- Home

- »

- Biotechnology

- »

-

U.S. DNA Manufacturing Market Size, Industry Report, 2030GVR Report cover

![U.S. DNA Manufacturing Market Size, Share & Trends Report]()

U.S. DNA Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Plasmid DNA, Synthetic DNA), By Grade (GMP & R&D), By Application (Cell & Gene Therapy, Vaccines, Oligonucleotide-based Drugs), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-630-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. DNA Manufacturing Market Summary

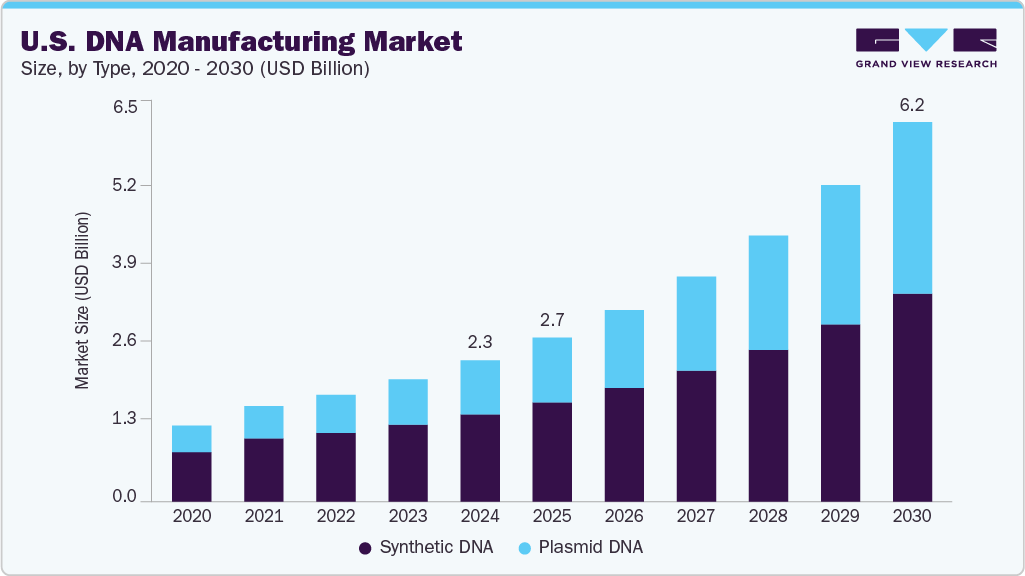

The U.S. DNA manufacturing market size was estimated at USD 2.29 billion in 2024 and is projected to reach USD 6.16 billion by 2030, growing at a CAGR of 18.27% from 2025 to 2030. The increasing demand for gene therapies, personalized medicine, and advancements in synthetic biology drives this growth.

Key Market Trends & Insights

- Based on type, the synthetic DNA segment held the largest market share in 2024.

- By grade, the GMP grade segment held the largest market share in 2024.

- By application, cell and gene therapy segment led the market in 2024.

