- Home

- »

- Next Generation Technologies

- »

-

U.S. Edge AI Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Edge AI Market Size, Share & Trends Report]()

U.S. Edge AI Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Edge Cloud Infrastructure, Service) By End User (Consumer Electronics, Smart Cities, Manufacturing), And Segment Forecasts

- Report ID: GVR-4-68040-584-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Edge AI Market Size & Trends

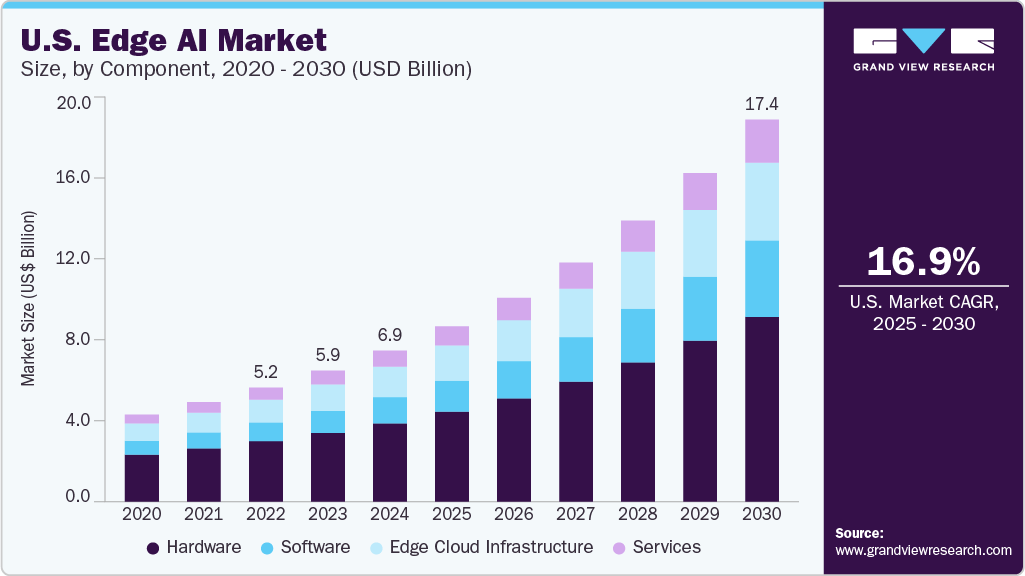

The U.S. edge AI market size was valued at USD 6898.8 million in 2024 and is expected to grow at a CAGR of 16.9% from 2025 to 2030. This substantial growth can be attributed to several factors, including government initiatives that promote AI adoption and significant investments from private enterprises. Moreover, the growth in this country is driven by the increasing demand for real-time data processing and analysis at the network's edge. This surge is propelled by industries such as healthcare, manufacturing, and telecommunications, which seek to enhance operational efficiency and reduce latency by processing data closer to its source.

Furthermore, the U.S. market benefits from a highly skilled workforce and advanced research institutions that drive technological advancements in AI. Integrating AI into sectors such as automotive, healthcare, and retail is enhancing operational efficiencies and enabling new service models that rely on real-time data analysis at the edge. This trend underscores the importance of edge AI in meeting the growing demand for faster and more reliable data processing.

As organizations across the U.S. continue to invest in edge AI technologies, the market is expected to witness an influx of new applications and services designed to improve user experience and operational outcomes. The focus on developing scalable solutions that can adapt to varying industry needs is likely to further contribute to the dynamic growth of the U.S. market.

Moreover, in January 2025, Synaptics Incorporated announced its partnership with Google to advance edge AI for the Internet of Things (IoT). This collaboration aims to establish the best practices for multimodal processing in context-aware computing. As per the collaboration, Google's machine learning core, which complies with the MLIR framework, will be integrated on Synaptics' Astra hardware with open-source software tools.

