- Home

- »

- Consumer F&B

- »

-

U.S. Yogurt And Probiotic Drink Market Size Report, 2030GVR Report cover

![U.S. Yogurt And Probiotic Drink Market Size, Share & Trends Report]()

U.S. Yogurt And Probiotic Drink Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Yogurt Drink, Probiotic Drink), By Type, By Distribution Channel, By Region, And Segment Forecast

- Report ID: GVR-4-68040-102-4

- Number of Report Pages: 93

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

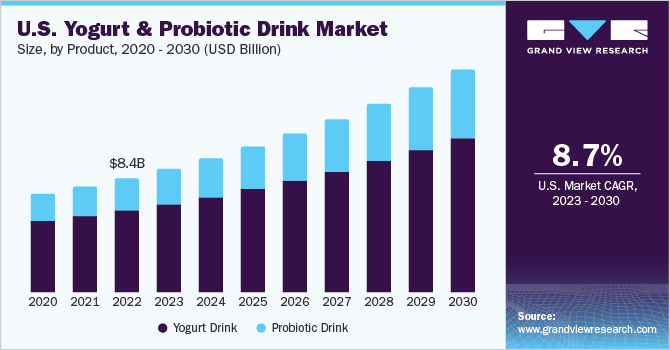

The U.S. yogurt and probiotic drink market size was estimated at USD 8.43 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. Increasing consumer awareness and understanding of the importance of maintaining a healthy gut are fueling the growth of the market. Consumers are becoming more conscious of the role of gut health in overall well-being and actively seek products that promote digestive health and improve gut flora. Factors, such as growing awareness about following a healthy lifestyle have driven the market growth in recent years. The increased demand for probiotics is driven by the growing consumer awareness about the importance of gut health and its impact on overall well-being. Beneficial probiotics are known to promote a healthy balance of microorganisms in the gut, thereby improving digestion, immunity, and overall health.

In addition, lifestyle changes and dietary preferences have also played a role in driving market growth. With the growing consumption of processed and unhealthy food products, many individuals are seeking ways to improve their diet and incorporate more natural and beneficial ingredients. Probiotics offer a convenient and accessible solution, as they can be consumed through supplements, fermented foods like yogurt and kefir, or even functional beverages. Furthermore, the expanding range of probiotic products available in the market has contributed to its growth. Manufacturers have introduced a variety of innovative and convenient formats, including capsules, tablets, powders, and even gummies, catering to different consumer preferences.

This diversification has made probiotics more appealing and accessible to a wider audience. In April 2022, the International Food Information Council (IFIC) conducted a study titled "Consumer Insights on Gut Health and Probiotics," which revealed a notable increase in Americans' curiosity regarding prebiotics, probiotics, postbiotics, and the gut microbiome. This study highlights a growing interest among the population in understanding the importance of these elements for maintaining a healthy gut and overall well-being. Approximately 32% of individuals actively make an effort to consume probiotics, with 60% of them aiming to consume probiotics once a day and 24% attempting to consume them multiple times daily.

Digestive health was considered the most crucial aspect of overall health by 24% of survey respondents. The survey also revealed that more individuals were actively trying to incorporate probiotics and prebiotics into their diets in 2021 compared to the previous year. These statistics indicate a growing preference for gut-healthy yogurt and probiotic beverages. Yogurt and probiotic beverages contain active bacteria that improve intestinal health and support healthy digestion. Probiotic drinks are currently experiencing rapid growth in the U.S. market.

The increasing awareness among consumers has led food system manufacturers to adopt a new approach to food production, wherein they incorporate or enhance the health benefits of yogurt and probiotic beverages to make them more beneficial and effective. Yogurt and probiotics-based foods and beverages are becoming increasingly popular and accepted among consumers as emerging functional foods. Traditional fermented beverages and functional drinks have long been recognized for including probiotic microorganisms. Among these options, fermented dairy products such as yogurt, cheese, acidified milk, and drinkable yogurt have gained significant acceptance as effective carriers of probiotics.