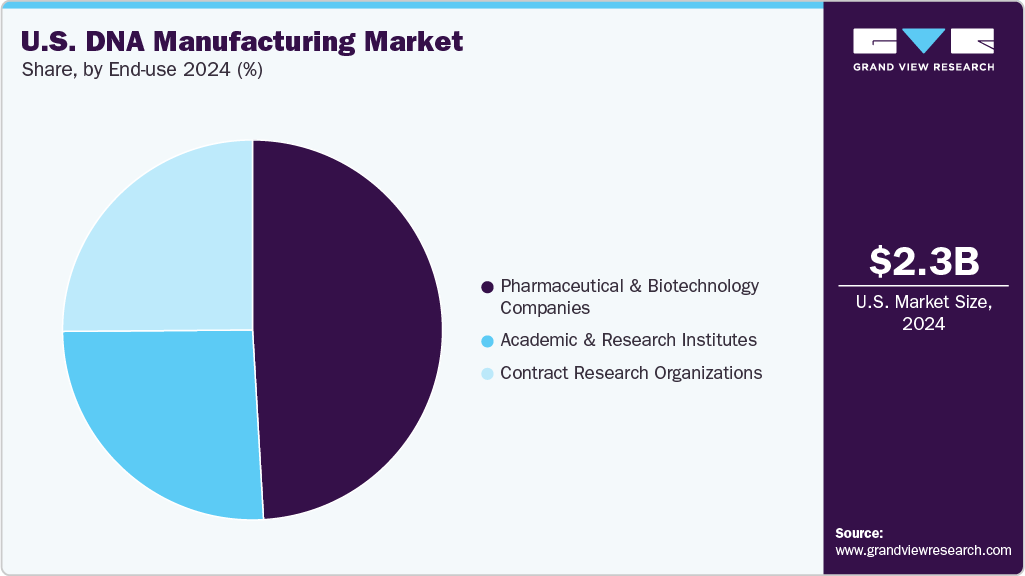

- By end-use, pharmaceutical and biotechnology companies represented 49.08% of the market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.29 Billion

- 2030 Projected Market Size: USD 6.16 Billion

- CAGR (2025-2030): 18.27%

The expanding applications of DNA manufacturing in biotechnology, pharmaceutical research, and vaccine development also play a significant role in market expansion. For instance, in May 2025, VGXI completed an FDA inspection, enabling its client to reach a key BLA approval milestone. This achievement highlights VGXI’s leadership in plasmid DNA manufacturing, responding to the increasing demand for high-quality DNA production in gene therapy applications.

Advancement in Gene Editing Technology

The rapid progress of gene editing technologies has significantly influenced the demand for DNA manufacturing in the U.S. Advanced tools such as CRISPR-Cas9, TALENs, and Zinc Finger Nucleases are transforming the biotechnology landscape by enabling precise, targeted genome modifications. For instance, in November 2024, the first U.S. trial using non-viral CRISPR technology to correct the sickle cell mutation was launched, marking a significant milestone in gene editing and offering new potential for genetic disease treatments. These technologies allow for the correction of genetic mutations, the development of customized therapies, and advancements in genetic research, fueling the need for high-quality DNA.

As gene editing technologies evolve, their integration into therapeutic development and scientific research has created new, ongoing demands for custom DNA production. Gene-editing platforms require specific DNA sequences for delivery, amplification, and modification, driving the need for sophisticated DNA manufacturing processes. With gene editing continuing to progress, the U.S. market for DNA manufacturing is expected to experience sustained growth, supporting the next generation of precision medicine and biotechnology.

Expanding Role of DNA in Vaccine Development and Infectious Disease Management

The rising focus on vaccines and infectious disease solutions is a critical driver of the U.S. DNA manufacturing market growth. The COVID-19 pandemic underscored the importance of rapid vaccine development, with DNA- and mRNA-based vaccines emerging as key tools in combating infectious diseases. For instance, in April 2025, Technology Networks highlighted the growing interest in DNA vaccines as a promising alternative to mRNA technology. The article emphasized that DNA vaccines offer several advantages, including enhanced stability, ease of storage, and cost-effectiveness, which are crucial for global vaccine distribution. The discussion also pointed to recent advancements in DNA vaccine platforms, such as IMUNON’s PlaCCine, which aim to improve immune responses and broaden the applicability of DNA-based vaccines beyond infectious diseases.

Ongoing efforts to develop next-generation vaccines against emerging infectious diseases and improvements in synthetic vaccine platforms continue to drive the need for scalable and reliable DNA synthesis. Moreover, growing investments in pandemic preparedness and vaccine research further amplify this demand. As a result, the U.S. DNA manufacturing industry is expected to expand substantially, supported by the increasing application of DNA manufacturing technology in vaccine development and infectious disease control.

