- Home

- »

- Animal Health

- »

-

U.S. Veterinary Eye Care Market Size, Industry Report, 2033GVR Report cover

![U.S. Veterinary Eye Care Market Size, Share & Trends Report]()

U.S. Veterinary Eye Care Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Canine, Feline, Equine, Bovine), By Product (Devices & Instruments, Medications), By Indication, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-724-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinary Eye Care Market Summary

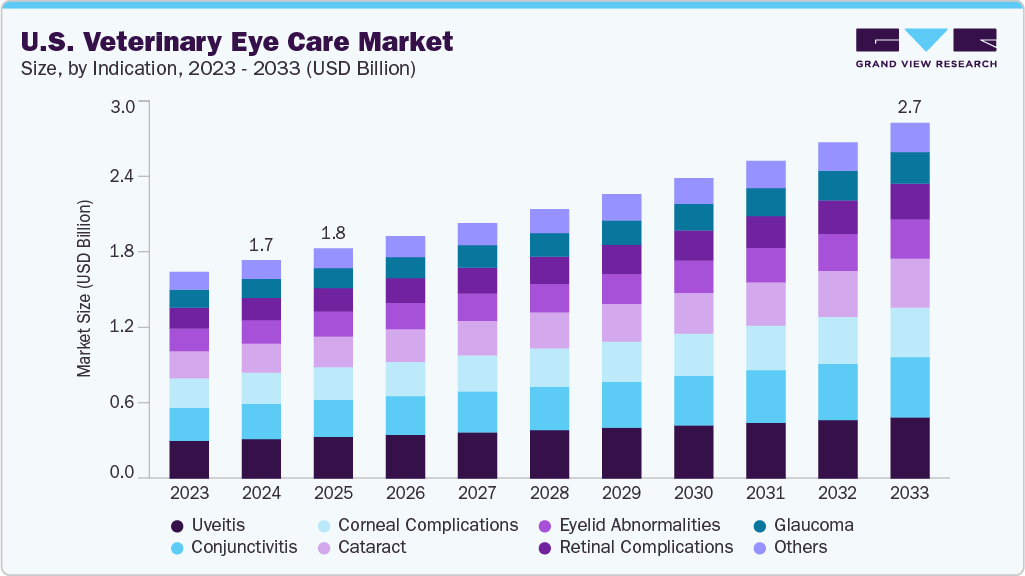

The U.S. veterinary eye care market size was estimated at USD 1.66 billion in 2024 and is projected to reach USD 2.71 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The market is advancing owing to factors such as expanding veterinary eye care avenues, increasing advocacy for rationale use of antibiotics, growing involvement of veterinary professionals in spreading awareness, and technological advancements in veterinary eye care

Key Market Trends & Insights

- By product, medications is expected to grow at the fastest rate of more than 6% over 2025 - 2033.

- By animal, canine segment dominated the U.S. market with a share of about 34% in 2024.

- Based on indication, cataract segment is expected to grow at the fastest rate over 2025 - 2033.

- By distribution channel, e-commerce is the fastest-growing segment in the veterinary eye care market

Market Size & Forecast

- 2024 Market Size: USD 1.66 Billion

- 2033 Projected Market Size: USD 2.71 Billion

- CAGR (2025-2033): 5.6%

The veterinary eye care sector in the U.S. is experiencing significant growth, driven by advancements in surgical techniques, genetic research, and diagnostic technologies. These developments are expanding the scope of eye care for animals, offering new hope for conditions that were once considered untreatable.

A notable example is the use of retinal reattachment surgery, or retinopexy, conducted in January 2025, by UC Davis, to address retinal tears in dogs. This procedure involves replacing the natural gel in the eye with silicone oil to reposition the retina, effectively restoring vision in affected animals. Such specialized surgeries are becoming more accessible, thanks to improvements in surgical equipment and training.

Genetic research is also playing a pivotal role in veterinary eye care. Studies such as the March 2025 article published by dvm360 have identified specific genetic mutations responsible for conditions such as progressive retinal atrophy (PRA) in dogs. For instance, a 3-base pair deletion in the GTPBP2 gene has been linked to PRA, providing a basis for genetic testing and informed breeding decisions. This approach aims to prevent the hereditary transmission of such conditions, thereby reducing their prevalence in future generations.

