- Home

- »

- Electronic Devices

- »

-

U.S. Electric Motor Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Electric Motor Market Size, Share & Trends Report]()

U.S. Electric Motor Market (2024 - 2030) Size, Share & Trends Analysis Report By Motor Type (AC Motor, DC Motor, Hermetic Motor), By Power Output (Integral HP Output, Fractional HP Output), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-217-0

- Number of Report Pages: 94

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electric Motor Market Size & Trends

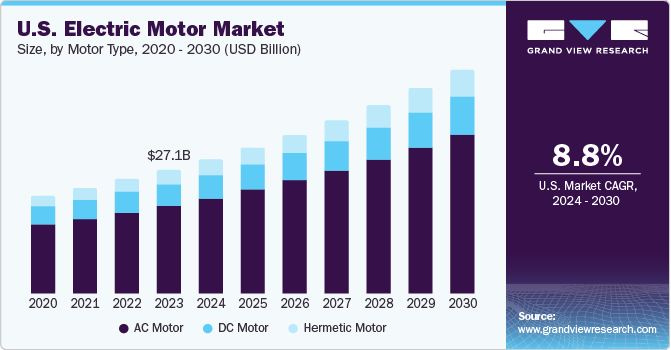

The U.S. electric motor market size was estimated at USD 27.11 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030. The growing awareness regarding green vehicles (electric vehicles) among customers is a critical factor in the growth of the market. In addition, the U.S. government is providing incentives for adopting electric vehicles (EVs) as they have zero carbon emissions, which is also aiding in market growth. There are several advancements to the electric motor technology such as the advent of better insulation materials that enhance the operational efficiency and product life, which in turn, are propelling the market growth. Moreover, with the potential increase in automobile production over the forecast period, the market is anticipated to witness an upward growth curve.

In 2023, the U.S. accounted for approximately 14.82% share of the global electric motor market. The electric motors are utilized in various components such as compressors, machine tools, fans, pumps, domestic appliances, HVAC applications, power tools, electric cars, and automated robots. These high-efficiency motors have long operating life, low maintenance, low energy consumption, and a high tolerance for fluctuating voltages, which results in effective cost savings. Therefore, electric motors have a high adoption rate for energy-efficient products in both the industrial and agricultural sectors.

The energy-efficient motor's demand is driven by rising electricity prices and stringent electricity consumption standards. In addition, companies are adopting stringent manufacturing and designing standards to develop efficient products. There has been a gradual shift in the industry towards efficient motorized systems. In addition, the U.S. Environmental Protection Agency (EPA)’s regulations recommend optimal power-consuming motors, which may require replacing older electric motors. These factors are resulting in increased sales of electric motors, which is fueling the market growth.

As the environmental benefits offered by EVs are helping reducing carbon footprints, the introduction and progress of EVs have significantly impacted the electric motor industry, which is boosting their implementation in EVs. These machines aid in augmenting a device’s efficiency, as compared to standard ones, and save costs related to energy consumed. Moreover, growing concern and awareness regarding global climate changes and the greenhouse effect is anticipated to shift consumers’ focus towards electric type vehicles, which is projected to bolster the demand for electric motors. The need for low-power consumption and improved efficiency products is poised to fuel the demand for the product over the next few years.

However, the awareness about the advantages of electric motors offered by their efficiency and cost savings has still not reached the desired level, which is acting as a market restraint. In addition, the high initial purchase costs are also a factor, which is restraining the market growth.

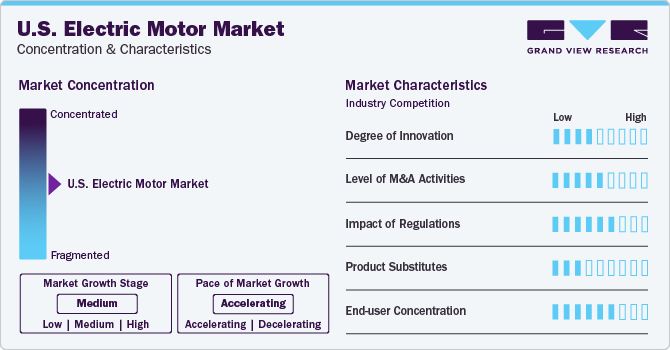

Market Concentration & Characteristics

The market growth stage is medium and rate of growth is accelerating. There has been a significant amount of innovation in the electric motor industry over the past few years. Among the main evolving factors in innovations has been the technology aspect, which is continuously improving, especially aiding in enhanced electric motor design and efficiency. The industry has witnessed a shift toward more ecologically friendly and energy-efficient electric motors, which are overall cost-effective and have better performance. The integration of smart technology is also growing and providing consumers with more options for monitoring and control. For example, with the IoT, every electric motor on a factory floor is equipped with one or multiple sensors that are connected (preferably wirelessly) to a control database that continuously collects data about the motors.

