- Home

- »

- Consumer F&B

- »

-

U.S. Flavors Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Flavors Market Size, Share & Trends Report]()

U.S. Flavors Market (2025 - 2033) Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By Form (Powder, Liquid/Gel), By Application (Food, Beverages), By End-use (Established National Brands, Private Label Brands, Foodservice Industry), And Segment Forecasts

- Report ID: GVR-1-68038-984-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Flavors Market Summary

The U.S. flavors market size was estimated at USD 3,887.7 million in 2024 and is projected to reach USD 6,108.4 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The industry is experiencing robust growth, driven by several factors with respect to evolving consumer preferences and industry trends.

Key Market Trends & Insights

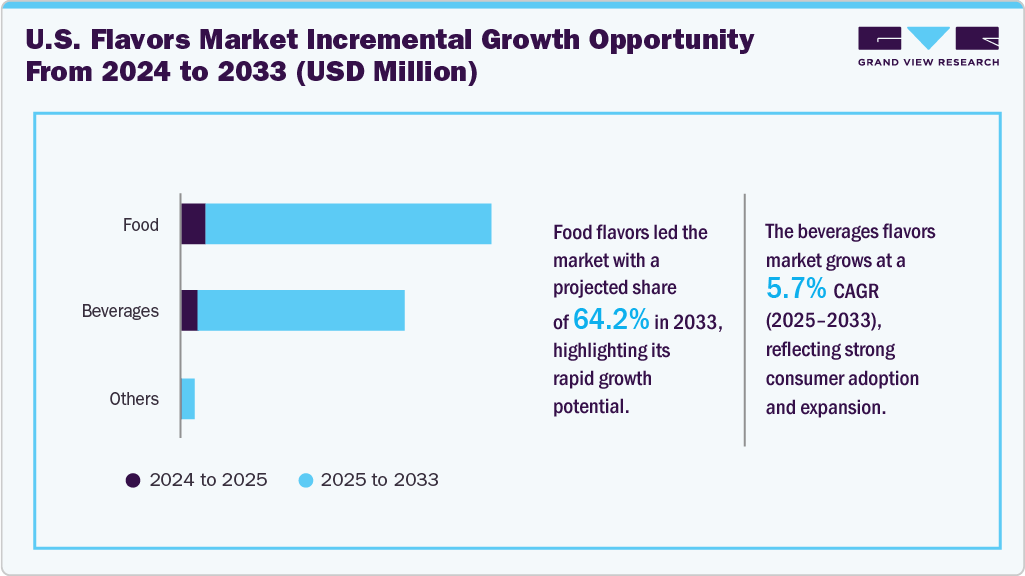

- By application, the U.S. flavors market for food application emerged as the largest segment in 2024, accounting for a revenue share of 65.3%.

- By nature, the synthetic segment accounted for the largest revenue share of 66.4% in 2024.

