- Home

- »

- Biotechnology

- »

-

DNA Manufacturing Market Size, Share, Industry Report 2030GVR Report cover

![DNA Manufacturing Market Size, Share & Trends Report]()

DNA Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Plasmid DNA, Synthetic DNA), By Grade (GMP Grade, R&D Grade), By Application (Cell & Gene Therapy, Oligonucleotide-based Drugs), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-608-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Manufacturing Market Summary

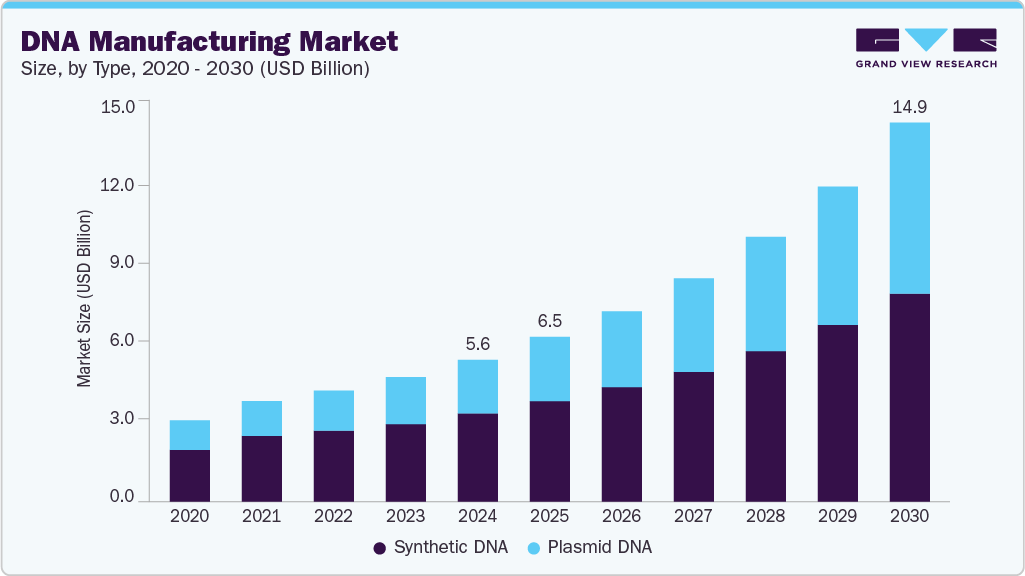

The global DNA manufacturing market size was estimated at USD 5.65 billion in 2024 and is projected to reach USD 14.96 billion by 2030, growing at a CAGR of 18.10% from 2025 to 2030. This growth is driven by increasing demand for gene therapies, personalized medicine, and advancements in synthetic biology.

Key Market Trends & Insights

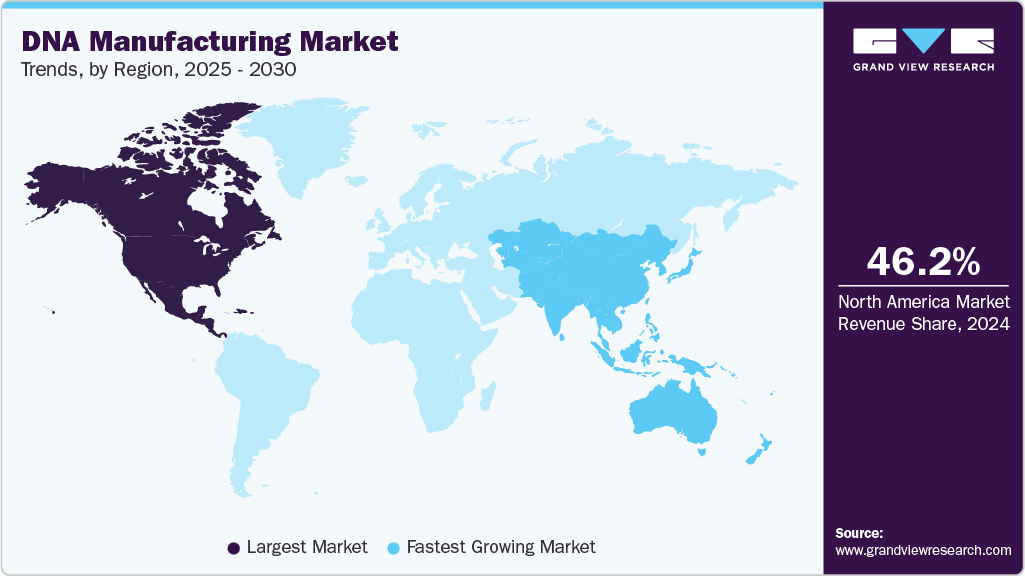

- North America DNA manufacturing market dominated the global market with the largest revenue share of 46.23% in 2024.

