Video Streaming Market Size, Share & Trends Analysis Report By Streaming Type, By Solution, By Platform, By Service, By Revenue Model, By Deployment Type, By User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-629-5

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

We value your investment and offer free customization with every report to fulfil your research needs.

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

- Home

- »

- Digital Media

- »

-

Video Streaming Market Size, Share & Growth Report, 2030GVR Report cover

![Video Streaming Market Size, Share & Trends Report]()

Video Streaming Market Size, Share & Trends Analysis Report By Streaming Type, By Solution, By Platform, By Service, By Revenue Model, By Deployment Type, By User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-629-5

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Video Streaming Market Size & Trends

The global video streaming market size was estimated at USD 106.83 billion in 2023 and is expected to grow at a CAGR of 21.5% from 2024 to 2030. Innovations such as blockchain technology and Artificial Intelligence (AI) are used to improve video quality. AI is playing an essential role in editing, cinematography, voice-overs, scriptwriting, and several other aspects of video production and upload. These innovations are anticipated to positively influence the market growth.

Many video streaming service providers use AI to enhance video content quality. These channels have recently become much more popular than mainstream media outlets like YouTube and Netflix. In May 2016, AI technology was implemented by Netflix to create a superior personalized experience for its subscribed consumers. This AI-empowered system automatically accomplished several machine learning pipelines, which offered shows/movies/program recommendations. Moreover, the market expansion is predicted to be fueled by the quick uptake of mobile phones due to the rising popularity of social media platforms and other digital channels for branding and marketing.

The growing adoption of cloud-based solutions to increase the reach of video content is positively influencing market growth. Majorly this trend is witnessed in the countries of Europe and North America. The ongoing innovations and technological advancements are expected to meet users’ expectations for exceptional video quality, performance, and security. For instance, in April 2019, Akamai Technologies spotlighted its initiatives and innovations in delivering digital experiences of high quality at the 2019 NAB Show (U.S.). The company showcased its advancement in live and on-demand media services such as cloud wrapper, direct connect, cloud interconnects, VPN & DNS proxy detection, and token authentication.

The rising adoption of digital media across various industries has resulted in the consumers’ inclination toward multiple streaming solutions and services. For instance, in November 2019, Apple Inc. entered the online video cascading industry by launching its TV+ service. In June 2019, a variety of expert services for video-related solutions providers was announced to launch by Wowza Media Systems, LLC. Furthermore, in April 2022, Google, the subsidiary of Alphabet Inc., unveiled CDN tools for streaming media.

A rise in technological advancements and service providers poses a threat to the standalone streaming giants in the video streaming market. The streaming television space seems to be the fastest-growing sector for TV service providers to grab revenue share from existing key players such as Netflix. For instance, in July 2019, AT&T Intellectual Property launched a new streaming service called AT&T TV to facilitate people watching television online. In April 2018, Amazon.com, Inc. partnered with Google to bring official YouTube applications to Amazon’s Fire TV. These complementary services for television and other entertainment content are anticipated to threaten the existing key players.

In the education and academic sector, videos can be effectively used in webinars and courses to enhance teaching and learning processes. Visual recordings have a powerful impact on students’ ability to retain information. Therefore, schools, universities, and colleges are now creating multimedia content and delivering it in the form of video presentations. Factors such as easy access to educational video content, growing demand for mobile devices, and increasing availability of the internet are positively influencing the adoption of live video streaming services for educational purposes.

The COVID-19 pandemic placed more than one-fourth of the world’s population under lockdown. As millions of individuals remained locked in their homes, online video streaming and entertainment services experienced a rise of around 10% in viewership during the lockdown. As a result, various video streaming platforms, such as YouTube, Amazon Prime Video, Netflix, and Disney+ registered a spike in viewership worldwide. For instance, in March 2020, a 50% increase was registered by Netflix in the number of new installations of its mobile application in Italy and more than 30% of that in Spain.

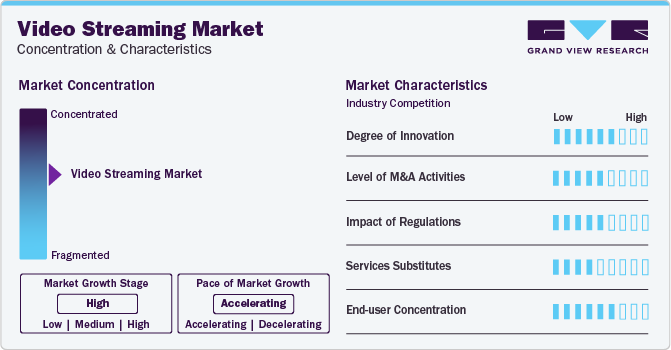

Market Concentration & Characteristics

In the video streaming domain, innovation flourishes due to rapid advancements in technology and growing demand for features such as 360-degree video streaming and virtual reality (VR). These technologies have transformed the way consumers consume and interact with video content, opening new opportunities for education, entertainment, and even virtual tourism. Moreover, innovative video streaming applications are constantly emerging, disrupting existing industries and creating new ones.

The video streaming industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the huge demand for streaming services, the requirement to access new video streaming services, and the need to stay competitive in a rapidly growing market.

In the video streaming service domain, the limited availability of substitutes at similar prices and offering the same benefits presents the challenge of high switching costs for consumers. The unavailability of external substitutes, scarce availability of limited internal substitutes, and high switching costs are expected to impact the global marketplace positively. This advanced technology does not have an external substitute.

Regulation significantly molds the market for video streaming by establishing ethical guidelines, data privacy standards, and compliance necessities. A host of states and municipalities are striving to extend franchise fees, which typically depend on cable and internet service providers, to streaming video companies. It is important to monitor policy and regulatory activities to ensure that the market is growing positively.

End-user concentration is crucial in this market, which is influenced by factors such as user preferences, content libraries, pricing and geographical availability. The high concentration is driven by barriers to the entry, and substantial investment in content creation.

Streaming Type Insights

The live streaming segment accounted for the largest revenue share in 2023, with 62.28%. The increased demand for digital media devices and the accessibility of quicker internet to view media content remotely are associated with the market growth. Other elements that enhance live video streaming include the utilization of a lot of content, ad-free content, mobile viewing, analytics tracking, and a huge potential audience.

Live content such as sports and musical events have preserved the high importance of live video streaming. However, non-linear streaming (video on demand) is expected to demonstrate significant growth in the coming years, owing to the convenience and series linking. Several other factors that fuel the growth of the non-linear streaming segment include watch-time feasibility, no buffering, large capacity, and live pause. Moreover, video-on-demand is expected to become mainstream in all age-group populations with both the streaming types.