In terms of treatment options, the use of latanoprost in managing glaucoma in cats highlights the complexities of veterinary ophthalmology. While latanoprost has shown efficacy in lowering intraocular pressure in cats, its limitations underscore the need for ongoing research and development of more effective therapies tailored to feline physiology.

Furthermore, the adoption of laser technology for treating canine eyelid tumors represents a significant advancement in non-invasive surgical techniques. As per March 2025 article published by dvm360, laser treatments offer precision and reduced recovery times compared to traditional methods, enhancing the overall treatment experience for both pets and their owners.

Collectively, these innovations are contributing to a dynamic and rapidly evolving veterinary ophthalmology landscape. As the field continues to progress, it holds the promise of improved outcomes for animals suffering from a range of ocular conditions, reflecting a broader trend toward specialized and compassionate veterinary care.

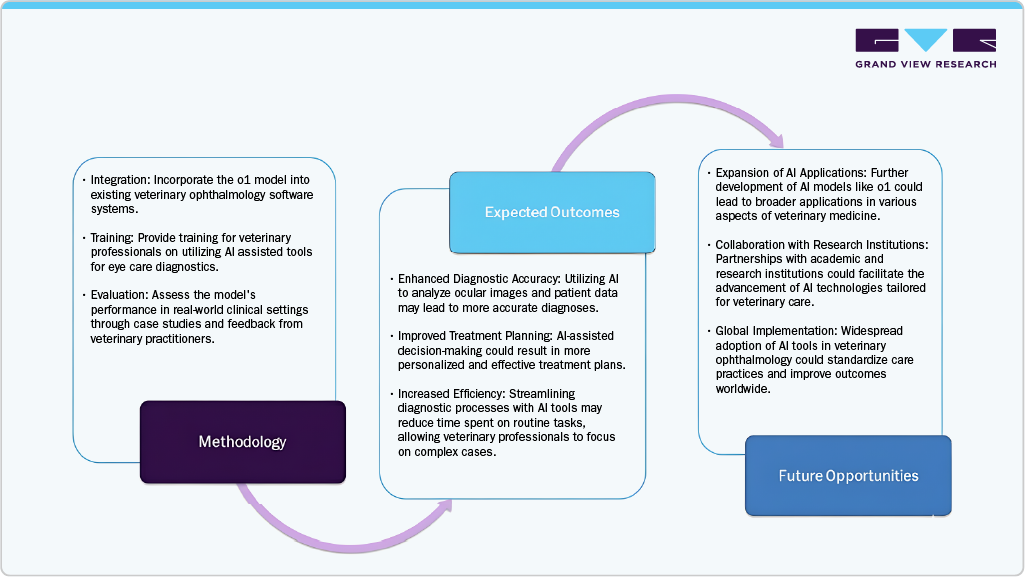

Case Study: Integrating OpenAI's o1 Model into Veterinary Eye Care

Objective: To evaluate the effectiveness of OpenAI's o1 model in improving diagnostic accuracy and treatment planning in veterinary ophthalmology.

By integrating AI models such as OpenAI's o1 into veterinary eye care, the industry has the potential to enhance diagnostic capabilities, optimize treatment strategies, and improve overall patient outcomes.