The industry experiences a moderate-to-high level of M&A activities as both the key and emerging companies are competing for increased market share and for gaining access to the latest technological innovations to obtain a competitive edge against competitors. Many companies are forming strategic partnerships through M&A to expand their product portfolios and open up new markets.

The electric motor industry is significantly impacted by regulations, thereby affecting the market dynamics and product development. According to the EPA, manufacturers should follow regulations and guidelines to manufacture motors that adhere to environmental restrictions and strict energy efficiency criteria. The adoption of high-efficiency electric motors is being encouraged by initiatives that support sustainable practices and reduce carbon footprints.

Alternative technologies, such as piezoelectric and hydraulic systems in some specialized applications, are becoming more widely recognized. The development of these alternative technologies can be a threat for conventional electric motors at risk, particularly in specific sectors. However, alternatives to electric motors exhibit more niche-oriented competition rather than a broad market displacement, which is partly explained by the adaptability and extensive use of electric motors across multiple sectors.

The electric motor market exhibits varying degrees of end-user concentration, depending on the industry and application. There may be a high end-user concentration in certain industries due to a limited number of large industrial users making up a sizable portion of the revenue.

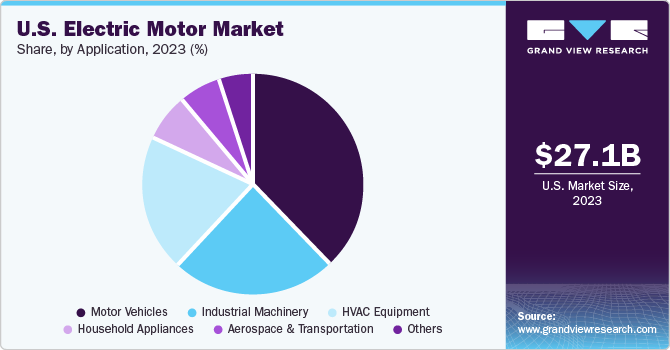

Application Insight

In terms of application, the motor vehicles segment dominated the market in 2023 with the largest revenue share of more than 42.0%. This large share is attributable to the increased adoption of electric motors in the automotive industry. An average commercial car has more than 40 electric motors ranging from low to high power. Further, the advent of low-cost and highly efficient electronics, coupled with improvements in permanent magnetic materials, drives the market growth in the automotive industry. Rising fuel prices and pollution are leading to a rapid increase in the demand for EVs in developed economies such as the U.S. Thus, the high demand for electric motors from the electric vehicle industry drives the market growth significantly.

Electric motors are extensively used in heavy industrial equipment as well as agricultural types of machinery and vehicles. In the U.S., the agricultural sector is highly mechanized and uses heavy industrial equipment on a large scale. Therefore, the demand for low-cost and energy-efficient products has increased in these countries. The HVAC equipment, such as commercial and industrial air conditioners, relies heavily on electric motors. The segment is anticipated to register the fastest CAGR of more than 10.5% from 2024 to 2030. Increasing applications of electric motors in various residential and office buildings, hotels, and warehouses, are likely to encourage the growth of the segment.

Motor Type Insights

Based on motor type, the AC motor segment dominated the market in 2023 with the largest revenue share of more than 70.0%. This large share is attributable to AC motors' extensive applications ranging from irrigation pumps to modern-day robotics. Furthermore, they are compact, economical, and lightweight and are also widely used in HVAC equipment. The adoption of electric AC motors in the automotive industry has increased exponentially, owing to the advent of highly efficient and low-cost electronics, accompanied by improvements in permanent magnetic materials. The increasing demand for electric AC motors in various industries, including chemicals, paper and pulp, cement, and wastewater treatment, is expected to further contribute to the growth of the segment. Growing sales of EVs and the subsequent scope of the machine type are also expected to spur the segment's growth over the forecast period.

The hermetic type electric motor is anticipated to register the fastest CAGR exceeding 9.4% from 2024 to 2030, owing to ease of handling, less maintenance, and easy transportation. The segment's growth can also be attributed to increasing demand from HVAC system manufacturers backed by suitability in such applications. The burgeoning popularity of vehicle features such as motorized seats, adjustable mirrors, and sunroof systems is fueling the demand for brushless DC motors. DC types are used for variable speed control applications in industrial machinery and equipment and electronic toys. Brushless DC motors are widely used owing to their low cost of maintenance, thus, generating higher revenue in the DC segment.

Power Output Insights

In terms of power output, the Fractional Horsepower (FHP) output segment dominated the market in 2023 with the largest revenue share of more than 78.0%. This large share is attributable to its applications in all household appliances, ranging from vacuum cleaners to coffee machines and refrigerators. They are also used in industrial equipment as they are suitable for operations in a heavy industrial environment. These motors have numerous advantages, including high starting torque and stability over electric current fluctuations.

