- Home

- »

- Homecare & Decor

- »

-

U.S. Event Management Market Size, Industry Report, 2033GVR Report cover

![U.S. Event Management Market Size, Share & Trends Report]()

U.S. Event Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Event Type (MICE, Weddings, Social Events), By Service (Event Planning & Coordination, Event Marketing & Promotion), By Delivery Mode, And Segment Forecasts

- Report ID: GVR-4-68040-769-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Event Management Market Trends

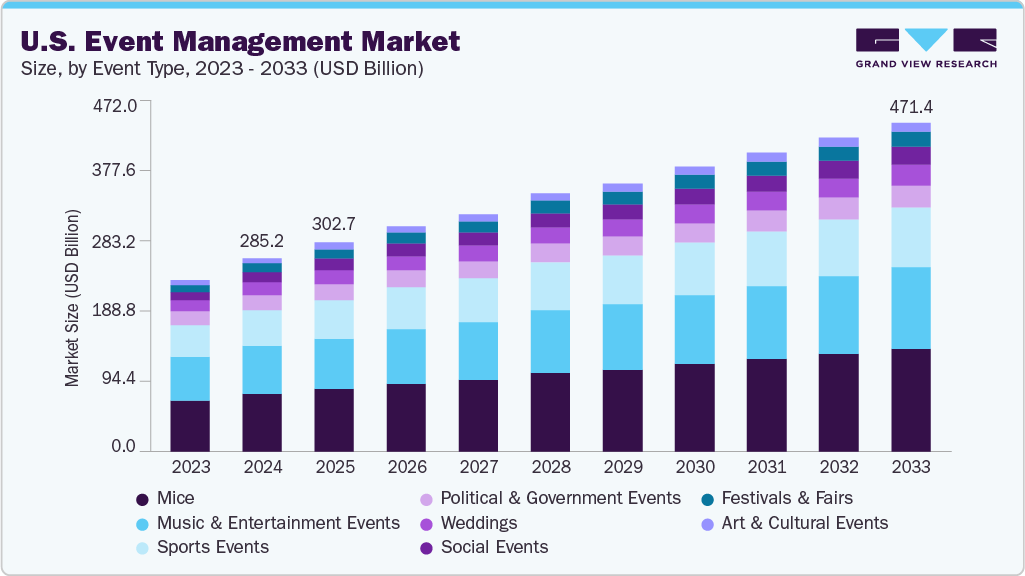

The U.S. event management market size was estimated at USD 285.18 billion in 2024 and is projected to reach USD 471.44 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. This growth is being driven by rising corporate demand for conferences, trade shows, and brand-building events; higher consumer spending on weddings and social celebrations; accelerated adoption of technology such as event management software, hybrid platforms, and AI-based analytics; and the widespread outsourcing of event services for cost efficiency and expertise.

The post-pandemic revival of in-person gatherings has been driving momentum in the U.S. event management industry, supported by a growing emphasis on sustainability and the continued adoption of hybrid formats for broader reach. This recovery is reflected in attendee sentiment, as 65% of U.S. participants reported feeling happy after attending events, and 55% said they left feeling energized, showing that live and hybrid gatherings not only meet practical needs but also deliver strong emotional and experiential value.

Personalization and immersive experiences are being prioritized in the market to enhance attendee engagement and satisfaction. Events are increasingly designed to move beyond traditional formats by incorporating experiential elements such as gamification, interactive installations, and immersive technologies like augmented and virtual reality. These approaches create memorable, tailored experiences that resonate with participants, strengthen brand connections, and encourage deeper audience involvement, reflecting a broader shift toward experience-driven event strategies.

Sustainability initiatives are increasingly being embedded in U.S. event design and execution, with organizers emphasizing green venues, reduced carbon footprints, waste management, and the use of sustainable materials. For example, the Greenbuild International Conference and Expo, hosted annually in the U.S., has implemented carbon offsetting, zero-waste strategies, and partnerships with eco-certified venues to minimize environmental impact. Such initiatives reflect a broader industry trend where sustainability is a regulatory or ethical priority and a key factor in enhancing brand reputation and meeting attendee expectations.