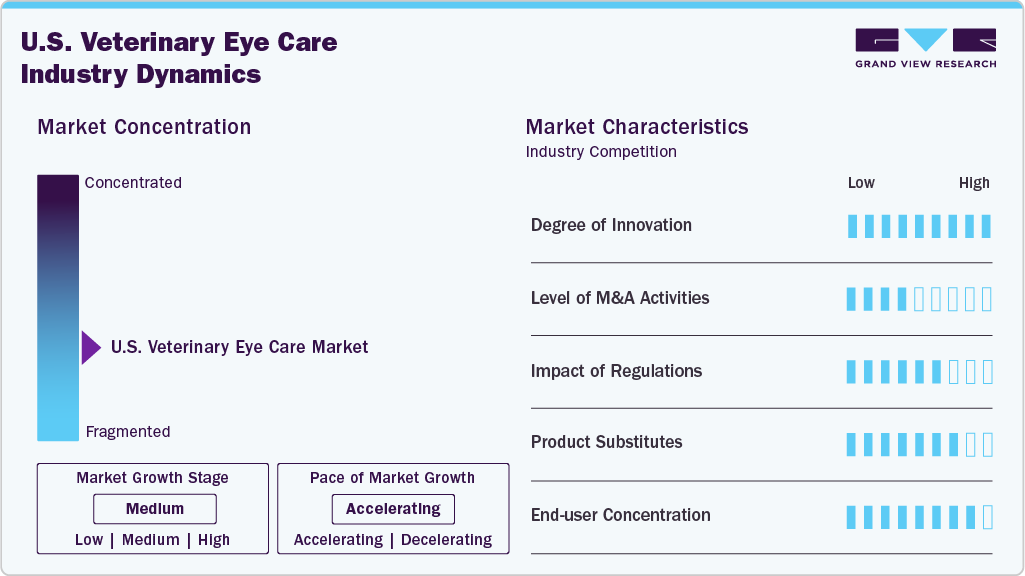

Market Concentration & Characteristics

The U.S. veterinary eye care market is characterized by a high concentration of innovation and expertise, led by specialized institutions and niche ophthalmic firms. Mergers and acquisitions are consolidating capabilities, while strategic partnerships and regulatory alignment support accelerated adoption of advanced technologies. Although product substitution exists, the growing focus on veterinary-specific solutions is reducing reliance on general or human-adapted treatments. Regional expansions into underserved areas further strengthen market presence and reinforce competitiveness across the country.

The U.S. veterinary eye care market demonstrates a very high degree of innovation, driven by leading institutions like UC Davis. Specialized surgical techniques can now restore vision in dogs with cataracts, while minimally invasive laser treatments remove eyelid tumors without the risks of general anesthesia. These advancements improve outcomes, particularly for elderly or medically compromised pets. Additionally, programs enhancing access to veterinary eye care ensure underserved communities benefit from these innovations. Overall, the U.S. market is setting global standards in veterinary ophthalmology.

In the U.S., mergers and acquisitions are playing a growing role in shaping the veterinary ophthalmology market, with large animal health companies acquiring niche ophthalmic firms and technology developers. For example, in August 2023, Dômes Pharma acquired U.S.-based SentrX Animal Care, expanding its domestic ophthalmology portfolio with BioHAnce technology. This acquisition strengthens its presence in the U.S. market, supported by local subsidiaries and leadership focused on North American growth. Additionally, strategic partnerships with diagnostic imaging firms and pharmaceutical companies are driving innovation and enhancing competitiveness within the U.S. veterinary eye care segment.

In the U.S., regulations strongly shape the veterinary eye care market by ensuring safety, efficacy, and compliance for ophthalmic drugs, devices, and diagnostics. The FDA’s Center for Veterinary Medicine oversees approvals, which impact development timelines and market entry. Alignment with human ophthalmology frameworks helps accelerate adoption of innovations like advanced imaging and surgical tools. However, outdated regulatory processes often delay product launches, pushing some companies to seek approvals abroad first. Recent calls for reform aim to modernize FDA pathways and better support the fast-growing U.S. veterinary ophthalmology sector.

In the U.S. veterinary eye care market, product substitution remains moderate, as some general ophthalmic drugs and human eye care tools are still adapted for animal use. However, reliance on these substitutes is steadily decreasing with the rising demand for veterinary-specific formulations, surgical devices, and diagnostic technologies. Innovations such as minimally invasive laser treatments and advanced imaging systems are further reducing the need for human-adapted alternatives. This shift toward tailored, species-specific solutions not only enhances treatment outcomes but also drives market growth and differentiation within U.S. veterinary ophthalmology.

Regional expansion is a key growth strategy in the U.S. market, as companies seek to capitalize on underserved areas and increasing pet ownership. For example, in December 2024, Nightingale Veterinary Partners is establishing a specialized eye and surgery center in Greenwich, Connecticut, to fill a local gap in advanced veterinary services. Similarly, in April 2025, Chewy Vet Care launched a new clinic in Austin, Texas, offering comprehensive veterinary services with a focus on transparency and convenience. These expansions not only enhance access to specialized care but also reflect the industry's response to the growing demand for quality veterinary services across the country.