Solution Insights

The OTT segment accounted for the largest revenue share of 43.19% in 2023. This is owing to the factor that OTT-based solutions offer film and TV content through internet without users’ subscription to traditional cable or pay-TV services. The segment is expected to witness notable growth over the forecast period, owing to the growing demand for enhanced automation of business practices and the full availability of broadband infrastructure. OTT’s emerging features such as hybrid monetization models, digital original content, and content fragmentation due to intensive competition are expected to propel the growth of OTT streaming solutions.

The pay-TV segment accounted for a notable revenue share in 2023, due to a significant rise in demand for pay-TV services in countries such as China, India, Mexico, and Brazil. Moreover, customers are opting for OTT services owing to the increased programming expenses in pay-TV or IPTV services. The growing availability of unlimited wireless data plans and public Wi-Fi has also increased the number of OTT service providers. For instance, Home Box Office, Inc. launched HBO Now, an online streaming platform, which enabled an online view of HBO shows without a cable subscription.

Platform Insights

The smartphones and tablets segment accounted for the largest revenue share of 31.1% in 2023. This can be attributed to the factors such as easy accessibility of the internet, increasing disposable income, better standard of living, and changing lifestyles. The smart TV segment, on the other hand, is expected to register significant growth over the forecast period, as smart TV offers a comprehensive option of TV channels along with video streaming services such as Netflix.

Smartphones/tablet streaming allows trouble-free live streaming owing to the abundance of reliable internet services. Owing to ease in remote access and portability, smartphones and tablets are more likely to be preferred for online content watching. However, the availability of several video streaming applications, such as Hulu, PlayStation Vue, DirectTV Now, YouTube TV and Sling TV has drawn the attention toward the smart TV segment. Moreover, applications such as PLEX to organize TV content are anticipated to propel the growth of this segment as they provide the ability to play any compatible media content on smart TV.

Service Insights

The training & support segment accounted for the largest revenue share of over 38% in 2023. The managed services segment, on the other hand, is estimated to have a significant market share, representing around 31% of the total market in 2023. Managed services help combine broadcast and OTT solutions in one online video management solution to provide a personalized experience to viewers. This advantage is anticipated to propel the growth of the segment.

Video managed services deliver highly evolved media services to the viewers, helping them achieve a better content quality with higher monetization. These services include localization & access services, digital packaging & fulfillment, creative video services, and compliance & metadata services, among others. Moreover, managed Services combine intelligent content distribution capabilities for third-party and direct OTT streaming service providers. As managed services helps manage and monetize a comprehensive OTT platform and streaming-related service, managed services are anticipated to grow at a significant rate over the forecast period.

Revenue Model Insights

The subscription segment accounted for the largest revenue share of 45.1% in 2023. This can be attributed to the increasing number of video streaming subscriptions worldwide. Moreover, the subscription model offers streaming of online videos with an access fee or a subscription. For instance, Netflix offers various monthly subscription plans or programs.

The advertising segment-based solutions operate on the hosting of advertisements. Advertising is one of the common forms of monetizing streaming videos where the revenues are generated from the advertisers. Since advertisers pay a massive amount for streaming their advertisements on on-demand streaming platforms, owing to the marketing requirements, the advertising segment accounts for a significant share of the market. However, subscription models have gained momentum owing to a wide variety of video content as well as original content offered by OTT providers such as Netflix Originals and Prime Originals.

Deployment Type Insights

The cloud segment accounted for the largest revenue share of more than 59% in 2023. The cloud computing developments have transformed video streaming and enabled the creation of platforms such as YouTube and Netflix for streaming purposes. The cloud segment in Asia Pacific is expected to register the highest CAGR from 2024 to 2030. In 2023, the segment acquired the largest market share in North America, attributed to the growth of cloud-based services in countries such as the U.S. and Canada.

Video streaming platforms have adopted cloud-based deployment to enable large bandwidth and enhanced speed. The capability of cloud-based deployment to handle more substantial data content along with providing a better viewing experience has promoted several streaming service providers to choose cloud-based deployment over on-premises. Moreover, cloud scaling helps in increasing the bandwidth and dealing with buffering and latency issues. Since most enterprises don’t have the networks and infrastructure capable of handling heavy traffic in online streaming, there is a huge demand for cloud-based deployment in the video streaming process.

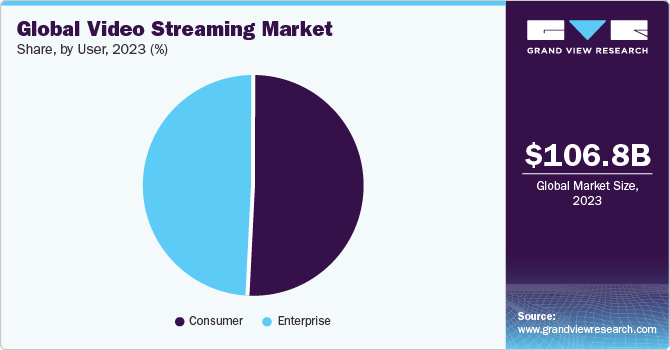

User Insights

The consumer segment accounted for the largest revenue share of nearly 50% in 2023. This is attributed to the rise in the viewership of video on demand and live streaming services from the media and entertainment sector. The consumer segment is anticipated to grow owing to the convenience offered by watching videos remotely. Emerging adoption of connected devices, especially smartphones, and mobile subscriptions are expected to contribute to the growth of the segment.

The enterprise segment is expected to grow at a CAGR of 22.1% over the forecast period. This growth is attributed to the increasing use of video streaming services by enterprises for training and consulting. Technological advancements such as captioning, superior video codec, indexing, web-based real-time transcoding, aggregation and, communication are expected to spur the demand for video streaming for enterprise users. Moreover, the technology improves the communication efficiency in an organization through measures such as on-demand video and flexibility in remote working conditions.

Regional Insights

The North America video streaming market accounted for the largest revenue share of 31.6% in 2023. This was majorly owing to the rapid growth of cloud-based streaming services. Streaming giants like Netflix, Disney+, and Amazon Prime Video compete fiercely for subscribers in North America with original content and diverse libraries.

