- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Protein Supplements Market Size & Share Report, 2030GVR Report cover

![U.S. Protein Supplements Market Size, Share & Trends Report]()

U.S. Protein Supplements Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Animal-based, Plant-based), By Product, By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-2-68038-775-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

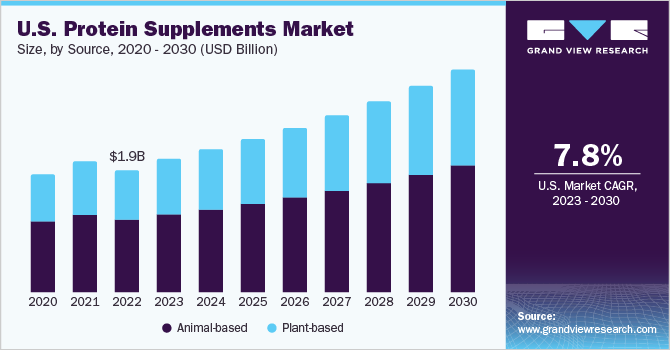

The U.S. protein supplements market size was estimated at USD 1.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The growth is anticipated to be driven by the increasing demand for products due to growing consumer awareness regarding the importance of a healthy diet and active lifestyle. Additionally, manufacturers are innovating in terms of protein manufacturing by incorporating a wide range of amino acids and developing proteins that serve specific functions such as energy balance, weight loss, muscle repair, and satiety. These advancements are expected to create significant market potential. Factors such as the rising trend of healthy eating, increasing interest in sports activities and bodybuilding, and expanding geriatric population have led to an increased demand for protein supplements in the U.S.

Customers are seeking ingredients with clean labels, high efficacy, and minimal side effects. As a result, protein supplement manufacturers are developing blends of natural and synthetic ingredients that cater to the nutritional requirements of consumers across the country.

Leading protein supplement producers in the U.S. are focusing on developing new products through investments in research and development and technological advancements. They aim to offer cost-effective and high-quality products. These market participants are also engaging in joint ventures, partnerships, agreements, and mergers & acquisitions to increase their market share and expand their geographic reach. Furthermore, they are making efforts to educate consumers about the benefits of protein ingredients while adhering to the regulatory standards set by the U.S. Food and Drug Administration (FDA).

Protein supplements are available in various forms such as powders, bars, and ready-to-drink beverages. Manufacturers source raw materials from third-party suppliers through competitively priced supply contracts. These raw materials are then processed to produce protein supplements. Prominent protein supplement manufacturers in the U.S. include MusclePharm, Abbott, Glanbia PLC, and NOW Foods.

The prevailing trends of digital sports coaching and fitness training programs in the U.S. have increased the demand for nutritional products and certified supplements. This has led to a surge in the consumption of sports supplements, thereby driving the growth of the protein supplements industry in the U.S. Additionally, the emergence of fitness apps utilizing artificial intelligence, elite coaches, and virtual nutritionists is expected to contribute to the demand for protein supplements in the country during the forecast period.

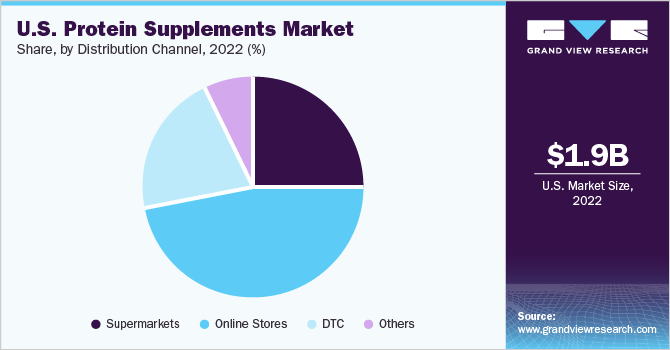

The increasing number of internet users, fast-paced lifestyle, easy access to various brands, convenience of online shopping, availability of a wide range of products, and 24/7 accessibility are factors driving the sales of protein supplements through online channels in the U.S. The advantages offered to customers through this medium, such as access to numerous brands, customer reviews, and price comparisons, are boosting the sales of protein supplements online in the country.

Source Insights

Based on source, the animal-based segment held the largest share of 59.4% in 2022. Protein plays an important role in improving health by maintaining a balance between acid and base fluids and assisting in metabolism by controlling antibody synthesis. Protein supplements are majorly marketed as performance-enhancing supplements for athletes and habitually active consumers, as they aid muscle growth and energy management. Moreover, they are also marketed as weight-loss supplements owing to their high-protein and low-carbohydrate compositions.