Animal Insights

The U.S. veterinary eye care market's canine segment, which held a share of about 34% in 2024, is experiencing significant growth due to advancements in treatment options. UC Davis veterinary hospital's retinal reattachment surgery has achieved a high success rate, restoring vision in dogs with retinal detachment . In addition, the identification of a genetic mutation causing progressive retinal atrophy in English Shepherd dogs has opened avenues for genetic testing and breeding strategies to prevent this form of blindness. Moreover, the adoption of minimally invasive laser treatments for canine eyelid tumors offers a safer alternative to traditional surgery, particularly benefiting aging dogs. These innovations not only enhance treatment outcomes but also contribute to the overall expansion of the canine segment in the U.S. veterinary eye care market.

The feline segment is emerging as the fastest-growing category in the veterinary eye care market, spurred by the recognition of unique challenges in treating feline glaucoma. A notable limitation is the reduced efficacy of latanoprost-a commonly used glaucoma medication in dogs-in cats, as it doesn't work as effectively due to species-specific differences in receptor activity. This limitation has catalyzed increased research and development efforts to identify and develop alternative treatments tailored for cats. Veterinary professionals are exploring new pharmacological agents and surgical techniques to better manage glaucoma in felines. This focus on feline-specific therapies is driving innovation and contributing to the rapid growth of the feline segment within the veterinary eye care market.

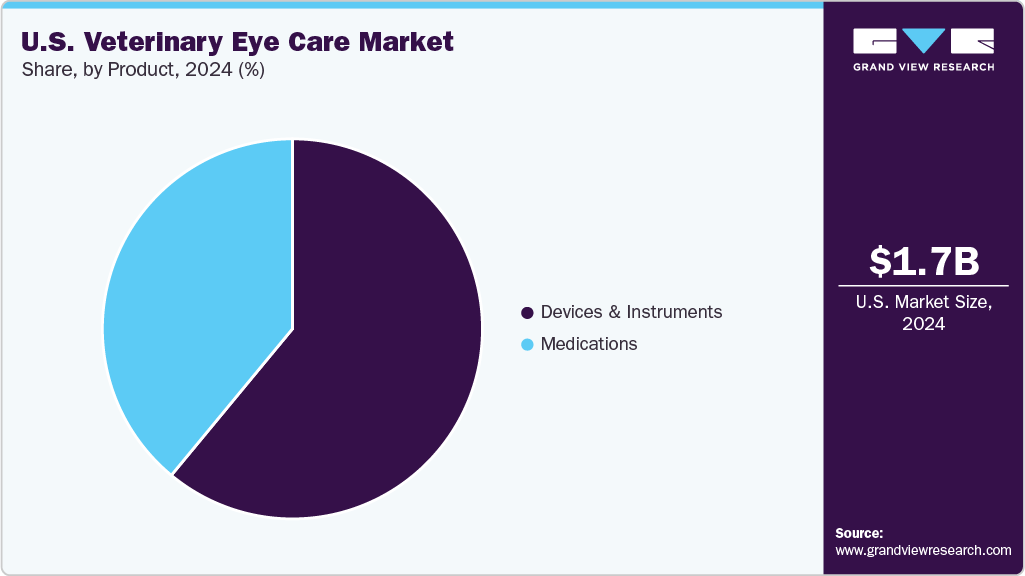

Product Insights

Devices and instruments segment represented the largest share of about 61% in 2024, driven by advancements in ophthalmic technology. A notable example is the UC Davis Veterinary Medical Teaching Hospital's recent upgrade to its surgical microscope, incorporating advanced imaging capabilities such as optical coherence tomography (OCT). This enhancement allows for detailed, near-histologic imaging during surgeries, improving precision and patient outcomes. In addition, the new equipment has enabled the hospital to perform retinal reattachment surgery, a procedure previously not offered, positioning UC Davis as one of the few institutions in the U.S. to provide this specialized care. These technological advancements not only enhance clinical capabilities but also contribute to the growth of the devices and instruments segment by setting new standards in veterinary ophthalmology.