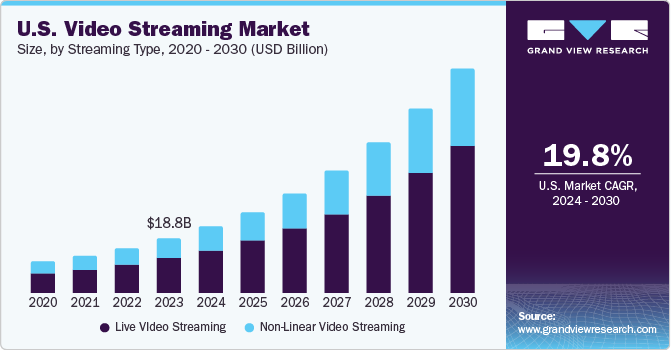

U.S. Video Streaming Market Trends

The video streaming market in the U.S. is evolving rapidly, with niche platforms rising, mobile viewing dominating, and ad-supported models gaining traction. As traditional giants push to keep up, this dynamic shift in the U.S. video streaming industry presents both opportunities and challenges. Niche platforms cater to specific audiences with hyper-focused content, creating loyal communities and fostering engagement. Mobile viewing, meanwhile, demands seamless user experiences and bite-sized content, prompting platforms to adapt their offerings.

Europe Video Streaming Market Trends

The video streaming market in Europe anticipates robust growth, during the forecast period, driven by its large and engaged online audience. Increasing disposable income and diverse content offerings, including locally produced originals, further fuel this expansion. Technological advancements, such as the widespread adoption of smartphones, enhance accessibility and convenience further.

The UK video streaming market anticipates steady growth from 2024 to 2030. Platforms even tailor their services to specific European or British markets, fostering a sense of local relevance and connection. While challenges exist in the form of competition and regulatory landscapes, the UK market presents promising future growth.

Asia Pacific Video Streaming Market Trends

The video streaming market in Asia Pacific is projected to demonstrate growth at the highest CAGR from 2024 to 2030, owing to the rapid technological advancements, increasing use of mobiles and tablets, and the popularity of online streaming. Also, Asia has expanded the monetization opportunities by offering video streaming multichannel services along with fixed-mobile packages, with the fastest growing broadband internet population operators in Southeast.

The China video streaming market dominated the Asia Pacific region in 2023. Over-the-top (OTT) solutions have transformed the way content consumption among viewers in the country. Established telecommunications companies and multichannel operatives have keenly pursued business innovation and advancement employing cutting-edge marketing strategies like video streaming.

Key Video Streaming Company Insights

Key video streaming companies include The Walt Disney Company; Netflix Inc.; Amazon Inc.; and Google LLC. The vendors focus on increasing the customer base to gain a competitive edge. They also focus on strategic initiatives such as collaborations, mergers & acquisitions, and partnerships.

Key Video Streaming Companies:

The following are the leading companies in the video streaming market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Amazon Web Services, Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- Kaltura, Inc.

- Netflix, Inc.

- International Business Machine Corporation (IBM Cloud Video)

- Wowza Media Systems, LLC

- Hulu, LLC

Recent Developments

-

In March 2023, Brightcove, Inc., a U.S.-based internet company, announced integrations with Instagram, Shopify, and Salesforce Sales Cloud to their video cloud platform. This integration aims to enable companies to reach, capture, and activate audiences with interactive, immersive, and live and on-demand video content.

-

In March 2023, IBM Watson Media, an American virtual events platform company, announced some event registration features integrated into IBM Enterprise Video Streaming. This enterprise video streaming registration form feature aims to enable customers to manage events more efficiently.

-

In December 2022, Vbrick, a U.S.-based Enterprise Video Platform provider, acquired Ramp Holdings, a U.S.-based enterprise content delivery network (eCDN) provider. This collaboration integrates the best features of eCDN market into multicast solutions and edge caching.

Video Streaming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 129.26 billion

Revenue forecast in 2030

USD 416.84 billion

Growth rate

CAGR of 21.5% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Streaming type, solution, platform, service, revenue model, deployment type, user, region

Region scope

North America, Europe, Asia Pacific, South America, Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Akamai Technologies; Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Streaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global video streamingmarket report based on streaming type, solution, platform, service, revenue model, deployment type, user, and region:

-

Streaming Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Live Video Streaming

-

Non-Linear Video Streaming (Video on Demand)

-

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Internet Protocol TV

-

Over-the-Top (OTT)

-

Pay-TV

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gaming Consoles

-

Laptops & Desktops

-

Smartphones & Tablets

-

Smart TV

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consulting

-

Managed Services

-

Training & Support

-

-

Revenue Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Advertising

-

Rental

-

Subscription

-

-

Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprise

-

Corporate Communications

-

Knowledge Sharing & Collaborations

-

Marketing & Client Engagement

-

Training & Development

-

-

Consumer

-

Real-Time Entertainment

-

Web Browsing & Advertising

-

Gaming

-

Social Networking

-

E-Learning

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the video streaming market growth include extensive growth of online video streaming and the rising demand for on-demand streaming and the growing demand for high-speed internet connectivity.

b. The global video streaming market size was estimated at USD 106.83 billion in 2023 and is expected to reach USD 129.26 billion in 2024.

b. The global video streaming market is expected to grow at a compound annual growth rate of 21.5% from 2024 to 2030 to reach USD 416.84 billion by 2030.

b. North America dominated the video streaming market with a share of 31.6 % in 2023. This is attributable to the increasing use of mobiles and tablets, rapid technological advancements, and the popularity of online streaming.

b. Some key players operating in the video streaming market include Akamai Technologies; Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google; Kaltura, Inc.; Netflix, Inc; Wowza Media Systems, LLC; AT&T Intellectual Property; and Hulu.

