- Home

- »

- Medical Devices

- »

-

U.S. Wound Care Market Size, Share Analysis Report, 2030GVR Report cover

![U.S. Wound Care Market Size, Share & Trends Report]()

U.S. Wound Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Advanced Wound Dressing, Surgical Wound Care, Traditional Wound Care), By Application, By End-use, By Mode Of Purchase, Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-160-5

- Number of Report Pages: 176

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

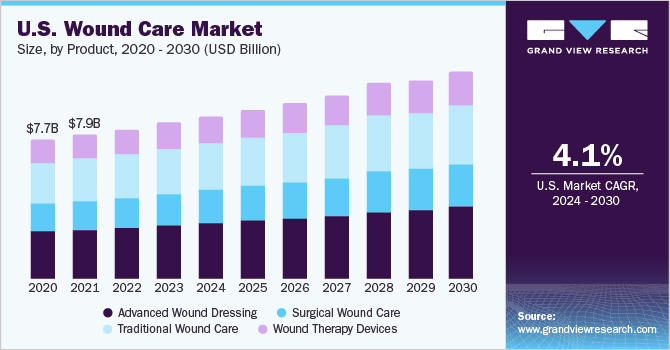

The U.S. wound care market was valued at USD 8.63 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.11% from 2024 to 2030. The market will continue to grow as a result of factors such as the rising number of sports injuries and the increasing prevalence of diabetes. These factors are anticipated to propel the market growth over the forecast period and the rising geriatric population. For instance, as per the report of the Centers for Disease Control and Prevention (CDC) last reviewed in April 2023, 37.3 million Americans have diabetes. Moreover, as per the same source, 96 million American adults have prediabetes. These factors are expected to boost the market growth over the forecast period.

The rising technological advancements in wound care is one of the major driver for the market for U.S. wound care. For instance, in January 2023, Convatec launched the ConvaFoam in the U.S. ConvaFoam is a family of advanced foam dressings designed to meet the demands of medical professionals and their patients. Furthermore, In December 2022, MediWound Ltd. obtained the U.S. Food and Drug Administration (FDA) approval for its NexoBrid. This product is intended to remove eschar in adults with deep partial-thickness and full-thickness thermal burns. Furthermore, numerous academic and research institutes are involved in R&D, which is likely to propel the growth of the wound care market during the forecast period. Hence, increased R&D expenditure and the introduction of enhanced wound healing products by key players are among the factors likely to drive the adoption of advanced wound dressing and active therapies for the management of chronic & acute wounds.

Increasing incidence of accidents such as road accidents and trauma events is anticipated to drive the market growth. As per the report of Amaro Law Firm published on March 2023, 7.3 million motor vehicle accidents occur each year across the U.S. Thus, the rising number of accidents is expected to boost the demand for wound care products over the forecast period. In addition, according to Stanford Children’s Health, injury is a major cause of child admission in hospitals & emergency departments. Furthermore, according to a similar source, every year, more than 3.5 million kids under the age of 14 incur injuries while engaging in recreational activities or sports.

Moreover, an increasing number of Ambulatory Surgical Centers (ASCs) is expected to drive the market. ASCs offer various services, such as surgical care, diagnostics, and preventive procedures. Surgeries for pain management, urology, orthopedics, restorative care, reconstruction, or alternative plastic surgeries and Gastrointestinal (GI)-related surgeries are also performed in ASCs. Earlier, ASCs were only capable of performing GI-related minor surgeries; however, with an increase in the number of minimally invasive surgical procedures, services offered by ASCs expanded and grew exponentially. For instance, according to the report of Advancing Surgical Care, as of August 2023, the number of ASCs in the U.S. is estimated to be 6,223. Thus, with an increasing number of ASCs, the market growth is expected to propel during the forecast period.