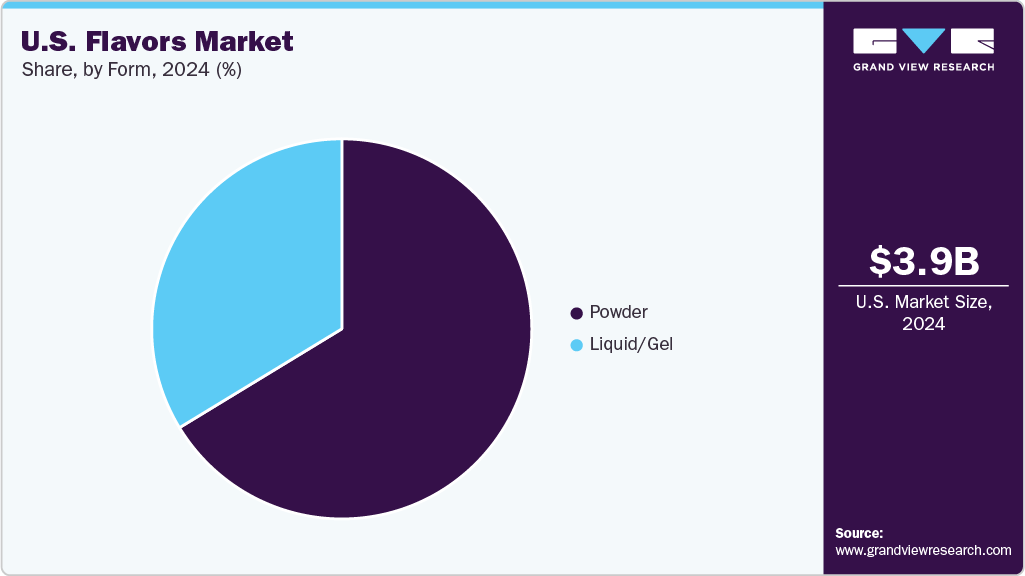

- By form, the powdered flavors segment accounted for the largest revenue share of 66.3% in 2024.

- By end-use, the established national brands in the U.S. market accounted for the largest revenue share of 47.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,887.7 Million

- 2033 Projected Market Size: USD 6,108.4 Million

- CAGR (2025-2033): 5.2%

- North America: Largest Market in 2024

One of the primary drivers is the increasing demand for processed foods that offer convenience and affordability, making them highly popular among consumers with hectic lifestyles. Flavors play a pivotal role in enhancing the taste and overall palatability of these processed foods, making them more appealing to consumers.The rising demand for diverse flavor combinations is significantly reshaping the regional market, as consumers increasingly seek unique and memorable taste experiences. Younger demographics, particularly Gen Z and millennials, are driving this shift by favoring bold, adventurous, and globally inspired flavor pairings that go beyond traditional profiles. This has opened the door for botanical infusions, floral notes like lavender and elderflower, and exotic fruit blends to gain traction across categories. The appeal lies not only in novelty but also in the ability of these flavors to deliver engaging, shareable experiences that resonate with lifestyle and cultural trends.

Consumer preferences for natural and clean-label products have driven flavor ingredient manufacturers to develop new and innovative natural flavor products. According to the Food and Drug Administration (FDA) Code of Federal Regulations, natural flavors are derived from substances extracted from various plant or animal sources, including spices, vegetables or vegetable juice, herbs, fruit or fruit juice, edible yeast, eggs, buds, root leaves, bark, or plant material, meat, poultry, seafood, and dairy products (including fermented products).

Tea, herbal blends, and cold-pressed citrus (orange) extracts are among the most available certified organic flavors in the market, with orange essence being specifically highlighted as one of the few flavors labeled “100% organic” in the USDA database.

According to a report published on the USDA website in October 2023, around 14,877 certified organic flavor products were produced by approximately 154 certified organic handling operations in the U.S., overseen by 25 USDA-accredited certifiers.

In addition, manufacturers increasingly use enzymes to extract flavor components from plant sources to address the rising demand for natural flavors. These natural flavors are primarily used to enhance the taste of food and beverages. The IFIC 2024 spotlight survey reports that about one-third of Americans say they avoid specific food ingredients such as dyes/colors (35%), sugar substitutes (34%), MSG (29%), bioengineered/GMO ingredients (27%), nanoplastics (26%), and preservatives (25%).

Application Insights

The U.S. flavors market for food application emerged as the largest segment in 2024, accounting for a revenue share of 65.3%. The market is driven by evolving consumer preferences toward authentic and exotic food products. The rising adoption of natural and organic products is reshaping the flavors industry landscape. Moreover, various players contributing to the market growth are investing in botanical flavors. For instance, in April 2024, Flavorchem & Orchidia Fragrances launched its Bloom collection in the U.S., responding to rising global demand for wellness-driven and sustainable botanical ingredients. The collection featured six nature-inspired flavors: Cranberry Ginger, Grapefruit Bergamot, Lychee Rose, Peach Lavender, Pear Elderflower, and Watermelon Mint, designed for food & beverage applications.

Regulatory frameworks emphasizing transparency and clean labeling also encourage the adoption of natural and organic flavors, reinforcing consumer trust and preference. Emerging market trends, including rising interest in vegan diets and sustainably sourced ingredients, shape flavoring innovation. For instance, in July 2025, the U.S. Food and Drug Administration announced the elimination of 52 standards of identity (SOIs) for various food products, including flavorings, vanilla/vanilla extract, and powders. This will help in basic regulatory cleanup, which is intended to reduce outdated, cumbersome rules and increase flexibility and transparency in labeling.

