- Home

- »

- Medical Devices

- »

-

U.S. Clinical Trials Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Clinical Trials Market Size, Share & Trends Report]()

U.S. Clinical Trials Market (2025 - 2030) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Indication, By Study Design, By Indication by Study Design, By Sponsor, By Service, And Segment Forecasts

- Report ID: GVR-4-68039-580-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Clinical Trials Market Size & Trends

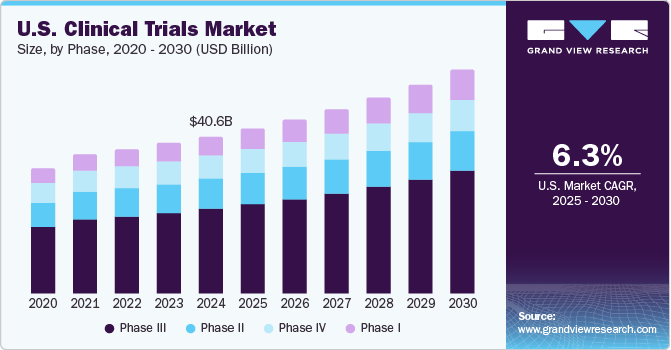

The U.S. clinical trials market size was estimated at USD 40.56 billion in 2024 and is estimated to grow at a CAGR of 6.30% from 2025 to 2030. The market growth is due to the increasing demand for innovative treatments and advancements in biotechnology and personalized medicine. This market is characterized by its robust infrastructure, extensive regulatory frameworks, and growing collaboration between pharmaceutical companies, research institutions, and government bodies. Increasing demand for personalized medicine, the rising prevalence of chronic diseases, and technological advancements in clinical research methodologies are key factors driving the market growth.

Moreover, the growing adoption of decentralized clinical trials and telemedicine in clinical trials offers several advantages, which are expected to drive overall market growth potential. Moreover, the integration of remote monitoring technology enables continuous patient data collection outside clinical settings. This real-time data improves trial accuracy, enhances patient engagement, and allows more comprehensive insights into patient health.

Digitalization in biomedical research is significantly contributing to the growth of the U.S. clinical trials market. The integration of advanced technologies, such as Electronic Data Capture (EDC) systems to streamline data collection and manage patient information more efficiently. This reduces monitoring costs and accelerates clinical trial timelines by accelerating real-time data access and analysis. The use of Clinical Outcome Assessment (e-COA) software to maintain patient records ensures compliance with stringent regulations and minimizes errors during trials. Additionally, the growing adoption of telemedicine and virtual clinical trials enhances patient recruitment and retention positively impacting market growth. The integration of remote monitoring technology further supports continuous data collection outside clinical environments, improving trial accuracy, boosting patient engagement, and providing deeper insights into patient health.

The clinical trial market is predicted to have a positive impact due to the shift toward personalized medicine. The traditional clinical trial process involves testing drugs on thousands of people, whereas personalized medicine focuses on the effects of drugs on individual patients during a specific period. The traditional approach hinders the development of many potential drugs that may not pass all clinical trial phases. The growing usage of pharmacogenetics in the clinical trial process is expected to impel the number of drugs that pass all phases, by eliminating the “one size fits all” mentality. The shift toward personalized medicine owing to increasing usage of pharmacogenetics in the clinical trial phase is expected to boost the number of drugs in the pipeline. This trend will impel investments in personalized medicine clinical trials.

Further, growing prevalence of chronic diseases and the incidence of novel diseases is estimated to boost the clinical trials market. According to the Centers for Disease Control and Prevention (CDC), over one in 20 adults aged over 20 and above are suffering from coronary artery diseases (CAD) in the U.S. Meanwhile, as per the Parkinson’s Foundation, currently around 1 million individuals suffer from Parkinson's Disease (PD), which is projected to increase to over 1.2 million by 2030. Moreover, the infectious diseases pharmaceutical market has witnessed dynamic trends and scenarios across various segments. Starting with influenza (Flu), the market's cyclic nature is driven by seasonal demand for vaccines during flu outbreaks. However, the initiation of universal flu vaccine research could disrupt this pattern, potentially providing longer protection against multiple strains.

The U.S. population presents a broad spectrum of disease profiles, with emerging countries showing even greater diversity. This diversity is anticipated to drive clinical trials for new or rare conditions. A higher number of patients with specific diseases encourages biopharmaceutical companies to increase investments in clinical trials for targeted disease segments. Additionally, a diverse population enables easier patient recruitment and accelerates the trial process. The growing use of clinical trials to address these variations is projected to fuel market growth. The rise in rare and orphan diseases has also gained significant attention, creating the need for specialized trials. As diseases become more complex, there is an increasing demand for expertise in trial design, patient recruitment, and data analysis. Sponsors are seeking specialists to navigate the complexities of these diverse conditions, which is expected to further boost market demand.

