- Home

- »

- Medical Devices

- »

-

U.S. Skin Boosters Market Size, Share, Growth Report, 2030GVR Report cover

![U.S. Skin Boosters Market Size, Share & Trends Report]()

U.S. Skin Boosters Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Mesotherapy, Micro-needle), By Gender (Female, Male), By End-use (Medical Spa, Dermatology Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-202-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

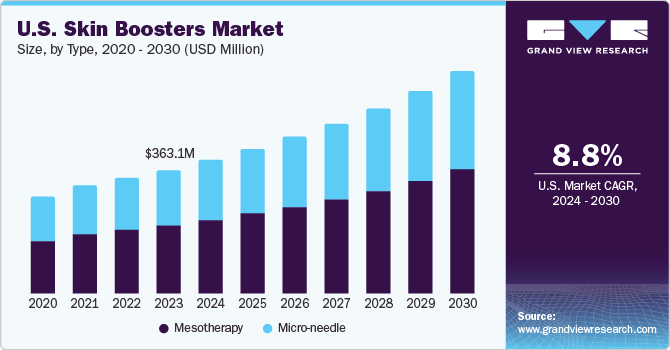

The U.S. skin boosters market size was valued at USD 363.1 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030. The continuous research and innovation in cosmetic industry, changing beauty standards, growing demand for cosmetic procedures from the aging population, and the increasing governmental approvals for the new skin boosters are some of the key factors driving the adoption of skin booster. The ever-increasing U.S. FDA approvals for these treatments has always been an essential element for the growth of this market. For instance, Allergan Aesthetics announced the FDA approval in May 2023 for its microdroplet injection for skin improvement in the U.S that is expected to fuel the market’s growth.

Throughout the projection period, the market is anticipated to rise as a result of the increasing popularity of nonsurgical cosmetic procedures. There is a greater demand for non-invasive and minimally invasive cosmetic surgeries as more patients are becoming aware of the side effects of invasive surgical procedures, such as delayed healing, scarring from incisions, and anesthesia-related responses. The rise in awareness regarding skin health has led consumers to prioritize skincare products in their daily routines. This has led to an increase in demand for products, services and treatments that address specific skin concerns such as anti-aging, acne, and hyperpigmentation, among many others.

Moreover, the rising number of elderly people worldwide is linked to the growing demand for aesthetic cosmetic treatments, thereby creating market opportunities for skin boosters. According to the data published by America’s Health Rankings 2022, approximately 58 million adults in the nation includes the aged population constituting age of 65 years or older which accounts for nearly 17.3% of the total population in the U.S.

The New York skin boosters market is equipped with a number of new launches, and FDA approvals. For instance, in September 2023, Mayfarm, a company specializing in cosmetic medicine for skin care and rejuvenation in New York launched a new skin booster, metoo healer to expand its product portfolio. The increasing demands of the skin boosters treatments, approvals and the new launches in the Northeast, Southeast, Midwest, Southwest, and the West region in the U.S. are expected to contribute to the market growth. The West region in the U.S. is one of the regions with the maximum demand for the skin boosters comprising of New Mexico, Arizona, and California.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The U.S. skin booster market is characterized by the rapid advancements in the field, rise in various insurance schemes for cosmetic procedures, and the increase in the geriatric population. Subsequently, innovative technologies and products are emerging and are expected to propel the growth of the market.

The U.S. skin booster market is characterized by a high level of merger and acquisition (M&A) activities by the market players. For instance, in 2019, Dermatology Solutions Group completed its acquisition of The Skin Surgery System, a dermatology and skin clinic based in North Carolina in the aim to expand the existing portfolio of the treatments.

There are a very few number of product substitutes for the boosters treatment. Treatments such as chemical peels, laser treatments, and other vitamin C products achieve similar outcomes as compared to the outcomes of the boosters treatment. However, these treatments are not permanent solutions for ailments such as fine lines and other signs of ageing. The industry for boosters is experiencing an increasing number of regulatory inspections and approvals for injectables and other skin boosters. For instance, in May 2023, Skinvive, a product by Juvederm received FDA approval for its capability to improve skin smoothness in adults over the age of 21.

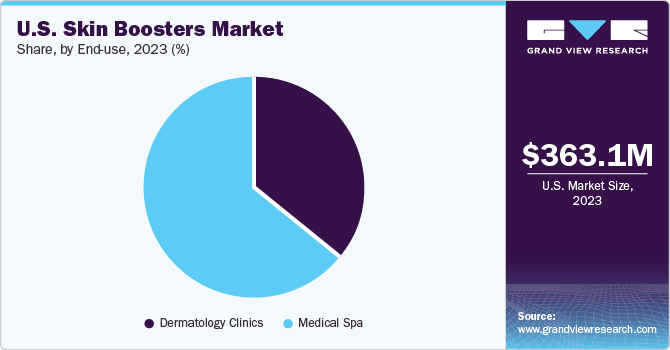

One important aspect of the skin boosters industry is end-user focus. The need for injectable treatments is being driven by several end-user providers, including dermatological clinics, Medspas, and hospitals. Due to the availability of several goods from different manufacturers that offer comparable patient advantages and outcomes, practitioners are requesting further rebates and discounts from distributors to utilize their products for cosmetic treatments.

Type Insights

The mesotherapy segment dominated the market in terms of revenue share and accounted for a share of 54.6% in 2023 and is also expected to witness the fastest CAGR over the forecast period. Mesotherapy enhances customization by offering a tailored course of treatment to target specific skincare concerns. Using tiny injections of hyaluronic acid, vitamins, and minerals, the deeper layers of the skin can get tailored hydration. It works well to reduce dullness, wrinkles, and fine lines.