Medications segment is the fastest growing over the forecast period, driven by advancements in antibiotic stewardship and targeted therapies. BOVA's online seminar on the rational use of antibiotics in veterinary ophthalmology, emphasized on evidence-based prescribing practices to combat antimicrobial resistance. The session covered critical aspects such as identifying when antibiotic therapy is necessary, understanding the potential toxicity of certain antibiotics to the corneal surface, and making informed choices to optimize patient outcomes. This focus on responsible antibiotic use not only enhances treatment efficacy but also fosters innovation in developing safer, more effective ophthalmic medications, thereby propelling the growth of the medications segment in the U.S. veterinary eye care market.

Indication Insights

The uveitis segment led the U.S. veterinary eye care market in 2024, driven by increasing recognition of its prevalence and the need for specialized treatment. A January 2025 study found that 38% of dogs and cats with systemic inflammatory response syndrome (SIRS) developed anterior uveitis, compared to 7.7% in healthy controls, highlighting the condition's significance in critically ill animals. This has spurred research into early detection and tailored therapies. In addition, advancements in non-infectious uveitis treatment, including corticosteroids and biologic agents such as TNF-α inhibitors, are enhancing management strategies. These developments are propelling growth in the uveitis segment by improving outcomes and driving innovation in veterinary ophthalmology.

Conjunctivitis is emerging as the fastest-growing segment in the U.S. veterinary eye care market, driven by its high prevalence and the increasing demand for effective treatments. This condition, commonly known as "pink eye," affects a significant number of dogs and cats, leading to a steady need for veterinary care. The growth is further fueled by advancements in diagnostic tools and therapeutic options, enabling more precise and efficient management of the disease. In addition, heightened awareness among pet owners about eye health and the availability of specialized veterinary services contribute to the expanding market. These factors collectively underscore the importance of addressing conjunctivitis in veterinary ophthalmology.

Distribution Channel Insights

Veterinary hospitals and clinics are the cornerstone of the U.S. veterinary eye care market, serving as primary centers for the diagnosis, treatment, and management of ocular disorders in animals. A notable example is the December 2024 establishment of a specialized veterinary hospital in Greenwich, Connecticut, by Nightingale Veterinary Partners. This facility, located at 5 Western Junior Highway, will house both an eye center and a surgery center dedicated to cats and dogs. The hospital is set to employ four doctors and 20 veterinary staff members, providing consultations, specialized surgeries, and post-operative care, with minimal overnight boarding. The initiative aims to fill a niche in the local veterinary field, as there are no other specialty veterinary hospitals in the area, thereby enhancing access to specialized eye care services for pets in the region.

In the U.S., e-commerce is the fastest-growing segment in the veterinary eye care market, fueled by pet owners’ demand for convenient access to medications, supplements, and ophthalmic products. Online platforms offer a wide array of solutions, including lubricating drops, diagnostic kits, and prescription refills, delivered directly to homes. The rise of tele-ophthalmology further supports e-commerce by enabling remote consultations and personalized product recommendations. Increasing digital adoption, competitive pricing, and subscription-based models are accelerating growth, making e-commerce a key distribution channel for veterinary eye care in the U.S.

Key U.S. Veterinary Eye Care Company Insights

The U.S. market is highly dynamic, driven by innovation, specialized surgical techniques, and the growing adoption of veterinary-specific drugs and devices. Mergers, acquisitions, and strategic partnerships are consolidating expertise and accelerating technology adoption, while regulatory oversight ensures safety and efficacy. Regional expansions and tele-ophthalmology are enhancing access to specialized care, supporting market growth across the country. Key players, including Merck, Zoetis, Bausch & Lomb, Dechra, and Accutome, dominate the market, offering a mix of pharmaceuticals, diagnostics, and ophthalmic devices, reflecting a competitive yet innovation-focused landscape.

Key U.S. Veterinary Eye Care Companies:

- Merck & Co., Inc.

- An-Vision GmbH

- Jorgensen Laboratories

- LKC Technologies Inc.

- Accutome Inc.

- Dechra Pharmaceuticals

- Bausch & Lomb Incorporated

- Zoetis Services LLC.

- Ceva Sante Animale

- Sandoz

- Boehringer Ingelheim

- I-Med Animal Health

- Iridex Corporation

- Baxter (Welch Allyn)

- OptoMed

- Reichert, Inc.

