- Home

- »

- Petrochemicals

- »

-

U.S. Chemical Distribution Market, Industry Report, 2030GVR Report cover

![U.S. Chemical Distribution Market Size, Share & Trends Report]()

U.S. Chemical Distribution Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Specialty, Commodity), By End-use (Plastic & Polymers, Synthetic Rubber, Downstream Chemicals), And Segment Forecasts

- Report ID: GVR-4-68040-220-9

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Chemical Distribution Market Trends

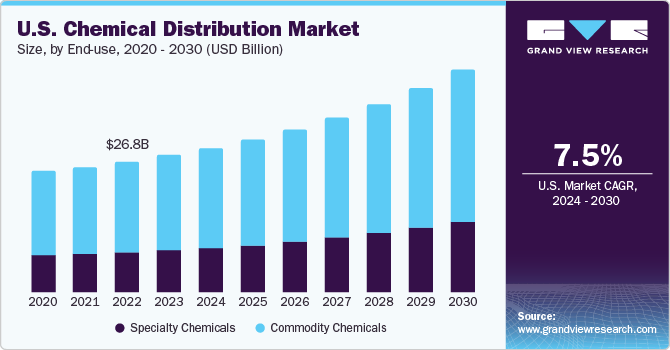

The U.S. chemical distribution market size was estimated at USD 28.03 billion in 2023 and is anticipated to grow at a CAGR of 7.5% from 2024 to 2030. The U.S. chemical distribution industry is reasonably fragmented, with many chemical distributors serving the U.S. market. These major players often have extensive geographic reach, diverse product offerings, and strong supplier relationships, which gives them an edge over competitors. Despite this, smaller market players can still thrive and contribute to a moderately fragmented market landscape. The strong growth in the United States is due to high demand in various end-use markets. Moreover, a rise in large-scale infrastructure investment projects, such as hotels and hospitals in New York, Missouri, and Los Angeles, is projected to drive the growth of the construction industry. This, in turn, will drive the demand for chemicals in the United States, benefiting the chemical distribution sector's growth.

There is a growing demand for downstream chemicals such as diesel fuel, heating oil, and lubricants in various industries like construction, automotive, and pharmaceutical. This demand is expected to contribute to the growth of the chemical distribution market over time. According to the U.S. Energy Information Administration, diesel fuel consumption in the U.S. averaged around 159 million gallons per day in 2020. Chemical companies and the growth of the construction and pharmaceutical industries anticipate the chemical distribution market to grow further due to the expansion of production units.

Chemical distributors have a new opportunity to act as intermediaries between producers and end-users. They can leverage information from the chemical industry about planned applications and allied products and the development of environmentally friendly products. By offering advisory services for sustainable products alongside trading activities, distributors can contribute to the growth of the market. Chemical distribution involves the transportation and storage of chemicals in bulk and packaged form. Chemicals are disseminated using sacks, barrels, containers, and pipelines. The chemical industry provides raw materials for numerous industries such as oil and petroleum, cosmetics, food, textiles, paint, building construction, and agriculture. Distributors worldwide offer a range of specialty and common chemicals.

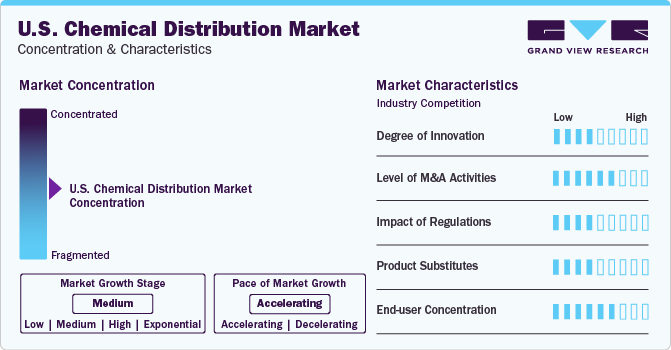

Market Concentration & Characteristics

The U.S. market for chemical distribution is fragmented, with several chemical distributors operating in the country. The U.S. chemical distribution market is marked by a high level of innovation owing to the constant advancement in the processes, chemical products, and applications. The need for enhanced efficacy, sustainability, and compliance with fluctuating customer preferences drives innovation in the market.