Component Insights

The hardware segment accounted for the highest revenue share of 51.9% in 2024. The rising need for real-time data processing capabilities in various applications such as IoT devices, autonomous vehicles, and smart cities primarily fuels this growth. With businesses increasingly relying on local data processing to enhance operational efficiency and reduce latency, the demand for advanced hardware solutions is increasing. Major players in the market are focusing on developing specialized processors and GPUs that cater to these needs, thereby expanding their market share. Major initiatives in the market. For instance, in April 2025, NVIDIA is launching the first-ever American-made AI supercomputers, partnering with leading manufacturers to build and test NVIDIA Blackwell chips and AI systems in Arizona and Texas. This initiative aims to produce up to half a trillion dollars of AI infrastructure in the U.S., creating hundreds of thousands of jobs and strengthening the domestic AI supply chain

The software segment registered a CAGR of 19.7% from 2025 to 2030. This can be attributed to the increasing demand for software solutions that facilitate real-time analytics and machine learning at the edge. As organizations seek to harness the power of AI-driven insights without relying heavily on centralized cloud systems, there is a growing emphasis on developing sophisticated software applications tailored for edge environments. Key initiatives in the country. For instance, in May 2025. Qualcomm Technologies and Aramco Digital have entered a strategic collaboration to develop, deploy, and commercialize advanced edge AI and industrial IoT solutions, leveraging Aramco Digital’s 450 MHz 5G industrial network to enhance efficiency, safety, and sustainability across Saudi Arabia’s industries in alignment with Vision 2030. This partnership aims to accelerate digital transformation and innovation in the Kingdom’s industrial sectors through cutting-edge AI and 5G technologies

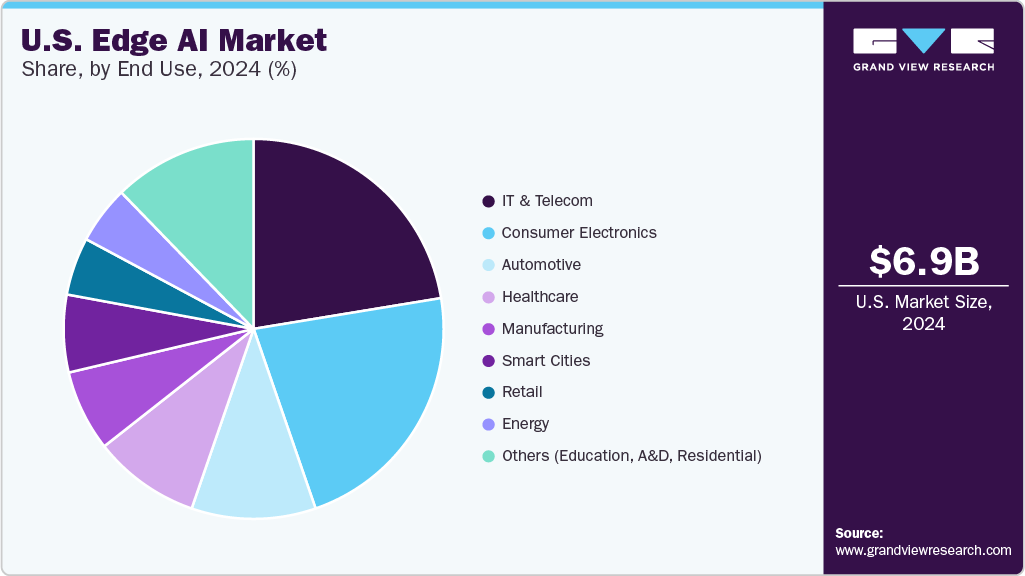

End Use Insights

The consumer electronics segment accounted for the largest market revenue share in 2024.The market in the country is driven by the increasing integration of Artificial Intelligence (AI) into everyday devices such as smartphones, smart speakers, and wearables. For instance, Amazon’s Alexa operating in the U.S. employs AI through Natural Language Processing (NLP) to interpret and respond to voice commands. Furthermore, Alexa utilizes Machine Learning (ML) to refine its responses by continuously learning from user interactions. These devices are becoming more intelligent and capable of processing data locally through AI technologies. This shift enhances user experience by enabling features such as voice recognition, personal recommendations, and real-time analytics.

The manufacturing segment is projected to grow significantly over the forecast period. The market is driven by the ongoing transformation within the industry toward Industry 4.0 practices that emphasize automation and data-driven decision-making. Edge AI technologies enable real-time monitoring and predictive machinery maintenance, significantly enhancing operational efficiency. For instance, in May 2025, Schneider Electric launched a generative AI factory-edge copilot in the U.S., developed with Microsoft, to address labor shortages and optimize factory performance. Simultaneously, it opened a 26MW renewable-powered AI data center in Sines, Portugal, establishing a major green AI hub to support Europe's digital sovereignty and AI infrastructure. These initiatives strengthen Schneider’s edge-to-core industrial AI capabilities, combining advanced automation, robotics, and sustainable energy solutions for smart manufacturing and digital infrastructure.