Product Insights

The yogurt drinks are the leading product segment, which accounted for a revenue share of 71.6% in 2022. The segment growth is being driven by the increasing preference of consumers for healthier food products and enhanced nutrition. Yogurt drinks provide the convenience of a ready-to-drink option while offering low-fat yogurt, which is rich in beneficial components like lean protein, branched-chain amino acids, calcium, and vitamin D. Research conducted by the Grande Cheese Company reveals that yogurt consumption can lead to a significant reduction in the risk of high blood pressure, potentially lowering it by up to 50%. This reduction in blood pressure is particularly important as it addresses a significant factor contributing to the development of heart disease.

Furthermore, it helps improve digestion, control appetite, and results in weight loss. According to a report published by International Dairy Foods Association in 2021, the upward surge in dairy consumption persisted in the U.S. owing to the growth in yogurt, butter, and cream consumption. In the yogurt drink segment, dairy-based yogurt drinks accounted for a prominent market share of 95.0% in 2022. However, the vegan yogurt drinks segment is expected to witness a lucrative growth rate of 10.6% during the forecast period of 2023 to 2030. The increasing adoption of vegan diets among consumers is a primary driver of growth in this segment.

A report titled "2021 Trend Insight: The Opportunity in Plant" by FONA International Inc. in April 2021 revealed that a significant portion, 39%, of consumers in the U.S. expressed interest in transitioning to a vegan lifestyle after the pandemic. Among those surveyed, 20% attributed health concerns as the main motivation behind their decision. These factors are expected to positively impact the growth of this segment. Probiotic drinks is the most lucrative product segment, which is projected to accelerate at a CAGR of 10.0% during the forecast period. Functional beverages containing probiotics are gaining traction among consumers owing to rising awareness about gut health and wellness.

The introduction of novel and exotic-flavored probiotic beverages with useful qualities is anticipated to open up lucrative chances in the market. In 2022, the water-based probiotic drink segment accounted for the dominant share of 56.5% of the probiotic drink segment. However, the vegan probiotic drink segment is projected to grow at a prominent growth rate of 12.7% during the forecast period. Vegan probiotic drinks have gained considerable popularity in recent years as more individuals adopt plant-based diets and seek alternatives to traditional dairy-based probiotic products. These drinks offer a nutritious and cruelty-free option for those looking to improve their gut health while adhering to a vegan lifestyle.

Type Insights

In the yogurt drink segment, drinks with probiotics are estimated to be the leading market. Yogurt drinks with probiotics held the dominant share of 54.4% in 2022. The main growth driver of the category is the growing customer interest in food and beverages with probiotics. A significant share of consumers in the U.S. are including probiotics in their daily diet, through breakfast, dinner, lunch, and snacks. This scenario is favorable for the segment's expansion. Kombucha dominated the probiotic drink market and accounted for a revenue share of 46.4% in 2022. Kombucha is a fermented probiotic drink that has gained significant popularity in recent years.

It is made by fermenting sweetened tea with a culture of bacteria and yeast, often referred to as a Symbiotic Culture of Bacteria and Yeast (SCOBY). In probiotic drinks, probiotic water is projected to witness a significant growth rate of 13.3% over the forecast period of 2023 to 2030.Probiotic waters, also known as probiotic-infused waters, have gained popularity as a convenient and refreshing way to incorporate probiotics into one's daily routine. Unlike traditional probiotic drinks that are dairy-based, or yogurt-based, probiotic waters are typically made by infusing water with specific strains of beneficial bacteria.

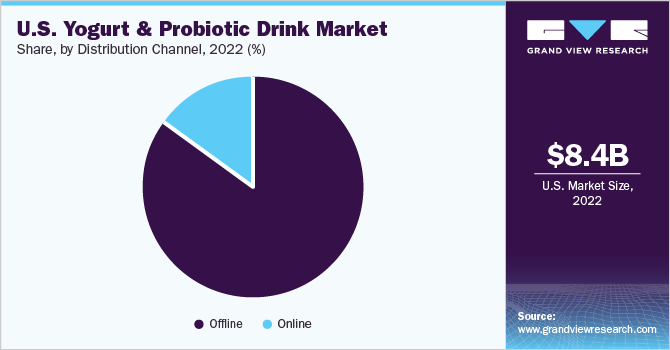

Distribution Channel Insights

The product sales through offline distribution channels accounted for the largest revenue share of 85.1% in 2022. Offline distribution channels, which include hypermarkets, supermarkets, and convenience stores, play an important role in product distribution in the U.S. These channels offer consumers the opportunity to compare products from different brands along with their prices, leading to a rational decision to purchase the product. Offline distribution channels provide consumers with the option of immediate purchase, eliminating the need to wait for delivery.