The beverages segment is projected to register the fastest CAGR of 5.7% from 2025 to 2033. The demand is driven by evolving consumer preferences, health awareness, and competitive market dynamics. Consumers are influenced by digital media and a preference for authenticity. Flavors inspired by natural trends, such as citrus, berry, herbal, and floral, are gaining traction as they align with consumer perception of wellness and freshness. In June 2025, Sensient Flavors & Extracts introduced a BioSymphony portfolio of natural flavors derived from natural ingredients. The range was designed to deliver authentic, high-impact flavor solutions tailored to the evolving demand of food & beverage manufacturers.

Sustainability has become a key priority, with brands emphasizing responsibly sourced ingredients and environmentally conscious production processes to enhance consumer confidence. In May 2024, International Flavors & Fragrances (IFF) published its Do Better 2023 report, highlighting that 90% of the flavor innovations introduced in 2023 included a sustainability value proposition aimed at benefiting both people and the planet. Furthermore, the rise of limited-edition, seasonal, and craft-inspired flavors is intensifying competition, creating opportunities for premium positioning in both non-alcoholic and alcoholic beverage categories.

Nature Insights

The synthetic segment accounted for the largest revenue share of 66.4% in 2024. The demand for synthetic flavors is driven by the strong presence of processed and convenience foods across the country, where synthetic flavors offer desirable taste characteristics while keeping production costs manageable. The versatility of synthetic flavor compounds enables innovation, such as carbonated drinks, candies, and flavored snacks, in product categories where bold, uniform taste profiles are essential. According to a study by Elsevier published in the Journal of the Academy of Nutrition and Dietetics in March 2023, 60% of foods purchased by Americans contain technical food additives, including coloring or flavoring agents, preservatives, and sweeteners. The study also stated that consumers in the U.S. purchase over 400,000 different packaged food & beverage products every year at grocery stores, with new products continuously getting added across the stores nationwide.

The natural flavors segment is expected to account for the fastest CAGR of 6.8% from 2025 to 2033. The market segment is experiencing growth with consumers increasingly prioritizing clean-label, health-focused products formulated with simple and natural ingredients. This trend is driven by rising awareness regarding health and wellness and a shift in consumers’ preferences toward alternatives to artificial additives and products perceived as safer and more authentic. The rapid rise of plant-based food & beverages is further expected to fuel the demand for natural flavors as manufacturers strive to deliver products that cater to particular tastes and align with evolving dietary preferences.

Moreover, advancements in extraction technologies, such as supercritical CO₂ extraction and enzymatic processing, are enabling companies to capture more authentic flavor profiles while maintaining nutritional integrity. For instance, in July 2024, HealthTech Bio Actives (HTBA) launched high-purity natural flavoring for taste modulation at IFT FIRST 2024.

Form Insights

The powdered flavors segment accounted for the largest revenue share of 66.3% in 2024. Powdered flavors provide superior shelf stability and easier transportation than their liquid counterparts, making them a preferred choice for manufacturers and end-users seeking efficiency in food preparation and distribution. Their adaptability allows seamless incorporation into a broad spectrum of applications, including beverages, snacks, baked goods, dairy products, nutritional supplements, and ready-to-eat meals. For instance, in January 2025, Celsius Holdings, Inc. launched a new powder-based electrolyte product line, CELSIUS HYDRATION, in the Arctic Cherry, Blue Razz, Fruit Punch, Strawberry Watermelon, and Lemon Lime flavors in the U.S.