There has been a considerable level of merger and acquisition activities in the market, as companies aim to grow their product portfolios, increase their market share, and expand their reach. These companies' consolidation efforts are focused on achieving competitiveness, gaining entry to new technologies and markets, as well as achieving economies of scale. For example, in January 2024, Shrieve Chemical Company, a leading chemicals distributor and a portfolio company of Gemspring Capital, announced its acquisition of TLC Ingredients, a Crest Hill-based distributor of food ingredients, industrial chemicals, and phenolic resins. The terms of the deal were not disclosed.

Furthermore, chemical distributors are expanding their product range to meet the diverse needs and requests of their customers across various industries. This expansion may involve providing an extensive range of specialty chemicals, custom formulations, and value-added services, such as blending or technical support. In November 2023, Insecticides (India) Limited, agrochemical manufacturer, has recently announced the launch of four new products: Nakshatra, Supremo SP, Opaque, and Million. These products are designed to provide effective protection from weeds, pests, and the Phalaris minor weed in wheat, benefiting farmers and promoting sustainability in the agricultural sector.

Product Insights

The commodity segment dominated the market with the largest market share of 69.80% in 2023. The increased usage of chemicals in plastics and polymers, petrochemicals industries has led to the growth of the commodity chemicals market. Commodity chemicals, also known as bulk chemicals, are used for manufacturing other chemicals on a large scale. These chemicals have been classified into two broad categories—organic and inorganic chemicals. Inorganic chemicals include soda ash, chlorine, caustic soda, carbon black, calcium carbonate, and others. Organic chemicals include methanol, acetic acid, formaldehyde, and many more.

Petrochemicals held the largest market share within the commodity chemical market due to their usability in downstream derivatives like plastic resins, man-made fibers, dyes & pigments, synthetic rubber, surfactants, and others. Petrol is the main fuel and feedstock for petrochemicals.

Specialty chemicals accounted for a significant market share in 2023. This is attributed to its ability to increase the performance of the manufacturing process and products. These chemicals are specifically designed to cater to particular services and consumer demands. However, their availability is often restricted due to patent limitations, and a few manufacturers may only produce them.

The CASE segment held the largest revenue share within the specialty chemicals market in 2023. This is because it can enhance the performance and durability of various building materials like concrete, steel, and others at commercial and industrial levels. The demand for specialty adhesives, coatings, and other materials in high-performance applications such as construction, automotive, and paints is projected to increase, which will subsequently drive the demand for CASE in the market and boost the demand for specialty chemicals.

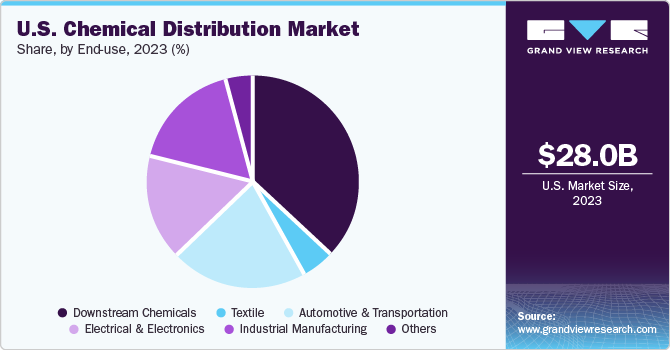

End-use Insights

The downstream segment within the commodity chemical segment held the largest market share of 37.48% in 2023. The key factor for this growth is the usability of the downstream chemical to manufacture petrochemical products like petrol, kerosene, jet fuel, diesel oils, lubricants, waxes, and asphalt, which are directly used in final consumption in various heavy manufacturing industries such as automotive, aviation, steel, and shipping. The demand for petrochemicals is expected to rise over the forecast period because of the notable growth in the above-mentioned end-user industries, thereby fueling the growth of downstream chemicals.

In addition, the automotive & transportation segment within the commodity segment accounted for a significant market share in 2023. In the automotive & transportation industry, commodity chemicals are used in required raw materials, which are used to manufacture automobile vehicle parts such as HVAC systems and basic building blocks, among others, resulting in the increased growth of the segment.