Key U.S. Edge AI Market Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Qualcomm Technologies, Inc., headquartered in San Diego, specializes in semiconductor design, software, and wireless technology. Renowned for its breakthroughs in 5G and Snapdragon chipsets, Qualcomm supports a broad spectrum of devices, including smartphones, IoT products, and automotive systems. The company continues to advance wireless connectivity solutions through its main business divisions and global technology licensing.

-

Ambarella International LP is a fabless semiconductor company focusing on low-power, high-definition video compression, image processing, and AI vision technologies. Its solutions are used across various applications such as video surveillance, advanced driver assistance systems (ADAS), autonomous vehicles, and robotics, enabling smart data analysis from high-resolution video. The company has transitioned from HD video encoding to leading advancements in AI-driven computer vision, with a strategic emphasis on the automotive and AIoT sectors.

Key U.S. Edge AI Companies:

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Intel Corporation

- Advanced Micro Devices, Inc.

- Ambarella International LP.

- Synaptics Incorporated.

- Amazon Web Services, Inc.

- Nutanix

- BrainChip, Inc.

Recent Developments

-

In May 2025, NVIDIA and its partners announced cutting-edge robotic and industrial AI technologies to tackle key manufacturing issues such as labor shortages and reshoring. NVIDIA Isaac Lab 2.1 uses synthetic data to speed up robot training, and state-of-the-art robots like Universal Robots’ UR15 and Vention’s MachineMotion AI controller leverage NVIDIA’s high-performance computing platforms. NVIDIA also launched AI agents for real-time video analysis in factory settings, improving efficiency and safety, supported by solutions such as Siemens’ Industrial Copilot for Operations.

-

In March 2025, Intel introduced its new Intel AI Edge Systems, Edge AI Suites, and the Open Edge Platform. That helps to speed up AI implementation at the edge across sectors such as retail, manufacturing, smart cities, and media. These offerings streamline the integration of AI into current infrastructure, enhancing performance, energy efficiency, and reducing overall costs. By embracing an open ecosystem, Intel empowers partners to quickly create and deploy AI solutions designed to address real-world edge challenges, fostering innovation and accelerating the launch of AI applications.

U.S. Edge AI Market Report Scope

Report Attribute

Details

Market size in 2025

USD 8002.4 million

Revenue forecast in 2030

USD 17437.6 million

Growth rate

CAGR of 16.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end use

Key companies profiled

NVIDIA Corporation; Qualcomm Technologies, Inc.; Intel Corporation; Advanced Micro Devices, Inc; Ambarella International LP.; Synaptics Incorporated.; Amazon Web Services, Inc.; Google; Nutanix; BrainChip, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Edge AI Market Report Segmentation

This report forecasts revenue growth at U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. edge AI market report based on component and end use.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Edge Cloud Infrastructure

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Smart Cities

-

Manufacturing

-

Automotive

-

Government

-

Healthcare

-

IT & Telecom

-

Energy

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. edge AI market size was estimated at USD 6,898.8 million in 2024 and is expected to reach USD 8,002.4 million in 2025.

b. The U.S. edge AI market is expected to grow at a compound annual growth rate of 16.9% from 2025 to 2030 to reach USD 17,437.6 million by 2030.

b. Manufacturing dominated the end user in U.S. edge AI market with a significant CAGR over the forecast period. The market is driven by the ongoing transformation within the industry toward Industry 4.0 practices that emphasize automation and data-driven decision-making. Edge AI technologies enable real-time monitoring and predictive maintenance of machinery, significantly enhancing operational efficiency

b. Some key players operating in the U.S. edge AI market include NVIDIA Corporation; Qualcomm Technologies, Inc.; Intel Corporation; Advanced Micro Devices, Inc; Ambarella International LP.; Synaptics Incorporated.; Amazon Web Services, Inc.; Google; Nutanix; BrainChip, Inc.

b. Key factors that are driving the market growth include the U.S. market benefits from a highly skilled workforce and advanced research institutions that drive technological advancements in AI. The integration of AI into sectors such as automotive, healthcare, and retail is enhancing operational efficiencies and enabling new service models that rely on real-time data analysis at the edge.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.