- Home

- »

- Medical Devices

- »

-

Wearable Artificial Organs Market Size, Industry Report, 2030GVR Report cover

![Wearable Artificial Organs Market Size, Share & Trends Report]()

Wearable Artificial Organs Market (2025 - 2030) Size, Share & Trends Analysis Report By Artificial Organ (Kidney, Pancreas, Cochlear Implant, Exoskeleton, Bionic Limbs, Brain Bionics, Vision Bionics), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-842-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Artificial Organs Market Trends

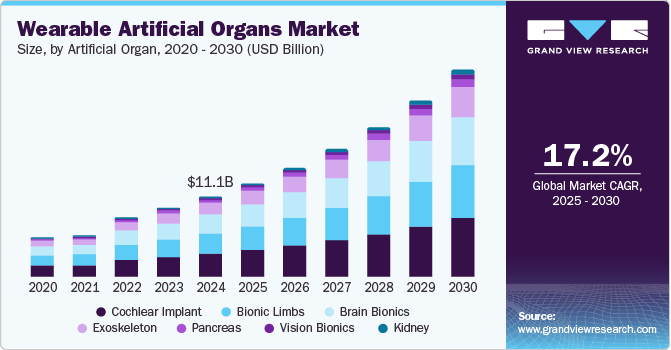

The global wearable artificial organs market size was estimated at USD 11.13 billion in 2024 and is projected to grow at a CAGR of 17.2% from 2025 to 2030. The increasing prevalence of chronic diseases, such as heart and kidney disorders, has led to a surge in demand for organ transplants. The growing number of patients on waiting lists for organ transplants exacerbates this need, creating a significant market opportunity for artificial organs. Technological advancements in biomaterials and device design have also contributed to the wearable artificial organs industry growth, enabling the development of more effective and reliable wearable solutions. Moreover, favorable reimbursement policies and expedited regulatory approvals have facilitated quicker access to these lifesaving technologies.

In addition, with the ongoing advancements in medical technology, particularly in electronics and bionics, the demand for wearable solutions is expected to grow significantly. One major factor driving this growth is the increasing incidence of organ failures, which can be attributed to the aging population and lifestyle-related diseases. As these health challenges rise, wearable devices will be needed to monitor, manage, or replace lost bodily functions. Integrating Artificial Intelligence (AI) and Machine Learning (ML) into wearable technology will enhance functionality and overall user experience. These innovations will make wearables more effective and appealing to consumers, further accelerating market growth.

The increase in the aging population is also driving demand for wearable artificial organs as older individuals are more susceptible to chronic diseases and organ failures. With growing life expectancy, the need for devices to enhance the quality of life and support failing organs is also increasing. This demographic shift creates a significant market opportunity for manufacturers focused on developing solutions tailored to the needs of elderly patients. For instance, the National Institutes of Health reports that chronic diseases such as heart failure affect nearly 6.2 million adults in the U.S., and according to the National Kidney Foundation, approximately 90,000 people were currently on the kidney transplant waitlist in the U.S. as of April 2024, further driving demand for wearable organ solutions.

Artificial Organ Insights

The cochlear implant segment dominated the market with a revenue share of 29.5% in 2024, which can be attributed to its established efficacy in treating hearing loss. Cochlear implants have become a standard solution for individuals with severe to profound hearing impairment, leading to increased adoption rates. The growing awareness of hearing health and advancements in implant technology have further fueled demand. In addition, favorable reimbursement policies and support from healthcare providers enhance patient accessibility. As more individuals seek solutions for hearing restoration, the cochlear implant segment is likely to maintain its leading position in the wearable artificial organs industry.