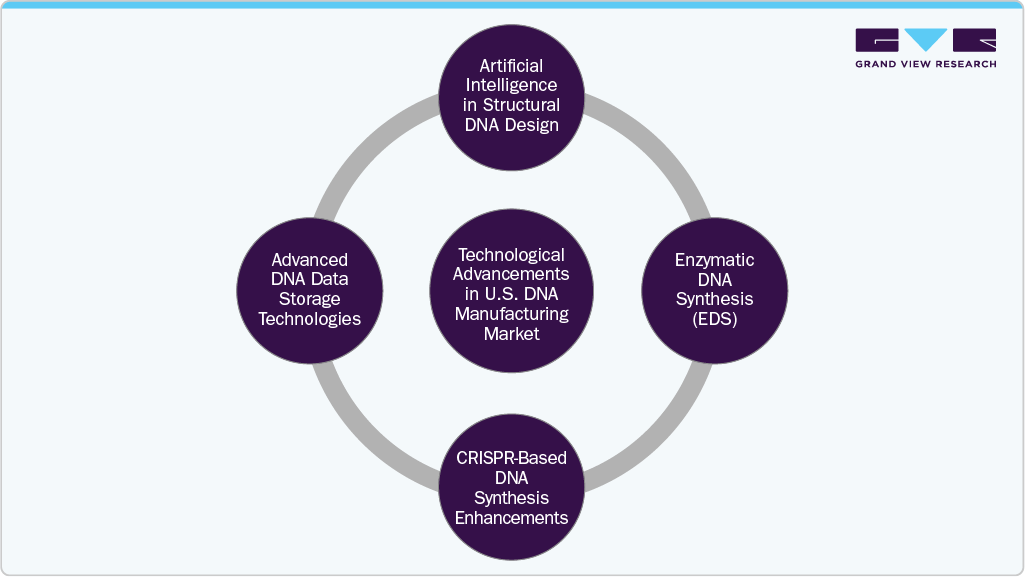

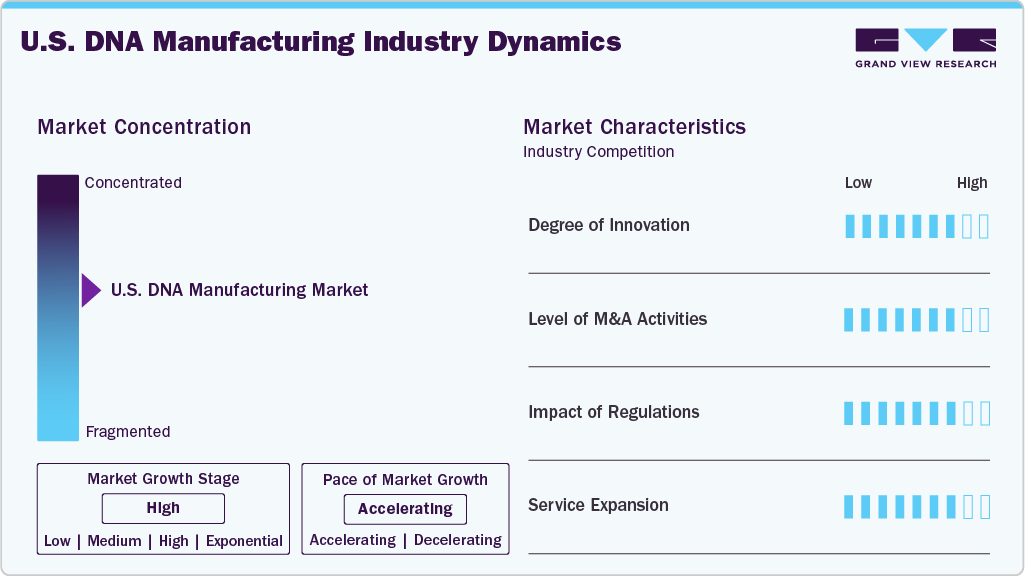

Market Concentration & Characteristics

The U.S. DNA manufacturing market’s growth is driven by a high degree of innovation, with continuous advancements in synthesis technologies enhancing production speed, accuracy, and scalability. Cutting-edge methods such as automated high-throughput platforms and enzymatic DNA synthesis enable the efficient creation of complex, custom DNA sequences essential for gene therapy, synthetic biology, and personalized medicine. Significant investments in research and development by industry leaders and collaborations among biotech companies, academic institutions, and government bodies are accelerating the introduction of next-generation DNA manufacturing solutions. For instance, in March 2025, a study published in Cell Reports Medicine demonstrated a next-generation DNA delivery technology combining plasmid DNA with lipid nanoparticles (LNPs). After a single dose, the study revealed that this DNA-LNP formulation induced robust and durable immune responses, including T-cell and antibody activation. This ongoing innovation is critical in driving market growth and reinforcing the U.S. as a global leader in DNA manufacturing.

The U.S. DNA manufacturing industry has experienced significant mergers and acquisitions (M&A) activities, underscoring its strategic importance in biotechnology and healthcare. For instance, in February 2025, Maravai LifeSciences completed the acquisition of Officinae Bio's DNA and RNA business, integrating Officinae Bio's AI-driven mRNA design platforms. Companies seek to enhance their technological capabilities, expand their product portfolios, and achieve economies of scale to remain competitive in a rapidly evolving market. The high level of M&A activity indicates a dynamic and growth-oriented industry, with firms actively pursuing opportunities to strengthen their positions in the field of DNA manufacturing.