- The US DNA manufacturing market remains the largest, primarily due to its leadership in biotechnology innovation and significant investments in genomic research and therapies.

- By type, the synthetic DNA segment held the largest revenue share of the market in 2024.

- By grade,GMP-grade DNA manufacturing held the largest revenue share in 2024.

- By application,the cell and gene therapy (CGT) segment held the largest revenue share of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.65 Billion

- 2030 Projected Market Size: USD 14.96 Billion

- CAGR (2025-2030): 18.10%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expanding applications in pharmaceutical research and vaccine development also contribute to market expansion. For instance, in July 2024, GenScript Biotech announced the launch of an advanced DNA synthesis platform that reduces production time, enabling faster development of gene therapies and synthetic vaccines. Moreover, supportive government initiatives and rising investments in genomics are expected to accelerate further growth in the market.

Growth of Gene Therapy

Gene therapies are transforming the treatment landscape for genetic disorders, rare diseases, and common chronic conditions. Gene therapies directly modify or replace faulty genes within a patient’s cells, offering the potential for long-lasting or curative effects. For instance, in September 2022, GenScript USA Inc. introduced the GenWand Double-Stranded DNA (dsDNA) service, designed to enhance CRISPR-based gene editing in T-cell engineering.

This service offers covalently closed-end linear DNA templates, which are more stable and less prone to endonuclease degradation, thereby improving homology-directed repair (HDR) efficiency and reducing off-target effects compared to traditional PCR-based methods. This innovative approach requires large-scale production of highly precise and pure DNA sequences to develop therapeutic vectors, such as viral carriers or plasmids, which deliver the corrective genes into patient cells.

Product name

Generic name

Year first approved

Disease(s)

Locations approved

Company

zevorcabtagene autoleucel

zevorcabtagene autoleucel

2024

Relapsed or refractory multiple myeloma

China

CARsgen Therapeutics

Beqvez

fidanacogene elaparvovec

2024

Hemophilia B

Canada

Pfizer

Lyfgenia

lovotibeglogene autotemcel

2023

Sickle cell anemia

U.S.

bluebird bio

inaticabtagene autoleucell

inaticabtagene autoleuce

2023

Acute lymphocytic leukemia

China

Juventas Cell Therapy

Casgevy

exagamglogene autotemcel

2023

Sickle cell anemia; thalassemia

U.S., UK, Bahrain, Saudi Arabia, EU

CRISPR Therapeutics

Fucaso

equecabtagene autoleucel

2023

Multiple myeloma

China

Nanjing IASO Biotechnology

Vyjuvek

beremagene geperpavec

2023

Dystrophic epidermolysis bullosa

U.S.

Krystal Biotech

Elevidys

delandistrogene moxeparvovec

2023

Duchenne muscular dystrophy

US

Sarepta Therapeutics

Source: ASCGT, Primary Interviews, Grand View Research

For instance, in November 2024, NewBiologix launched its Xcell rAAV Production and Analytics Platform. It enables simultaneous screening of multiple rAAV candidates and provides comprehensive data reports that support preclinical and clinical development. Key features include detailed characterization of encapsulated DNA, including full and empty capsid ratios and gene sequence integrity, to accelerate gene therapy development. As more gene therapies progress through clinical trials and receive regulatory approvals, the demand for DNA manufacturing grows exponentially. The complexity and customization required for each treatment drive the need for advanced DNA synthesis technologies capable of producing high-quality DNA at scale and speed. Diseases like spinal muscular atrophy, certain types of inherited blindness, and blood disorders such as beta-thalassemia have seen successful gene therapy treatments, fueling the market expansion of DNA manufacturing.

Automation And Grade Improvements

Technological advancements and automation are revolutionizing the DNA manufacturing market by making the synthesis process faster, more accurate, and significantly more cost-effective. Innovations such as silicon-based DNA synthesis, microfluidics, and AI-powered design tools enable high-throughput production with enhanced precision and reproducibility. For instance, Twist Bioscience offers gene synthesis on a high-throughput, scalable platform in the United States, enabling rapid, accurate DNA construction for research and therapeutic applications.