Phase Insights

The Phase III segment accounted for the highest revenue share in 2024. The segment growth is owing to a number of phase III trials, which are the most expensive and involve a large number of subjects. The median cost for a single phase III trial is over USD 19.0 million. Furthermore, rising prevalence of chronic diseases, demand for advanced therapeutic solutions, and stringent regulatory requirements. These trials focus on large-scale patient populations to validate efficacy and monitor adverse reactions, making them critical for final FDA approval. The growing investments from pharmaceutical companies and advancements in biotechnology are accelerating trial initiations. Additionally, increasing patient enrollment challenges and the need for real-world evidence are prompting innovations in trial design and execution, further driving this segment revenue growth.

The Phase I segment is expected to witness the highest market growth potential over the analysis period. The segment growth is primarily attributed to rising demand for innovative treatments and personalized medicine, increased funding from pharmaceutical companies and government initiatives, and technological advancements in drug discovery and development. The growth in oncology, rare diseases, and CNS disorder research has further boosted early-phase trials. Additionally, regulatory support for fast-tracked drug approvals and a growing number of biopharmaceutical startups contribute to the growth of the Phase I clinical trial segment.

Study Design Insights

The interventional design segment dominated the market and accounted for the largest revenue share in 2024. Interventional design is a structured approach utilized to evaluate the efficacy and safety of medical treatments, devices, or interventions. This design includes randomized controlled trials (RCTs), allows for precise control over variables, and enables clear cause-and-effect relationships, making it the gold standard in clinical research. The growing demand for innovative therapies in areas such as oncology, rare diseases, and personalized medicine is fueling the adoption of interventional studies, further driving market growth. Regulatory support and advancements in trial technologies also contribute to the segment's expansion.

The observational design segment is expected to witness considerable growth over the forecast period. As observational studies allow researchers to assess real-world outcomes without intervention. This approach is increasingly preferred due to its ability to provide insights into patient populations, disease progression, and treatment patterns in naturalistic settings. The growing emphasis on personalized medicine, the need for diverse and large-scale data, and regulatory support for real-world evidence are anticipated to drive the adoption of observational studies.

Indication by Study Design Insights

The interventional trials market for autoimmune/inflammation accounted for the largest share in 2024. This can be attributed to the increasing prevalence of autoimmune diseases, rising awareness of these conditions, and advances in biologics and immunotherapies. With the growing burden of diseases like rheumatoid arthritis, lupus, and inflammatory bowel disease, there is a heightened demand for novel treatment options. Pharmaceutical companies are investing heavily in clinical trials to address unmet needs, while regulatory support and expedited pathways for drug approval further accelerate research activity in this segment. Additionally, advancements in precision medicine and biomarker-based approaches enhance the potential for targeted therapies. In the U.S. There were around 3,774 interventional studies listed on Clinicaltrails.gov related to autoimmune diseases.

The observational trials market for autoimmune/inflammation accounted for the second-largest share in 2024. Out of the total autoimmune/inflammation studies listed on Clinicaltrials.gov, more than 3,300 are observational.

Indication Insights

The oncology segment accounted for the largest revenue share in the U.S. market in 2024. The segment growth is owing to the increasing prevalence of cancer, rising demand for targeted therapies, and advancements in precision medicine. Growing investments from pharmaceutical companies, coupled with favorable regulatory support, further accelerate clinical research. According to the U.S. FDA and various reports, the pharmaceutical industry is currently investing over USD 38.0 billion in the pre-clinical and clinical development stages of cancer treatment products. The development of novel immunotherapies and personalized treatment approaches contributes to the surge in oncology trials. Additionally, collaborations between research institutions and biotechnology firms enhance innovation and expedite the clinical trial process in this segment.

The cardiovascular segment is also anticipated to witness lucrative growth over the forecast period. Rising prevalence of cardiovascular diseases, advancements in medical technology, and increased funding for research and development. Growing healthcare awareness, coupled with an aging population, has expanded the demand for innovative treatments and interventions. Regulatory support for faster drug approvals and the expanding adoption of digital health tools to monitor and manage cardiovascular health further fuel the growth of clinical trials in this segment.

Service Insights

The patient recruitment segment held the largest market share in 2024. This segment growth is driven by the increasing number of clinical studies worldwide, boosting the need for patient recruitment services. Additionally, rising funding for clinical research and the widespread adoption of digital technologies in the field further support market expansion. Significant R&D investments and government backing for clinical trials also contribute to growth. Leading CROs offering extensive support services including patient recruitment, alongside the active involvement of global pharmaceutical and biopharmaceutical companies, have played a key role in driving market expansion.

The clinical trial data management services segment also held a substantial market share in 2024. This is attributed to the increasing use of data management services and the growing shift toward decentralized trials. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for data entry, analysis, and quality control is further enhancing segmental demand.

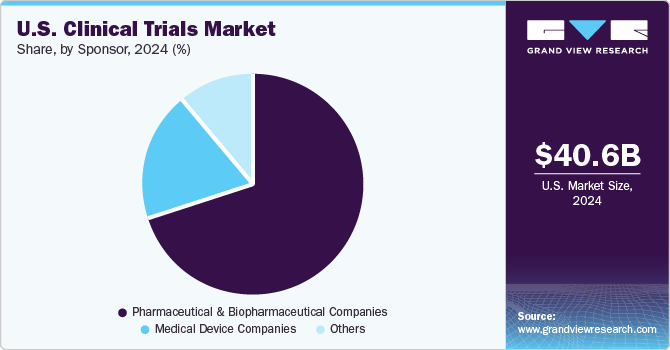

Sponsor Insights

The pharmaceutical & biopharmaceutical companies accounted for the largest share in 2024. This can be attributed to the greater interest of the pharmaceutical industry in the research field. In addition, there has been an increase in the number of clinical trials funded by pharmaceutical & biopharmaceutical companies. The pharmaceutical industry plays a vital role in financing the research for the development of new drugs.