Table of Contents

Chapter 1 Video Streaming Market: Methodology and Scope

1.1 Information Procurement and Research Scope

1.2 Information Analysis

1.3 Market Formulation & Data Visualization

1.4 Market Scope and Assumptions

1.4.1 Secondary Sources

1.4.2 Primary Sources

Chapter 2 Video Streaming Market: Executive Summary

2.1 Market Outlook

2.2 Global

2.2.1 Global Video Streaming Market, 2017 - 2030

2.2.2 Global Video Streaming Market, by Region, 2017 - 2030

2.2.3 Global Video Streaming Market, by Streaming Type, 2017 - 2030

2.2.4 Global Video Streaming Market, by Solution, 2017 - 2030

2.2.5 Global Video Streaming Market, by Platform, 2017 - 2030

2.2.6 Global Video Streaming Market, by Service, 2017 - 2030

2.2.7 Global Video Streaming Market, by Revenue Model, 2017 - 2030

2.2.8 Global Video Streaming Market, by Deployment Type, 2017 - 2030

2.2.9 Global Video Streaming Market, by User, 2017 - 2030

2.2.9.1 Global Enterprise Video Streaming Market, by Application, 2017 - 2030

2.2.9.2 Global Consumer Video Streaming Market, by Application, 2017 - 2030

2.3 Segmental Trends

Chapter 3 Video Streaming Market: Variables, Trends & Scope

3.1 Market Segmentation & Scope

3.2 Video Streaming - Value Chain Analysis

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.1.1 Extensive Growth of Online Video Streaming and the Rising Demand for On-Demand Streaming