Data analytics and AI-driven decision-making are increasingly being leveraged in the event management industry to enhance efficiency and outcomes. According to the 2023 data, the number of AI-focused events in the U.S. experienced nearly a 4x increase. Organizers can gain actionable insights that inform event programming, personalize marketing strategies, and improve real-time engagement by analyzing attendee behavior, preferences, and sentiment. Predictive analytics and AI tools are also being applied to forecast attendance, optimize resource allocation, and refine content delivery, resulting in more targeted, impactful, and data-backed event experiences.

Consumer Insights

Consumers in the U.S. are increasingly seeking local experiences, with preferences often shaped by generational differences. While Gen Z and Millennials are more open to exploring new and unique formats, Gen X and Boomers favor familiar events that resonate with their past interests. Research shows that nearly 70% of American respondents prefer attending events close to home, reflecting a strong inclination toward convenience and community-based engagement. This trend is further evident in the growing demand for specific formats: in 2023, 79% of attendees expressed interest in more music festivals, 78% desired additional live performing arts events, and 67% favored outdoor fitness activities. Among Gen X and Boomers, 44% indicated a preference for concerts at independent or local venues that showcase the music acts they grew up with, underscoring the role of nostalgia in shaping participation. Adding to this shift, game-based single events witnessed a fourfold surge in popularity in 2024, highlighting how traditional and emerging event types are being embraced differently across audience segments.

Event Type Insights

MICE accounted for a revenue share of 30.08% in the U.S. event management industry in 2024. They are driven by strong corporate demand, world-class infrastructure, and the country’s role as a global business hub. U.S. cities like Las Vegas, Orlando, and Chicago offer large convention centers, luxury hotels, and advanced technology, making them ideal for hosting large-scale business gatherings. MICE events also generate high ROI and spending, as participants spend more on travel, accommodation, and hospitality than leisure tourists. Moreover, they support innovation and networking across industries, attract international participants, and benefit from government and city-level investments in business tourism. For instance, the Consumer Electronics Show (CES) is held annually in Las Vegas. It is one of the largest conferences and exhibitions in the world, organized by the Consumer Technology Association. CES brings together more than 130,000 industry professionals, exhibitors, and innovators to showcase cutting-edge technologies. The event not only drives billions in business deals but also contributes significantly to the local economy through hotel bookings, dining, and entertainment spending.

Music and entertainment events is expected to grow at a CAGR of 6.1% from 2025 to 2033, driven by consumers’ strong desire for live, shared experiences after the pandemic, higher disposable incomes with younger generations prioritizing experiences over material goods, and the growth of large-scale festivals and diverse event formats that appeal to wider audiences. Advancements in hybrid and digital technologies have further expanded accessibility, while music tourism and city-level economic incentives boost event hosting. At the same time, infrastructure is catching up, with private promoters and governments investing in adaptive, future-ready venues. For instance, Live Nation has pledged USD 1 billion to develop 18 new mid-sized, multipurpose facilities across emerging metros, ensuring that rising demand matches modern spaces.

Service Insights

Event production and technical services accounted for a revenue share of 30.38% in the U.S. event management industry in 2024. Event production and technical services are the foundation of delivering high-quality experiences. Modern events, from advanced staging, lighting, and sound to hybrid broadcasting and AR/VR, demand seamless technical execution to meet rising audience expectations. With the growth of large concerts, corporate events, and hybrid formats post-pandemic, organizers rely heavily on specialized production providers to enhance engagement and ROI. For instance, Live Nation, which invests heavily in cutting-edge production for major U.S. festivals like Lollapalooza and Austin City Limits, uses advanced technologies to create immersive experiences that attract millions of attendees and major sponsors.