Regulatory frameworks significantly influence the U.S. DNA manufacturing industry, ensuring genetic technologies' safety, efficacy, and ethical application. The U.S. Food and Drug Administration (FDA) oversees the regulation of gene therapy products, including those involving genome editing, under the Public Health Service Act and the Federal Food, Drug, and Cosmetic Act. Manufacturers must comply with strict guidelines, such as Good Laboratory Practice (GLP) and Good Tissue Practice (GTP), to ensure the quality and safety of their products. Moreover, the FDA provides guidance on developing gene therapy products, emphasizing the need for comprehensive safety testing, long-term follow-up studies, and considerations for using human- and animal-derived materials in manufacturing. These regulatory measures protect public health while fostering innovation in DNA manufacturing.

Service expansion is a significant market growth driver as companies diversify their offerings to meet the increasing demand for gene therapies, synthetic biology, and personalized medicine. For instance, in June 2024, Thermo Fisher Scientific introduced the Thermo Scientific KingFisher PlasmidPro Maxi Processor, the only fully automated maxi-scale plasmid DNA (pDNA) purification system. This innovation addresses the growing demand for high-purity plasmid DNA in cell and gene therapies, mRNA vaccines, and monoclonal antibody development. This development enhances efficiency and consistency in plasmid DNA extraction, accelerating therapeutic discoveries and developments. These expansions enable companies to offer a broader range of services, supporting the growing needs of the biotechnology and pharmaceutical industries.

Type Insights

The plasmid DNA manufacturing segment is expected to experience the fastest CAGR, driven by the expanding application of plasmid DNA in gene therapy, mRNA vaccine production, and cell and gene therapies. Plasmid DNA serves as a critical vector for delivering genetic material into cells, making it essential for developing advanced therapeutics targeting various genetic and infectious diseases. For instance, in January 2023, Charles River Laboratories launched its eXpDNA plasmid manufacturing platform to expedite DNA program timelines for cell and gene therapy developers. The platform offers a standardized approach, providing a plug-and-play screening toolbox, phase-appropriate production facilities, on-hand materials, and in-house analytics. Moreover, increasing investments in personalized medicine and the number of clinical trials utilizing plasmid DNA fuel demand in the DNA manufacturing market.