Furthermore, the energy efficiency provided by FHP motors is higher than its counterparts, which is poised to translate into greater demand from industrial users willing to replace existing machines with more efficient ones. However, the Integral Horsepower (IHP) output segment is anticipated to register the fastest CAGR from 2024 to 2030. The high growth is attributable to the increasing demand for these motors for industrial applications. IHP motors provide more power to the machines and devices, which drives its demand from high-end applications in the aerospace and transportation industry.

Key U.S. Electric Motor Company Insights

Some of the key players operating in the market include WorldWide Electric Corporation and ABB Ltd. among others.

-

In January 2024, WorldWide Electric’s strategic acquisition of North American Electric, Inc. combines two leading customer-centric organizations to create an unparalleled customer experience across the industrial market for electric motors, motor controls, gear reducers, and generators.

-

ABB Ltd. is a holding company, which engages in the development and provision of power and automation technologies. It operates through the following business segments: Electrification, Industrial Automation, Motion, Robotics & Discrete Automation, and Corporate and Other. The Motion segment manufactures and sells motors, generators, drives, wind converters, mechanical power transmissions, complete electrical powertrain systems, and related services and digital solutions for a wide range of applications in industry, transportation, infrastructure, and utilities.

Allied Motion Technologies, Inc. and Franklin Electric Co., Inc. are some of the emerging market participants in the target market.

-

Franklin Electric Co., Inc. designs, manufactures, and distributes water and fuel pumping systems, composed primarily of submersible motors, pumps, electronic controls, water treatment systems, and related parts and equipment. The Company’s water pumping systems move fresh and wastewater to the residential, agricultural, and other industrial end markets..

-

Allied Motion designs, manufactures and sells precision-controlled motion products and solutions used in a broad range of applications within the Vehicle, Medical, Aerospace & Defense, Electronic, and Industrial Markets. Headquartered in Amherst, NY, the Company has global operations and sells into markets across the United States. Allied Motion is focused on controlled motion applications and is known worldwide for its expertise in electromagnetic, mechanical, and electronic controlled motion technologies.

Key U.S. Electric Motor Companies:

- ABB Ltd.

- Allied Motion Technologies, Inc.

- Ametek Inc.

- Johnson Electric Holdings Limited

- Nidec Motor Corporation

- Franklin Electric Co., Inc.

- Regal Rexnord Corporation

- Schneider Electric

- Siemens

- ORIENTAL MOTOR USA CORP

- WorldWide Electric Corporation

Recent Developments

-

In September 2023, AMETEK, Inc. announced the acquisition of United Electronic Industries (UEI), a leading provider of data acquisition and control solutions for the aerospace, defense, energy and semiconductor industries. UEI specializes in the design and manufacture of high-performance test, measurement, simulation, and control solutions that enable customers to build smart, reliable, flexible, and rugged systems. The company's products are used in a variety of mission-critical applications, including flight simulation and training, machine health and usage monitoring, and automated testing.

-

IN May 2023, AMETEK, Inc. announced the acquisition of Bison Gear & Engineering Corp. (Bison), a leading manufacturer of highly engineered motion control solutions serving diverse markets and applications. Bison designs and manufactures custom motion control solutions for use in demanding and high-precision applications within the automation, power, food and beverage, and transportation markets.

-

In April 2023, Regal Rexnord acquired Altra Industrial Motion, a global industrial automation and power transmission business, which will enable both companies to offer improved service capability breadth, technology content, and domain expertise.

U.S. Electric Motor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.42 billion

Revenue forecast in 2030

USD 48.73 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Actual data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, power output, motor type

Country scope

U.S.

Key companies profiled

ABB Ltd.; Allied Motion Technologies, Inc.; Ametek Inc.; Johnson Electric Holdings Limited; Nidec Motor Corporation; Franklin Electric Co., Inc.; Regal Rexnord Corporation; Schneider Electric; Siemens; ORIENTAL MOTOR USA CORP; WorldWide Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric Motor Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. electric motor market report based on application, power output, and motor type:

-

Motor Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

AC Motor

-

Synchronous AC Motor

-

Induction AC Motor

-

-

DC Motor

-

Brushed DC Motor

-

Brushless DC Motor

-

-

Hermetic Motor

-

-

Power Output Outlook (Revenue, USD Billion, 2017 - 2030)

-

Integral HP Output

-

Fractional HP Output

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial Machinery

-

Motor Vehicles

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. electric motor market size was estimated at USD 27.11 billion in 2023 and is expected to reach USD 29.42 billion in 2024.

b. The U.S. electric motor market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 48.73 billion by 2030.

b. The AC motor dominated the U.S. electric motor market with a share of over 70.89% in 2023.

b. Some key players operating in the U.S. electric motor market include ABB Ltd.; Allied Motion Technologies, Inc.; Ametek Inc.; Johnson Electric Holdings Limited; Nidec Motor Corporation; and Franklin Electric Co., Inc.

b. Key factors driving the market growth include the urbanization and demand for automotive and HVAC applications and Increasing adoption across various sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.