Improvements in sequencing technologies and bioinformatics have further streamlined quality control processes, ensuring that synthetic DNA products consistently meet the stringent standards required for clinical and research use. For instance, in March 2025, WuXi Biologics launched EffiX, a proprietary E. coli expression system designed to enhance the production of recombinant proteins and plasmid DNA. The platform achieves titers exceeding 15 g/L for non-monoclonal antibody (non-mAb) recombinant proteins and over 1 g/L for plasmid DNA. EffiX offers high yield, stability, and scalability. This platform supports the efficient development and manufacturing of diverse biologics modalities. The continued adoption of automation and advanced technologies is transforming the market landscape by enabling the rapid production of complex, high-quality DNA sequences at scale. This evolution accelerates research and development while opening new frontiers in synthetic biology, personalized medicine, and industrial biotechnology, driving market growth.

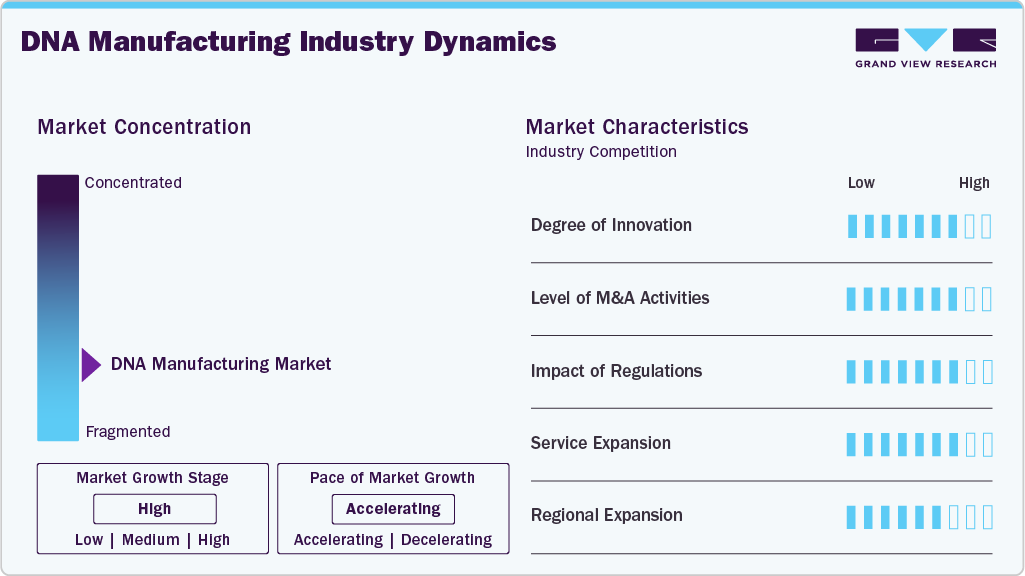

Market Concentration & Characteristics

The DNA manufacturing market exhibits high innovation, driven by advancements in synthesis technologies, automation, and AI integration. Breakthroughs such as silicon-based and enzymatic DNA synthesis have enabled faster, more scalable, and environmentally sustainable production. Automation and AI tools enhance sequence accuracy and reduce turnaround time, while long and complex DNA synthesis innovations expand applications in gene therapy, synthetic biology, and biotechnology.

For instance, in May 2025, researchers highlighted the transformative potential of cell-free DNA synthesis in accelerating next-generation mRNA therapeutics. By integrating AI-driven sequence design with rapid, scalable synthesis platforms, scientists can now swiftly generate and optimize mRNA sequences for diverse applications, including vaccines, cancer therapies, and gene editing. The combination of advanced synthesis technologies and AI optimization is poised to revolutionize the landscape of genetic medicine, enabling more effective and accessible therapeutic solutions. As demand for personalized medicine and genetic engineering grows, these innovations transform DNA manufacturing into a faster, smarter, and more globally accessible industry.

The DNA manufacturing market is experiencing moderate to high M&A activity, driven by rapid industry growth, technological advancements, and increased demand for gene therapies and personalized medicine. For instance, in March 2025, Integrated DNA Technologies (IDT) and Elegen partnered to enhance long DNA synthesis capabilities. This collaboration introduces Elegen’s ENFINIA Plasmid DNA service, enabling the rapid delivery of next-generation sequencing (NGS)-verified clonal genes ranging from 5 to 15 kb. These mergers reflect a broader consolidation trend as companies seek to enhance technological capabilities, expand service offerings, and strengthen their competitive positions in a rapidly evolving global DNA manufacturing industry.

Regulations have a significant dual impact on the DNA manufacturing market. Strict guidelines from agencies like the FDA and EMA ensure safety, quality, and ethical standards, particularly for clinical applications such as gene therapies and diagnostics, which can increase costs and slow time-to-market. Clear regulatory pathways and supportive policies, including fast-track approvals and public-private partnerships, help foster innovation and commercial growth. Moreover, emerging regulations around biosecurity and genetic data privacy shape how DNA is synthesized and used globally, making compliance challenging and a driver of trust and long-term market stability.