The kidney segment is projected to witness the highest CAGR of 25.1% over the forecast period, driven by the urgent need for effective renal support solutions. This demand is largely fueled by the rising incidence of Chronic Kidney Disease (CKD), which affects over 35 million adults in the U.S. alone, leading to increased organ failure rates. Traditional treatment options, such as dialysis, may only suffice for some patients, highlighting the need for innovative alternative wearable artificial kidneys. Artificial kidney technologies, including externally worn devices, are expected to significantly enhance patient outcomes and improve quality of life. Furthermore, increasing investment in research and development will likely result in new product launches tailored to meet diverse healthcare needs, addressing the specific challenges CKD patients face. As awareness of these advancements grows within the medical community and among patients, the rapid growth of the kidney segment is anticipated to continue, positioning it as a significant area of focus in the wearable artificial organs industry.

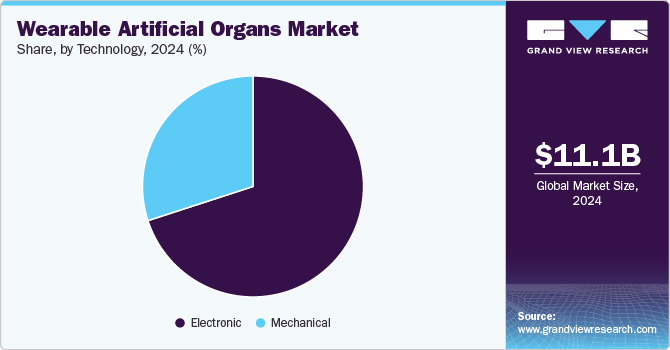

Technology Insights

The electronic segment dominated the market with the largest revenue share in 2024, which can be attributed to advancements in electronic components that enhance device performance and patient comfort. Electronic artificial organs offer improved functionality, such as real-time monitoring and data integration, which is crucial for effective patient management. The ongoing development of miniaturized electronics has also made these devices more accessible and user-friendly. With ongoing technological innovations, the electronic segment is expected to maintain its leading position within the wearable artificial organs industry.

The mechanical segment is projected to grow significantly over the forecast period, driven by advancements in engineering and materials science. Mechanical devices often provide essential support functions for patients with organ failures or deficiencies. Innovations in biocompatible materials and design enhancements are expected to improve the performance and longevity of mechanical artificial organs. As healthcare providers increasingly recognize the importance of integrating mechanical solutions into treatment plans, the demand for these devices is expected to rise. This trend indicates a favorable future for the mechanical segment within the wearable artificial organs market.

Regional Insights

North America wearable artificial organs market dominated the global market with a revenue share of 44.2% in 2024, which can be attributed to advanced healthcare infrastructure that supports the rapid development and adoption of innovative medical technologies. For instance, the U.S. Food and Drug Administration (FDA) has proactively approved new medical devices, including wearable artificial organs, facilitating quicker patient access. In 2021, the FDA granted breakthrough device designation to several wearable kidney devices, highlighting the regulatory support and accelerating innovation in the wearable artificial organs industry.

U.S. Wearable Artificial Organs Market Trends

The U.S. wearable artificial organs market dominated North America with a significant revenue share in 2024. The presence of major manufacturers and ongoing advancements in device design contribute to this dominance. Furthermore, the U.S. benefits from a large patient population that drives the demand for effective organ failure and dysfunction solutions. For instance, in a study published by the Centers for Disease Control and Prevention (CDC), heart disease is one of the leading causes of fatality in the U.S., affecting approximately 697,000 Americans annually. This alarming statistic highlights the urgent need for effective wearable solutions to assist patients with organ dysfunction and improve their quality of life.

Europe Wearable Artificial Organs Market Trends

Europe wearable artificial organs market held a substantial share in 2024, driven by advancements in medical technology and increasing healthcare investments. The region benefits from a strong emphasis on research and development, leading to innovative solutions that enhance patient care and quality of life. In addition, an aging population prone to chronic diseases contributes to the rising demand for effective organ replacement options. Regulatory frameworks in Europe support swift approval processes for new medical devices, facilitating quicker patient access. Hence, the Europe market for wearable artificial organs is expected to remain significant and competitive on a global scale.