Registration, ticketing & attendee management is expected to grow at a CAGR of 7.0% from 2025 to 2033. Events are becoming larger, more complex, and increasingly hybrid. Organizers need advanced systems to manage high volumes of participants, ensure smooth entry, and provide personalized experiences. Digital ticketing platforms and mobile apps now integrate features like cashless payments, QR codes, seat selection, and real-time updates, making the process seamless for organizers and attendees. Post-pandemic, contactless check-ins and health/safety compliance have further boosted reliance on tech-driven registration. Moreover, data from these systems offers valuable insights into attendee behavior, helping organizers improve marketing, engagement, and ROI.

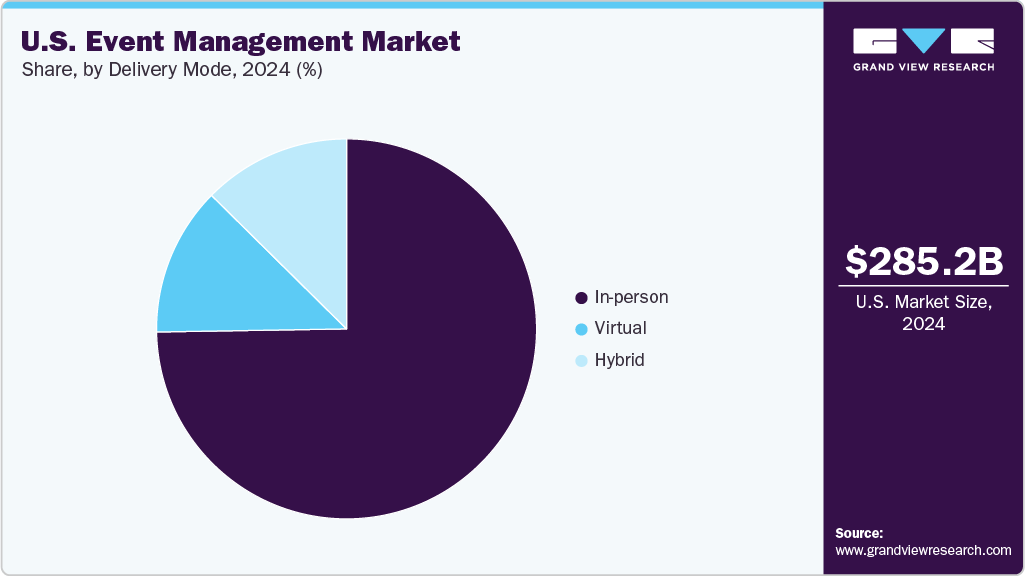

Delivery Mode Insights

In-person events accounted for a revenue share of 74.75% in the U.S. event management industry in 2024. In-person events provide the human connection and immersive experiences that virtual formats cannot replicate. Attendees value networking, collaboration, and the energy of live gatherings, while organizers and sponsors benefit from higher engagement, brand visibility, and economic impact through travel, hotels, and dining. For instance, the California Coachella Valley Music and Arts Festival attracts over 250,000 attendees and generates significant local and national economic activity.

Virtual events are expected to grow at a CAGR of 9.2% from 2025 to 2033. Virtual events offer flexibility, cost-efficiency, and global reach that in-person events cannot always provide. Organizations can engage attendees from anywhere without travel costs, while reaching larger, geographically diverse audiences. Virtual platforms enable interactive features like live polling, Q&A, networking lounges, and real-time analytics, helping organizers measure engagement and ROI more effectively. Post-pandemic businesses have embraced hybrid work and digital experiences, making virtual events convenient for continuity, accessibility, and inclusivity. For instance, CES 2021 was held fully virtual, allowing tens of thousands of participants worldwide to attend keynote sessions, product demos, and networking events online.

Key U.S. Event Management Company Insights

The U.S. market is shaped by a mix of established players and emerging firms adapting to evolving industry dynamics. Organizers elevate attendee experiences through innovative engagement methods, immersive technologies, and integration of sustainable practices in planning and execution. By expanding their service portfolios and tailoring solutions to shifting attendee expectations, companies can strengthen their market position and drive sustained growth in the competitive U.S. event industry.