DNA manufacturing is experiencing significant momentum through continuous product expansion as companies broaden their offerings to meet the increasing demand for healthcare, biotechnology, and synthetic biology. Manufacturers are moving beyond basic gene synthesis to provide custom oligonucleotides, plasmid DNA, gene libraries, and CRISPR components, supporting diverse applications like gene therapy, diagnostics, and vaccine development.

For instance, in May 2025, Oligo Factory introduced a low-scale oligonucleotide synthesis platform. This expansion enables the production of small, GMP-ready custom nucleotides in quantities as low as 25 mg. The initiative aims to enhance accessibility for early-stage therapeutic, diagnostic, and life sciences applications, facilitating rapid prototyping and accelerating the development of novel oligonucleotide-based solutions. Such expansions strengthen market competitiveness and open new revenue streams across research and commercial sectors.

Regional expansion is a key growth strategy in the DNA manufacturing market, with North America and Europe leading due to established biotech infrastructure and favorable regulations. Asia-Pacific is rapidly emerging as a major hub driven by government investments and growing demand for genomics and personalized medicine. Companies are expanding their global presence by establishing regional manufacturing sites, forming partnerships, and enhancing distribution networks to improve accessibility and reduce turnaround times. This geographic diversification enables firms to serve local markets better, optimize supply chains, and capitalize on the increasing global demand for DNA manufacturing products.

Type Insights

The synthetic DNA segment held the largest revenue share of the market in 2024, driven by increasing applications in gene editing, synthetic biology, diagnostics, and personalized medicine. Chemical synthesis and enzymatic methods have improved synthetic DNA production's length, accuracy, and scalability, making complex constructs more accessible. For instance, in December 2024, researchers achieved a significant milestone by directly synthesizing genes up to 1,728 nucleotides long. This breakthrough utilized a novel approach involving smooth glass surfaces and the Catching-by-Polymerization (CBP) method. The successful synthesis of an 800-mer green fluorescent protein gene and a 1,728-mer Φ29 DNA polymerase gene on an automated synthesizer marks a notable advancement in chemical gene synthesis. Companies are investing heavily in improving synthesis speed, reducing costs, and integrating automation to meet the needs of diverse end-users, driving innovation and market growth.

The plasmid DNA manufacturing market is expected to grow at the fastest CAGR over the forecast period, driven by its crucial role in gene therapies and DNA vaccines. Advancements in production technologies, strategic partnerships, and the growing prevalence of genetic disorders necessitate innovative therapeutic solutions. For instance, in June 2024, Thermo Fisher Scientific launched the Thermo Scientific KingFisher PlasmidPro Maxi Processor, the only fully automated maxi-scale plasmid DNA (pDNA) purification system. This system streamlines the purification process by eliminating manual column preparation, centrifugation, and pipetting. The PlasmidPro system can process 100-150 mL of fresh overnight culture, yielding up to 1.5 mg of high-purity plasmid DNA in approximately 75 minutes.

Grade Insights

GMP-grade DNA manufacturing held the largest revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The strict quality and regulatory standards associated with GMP-grade plasmids are essential for clinical applications, ensuring safety, consistency, and compliance with regulatory requirements. This has increased the demand for GMP-grade plasmid DNA in clinical trials and therapeutic applications. Leading companies, such as Eurogentec, offer scalable GMP-grade plasmid manufacturing services with capacities ranging from grams to kilograms.

For instance, in April 2025, ProBio Inc., a contract development and manufacturing organization (CDMO), announced the launch of a GMP plasmid DNA manufacturing service at its Hopewell facility. This service enables the delivery of clinical-grade plasmid DNA from the cell bank to batch release in just three months, surpassing typical industry timelines. They utilize FDA-inspected facilities and proprietary purification technologies. As the demand for advanced therapies continues to rise, the GMP-grade DNA segment is expected to maintain its prevailing position in the DNA manufacturing market, which is driven by technological advancements, regulatory support, and the increasing prevalence of genetic disorders necessitating innovative therapeutic solutions.

The R&D-grade DNA manufacturing is projected to grow at a significant CAGR over the forecast period, driven by its essential role in foundational research, drug discovery, and early-stage therapeutic development. Manufactured under standard laboratory conditions, R&D-grade plasmids are tailored for basic research applications, including viral vector development and DNA vaccine research. The increasing demand for R&D-grade DNA manufacturing is attributed to the growing need for high-quality materials in research and drug development endeavors. Manufacturing facilities and grade advancements are expected to drive the adoption rate of R&D-grade DNA manufacturing.