In addition, the increasing complaints for facial wrinkles due to chronic obstructive pulmonary disorder (COPD) is anticipated to contribute to the rising demand for skin boosters. According to an article published by the NCBI in February 2023, patients suffering from COPD are anticipated to witness significant wrinkle formation. According to the American Lung Association 2022, 4.6% of the total adults reported COPD in the U.S. which, in turn, drives the market growth.

Mesotherapy treatments can be used to treat a large number of skincare problems allowing it to be a versatile treatment for various skin ailments. Patients typically face minimum recovery time after this treatment, allowing them to choose it over micro-needle treatment.

Gender Insights

The female segment dominated the market and accounted for a share of 84.8% in 2023 and is also expected to witness the fastest CAGR over the forecast period as women exhibit dullness and early aging, mostly as a result of hormonal swings and associated issues. In addition, a large percentage of women undergo cosmetic procedures due to cultural standards and consciousness. According to an article published by International Society of Aesthetic Plastic Surgery (ISAPS), in 2023, women accounted for over 85% of the total number of aesthetic procedures. Skin conditions such as acne, pigmentation, and dullness are also more common among women. According to an article published in The Dermatology Times, 2022, adult acne has increased 10% worldwide in the past 10 years.

In case of women, hormonal changes during the onset of puberty, pregnancy and menopause fluctuates the levels of estrogen and progesterone that affects oil products and in turn, causes acne. This is a common reason for females getting more acne in comparison to men. Moreover, factors such as genetics, lifestyle changes and skincare habits contribute to the development of acne. The female population of the U.S. is increasingly turning to medical spas for their aesthetic and wellness needs. With a focus on non-surgical cosmetic procedures and wellness services, medical spas offer a convenient and affordable alternative to traditional plastic surgery procedures. As women continue to prioritize their appearance and wellbeing, the demand for medical spa services is likely to continue growing in the coming years.

End-use Insights

The medical spa segment dominated the market in 2023 and is also anticipated to witness the fastest CAGR over the forecast period. Medical spas offer skin services in between that of traditional spas and medical clinics, providing an extra scope of relaxation along with the skin boosters treatment. These medical spas are closely monitored by medical professionals to ensure the skin booster treatments are performed effectively and safely. These facilities can tailor or customize these skin treatments, contributing to more noticeable and preferred changes for conditions such as fine lines and hydration in patients. Moreover, the relaxing and comforting environment provided by the ambiance of these spas enhances the overall experience of these treatments.

The segment growth in this segment is driven by various advantages of the user experience such as the involvement of an extra dose of comfort and relaxation during the skincare treatments, the presence of closely monitored treatments by medically trained professionals, and facilities of customizable treatments for the patients.

The dermatology clinics conduct dermatology assessments to understand the issues and the individual concerns and issues. They provide customizable plans for different skin concerns combining a holistic approach to skincare.

Key U.S. Skin Boosters Company Insights

Some of the key players operating in the market include Bloomage Biotech Co. Ltd.; Medytox, Inc, AbbVie Inc.; and Merz Pharma.

Galderma, Teoxane, IBSA are some of the other market participants in the U.S. skin booster market.

-

Galderma specializes in skin treatments and dermatology solutions providing skin rejuvenation, delivers hydration and improvements for skin perfection

-

Teoxane is a major player in the industry involving aesthetic medicine and skin care. It is a leader in derma fillers, and tailored skin treatments

Key U.S. Skin Boosters Companies:

The following are the leading companies in the U.S. skin booster market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. skin boosters companies are analyzed to map the supply network.

- Bloomage Biotech Co., Ltd.

- Medytox, Inc.

- AbbVie Inc.

- Merz Pharma

- Galderma

- Teoxane

- IBSA Farmaceutici Italia Srl

- PharmaResearch Co., Ltd.

Recent Developments

-

In January 2024, AbbVie Inc. expanded its manufacturing capacity involving an investment in the manufacturing site. It is expected to expand and strengthen the Abbvie’s global network.

-

In May 2023, Allergan Aesthetics, a part of AbbVie announced the FDA approval of the product, Skinvive. This product helped to improve skin smoothness of adults above the age of 21.

-

In August 2021, IBSA Farmaceutici Italia Srl announced its acquisition with Laboratoires Genevrier SAS. This acquisition was aimed to strengthen and expand to the French market.

U.S. Skin Boosters Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 650.8 million

Growth rate

CAGR of 8.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, gender, end-use

Country scope

U.S.

Key companies profiled

Bloomage Biotech Co., Ltd.; Medytox, Inc.; AbbVie Inc.; Merz Pharma; Galderma; Teoxane; IBSA Farmaceutici Italia Srl; PharmaResearch Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Skin Boosters Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. skin boosters market report based on type, gender, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mesotherapy

-

Micro-needle

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Spa

-

Dermatology Clinics

-

Frequently Asked Questions About This Report

b. The U.S. skin boosters market size was estimated at USD 363.1 million in 2023.

b. The U.S. skin boosters market is expected to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030 to reach USD 650.8 million by 2030.

b. The mesotherapy segment dominated the market with the largest market share of 54.6% in 2023. This high share is attributable to the customization by offering a tailored course of treatment to target specific skincare concerns.

b. Some of the key players operating in the U.S. skin boosters market include Bloomage Biotech Co., Ltd.; Medytox, Inc.; AbbVie Inc.; Merz Pharma; Galderma; among others.

b. Key factors driving the market growth include the increasing aging population, changes in skin standards and consciousness, and technological innovation in technology worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.