The liquid/gel flavors segment is expected to account for a notable CAGR of 4.4% from 2025 to 2033. The demand is driven by a combination of consumer preferences and market trends. These flavor formats offer manufacturers significant flexibility in product formulation, enabling easy incorporation into a wide range of beverages, ready-to-eat meals, and other processed foods. This aligns with the growing consumer desire for convenience and customization. Therefore, various food and beverage companies are acquiring flavor houses, which is expected to strengthen the growth of the liquid/gel flavors segment across the country over the coming years. For instance, in April 2025, Döhler North America announced the expansion of its presence with the acquisition of Premier Juice brands to strengthen its offerings in natural fruit-based products and solutions. The former’s portfolio includes natural flavors, colors, and health ingredients, including plant-based products, ingredient systems, and end-to-end solutions.

End-use Insights

The established national brands in the U.S. market accounted for the largest revenue share of 47.6% in 2024. Leading national brands, such as PepsiCo, The Coca-Cola Company, and Nestlé, rely on leading flavor houses based in the U.S. to develop and supply diverse flavors that characterize their extensive product portfolios. These flavor houses, including prominent companies such as International Flavors & Fragrances (IFF), Givaudan, and Sensient Technologies, play a pivotal role in formulating the taste profiles of beverages & food products that resonate with consumers across various markets.

PepsiCo's extensive portfolio encompasses iconic beverages such as Pepsi, Mountain Dew, and Gatorade, as well as a variety of snack products. For instance, in April 2024, PepsiCo introduced limited-edition flavors such as Peach & Lime to cater to evolving consumer preferences. The collaboration between these flavor suppliers and major brands involves a structured process of cooperation, development, testing, and scaling to ensure that the flavors meet consumer expectations and regulatory standards.

Emerging brands in the U.S. are expected to account for the fastest CAGR of 6.7% from 2025 to 2033. Rising brands, such as Stiller’s Soda, Daybright by Chick-fil-A, and Wandering Bear, represent innovative entrants that leverage distinctive flavor profiles to capture niche market segments. In September 2025, Stiller’s Soda, launched by actor Ben Stiller, offers a healthier take on classic sodas with options such as Shirley Temple, Lemon Lime, and Root Beer, each formulated with natural sweeteners and fortified with vitamins. Similarly, Daybright, a new beverage concept by Chick-fil-A under its Red Wagon Ventures innovation arm, is set to launch specialty coffees, smoothies, and cold-pressed juices in the Greater Atlanta area. Wandering Bear, specializing in organic cold brew coffee, offers flavors like Straight Black, Vanilla, Caramel, Mocha, and Decaf Black, emphasizing smooth, rich taste profiles.