Application Insights

The cell and gene therapy (CGT) segment held the largest revenue share of the market in 2024. It is driven by its essential role in developing advanced therapies for cancers, genetic disorders, and rare diseases. This segment relies heavily on high-quality DNA products such as plasmid and synthetic DNA to produce viral vectors, gene editing tools, and therapeutic constructs. For instance, in June 2023, GenScript ProBio and Comprehensive Cell Solutions (CCS) formed a strategic partnership to advance cell and gene therapy (CGT) development and manufacturing. GenScript ProBio will leverage CCS’s expertise in clinical cell therapy manufacturing, bone marrow transplant services, and access to blood-related products. At the same time, CCS will benefit from GenScript ProBio’s capabilities in developing and manufacturing plasmids, viral vectors, vaccines, and mRNA. This alliance aims to streamline the CGT supply chain and accelerate the journey from development to clinical and commercial supply, ultimately improving patient outcomes, challenges, including manufacturing complexities and regulatory requirements, continuous innovation and expanding clinical approvals, drive strong growth in this segment, making it a critical driver within the DNA manufacturing market.

The oligonucleotide-based drugs segment is anticipated to grow at the fastest CAGR of 20.9% throughout the forecast period. This is driven by the increasing development of therapies that utilize short DNA or RNA sequences to modulate gene expression. High demand for customized, high-purity oligonucleotides has stimulated advances in manufacturing technologies, enabling scalable and cost-effective production. As precision medicine and RNA-based therapeutics evolve, oligonucleotide-based drugs continue driving innovation in DNA manufacturing.

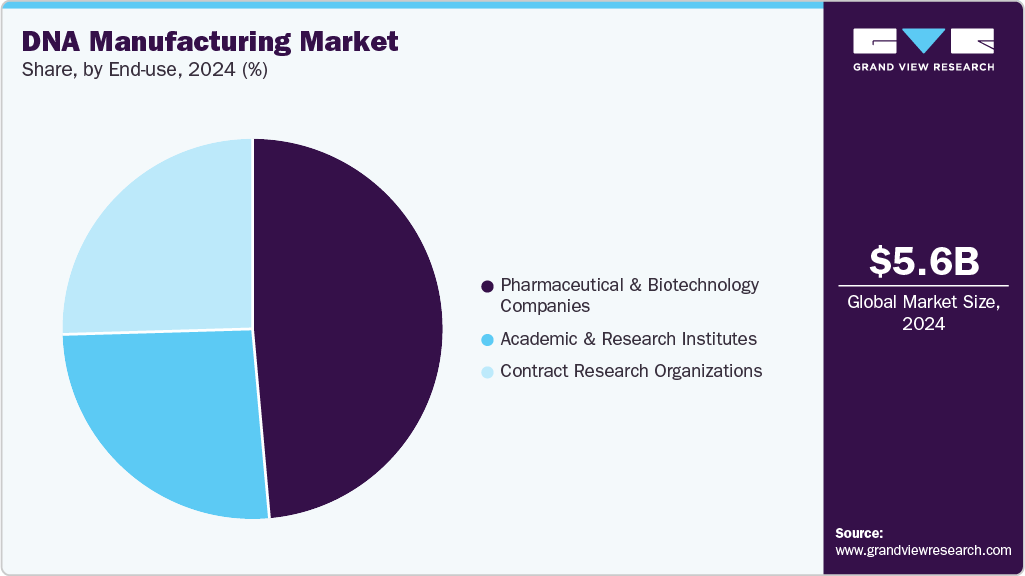

End-use Insights

Pharmaceutical and biotechnology dominated DNA manufacturing with the largest revenue share of 48.68% in 2024. These companies rely heavily on synthetic DNA, plasmid DNA, and oligonucleotides for drug discovery, gene therapy development, vaccine production, and synthetic biology applications. The increasing focus on personalized medicine, gene editing technologies such as CRISPR, and novel biologics has driven demand for high-quality, scalable DNA manufacturing solutions. Pharmaceutical and biotech firms continue to innovate and expand their pipelines, increasing the demand for advanced DNA manufacturing products and services.

The Contract Research Organizations (CROs) segment is anticipated to grow at the fastest CAGR throughout the forecast period. The increasing trend of outsourcing complex DNA manufacturing processes to CROs allows companies to reduce costs, accelerate timelines, and access specialized expertise and advanced technologies. Growing demand for personalized medicine and innovative therapies further fuels CRO involvement, making them essential partners in driving efficiency and scalability within the DNA manufacturing supply chain.