Offline channels also allow manufacturers to establish secure relationships, leading to long-term partnerships and increased brand recognition. The online distribution channel is expected to register the fastest CAGR of 12.2% from 2023 to 2030. Recent consumption patterns and shifting shopper sentiments indicate that the online segment is poised for robust growth. The emergence of online shopping and the benefits of at-home delivery have persuaded consumers to shop for yogurt and probiotic drinks through online portals.

Key Companies & Market Share Insights

Companies have been implementing various expansion strategies, such as mergers and acquisitions, capacity expansions, strengthening of online presence, and new product launches to gain a competitive advantage. For instance:

-

In November 2022, Chobani launched a contest to celebrate National Greek Yogurt Day. The company engaged its audience through the popular social media platform TikTok. The Flip Chief Flavor Taster contest was designed to encourage participation and creativity among TikTok users. It involved creating unique recipes, showcasing yogurt-based creations, or highlighting the benefits of Greek yogurt. The winner of the contest got a chance to visit Chobani’s facility at Twin Falls, Idaho, to try its new flavors of Greek yogurt

-

In September 2022, Nine of the LALA U.S. dairy products, including LALA Guava Yogurt Smoothie, with Probiotics were honored at the 2022 World Dairy Expo Championship Product Contest. This recognition bolstered LALA U.S.'s reputation, strengthened consumer trust, and potentially attracted new customers who value high-quality dairy products

-

In March 2022, GoodBelly introduced two distinct product lines: GoodBelly Immune Support and GoodBelly KIDS! GoodBelly KIDS! is the brand's only multi-serve probiotic beverage designed specifically for children. GoodBelly Immune Support line is formulated to enhance the immune system with specific ingredients that can support immune health

Some prominent players in the U.S. yogurt and probiotic drink market include:

-

Yakult Honsha Co. Ltd.

-

Chobani LLC

-

Danone

-

Grupo Lala

-

Califia Farms LLC

-

Bio K+ Kerry Company

-

Harmless Harvest

-

Goodbelly Probiotics

-

KeVita

-

Lifeway Foods Inc.

U.S. Yogurt And Probiotic Drink Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.12 billion

Revenue forecast in 2030

USD 16.48 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel

Country Scope

U.S.

Key companies profiled

Yakult Honsha Co. Ltd.; Chobani LLC; Danone; Grupo Lala; Califia Farms LLC; Bio K+ Kerry Company; Harmless Harvest; Goodbelly Probiotics; KeVita; Lifeway Foods Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Yogurt And Probiotic Drink Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. yogurt and probiotic drink market report based on product, type, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Yogurt Drink

-

Dairy-based

-

Vegan

-

-

Probiotic Drink

-

Vegan

-

Dairy-based

-

Water-based

-

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Yogurt Drink

-

With Probiotics

-

Without Probiotics

-

-

Probiotic Drink

-

Kefir

-

Water

-

Milk

-

Juice

-

Kombucha

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. yogurt and probiotic drink market size was estimated at USD 8.43 billion in 2022 and is expected to reach USD 9.12 billion in 2023.

b. The U.S. yogurt and probiotic drink market is expected to grow at a compounded growth rate of 8.7% from 2023 to 2030 to reach USD 16.48 billion by 2030.

b. Yogurt drink dominated the U.S. yogurt and probiotic drink market with a share of 71.6% in 2022. This is attributed to the increasing preference of consumer for healthier food products and enhanced nutrition,

b. Some key players operating in the U.S. yogurt and probiotic drink market include Yakult Honsha Co. Ltd., Chobani LLC, Danone, Grupo Lala, Califia Farms LLC, and KeVita

b. Key factors that are driving the market growth include increasing consumer awareness and understanding of the importance of maintaining a healthy gut.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.