Distribution Channel Insights

Based on distribution channels, the market is segmented into institutional sales and retail sales. The institutional sales segment dominated the market with a market share of 81.56% in 2023. The majority of the products for advanced wound care are directly distributed across various settings, such as hospitals & other healthcare facilities. Institutional sales majorly comprise distributors and manufacturers. Hospitals, clinics, wound care centers, and other healthcare facilities, such as nursing homes, long-term care facilities, diagnostic laboratories, & birth centers, usually have long-term contracts and tie-ups with distributors & manufacturers. Key players are adopting long-term contracts with end users as a strategy to expand their reach and strengthen their foothold in the market. These above-mentioned factors are propelling the segment's growth.

The retail sales segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.48% in 2024 to 2030. Retail sales mainly comprises retail pharmacy stores, e-commerce, etc. Customers benefit from pharmacies as they are available in large numbers. They offer various delivery concepts and usually provide good service. Prescription and non-prescription wound care products are typically purchased at retail pharmacy stores by customers. However, they may lack enough product knowledge, and not all products are available in all pharmacies. These factors are anticipated to propel market growth over the forecast period.

Product Insights

Based on the product, the market is segmented into advanced wound dressing, surgical wound care, traditional wound care, and wound therapy devices. The advanced wound dressing segment dominated the market with the highest market share of around 34.84% in 2023 and is also expected to grow at the highest compound annual growth rate (CAGR) of 4.37% from 2024 to 2030. Advanced wound dressing is mainly used to treat chronic and nonhealing wounds. Some products of advanced wound dressings are equipped with antimicrobial agents, such as honey & silver, for rapid wound healing and preventing further infections. The limitations of traditional wound dressings have propelled the growth of this market. Moreover, increasing cases of diabetes are also expected to impel segment growth over the forecast period. For instance, as per the report of the Centers for Disease Control and Prevention (CDC) last reviewed in April 2023, 37.3 million Americans have diabetes, whereas 96 million American adults are expected to have prediabetes.

Application Insights

Based on application, the market is segmented into chronic wounds and acute wounds. The chronic wounds segment dominated the market with a market share of 60.03% in 2023. This growth can be attributed to factors such as the increase in the number of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which are expected to drive the demand for wound care products. Moreover, the increasing incidence of diabetes and diabetic foot ulcers is a major factor driving the segment's growth. For instance, according to ScienceDirect, diabetic foot ulcers may affect more than 25% of the diabetic population and may lead to the amputation of the foot in 20% of patients.

The acute wounds segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.22% in 2024 to 2030. The rising number of Surgical-site Infections (SSIs) and the Increasing cases of burn injuries is the major driving factors for the segment growth. Furthermore, the rising incidence of trauma is contributing to segment growth. For instance, as per a study by ResearchGate, in 2020, around 6.6% of deaths occurred every year due to trauma. Hence, an increase in the incidence of traumatic wounds and a rise in the prevalence of SSI are among the factors anticipated to propel market growth over the forecast period.

End-use Insights

On the basis of end-use, the market is segmented into hospitals, outpatient facilities, home care, and research & manufacturing. The hospitals segment held the largest share of 45.07% in the market in 2023. Hospitals use wound care products to treat a variety of wounds, including surgical wounds, burns, pressure ulcers, and diabetic foot ulcers. The demand for advanced wound care products in hospitals is driven by factors such as the growing incidence of chronic wounds, an increase in the number of surgeries, and a rise in the aging population. Surgical wound care dressings and Negative Pressure Wound Therapy (NPWT) are predominantly suitable for hospital use and are not feasible for home care. Thus, with an increasing number of hospitals and hospitalization cases, the segment is expected to have significant growth over the forecast period.

The home care segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.81% from 2024 to 2030. An increase in the aging population and technological advancement in wound care is expected to drive the segment growth. The advanced wound care products industry has seen significant technological advancements, such as the development of smart dressings that can monitor and manage wounds. These technologies are increasingly being adopted in home healthcare settings, allowing for better wound management and reducing the need for frequent visits to healthcare facilities. Furthermore, home healthcare services are often more cost-effective than inpatient care, making them an attractive option for patients, insurers, and healthcare providers. These factors are expected to boost the segment growth over the forecast period.