-

MKG Productions, LLC (MKG) is a creative agency based in New York with an additional office in Los Angeles. It specializes in immersive brand experiences and designs human-centered campaigns across live events, mobile tours, retail activations, and digital content for clients in entertainment, fashion, beauty, technology, and consumer goods, including Netflix, Spotify, HBO Max, and Pinterest.

-

EGG Events is an international experiential communication agency crafting transformative brand experiences. Founded in 2000 and headquartered in Neuilly-sur-Seine, France, EGG operates with a team of approximately 200 creative professionals from diverse backgrounds. The agency focuses on creating immersive and emotionally resonant events that engage audiences through storytelling, interactive environments, and innovative design.

Key U.S. Event Management Companies:

- MKG Productions, LLC.

- Maritz Holdings Inc.

- EA Collective, LLC

- BCD Travel Services B.V.

- EGG Events

- George P. Johnson Company

- Event Solutions

- Eventive LLC

- TeamOut

- AMP Event Group

Recent Developments

-

In July 2024, Maritz, a meetings and event management leader, acquired Convention Data Services (CDS) from Freeman. This strategic acquisition enhances Maritz's capabilities in registration and on-site and leads services for top trade shows and association events. By integrating CDS's portfolio, Maritz significantly increases its market share and positions itself to better support event attendees' evolving expectations.

-

In December 2024, Events.com acquired the Wonderfront Music & Arts Festival in San Diego, moving from sponsor to sole owner. This acquisition allows Events.com to expand its presence in large-scale consumer entertainment while enhancing its event management portfolio. The company announced that the 2025 edition of Wonderfront will be its largest yet, reflecting growing demand for immersive music and cultural experiences in the U.S.

U.S. Event Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 302.70 billion

Revenue forecast in 2033

USD 471.44 billion

Growth rate (revenue)

CAGR of 5.7% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event type, service, delivery mode

Country scope

U.S.

Key companies profiled

MKG Productions, LLC.; Maritz Holdings Inc.; EA Collective, LLC; BCD Travel Services B.V.; EGG Events; George P. Johnson Company; Event Solutions; Eventive LLC; TeamOut; AMP Event Group

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Event Management Market Report Segmentation

This report forecasts revenue growth at the country’s level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. event management market report by event type, service, and delivery mode:

-

Event Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

MICE

-

Weddings

-

Social Events

-

Sports Events

-

Music & Entertainment Events

-

Art & Cultural Events

-

Political & Government Events

-

Festivals & Fairs

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Event Planning & Coordination

-

Event Production & Technical Services

-

Event Marketing & Promotion

-

Venue Sourcing & Logistics Management

-

Registration, Ticketing & Attendee Management

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

In-Person

-

Virtual

-

Hybrid

-

Frequently Asked Questions About This Report

b. The U.S. event management market was estimated at USD 285.2 billion in 2024 and is expected to reach USD 302.7 billion in 2025.

b. The U.S. event management market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 471.4 billion by 2033.

b. MICE accounted for a revenue share of 30.08% in the U.S. event management industry in 2024. They are driven by strong corporate demand, world-class infrastructure, and the country’s role as a global business hub.

b. Some of the key players in the U.S. event management market is MKG Productions, LLC.; Maritz Holdings Inc.; EA Collective, LLC; BCD Travel Services B.V.; EGG Events; George P. Johnson Company; Event Solutions; Eventive LLC; TeamOut; AMP Event Group.

b. Growth in the U.S. event management market is being driven by rising corporate demand for conferences, trade shows, and brand-building events; higher consumer spending on weddings and social celebrations; accelerated adoption of technology such as event management software, hybrid platforms, and AI-based analytics; and the widespread outsourcing of event services for cost efficiency and expertise.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.