The synthetic DNA segment held the largest revenue share of the U.S. DNA manufacturing market in 2024, driven by its extensive applications in gene synthesis, therapeutic development, and biotechnology research. Oligonucleotides are essential for processes like PCR, sequencing, and gene editing, while synthetic DNA supports advancements in synthetic biology by creating customized genetic constructs. Moreover, innovations in DNA synthesis technologies have enhanced effectiveness and reduced manufacturing expenses, making these products more accessible to researchers and biotech firms. For instance, in August 2024, the Foundation for Applied Molecular Evolution (FfAME), supported by NASA's Astrobiology Program, unveiled synthetic DNA-like molecules incorporating more than the traditional four nucleotides. These "alien" DNA constructs can replicate, evolve, and encode proteins, offering novel disease diagnostics and treatment avenues. This advancement enhances diagnostic accuracy and paves the way for more precise and effective treatments. With synthetic biology expanding in healthcare, agriculture, and other industries, the synthetic DNA segment is poised to maintain its leading position in the market.

Grade Insights

GMP-grade DNA manufacturing held the largest share of the U.S. DNA manufacturing industry in 2024, primarily driven by the increasing demand for high-quality plasmid DNA in clinical applications, including gene therapies, mRNA vaccines, and cell-based treatments. GMP-grade plasmid DNA ensures consistent quality and regulatory compliance, which are critical for developing and commercializing these advanced therapeutics. The surge in clinical trials and the approval of new therapies have further amplified the need for GMP-grade DNA manufacturing capabilities. For instance, in April 2025, ProBio introduced a fast-track GMP plasmid DNA manufacturing service at its Hopewell, New Jersey facility, enabling clinical-grade plasmid DNA delivery in as little as three months. This service guarantees ≥85% supercoiled DNA content and offers fixed-cost pricing with transparent, no-hidden-fee contracts. Moreover, the trend of outsourcing manufacturing to specialized Contract Development and Manufacturing Organizations (CDMOs) that adhere to GMP standards is contributing to the expansion of this segment.

The R&D-grade DNA manufacturing segment is anticipated to grow at a significant CAGR over the forecast period. This dominance is attributed to its extensive applications in research and development, particularly in viral vector development, mRNA development, antibody development, and DNA vaccine development. R&D-grade DNA is a critical component in the early stages of therapeutic development, providing researchers with the necessary tools to explore and validate novel genetic constructs. The high share reflects the foundational role of R&D-grade DNA in advancing scientific understanding and innovation in genetic therapies.

Application Insights

The cell and gene therapy (CGT) segment held the largest revenue share of 43.81% in 2024, driven by the rising prevalence of genetic disorders and cancers, increasing investment in advanced therapies, and growing adoption of gene editing technologies such as CRISPR-Cas9. Expanding clinical trials and regulatory approvals for gene and cell-based treatments have further accelerated demand for high-quality DNA products. In support of these developments, regulatory and quality frameworks are evolving to ensure consistency and safety in therapeutic manufacturing. For instance, in May 2025, the United States Pharmacopeia (USP) launched a webinar focused on plasmid DNA standards, highlighting the importance of quality control in CGT manufacturing and the need for robust regulatory practices. Such initiatives are helping to strengthen industry standards and reinforce the critical role of DNA manufacturing in enabling safe and effective cell and gene therapies.

The oligonucleotide-based drugs segment is anticipated to grow at the fastest CAGR of 21.09% during the forecast period. This rapid growth is driven by advancements in RNA-based therapies, increasing regulatory approvals, and expanding clinical applications for treating various genetic disorders and cancers. Oligonucleotides play a crucial role in precision medicine by enabling targeted gene regulation, which has led to heightened demand for synthetic DNA products tailored for drug development. For instance, in May 2025, Oligo Factory introduced low-scale oligo synthesis capabilities in the United States, enabling the production of small, GMP-ready custom nucleotides. This expansion enhanced access to therapeutic, diagnostic, and life science applications. Continued innovation in oligonucleotide synthesis and delivery technologies is expected to expand this segment further.