On the other hand, the construction segment within specialty chemicals accounted for the largest market share of 31.71% in 2023. Chemicals are used to enrich the aesthetic appeal of buildings. The demand for specialty chemicals in construction applications is directly related to the growth of construction activities across the globe.

Furthermore, the industrial manufacturing segment within specialty chemicals accounted for a significant market share in 2023. The favorable physicochemical properties of specialty chemicals have triggered their demand in lubricants and oil additives, which are witnessing significant demand across various industries including rubber processing, metalworking, oil fields, and pulp & paper.

Key U.S. Chemical Distribution Company Insights

Due to the large number of local businesses, the market is somewhat fragmented. A number of the industry's participants are exploring acquisition, merger, partnership, and investment methods in an attempt to increase their market share. Companies are also investing capital to enhance their products and services. They are also keeping an eye on keeping their rates competitive.

Key players operating in the market include ICC Industries, Inc.; Univar Solutions Inc., Brenntag AG.

-

ICC Industries, Inc. trades and supplies medicines, polymers, and chemicals worldwide. It handles the financing, shipping, and acquisition of imported goods. so giving its clients in North America and Europe the materials. The business serves both domestic and foreign suppliers through its networks of warehouses and tank ports.

-

Univar Solutions is a global partner for customers & suppliers for the chemical distribution.

Key U.S. Chemical Distribution Companies:

- Univar Solutions Inc.

- Helm AG

- Brenntag AG

- Barentz

- Azelis

- Safic Alan

- Ashland

- Biesterfeld AG

- ICC Industries, Inc.

Recent Developments

-

On November 2023, Brenntag opened its new facility in Maurice, Louisiana, USA. The new site will be operations hub for Coastal Chemical, a subsidiary of Brenntag.

-

On September 2023, US specialty ingredients and chemicals distributor Univar Solutions announced that it acquired Canadian company FloChem and certain of its affiliates, giving Univar access to new market segments and new service capabilities.

-

In May 2023, Azelis joined forces with Sirius International to cater to Azelis’ ambition to emerge as a global leader in providing sustainable chemical raw materials.

-

In March 2023, Brenntag acquired Aik Moh Group to enhance its production and distribution of industrial chemicals, and offer value-added services including logistics, repacking, warehousing, and mixing and blending.

U.S. Chemical Distribution Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.52 billion

Revenue forecast in 2030

USD 45.62 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

Univar Solutions Inc.; Helm AG; Brenntag AG; Barentz; Azelis; Safic Alan; Ashland; Biesterfeld AG; ICC Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Chemical Distribution Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. chemical distribution market report based on product, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Chemicals

-

CASE

-

Agrochemicals

-

Electronic

-

Construction

-

Specialty Polymers & Resins

-

Flavor & Fragrances

-

Others

-

-

Commodity Chemicals

-

Plastic & Polymers

-

Synthetic Rubber

-

Explosives

-

Petrochemicals

-

Others

-

-

-

U.S. Chemical Distribution End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Chemicals

-

Automotive & Transportation

-

Construction

-

Agriculture

-

Industrial Manufacturing

-

Consumer Goods & Appliances

-

Textiles

-

Healthcare Industry

-

Others

-

-

Commodity Chemicals

-

Downstream Chemicals

-

Textile

-

Automotive & Transportation

-

Electrical & Electronics

-

Industrial Manufacturing

-

Other

-

-

Frequently Asked Questions About This Report

b. The U.S. chemical distribution market size was estimated at USD 28.03 billion in 2023

b. The U.S. chemical distribution market is anticipated to register a compound annual growth rate (CAGR) of 7.5 % from 2024 to 2030.

b. The commodity segment dominated the market with the largest market share of 69.80% in 2023. The increased usage of chemicals in plastics and polymers, petrochemicals industries has led to the growth of the commodity chemicals market.

b. Some of the prominent players in the U.S. Chemical Distribution Market include: • Univar Solutions Inc. • Helm AG • Brenntag AG • Barentz • Azelis • Safic Alan • Ashland • Biesterfeld AG • ICC Industries, Inc.

b. The rise in large-scale infrastructure investment projects, such as hotels and hospitals in New York, Missouri, and Los Angeles, is projected to drive the growth of the construction industry. This, in turn, will drive the demand for chemicals in the United States, benefiting the chemical distribution sector's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.