These companies conduct extensive clinical trials to meet regulatory requirements, evaluate drug efficacy, and gain FDA approval. The surge in chronic diseases, advancements in biotechnology, and an expanding pipeline of biologics and biosimilars further bolster their reliance on clinical trials. Additionally, collaborations with Contract Research Organizations (CROs) enhance operational efficiency, accelerating the pace of clinical research and driving market growth.

Key U.S. Clinical Trials Company Insights

The key market players are undertaking several strategic initiatives, such as acquisitions, partnerships, expansion, agreements, collaborations, etc., to increase market presence and gain a competitive edge, driving market growth. For instance, in August 2024, SGS launched new specialized bioanalytical testing services in Hudson, U.S. Such introduction broadened the company’s service offerings to cater large client base.

Key U.S. Clinical Trials Companies:

- IQVIA

- Fortrea Inc.

- PAREXEL International Corporation

- Thermo Fisher Scientific Inc.

- Charles River Laboratories

- ICON Plc

- Wuxi AppTec Inc.

- Medpace

- Syneos Health

- AstraZeneca

- Merck & Co.

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Caidya

Recent Developments

-

In July 2024, Charles River Laboratories International, Inc. collaborated with the FOXG1 Research Foundation (FRF) to accelerate drug development through the clinical phase for FOXG1 syndrome.

-

In March 2024, Thermo Fisher Scientific Inc. Launched a CorEvitas syndicated clinical registry in Generalized Pustular Psoriasis (GPP) to address the need for real-world evidence on clinical and patient-reported outcomes. This new registry will gather comprehensive patient-level data to assess disease progression, treatment patterns, and comorbidities.

U.S. Clinical Trials Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 42.58 billion

The revenue forecast in 2030

USD 57.79 billion

Growth rate

CAGR of 6.30% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Phase, study design, indication, sponsor, indication by study design, service

Key companies profiled

IQVIA; Fortrea Inc.; PAREXEL International Corporation; Thermo Fisher Scientific Inc.; Charles River Laboratories; ICON Plc; Wuxi AppTec Inc.; Medpace; Syneos Health; AstraZeneca;, Merck & Co.; Eli Lilly and Company; Novo Nordisk A/S; Pfizer; Caidya

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Clinical Trials Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. clinical trials market report based on the phase, study design, indication, sponsor, indication by study design, and service:

-

Phase Outlook, (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook, (Revenue, USD Million, 2018 - 2030)

-

Interventional

-

Observational

-

Expanded Access

-

-

Indication Outlook, (Revenue, USD Million, 2018 - 2030)

-

Autoimmune/Inflammation

-

Rheumatoid Arthritis

-

Multiple Sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

Pain Management

-

Chronic Pain

-

Acute Pain

-

-

Oncology

-

Blood Cancer

-

Solid Tumors

-

Other

-

-

CNS Conditions

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle Regeneration

-

Others

-

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

Indication By Study Design Outlook, (Revenue, USD Million, 2018 - 2030)

-

Autoimmune/Inflammation

-

Interventional

-

Observational

-

Expanded Access

-

-

Pain Management

-

Interventional

-

Observational

-

Expanded Access

-

-

Oncology

-

Interventional

-

Observational

-

Expanded Access

-

-

CNS Conditions

-

Interventional

-

Observational

-

Expanded Access

-

-

Diabetes

-

Interventional

-

Observational

-

Expanded Access

-

-

Obesity

-

Interventional

-

Observational

-

Expanded Access

-

-

Cardiovascular

-

Interventional

-

Observational

-

Expanded Access

-

-

Others

-

Interventional

-

Observational

-

Expanded Access

-

-

-

Service Outlook, (Revenue, USD Million, 2018 - 2030)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Bioanalytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

-

Sponsor Outlook, (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. clinical trials market size was estimated at USD 40.56 billion in 2024 and is expected to reach USD 42.58 billion in 2025.

b. The U.S. clinical trials market is expected to grow at a compound annual growth rate of 6.30% from 2025 to 2030 to reach USD 57.79 billion by 2030.

b. Phase III dominated the U.S. clinical trials market with a share of 53.76% in 2024. Patent expirations of blockbuster drugs and the global financial crisis are factors expected to propel the market growth over the forecast period.

b. Some key players operating in the U.S. clinical trials market include IQVIA; PAREXEL International Corporation; Thermo Fisher Scientific; PAREXEL International Corporation; Charles River Laboratories; ICON Plc; and Wuxi AppTec

b. Key factors that are driving the U.S. clinical trials market growth include the increasing prevalence of chronic disease and the growing demand for clinical trials in developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.