End-use Insights

The pharmaceutical and biotechnology segment dominated the U.S. DNA manufacturing market, holding the largest revenue share of 49.08% in 2024. This dominance is driven by the extensive use of high-purity DNA products in drug development, gene therapies, and vaccine manufacturing. Pharmaceutical companies rely heavily on biotechnology DNA to ensure safety, efficacy, and regulatory compliance in clinical and commercial applications. For instance, in January 2025, Applied DNA Sciences’ subsidiary LineaRx completed a GMP facility in New York, addressing the rising demand for domestic DNA manufacturing to support mRNA therapeutics and reshoring initiatives. Moreover, the growing pipeline of biologics and personalized medicines continues to fuel demand for pharmaceutical-grade DNA, solidifying this segment’s leading position in the market.

The Contract Research Organizations (CROs) segment within the U.S. DNA manufacturing industry is expected to experience the fastest CAGR throughout the forecast period. This rapid expansion is driven by increasing demand for outsourced DNA synthesis and manufacturing services, enabling biotechnology and pharmaceutical companies to accelerate research and development timelines while optimizing costs. The growing complexity of DNA-based therapeutics and personalized medicine further fuels the reliance on CROs, positioning them as key contributors to the overall market growth.

Key U.S. DNA Manufacturing Company Insights

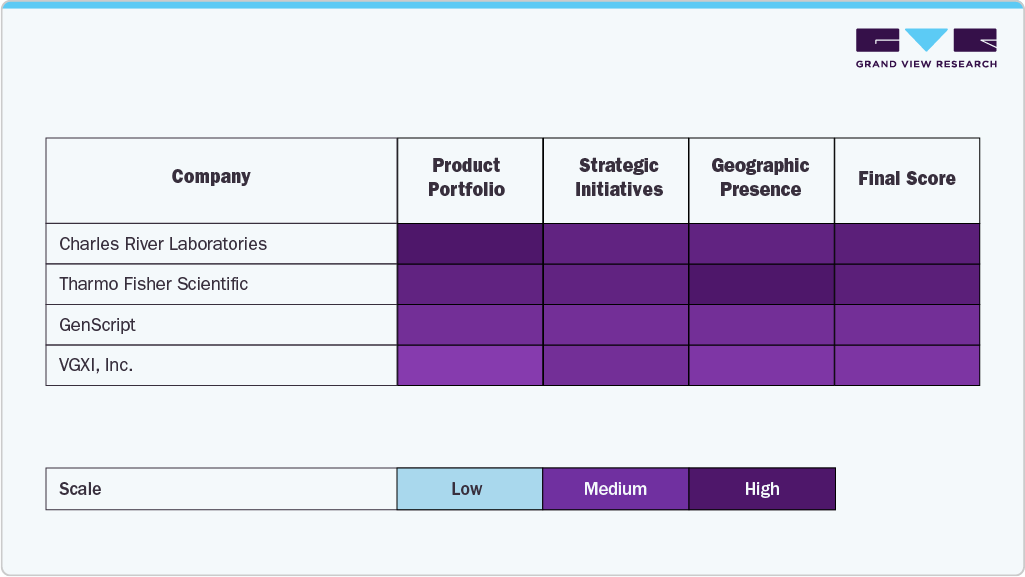

The U.S. DNA manufacturing market is characterized by several established players who dominate through strong product portfolios, strategic collaborations, and consistent R&D investments. Leading companies such as Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); and Thermo Fisher Scientific have maintained significant market share due to their comprehensive service offerings, advanced manufacturing capabilities, and ability to rapidly adapt to evolving industry demands.

Leading companies, including Lonza, Charles River Laboratories, and Thermo Fisher Scientific, continue to dominate the landscape through a combination of advanced technological capabilities, end-to-end service offerings, and strategic growth initiatives. These organizations have solidified their leadership in the DNA manufacturing market by addressing the growing demand for high-quality plasmid DNA and other genetic materials used in gene therapies, vaccines, and cell-based treatments.

Firms like GenScript, Catalent, and Twist Bioscience are expanding their footprint in the DNA manufacturing market through strategic investments, facility expansions, and acquisitions.