- Occuity

Recent Developments

-

In August 2025, Inspire Veterinary Partners (IVP) signed an exclusive, non-binding letter of intent to acquire a New Jersey-based animal hospital. The proposed acquisition is expected to close in Q4 2025 and would add approximately USD 2 million in annual revenue to IVP's network. This move aligns with IVP's strategy to expand its presence in the veterinary care sector and enhance its service offerings.

-

In May 2025, research by MyDogDNA identified the CPT1A gene as a significant factor in the development of hereditary cataracts in Arctic dog breeds such as the Siberian Husky and Samoyed. This discovery underscores the importance of genetic testing in managing eye health within these breeds

-

In January 2025, Tractor Supply Company completed its acquisition of Allivet, a privately held online pet pharmacy. This strategic move allows Tractor Supply to expand its offerings in the pet and animal healthcare sector. The acquisition enhances Tractor Supply's portfolio, providing a comprehensive range of pet medications and services to its extensive customer base.

-

In October 2025, The Vets, a provider of at-home veterinary care, announced its merger with BetterVet, a mobile veterinary service specializing in at-home visits and telehealth. Operating under The Vets brand, the merger aims to expand pet healthcare delivery across the United States. The combined entity will offer a wider range of veterinary services to more geographical regions, enhancing access to comprehensive, convenient, and compassionate care for pet owners.

U.S. Veterinary Eye Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2033

USD 2.71 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, indication, distribution channel

Country scope

U.S.

Key companies profiled

Merck & Co., Inc.; An-Vision GmbH; Jorgensen Laboratories; LKC Technologies Inc.; Accutome Inc.; Dechra Pharmaceuticals; Bausch & Lomb Incorporated; Zoetis Services LLC.; Ceva Sante Animale; Sandoz; Boehringer Ingelheim; I-Med Animal Health; Iridex Corporation; Baxter (Welch Allyn); OptoMed; Reichert, Inc.; Occuity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Eye Care Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. veterinary eye care market report based on animal, product, indication, and distribution channel:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Canine

-

Feline

-

Equine

-

Bovine

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Devices & Instruments

-

Diagnostic Devices

-

Tonometers

-

Ophthalmic Test Kits

-

Electroretinogram (ERG)

-

Fundus Camera

-

Ophthalmoscopes

-

Pachymeter

-

Other Diagnostic Devices

-

-

Treatment Devices

-

Lenses

-

Bandage Lenses

-

Intraocular Lenses

-

-

Laser Devices

-

Other Treatment Devices

-

-

-

Medications

-

Antibiotics

-

NSAIDs

-

Corticosteroids

-

Lubricants / Artificial Tears

-

Analgesics / Pain Relievers

-

Other Medications

-

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Eyelid Abnormalities

-

Cataract

-

Glaucoma

-

Retinal Complications

-

Uveitis

-

Conjunctivitis

-

Corneal Complications

-

Other Indications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

Specialty Stores

-

E-Commerce

-

Other Distribution Channels

-

Frequently Asked Questions About This Report

b. The U.S. veterinary eye care market size was estimated at USD 1.66 billion in 2024 and is expected to reach USD 1.75 billion in 2025.

b. The U.S. veterinary eye care market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 2.71 billion by 2033.

b. By animal, canine segment, holding about 34% share in 2024, is growing due to advanced treatments like UC Davis’s successful retinal reattachment surgery. Genetic discoveries in English Shepherds enable testing and preventive breeding against progressive retinal atrophy. Minimally invasive laser therapies for eyelid tumors further improve outcomes, driving expansion of the canine ophthalmology segment.

b. Some key players operating in the U.S. veterinary eye care market include Merck & Co., Inc., An-Vision GmbH, Jorgensen Laboratories, LKC Technologies Inc., Accutome Inc., Dechra Pharmaceuticals, Bausch & Lomb Incorporated, Zoetis Services LLC., Ceva Sante Animale, Sandoz, Boehringer Ingelheim, I-Med Animal Health, Iridex Corporation, Baxter (Welch Allyn), OptoMed, Reichert, Inc., and Occuity

b. Key factors that are driving the market growth include owing to factors such as expanding veterinary eye care avenues, increasing advocacy for rationale use of antibiotics, growing involvement of veterinary professionals in spreading awareness, and technological advancements in veterinary eye care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.