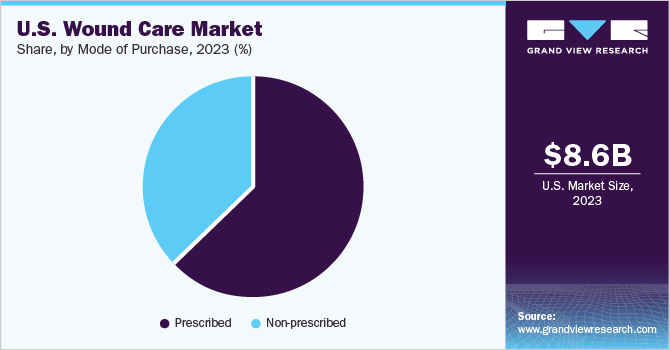

Mode of Purchase Insights

Based on the mode of purchase, the U.S. wound care industry is segmented into prescribed and non-prescribed. The prescribed segment dominated the market with a market share of 62.75% in 2023. Also, prescribed segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.92% in 2024 to 2030. Prescribed wound care medications require a prescription from a licensed medical practitioner as they are harmful if not monitored. Moreover, people are more inclined toward prescribed wound care products as Medicare covers around 80% of the cost of medically necessary wound care supplies and surgical dressings. This encourages people to visit physicians and receive prescribed wound care medication. These factors are propelling the segment's growth.

Key Companies & Market Share Insights

The competitors in the market are involved in the development and launch of new products also they formed a strategic partnership with the major players to strengthen their presence in the market. For instance, in January 2023, Convatec announced the U.S. launch of the ConvaFoam. ConvaFoam is a category of advanced foam dressings designed to meet the demands of patients and healthcare professionals. Also, in April 2023, 3M announced FDA approval for the 3M Veraflo Therapy dressings, intended for hydromechanical removal of nonviable tissue.

Key U.S. Wound Care Companies:

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences (Integra LifeSciences)

- Medline Industries, Inc.

- Ethicon (Johnson & Johnson)

- B. Braun SE

- Cardinal Health, Inc.

- Organogenesis Inc

- MIMEDX Group, Inc.

U.S. Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.97 billion

Revenue forecast in 2030

USD 11.42 billion

Growth rate

CAGR of 4.11% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, mode of purchase, distribution channel

Key companies profiled

Smith & Nephew PLC; Mölnlycke Health Care AB ; ConvaTec Group PLC; Baxter International; URGO Medical; Coloplast Corp.; Medtronic; 3M; Derma Sciences (Integra LifeSciences); Medline Industries, Inc.; Ethicon (Johnson & Johnson); B. Braun SE; Cardinal Health, Inc.; Organogenesis Inc; MIMEDX Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Care Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. wound care market report on the basis of product, application, end-use, mode of purchase, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Wound Dressing

-

Surgical Wound Care

-

Traditional Wound Care

-

Wound Therapy Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Chronic Wounds

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Research & Manufacturing

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescribed

-

Non-prescribed (OTC)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

Frequently Asked Questions About This Report

b. The U.S. wound care market was estimated at USD 8.63 billion in 2023 and is expected to reach USD 8.97 billion in 2024.

b. The U.S. wound care market is expected to grow at a compound annual growth rate of 4.11% from 2024 to 2030, reaching USD 11.42 billion by 2030.

b. Hospitals will make up the majority of the end-use segment of the U.S. wound care market in 2023, with a market share of more than 45.0%.

b. Some key players operating in the U.S. wound care market include 3M, Baxter, Coloplast, ConvaTec Group PLC, Hollister Incorporated, Integra LifeSciences, Johnson & Johnson (Ethicon), Molnlycke Health Care, Smith + Nephew, Medtronic, Becton, Dickinson and Company, and Cardinal Health, among others.

b. Key factors that are driving the U.S. wound care market include include increasing geriatric population, and rising incidences of chronic wounds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.