Companies such as Charles River Laboratories, GenScript, and Lonza are leading the charge by providing advanced contract development and manufacturing services (CDMO) for the biotechnology and pharmaceutical industries. These organizations offer comprehensive solutions ranging from preclinical research and process development to clinical and commercial-scale manufacturing.

The U.S. DNA manufacturing industry is experiencing a dynamic convergence of established expertise and startup innovation. Increasing mergers and acquisitions (M&A), strategic partnerships, and breakthrough product developments are driving intensified competition across the industry. Companies that successfully integrate scientific rigor with consumer-centric trends are poised to create sustained value in this rapidly evolving sector. As demand for precision health solutions continues to grow, commitments to accessibility, affordability, and ethical sourcing will play a critical role in shaping the future market landscape.

Key U.S. DNA Manufacturing Companies:

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Thermo Fisher Scientific

- Lonza

- GenScript

- Twist Bioscience

- AGC Biologics

- Catalent

- Eurofins Genomics

Recent Developments

-

In May 2025, Aldevron and Integrated DNA Technologies (IDT) achieved a significant milestone by manufacturing the world’s first mRNA-based personalized CRISPR therapy. This innovative treatment was developed for an infant with a life-threatening urea cycle disorder (UCD) and delivered in just six months, three times faster than the standard timeline for gene editing drug products.

-

In May 2025, VGXI, Inc., a contract development and manufacturing organization (CDMO) specializing in nucleic acid-based therapeutics, announced the successful completion of a U.S. Food and Drug Administration (FDA) inspection at its Conroe, Texas facility. This milestone enables VGXI's client to submit a Biologics License Application (BLA) for clinical trials involving plasmid DNA, a critical component in gene therapies and mRNA vaccines. VGXI's achievement underscores its leadership in plasmid DNA manufacturing, offering scalable and high-purity production capabilities. The company has been a trusted partner in advancing life-changing medical research and innovation worldwide.

-

In October 2024, Twist Bioscience entered into a USD 15 million royalty purchase agreement with XOMA Royalty, granting XOMA rights to royalties from Twist's gene therapy and mRNA vaccine collaborations. This strategic move aims to bolster Twist’s financial flexibility and accelerate the development of its synthetic biology platforms, including gene synthesis, CRISPR, and mRNA technologies. The partnership underscores Twist’s commitment to advancing gene therapy and mRNA vaccine innovations.

U.S. DNA Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.66 billion

Revenue forecast in 2030

USD 6.16 billion

Growth rate

CAGR of 18.27% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, grade, application, end-use

Country scope

U.S.

Key companies profiled

Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Thermo Fisher Scientific; Lonza; GenScript; Twist Bioscience; AGC Biologics; Catalent; Eurofins Genomics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. DNA manufacturing market report based on type, grade, application, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plasmid DNA

-

Synthetic DNA

-

Gene Synthesis

-

Oligonucleotide Synthesis

-

-

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

GMP Grade

-

R&D Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell & Gene Therapy

-

Vaccines

-

Oligonucleotide-based Drugs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Academic & Research Institutes

-

Contract Research Organizations

-

Frequently Asked Questions About This Report

b. The U.S. DNA manufacturing market size was estimated at USD 2.29 billion in 2024 and is expected to reach USD 2.66 billion in 2025.

b. The U.S. DNA manufacturing market is expected to grow at a compound annual growth rate of 18.27% from 2025 to 2030 to reach USD 6.16 billion by 2030.

b. The oligonucleotide synthesis segment dominated the U.S. DNA manufacturing market with a share of 55.49% in 2024. This is attributable to high research, diagnostics, and therapeutics demand, driven by personalized medicine growth.

b. Some key players operating in the U.S. DNA manufacturing market include Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Thermo Fisher Scientific; Lonza; GenScript; Twist Bioscience; AGC Biologics; Catalent; Eurofins Genomics.

b. Key factors driving the market growth include the growing demand for gene therapy, personalized medicine, synthetic biology advances, and biopharma R&D investment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.