Animal proteins are considered the highest quality protein sources, moreover, they are called the completed proteins as they provide all the necessary amino acids for the human body. On the back of these factors, animal-based protein supplements account for the largest revenue share of 65.09% in the U.S. protein supplements industry.

Consumers in the U.S. are more interested in both fat loss and muscle growth and endurance. The consumption of animal-based protein supplements such as whey protein supplements, fish protein supplements, and egg protein supplements is gaining popularity among the U.S.-based population. These animal-based protein supplements have been witnessing increasing demand from fitness enthusiasts for reducing body fat. Thus, the increasing demand from athletes and other end-users is expected to boost the demand for animal-based protein supplements in the country over the forecast period.

The plant-based protein segment is expected to showcase the fastest CAGR of 8.7% during the forecast period. Plant-based proteins are the building blocks of healthy muscles and tissues. Moreover, unlike animal-based proteins, protein supplements have fewer side effects, and the bioavailability of plant-based proteins is higher than their counterparts. The study conducted by Nutrition Business Journal in 2020, found that organic plant-based protein supplements are more effective in weight loss. Furthermore, consumption of plant-based protein supplements also aids gut health by treating gut microbiome diversity. On the back of these factors, the demand for plant-based proteins is anticipated to witness substantial growth over the forecast period.

The lactose-intolerant population in the U.S. has increased significantly in the past few years. According to research conducted by the National Institute of Health (NIH), in 2021, approximately 36% of the total population of the U.S. has lactose malabsorption, which causes lactose intolerance. Owing to these health issues, most consumers from the U.S. have started intake of plant-based protein supplements over animal-based protein supplements such as whey protein and casein. The factor coupled with the increasing vegan population is expected to boost the growth of the plant-based protein supplements market in the U.S.

Product Insights

The protein powder segment held the largest share of 44% over the forecast period. Protein powder is derived from various raw materials, including egg, whey, soy, pea, and casein. It is formulated with substantial quantities of vitamins, additional fats, thickeners, minerals, and fibers. Besides its role in promoting muscle and tissue development, protein powder aids in weight management, tissue repair, maintenance of healthy cholesterol levels, strengthening of the immune system, and enzyme production. As per the U.S. Department of Agriculture's Food and Nutrition Board, the average adult's protein requirement is approximately 0.66 grams per kilogram of body weight per day.

Organic protein powders are gaining traction currently owing to the rising trend of using clean-label products, in which consumers prefer natural products that contain fewer additives and chemicals. For instance, in June 2020, Ancient Brands, LLC, a wellness and health supplement brand, launched a new protein powder, Plant Protein+, which is a USDA-certified organic superfood. Plant Protein+ is a plant-based protein powder made from organic seeds, botanicals, functional mushrooms, and adaptogens.

The RTD segment is expected to showcase the fastest growth at 9.5% CAGR during the forecast period. The RTD protein beverages are the easiest and most convenient sources of protein and provide numerous health benefits such as anti-aging properties, fat loss, and others associated with the consumption of adequate amounts of protein as part of the regular diet. Another factor driving market growth is the growing recognition of healthy aging, as well as the role of protein in a healthy diet, which is expanding rapidly.

The increasing vegetarian population is propelling the growth of plant-based ready-to-drink beverages. As a result, players are looking to capitalize on the increasing popularity of plant-based protein drinks to tap into such significant market opportunities. PepsiCo, for example, launched plant-based ready-to-drink protein shakes called EVOLVE. This brand launched in March 2021, with new formulations and packaging, and aims to expand its distribution network across the country.

Application Insights

The functional food segment held the largest share of 52.8% in 2022. The demand for functional foods has increased due to consumer interest in diet and health. To lower their risk of developing certain health conditions like weight management, cardiovascular diseases, obesity, and diabetes, which are caused by hectic lifestyles and rising stress, consumers are increasingly drawn to foods with functional ingredients.

Product innovations are also being driven by the development of advanced technologies for the formulation of functional food products in the U.S. To develop functional foods, technologies like enzyme technology, encapsulation, edible coating technology, and vacuum impregnation technology are increasingly being used, which is fueling the market's expansion.

The sports nutrition segment is anticipated to grow at a CAGR of 9.4% during the forecast period. Bodybuilders and athletes are becoming more aware of the health advantages of sports nutrition products, which, in turn, is propelling the growth of the protein supplements industry. Furthermore, the increasing adoption of sports nutrition products by active lifestyle consumers and gym-goers supports market growth potential. In the U. S., demand for sports nutrition products is increasing rapidly, especially among active lifestyle consumers.

Many retailers are implementing a variety of strategies to enhance the adoption of sports nutrition products and, as a result, drive market growth. For instance, MusclePharm, a major player in sports nutrition as well as lifestyle nutritional supplements, launched a new whey protein drink under its ready-to-drink protein category in the summer of 2022. The new drink is sugar-free, high in protein, and available in various flavors.

