during the forecast period. The consumables segment is further categorized into reagents, media, & sera. Media held the largest market share in the consumables segment.

The instruments segment is expected to register at a significant CAGR over the forecast period. The applications engaged are vaccination, research on cancer, drug screening & development, recombinant products, toxicity testing, stem cell technology, regenerative therapies, and other areas used by end-users, such as industrial, biotechnology, & agriculture. For instance, in June 2022, FUJIFILM Corporation invested USD 1.6 billion to expand and improve its cell culture manufacturing services. This investment would boost FUJIFILM sites in Denmark and Texas.

Application Insights

Based on application, the market is segmented into biopharmaceutical production, drug development, diagnostics, tissue culture & engineering, cell and gene therapy, toxicity testing, and other applications. The biopharmaceutical production segment led the market with the largest revenue share of 31.9% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Mammalian cell cultures are primarily used in the production of biopharmaceuticals, and the growing demand for nonconventional therapeutic options has led to a substantial increase in the bioproduction of genetically enhanced drugs. Due to this, demand for various cell culture consumables, such as media, is expected to increase.

The diagnostics segment is expected to grow at a significant CAGR over the forecast period. Cell cultures can be used in metabolomics for the identification of biomarkers of pathologically relevant conditions. Moreover, metabolic pathways that lead to the production of such biomarkers can also be identified to determine underlying metabolic disorders. Similarly, metabolites also play a crucial role in the diagnosis of cancer and its recurrence, which increases the scope of applications for cell culture products. Thus, this is expected to drive the market growth.

Key U.S. Cell Culture Company Insights

The market players operating in the U.S. market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key U.S. Cell Culture Companies:

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Corning Inc.

- Avantor, Inc.

- BD

- Eppendorf SE

- Bio-Techne

- PromoCell GmbH

Recent Developments

-

In May 2023, BD announced the global commercial launch of a new-to-the-world cell sorting equipment featuring two revolutionary innovations that allow researchers to reveal more comprehensive information regarding cells previously unseen in typical flow cytometry research

-

In March 2023, Danaher and the University of Pennsylvania announced a strategic alliance to advance cell therapy. The multi-year partnership aims to create new technologies, reduce delays in manufacturing, and provide next generation engineered cell products to patients with more consistent clinical outcomes

-

In February 2023, Thermo Fisher Scientific together with Celltrio announced a collaboration to provide clients in the biotherapeutics business with a fully controlled cell culture system

-

In February 2023, Corning Incorporated showcased its latest technology in automation & 3D cell culture at Society for Laboratory Automation & Screening (SLAS) conference in San Diego, California

U.S. Cell Culture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.18 billion

Revenue forecast in 2030

USD 10.97 billion

Growth rate

CAGR of 10.02% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor, Inc.; BD; Eppendorf SE; Bio-Techne; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cell Culture Market Report Segmentation

This report forecasts revenue growth at U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cell culture market report based on product, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Sera

-

Fetal Bovine Serum

-

Other

-

-

Reagents

-

Albumin

-

Others

-

-

Media

-

Serum-free Media

-

CHO Media

-

HEK 293 Media

-

BHK Medium

-

Vero Medium

-

Other Serum-free Media

-

Classical Media

-

Stem Cell Culture Media

-

Chemically Defined Media

-

Specialty Media

-

Other Cell Culture Media

-

-

-

Instruments

-

Culture Systems

-

Incubators

-

Centrifuges

-

Cryostorage Equipment

-

Pipetting

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Drug Development

-

Diagnostics

-

Tissue Culture & Engineering

-

Cell & Gene Therapy

-

Toxicity Testing

-

Other Applications

-

Frequently Asked Questions About This Report

b. The global U.S. cell culture market size was estimated at USD 5.61 billion in 2023 and is expected to reach USD 6.18 billion in 2024.

b. The global U.S. cell culture market is expected to grow at a compound annual growth rate of 10.02% from 2024 to 2030 to reach USD 10.97 billion by 2030.

b. Based on product, the consumables segment held the largest market share of 58.0% in 2023, primarily due to recurring demand and purchase of consumables.

b. Some prominent players in the U.S. cell culture market include Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor, Inc.; BD; Eppendorf SE; Bio-Techne; PromoCell GmbH

b. Key factors that are driving the market include the increasing prevalence of chronic & infectious diseases (including COVID-19), the rapid adoption of cell culture techniques to develop substrates for safe production of viral vaccines, and the rising global demand for advanced therapy medicinal products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.