Regional Insights

North America DNA manufacturing market dominated the global market with the largest revenue share of 46.23% in 2024 due to its robust biotech infrastructure, strong academic research institutions, and advanced healthcare systems. The high demand for gene therapies, precision medicine, and cutting-edge biotech research contributes significantly to the growth of the DNA manufacturing market. The presence of leading biotech companies, government support for genomics research, and favorable regulatory frameworks has made the region a global leader in DNA manufacturing. Moreover, the ongoing development of mRNA-based vaccines and genetic treatments drives demand for synthetic and plasmid DNA, positioning North America as a key region in the market.

U.ScDNA Manufacturing Market Trends

The US DNA manufacturing market remains the largest, primarily due to its leadership in biotechnology innovation and significant investments in genomic research and therapies. For instance, in July 2024, Charles River performed plasmid manufacturing for AVantgarde’s gene therapy programs, supporting their expansion in the United States with advanced viral vector production capabilities. The rise of personalized medicine, gene-editing technologies, and cell and gene therapies has created a sustained need for high-quality DNA products. The FDA’s regulatory support for gene-based therapies and expanding clinical trials has accelerated the demand for DNA manufacturing services. Moreover, the country’s well-established healthcare system and numerous biotech hubs ensure a constant demand for advanced DNA manufacturing technologies.

Europe DNA Manufacturing Market Trends

Europe DNA manufacturing market holds a significant revenue share of the global market, driven by the continuous growth of its pharmaceutical and biotechnology sectors. For instance, in March 2023, Catalent opened a state-of-the-art commercial-scale plasmid DNA (pDNA) manufacturing facility at its European Center of Excellence in Gosselies, Belgium, spanning over 12,000 square feet with multiple cleanrooms designed for CGMP-grade pDNA production for clinical and commercial applications. Moreover, the region benefits from a favorable regulatory environment, with the European Medicines Agency (EMA) supporting the approval of gene-based treatments. The increasing prevalence of genetic diseases, cancer, and rare disorders has fueled demand for gene therapies and synthetic DNA products.

The UK DNA manufacturing market is experiencing strong growth, as the country is home to several world-renowned research institutions, such as the Francis Crick Institute, and has become a leader in gene-editing technologies like CRISPR. The UK government has introduced initiatives such as the Life Sciences Industrial Strategy, which aims to bolster the country’s biotech capabilities, including DNA manufacturing. For instance, in April 2025, 4basebio received GMP certification from the UK’s MHRA, enabling it to manufacture and supply GMP-grade synthetic DNA for clinical trials, particularly in cell and gene therapies and mRNA vaccines. With a growing focus on personalized medicine and cancer treatment, the demand for DNA-based therapies and gene synthesis continues to rise, making the UK a crucial market for DNA manufacturing.

Germany DNA manufacturing market is experiencing significant growth, driven by the country's strong emphasis on pharmaceutical manufacturing and biotech research. The country benefits from advanced infrastructure, a highly skilled workforce, and close collaboration between academia and industry. This collaborative environment is fueling demand for high-quality synthetic DNA. For instance, in January 2024, Elegen announced a collaboration and licensing agreement with GSK to utilize Elegen's cell-free DNA manufacturing grade for GSK's vaccines and medicines. The grade rapidly delivers high-complexity, clonal-quality linear DNA, offering significant time and cost savings for mRNA, cell, and gene therapies. Moreover, the regulatory environment in Germany, supported by the European Medicines Agency (EMA), provides a stable framework for the approval of gene-based treatments, driving demand for plasmid and synthetic DNA products used in clinical applications.

Asia Pacific DNA Manufacturing Market Trends

The Asia-Pacific DNA manufacturing market is expected to grow at the fastest CAGR of 19.03% in the DNA manufacturing market during the forecast period, driven by the expanding pharmaceutical and biotechnology industries in countries like China, Japan, and India. The region’s growing emphasis on personalized medicine, gene therapy, and vaccine development has increased demand for DNA manufacturing solutions. Moreover, the increasing adoption of cell and gene therapies and strong government support for biotech innovations are poised to accelerate demand for the DNA manufacturing industry further.

China DNA manufacturing market has become one of the largest markets in the Asia-Pacific region, driven by substantial government investments in genomics and biotechnology research. The Chinese government’s support for the development of gene therapies and the growing healthcare needs of its aging population has accelerated the demand for synthetic DNA and plasmid DNA for gene therapy applications. For instance, in May 2025, Chinese scientists at Fudan University successfully cured thalassemia in children using the domestically developed CS-101 DNA base editing therapy, advancing gene therapy for severe blood disorders in China. Moreover, the country’s growing biotech ecosystem, supported by initiatives like the “Made in China 2025” plan, continues to drive the demand for high-quality DNA manufacturing solutions for research and commercial applications.