Asia Pacific Wearable Artificial Organs Market Trends

The Asia Pacific wearable artificial organs market is expected to register the highest CAGR of 19.2% over the forecast period, which can be attributed to the large patient pool and the high incidence of organ failure in the region. Countries such as India and China have been experiencing a rising prevalence of chronic diseases, leading to an increased demand for effective organ replacement solutions. Rising disposable incomes enable more patients to seek advanced healthcare options, contributing to market growth significantly. For instance, the initiative launched by the School of Medical Research and Technology (SMRT) of IIT Kanpur aims to develop an advanced artificial heart called the Left Ventricular Assist Device (LVAD) for patients with end-stage heart failure. As awareness of wearable technologies increases among consumers and healthcare providers alike, the Asia Pacific market is expected to experience substantial growth in the coming years.

The China wearable artificial organs market is experiencing significant growth due to the rise in chronic diseases, including diabetes, hypertension, and cardiovascular conditions, creating an increased demand for wearable solutions supporting organ function. For instance, the National Health Commission of China reports that over 116 million people in the country have diabetes. This urgent need for effective management tools is reflected in the development of innovative devices such as the Wearable Artificial Kidney (WAK), which enables continuous dialysis and provides greater mobility than traditional machines.

Key Wearable Artificial Organs Company Insights

Some key companies operating in the market include Medtronic, Vivance, Vivani Medical, Inc., Cochlear Ltd., and Ekso Bionics. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches to expand their market presence and address the evolving healthcare demands in the wearable artificial organs market.

-

Medtronic offers advanced wearable solutions for patients with organ failure, including the HeartWare HVAD system and a Left Ventricular Assist Device (LVAD) that supports heart function in severe heart failure cases. It also provides wearable dialysis solutions, allowing kidney failure patients to manage treatments at home efficiently. In addition, Medtronic integrates remote monitoring technology into these devices, enabling real-time tracking of health data for better care management.

-

Cochlear Ltd. offers advanced hearing solutions. Its flagship products include the Nucleus and Baha Systems, designed to restore hearing in patients with severe hearing loss or those without traditional hearing aids. These implants directly stimulate the auditory nerve, offering a more permanent and effective solution than external devices.

Key Wearable Artificial Organs Companies:

The following are the leading companies in the wearable artificial organs market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Vivance

- Vivani Medical, Inc.

- Cochlear Ltd.

- Ekso Bionics

- MED-EL Medical Electronics

- Abbott

- Boston Scientific Corporation

- HDT Global

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD

Recent Developments

-

In January 2024, Medtronic declared the world's first approval for its MiniMed 780G System, featuring the Simplera Sync disposable all-in-one sensor. This innovative system enhances diabetes management by enabling continuous glucose monitoring and automated insulin delivery, helping patients maintain optimal blood sugar levels more effectively.

-

In November 2022, Cochlear Ltd. announced that the Cochlear Nucleus 8 Sound Processor received FDA approval, marking a significant advancement in hearing restoration technology. The Nucleus 8 also features next-generation Bluetooth connectivity, allowing users to stream audio directly from their devices, thereby improving accessibility and convenience for individuals with severe to profound hearing loss.

Wearable Artificial Organs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.97 billion

Revenue forecast in 2030

USD 28.74 billion

Growth rate

CAGR of 17.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Artificial organ,technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medtronic; Vivance; Vivani Medical, Inc.; Cochlear Ltd.; Ekso Bionics; MED-EL Medical Electronics; Abbott; Boston Scientific Corporation; HDT Global; ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Artificial Organs Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global wearable artificial organs market report based on artificial organs, technology, and region:

-

Artificial Organ Outlook (Revenue, USD Million, 2018 - 2030)

-

Kidney

-

Pancreas

-

Cochlear Implant

-

Exoskeleton

-

Bionic Limbs

-

Brain Bionics

-

Vision Bionics

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Electronic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.