3.3.1.2 Growing Demand for High-Speed Internet Connectivity

3.3.1.3 Increasing Usage of Videos in Corporate Training

3.3.2 Market Restraints

3.3.2.1 High Cost of Content Creation

3.3.2.2 Network Connectivity and Technical Difficulties Involved in Video Streaming

3.3.3 Market Opportunities

3.3.3.1 Impact of Video Streaming in the Education Sector

3.3.3.2 Use of Artificial Intelligence in Video Streaming

3.3.3.3 Implementation of Blockchain in Video Streaming

3.4 Industry Analysis - Porter’s

3.4.1 Supplier Power: Low

3.4.2 Buyer Power: Moderate

3.4.3 Substitution Threat: Low

3.4.4 Threat From New Entrant: Low

3.4.5 Competitive Rivalry: High

3.5 Key Opportunities - Prioritized

3.6 Video Streaming Market - Key Company Analysis

3.6.1 Key Company Analysis

3.6.2 List of Key Market companies

3.7 Video Streaming - PEST Analysis

3.7.1 Political

3.7.2 Economic

3.7.3 Social

3.7.4 Technological

Chapter 4 Video Streaming: Streaming Type Outlook

4.1 Video Streaming Market Share by Streaming Type, 2023 & 2030

4.2 Live Video Streaming

4.2.1 Live Video Streaming Market, by Region, 2017 - 2030

4.3 Non-Linear Video Streaming (Video on Demand)

4.3.1 Non-Linear Video Streaming Market, by Region, 2017 - 2030

Chapter 5 Video Streaming: Solution Outlook

5.1 Video Streaming Market Share by Solution, 2023 & 2030

5.3 Internet Protocol TV

5.3.1 Internet Protocol TV Video Streaming Market, by Region, 2017 - 2030

5.4 Over-the-Top (OTT)

5.4.1 Over-The-Top (Ott) Video Streaming Market, by Region, 2017 - 2030

5.5 Pay-TV

5.5.1 Pay-TV Video Streaming Market, by Region, 2017 - 2030

Chapter 6 Video Streaming: Platform Outlook

6.1 Video Streaming Market Share by Platform, 2023 & 2030

6.1.1 Gaming Consoles

6.1.1.1 Gaming Consoles Video Streaming Market, bY Region, 2017 - 2030

6.1.2 Laptops & Desktops

6.1.2.1 Laptops & Desktops Video Streaming Market, bY Region, 2017 - 2030

6.1.3 Smartphones & Tablets

6.1.3.1 Smartphones & Tablets Video Streaming Market, bY Region, 2017 - 2030

6.1.4 Smart TV

6.1.4.1 Smart TV Video Streaming Market, by Region, 2017 - 2030

Chapter 7 Video Streaming: Service Outlook

7.1 Video Streaming Market Share by Service, 2023 & 2030

7.2 Consulting

7.2.1 Consulting Video Streaming Market, by Region, 2017 - 2030

7.3 Managed Services

7.3.1 Managed Services Video Streaming Market, by Region, 2017 - 2030

7.4 Training & Support

7.4.1 Training & Support Video Streaming Market, by Region, 2017 - 2030

Chapter 8 Video Streaming: Revenue Model Outlook

8.1 Video Streaming Market Share by Revenue Model, 2023 & 2030

8.2 Advertising

8.2.1 Advertising Video Streaming Market, by Region, 2017 - 2030

8.3 Rental

8.3.1 Rental Video Streaming Market, by Region, 2017 - 2030

8.4 Subscription

8.4.1 Subscription Video Streaming Market, by Region, 2017 - 2030

Chapter 9 Video Streaming: Deployment Type Outlook

9.1 Video Streaming Market Share by Deployment Type, 2023 & 2030

9.2 Cloud

9.2.1 Cloud Video Streaming Market, by Region, 2017 - 2030

9.3 On-Premises

9.3.1 On-Premises Video Streaming Market, by Region, 2017 - 2030

Chapter 10 Video Streaming: User Outlook

10.1 Video Streaming Market Share by User, 2023 & 2030

10.2 Enterprise Video Streaming

10.2.1 Enterprise Video Streaming Market, by Region, 2017 - 2030

10.3 Consumer Video Streaming

10.3.1 Consumer Video Streaming Market, by Region, 2017 - 2030

Chapter 11 Video streaming: Regional Outlook

11.1 North America

11.1.1 North America Video Streaming Market, by Streaming Type, 2017 - 2030

11.1.2 North America Video Streaming Market, by Solution, 2017 - 2030

11.1.3 North America Video Streaming Market, by Platform, 2017 - 2030

11.1.4 North America Video Streaming Market, by Service, 2017 - 2030

11.1.5 North America Video Streaming Market, by Revenue Model, 2017 - 2030

11.1.6 North America Video Streaming Market, by Deployment Type, 2017 - 2030

11.1.7 North America Video Streaming Market, by User, 2017 - 2030

11.1.7.1 North America Enterprise Video Streaming Market, by Application, 2017 - 2030

11.1.7.2 North America Consumer Video Streaming Market, by Application, 2017 - 2030

11.1.8 U.S.

11.1.8.1 U.S. Video Streaming Market, by Streaming Type, 2017 - 2030

11.1.8.2 U.S. Video Streaming Market, by Solution, 2017 - 2030

11.1.8.3 U.S. Video Streaming Market, by Platform, 2017 - 2030

11.1.8.4 U.S. Video Streaming Market, by Service, 2017 - 2030

11.1.8.5 U.S. Video Streaming Market, by Revenue Model, 2017 - 2030

11.1.8.6 U.S. Video Streaming Market, by Deployment Type, 2017 - 2030

11.1.8.7 U.S. Video Streaming Market, by User, 2017 - 2030

11.1.8.7.1 U.S. Enterprise Video Streaming Market, by Application, 2017 - 2030

11.1.8.7.2 U.S. Consumer Video Streaming Market, by Application, 2017 - 2030

11.1.9 Canada

11.1.9.1 Canada Video Streaming Market, by Streaming Type, 2017 - 2030

11.1.9.2 Canada Video Streaming Market, by Solution, 2017 - 2030

11.1.9.3 Canada Video Streaming Market, by Platform, 2017 - 2030

11.1.9.4 Canada Video Streaming Market, by Service, 2017 - 2030

11.1.9.5 Canada Video Streaming Market, by Revenue Model, 2017 - 2030

11.1.9.6 Canada Video Streaming Market, by Deployment Type, 2017 - 2030

11.1.9.7 Canada Video Streaming Market, by User, 2017 - 2030

11.1.9.7.1 Canada Enterprise Video Streaming Market, by Application, 2017 - 2030

11.1.9.7.2 Canada Consumer Video Streaming Market, by Application, 2017 - 2030

11.2 Europe

11.2.1 Europe Video Streaming Market, by Streaming Type, 2017 - 2030

11.2.2 Europe Video Streaming Market, by Solution, 2017 - 2030

11.2.3 Europe Video Streaming Market, by Platform, 2017 - 2030

11.2.4 Europe Video Streaming Market, by Service, 2017 - 2030

11.2.5 Europe Video Streaming Market, by Revenue Model, 2017 - 2030

11.2.6 Europe Video Streaming Market, by Deployment Type, 2017 - 2030

11.2.7 Europe Video Streaming Market, by User, 2017 - 2030

11.2.7.1 Europe Enterprise Video Streaming Market, by Application, 2017 - 2030

11.2.7.2 Europe Consumer Video Streaming Market, by Application, 2017 - 2030

11.2.8 Germany

11.2.8.1 Germany Video Streaming Market, by Streaming Type, 2017 - 2030

11.2.8.2 Germany Video Streaming Market, by Solution, 2017 - 2030

11.2.8.3 Germany Video Streaming Market, by Platform, 2017 - 2030

11.2.8.4 Germany Video Streaming Market, by Service, 2017 - 2030

11.2.8.5 Germany Video Streaming Market, by Revenue Model, 2017 - 2030

11.2.8.6 Germany Video Streaming Market, by Deployment Type, 2017 - 2030

11.2.8.7 Germany Video Streaming Market, by User, 2017 - 2030

11.2.8.7.1 Germany Enterprise Video Streaming Market, by Application, 2017 - 2030

11.2.8.7.2 Germany Consumer Video Streaming Market, by Application, 2017 - 2030

11.2.9 UK

11.2.9.1 UK Video Streaming Market, by Streaming Type, 2017 - 2030