DNA manufacturing market in Japan is growing rapidly, particularly in regenerative medicine, gene therapies, and cell therapies. The country's regulatory environment, which supports the continuous development and approval of gene therapies, plays a crucial role in driving the expansion of the DNA manufacturing market. For instance, in December 2023, Synplogen and Ginkgo Bioworks signed a non-binding Memorandum of Understanding to accelerate DNA manufacturing and gene therapy platform services in Japan, aiming to strengthen the local biotech ecosystem. This collaboration seeks to improve Japan's local biotech ecosystem. Moreover, Japan's advanced research infrastructure and strong partnerships between academia and industry fuel the market demand.

Middle East and Africa DNA Manufacturing Market Trends

The Middle East and Africa DNA manufacturing market is witnessing growing demand for DNA manufacturing due to increasing investments in healthcare infrastructure, biotechnology research, and medical advancements. Countries like the United Arab Emirates (UAE), Saudi Arabia, and Kuwait are making significant strides in healthcare innovation, focusing on gene therapies and personalized medicine. Moreover, the demand for vaccines, including mRNA-based vaccines, further expands the DNA manufacturing market in the MEA region.

For instance, in February 2025, Africa’s EVA Pharma, France’s DNA Script, and Belgium’s Quantum Biosciences signed an MoU in Cairo to develop an end-to-end mRNA production platform, aiming to manufacture 100 million doses of RNA-based vaccines annually. The collaboration combines expertise in DNA synthesis, mRNA technologies, vaccine development, and GMP manufacturing, aiming to enhance vaccine production and regional health security in Africa and the Middle East. The project supports Africa CDC’s goal of local vaccine production and Egypt’s ambition to become a vaccine production hub, further driving the market growth.

The Kuwait DNA manufacturing market is projected to grow steadily with its growing healthcare sector and investments in medical research. The country's focus on improving healthcare outcomes and diversifying its economy has increased interest in advanced biotechnology. As the demand for precision medicine and gene-based treatments rises, the need for high-quality DNA products such as synthetic DNA and plasmids has grown. Moreover, Kuwait's collaboration with international biotech companies and research institutions is expected to fuel the country's demand for DNA manufacturing solutions.

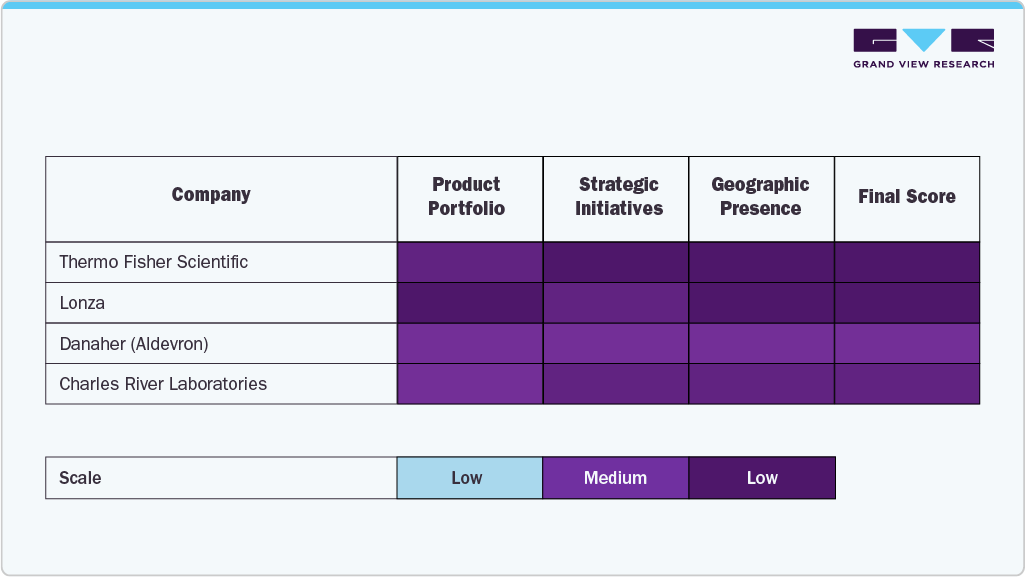

Key DNA Manufacturing Company Insights

The DNA manufacturing market is characterized by several established players who dominate through strong product portfolios, strategic collaborations, and consistent R&D investments. Leading companies such as Charles River Laboratories, VGXI, Inc., Danaher (Aldevron), and Thermo Fisher Scientific have maintained significant market share due to their comprehensive service offerings, advanced manufacturing capabilities, and global reach.