Distribution Channel Insights

The online stores segment held the largest share of 60.4% in 2022. The COVID-19 outbreak has impacted the buying behavior of consumers in the U.S. Consumers are transitioning from offline purchases of products to online purchases. They are less affected by the familiarity of just one shopping channel and are willing to explore different types of touch points after experiencing frenzied buying behavior during the pandemic, along with increased leisure time. COVID-19 attracted more customer traffic to already dominant and comprehensive e-commerce platforms, resulting in the easy availability of different protein supplement products and brands to consumers.

Online is a preferred distribution channel for millennials and a close second for Gen X consumers. These target audiences are among the top buyers of protein supplements in the U.S. owing to the growing importance of a healthy lifestyle. The brands adopting online distribution channels are most likely to have a higher market share in the increasingly competitive U.S. protein supplements industry.

The supermarket segment is anticipated to grow at a CAGR of 9.8% during the forecast period. Supermarkets and hypermarkets conduct detailed consumer sentiment analyses to understand customer preferences for products and brands. This allows them to offer products that are most likely to sell well, and they can charge premium prices if customers are willing to pay for them.

Supermarkets are easily accessible and provide a convenient shopping experience for customers. They offer a variety of protein supplement options under one roof, making it easier for customers to compare and choose the products that best meet their needs. Customers tend to trust established brands, and supermarkets and hypermarkets offer a wide selection of reputable brands in the protein supplements market. This builds customer confidence in the products being sold and can lead to repeat purchases.

Key Companies & Market Share Insights

The global protein supplements market is highly competitive, primarily due to the presence of numerous players in the industry. Many companies in the market are actively engaged in developing innovative products to meet the demands of consumers. For example, in October 2022, Optimum Nutrition, a sports nutrition brand of Glanbia, launched a new plant-based protein powder called Gold Standard 100% Plant Protein. The formula is made with 100% vegan ingredients and contains 24 grams of protein to support fitness activities. The launch is in response to the growing trend of plant-based alternatives in the market. Some prominent players in the U.S. protein supplements market include:

-

Glanbia Plc

-

MusclePharm

-

Abbott

-

CytoSport Inc.

-

QuestNutrition LLC

-

Iovate Health Sciences International Inc

-

The Bountiful Company

-

AMCO Proteins

-

Now Foods

-

Transparent Labs

-

WOODBOLT DISTRIBUTION LLC

-

Dymatize Enterprises LLC

-

BPI Sports

-

Jym-Supplement-Science

-

RSP Nutrition

-

International Dehydrated Foods, Inc

-

BRF

-

Rousselot

-

Gelita AG

-

Hoogwegt

U.S. Protein Supplements Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.52 billion

Growth rate (Revenue)

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, product, application, distribution channel

Country scope

U.S.

Key companies profiled

Glanbia Plc; MusclePharm; Abbott; CytoSport Inc.; QuestNutrition LLC; Iovate Health Sciences International Inc; The Bountiful Company; AMCO Proteins; Now Foods; Transparent Labs; WOODBOLT DISTRIBUTION LLC; Dymatize Enterprises LLC; BPI Sports; Jym-Supplement-Science; RSP Nutrition; International Dehydrated Foods, Inc; BRF; Rousselot; Gelita AG; Hoogwegt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Protein Supplements Market Report Segmentation

This report forecasts volume & revenue growth and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. protein supplements market report based on source, product, application, and distribution channel:

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Animal-based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-based

-

Soy

-

Spirulina

-

Pumpkin Seeds

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Protein Powders

-

Protein Bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Sports Nutrition

-

Functional Foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets

-

Online Stores

-

DTC

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. protein supplements market size was estimated at USD 1.90 billion in 2022 and is expected to reach USD 2.10 billion in 2023.

b. The U.S. protein supplements market is expected to grow at a compound annual growth rate of 7.8% from 2022 to 2030 to reach USD 3.52 billion by 2030.

b. Animal-based dominated the U.S. protein supplements market with a share of 59.7% in 2022. This is attributable to animal-based proteins having all the essential amino acids and nutrients consumers expect from the product.

b. Some of the major players in the U.S. protein supplements market include Glanbia Plc, MusclePharm, Abbott, CytoSport Inc., QuestNutrition LLC, Iovate Health Sciences International Inc, The Bountiful Company, AMCO Proteins, Now Foods, among others.

b. The rising popularity of plant-based diets has boosted the market growth. The growing food service sector, enhanced supply chain infrastructure have increased the popularity of U.S. protein supplements in diverse applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.