11.2.9.2 UK Video Streaming Market, by Solution, 2017 - 2030

11.2.9.3 UK Video Streaming Market, by Platform, 2017 - 2030

11.2.9.4 UK Video Streaming Market, by Service, 2017 - 2030

11.2.9.5 UK Video Streaming Market, by Revenue Model, 2017 - 2030

11.2.9.6 UK Video Streaming Market, by Deployment Type, 2017 - 2030

11.2.9.7 UK Video Streaming Market, by User, 2017 - 2030

11.2.9.7.1 UK Enterprise Video Streaming Market, by Application, 2017 - 2030

11.2.9.7.2 UK Consumer Video Streaming Market, by Application, 2017 - 2030

11.2.10 France

11.2.10.1 France Video Streaming Market, by Streaming Type, 2017 - 2030

11.2.10.2 France Video Streaming Market, by Solution, 2017 - 2030

11.2.10.3 France Video Streaming Market, by Platform, 2017 - 2030

11.2.10.4 France Video Streaming Market, by Service, 2017 - 2030

11.2.10.5 France Video Streaming Market, by Revenue Model, 2017 - 2030

11.2.10.6 France Video Streaming Market, by Deployment Type, 2017 - 2030

11.2.10.7 France Video Streaming Market, by User, 2017 - 2030

11.2.10.7.1 France Enterprise Video Streaming Market, by Application, 2017 - 2030

11.2.10.7.2 France Consumer Video Streaming Market, by Application, 2017 - 2030

11.3 Asia Pacific

11.3.1 Asia Pacific Video Streaming Market, by Streaming Type, 2017 - 2030

11.3.2 Asia Pacific Video Streaming Market, by Solution, 2017 - 2030

11.3.3 Asia Pacific Video Streaming Market, by Platform, 2017 - 2030

11.3.4 Asia Pacific Video Streaming Market, by Service, 2017 - 2030

11.3.5 Asia Pacific Video Streaming Market, by Revenue Model, 2017 - 2030

11.3.6 Asia Pacific Video Streaming Market, by Deployment Type, 2017 - 2030

11.3.7 Asia Pacific Video Streaming Market, by User, 2017 - 2030

11.3.7.1 Asia Pacific Enterprise Video Streaming Market, by Application, 2017 - 2030

11.3.7.2 Asia Pacific Consumer Video Streaming Market, by Application, 2017 - 2030

11.3.8 China

11.3.8.1 China Video Streaming Market, by Streaming Type, 2017 - 2030

11.3.8.2 China Video Streaming Market, by Solution, 2017 - 2030

11.3.8.3 China Video Streaming Market, by Platform, 2017 - 2030

11.3.8.4 China Video Streaming Market, by Service, 2017 - 2030

11.3.8.5 China Video Streaming Market, by Revenue Model, 2017 - 2030

11.3.8.6 China Video Streaming Market, by Deployment Type, 2017 - 2030

11.3.8.7 China Video Streaming Market, by User, 2017 - 2030

11.3.8.7.1 China Enterprise Video Streaming Market, by Application, 2017 - 2030

11.3.8.7.2 China Consumer Video Streaming Market, by Application, 2017 - 2030

11.3.9 Japan

11.3.9.1 Japan Video Streaming Market, by Streaming Type, 2017 - 2030

11.3.9.2 Japan Video Streaming Market, by Solution, 2017 - 2030

11.3.9.3 Japan Video Streaming Market, by Platform, 2017 - 2030

11.3.9.4 Japan Video Streaming Market, by Service, 2017 - 2030

11.3.9.5 Japan Video Streaming Market, by Revenue Model, 2017 - 2030

11.3.9.6 Japan Video Streaming Market, by Deployment Type, 2017 - 2030

11.3.9.7 Japan Video Streaming Market, by User, 2017 - 2030

11.3.9.7.1 Japan Enterprise Video Streaming Market, by Application, 2017 - 2030

11.3.9.7.2 Japan Consumer Video Streaming Market, by Application, 2017 - 2030

11.3.10 India

11.3.10.1 India Video Streaming Market, by Streaming Type, 2017 - 2030

11.3.10.2 India Video Streaming Market, by Solution, 2017 - 2030

11.3.10.3 India Video Streaming Market, by Platform, 2017 - 2030

11.3.10.4 India Video Streaming Market, by Service, 2017 - 2030

11.3.10.5 India Video Streaming Market, by Revenue Model, 2017 - 2030

11.3.10.6 India Video Streaming Market, by Deployment Type, 2017 - 2030

11.3.10.7 India Video Streaming Market, by User, 2017 - 2030

11.3.10.7.1 India Enterprise Video Streaming Market, by Application, 2017 - 2030

11.3.10.7.2 India Consumer Video Streaming Market, by Application, 2017 - 2030

11.3.11 South Korea

11.3.11.1 South Korea Video Streaming Market, by Streaming Type, 2017 - 2030

11.3.11.2 South Korea Video Streaming Market, by Solution, 2017 - 2030

11.3.11.3 South Korea Video Streaming Market, by Platform, 2017 - 2030

11.3.11.4 South Korea Video Streaming Market, by Service, 2017 - 2030

11.3.11.5 South Korea Video Streaming Market, by Revenue Model, 2017 - 2030

11.3.11.6 South Korea Video Streaming Market, by Deployment Type, 2017 - 2030

11.3.11.7 South Korea Video Streaming Market, by User, 2017 - 2030

11.3.11.7.1 South Korea Enterprise Video Streaming Market, by Application, 2017 - 2030

11.3.11.7.2 South Korea Consumer Video Streaming Market, by Application, 2017 - 2030

11.3.12 Australia

11.3.12.1 Australia Video Streaming Market, by Streaming Type, 2017 - 2030

11.3.12.2 Australia Video Streaming Market, by Solution, 2017 - 2030

11.3.12.3 Australia Video Streaming Market, by Platform, 2017 - 2030

11.3.12.4 Australia Video Streaming Market, by Service, 2017 - 2030

11.3.12.5 Australia Video Streaming Market, by Revenue Model, 2017 - 2030

11.3.12.6 Australia Video Streaming Market, by Deployment Type, 2017 - 2030

11.3.12.7 Australia Video Streaming Market, by User, 2017 - 2030

11.3.12.7.1 Australia Enterprise Video Streaming Market, by Application, 2017 - 2030

11.3.12.7.2 Australia Consumer Video Streaming Market, by Application, 2017 - 2030

11.4 South America

11.4.1 South America Video Streaming Market, by Streaming Type, 2017 - 2030

11.4.2 South America Video Streaming Market, by Solution, 2017 - 2030

11.4.3 South America Video Streaming Market, by Platform, 2017 - 2030

11.4.4 South America Video Streaming Market, by Service, 2017 - 2030

11.4.5 South America Video Streaming Market, by Revenue Model, 2017 - 2030

11.4.6 South America Video Streaming Market, by Deployment Type, 2017 - 2030

11.4.7 South America Video Streaming Market, by User, 2017 - 2030

11.4.7.1 South America Enterprise Video Streaming Market, by Application, 2017 - 2030

11.4.7.2 South America Consumer Video Streaming Market, by Application, 2017 - 2030

11.4.8 Brazil

11.4.8.1 Brazil Video Streaming Market, by Streaming Type, 2017 - 2030

11.4.8.2 Brazil Video Streaming Market, by Solution, 2017 - 2030

11.4.8.3 Brazil Video Streaming Market, by Platform, 2017 - 2030

11.4.8.4 Brazil Video Streaming Market, by Service, 2017 - 2030

11.4.8.5 Brazil Video Streaming Market, by Revenue Model, 2017 - 2030

11.4.8.6 Brazil Video Streaming Market, by Deployment Type, 2017 - 2030

11.4.8.7 Brazil Video Streaming Market, by User, 2017 - 2030

11.4.8.7.1 Brazil Enterprise Video Streaming Market, by Application, 2017 - 2030

11.4.8.7.2 Brazil Consumer Video Streaming Market, by Application, 2017 - 2030

11.4.9 Mexico

11.1.9.1 Mexico Video Streaming Market, by Streaming Type, 2017 - 2030

11.1.9.2 Mexico Video Streaming Market, by Solution, 2017 - 2030

11.1.9.3 Mexico Video Streaming Market, by Platform, 2017 - 2030

11.1.9.4 Mexico Video Streaming Market, by Service, 2017 - 2030