Leading companies, including Lonza, Charles River Laboratories, Thermo Fisher Scientific, and VGXI, Inc., continue to dominate the landscape through a combination of advanced technological capabilities, end-to-end service offerings, and strategic growth initiatives. These organizations have solidified their leadership in the DNA manufacturing market by addressing the growing demand for high-quality plasmid DNA and other genetic materials used in gene therapies, vaccines, and cell-based treatments.

Firms like GenScript, Catalent, and Wuxi AppTec are expanding their footprint in the DNA manufacturing market through strategic investments, facility expansions, and acquisitions.

Emerging players such as Standard

Companies such as Charles River Laboratories, VGXI, Inc., and Lonza are leading the charge by providing advanced contract development and manufacturing services (CDMO) for the biotechnology and pharmaceutical industries. These organizations offer comprehensive solutions ranging from preclinical research and process development to clinical and commercial-scale manufacturing, playing a crucial role in accelerating the development of gene therapies, vaccines, and other biologics.

The DNA manufacturing market is experiencing a dynamic convergence of established expertise and startup innovation. Increasing mergers and acquisitions (M&A), strategic partnerships, and breakthrough product developments are driving heightened competition across the industry. Companies that successfully integrate scientific rigor with consumer-centric trends are poised to create sustained value in this rapidly evolving sector. As demand for precision health solutions continues to grow, the market will be increasingly shaped by commitments to accessibility, affordability, and ethical sourcing will play a critical role in shaping the future market landscape.

Key DNA Manufacturing Companies:

The following are the leading companies in the DNA manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Thermo Fisher Scientific

- Lonza

- GenScript

- Catalent

- Wuxi AppTec

- Kaneka Corp.

- Eurofins Genomics

Recent Developments

-

In May 2025, VGXI, Inc., a CDMO specializing in nucleic acid-based therapeutics, successfully completed an FDA inspection at its Conroe, Texas facility. This milestone allows its client to submit a Biologics License Application (BLA) for plasmid DNA used in gene therapies and mRNA vaccines, reinforcing VGXI's leadership in scalable, high-purity plasmid DNA manufacturing.

-

In January 2025, Catalent partnered with Galapagos NV to support decentralized manufacturing of GLPG5101, an investigational CAR-T therapy for relapsed/refractory non-Hodgkin lymphoma. The collaboration aims to streamline delivery by bringing production closer to treatment centers, reducing logistical barriers, and improving patient access. Galapagos' platform enables delivery of fresh, stem-like cell therapy within a median vein-to-vein time of seven days, avoiding cryopreservation and bridging therapy.

-

In September 2024, Eurofins Genomics US opened a GMP-certified oligonucleotide manufacturing facility in Louisville, Kentucky, to meet rising demand for high-quality synthetic DNA and RNA. Featuring separate RUO and GMP production streams, the facility ensures regulatory compliance and prevents cross-contamination. Advanced automation boosts efficiency, purity, and traceability-especially for NGS applications-nearly doubling production capacity and improving lead times.

DNA Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.51 billion

Revenue forecast in 2030

USD 14.96 billion

Growth rate

CAGR of 18.10% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, grade, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Thermo Fisher Scientific; Lonza; GenScript; Catalent; Wuxi AppTec; Kaneka Corp.; Eurofins Genomics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global DNA manufacturing market based on type, grade, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plasmid DNA

-

Synthetic DNA

-

Gene Synthesis

-

Oligonucleotide Synthesis

-

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

GMP Grade

-

R&D Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell & Gene Therapy

-

Vaccines

-

Oligonucleotide-based drugs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Academic & Research Institutes

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA manufacturing market size was estimated at USD 5.65 billion in 2024 and is expected to reach USD 6.51 billion in 2025.

b. The global DNA manufacturing market is expected to grow at a compound annual growth rate of 18.10% from 2025 to 2030 to reach USD 14.96 billion by 2030.

b. North America dominated the DNA manufacturing market with a share of 46.23% in 2024. This is attributable to strong biotech infrastructure, high R&D investment, supportive regulations, and demand for genetic therapies.

b. Some key players operating in the DNA manufacturing market include Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Thermo Fisher Scientific; Lonza; GenScript; Catalent; Wuxi AppTec; Kaneka Corp.; Eurofins Genomics

b. Key factors driving market growth include increasing demand for gene therapies, mRNA vaccines, and personalized medicine in the global DNA manufacturing sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.