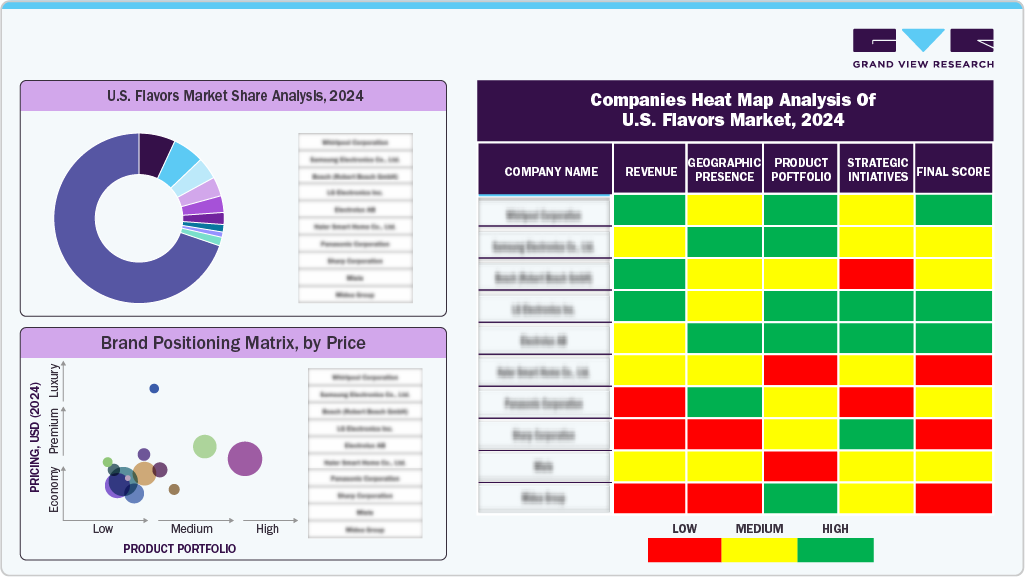

Key U.S. Flavors Company Insights

Leading players in the market include International Flavors & Fragrances Inc., DSM-Firmenich AG, and Givaudan S.A. These companies focus on innovation through advanced flavor formulation technologies, AI-driven sensory analysis, and digital platforms to enhance product development and consumer engagement. Moreover, the market is experiencing increased participation from health and wellness brands that emphasize natural ingredients, clean-label positioning, and lifestyle-oriented branding to strengthen consumer loyalty and broaden their market presence.

Key U.S. Flavors Companies:

- Givaudan S.A.

- DSM-Firmenich AG

- Symrise AG

- Sensient Technologies Corporation

- International Flavors & Fragrances Inc.

- Takasago International Corporation

- Kerry Group plc

- Archer Daniels Midland Company

- Corbion N.V.

- McCormick & Company, Inc.

Recent Developments

-

In June 2025, Sensient Technologies Corporation created a portfolio of natural flavors made from nature’s finest ingredients named BioSymphony. It offers authentic, bold-flavored solutions designed to meet the changing demands of food and beverage manufacturers.

-

In May 2025, OSF Flavors inaugurated a 20,000-square-foot research and development center within its Windsor, Connecticut, facility, enhancing its capabilities in crafting custom flavors for sweet, savory, and organic applications.

-

In March 2025, Blue Pacific Flavors entered into a strategic partnership with Ketone Labs to drive innovation in goBHB-powered functional beverages. This collaboration combines Ketone Labs' patented goBHB technology with Blue Pacific's expertise in flavor science, aiming to enhance the development of functional beverages.

-

In January 2025, McCormick for Chefs launched three new products tailored for professional kitchens: McCormick Culinary Blackened Seasoning, McCormick Culinary Korean BBQ Gochujang Style Seasoning, and Frank’s RedHot Mango Habanero Wings Sauce. Crafted with high-quality ingredients, these additions reflect evolving consumer flavor preferences while helping chefs save time without compromising on bold, robust taste.

U.S. Flavors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,077.9 million

Revenue Forecast in 2033

USD 6,108.4 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, nature, form, end-use

Key companies profiled

Givaudan S.A.; DSM-Firmenich AG; Symrise AG; Sensient Technologies Corporation; International Flavors & Fragrances Inc.; Takasago International Corporation; Kerry Group plc; Archer Daniels Midland Company; Corbion N.V.; McCormick & Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flavors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. flavors market report by application, nature, form, and end-use:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food

-

Dairy Products

-

Bakery & Confectionery

-

Supplements & Nutrition Products

-

Meat & Seafood Products

-

Snacks

-

Pet Foods

-

Sauces, Dressings & Condiments

-

Others (plant-based food, baby food)

-

-

Beverages

-

Juices & Juice Concentrates

-

Functional Beverages

-

Alcoholic Beverages

-

Carbonated Soft Drinks

-

Others (Smoothies, Coffee)

-

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid/Gel

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Established National Brands

-

Private Label Brands

-

Emerging Brands

-

Foodservice Industry

-

Frequently Asked Questions About This Report

b. The U.S. flavors market size was estimated at USD 3,887.7 million in 2024 and is expected to reach USD 4,077.9 million in 2025.

b. The U.S. flavors market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 6,108.4 million by 2033.

b. Powdered flavors dominated the U.S. flavors market with a share of 66.3% in 2024. Increasing demand for this form of flavor is often driven by versatility and the ability to improve the flavor content of various foods and beverages.

b. Some key players operating in the U.S. flavors market include Givaudan S.A.; DSM-Firmenich AG; Symrise AG; Sensient Technologies Corporation; International Flavors & Fragrances Inc.; Takasago International Corporation; Kerry Group plc; Archer Daniels Midland Company; Corbion N.V.; McCormick & Company, Inc.

b. Key factors that are driving the market growth include the increasing number of people consuming packaged foods & beverages and the growing percentage of consumers choosing convenience & affordability over cooking and the associated time-consuming activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.