11.1.9.5 Mexico Video Streaming Market, by Revenue Model, 2017 - 2030

11.1.9.6 Mexico Video Streaming Market, by Deployment Type, 2017 - 2030

11.1.9.7 Mexico Video Streaming Market, by User, 2017 - 2030

11.1.9.7.1 Mexico Enterprise Video Streaming Market, by Application, 2017 - 2030

11.1.9.7.2 Mexico Consumer Video Streaming Market, by Application, 2017 - 2030

11.5 MEA

11.5.1 MEA Video Streaming Market, by Streaming Type, 2017 - 2030

11.5.2 MEA Video Streaming Market, by Solution, 2017 - 2030

11.5.3 MEA Video Streaming Market, by Platform, 2017 - 2030

11.5.4 MEA Video Streaming Market, by Service, 2017 - 2030

11.5.5 MEA Video Streaming Market, by Revenue Model, 2017 - 2030

11.5.6 MEA Video Streaming Market, by Deployment Type, 2017 - 2030

11.5.7 MEA Video Streaming Market, by User, 2017 - 2030

11.5.7.1 MEA Enterprise Video Streaming Market, by Application, 2017 - 2030

11.5.7.2 MEA Consumer Video Streaming Market, by Application, 2017 - 2030

11.5.8 Kingdom of Saudi Arabia

11.5.8.1 Kingdom of Saudi Arabia Video Streaming Market, by Streaming Type, 2017 - 2030

11.5.8.2 Kingdom of Saudi Arabia Video Streaming Market, by Solution, 2017 - 2030

11.5.8.3 Kingdom of Saudi Arabia Video Streaming Market, by Platform, 2017 - 2030

11.5.8.4 Kingdom of Saudi Arabia Video Streaming Market, by Service, 2017 - 2030

11.5.8.5 Kingdom of Saudi Arabia Video Streaming Market, by Revenue Model, 2017 - 2030

11.5.8.6 Kingdom of Saudi Arabia Video Streaming Market, by Deployment Type, 2017 - 2030

11.5.8.7 Kingdom of Saudi Arabia Video Streaming Market, by User, 2017 - 2030

11.5.8.1 Kingdom of Saudi Arabia Enterprise Video Streaming Market, by Application, 2017 - 2030

11.5.8.2 Kingdom of Saudi Arabia Consumer Video Streaming Market, by Application, 2017 - 2030

11.5.9 UAE

11.5.9.1 UAE Video Streaming Market, by Streaming Type, 2017 - 2030

11.5.9.2 UAE Video Streaming Market, by Solution, 2017 - 2030

11.5.9.3 UAE Video Streaming Market, by Platform, 2017 - 2030

11.5.9.4 UAE Video Streaming Market, by Service, 2017 - 2030

11.5.9.5 UAE Video Streaming Market, by Revenue Model, 2017 - 2030

11.5.9.6 UAE Video Streaming Market, by Deployment Type, 2017 - 2030

11.5.9.7 UAE Video Streaming Market, by User, 2017 - 2030

11.5.9.1 UAE Enterprise Video Streaming Market, by Application, 2017 - 2030

11.5.9.2 UAE Consumer Video Streaming Market, by Application, 2017 - 2030

11.5.10 South Africa

11.5.10.1 South Africa Video Streaming Market, by Streaming Type, 2017 - 2030

11.5.10.2 South Africa Video Streaming Market, by Solution, 2017 - 2030

11.5.10.3 South Africa Video Streaming Market, by Platform, 2017 - 2030

11.5.10.4 South Africa Video Streaming Market, by Service, 2017 - 2030

11.5.10.5 South Africa Video Streaming Market, by Revenue Model, 2017 - 2030

11.5.10.6 South Africa Video Streaming Market, by Deployment Type, 2017 - 2030

11.5.10.7 South Africa Video Streaming Market, by User, 2017 - 2030

11.5.10.1 South Africa Enterprise Video Streaming Market, by Application, 2017 - 2030

11.5.10.2 South Africa Consumer Video Streaming Market, by Application, 2017 - 2030

Chapter 12 Competitive Landscape

12.1 Akamai Technologies

12.1.1 Company Overview

12.1.2 Financial Performance

12.1.3 Product Benchmarking

12.1.4 Recent Developments

12.2 Amazon Web Services, Inc.

12.2.1 Company Overview

12.2.2 Financial Performance

12.2.3 Product Benchmarking

12.2.4 Recent Developments

12.3 Google LLC

12.3.1 Company Overview

12.3.2 Financial Performance

12.3.3 Product Benchmarking

12.3.5 Recent Developments

12.4 Microsoft Corporation

12.4.1 Company Overview

12.4.2 Financial Performance

12.4.3 Product Benchmarking

12.4.4 Recent Developments

12.5 Netflix

12.5.1 Company Overview

12.5.2 Financial Performance

12.5.3 Product Benchmarking

12.5.4 Recent Developments

12.6 Tencent

12.6.1 Company Overview

12.6.2 Financial Performance

12.6.3 Product Benchmarking

12.6.4 Recent Developments

12.7 iQIYI, Inc.

12.7.1 Company Overview

12.7.2 Financial Performance

12.7.3 Product Benchmarking

12.7.4 Recent Developments

12.8 Novi Digital Entertainment Pvt Ltd. (Hotstar)

12.8.1 Company Overview

12.8.2 Product Benchmarking

12.8.3 Recent Developments

12.9 iflix

12.9.1 Company Overview

12.9.2 Product Benchmarking

12.9.3 Recent Developments

12.10 HOOQ

12.10.1 Company Overview

12.10.2 Product Benchmarking

12.10.3 Recent Developments

12.11 Rakuten Viki

12.11.1 Company Overview

12.11.2 Product Benchmarking

12.11.3 Recent Developments

List of Tables

Table 1 Video Streaming Market - Industry Snapshot & Key Buying Criteria, 2017 - 2030

Table 2 Global Video Streaming Market, 2017 - 2030 (USD Billion)

Table 3 Global Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 4 Global Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 5 Global Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 6 Global Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 7 Global Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 8 Global Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 9 Global Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 10 Global Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 11 Global Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 12 Global Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 13 Key Market Driver Impact

Table 14 Key Market Restraint Impact

Table 15 Key Market Opportunity Impact

Table 16 List of Key Market Players

Table 17 Live Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 18 Non-Linear Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 19 Internet Protocol TV Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 20 Over-the-Top (OTT) Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 21 Pay-TV Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 22 Gaming Consoles Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 23 Laptops & Desktops Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 24 Smartphones & Tablets Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 25 Smart TV Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 26 Consulting Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 27 Managed Services Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 28 Training & Support Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 29 Advertising Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 30 Rental Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 31 Subscription Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 32 Cloud Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 33 On-Premises Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 34 Enterprise Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 35 Consumer Video Streaming Market, by Region, 2017 - 2030 (USD Billion)

Table 36 North America Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 37 North America Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 38 North America Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 39 North America Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 40 North America Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 41 North America Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 42 North America Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 43 North America Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 44 North America Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 45 U.S. Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 46 U.S. Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 47 U.S. Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 48 U.S. Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 49 U.S. Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 50 U.S. Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 51 U.S. Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 52 U.S. Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 53 U.S. Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 54 Canada Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 55 Canada Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 56 Canada Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 57 Canada Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 58 Canada Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 59 Canada Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 60 Canada Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 61 Canada Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 62 Canada Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 63 Mexico Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 64 Mexico Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 65 Mexico Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 66 Mexico Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 67 Mexico Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 68 Mexico Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 69 Mexico Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 70 Mexico Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 71 Mexico Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 72 Europe Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 73 Europe Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 74 Europe Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 75 Europe Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 76 Europe Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 77 Europe Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 78 Europe Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 79 Europe Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 80 Europe Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 81 Germany Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 82 Germany Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 83 Germany Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 84 Germany Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 85 Germany Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 86 Germany Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 87 Germany Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 88 Germany Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 89 Germany Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 90 UK Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 91 UK Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 92 UK Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 93 UK Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 94 UK Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 95 UK Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 96 UK Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 97 UK Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 98 UK Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 99 France Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 100 France Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 101 France Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 102 France Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 103 France Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 104 France Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 105 France Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 106 France Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 107 France Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 108 Asia Pacific Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 109 Asia Pacific Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 110 Asia Pacific Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 111 Asia Pacific Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 112 Asia Pacific Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 113 Asia Pacific Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 114 Asia Pacific Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 115 Asia Pacific Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 116 Asia Pacific Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 117 China Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 118 China Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 119 China Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 120 China Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 121 China Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 122 China Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 123 China Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 124 China Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 125 China Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 126 Japan Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 127 Japan Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 128 Japan Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 129 Japan Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 130 Japan Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 131 Japan Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 132 Japan Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 133 Japan Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 134 Japan Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 135 India Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 136 India Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 137 India Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 138 India Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 139 India Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 140 India Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 141 India Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 142 India Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 143 India Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 144 Australia Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 145 Australia Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 146 Australia Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 147 Australia Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 148 Australia Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 149 Australia Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 150 Australia Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 151 Australia Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 152 Australia Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 153 Australia Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 154 Australia Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 155 Australia Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 156 Australia Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 157 Australia Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 158 Australia Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 159 Australia Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 160 Australia Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 161 Australia Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 162 South America Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 163 South America Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 164 South America Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 165 South America Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 166 South America Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 167 South America Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 168 South America Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 169 South America Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 170 South America Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 171 Brazil Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 172 Brazil Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 173 Brazil Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 174 Brazil Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 175 Brazil Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 176 Brazil Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 177 Brazil Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 178 Brazil Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 179 Brazil Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 180 Mexico Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 181 Mexico Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 182 Mexico Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 183 Mexico Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 184 Mexico Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 185 Mexico Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 186 Mexico Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 187 Mexico Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 188 Mexico Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 189 MEA Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 190 MEA Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 191 MEA Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 192 MEA Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 193 MEA Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 194 MEA Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 195 MEA Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 196 MEA Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 197 MEA Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 198 Kingdom of Saudi Arabia Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 199 Kingdom of Saudi Arabia Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 200 Kingdom of Saudi Arabia Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 201 Kingdom of Saudi Arabia Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 202 Kingdom of Saudi Arabia Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 203 Kingdom of Saudi Arabia Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 204 Kingdom of Saudi Arabia Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 205 Kingdom of Saudi Arabia Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 206 Kingdom of Saudi Arabia Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 207 UAE Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 208 UAE Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 209 UAE Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 210 UAE Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 211 UAE Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 212 UAE Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 213 UAE Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 214 UAE Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 215 UAE Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 216 South Africa Video Streaming Market, by Streaming Type, 2017 - 2030 (USD Billion)

Table 217 South Africa Video Streaming Market, by Solution, 2017 - 2030 (USD Billion)

Table 218 South Africa Video Streaming Market, by Platform, 2017 - 2030 (USD Billion)

Table 219 South Africa Video Streaming Market, by Service, 2017 - 2030 (USD Billion)

Table 220 South Africa Video Streaming Market, by Revenue Model, 2017 - 2030 (USD Billion)

Table 221 South Africa Video Streaming Market, by Deployment Type, 2017 - 2030 (USD Billion)

Table 222 South Africa Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 223 South Africa Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 224 South Africa Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 225 South Africa Video Streaming Market, by User, 2017 - 2030 (USD Billion)

Table 226 South Africa Enterprise Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

Table 227 South Africa Consumer Video Streaming Market, by Application, 2017 - 2030 (USD Billion)

List of Figures

Fig. 1 Research Process

Fig. 2 Market Formulation

Fig. 3 Market Segmentation and Scope

Fig. 4 Video Streaming Market, 2017 - 2030

Fig. 5 Key Opportunities Analysis

Fig. 6 Video Streaming - Value Chain Analysis

Fig. 7 Video Streaming Market Dynamics

Fig. 8 Industry Analysis - Porter’s Five Forces Analysis

Fig. 9 Video Streaming - Pest Analysis

Fig. 10 Video Streaming Market Share by Streaming Type, 2023 & 2030

Fig. 11 Video Streaming Market Share by Solution, 2023 & 2030

Fig. 12 Video Streaming Market Share by Platform, 2023 & 2030

Fig. 13 Video Streaming Market Share by Service, 2023 & 2030

Fig. 14 Video Streaming Market Share by Revenue Model, 2023 & 2030

Fig. 15 Video Streaming Market Share by Deployment Type, 2023 & 2030

Fig. 16 Video Streaming Market Share by User, 2023 & 2030

Fig. 17 Video Streaming Market Share by Region, 2023 & 2030

Fig. 18 North America Marketplace: Key Takeaways

Fig. 19 Europe Marketplace: Key Takeaways

Fig. 20 Asia Pacific Marketplace: Key Takeaways

Fig. 21 South America Marketplace: Key Takeaways

Fig. 22 MEA Marketplace: Key TakeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Video Streaming Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Live Video Streaming

- Non-Linear Video Streaming

- Video Streaming Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- Video Streaming Platform Outlook (Revenue, USD Billion, 2017 - 2030)

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- Video Streaming Service Industry Outlook (Revenue, USD Billion, 2017 - 2030)

- Consulting

- Managed Services

- Training & Support

- Video Streaming Revenue Model Outlook (Revenue, USD Billion, 2017 - 2030)

- Advertising

- Rental

- Subscription

- Video Streaming Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Cloud

- On-Premises

- Video Streaming User Outlook (Revenue, USD Billion, 2017 - 2030)

- Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Enterprise

- Video Streaming Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- North America Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- North America Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- North America Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- North America Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- North America Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- North America Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- U.S.

- U.S. Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- U.S. Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- U.S. Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- U.S. Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- U.S. Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- U.S. Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- U.S. Video Streaming Market, By Streaming Type

- Canada

- Canada Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- Canada Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- Canada Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- Canada Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- Canada Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- Canada Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- Canada Video Streaming Market, By Streaming Type

- North America Video Streaming Market, By Streaming Type

- Europe

- Europe Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- Europe Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- Europe Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- Europe Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- Europe Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- Europe Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- Germany

- Germany Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- Germany Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- Germany Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- Germany Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- Germany Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- Germany Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- Germany Video Streaming Market, By Streaming Type

- UK

- UK Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- UK Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- UK Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- UK Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- UK Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- UK Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- UK Video Streaming Market, By Streaming Type

- France

- France Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- France Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- France Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- France Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- France Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- France Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- France Video Streaming Market, By Streaming Type

- Europe Video Streaming Market, By Streaming Type

- Asia Pacific

- Asia Pacific Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- Asia Pacific Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- Asia Pacific Video Streaming Market, By Service

- Consulting

- Managed Services

- Training & Support

- Asia Pacific Video Streaming Market, By Revenue Model

- Advertising

- Rental

- Subscription

- Asia Pacific Video Streaming Market, By Deployment Type

- Cloud

- On-Premises

- Asia Pacific Video Streaming Market, By User

- Cloud Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

- Cloud Enterprise

- China

- China Video Streaming Market, By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

- North America Video Streaming Market, By Solution

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay-TV

- China Video Streaming Market, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV